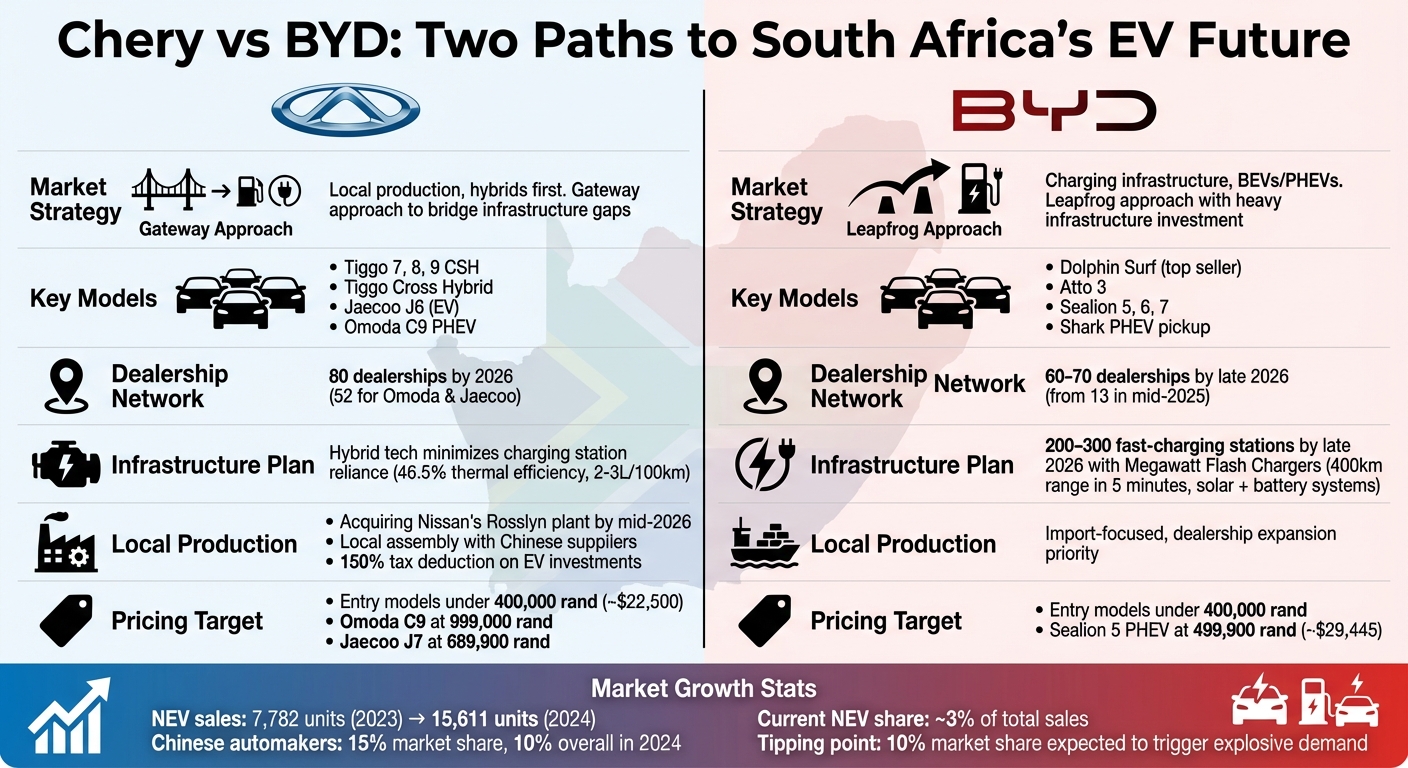

Chery Automobile and BYD are reshaping South Africa’s electric vehicle (EV) market with two different strategies.

- Chery: Acquiring Nissan’s Rosslyn plant in Pretoria by mid-2026 to start local production. Focused on plug-in hybrids (PHEVs) and extended-range electric vehicles (EREVs) to address infrastructure challenges. Local manufacturing will benefit from government incentives, like a 150% tax deduction on EV-related investments.

- BYD: Expanding its dealership network and installing 200–300 fast-charging stations by late 2026. Focused on battery electric vehicles (BEVs) and PHEVs, offering models like the Dolphin Surf and Sealion 5. Charging stations will include solar and battery systems to counter power grid issues.

