Africa’s electric vehicle (EV) market is growing fast, with over 30,000 EVs in operation as of 2025 and a projected market value of $4.2 billion by 2030. Key drivers include falling battery prices, local EV assembly, and supportive government policies. Ethiopia leads with bold ICE bans, while countries like Kenya, Rwanda, and Uganda focus on affordable electric two- and three-wheelers. However, challenges like limited charging infrastructure, high upfront costs, and inconsistent policies slow progress. Innovative financing models, solar-powered charging stations, and platforms like EV24.africa are helping bridge gaps, signaling a promising shift toward cleaner mobility across Africa.

Focus On New Energy Vehicle Summit 2025: Leading the Charge to a Greener Tomorrow

Market Growth and Size: 2025 Projections

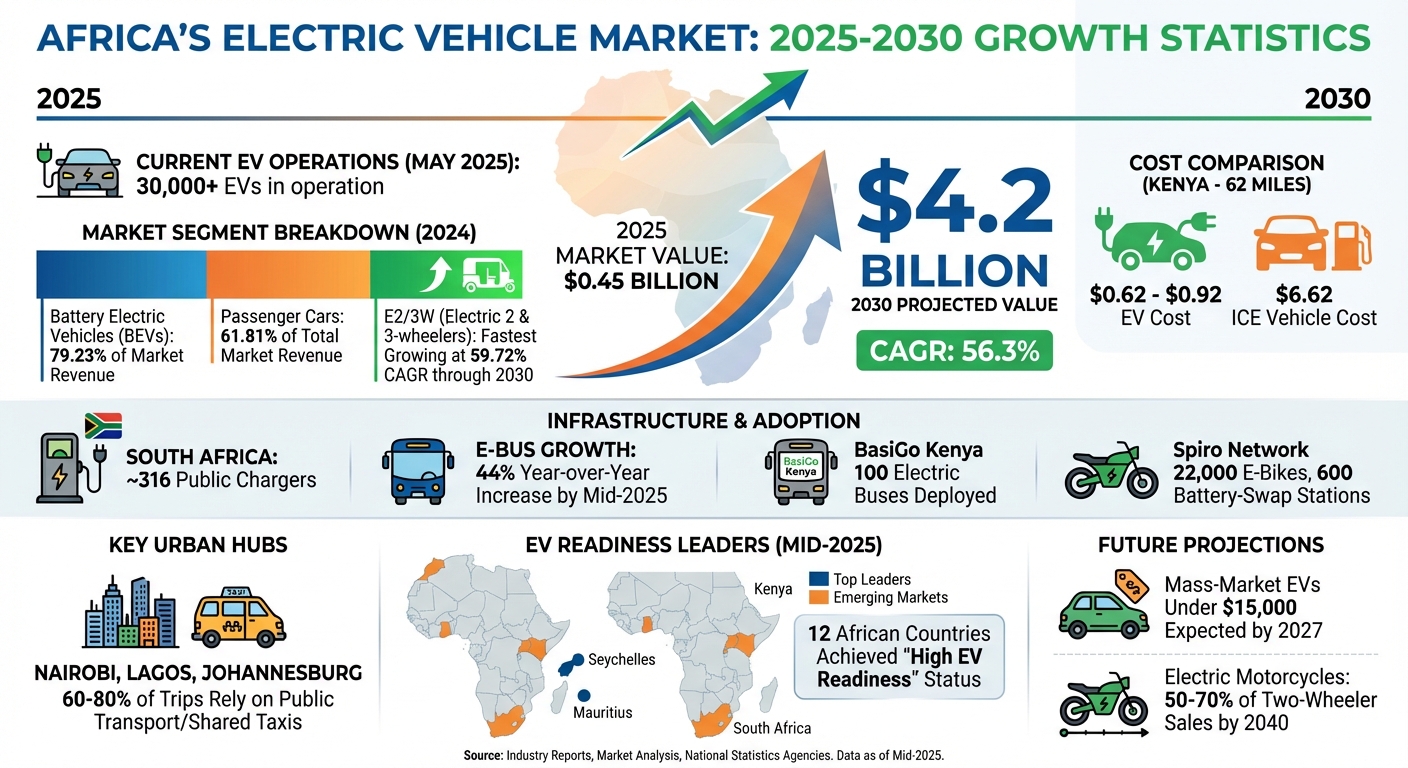

Africa Electric Vehicle Market Growth Statistics 2025-2030

Market Value and Vehicle Numbers

By 2025, Africa’s electric vehicle (EV) market is estimated to be worth $0.45 billion, showcasing its early but rapid expansion. As of May 2025, more than 30,000 EVs were already in operation across the continent, signaling a growing interest in electric mobility.

