Africa’s electric vehicle (EV) market is growing fast, reaching $17.4 billion in 2025 and expected to hit $28 billion by 2030. This growth is driven by:

- Rising EV sales: Electric car sales doubled in 2024, with South Africa seeing an 82.7% increase in Q1 2025.

- Government incentives: Countries like Kenya, Ethiopia, and South Africa are reducing taxes and investing in EV infrastructure and production.

- Tech improvements: Advances in batteries and local manufacturing make EVs more affordable.

- Consumer interest: More people are choosing EVs due to rising fuel costs and leasing options.

Challenges remain, including limited charging infrastructure, high upfront costs, and uneven adoption across the region. However, with increased investment and collaboration, Africa’s EV market has the potential to transform transportation by 2040, with millions of electric vehicles on the road.

This African EV Charges in 30 Minutes – Here’s Why It Matters!

What’s Driving Africa’s EV Market Growth

Africa’s electric vehicle (EV) market is expanding, fueled by government initiatives, advancements in technology, and evolving consumer preferences.

Government Policies Supporting EV Adoption

Governments across Africa are rolling out incentives to encourage EV adoption. South Africa, for example, offers a 150% tax deduction on investments in electric and hydrogen-powered vehicle production starting March 2026. This initiative is backed by $54.27 million to boost local production of new energy vehicles (NEVs), battery manufacturing, and infrastructure development, with a goal of attracting 30 billion rand in private investments.

"Consideration must be given to incentives for manufacturers, as well as tax rebates or subsidies for consumers, to accelerate the uptake of electric vehicles." – Cyril Ramaphosa, President of South Africa

Other nations are also stepping up. Kenya has halved the excise duty on EV imports from 20% to 10%, aiming for EVs to make up 5% of vehicle imports by 2025. Ethiopia has gone further by banning internal combustion engine vehicle imports entirely, while Zimbabwe has reduced import duties on EVs. Public charging infrastructure is set to grow significantly, with projections showing an increase from fewer than 1,000 charging points in 2021 to over 20,000 by 2025. These measures create a strong foundation for technological progress that lowers costs and improves efficiency.

Improvements in EV Technology

Government support is driving rapid advancements in EV technology, making vehicles more affordable and efficient. Innovations in battery technology, such as solid-state and lithium-iron-phosphate batteries, are reducing costs while improving performance. Battery swapping technology is also emerging as a practical solution to address the challenges of limited charging infrastructure. In Nigeria, the government has partnered with BAIC Motor to implement a battery swap system, supported by a ₦151.9 billion funding initiative for electric buses, tricycles, and charging stations.

Local manufacturing is gaining traction as well. CIG Motors in Lagos has started assembling EVs under a public-private partnership model, producing 2,000 vehicles annually. Meanwhile, Chinese manufacturers are introducing lower-cost EVs to African markets. In China, a standard family electric car, including subsidies, costs around $15,000.

"This is more than trade; it’s about development." – Yu Dunhai, China’s Ambassador to Nigeria

These advancements not only make EVs more affordable but also improve their performance, increasing their appeal to consumers.

Consumer Shift Toward Cleaner Transportation

Environmental awareness, rising fuel prices, and practical benefits are pushing consumers toward EVs. In 2024, electric car sales in Africa more than doubled, with emerging and developing economies seeing year-on-year growth of over 60%. A survey in Tanzania revealed that 45.5% of respondents preferred EVs priced around $20,000, while 47.3% prioritized a driving range of about 300 km.

Flexible financing options are also making EV ownership more accessible. For instance, Kenya offers a $25-per-day EV lease, and Ebikes Africa provides installment plans over 11 months. MojaEV’s launch of 100 electric taxis in Nairobi showcases the commercial viability of EVs. However, concerns about unreliable grid electricity persist, leading some consumers to favor hybrid vehicles as a transitional option.

Together, these policies, technological advancements, and shifting consumer attitudes are driving Africa’s EV market to an expected annual growth rate of 30% through 2030.

Market Players and Business Opportunities in Africa’s EV Sector

Africa’s electric vehicle (EV) market is gaining momentum, drawing attention from major automakers and investors. The market is projected to grow from $17.4 billion in 2025 to $28 billion by 2030.