Both companies aim to make EVs more affordable, with entry-level models priced under 400,000 rand (~$22,500). Chery is banking on local production to cut costs, while BYD relies on imports and charging infrastructure investments.

Quick Comparison:

| Factor | Chery | BYD |

|---|---|---|

| Approach | Local production, hybrids first | Charging infrastructure, BEVs/PHEVs |

| Key Models | Tiggo 7, 8, 9; Omoda C9 | Dolphin Surf; Sealion 5, 7 |

| Dealerships | 80 by 2026 | 60–70 by 2026 |

| Infrastructure | Relies on hybrid tech | 200–300 fast chargers by 2026 |

Both strategies address South Africa’s unique challenges, like limited charging infrastructure and high import duties, while aiming to grow the EV market.

Chery vs BYD: EV Market Strategies in South Africa Comparison

1. Chery Automobile

Market Strategy

Chery views South Africa as a key entry point to the broader African market. The company is transitioning from simply importing vehicles to building local manufacturing capabilities. This move positions Chery to take advantage of government incentives while sidestepping potential tariff hikes. Tony Liu, CEO of Chery South Africa, highlighted the importance of this strategy: "We treat South Africa as a very important market for our global expansion… a gateway to the African continent."

From January to August 2025, Chery’s sales climbed by 27%, surpassing 16,000 units. This growth contributed to Chinese automakers securing a 15% share of the market and exporting 20,069 vehicles in December 2025. Chery’s evolving product lineup reflects its commitment to this robust market approach.

Model Offerings

Chery’s product strategy focuses on hybrids as a bridge to full electrification. In June 2025, the company unveiled eight hybrid models at Montecasino in Johannesburg, including the Tiggo 7, 8, and 9, all equipped with Super Hybrid (CSH) technology. These models achieve impressive fuel consumption rates of just 2 to 3 liters per 100 km, with a thermal efficiency of 46.5%.

The Omoda C9 plug-in hybrid, priced at 999,000 rand ($56,275), offers a combined range of 1,100 km and includes a 34.5 kWh battery capable of delivering up to 150 km of all-electric driving. For a more affordable option, the Jaecoo J7 Super Hybrid starts at 689,900 rand. Looking ahead, Chery plans to launch its iCar electric brand in early 2026. This line will feature Range-Extender Electric Vehicles (REEV), which use a petrol engine to recharge the battery – an innovative solution for South Africa’s inconsistent power grid.

Impact on Affordability

Chery aims to make electrified vehicles accessible, with starting prices under 400,000 rand ($22,500). This pricing strategy is designed to compete with legacy brands by offering similar features at a lower cost. Greg Cress, Principal Director at Accenture, commented: "As long as they remain affordable from an up-front cost perspective, they will be differentiated against legacy brands offering similar specifications."

To support this affordability, Chery plans to produce vehicles locally, benefiting from a 150% tax deduction on EV-related investments. Additionally, the company intends to bring Chinese suppliers to South Africa to meet local content requirements. This approach creates a cost-effective supply chain, ensuring competitive pricing for consumers.

sbb-itb-99e19e3

2. BYD (Build Your Dreams)

Market Strategy

BYD is prioritizing rapid growth in retail and infrastructure. The company has ambitious plans to expand its dealership network from 13 locations in mid-2025 to 60–70 by the end of 2026, with 35 of these expected to be operational by the first quarter of 2026. Their "dual-powertrain" strategy, which offers both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), is designed to address local challenges like limited charging infrastructure and grid reliability. Steve Chang, General Manager of BYD Auto South Africa, highlighted their approach:

"We want to educate and cultivate the market of South Africa and make sure that the South African consumers can catch up with the rest of the world".

Instead of focusing on local manufacturing, BYD is channeling its efforts into market expansion. Stella Li, Executive Vice President at BYD, emphasized the importance of this strategy:

"South Africa is a very important market… Once we start here, you can duplicate the story into other African countries".

This forward-thinking approach aims to introduce a diverse product lineup while ensuring strong market support.

