Chinese electric vehicles (EVs) are reshaping Africa’s car market. Here’s why:

- Affordability: Brands like BYD and Chery offer EVs priced significantly lower than Western competitors, making them accessible to African buyers. For example, BYD‘s Seagull costs $26,100 compared to higher-priced Western models.

- Local Production: Chinese automakers are setting up assembly plants in countries like Egypt and Kenya, reducing costs and addressing local infrastructure challenges.

- Infrastructure Focus: Partnerships with governments and startups are improving charging networks and public transport electrification, such as BYD’s collaboration with BasiGo in Kenya.

- Adaptation to Needs: Companies like Chery prioritize plug-in hybrids (PHEVs) to address unreliable power grids.

- Market Expansion: Platforms like EV24.africa connect buyers across Africa with affordable EVs, transparent pricing, and financing options.

Chinese brands dominate because they meet Africa’s demand for affordable, reliable, and locally tailored solutions.

1. BYD

Affordability

BYD’s knack for producing affordable electric vehicles (EVs) is rooted in its strategy of vertical integration. Since its early days as a battery manufacturer, the company has focused on producing 75% of its parts in-house. This approach significantly cuts costs, giving BYD a clear edge over traditional automakers who rely on external suppliers.

From 2009 to 2023, BYD benefited from around $231 billion in Chinese government subsidies, which helped the company scale up production and lower prices for global markets. These subsidies enabled BYD to launch competitively priced models like the Seagull (also called the Dolphin Surf), which costs as little as $7,789 in China. Even with export pricing at $26,100, the Seagull remains far more affordable than similar Western EVs, while still offering advanced smart features and driver assistance systems.

This pricing approach has been instrumental in BYD’s push into emerging markets, where cost is often a major barrier to EV adoption.

Market Penetration

BYD is making major strides in expanding its presence across Africa. In South Africa, for example, General Manager Steve Chang outlined plans to increase the dealership network from 20 locations in 2025 to 30–35 locations by the end of 2026. This expansion supports BYD’s six-model lineup and ensures that new EV owners have access to essential maintenance services.

What sets BYD apart is its 18-month development cycle, which is much faster than the 4-to-5-year timelines typical of Western automakers. Since 2020, BYD has launched over 40 new models and rolled out 139 updates, offering African buyers a wide range of options across different price points. This agility has helped BYD secure a 19.3% share of the global EV market (including plug-in hybrids) by late 2025.

Infrastructure Support

Beyond affordability and market penetration, BYD is also investing in local infrastructure development. In Kenya, the company has partnered with Nairobi-based startup BasiGo to electrify public transportation. Through this collaboration, BasiGo imports BYD electric bus components for local assembly and offers a "pay-as-you-drive" financing model. This setup reduces fuel costs by 5% to 15% compared to traditional diesel buses, with plans to deploy 1,000 electric buses across East Africa by 2028.

"Chinese EV companies are not waiting for Africa’s EV market to mature. They are engineering the conditions for its emergence, controlling vehicles, batteries, financing, and infrastructure simultaneously." – Njenga Hakeenah, Analyst, China-Global South Project

BYD is also addressing critical concerns like charging infrastructure and range anxiety. In March 2025, the company revealed a new battery technology capable of delivering 248 miles (400 km) of range with just five minutes of charging. Alongside this, BYD is building charging networks and training local technicians in EV maintenance and repair, ensuring long-term reliability for its vehicles.

2. Chery

Affordability

Chery has established itself as the second-largest Chinese automaker in South Africa, primarily by focusing on affordability. The company offers advanced technology at a fraction of the cost of legacy brands.

To cut costs further, Chery is considering local partnerships and even building a factory in South Africa. This move would reduce import duties, secure government incentives, and ultimately lower prices for buyers.

Instead of diving straight into fully electric vehicles, Chery is focusing on plug-in hybrids (PHEVs). This approach makes sense in regions where power grids can be unreliable. With PHEVs, drivers have the option to switch to gasoline when charging isn’t feasible. Chery aims to keep the starting price for these vehicles under $22,500, making them accessible to a broader audience.

"As long as they remain affordable from an up-front cost perspective, they will be differentiated against legacy brands offering similar specifications." – Greg Cress, Advisory Firm Accenture

This pricing strategy has helped Chery quickly establish a strong presence in the market.

Market Penetration

South Africa serves as Chery’s gateway for expansion across Africa. Through its premium brand, Omoda & Jaecoo, the company operates 52 dealerships across South Africa, Namibia, Eswatini, and Botswana as of June 2025.

