Algeria is opening its doors to electric vehicles (EVs) with updated import and tax rules. Here’s what you need to know:

- Customs Duty: EVs are subject to a 30% duty but are exempt from the Internal Consumption Tax (TIC), which can go as high as 60% for gasoline cars.

- VAT: A 19% VAT applies to all EV imports.

- Tax Reductions: Used EVs under three years old qualify for an 80% tax reduction.

- Duty-Free Import: Algerian nationals returning after three years abroad can import one new EV tax-free within specific value limits.

- Documentation: Importing requires detailed paperwork, including a Certificate of Conformity in Arabic, technical inspection certificates, and more.

- Safety Standards: EVs must meet specific safety and technical criteria, such as ABS, airbags, and CCS2 charging compatibility.

Algeria’s EV market is growing, supported by government incentives and a push for cleaner transportation. However, navigating customs and tax regulations can be complex. Platforms like EV24.africa can simplify the process by handling sourcing, documentation, and compliance.

Regulatory Framework for EVs in Algeria

Government Agencies That Control EV Regulations

In Algeria, several government bodies play key roles in overseeing electric vehicle (EV) imports and ownership. The Ministry of Industry handles the authorization process for vehicle dealers. Algerian Customs (Direction Générale des Douanes) calculates import duties and taxes based on the vehicle’s CIF value. Meanwhile, the Ministry of Commerce ensures goods meet fraud prevention standards and stamps shipping documents. For duty-free imports, Consular Services manages the Certificate of Change of Residence (CCR). Finally, the Bank of Algeria oversees all import-related payments. Together, these agencies enforce strict regulations to maintain compliance and safety within the EV market.

Current Import Rules for EVs

Algeria has implemented regulations that prioritize newer, cleaner vehicle technologies. Individuals importing used EVs must ensure the vehicle is no more than three years old, and imports are limited to one vehicle every three years. Additionally, the country has banned the import of diesel-engine vehicles, encouraging a shift toward gasoline, hybrid, and electric alternatives.

Imported vehicles must meet specific safety and technical standards, including features like ABS, speed limiters, front airbags, and metric speedometers (km/h). Window tinting must allow at least 70% visibility in the front. For EVs, additional requirements include a UN38.3 battery test report, proof of CCS2 charging compatibility, and an Arabic-language Certificate of Conformity (COC), which became mandatory in 2025. These regulations align with Algeria’s broader goals of promoting EV adoption and ensuring vehicle safety.

Government Plans for Electric Vehicle Adoption

Algeria’s regulatory framework not only enforces compliance but also shapes the financial and operational landscape for EV importers. Dealers are required to offer at least one electric vehicle model within five years of obtaining authorization. Additionally, they must establish operations in 28 Algerian provinces within their first year.

To simplify the import process, the government has embraced digital tools. The introduction of a blockchain-based customs platform and the "Mirsal 2" e-declaration system has significantly reduced document processing times – from seven days to just 48 hours. Furthermore, businesses that establish EV service points benefit from a 90% reduction in industrial zone rent, providing a clear incentive to invest in charging infrastructure. These initiatives highlight Algeria’s efforts to expand its EV market, address vehicle shortages, and work toward environmental sustainability goals.

