Electric vehicles (EVs) are transforming transportation in East Africa, with Rwanda, Kenya, and Uganda taking distinct approaches to adoption. These countries are leveraging tax incentives, infrastructure development, and local manufacturing to make EVs more accessible. Here’s a quick breakdown:

- Rwanda: Focuses on tax exemptions for EVs, expanding charging networks, and electrifying motorcycles and buses.

- Kenya: Combines policy reforms, private investments, and local assembly to target a 5% EV market share by the end of 2025.

- Uganda: Prioritizes government investment and local production, aiming for full EV adoption in public transport by 2040.

Challenges like high costs and limited infrastructure remain, but platforms like EV24.africa are simplifying EV access by offering transparent pricing, financing options, and delivery services, driving the region’s progress toward cleaner transportation.

Kenya’s Bold Move: The EV Company Set to Disrupt African Automotive!

Rwanda: Leading EV Policies and Infrastructure

Rwanda is at the forefront of East Africa’s electric vehicle (EV) movement, thanks to its well-defined policies and targeted initiatives. The government is focused on making EV adoption more accessible by reducing financial hurdles and improving infrastructure. This comprehensive strategy covers key areas like tax incentives, charging networks, and integrating EVs into public transportation.

Tax Incentives for EV Adoption

To make EVs more affordable and attract investment, Rwanda offers a range of tax benefits. These include reduced import duties, special tax rates for EV-related businesses, and exemptions on certain taxes. These measures aim to lower the initial costs for consumers and encourage businesses to invest in the sector.

Expanding Charging Infrastructure

The government, in collaboration with private companies, is working to establish a robust network of charging stations. These stations are being set up not just in cities but also in rural areas, addressing accessibility issues and encouraging more widespread EV use.

Focus on Electric Motorbikes and Public Transit

Rwanda is also prioritizing the electrification of its commercial motorcycle fleets, a significant part of its transportation system. Through financial support programs, businesses are transitioning to electric motorbikes. Additionally, the government is piloting electric buses in public transit systems. Plans to explore local assembly and manufacturing of EVs are also in motion, aiming to create jobs and build a self-sustaining automotive industry.

Kenya: Growing EV Market Through Investment

Kenya is making strides in electric vehicle (EV) adoption by combining government initiatives, policy changes, and private sector partnerships. While Rwanda focuses heavily on charging infrastructure, Kenya is taking a broader approach, emphasizing policy reforms and market investments to accelerate the shift to EVs. This proactive strategy is paving the way for private sector involvement, as we’ll explore further.

Government Targets and Policy Support

Kenya has set an ambitious goal: 5% of all vehicle sales to be electric by the end of 2025. To make this a reality, the government has introduced policies aimed at reducing costs and improving access to EVs.

The Finance Bill 2025 offers substantial tax breaks for e-mobility, including VAT exemptions on electric bicycles and buses. Kenya’s focus isn’t limited to private vehicles; the government plans to fully electrify its public bus fleet by 2027. This bold move highlights its commitment to clean transportation and sets an example for other sectors to follow.

Additionally, the Draft National E-mobility Policy aims to boost local production by prioritizing the development of the e-mobility value chain, especially for two- and three-wheelers and buses. Supporting this, Kenya’s Energy Transition and Investment Plan (ETIP), adopted in 2023, outlines the investments required to achieve net-zero emissions by 2050. Together, these policies create a robust framework for EV adoption and local industry growth.

Private Companies Building Charging and Assembly

Kenya’s private sector is stepping up to meet the growing demand for EV infrastructure and manufacturing. The government’s plan to install 1,000 EV charging stations by 2027 has opened the door for private companies to play a significant role in expanding charging networks.

Industry leaders are optimistic about the future, pointing to Kenya’s draft e-mobility policy as a key driver of growth. The Draft National Energy Policy 2025-2034 further supports this momentum by promoting local manufacturing hubs for renewable energy technologies and components. This creates opportunities for businesses to establish assembly plants and produce EV parts domestically, which can help lower costs and generate jobs. Private companies are already investing in these areas, building the foundation for a sustainable EV market in Kenya.

Consumer Interest and Cost Challenges

While government policies and private investments are creating a favorable environment, high upfront costs remain a significant barrier for many consumers. Limited financing options make it even harder for potential buyers, as traditional auto loans often don’t cater to the unique needs of EV purchases.