On June 20, 2025, Chery unveiled its "Super Hybrid" (CSH) lineup at Montecasino in Johannesburg. The launch introduced eight hybrid models, including five extended-range plug-in hybrids and three traditional hybrids. This came at a pivotal time, as new energy vehicle sales in South Africa doubled to 15,611 units, accounting for 3% of total new vehicle sales [18, 19].

Chery’s plans extend beyond Southern Africa. In late 2024, the company announced the creation of a dedicated assembly line in Kenya, aiming to localize production for East African markets.

"Based on our experience in China, once the market share of new energy vehicles reaches almost 10%, then the demand will start to explode." – Tony Liu, CEO of Chery South Africa

Infrastructure Support

Chery isn’t just selling cars – it’s adapting to Africa’s unique challenges. By prioritizing plug-in and extended-range hybrids, the company ensures its vehicles remain practical even in areas with limited charging infrastructure.

In October 2023, Riccardo Tonelli, a senior vehicle-dynamics expert, spearheaded a six-week redesign of the Omoda 5 SUV at Zhaoyuan’s proving grounds in China. His team fine-tuned the vehicle to handle Africa’s tough road conditions. Using a "fail-fast" approach, Chery delivered these upgrades to dealers in under two years – well ahead of the typical 12-month timeline seen with legacy automakers.

"Battery electric vehicles have not really taken off in South Africa. We’ve gone the route of looking more towards traditional hybrids or plug-in hybrids." – Hans Greyling, General Manager, Omoda & Jaecoo South Africa

Plans for local assembly in South Africa and Kenya are also expected to strengthen the supply chain and ensure easier access to spare parts across the continent.

How Chinese EV Makers Are Building a Lead in African Countries

sbb-itb-99e19e3

3. EV24.africa

EV24.africa plays a pivotal role in driving electric vehicle (EV) adoption across Africa, acting as a key marketplace that connects buyers with affordable and accessible EV solutions.

Affordability

One of EV24.africa’s strengths lies in addressing the cost barriers that often hinder EV adoption in Africa. By offering budget-friendly vehicles and financing options tailored to local economic conditions, the platform makes EV ownership more feasible. For many, high upfront costs and limited access to credit have been significant obstacles, but EV24.africa bridges this gap with transparent pricing and flexible payment plans suited to the region’s realities.

As Chinese manufacturers increasingly embrace local assembly, EV24.africa connects buyers to these locally made EVs, which avoid certain trade restrictions. This approach helps reduce prices further, filling the void left by the absence of government incentives in many countries. By focusing on affordability, the platform is setting the stage for broader adoption across the continent.

Market Penetration

EV24.africa serves as a central hub, linking buyers across all 54 African nations to leading Chinese EV brands, including BYD, Leapmotor, ROX, Dongfeng, and Geely. With a strong dealer network, the platform supports the shift from importing fully assembled vehicles to fostering local assembly partnerships. This shift makes EVs more accessible in major markets like Kenya, Egypt, and Nigeria.

The marketplace simplifies the buying process by listing both new and used EVs, complete with detailed specifications and user reviews. Reliable delivery options further lower the barriers for first-time buyers, even in remote areas.

Infrastructure Support

Beyond affordability and accessibility, EV24.africa tackles one of Africa’s biggest EV challenges: charging infrastructure. Recognizing the limitations in existing charging networks, the platform emphasizes vehicles that are better suited to regions with minimal infrastructure. Additionally, it highlights partnerships between Chinese manufacturers and local renewable energy providers, such as collaborations to develop solar-powered charging solutions. These efforts aim to expand the charging network and build consumer confidence, particularly in countries like Nigeria, where infrastructure development is still a work in progress.