Model Offerings

BYD’s vehicle range is tailored to meet various consumer needs. The Dolphin Surf, an entry-level BEV, has already gained traction as a top-seller. For utility vehicle enthusiasts, the Shark 6 PHEV pickup offers a 29.5 kWh battery, an impressive 840 km range, and a 2.5-ton towing capacity. In the family SUV category, the Sealion 5 PHEV starts at 499,900 rand (about $29,445) and directly competes with the Toyota Corolla Cross hybrid. For those seeking performance, the Sealion 7 BEV delivers with an 82.5 kWh battery and accelerates from 0 to 100 km/h in just 4.3 seconds. This lineup reflects BYD’s commitment to addressing the evolving demands of consumers transitioning away from traditional internal combustion engines.

Infrastructure Development

To ease concerns about range and power grid reliability, BYD plans to install 200–300 Flash charging stations across South Africa by late 2026. These Megawatt Flash Chargers, capable of delivering up to 1 MW of power, can add approximately 400 km of range in just five minutes. Recognizing the challenges posed by grid instability, BYD is incorporating solar panels and battery storage into its charging stations. Additionally, they aim to offer home solar and battery solutions, allowing customers to charge their vehicles independently of the grid. Stella Li outlined the scale of their vision:

"By the end of next year, we will have 200 or 300 Flash charging stations in South Africa… We want to cover 100% of the country".

Impact on Affordability

BYD’s pricing strategy is designed to make EVs more accessible. The Sealion 5 PHEV, priced at 499,900 rand (≈$29,445), provides a budget-friendly option, while the Dolphin Surf has already driven early growth in the new energy vehicle market, with sales rising from 7,782 units in 2023 to 15,611 units in 2024. Despite high import duties that increase costs compared to internal combustion engine vehicles, Chinese brands, including BYD, captured around 10% of the South African automotive market in 2024. To address lingering skepticism about Chinese vehicles, BYD is emphasizing a strong after-sales support network. These efforts align with BYD’s broader goal of making electric mobility more attainable in the region.

BYD to invest in solar-panel fast-charging EV technology to stimulate electric car sales in SA

Pros and Cons

Chery and BYD are taking distinctly different paths in South Africa’s electric vehicle (EV) market, each tailored to tackle the region’s unique challenges. Chery’s strategy leans on plug-in hybrids and local manufacturing, aiming to address infrastructure limitations, while BYD is betting on a direct shift to EVs, backed by significant investments in charging infrastructure.

Here’s a closer look at how their strategies stack up:

One major distinction lies in their approach to infrastructure. BYD plans to roll out 200–300 fast-charging stations equipped with Megawatt Flash Chargers, capable of delivering roughly 248 miles (400 km) of range in just five minutes. In contrast, Chery relies on its Super Hybrid technology, which boasts 46.5% thermal efficiency and fuel consumption as low as 2–3 liters per 100 km, effectively sidestepping the need for immediate charging infrastructure.

Local production is another key area where the two brands diverge. Chery is exploring the feasibility of setting up local assembly plants or factories, which could help it tap into government tax incentives and rebates. BYD, however, is focusing its efforts on expanding its dealership network, aiming to grow from 13 locations in mid-2025 to 60–70 by the end of 2026, rather than prioritizing local manufacturing.

| Factor | Chery (including Omoda & Jaecoo) | BYD (Build Your Dreams) |

|---|---|---|

| Market Strategy | "Gateway" approach: hybrid-first to bridge infrastructure gaps | "Leapfrog" approach: BEV/PHEV focus with heavy infrastructure investment |

| Key Models | Tiggo 7, 8, 9 CSH; Tiggo Cross Hybrid; Jaecoo J6 (EV); Omoda C9 | Dolphin Surf (top seller); Atto 3; Sealion 5, 6, 7; Shark PHEV pickup |

| Infrastructure Plan | Hybrid tech minimizes reliance on charging stations | 200–300 fast-charging stations by 2026, with solar and battery systems |

| Local Production | Considering local assembly and factories | Focused on imports and dealership growth |

| Dealership Network | 52 dealerships for Omoda & Jaecoo; 80 total for Chery | Expanding from 13 to 60–70 by late 2026 |

| Pricing Target | Entry-level models starting under 400,000 rand (~$22,500) | Entry-level models under 400,000 rand; Sealion 5 PHEV priced at 499,900 rand (~$29,445) |

Both companies are navigating similar hurdles, such as consumer skepticism, limited access to spare parts, and concerns about resale value. Additionally, high import duties continue to push up costs, leading both brands to lobby for policy changes with the South African government. These challenges highlight the complexities of establishing a foothold in this evolving market.