Major Automakers and EV Brands in Africa

Chinese automakers, including BYD, Chery, and GWM, are making significant moves in Africa, focusing on electric and hybrid models. These brands are capitalizing on competitive pricing, with some models starting at under $22,500, a sharp contrast to Western markets with tighter restrictions. In South Africa, nearly half of the 14 active Chinese auto brands launched in just the past year, helping double sales of new energy vehicles between 2023 and 2024. These vehicles now make up 3% of total new car sales in the country.

"We treat South Africa as a very important market for our global expansion." – Tony Liu, CEO of Chery South Africa

Global players like Nissan, Volkswagen, Tesla, BMW, and Toyota are also vying for a share of the market. However, Chinese brands are gaining traction due to their cost-effective options. For example, the Dayun Yuehu is priced between $22,500 and $25,300, while the BYD Dolphin ranges from $30,400 to $33,800. Local production is becoming a critical strategy as well. In November 2023, Ford South Africa announced a $281 million investment to manufacture hybrid vehicles domestically. Although South Africa produced just under 600,000 vehicles in 2024, government projections show this number could reach 1.5 million by 2035 with appropriate incentives.

"I think South Africa and the rest of Africa have a very big opportunity to what I call leapfrog from ICE into renewable energy (cars). Africa is a very big market." – Steve Chang, BYD Auto South Africa’s general manager

This competitive landscape is also driving demand for better charging infrastructure and expanded local production.

Infrastructure Development Opportunities

Expanding Africa’s EV infrastructure is a critical challenge. The continent needs $1 billion to grow its public charging network from fewer than 1,000 stations in 2021 to over 20,000 by 2025. Key opportunities include urban charging networks, highway fast-charging stations, and depots for commercial fleets. These investments can deliver annual returns of 18–25%, though the cost of installing a single EV charging station in South Africa ranges from $28,000 to $112,000.

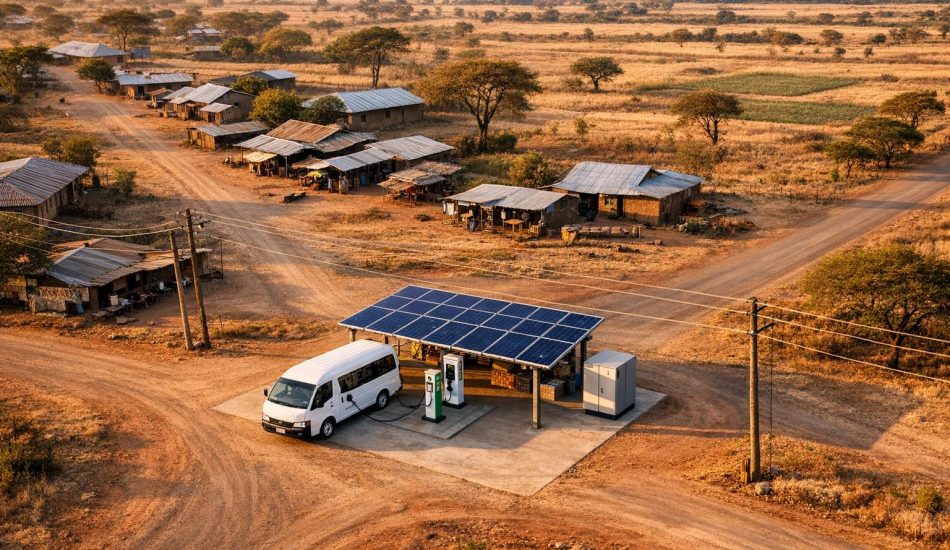

Innovative financing solutions are beginning to emerge. In November 2024, Zero Carbon Charge launched the first off-grid solar-powered EV charging station in Wolmaransstad, North West Province. The company plans to expand to at least 120 sites by September 2025. Backed by a $5.5 million equity investment from the DBSA, they aim to install ultra-fast charging stations every 93 miles along major highways.

"We are completely off-grid… we do not have a middleman selling electricity, which if you’re grid-dependent, you are subject to inflation increases." – Larissa Venter, Chief Stakeholder Officer at Zero Carbon Charge

Battery production is another area ripe with potential. Africa holds approximately 65% of the world’s cobalt reserves, making it a prime location for large-scale battery manufacturing. Regional cooperation through the AfCFTA and strong public-private partnerships will be essential to close the financing gap for these projects.