Looking further ahead, the market is expected to surge to $4.2 billion by 2030, with a compound annual growth rate (CAGR) of 56.3%. This impressive growth is being fueled by factors like falling battery prices, increased local assembly initiatives, and the anticipated arrival of mass-market EVs priced under $15,000 by 2027.

Regional and Segment Differences

The market’s growth reveals notable differences across regions and vehicle categories. In 2024, Battery Electric Vehicles (BEVs) claimed the largest share, contributing 79.23% of the market’s revenue, while passenger cars accounted for 61.81% of total market revenue. However, the fastest-growing segment is electric two- and three-wheelers (E2/3W), projected to expand at an impressive 59.72% CAGR through 2030.

East Africa, particularly Kenya and Tanzania, is leading the charge in the E2/3W market. Moto-taxi operators in these regions are increasingly opting for EVs due to their lower operational costs. For instance, in Kenya, driving 62 miles in an EV costs between $0.62 and $0.92, compared to $6.62 for a light-duty internal combustion vehicle. Companies like Spiro are capitalizing on this trend, deploying 22,000 electric bikes and establishing 600 battery-swap stations to support pay-per-use models.

Regional leadership varies by vehicle segment. South Africa dominates the light-duty passenger vehicle market, supported by around 316 public chargers, most of which are located in Gauteng. Egypt, on the other hand, has taken the lead in e-bus adoption, while East Africa continues to excel in the E2/3W category . E-bus deployments have grown significantly, with a 44% year-over-year increase by mid-2025. Companies like BasiGo have introduced 100 electric buses in Kenya, serving thousands of passengers daily.

Urban centers such as Nairobi, Lagos, and Johannesburg are key hubs for EV adoption, where 60–80% of trips rely on public transport or shared taxis – ideal conditions for commercial EV use. By mid-2025, 12 African countries had achieved "high EV readiness" status. Seychelles and Mauritius are leading the pack, followed by emerging markets like Kenya, Rwanda, Uganda, Ghana, South Africa, and Morocco. These regional dynamics highlight the opportunities and challenges shaping the future of Africa’s EV market.

What’s Driving EV Adoption in Africa

Government Policies and Incentives

Government actions are reshaping the electric vehicle (EV) landscape across Africa. A standout example is Ethiopia, which plans to enforce a complete ban on internal combustion engine (ICE) vehicle imports starting June 2025. This bold move aims to fast-track the nation’s shift toward electric mobility. Other countries, like Rwanda, Ghana, and Egypt, have introduced tax exemptions for EV sales and imports, making electric vehicles a more affordable option compared to traditional alternatives. Kenya and Uganda are also stepping up with their own comprehensive policies – Kenya’s Draft E-Mobility Policy and Uganda’s National Electric Mobility framework – designed to tackle challenges like high upfront costs and infrastructure gaps. Additionally, some governments are easing ownership costs by offering discounted electricity rates for EV charging.

However, the pace of policy adoption varies significantly. Only 28% of African nations have set at least one national EV target, and just 39% have implemented legally binding incentives for EVs. Chantelle Moyo, Policy Brief Author at Konrad-Adenauer-Stiftung, highlights Africa’s unique position in this transition:

"Africa must reposition itself to harness its competitive advantages, including access to mineral reserves required for battery-making… to ensure steady growth of the EV sector."

These policy efforts are being bolstered by advancements in technology and decreasing costs, making EVs more accessible.

Lower Costs and Better Technology

Falling prices and improved technology are breaking down barriers to EV adoption. By 2025, global lithium-ion battery production capacity is expected to hit 3.8 TWh, which is double the current demand. This oversupply is driving battery costs down significantly.

Charging technology is also advancing rapidly. In March 2025, BYD introduced its Super-e platform, which uses a 1,000V system to provide 248 miles (400 km) of range in just five minutes. Similarly, CATL’s Shenxing battery, developed in partnership with SAIC-GM in 2024, can recharge 40% of its capacity in five minutes, delivering 186 miles (300 km) of range. Meanwhile, the cost of ultra-fast charging units (150 kW and above) has dropped by 20% between 2022 and 2024.

