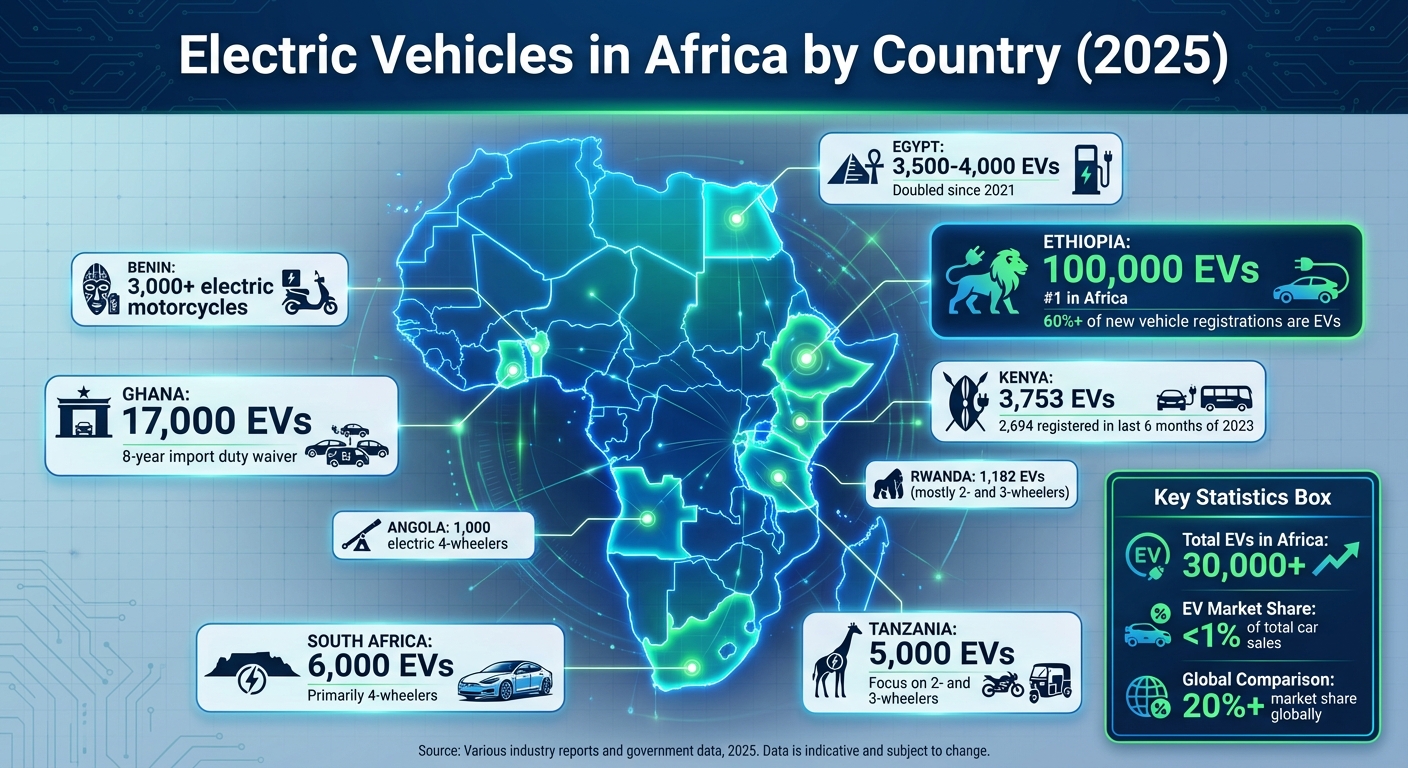

Africa’s electric vehicle (EV) market is growing but remains small. By May 2025, the continent had over 30,000 EVs, with two- and three-wheelers leading adoption. Ethiopia is the standout, with 100,000 EVs, driven by a 2024 ban on internal combustion engine imports. Other leaders include Ghana (17,000 EVs), South Africa (6,000 EVs), and Kenya (3,753 EVs). Key growth areas are public transportation (electric buses) and commercial fleets (e-bikes for deliveries). However, EVs still make up less than 1% of total car sales, compared to over 20% globally. Challenges include limited charging infrastructure, high costs, and unreliable electricity grids. Despite these hurdles, government incentives and affordable models are driving adoption in some regions.