How EV24.africa is Changing the Market

Amid these developments, EV24.africa is stepping in as a game-changer. The platform is Africa’s first comprehensive online EV marketplace, simplifying the process of importing EVs. It handles everything from customs and registration to pricing, financing, and delivery across all 54 African countries. The marketplace offers a range of brands, including Tesla, BYD, Leapmotor, ROX, Dongfeng, Geely, Hyundai, Toyota, and Suzuki.

By connecting buyers with both new and used EVs, EV24.africa is helping to build the critical mass needed for the market to thrive. Experts estimate that around 100,000 EVs must be on African roads before the ecosystem becomes truly profitable.

"We need about 100,000 vehicles on the road before any of us will see real profitability. But that doesn’t mean we shouldn’t build the foundation now." – Winstone Jordaan, Director of GridCars

sbb-itb-99e19e3

Challenges Facing Africa’s EV Market

Africa’s electric vehicle (EV) market faces several hurdles that could slow its growth. These include gaps in infrastructure, economic constraints, and uneven regional development across the continent.

Limited Charging Infrastructure

A lack of charging stations is one of the biggest challenges. For example, South Africa, often seen as one of Africa’s more developed markets, has just over 300 public charging stations – a number far too small to support widespread EV use. This creates a classic chicken-and-egg dilemma: businesses are reluctant to invest in charging infrastructure without strong demand, while potential buyers hesitate to adopt EVs due to the lack of charging options. Nick Hedley, an energy analyst and founder of The Progress Playbook, sums up the situation:

"EV charging companies will naturally follow demand, which is in rich areas. It’s a chicken and egg situation. Do you build the EV charging stations before there’s demand for them, or do you wait until EV adoption picks up?"

The problem is made worse by unreliable electricity grids in many African countries, which complicates efforts to establish dependable charging networks. This has sparked interest in off-grid, solar-powered charging solutions. However, scaling such initiatives will require significant investment and supportive government policies. Beyond infrastructure, the high cost of EVs remains a major obstacle.

High Upfront Costs of Electric Vehicles

For many African consumers, the high initial cost of EVs is prohibitive. Import taxes in sub-Saharan Africa significantly drive up prices, often requiring tax reductions of 40% or more to make EVs competitive with traditional vehicles. Battery packs also contribute to the steep price tag. In Tanzania, for instance, import taxes would need to drop by at least 40% to bring electric cars to cost parity with gas-powered vehicles. As one analyst explains:

"For electric cars, particularly battery electric vehicles, to reach TCO parity with ICE car counterparts, the current import taxes have to be reduced by 40% or more, which is equivalent to removing all import duty or value-added taxes."

On average, a new EV costs around $56,000, compared to $49,000 for a gas-powered car. Still, there are signs of progress. Rwanda, for example, has eliminated import taxes on EVs, while Kenya has introduced reduced excise duties and VAT exemptions, leading to a noticeable uptick in electric mobility. Even so, adoption remains uneven across the continent.

Uneven EV Adoption Across African Countries

The rate of EV adoption varies widely across Africa, reflecting disparities in wealth, infrastructure, and government policies. In South Africa, which boasts the continent’s most developed automotive market, only 0.3% of new cars sold in 2023 were fully electric or plug-in hybrids. Economic inequality plays a major role here – South Africa is classified by the World Bank as one of the most unequal countries globally, which directly limits access to EVs.

Charging infrastructure also reflects these economic divides. As climate researcher O’brien Nhachi points out:

"EV stations for now in South Africa are for the wealthy in malls, offices, and suburbs secured by armed private guards. It’s a mockery of equity, but unsurprising."

This disparity has led some to label the situation as "energy apartheid", where affluent areas benefit from EV adoption while others remain dependent on fossil fuels. Additionally, with 35% of South African workers relying on public transportation and 20% walking to work due to high transport costs, EVs remain out of reach for much of the population.

Inconsistent government policies across the continent further complicate matters. Rian Moosa, business development manager at EV Charge, highlights the challenge:

"We can’t do mass domestic production/importation of EVs and infrastructure at scale unlike Asia – we don’t have a huge affluent population. To make initial profits and hopefully lower prices, EVs and chargers will have to cater to a tiny base of affluent South African consumers first."

As a result, the early stages of EV adoption and infrastructure development are likely to focus on wealthier areas, which could slow broader market growth and deepen existing inequalities.

