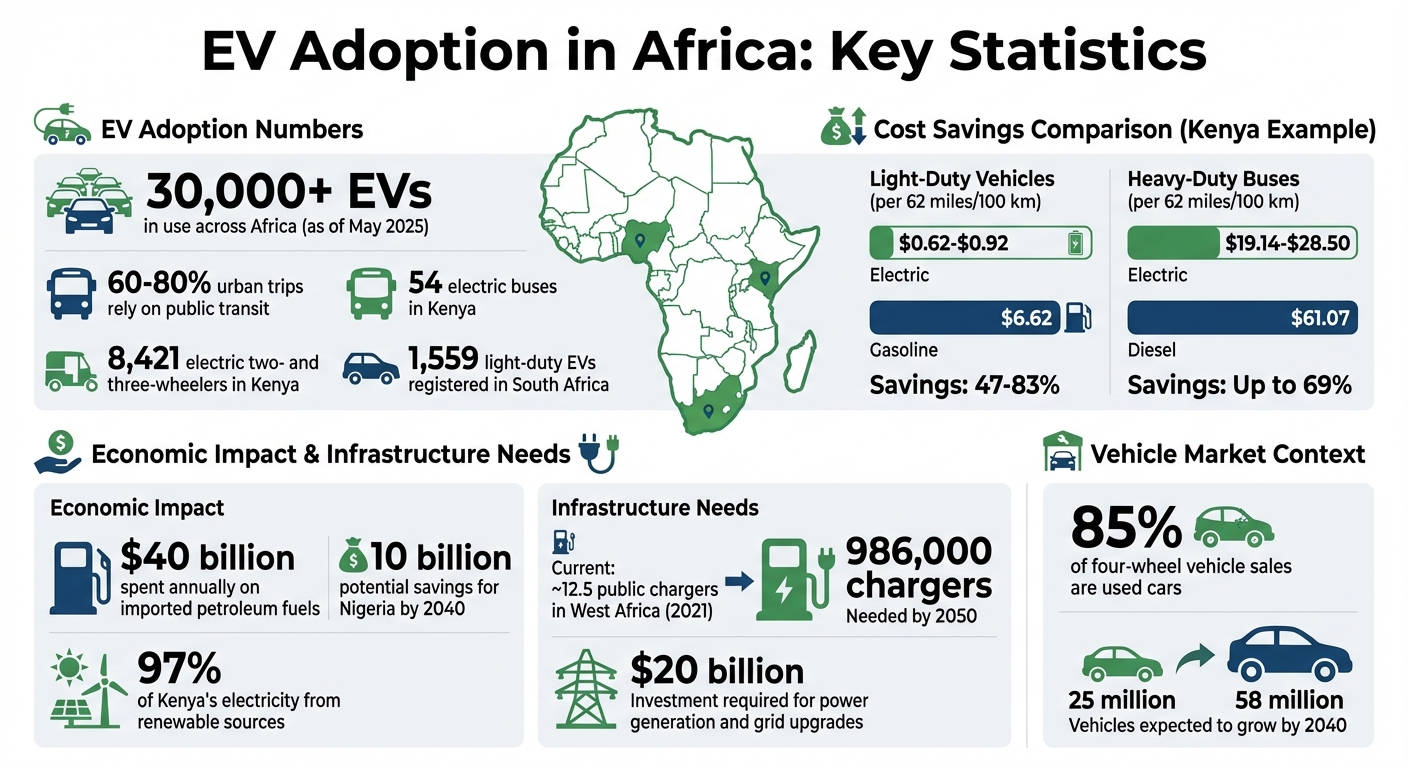

Electric vehicles (EVs) are reshaping transportation in Africa, with over 30,000 EVs in use as of May 2025. Unlike Western markets, where private cars dominate EV sales, Africa’s shift focuses on commercial vehicles like buses, motorcycle taxis, and delivery fleets. This approach aligns with the region’s reliance on public transit, which accounts for 60–80% of urban trips.

Key Points:

- Economic Impact: EVs significantly reduce fuel costs. For example, driving 62 miles in a light-duty EV in Kenya costs $0.62–$0.92 compared to $6.62 for gasoline cars.

- Government Support: Countries like Kenya, Rwanda, and Ethiopia are cutting import taxes, offering subsidies, and setting ambitious policies to promote EV adoption.

- Local Innovation: Companies in Kenya and Uganda are developing affordable EVs tailored for rough terrain and high usage. Battery-swapping and solar charging solutions are addressing infrastructure gaps.

- Challenges: High upfront costs, limited charging infrastructure, and unreliable electricity remain major barriers.

Africa has a unique opportunity to build EV-first transportation systems, avoiding reliance on fossil fuels while addressing urban mobility needs. Platforms like EV24.africa are making EVs more accessible with financing options and delivery services across the continent.

EV Cost Savings and Adoption Statistics in Africa 2025

What’s Driving EV Adoption in Africa

Environmental and Economic Benefits

Africa spends a staggering $40 billion annually on imported petroleum-based fuels. This hefty expense is pushing governments and businesses to explore alternatives, leveraging the continent’s wealth of renewable energy sources like solar, wind, and hydroelectric power instead of depending on costly foreign oil. On the environmental side, the case for electric vehicles (EVs) is equally compelling. EVs produce zero tailpipe emissions, which directly improves public health while addressing the annual 8% increase in transport-related emissions.