There’s a noticeable gap between consumer interest and affordability. Although awareness of EVs is rising and policies are addressing some cost concerns, most Kenyan consumers still lean toward conventional vehicles due to their lower initial price and more accessible financing options. However, VAT exemptions on electric bicycles and buses are starting to make a difference, particularly for commercial operators and individuals looking for affordable two-wheeled EV options. These measures are gradually improving accessibility and helping to bridge the affordability gap in key market segments.

Uganda: Building EV Market Momentum

Uganda is making bold moves to establish a thriving electric vehicle (EV) market by combining substantial government investment with local manufacturing efforts. The country’s approach focuses on creating a robust ecosystem that serves both domestic and regional markets.

Government Support and Market Demand

The Ugandan government has committed heavily to the electric mobility sector, investing 70% of the over $160 million allocated to the e-mobility ecosystem between 2018 and 2024. This investment spans areas like research and development, manufacturing, and charging infrastructure. Such financial backing underscores Uganda’s determination to develop a thriving EV industry.

Guided by its National E-Mobility Strategy, Uganda has set ambitious goals: transitioning public transport and motorcycles to electric by 2030, with a full shift to EV sales by 2040. To achieve these milestones, the government has implemented fiscal and non-fiscal measures aimed at attracting investment and building local production capacity.

Beyond setting goals, Uganda has adopted a data-driven approach to track its progress. The Ministry of Science, Technology, and Innovation releases the annual Uganda E-Mobility Outlook Report, which evaluates market developments and challenges. This ensures that policies and investments remain aligned with real-world needs. While the government’s efforts lay a strong foundation, infrastructure remains a key area requiring attention.

Infrastructure Challenges and Regional Trade

Despite the government’s significant investment, gaps in Uganda’s charging infrastructure persist, especially in rural areas and along major transportation routes. Addressing these issues is essential to encourage widespread EV adoption.

Uganda’s position within the East African Community (EAC) brings both opportunities and challenges. The EAC has been a major source of investment, contributing $1.4 billion in planned investments in Uganda during 2023/24, which accounted for 54% of all planned investments that year. These regional investments open doors for cross-border EV trade and collaborative infrastructure projects.

The Uganda Investment Authority (UIA) plays a central role in fostering these partnerships. Licensing over 380 new investment projects annually, surpassing its target of 300, the UIA has helped channel investments into manufacturing and technology sectors critical to the EV industry. Uganda’s industrial parks are already producing electric vehicles, showcasing the nation’s growing manufacturing capabilities and its potential to serve regional markets.

Growth Opportunities in Uganda’s EV Market

Uganda’s local manufacturing sector has the capacity to produce up to 10,000 EVs annually, with 40% of the components sourced locally. This capability not only supports domestic demand but also opens up opportunities for exports to neighboring countries.

The investment climate in Uganda is particularly welcoming for EV-related businesses. In the fiscal year 2023/24, Ugandan investors accounted for 37.3% of all licensed projects, reflecting strong local participation in the sector. This mix of domestic and foreign investments provides a solid base for the EV market’s expansion.

Several key growth areas stand out:

- Charging Infrastructure: Developing a nationwide charging network presents significant opportunities for private sector involvement.

- Battery Technology: Advancing battery production and exploring second-life applications, such as energy storage for off-grid communities, are gaining traction. Pilot projects in this area are already underway.

- Investment Incentives: The UIA offers attractive incentives to encourage participation. Domestic investors, for example, face a lower threshold of $50,000 to qualify for benefits, compared to $250,000 for foreign investors. Additionally, the authority connects investors with affordable financing options from government and development partners.

With its mix of government backing, local manufacturing strength, and regional partnerships, Uganda is positioning itself as a leader in East Africa’s transition to electric mobility. The country’s ambitious goals, significant investments, and focus on innovation provide a strong foundation for the EV market to flourish in the years ahead.