What’s Next for Africa’s EV Market

Africa’s electric vehicle (EV) market is on the brink of rapid growth. Projections suggest the market will grow from $17.4 billion in 2025 to $28 billion by 2030. Achieving this potential, however, will require coordinated efforts across governments, businesses, and consumers.

The challenges are clear, but so are the opportunities. As one industry expert puts it:

"Building an enabling ecosystem that addresses unique challenges and opportunities across the continent is crucial for electric vehicles to thrive in Africa, which has fast-growing urbanization."

The Role of Governments

Government leadership will play a central role in shaping the future of EVs in Africa. Instead of mirroring strategies from developed nations, African countries need to craft policies tailored to their unique markets. Nigeria is already leading by example with its Energy Transition Plan, which aims to put 13 million electric vehicles on the road by 2050. Lolade Abiola from Nigeria’s Energy Transition Office highlights the potential:

"Electric mobility holds the key to Nigeria’s sustainable future, offering not just cleaner transport solutions but also paving the way for technological advancement and energy security."

Private Sector Momentum

While governments set the stage, private companies are stepping up to drive tangible progress. In Rwanda, Kabisa is expanding EV infrastructure with ultrafast charging hubs. Meanwhile, Ampersand has partnered with BYD to produce 40,000 electric motorcycles by 2026. The charging infrastructure market is also surging, expected to grow from $31.93 million in 2022 to $256.53 million by 2030.

Strategic partnerships are another key driver. In Kenya, Untapped Global launched a $20 million Climate Action Initiative to boost EV adoption across the continent. Ride-hailing companies are also making waves – Uber recently introduced an electric boda service in Kenya, and Bolt plans to invest over $684,931 in the country’s e-mobility sector.

The Road Ahead

The next five years will be critical. Africa’s ability to overcome infrastructure and affordability challenges will determine whether the continent can seize its $28 billion EV market opportunity. Success will hinge on a few key factors: unified regional strategies to attract global manufacturers, creative financing models to make EVs accessible, and continued investment in charging networks to support widespread adoption.

Looking further ahead, McKinsey estimates that by 2040, 90% of two-wheelers and 70% of car sales in Africa will be electric. This transformation has the potential to reshape transportation across the continent, ensuring the benefits are felt far and wide.

FAQs

What challenges are slowing down the growth of Africa’s EV market, and what solutions are being implemented?

Africa’s electric vehicle (EV) market is grappling with several hurdles, such as the high upfront costs of EVs, a lack of widespread charging infrastructure, and policy gaps that complicate adoption. These challenges impact affordability, convenience, and the overall pace of market growth.

To tackle these obstacles, stakeholders are turning to creative approaches. For instance, expanding affordable and accessible charging networks is a priority, alongside building public-private partnerships that can drive investment and innovation. Additionally, governments are working on introducing policies that lower costs and support infrastructure development. Efforts to enhance energy access and offer better financing options are also gaining traction, making EV ownership more feasible for individuals and businesses alike. Together, these strategies aim to accelerate the shift to EVs and unlock the potential of this emerging market across the continent.

How are government policies in Africa driving the growth of electric vehicles?

Government policies across Africa are stepping up to drive the adoption of electric vehicles (EVs) in the region. Take South Africa, for instance – it offers a 150% tax deduction for investments in EV manufacturing. This approach not only encourages local production but also makes EVs more accessible to buyers. In Kenya, the government has set a bold goal: 5% of all new vehicle registrations to be electric by 2025. To back this up, they’ve introduced incentives like zero-rated VAT and import duty exemptions.

These initiatives don’t just lower the cost of EVs for consumers – they also attract investments in charging networks and other supporting industries. With more nations rolling out similar policies, the EV market across Africa is poised for rapid growth, paving the way for fresh ideas and cleaner transportation options.

How do advancements in technology and local manufacturing help make electric vehicles more affordable in Africa?

Advances in electric vehicle (EV) technology have significantly improved efficiency while driving down production costs. This progress has made EVs more affordable and accessible for consumers across Africa. Key factors behind these cost reductions include breakthroughs in battery technology, the use of lightweight materials, and smarter energy management systems.

Local manufacturing has also emerged as a game changer. By reducing reliance on imports, it not only cuts costs but also creates jobs and stimulates industries like steel, plastics, and electronics. For resource-rich countries such as Kenya and the Democratic Republic of Congo, processing raw materials and manufacturing EV components locally can help bring down the price of batteries and vehicles. This approach is paving the way for broader EV adoption across the continent.