Electric two-wheelers are emerging as an especially cost-effective option. Over a five-year lifecycle, they save about 25% in fuel and maintenance costs compared to their ICE counterparts. While their initial purchase price – around $1,700 to $1,800 – is slightly higher than ICE models, which cost about $1,300, the long-term savings make them a more economical choice.

These advancements are setting the stage for new trends in e-mobility across the continent.

New Trends in E-Mobility

With supportive policies and decreasing costs, new trends in e-mobility are unlocking opportunities across Africa. Electric motorcycles are leading the charge, projected to account for 50% to 70% of all two-wheeler sales by 2040. To accelerate this growth, Kenyan fintech companies like M-KOPA and Watu Credit are offering digital loans tailored for electric two-wheelers. This approach leverages Kenya’s 40% financial inclusion rate to bypass traditional banking systems.

Dedicated platforms are also making EVs more accessible. In March 2025, Africar Group and Auto24.Africa launched EV24.Africa, a pan-African marketplace offering buyers access to over 200 models from 25 global brands. The platform, led by CEO Axel Peyriere, simplifies the buying process by managing vetted suppliers and providing tools for financing and regulatory compliance tailored to each country.

Battery-swapping models are another game-changer, reducing range anxiety and cutting down charging times. Additionally, the Africa EV Readiness and Impact Index, set to launch fully in 2025, is providing policymakers with essential data on grid infrastructure, energy affordability, and power sector readiness. Rose Mutiso, Project Team Lead at Energy for Growth Hub, emphasizes the importance of localized strategies:

"Africa’s electric vehicle future can’t be built on guesswork… Key drivers of the EV transition in Africa will differ from those in mature markets, requiring tailored policies and infrastructure."

sbb-itb-99e19e3

Challenges Slowing EV Expansion

While electric vehicles (EVs) are gaining traction in Africa, several hurdles are holding back the market’s full potential. Issues like inadequate infrastructure, high costs, and inconsistent policies create significant barriers, slowing down progress in this promising sector.

Not Enough Charging Stations

Africa’s charging infrastructure is still in its infancy, especially outside major cities. Only 17% of African nations have more than 10 public charging stations, leaving vast regions without any EV charging options. For example, Ethiopia’s 2024 ban on petrol and diesel imports led to a surge of 100,000 electric vehicles, but the charging network remains largely confined to Addis Ababa. By mid-2025, garages struggled to find repair components, and the charging infrastructure barely extended beyond the capital.

Cities like Nairobi, Johannesburg, and Cape Town have relatively dense charging networks, but rural areas are left behind. In April 2024, BMW Group partnered with GridCars and City Power to install 60 fast-charging units in Johannesburg and Cape Town, yet these efforts remain localized.

Adding to the challenge is the unreliable power grid in countries like South Africa and Ghana, where frequent load-shedding disrupts electricity supply. In Lagos, Nigeria, diesel-powered backup generators are often used for EV charging, undermining the environmental benefits of going electric. A report from Market Data Forecast highlights the issue:

"Without substantial grid modernization, EV adoption risks becoming a niche phenomenon, disconnected from the broader energy system."

The lack of standardized charging protocols further complicates matters. Few African countries have adopted national EV charging standards, resulting in fragmented networks and compatibility issues. This is especially problematic in regions like West Africa, where the absence of harmonized grid codes and charging configurations discourages large-scale, cross-border EV deployments. These infrastructure gaps are deeply intertwined with financial and regulatory challenges, making the road to widespread EV adoption even steeper.

High Costs and Limited Financing

Beyond infrastructure woes, financial barriers remain a major obstacle. The upfront cost of EVs is prohibitively high for many African consumers. For instance, electric heavy-duty trucks often cost two to three times more than their diesel counterparts, deterring fleet operators. While battery pack prices dropped significantly in markets like Europe, the United States, and China during 2024, these reductions have not translated to Africa.

Although EV sales on the continent more than doubled in 2024, they still account for less than 1% of total car sales, a stark contrast to the 20% share in global markets. High import duties and taxes exacerbate the issue. For example, Zimbabwe imposes steep taxes on EV imports, while Morocco has reduced duties to 10%, spurring localized growth.

Financing options are another stumbling block. Many African consumers lack access to affordable loans or leasing programs, and the limited availability of market data makes it difficult for investors to provide tailored financial solutions or for policymakers to design effective incentives.

