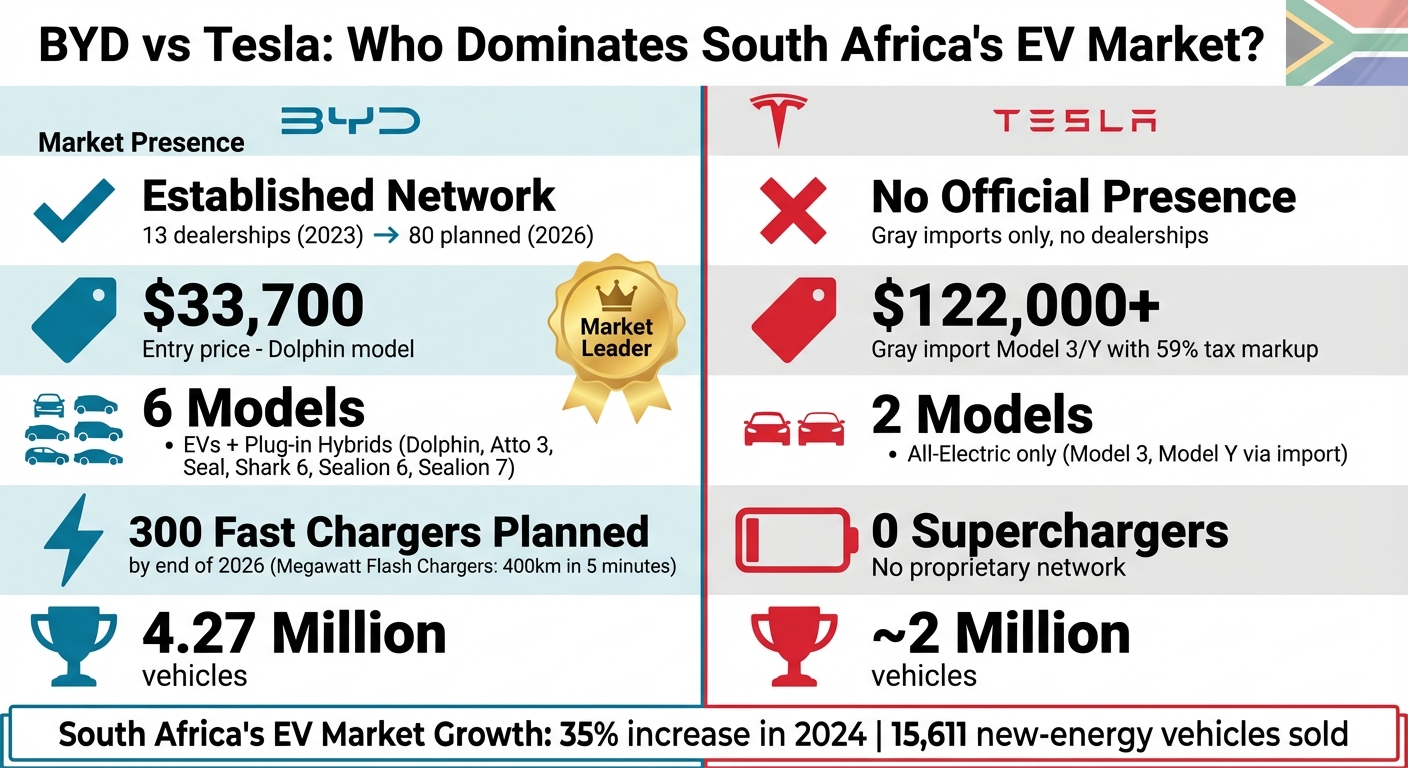

BYD leads South Africa’s electric vehicle (EV) market, while Tesla struggles to establish a presence. Here’s why:

- BYD’s Advantage: BYD has a strong dealership network, affordable models like the Dolphin (~$33,700), and plans for 300 fast-charging stations by the end of 2026. They also offer plug-in hybrids, addressing range concerns in a country with an unreliable power grid.

- Tesla’s Challenge: Tesla lacks an official presence in South Africa. Vehicles are only available through costly gray imports, with no local service centers or charging network. High import taxes further inflate prices, making Tesla less accessible.

- Market Growth: South Africa’s EV market grew 35% in 2024, with government incentives like reduced import duties (15%) and upcoming tax breaks in 2026. However, affordability and infrastructure remain barriers.