sbb-itb-99e19e3

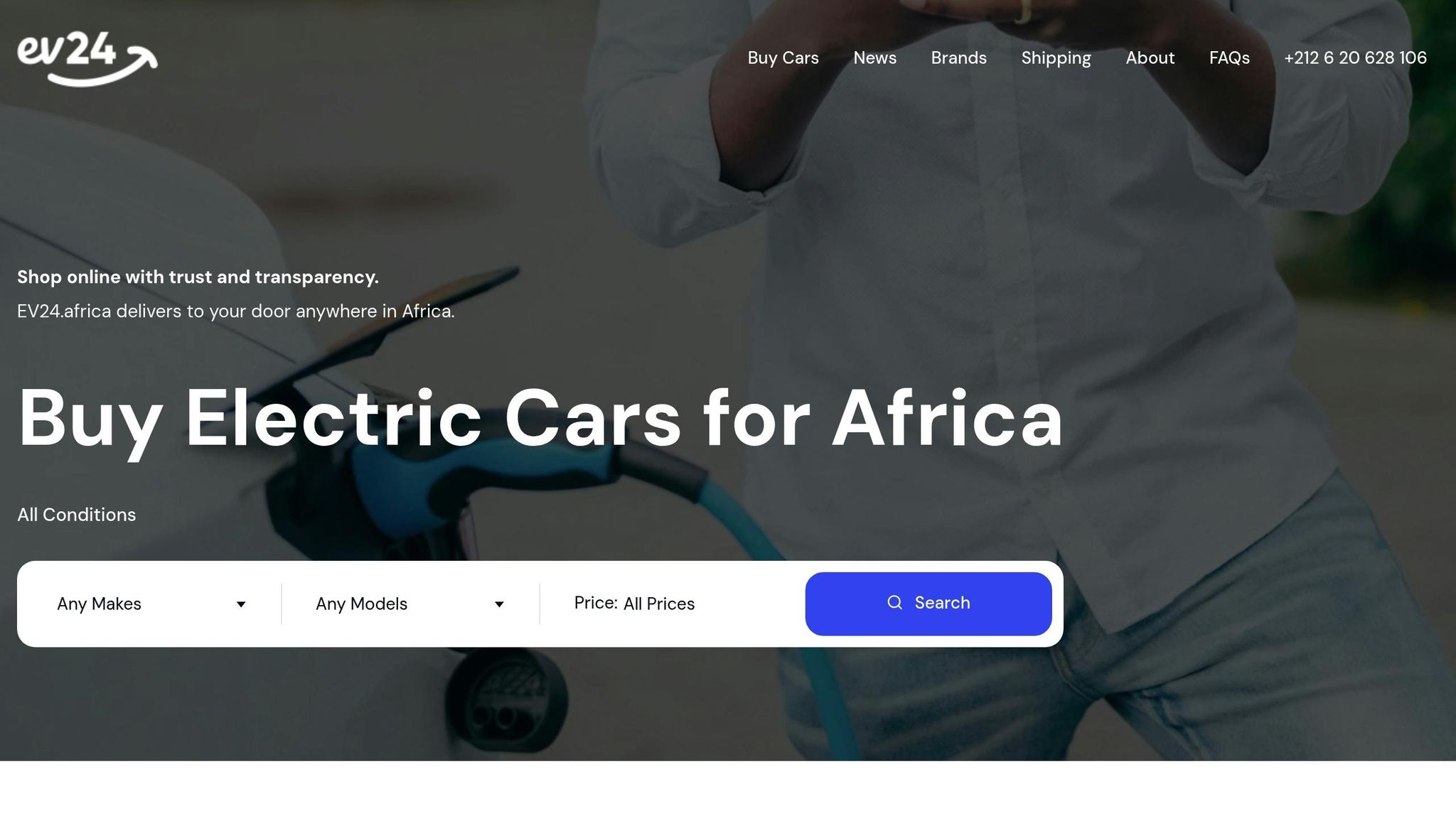

EV Marketplace: EV24.africa‘s Role in East Africa

As electric vehicles gain momentum in Rwanda, Kenya, and Uganda, EV24.africa has positioned itself as a key player in connecting East African consumers with the global EV market. By simplifying the import and purchase process, the platform addresses challenges like complicated procedures, unclear pricing, and limited local availability. This makes it easier for consumers in the region to access a variety of electric vehicles while supporting the broader shift toward sustainable transportation.

EV Brands and Models Available

EV24.africa offers an impressive selection of global EV brands, giving consumers plenty of choices. Some of the well-known names featured on the platform include Tesla, BYD, Volkswagen, XPeng, Leapmotor, Changan, Wuling, Mercedes-Benz, Citroën, and Peugeot.