Uneven Policy Implementation

Policy inconsistencies across Africa add another layer of uncertainty for both investors and consumers. Only 28% of African countries have set national EV targets, and just 39% have legally binding EV incentives in place. This lack of clear direction undermines confidence in the market.

Policy reversals have been particularly damaging. For instance, Kenya and Uganda recently rolled back EV tax incentives, creating uncertainty for consumers and businesses alike. The absence of standardized regulations and charging infrastructure across borders further complicates fleet scalability and cross-border mobility.

| Policy Approach | Example Country | Impact |

|---|---|---|

| ICE Import Bans | Ethiopia | Rapid adoption (60% of new sales by early 2025), but infrastructure strain |

| Zero-Tariff Windows | Ghana (8-year window) | Attracts global OEM assembly commitments and improves affordability |

| VAT/Tax Exemptions | Kenya, Rwanda | Drives short-term registration surges but vulnerable to policy reversals |

Ghana’s eight-year zero-tariff window, which eliminates import duties on fully electric vehicles, has successfully attracted commitments from global manufacturers. However, such forward-thinking policies are rare. In many countries, high import duties on batteries and components remain a significant barrier, even as neighboring nations offer zero-duty incentives.

Adding to these challenges is a severe shortage of certified EV technicians. In Nigeria, for example, a country with over 200 million people, only a handful of certified technicians are available to service EVs, leading to prolonged vehicle downtimes. These gaps in technical expertise further hinder the growth of the EV market across the continent.

Opportunities for Stakeholders in the African EV Market

Africa’s electric vehicle (EV) market is brimming with potential. Tailored charging solutions and innovative financing models could reshape the industry while addressing local challenges.

Building More Charging Infrastructure

The shortage of charging infrastructure creates a prime opportunity for businesses. Solar-powered charging stations are particularly effective in regions with limited or unreliable grid access. For example, the Lagos Island Solar Initiative in Nigeria has introduced photovoltaic charging stations to power e-buses and e-taxis, bypassing grid challenges entirely. Battery-swapping is another promising solution to minimize charging downtime and reduce upfront costs. A notable example is Renault‘s battery-swapping pilot launched in January 2024 in Casablanca, Morocco, in collaboration with the national utility ONEE.

Additionally, retired EV batteries, which retain about 70% of their original capacity, can find a second life powering essential facilities like health clinics and community centers. Stellenbosch University‘s ReCell project in South Africa is a great example – integrating second-life EV batteries into solar mini-grids to lower energy costs in rural areas.

Pay-Per-Use and Flexible Financing Models

High upfront costs remain a significant hurdle for EV adoption, but creative financing models are helping to break down these barriers. Battery-as-a-Service (BaaS), for instance, separates battery costs from the vehicle, allowing users to pay solely for the energy they use. Spiro has pioneered this model in Africa, operating 22,000 e-bikes and 600 battery-swapping stations across multiple countries. To date, they’ve facilitated 9 million battery swaps under a pay-per-use system.

Leasing programs are also gaining traction. In 2023, the Renault-Nissan Alliance collaborated with the African Development Bank to launch EV leasing initiatives for small businesses in Senegal and Côte d’Ivoire. Similarly, in April 2024, Roam Electric partnered with the County Bus Service in Kenya to roll out 200 electric buses by 2026, aiming to cut energy costs by 50% compared to diesel buses.

How EV24.africa Supports Market Access

Digital platforms like EV24.africa are playing a key role in addressing market challenges. By tackling infrastructure and financing gaps, EV24.africa simplifies access to EVs and flexible ownership options. The platform offers a wide range of new and used EVs from top brands like Tesla, BYD, Leapmotor, ROX, Dongfeng, Geely, Hyundai, Toyota, and Suzuki. It ensures transparent pricing and reliable delivery across all 54 African countries.

EV24.africa also bridges the affordability gap by facilitating asset financing and flexible ownership models. Buyers can access detailed car specifications, customer reviews, and dealership branding, enabling informed decisions while expanding reach for sellers.

"Emerging markets are no longer catching up, they are leading the shift to electric mobility."

This statement from Euan Graham, Electricity and Data Analyst at Ember, underscores the importance of platforms that connect buyers, sellers, and financing options. They are critical for addressing the data gaps that have long hindered the African EV market.