Customs Duties and Taxes on Electric Vehicles

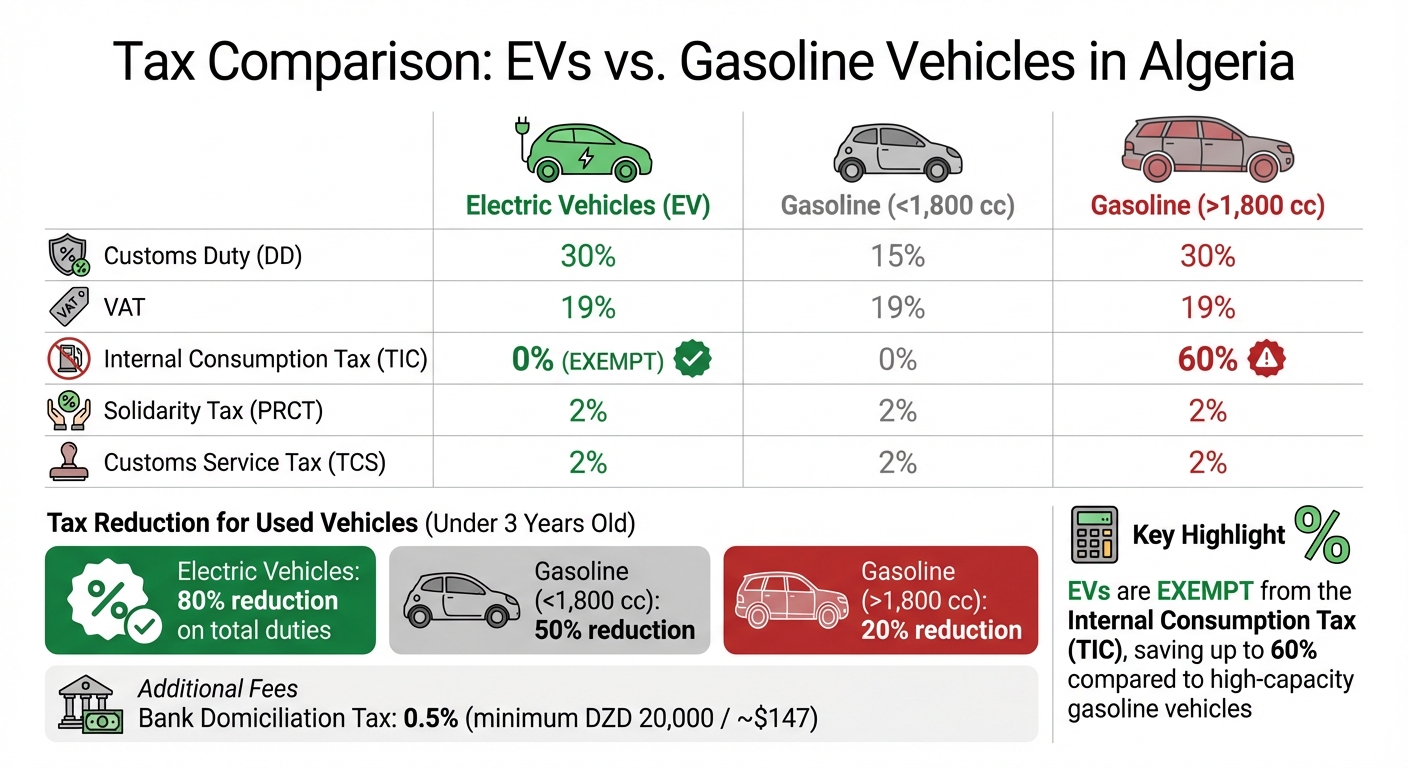

Algeria EV Import Tax Comparison: Electric vs Gasoline Vehicles

Import Duties, VAT, and Other Taxes

When importing electric vehicles (EVs), a 30% Customs Duty (DD) applies. However, EVs benefit from a 0% Internal Consumption Tax (TIC), unlike high-capacity gasoline vehicles, which face a steep 60% TIC .

All imported EVs are subject to a 19% VAT. Additional charges include a 2% PRCT, 2% TCS, and a 0.5% Bank Domiciliation Tax (with a minimum of DZD 20,000, approximately $147). Under the 2023 Finance Law, individuals importing used EVs less than three years old can enjoy an 80% reduction in the total duties and taxes, making EVs far more affordable compared to gasoline-powered vehicles.

How Customs Value Is Calculated

Algerian customs determine a vehicle’s taxable value using the CIF (Cost, Insurance, and Freight) method. This calculation combines the purchase price, shipping costs, and insurance into a single figure, which forms the basis for applying duties and taxes. Customs rely on the purchase invoice for this valuation, but if the declared value appears too low, they may apply a "fair price".

Exchange rates play a critical role in this process. The CIF value is converted into Algerian Dinars (DZD) based on the daily exchange rate at the time of import. For example, if an EV has a CIF value of $25,000 and the exchange rate is 136 DZD/USD, the base amount becomes DZD 3,400,000. Taxes and duties are then calculated on this amount, with the 80% reduction applied for qualifying used EVs. This method highlights the cost differences between EVs and gasoline vehicles.