The platform caters to a wide range of budgets and needs:

- The GEELY PANDA MINI BASE, priced at $5,880, is perfect for first-time EV buyers looking for affordability.

- The BYD DOLPHIN ACTIVE, available at $11,800, provides a solid mid-range option.

- For those seeking luxury and advanced features, the ZEEKR 009 is offered at $85,000.

Practical vehicles like the LEAPMOTOR C10 at $18,900 and the GEELY EMGRAND EV at $21,290 are also part of the lineup. These models align with the growing demand for electric motorcycles and public transport vehicles, particularly in Rwanda, where all public transport motorbikes must be electric by January 2025. With such variety, EV24.africa meets the needs of diverse consumer groups across the region.

Transparent Pricing and Financing Options

One standout feature of EV24.africa is its transparent pricing, listed in U.S. dollars. This clarity removes the guesswork often associated with vehicle imports, empowering buyers to make informed decisions. For example:

- The BYD ATTO 3 2025 is priced at $47,500.

- The DONGFENG eπ 008 EV comes in at $28,700.

- The AITO M5 EV 365 Kw is available for $39,410.

Detailed specifications accompany each listing, so buyers know exactly what they’re getting.

To make EV ownership more attainable, the platform also offers flexible financing options. This is particularly important in regions like Kenya, where cost remains a significant barrier to EV adoption. By bridging the gap between consumer interest and affordability, EV24.africa plays a pivotal role in accelerating the transition to electric mobility.

Delivery and Customer Support Across East Africa

EV24.africa goes beyond just selling vehicles – it provides a seamless experience from purchase to delivery. The platform handles logistics such as customs clearance and local registration, ensuring customers in Rwanda, Kenya, and Uganda receive their vehicles without the usual headaches of navigating import regulations.

Door-to-door delivery means buyers don’t have to worry about the complexities of transporting their new EVs. This service is especially valuable given the differing regulatory requirements across the three countries.

The platform’s commitment to customer satisfaction doesn’t end with delivery. Ongoing customer support ensures that buyers have assistance throughout their ownership journey. By simplifying logistics and offering robust support, EV24.africa complements government initiatives and private sector investments, helping to drive East Africa’s transformation into an EV-friendly region.

Comparing Rwanda, Kenya, and Uganda’s EV Progress

Rwanda, Kenya, and Uganda are all making strides in embracing electric vehicles (EVs), but their approaches vary significantly when it comes to policies, infrastructure, and market readiness. These differences reveal the unique strategies each country is employing to accelerate EV adoption. Let’s dive into how these elements shape the EV landscape across the three nations.

Policy, Infrastructure, and Market Comparison

Rwanda has adopted a bold approach by introducing sweeping tax exemptions for fully electric vehicles, while imposing taxes on hybrids. In February 2025, the Ministry of Finance and Economic Planning announced that pure EVs would be exempt from VAT, withholding tax, and excise duty. On the other hand, hybrid vehicles remain taxed, ensuring the country avoids becoming a dumping ground for outdated hybrid models.

Kenya, as of March 2025, has significantly reduced import duties on EVs to 10%, down from the 35% rate applied to fuel-powered vehicles. Additionally, excise duties have been cut from 20% to 10%, and the 16% VAT has been entirely removed for EVs, making them more accessible to consumers.

Uganda, however, is still in the process of crafting its EV policy framework. Tax incentives specific to EVs have yet to be clearly outlined, leaving room for further development in this area.

| Policy Aspect | Rwanda (Feb 2025) | Kenya (Mar 2025) | Uganda |

|---|---|---|---|

| Import Duty | Fully exempt for pure EVs | Reduced to 10% (from up to 35%) | Not specified |

| Excise Duty | Exempt for pure EVs; hybrids taxed | Reduced from 20% to 10% | Not detailed |

| VAT | Exempt for pure EVs; hybrids taxed | Removed for EVs | Not detailed |

| Hybrid Policy | Discouraged through taxation | No specific restrictions | Not specified |

In addition to fiscal policies, Rwanda is leading the way in infrastructure and recycling initiatives. The country operates Enviroserve Rwanda, a cutting-edge e-waste recycling facility located in Bugesera Industrial Park. This facility plays a crucial role in managing used batteries, including collection, testing, refurbishing, and recycling.

Kenya and Uganda, while still developing their recycling capabilities, are forming partnerships with international companies and setting up local recycling centers to address battery waste management.