Total Electric Vehicles in Africa (2025)

Current Numbers by Vehicle Type

By May 2025, Africa’s electric vehicle (EV) fleet has crossed the 30,000 mark, signaling progress, though EVs remain a small slice of the continent’s overall vehicle market.

The types of EVs in use vary widely. Two- and three-wheelers dominate, especially in commercial settings like motorcycle taxis and last-mile deliveries. A notable example is the Spiro network, which operates 22,000 e-bikes and supports them with 600 battery-swap stations. Light-duty vehicles, such as passenger cars, also play a role, with South Africa leading with 1,559 units, followed by Egypt with 380 and Kenya with 326. Electric buses, while fewer in number, carry significant importance. Egypt runs 200 electric buses, Senegal 155, and Kenya 54.

These numbers reflect a broader trend where 60–80% of urban trips depend on public or shared transportation, driving the rapid adoption of electric commercial vehicles. The breakdown of vehicle types illustrates the foundation for the strong growth patterns emerging in Africa’s EV market.

Year-Over-Year Growth Rates

Growth rates across vehicle categories are impressive. Electric buses have seen a 44% year-over-year increase, thanks to public transportation contracts and local assembly projects. Electric two- and three-wheelers have grown by 38%, while electric four-wheelers, including passenger cars, have risen by 28%.

Passenger car sales experienced a dramatic surge in 2024, doubling to nearly 11,000 units. Ethiopia, in particular, has seen transformative changes. Following its 2024 ban on internal combustion engine imports, EVs made up more than 60% of new vehicle registrations by early 2025. The country deployed 100,000 electric vehicles by early 2025, with a projected compound annual growth rate of 58.92%.

Focus On New Energy Vehicle Summit 2025: Leading the Charge to a Greener Tomorrow

EV Numbers by Country

Electric Vehicle Adoption Across Africa: Top Countries and Key Statistics 2025

Africa’s electric vehicle (EV) market is evolving rapidly, with certain countries leading the charge and others showing promising growth. Here’s a closer look at the current landscape.

Countries with the Most EVs

Ethiopia takes the top spot in Africa, boasting 100,000 EVs. This surge followed the country’s 2024 decision to ban petrol and diesel imports, a bold move that has significantly accelerated EV adoption.

Ghana is next, with approximately 17,000 EVs. The introduction of an 8-year import duty waiver in 2024 has made electric motorcycles and trikes particularly popular.

South Africa, despite its relatively low share of EVs overall, had around 6,000 electric vehicles by 2020, primarily 4-wheelers. Egypt, on the other hand, has seen its EV numbers grow to between 3,500 and 4,000 by 2023 – nearly double the figures from 2021. This growth has been fueled by government subsidies covering up to 35% of local EV production costs.

Kenya is another standout, with 3,753 EV registrations by the end of 2023. Notably, 2,694 of those were registered in the last six months of the year, thanks to new incentives. Tanzania, with about 5,000 EVs, primarily focuses on 2- and 3-wheelers. Meanwhile, Benin has surpassed 3,000 electric motorcycles, supported by investments in charging infrastructure from startups like Spiro.

These examples illustrate how targeted policies and incentives are shaping the EV market across Africa. While these countries are leading the way, smaller markets are also beginning to carve out their niches.

Smaller Markets with Growth Potential

Angola has made strides with about 1,000 electric 4-wheelers, thanks to tax reductions that will remain in place until 2032. In Rwanda, over 1,182 electric vehicles – mostly 2- and 3-wheelers – are now on the roads, driven by forward-thinking government policies aimed at expanding e-mobility.