Tax Comparison: EVs vs. Gasoline Vehicles

The tax benefits of importing an EV become evident when comparing tax obligations for different vehicle types. EVs completely avoid the TIC, while gasoline vehicles with engines over 1,800 cc incur this significant additional tax .

| Tax Component | Electric Vehicles (EV) | Gasoline (<1,800 cc) | Gasoline (>1,800 cc) |

|---|---|---|---|

| Customs Duty (DD) | 30% | 15% | 30% |

| VAT | 19% | 19% | 19% |

| Internal Consumption Tax (TIC) | 0% | 0% | 60% |

| Solidarity Tax (PRCT) | 2% | 2% | 2% |

| Customs Service Tax (TCS) | 2% | 2% | 2% |

For used vehicles under three years old, tax reductions amplify the financial advantage of EVs. While EVs get an 80% reduction on total duties, gasoline vehicles with engines under 1,800 cc receive only a 50% reduction, and those with larger engines are limited to a 20% reduction. These policies clearly aim to encourage EV adoption by offering considerable savings during the import process.

Import Requirements, Documentation, and Compliance

Who Can Import EVs and Under What Conditions

If you’re an individual looking to import an EV into Algeria, you’re allowed to bring in one vehicle for personal use every three years, as long as the car is under three years old. Payments must go through an Algerian bank, which registers the invoice before customs clearance.

For dealers, the rules are much stricter. They must obtain prior authorization from the Ministry of Industry and hold an exclusive contract with a foreign manufacturer. Additionally, within their first year of operation, they’re required to establish a presence in at least 28 Algerian provinces and provide after-sales service along with spare parts for the entire contract period, plus an extra five years.

Required Documents for Customs Clearance

To ensure smooth customs clearance, you’ll need to gather specific documents. First, the purchase invoice must include detailed information about the seller, the vehicle’s specifications, and the price. This invoice must be registered with an Algerian bank before customs release. Other crucial documents include the original registration papers from the vehicle’s country of origin, a Certificate of Conformity (COC) that’s less than three years old, and a technical inspection certificate, also less than three years old.

You’ll also need a copy of your passport or national ID. If importing from France, a Certificat de Cession is required to confirm the ownership transfer. For exports from the EU, an EX-A export declaration is necessary for customs clearance and to claim VAT refunds. Additionally, the Ministry of Commerce must stamp your shipping documents with a "Visa Fraud" note, certifying the vehicle has passed fraud inspections. Technical inspections, conducted by third-party providers, typically cost between €300 and €400 (around $315–$420).

Shipping and Handling Requirements for EVs

Shipping EVs comes with its own set of challenges, primarily due to their lithium-ion batteries. A Material Safety Data Sheet (MSDS) for the battery is essential to meet hazardous cargo regulations and adhere to International Maritime Organization (IMO) shipping rules. When it comes to shipping methods, you can choose between container shipping, which offers better protection, or Roll-on/Roll-off (RoRo) service, which is generally faster and more budget-friendly.

Customs clearance times can vary due to bureaucratic processes and mandatory fraud inspections. The customs valuation is based on the CIF (Cost, Insurance, and Freight) price, which determines the duties and taxes to be paid. If you’re an Algerian national returning home after living abroad for at least three years, you may qualify to import a new EV duty-free. This exemption applies as long as the vehicle’s value is between DZD 8,000,000 and DZD 10,000,000 (approximately $58,800–$73,500) and the vehicle is brought into Algeria within one month of your return.

sbb-itb-99e19e3

Tax Incentives, Cost Reduction, and Market Access

Tax Breaks for EVs in Algeria

Algeria provides a range of tax incentives aimed at reducing the costs of importing electric vehicles (EVs). For Algerian nationals who have lived abroad for at least three years, there’s a significant perk: they can import one new vehicle – including EVs – completely free of customs duties and taxes. The exemption applies if the vehicle’s value does not exceed 10,000,000 DZD for nationals (or 8,000,000 DZD for students and trainees) and is imported within one month of their return.

Additionally, if your EV is imported from the European Union or a member country of the Arab Free Exchange Zone (GZALE), it may qualify for reduced or even zero customs duties under Algeria’s free trade agreements. Companies setting up local EV manufacturing or assembly facilities can also take advantage of preferential tax treatment under Article 17 of Executive Decree 22-384. On top of that, the bank domiciliation tax for importing goods is just 0.5%, which is significantly lower than the 4% rate applied to services. These benefits make Algeria’s tax framework an attractive option for EV enthusiasts and businesses alike.

How to Reduce Import Costs

If you’re planning to import an EV, there are a few ways to cut costs further. First, check your vehicle’s Harmonized System (HS) code to determine if it qualifies for a reduced 9% VAT rate instead of the standard 19%. For individuals eligible for the Certificate of Change of Residence (CCR) exemption, applying through your local consulate before shipping your vehicle can save you from paying any import taxes at all.