Kenya also benefits from robust private sector investments and a growing consumer interest in EVs, propelling its market forward. Uganda, on the other hand, is still in the early stages, focusing on building the necessary infrastructure to support long-term EV adoption.

Conclusion: East Africa’s EV Future

East Africa’s shift toward electric vehicles is picking up speed. While hurdles like infrastructure gaps – particularly in rural areas – remain, rapid urbanization and the growing demand for cleaner transportation are pushing the movement forward. This momentum provides an opportunity for platforms like EV24.africa to play a pivotal role in shaping the region’s electric mobility landscape.

EV24.africa has quickly positioned itself as a leading electric vehicle marketplace in Africa, bridging the gap between buyers and over 50 global manufacturers. Its success is rooted in the supportive policies and investment efforts discussed earlier.

"In just three months, we’ve proven that the demand for electric mobility in Africa is not only real but accelerating. Our team is building more than a marketplace – we are laying the infrastructure and services to support Africa’s electric transition at scale", says Younes Rabeh, EV24.africa Business Manager.

This achievement highlights the region’s dedication to embracing an electrified future.

To tackle infrastructure challenges, the platform offers solar-powered off-grid charging solutions tailored for rural areas. Additionally, its logistics network spans 20 African ports, ensuring dependable vehicle delivery. With successful deliveries already made in ten African countries, EV24.africa is paving the way for sustainable electric mobility across East Africa.

As advancements in infrastructure and technology continue, East Africa is well-positioned to lead the way toward cleaner and more sustainable transportation solutions.

FAQs

What challenges do Rwanda, Kenya, and Uganda face in growing their electric vehicle infrastructure, and how are they overcoming them?

Rwanda, Kenya, and Uganda are making notable progress in embracing electric vehicles (EVs), but they face hurdles like limited grid capacity, high EV technology costs, and a lack of charging infrastructure. These challenges, typical in emerging markets, are being tackled with creative strategies.

Rwanda is rolling out a national EV charging master plan to ensure charging stations are spaced no more than 30 miles (50 km) apart, while also incorporating renewable energy into its power grid. Kenya has set an ambitious goal to install 1,000 charging stations by 2027, supported by government incentives and policies. Meanwhile, Uganda is revising import regulations and providing tax breaks to make EVs more affordable and accessible. These combined efforts are paving the way for a robust EV ecosystem across East Africa.

How does EV24.africa help drive electric vehicle adoption in Rwanda, Kenya, and Uganda, and what services make it stand out?

EV24.africa is paving the way for greater electric vehicle adoption in East Africa by making EV ownership more straightforward and accessible. The platform streamlines the import process, offers a wide selection of EV models, and supports the creation of infrastructure designed to meet the region’s specific needs.

Its key offerings include helping customers in Rwanda, Kenya, and Uganda with hassle-free purchasing and importation. Additionally, EV24.africa is introducing forward-thinking solutions such as battery-swap stations and integrating renewable energy into the mix. By tackling challenges like affordability, accessibility, and infrastructure gaps, the company is speeding up East Africa’s shift toward cleaner, more sustainable transportation.

How do Rwanda, Kenya, and Uganda differ in their policies and readiness for adopting electric vehicles?

Rwanda, Kenya, and Uganda: Different Paths to EV Adoption

When it comes to embracing electric vehicles (EVs), Rwanda, Kenya, and Uganda each have their own strategies, shaped by distinct policies and market conditions.

Rwanda has positioned itself as a regional leader by rolling out aggressive government incentives like tax exemptions. The country places a strong emphasis on electric motorcycles and building charging infrastructure to support EV growth. Private sector investments have further fueled these efforts, solidifying Rwanda’s leadership in the EV space.

Kenya is taking a slightly different route, focusing on reduced EV taxes and working on regional initiatives to standardize regulations. With a growing urban population and government-backed incentives, Kenya is steadily expanding its EV market, though its approach is less aggressive than Rwanda’s.

Uganda, while making progress, faces more hurdles. Policy reforms and funding initiatives are helping the country push forward, but challenges in infrastructure and market development have slowed its pace compared to its neighbors.

In summary, Rwanda’s bold incentives and infrastructure investments set it apart, while Kenya’s regulatory efforts and Uganda’s gradual reforms showcase the varied stages of EV adoption in the region.