In these smaller markets, practical applications are driving adoption. Commercial fleets, including motorcycle taxis, delivery vehicles, and buses, are gaining traction faster than private passenger cars. Rwanda and Uganda, in particular, are emerging as hubs for e-mobility startups, while larger nations focus on manufacturing vehicles for export.

Unique opportunities also arise from varying levels of grid readiness. Nigeria, for example, has a low grid readiness score but holds immense potential due to its large population and severe urban air pollution. On the other hand, island nations like Mauritius and Seychelles, with better grid infrastructure, are well-prepared for EV adoption, even though their smaller size limits their overall impact.

This dynamic mix of leaders and emerging players highlights the diverse paths African countries are taking to embrace the electric vehicle revolution.

sbb-itb-99e19e3

Regional Patterns and Market Factors

EV Adoption by Region

The electric vehicle (EV) landscape across Africa is a patchwork of diverse regional trends. In East Africa, countries are bypassing traditional vehicle ownership and embracing electric two- and three-wheelers. Kenya, Rwanda, and Ethiopia lead the charge. For example, motorcycles account for over a third of urban rides in the region, and Ethiopia’s recent import ban on internal combustion vehicles has pushed EV sales to over 60%.

In West Africa, Ghana stands out, claiming 29.31% of Africa’s EV market revenue in 2024. This success is largely due to its aggressive zero-tariff policies. Nigeria, despite its potential stemming from a large population and severe urban air pollution, continues to grapple with infrastructure challenges. Meanwhile, North Africa is making waves with Morocco not only becoming a key consumer market but also emerging as a manufacturing hub. Morocco produced 614,000 vehicles in 2024 and aims to manufacture 100,000 EVs annually by 2025, leveraging its proximity to Europe and a grid powered 40% by renewables.

Southern Africa is home to the continent’s most developed automotive industry. South Africa alone accounted for 31.7% of the Middle East and Africa EV market share in 2024, driven by production incentives and abundant mineral resources. In Central Africa, EV adoption remains slow, but the region plays a critical role in the supply chain. The Democratic Republic of Congo (DRC) and Zambia are forming an "EV corridor" to process essential battery minerals like cobalt and copper.

These regional dynamics highlight how local policies and market innovations are shaping Africa’s EV growth.

What’s Driving EV Growth

Government initiatives are the primary force behind Africa’s growing EV market. Ghana, for instance, has implemented an eight-year zero-tariff policy, while Kenya exempts EVs from VAT. These measures, combined with high fossil fuel import costs and the urgent need to improve urban air quality, are driving adoption. Interestingly, these efforts are more about addressing local challenges than meeting global decarbonization goals.

Innovative business models are also making EVs more accessible. Battery-swapping networks, which alleviate concerns about high upfront costs and range limitations, have already completed millions of swaps. Additionally, electric motorcycle operators report higher daily earnings compared to their gas-powered counterparts, thanks to fuel savings that outweigh battery subscription fees. In April 2024, Roam Electric partnered with County Bus Service to deploy 200 electric buses in Kenya by 2026, aiming to cut energy costs for operators by 50%.

Africa’s relatively low vehicle ownership – just 73 vehicles per 1,000 people on average, with 76% of countries below 100 vehicles per 1,000 – presents a unique opportunity to establish EVs as the norm. The African Continental Free Trade Area is also playing a role, encouraging regional specialization. For example, Ghana is focusing on vehicle assembly, while the DRC is prioritizing mineral processing.

Despite these promising developments, the road to widespread EV adoption is far from smooth.

Barriers to EV Adoption

One of the biggest hurdles is the lack of charging infrastructure. Only eight African countries currently meet high standards for grid reliability. Many nations would need to reallocate over 20% of their projected ten-year electricity demand growth to support just 30% EV penetration. Rose Mutiso, Research Director at Energy for Growth Hub, puts it plainly:

"Africa’s grids are not ready for large-scale EV adoption. Most countries would need to divert more than a fifth of their ten-year electricity demand growth to support a 30% conversion of road transportation to EVs".