Customs duties in Algeria are based on the CIF (Cost, Insurance, and Freight) price. This means negotiating lower shipping or insurance costs can directly reduce your taxable amount. However, be aware of Provisional Additional Safeguard Duties (DAPS), which can add a hefty 30–200% to the cost if your vehicle is classified as restricted. Double-checking that your EV isn’t on the restricted goods list is essential to avoid unexpected expenses.

How EV24.africa Helps with EV Imports

Navigating the complexities of EV imports can be daunting, but EV24.africa simplifies the process from start to finish. The platform specializes in sourcing vehicles that meet Algeria’s strict import guidelines, including the requirement for Complete Built Units (CBU). Whether you’re looking for new or used EVs, EV24.africa connects you with trusted brands like Tesla, BYD, Leapmotor, Geely, and Hyundai, offering clear pricing and detailed specifications.

Beyond vehicle sourcing, EV24.africa handles the paperwork and ensures all customs authorizations are in place, making customs clearance hassle-free. They also provide financing options and coordinate shipping and delivery across all 54 African countries. With EV24.africa, you’ll have a reliable partner to help you tap into Algeria’s growing EV market with ease.

Conclusion

Algeria has made strides in shaping a more favorable regulatory landscape for electric vehicles. Recent policy changes now allow dealerships to import Complete Built Units (CBU), offering a financial edge to EV buyers. One of the standout advantages is the exemption from the Domestic Consumption Tax (TIC), which is set at 0% for EVs, compared to a hefty 60% for gasoline vehicles with engines over 1,800 cc. Additionally, returning nationals can benefit from duty-free imports up to 10,000,000 DZD, further adding to the appeal.

Beyond individual incentives, the government is actively promoting investments in the EV sector. Under the 2022 Investment Law, eligible projects can enjoy a three-year corporate tax exemption and a 10-year break on real estate taxes. To push the transition toward electric mobility, all authorized dealers are now required to include at least one EV model in their lineup by their fifth year of operation.

However, navigating the customs process remains a challenge. Lengthy documentation and inspection requirements can delay clearance times, sometimes stretching from weeks to months. This is where EV24.africa steps in, streamlining the entire process. From sourcing CBU-compliant vehicles to securing customs authorizations and ensuring compliance with Algerian standards, the platform handles it all. With access to trusted brands like Tesla, BYD, Geely, and Hyundai, along with financing options and delivery across all 54 African countries, EV24.africa takes the hassle out of importing EVs.

FAQs

What tax benefits are available for importing electric vehicles into Algeria?

Electric vehicles (EVs) in Algeria come with notable tax breaks that make them a more affordable option. Import duties on EVs can be slashed by as much as 80%, and they are largely exempt from the usual 30% customs duty and 19% value-added tax (VAT). These incentives significantly lower the costs, making EV ownership a more appealing choice for both private buyers and businesses.

How can Algerian nationals returning to Algeria import an electric vehicle without paying taxes?

Algerian nationals planning to return permanently to Algeria have the opportunity to import an electric vehicle without paying taxes, thanks to the Certificate of Change of Residence (CCR). This certificate is available to those who have been registered with an Algerian consulate for at least three years and are making a permanent move back to the country. It’s important to note that the CCR can only be issued once per household and remains valid for six months.

To be eligible, the vehicle must be completely new and imported within one month of receiving the CCR. Additionally, the vehicle owner must be present at customs for clearance, as proxies are not permitted. The CCR provides an exemption from the 30% import duty and the 19% VAT that would normally apply to imported cars, offering a valuable cost-saving opportunity. Be sure to follow the application process carefully and adhere to all deadlines to make the most of this benefit.

What documents do I need to import an electric vehicle into Algeria?

To bring an electric vehicle into Algeria, you’ll need to gather several key documents:

- A commercial invoice that outlines the details of the vehicle purchase.

- A bill of lading, which provides shipping details.

- A certificate of origin to confirm where the vehicle was manufactured.

- A vehicle compliance certificate ensuring the car meets Algerian standards, including features like ABS and a speed limiter.

- A customs declaration form along with proof of payment or financing.

- An import license, if required.

It’s crucial to ensure all paperwork is accurate and complete to meet Algeria’s import requirements.