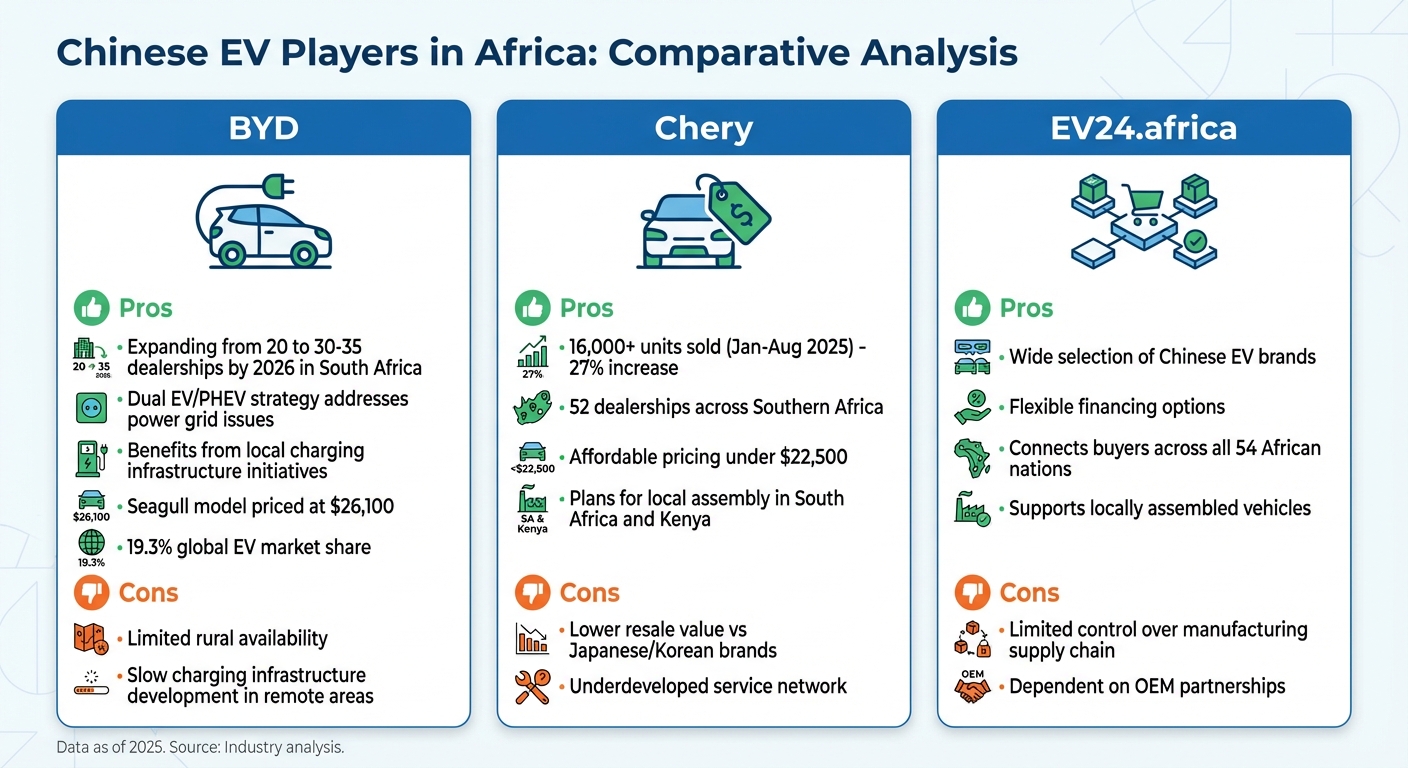

Pros and Cons

Chinese EV Brands in Africa: BYD vs Chery vs EV24.africa Comparison

Africa’s EV market is a complex landscape, with each player bringing its own strengths and challenges. Below is a closer look at how key participants are shaping the adoption of electric vehicles across the region.

BYD is set to grow its presence in South Africa, planning to expand from 20 dealerships to 30–35 by 2026. Its dual powertrain approach – offering both electric and plug-in hybrid models – helps address issues like unreliable power grids. The brand also benefits from local efforts to develop charging infrastructure, making EVs more accessible. However, rural areas still face significant hurdles due to the slower rollout of public charging stations.

Chery has achieved strong sales momentum, moving over 16,000 units in South Africa between January and August 2025 – a 27% increase. With a network of 52 dealerships and plans for local assembly, Chery is well-positioned to grow further. Its competitive pricing, with models starting under $22,500, makes it an attractive option for many buyers. On the downside, Chery vehicles generally have lower resale values compared to more established Japanese and Korean brands, and its service network is still a work in progress.

EV24.africa aggregates several leading Chinese EV brands onto a single online platform. Its flexible financing options help overcome credit barriers that often prevent consumers from purchasing EVs. Additionally, the platform connects buyers to locally assembled vehicles, sidestepping import restrictions. However, EV24.africa has less direct control over the manufacturing supply chain compared to traditional automakers.

| Brand/Platform | Pros | Cons |

|---|---|---|

| BYD | Expanding dealership network; dual EV/PHEV strategy; benefits from local charging initiatives | Limited rural availability due to slow charging infrastructure development |

| Chery | Strong sales growth (16,000+ units in 2025); extensive dealership network; affordable pricing under $22,500; plans for local assembly | Lower resale value compared to Japanese and Korean brands; underdeveloped service network |

| EV24.africa | Wide selection of brands; flexible financing; supports locally assembled vehicles | Limited control over the manufacturing supply chain compared to OEMs |

Conclusion

The success of Chinese electric vehicles (EVs) across Africa can be traced back to a combination of smart pricing strategies, local production efforts, and targeted infrastructure investments. By offering affordable yet advanced EVs, backed by government support and efficient manufacturing, Chinese brands have reshaped the automotive landscape in Africa. Take the BYD Dolphin Surf, for example – it’s priced at just $26,100, making it far more accessible compared to many Western models that often cater to premium markets.