High purchase costs remain another obstacle. However, sub-$15,000 mass-market EV models are expected to gain traction by 2027 as local battery production ramps up. For instance, the Sino-Moroccan company COBCO began producing EV battery materials in Morocco in June 2025, with an annual capacity of 70 GWh – enough to power nearly 1 million vehicles. Meanwhile, the influx of low-cost, used internal combustion vehicles from Europe and Asia continues to undermine demand for new EVs, especially in West and East Africa.

To address unreliable electricity supplies, some regions are turning to innovative solutions. In March 2025, Lagos launched Africa’s largest fast-charging station, equipped with 150 kW chargers powered by solar-storage hybrids to reduce reliance on the grid. However, rural areas in countries like Nigeria, Kenya, Ghana, and Tanzania still face significant challenges due to fragile grid infrastructure, slowing EV adoption outside major cities.

How EV24.africa Supports EV Access

As Africa’s electric vehicle (EV) market continues to grow, platforms like EV24.africa are stepping up to tackle some of the structural challenges holding the industry back.

What EV24.africa Offers

EV24.africa functions as a digital marketplace that brings together new and used EV listings from major brands like Tesla and BYD, among others. Instead of buyers having to navigate fragmented local dealerships or informal networks, the platform provides a centralized space where they can explore a wide range of options. It features transparent pricing and detailed specifications, making it easier for buyers to make informed decisions. This streamlined approach also addresses common financing and delivery hurdles across the continent.

One of the standout features of EV24.africa is its financing options, which help mitigate the high upfront costs of EV ownership. This is especially important in regions like Ethiopia, where only 5% of adults have borrowed from formal financial institutions. Similar credit access issues are widespread across Africa. By simplifying the financing process, the platform makes EV ownership more attainable for individuals and businesses that might otherwise stick to used internal combustion vehicles due to cost barriers.

Additionally, EV24.africa provides delivery services across all 54 African countries. Whether buyers are in bustling cities like Lagos or Nairobi or in more remote areas, the platform ensures access to EV options, leveling the playing field for those in landlocked or underserved regions.

Making EVs More Accessible

EV24.africa is breaking down barriers that have traditionally limited EV access. By consolidating vehicle listings from multiple sources, it offers buyers significantly more choices than any single dealership could. This is particularly beneficial in smaller markets that are just beginning to embrace EVs.

For businesses looking to electrify their commercial fleets – a segment expected to grow at a compound annual rate of 18.3% through 2033 – EV24.africa provides tailored dealer plans. These plans include bulk listing tools and support services, making it easier for businesses to transition from fossil fuel vehicles to electric ones. By reducing the complexity of managing multiple supplier relationships, the platform simplifies fleet electrification. With standardized purchasing processes and detailed vehicle information, EV24.africa is creating a foundation for Africa’s evolving automotive market.

Conclusion: What’s Next for EVs in Africa

Main Points

Africa’s electric vehicle (EV) market is small but showing signs of growth in specific regions. In 2024, electric car sales more than doubled, reaching close to 11,000 units. Despite this progress, EVs still account for less than 1% of total car sales across the continent. Ethiopia has made significant strides, deploying 100,000 electric vehicles after banning petrol and diesel car imports in January 2024. In North Africa, countries like Morocco and Egypt are advancing their manufacturing capabilities, with EVs making up nearly 2% of their domestic car sales. On the other hand, South Africa reported just 1,900 EV sales in 2024, which translates to a mere 0.09% of its market.

The biggest hurdles remain infrastructure and grid capacity. Many African countries face challenges in meeting reliable grid standards. To support a 30% shift to EVs, most nations would need to allocate over 20% of their projected ten-year electricity demand growth. As Rose Mutiso, Research Director at Energy for Growth Hub, explains:

"Africa’s grids are not ready for large-scale EV adoption".