Quick Comparison

| Feature | BYD | Tesla |

|---|---|---|

| Local Presence | Established dealerships and service | No official presence |

| Entry Price | ~$33,700 (Dolphin) | Gray imports only, higher costs |

| Model Range | EVs and hybrids (6 models) | All-electric (Model 3, Model Y via import) |

| Charging Network | Investing in 300 fast chargers | No proprietary network |

| Affordability | Competitive pricing | Premium pricing due to import taxes |

BYD’s local investments and hybrid options meet South Africa’s challenges, giving them a clear edge over Tesla.

BYD vs Tesla in South Africa: Market Presence and Key Metrics Comparison

BYD Expands Into South Africa With Major Solar Powered EV Investment

sbb-itb-99e19e3

BYD: Expansion, Models, and Strategy

BYD is making strides in South Africa, starting with 13 dealerships in 2023 and planning to expand to 35 locations by early 2026. By the end of 2026, they aim to have 60–70 outlets across the country. Steve Chang, General Manager of BYD Auto South Africa, emphasized the importance of this market:

"South Africa is actually one of the most important automotive markets in the southern Hemisphere… it’s a market that we have to look at and see how we can develop the market."

This growth aligns with BYD’s broader plans to enhance South Africa’s charging infrastructure.

Dealership Network and Infrastructure Investments

To address South Africa’s challenges with charging infrastructure, BYD is making significant investments. In October 2025, Executive Vice President Stella Li shared plans to install 200 to 300 fast-charging stations nationwide by the end of 2026. These stations will feature "Megawatt Flash Chargers", capable of delivering up to 1MW of power, providing 400 km (248 miles) of range in just five minutes. Construction for these stations is set to begin in the second quarter of 2026.

Recognizing the country’s unreliable power grid, BYD is integrating solar power and battery storage into its charging stations. Stella Li expressed the company’s ambitious goals:

"By the end of next year, we will have 200 or 300 Flash charging stations in South Africa… We want to cover 100% of the country."

Vehicle Models and Battery Technology

BYD has expanded its lineup since launching the Atto 3 SUV in 2023. Their offerings now include the entry-level Dolphin Surf, the Seal sedan, the Sealion 7 SUV, and plug-in hybrid models like the Shark 6 pickup and Sealion 6 SUV, which debuted in December 2025 at a price of approximately $29,445. To address local concerns about range and power stability, BYD adopted a dual-powertrain approach in 2024, combining hybrid and fully electric options.

All BYD models are equipped with the company’s proprietary Blade Battery technology. The Dolphin Surf, their best-selling model, comes with features like vehicle-to-load (V2L) technology, a 7kW home wallbox charger, and an 8-year/200,000 km battery warranty.

Tesla: Market Position and Challenges

Tesla currently has no formal presence in South Africa. There are no dealerships, service centers, or official market operations, leaving Tesla enthusiasts to navigate the complexities of private imports. CEO Elon Musk has pointed to high import duties – 25% for electric vehicles compared to 18% for gasoline cars – as a significant barrier to entry, especially since Tesla does not produce vehicles locally . This situation forces fans of the brand to rely on costly private imports, which come with limited support and increased expenses.

The numbers paint a clear picture of the challenges. Imported electric vehicles are subject to a 25% import duty. When combined with luxury excise taxes and VAT, the total tax burden can inflate the price by up to 59%. For example, a Tesla Cybertruck priced at $60,990 in the U.S. would cost around $122,000 (R1,955,416) in South Africa, with taxes alone adding approximately $49,700 (R795,551). These financial obstacles highlight why Tesla has yet to establish a foothold in the South African market.

Model Lineup and Import Adaptations

The majority of Teslas in South Africa, primarily right-hand drive Model 3 and Model Y vehicles, enter the market through gray imports. These vehicles lack factory warranties and access to official support, creating challenges for owners. Common issues include difficulties with software updates, limited access to replacement parts, and repair delays. Unlike Morocco, where Tesla operates an official subsidiary, South Africa remains excluded from Tesla’s global expansion plans. Until the country addresses hurdles like steep import taxes and the absence of domestic manufacturing incentives, this situation is unlikely to change.