Conclusion: What’s Next for Electric Mobility in Africa

By 2025, Africa’s electric vehicle market finds itself at a pivotal moment. The continent has a unique opportunity to bypass traditional combustion engine technology and embrace a cleaner, more sustainable future. Achieving this vision, however, requires teamwork. Governments need to align policies with market realities, private companies must invest in charging infrastructure – particularly in areas with existing parking and charging hubs – and international partners should step in to address long-standing data gaps that have discouraged investor confidence. The numbers make the case for urgency and action.

Transportation contributes 10% of Africa’s total greenhouse gas emissions, and with nearly 40% of the world’s used vehicles landing on the continent, the risk of becoming a dumping ground for outdated and polluting internal combustion vehicles looms large. Yet, there are clear signs of progress. For instance, electric two-wheelers are already 25% cheaper over a five-year lifecycle compared to their combustion engine equivalents, and the steady drop in battery prices is making imported electric models increasingly accessible.

"Without context-specific data and analysis, African policymakers and investors are flying blind." – Rose Mutiso, Hamna Tariq, and Daniel Johansson, Energy for Growth Hub

This quote highlights the importance of platforms like EV24.africa, which offer the data and tools needed to shape effective investment and policy decisions. The demand for electric vehicles is growing fast. In just three months after its launch in 2025, EV24.africa recorded over 350 qualified vehicle requests from more than 30 African countries, signaling a wave of interest and accelerating momentum. To keep this growth on track, efforts must focus on standardizing battery specifications, expanding asset financing options, and educating consumers on the total cost of ownership.

Africa isn’t merely catching up – it’s charting its own course. With well-crafted policies, innovative financing solutions, and streamlined access through platforms like EV24.africa, the continent is already driving its electric mobility revolution. The question now isn’t whether Africa will electrify its transportation systems, but how quickly stakeholders can come together to make it happen.

FAQs

What are the key challenges slowing down electric vehicle adoption in Africa?

Africa faces several hurdles when it comes to the adoption of electric vehicles (EVs). One of the biggest challenges is the absence of reliable, continent-wide data. Without this, governments and investors struggle to design effective policies or gauge the potential of the EV market. This lack of information creates uncertainty and slows progress.

Another key issue is the underdeveloped EV policies in many African nations. Paired with limited access to financing, this makes EVs out of reach for most individuals and businesses. Simply put, the high upfront costs of EVs remain a tough sell for consumers and fleet operators alike.

Then there’s the problem of charging infrastructure – or the lack of it. Charging networks are sparse, often fragmented, and heavily impacted by unreliable electricity grids. This makes it challenging to support widespread EV usage, especially in rural or less-developed areas.

Finally, economic factors play a major role. Many African countries have low average income levels and historically low vehicle ownership rates. Even a small price gap between EVs and traditional vehicles can deter potential buyers. Together, these issues create significant roadblocks to the growth of EV adoption across the continent.

How are new financing options making electric vehicles more affordable in Africa?

Innovative financing models are making electric vehicles (EVs) more affordable and accessible in Africa by tackling the high upfront costs that often discourage potential buyers. Options like low-interest loans, lease-to-own plans, and pay-as-you-go battery services allow consumers to break down payments into manageable installments, eliminating the need for a hefty initial outlay.

These initiatives typically thrive on collaborations between development organizations, private investors, and local entrepreneurs. By blending donor contributions with commercial funding, they create practical solutions that cater to middle-income buyers and small businesses. This approach not only reduces costs for consumers but also helps expand EV infrastructure and services, laying the groundwork for broader adoption across the continent.

Which African countries are leading the way in adopting electric vehicles, and what factors are driving their progress?

Morocco, South Africa, Seychelles, and Mauritius are at the forefront of electric vehicle (EV) adoption in Africa, with Rwanda, Ghana, Nigeria, and Angola also stepping into the spotlight. These countries are making strides thanks to a mix of supportive government policies, dependable power grids, and early investments in charging infrastructure. For instance, Morocco and South Africa have rolled out national incentives for EV buyers and are actively expanding public charging networks, positioning themselves as key markets for EV expansion.

Island nations like Seychelles and Mauritius are taking a different approach by adopting proven strategies from more developed regions. This has sped up the transition to electric options for both private and public transportation. Meanwhile, countries like Ghana and Rwanda are tapping into Africa’s rich reserves of cobalt and lithium to build local battery supply chains, which not only attract investment but also boost consumer trust. These combined efforts are laying a solid groundwork for the growth of e-mobility across the continent.