With an average motorization rate of just 73 vehicles per 1,000 people, there’s potential for demand growth as incomes rise. These challenges highlight the need for bold policy changes and market-driven solutions.

Looking Forward

Addressing these obstacles requires a combination of policy adjustments and market innovation. Nigeria took a significant step in 2024 by signing the Zero Emission Vehicles Declaration, committing to transition all new car and van sales to electric by 2040. Additionally, Nigeria is collaborating with Morocco to develop domestic EV manufacturing. Meanwhile, affordable Chinese EV models – responsible for 75% of the growth in emerging market EV sales in 2024 – are beginning to match the price of traditional vehicles in some African markets.

The future of EV adoption in Africa is likely to center on fleet electrification and the increased use of electric two- and three-wheelers rather than widespread private car ownership. By 2030, it’s projected that nearly one in three two- or three-wheelers sold globally will be electric. Commercial fleets can act as a proving ground for broader adoption. However, success will depend on governments prioritizing investments in grid infrastructure and framing EV adoption around practical benefits, such as improved urban air quality and reduced reliance on costly fossil fuel imports.

FAQs

What are the biggest challenges to adopting electric vehicles in Africa?

The path to widespread electric vehicle (EV) adoption in Africa is riddled with obstacles. One of the biggest challenges is the scarcity of charging infrastructure. In many countries, the number of public chargers barely reaches double digits, and across the entire continent, there are only a few hundred charging stations. This limited access fuels "range anxiety", discouraging potential buyers from making the switch to EVs.

Cost is another major barrier. EVs are much pricier than traditional gasoline-powered cars. High import duties, a lack of local manufacturing, and lengthy supply chains for parts and repairs all contribute to the steep price tags. Adding to the problem, financing options like loans or leasing programs are hard to come by, making EVs even less accessible for the average consumer.

Electricity supply issues further complicate matters. In many regions, the power grid is unreliable, making it difficult for individuals and businesses to charge their vehicles consistently. To make things worse, uncertain government policies – ranging from inconsistent tax incentives to unclear regulatory frameworks – create hesitation among manufacturers and investors.

Tackling these challenges will require a multi-pronged approach: expanding charging infrastructure, offering more affordable financing options, and establishing clear, supportive policies. These steps could help pave the way for EV adoption to gain traction across the continent.

What impact do government incentives have on the growth of electric vehicles in Africa?

Government incentives are playing a key role in encouraging the adoption of electric vehicles (EVs) across Africa. Many nations are introducing policies such as import-duty exemptions, tax breaks, and zero-tariff periods to lower the upfront costs of EVs, making them more affordable for consumers. For instance, Ethiopia has taken a bold step by banning the import of new internal combustion engine vehicles, while Ghana has introduced an eight-year zero-tariff period for EVs.

These initiatives do more than just cut costs – they also attract investments in areas like local EV assembly, battery manufacturing, and charging infrastructure. Although challenges like limited grid capacity and the high cost of vehicles remain, these incentives are paving the way for EV adoption and sparking advancements in sectors like electric public transportation.

Why is Ethiopia leading Africa in electric vehicle adoption?

Ethiopia is making waves in Africa’s electric vehicle (EV) market, driven by a mix of government initiatives and distinctive market dynamics. The country’s historically low vehicle ownership – just 6.7 vehicles per 1,000 people in 2016 – means any increase in sales has a noticeable impact. To push EV adoption, the government took bold steps, including banning imports of new internal combustion engine (ICE) vehicles and slapping steep import duties of up to 200% on used cars. These policies have made EVs a more accessible and appealing choice for buyers.

On top of that, Ethiopia has rolled out policies to promote electric mobility. These include incentives for assembling EVs locally, streamlining the licensing process for EVs, and investing in grid infrastructure to support the shift. Coupled with the country’s low per-capita income (under $1,000 GNI) and the reduced competition from used ICE vehicles, these efforts have propelled Ethiopia into an unexpected leadership role in Africa’s EV landscape.