Local manufacturing and assembly initiatives have also brought a major shift in how EVs are delivered to African consumers. A standout example is Burkina Faso’s Itaoua brand, which trains local engineers to assemble solar-powered vehicles instead of relying solely on imported, ready-made products. This approach not only reduces costs but also promotes genuine technology transfer, addressing affordability and easing import challenges.

"China is a key supplier of EVs to Africa, as Chinese EV brands are becoming increasingly popular among African consumers."

– Dennis Wakaba, Consultant, Electric Mobility Association of Kenya

China’s dominance in the EV market is further supported by its supply chain advantages. BYD, for instance, delivered over 4.54 million passenger vehicles globally in 2025, and CATL accounted for 33.3% of global EV battery production. These efficiencies help keep production costs low, giving Chinese brands a competitive edge.

Platforms like EV24.africa are playing a pivotal role in driving EV adoption by connecting buyers across all 54 African countries with a variety of Chinese EVs. They offer flexible financing options and emphasize locally assembled models, making EV ownership more attainable. As charging networks expand and more assembly plants are established, Chinese EVs are well-positioned to lead Africa’s shift toward electric mobility. Together, these efforts are paving the way for a strong and sustainable transition to electric transportation across the continent.

FAQs

Why are Chinese electric vehicles more affordable in Africa than Western brands?

Chinese electric vehicles (EVs) have gained traction in Africa largely because they’re more affordable, thanks to smart cost-saving strategies. Instead of shipping fully assembled cars, many Chinese manufacturers use completely-knocked-down (CKD) or semi-knocked-down (SKD) kits, which are then assembled locally. This method significantly cuts down on import taxes, shipping fees, and logistical costs. On top of that, local assembly taps into Africa’s lower labor costs, making the final product even cheaper.

China’s edge in large-scale EV production, its dominance in battery manufacturing, and government subsidies further contribute to the low prices. Brands like BYD, Chery, and Great Wall leverage these advantages to offer feature-rich models at prices that Western competitors struggle to match. By combining affordability with growing dealership networks, Chinese EV makers have become a top choice for African buyers looking for dependable and budget-friendly vehicles.

How does local production contribute to the success of Chinese EVs in Africa?

Local production has become a cornerstone of Chinese electric vehicle (EV) success in Africa. By establishing assembly plants and collaborating with local manufacturers, Chinese automakers cut down on import duties and shipping expenses. This strategy makes their vehicles more affordable for cost-conscious buyers across the continent. Additionally, these efforts align with government policies that reward local manufacturing through tax incentives and preferential treatment.

But it’s not just about cost. Local production also generates jobs, develops technical expertise, and fosters stronger ties with African nations. By weaving their operations into local supply chains – such as linking EV production with lithium mining in Nigeria – Chinese brands secure a steady flow of parts and services. This integration doesn’t just make EVs more accessible; it also roots these companies deeply within African economies, fueling market growth and supporting the shift toward cleaner, greener mobility.

How are Chinese EV companies solving Africa’s charging infrastructure challenges?

Chinese electric vehicle (EV) companies are tackling Africa’s limited charging infrastructure with creative solutions and smart partnerships. They’re teaming up with local businesses to build charging stations powered by renewable energy sources like solar and wind. This approach not only reduces dependence on unreliable grid electricity but also supports sustainable energy use. In some cases, manufacturers are setting up charging stations directly within their dealerships, turning them into convenient hubs for both EV sales and charging.

Another clever strategy involves shipping knock-down kits – packages that include chargers and modular charging equipment. These kits simplify the process of setting up charging infrastructure locally. To ensure smooth operations, Chinese automakers are also offering training programs for local technicians, equipping them with the skills needed to install and maintain these systems. By blending renewable energy, localized assembly, and financial partnerships, these companies are breaking down infrastructure barriers and paving the way for broader EV adoption across Africa.