Conclusion

BYD is making bold moves in charging infrastructure, while Chery is focusing on integrating into local markets and boosting regional manufacturing. BYD’s ambitious goal of installing 300 fast-charging stations by the end of 2026 is a game-changer, offering drivers up to 248 miles (400 km) of range in just five minutes. Meanwhile, Chery’s acquisition of Nissan’s Rosslyn plant and its emphasis on local assembly aim to take advantage of government tax incentives while contributing to the growth of Africa’s automotive sector.

To sum it up, both companies are taking different but complementary paths toward advancing sustainable mobility in Africa. BYD is pushing for a rapid transition, as General Manager Steve Chang explained:

"I think South Africa and the rest of Africa have a very big opportunity to what I call leapfrog from ICE into renewable energy (cars)".

In contrast, Chery is opting for a phased approach, promoting plug-in hybrids as a stepping stone until charging infrastructure becomes more widespread.

For consumers, plug-in hybrids offer a practical option during this transition, while Chery’s local manufacturing efforts open up new supply chain opportunities. By requiring 40–60% local content to qualify for government rebates, Chery’s strategy is set to stimulate local economic growth.

However, policy intervention is critical. Tony Liu, CEO of Chery South Africa, highlighted:

"Based on our experience in China, once the market share of new energy vehicles reaches almost 10%, then the demand will start to explode".

The numbers back this up. NEV sales in South Africa are on a steep upward trajectory, projected to double from 7,782 units in 2023 to 15,611 in 2024. With NEVs currently making up about 3% of total new vehicle sales, the market seems poised for rapid growth as it approaches the 10% tipping point.

FAQs

What impact will Chery’s local production have on South Africa’s EV market?

Chery’s move to set up local production in South Africa could play a big role in shaping the country’s electric vehicle (EV) market. By manufacturing vehicles locally – potentially including EVs and plug-in hybrids – Chery can cut costs, sidestep import tariffs, and tap into government incentives for locally produced cars. This approach might lower prices, making EVs more accessible to South African buyers.

On top of that, Chery’s interest in acquiring or partnering with existing manufacturing facilities, like Nissan’s plant, shows a clear dedication to establishing a strong foothold in the region. These initiatives could speed up EV adoption, make them more affordable, and even push the development of better charging infrastructure. Altogether, this supports South Africa’s transition toward cleaner and more sustainable transportation.

What obstacles does BYD face in building EV charging infrastructure in South Africa?

BYD is facing some tough obstacles as it works to establish a dependable EV charging network in South Africa. One of the biggest hurdles is the sheer time and effort needed to roll out a nationwide network of high-capacity chargers. The construction of their ambitious 1-megawatt superchargers isn’t set to kick off until mid-2026. This means it could be years before these chargers are widely available. On top of that, developing such advanced infrastructure comes with its own set of challenges, like ensuring the stability of the power grid and figuring out how to integrate these chargers into the existing energy systems.

Another major issue is the state of South Africa’s energy landscape. The national power grid, run by Eskom, is already under significant strain. Meeting the additional demand from EV charging will require major upgrades and hefty investments. BYD’s partnership with Eskom to install 200 charging stations is a positive move, but building a reliable and accessible charging network across the country will demand careful coordination and long-term planning.

How are Chery and BYD making EVs more affordable for South African buyers?

Chery and BYD are stepping up to offer budget-friendly hybrid and electric vehicles designed with South African drivers in mind. Chery has introduced models like the Omoda C9 and Jaecoo J7 hybrids, which strike a balance between performance and affordability. For example, the Jaecoo J7 comes with a price tag of approximately $38,827 (689,900 ZAR), making it an option for a broader range of buyers. These hybrids are particularly practical for South Africa, as they combine electric and gas power, offering a solution for areas where charging infrastructure is still developing.

BYD is also making waves with its Dolphin EV, priced at around $19,700 (339,900 ZAR). In addition to offering affordable electric models, BYD is actively growing its dealership network across the country. This expansion not only improves access to their vehicles but also helps lower costs for consumers.

Both companies are focusing on strategies like local manufacturing and dealership expansion to bring EVs within reach for more South Africans, paving the way for broader adoption of electric and hybrid vehicles in the region.