Supercharger Network and Access

Tesla’s renowned Supercharger network, which can add 200 miles (322 km) of range in just 15 minutes, is entirely absent in South Africa. While the country has rolled out pilot public charging networks in major urban areas, Tesla’s proprietary Supercharger technology is not part of this infrastructure. As a result, Tesla owners must depend on home charging setups or generic public charging stations, limiting one of Tesla’s key selling points: fast and convenient charging.

BYD vs Tesla: Direct Comparison

Building on earlier discussions about dealership networks and pricing strategies, this section highlights the key differences between BYD and Tesla in South Africa. The contrast between the two brands’ market approaches is striking: BYD has a formal dealership network with showrooms, service centers, and customer care facilities across the country, while Tesla has no official retail or service presence in South Africa. This difference sets the stage for a detailed comparison of their performance metrics.

Pricing is another area where the two brands diverge. BYD’s Dolphin, priced at R539,900 (~$33,700), is South Africa’s most affordable EV as of May 2024. Tesla vehicles, on the other hand, are only available through gray imports, which come with significantly higher price tags.

The brands also differ in their product lineups. BYD offers six models, including both electric and plug-in hybrid vehicles, such as the Shark 6 bakkie and Sealion 6 SUV. Tesla, however, sticks to an all-electric lineup, with only gray-market imports of the Model 3 and Model Y available locally. BYD’s hybrid options address challenges like range anxiety and limited charging infrastructure, giving it an edge in markets with developing EV ecosystems.

Comparison Table: Performance Metrics

The table below summarizes the critical differences between BYD and Tesla:

| Metric | BYD | Tesla |

|---|---|---|

| Official SA Presence | Established dealership & service network | No official retail or service presence |

| Entry-Level Price | R539,900 (~$33,700) – Dolphin | Not available locally; gray imports only |

| Model Availability | Dolphin, Atto 3, Seal, Shark 6 (PHEV), Sealion 6 (PHEV), Sealion 7 | Model 3, Model Y (gray imports) |

| Hybrid Options | Yes – plug-in hybrid bakkies and SUVs | No – all-electric only |

| Battery Technology | LFP Blade Battery (cobalt‑free) | Conventional lithium‑ion batteries |

| Charging Network | Access to public charging stations | Relies on home and public charging |

| 2024 Global Sales | 4.27 million vehicles | Approximately 2 million vehicles |

BYD benefits from vertical integration, which allows for more competitive pricing, especially when compared to Tesla’s premium pricing due to import restrictions. Additionally, BYD’s Blade Battery technology, which uses lithium‑ion phosphate (LiFePO4), avoids reliance on minerals like cobalt and nickel, often associated with ethical and environmental concerns. Tesla, meanwhile, appears to be prioritizing advancements in AI over expanding its EV footprint, leaving its local presence in South Africa minimal at best.

Buying Factors for South African Consumers

When South African buyers compare BYD and Tesla, three key factors stand out: affordability, charging infrastructure, and vehicle versatility. BYD’s approach caters to budget-conscious consumers with a variety of models at different price points. On the other hand, Tesla’s vehicles, positioned as premium offerings, face higher costs due to the lack of official local retail and service networks. These differences highlight the importance of evaluating price-performance and charging network availability.

Price vs. Performance Trade-offs

BYD offers a mix of fully electric vehicles (BEVs) and plug-in hybrids, aiming to meet diverse consumer needs. A standout is the Shark 6 plug-in hybrid, which appeals to South Africa’s popular pickup market. It offers a combined petrol-electric range of about 840 km (522 miles) and an electric-only range of roughly 100 km (62 miles), thanks to its 29.5 kWh Blade battery. Meanwhile, the all-electric Sealion 7, powered by an 82.5 kWh Blade battery, combines speed and efficiency, accelerating from 0 to 62 mph in just 4.3 seconds. These models showcase how BYD balances performance with practical local support.

Tesla, in contrast, focuses on high-performance electric vehicles that emphasize cutting-edge technology and brand prestige. However, without an official retail or service network in South Africa, Tesla’s vehicles come with higher costs and limited support options, making them less accessible to many buyers.

Charging Network Access

South Africa’s energy challenges make charging infrastructure a crucial factor for EV buyers. BYD addresses this issue with its plug-in hybrid models, such as the Shark 6 and Sealion 6, which help alleviate range anxiety in areas with fewer charging stations. This flexibility allows consumers to navigate the country’s evolving EV landscape more confidently.

Tesla, with its fully electric lineup, depends entirely on the availability of charging stations and a stable power grid. In the absence of a dedicated Supercharger network, Tesla owners must rely on public and home charging setups, which can be limiting. BYD’s strategy of offering both BEVs and plug-in hybrids provides a practical solution for South African drivers adapting to the country’s developing EV infrastructure.

As Tony Weber, CEO of FCAI, observed in early 2026:

"We are seeing fewer petrol vehicles sold and rapid growth in plug-in hybrids, while uptake of hybrid and battery electric vehicles is more stable".

These factors collectively steer the South African market toward vehicles that combine versatility, affordability, and reliable support.

Conclusion: Market Leader in South Africa

Current Market Position

BYD has firmly established itself as the leader in South Africa’s EV market, thanks to its local investments, growing dealership network, and charging infrastructure. With plans to expand to 80 dealerships and install 300 super-fast charging stations by mid-2026, its dominance is clear. On the other hand, Tesla has yet to make a significant impact, as it doesn’t feature among the top 20 best-selling EV models in the region.

One of BYD’s key strengths lies in its ability to offer vehicles that align with local preferences and affordability. Its diverse lineup addresses the financial realities of South African consumers. Meanwhile, Tesla’s premium-priced, fully electric vehicles, combined with the lack of local sales and service infrastructure, present significant barriers to accessibility.

Market Projections

BYD’s solid foundation positions it for even greater success in South Africa’s growing EV market. With sales of new-energy vehicles expected to double from 7,782 units in 2023 to 15,611 units in 2024, BYD is well-placed to capture a significant share of this growth. The company’s goal of achieving 100% provincial coverage by the end of 2027 further underscores its commitment. As BYD Executive Vice President Stella Li noted:

"South Africa is a very important market… It is the biggest [vehicle] market in the whole African continent, [so] we need to focus here".

Additionally, a 150% EV manufacturer tax incentive set to take effect in March 2026 is likely to fuel BYD’s continued success. For Tesla, breaking into the South African market will require establishing local infrastructure and introducing more affordable models. Without these changes, BYD’s head start in dealerships, charging networks, and product offerings will likely secure its position as the leading EV brand in the country.

FAQs

Why is BYD currently outperforming Tesla in South Africa?

BYD has outpaced Tesla in South Africa by focusing on affordability and practicality – two factors that resonate strongly with local consumers. Its electric vehicles come at competitive prices, making them accessible to a broader audience. On top of that, BYD has adapted its vehicles to work seamlessly with the region’s existing charging systems, eliminating compatibility concerns.

Another key factor in BYD’s success is its commitment to building a robust dealership network and expanding charging infrastructure. These efforts make it easier for South Africans to buy and maintain their electric vehicles without hassle. By addressing the specific needs of the local market, BYD has positioned itself as the go-to option for many, offering a more grounded alternative to Tesla.

What obstacles does Tesla face in bringing its EVs to South Africa?

Tesla faces a tough road ahead in South Africa, with several key obstacles standing in the way. One of the biggest challenges? High import taxes. These taxes, designed to protect local manufacturers, drive up the cost of Tesla vehicles, making them a pricey option for consumers. Without government incentives or a clear policy supporting electric vehicles (EVs), there’s little relief to offset these steep costs.

Another significant issue is infrastructure compatibility. Tesla’s cars depend on its proprietary Supercharger network, which hasn’t made its way to South Africa yet. While the country is working on improving EV charging infrastructure, it’s still in the early stages – far from being able to support Tesla’s advanced requirements.

Finally, there’s the matter of Tesla’s premium pricing. While the brand appeals to high-income buyers, affordability plays a huge role in encouraging EV adoption. In a market like South Africa, this pricing strategy could limit Tesla’s reach to a smaller, niche audience.

What is BYD doing to improve South Africa’s EV charging infrastructure?

BYD is gearing up to transform South Africa’s EV charging landscape with plans for a nationwide rollout of ultra-fast charging stations. A standout feature of this initiative is the introduction of a 1-megawatt supercharger network, with construction slated to kick off in the second quarter of 2026.

This move targets two major hurdles for EV adoption in South Africa: the scarcity of charging options and the lengthy wait times at existing stations. By addressing these issues, BYD aims to make owning an EV more convenient and practical for local drivers. This initiative underscores BYD’s dedication to advancing South Africa’s shift toward cleaner, more efficient transportation.