The economic potential is undeniable. For instance, Nigeria could save up to $10 billion by 2040 through reduced fuel imports and lower operational costs. Kenya offers another striking example: driving 62 miles (100 km) in a light-duty EV costs between $0.62 and $0.92, compared to $6.62 for a gasoline-powered car – representing savings of 47% to 83%. For heavy-duty buses, the difference is just as dramatic, with costs ranging from $19.14 to $28.50 per 62 miles for electric models versus $61.07 for diesel-powered ones.

"The climate case for EVs in Africa is weak, but air quality and economic gains are strong. EVs… can significantly improve urban air quality and reduce costly fossil fuel imports." – Rose Mutiso, Hamna Tariq, Daniel Johansson, and Adam Salzman, Energy for Growth Hub

These advantages are paving the way for bold government initiatives.

Government Policies and Incentives

Several African nations, including Kenya, Rwanda, and Ethiopia, are taking proactive steps with national e-mobility strategies. These plans are bolstered by fiscal incentives aimed at cutting the high upfront costs of EVs.

Take Rwanda, for example, which has introduced 0% import duties on EVs and eliminated VAT on charging equipment. South Africa is preparing to offer a 150% tax deduction for manufacturers investing in EV and hydrogen vehicle production, starting in March 2026. Nigeria’s 2023 National EV Policy includes 10-year tax holidays for EV-related investments, while Kenya has exempted electric motorcycles and buses from VAT, aligning with its Bus Rapid Transit system that prioritizes electric buses.

Some governments are also implementing restrictions to speed up the transition. Ethiopia, for instance, became the first country in the world to ban all imports of internal combustion engine passenger vehicles in January 2024, leveraging its renewable energy resources while addressing foreign exchange issues. Similarly, Kigali plans to switch all motorcycle taxis to electric by 2025.

To encourage local manufacturing, Ethiopia has structured its import duties to favor assembly over fully finished imports: 0% for Completely Knocked Down (CKD) kits, 5% for Semi-Knocked Down (SKD) kits, and 15% for Fully Built Up units.

These measures not only make EVs more affordable but also create an environment that encourages technological progress.

Technology Advances and Local Solutions

Local companies are stepping up with solutions designed for Africa’s specific needs. Firms in Kenya and Uganda, such as Afrigreen Automobile and Kiira Motors, are focusing on local assembly and research, offering EVs at prices that are far more accessible than imports. Kenya-based Roam (formerly Opibus) is developing motorcycles capable of traveling 130 km daily on rough terrain, tailored to local conditions.

Battery-swapping is another game-changer. Ampersand’s network in Kigali, for instance, helps commercial motorcycle riders cut downtime by quickly swapping batteries.

Innovative financing models are also making EVs more accessible. As of May 2025, BasiGo had deployed 100 e-buses in Kenya and secured $42 million to expand its fleet to 1,000 buses across Kenya and Rwanda. Their "Pay-As-You-Drive" battery leasing model significantly reduces upfront costs. Meanwhile, M-KOPA uses its fintech platform to provide digital loans for electric two-wheelers, contributing to the 40% financial inclusion rate among Kenyans over 15 years old.

Charging infrastructure is evolving too, with solar-powered solutions leading the way. In Uganda, companies like Zembo offer solar kiosks for charging in areas with unreliable electricity grids. In Kenya, organizations such as Drivelectric and the WEEE Centre are repurposing old EV batteries for solar energy storage, promoting a circular economy.

Country Spotlights: EV Programs Across Africa

Kenya: Electric Bus Programs

Kenya is making waves in electric mobility, with EV registrations skyrocketing from 475 in 2022 to 2,694 in 2023. By May 2025, the country had 8,421 electric two- and three-wheelers on the road, along with 54 electric buses. This growth is powered by Kenya’s renewable-heavy energy grid, with 97% of its electricity coming from sources like geothermal, wind, and solar.

BasiGo, a key player in Kenya’s EV push, has already deployed 100 electric buses in Nairobi’s Bus Rapid Transit system and aims to expand to 1,000 buses across Kenya and Rwanda. Their pay-per-kilometer financing model, supported by $42 million in funding, is central to this effort.

The financial appeal is clear. Locally assembled electric buses cost between $55,000 and $60,000, and their operating costs range from $19.14 to $28.50 per 62 miles (100 km), compared to $61.07 for diesel buses. To ensure quality, Kenya has banned the import of EV batteries with less than 80% state-of-health. Local initiatives to extend battery life further reduce costs and support a circular economy.

"Kenya has made remarkable strides in the twin sectors of energy and e-mobility, with 97 per cent of its electricity now coming from renewable sources such as geothermal, wind, and solar." – Samira Ally, Energy Adviser, Power Shift Africa

While Kenya focuses on scaling public transit solutions, other nations are tackling their unique mobility challenges with different strategies.

South Africa: Hybrid Vehicles and EV Growth

In Southern Africa, stringent import policies and incentives for local production are shaping the EV landscape. South Africa, unlike most of sub-Saharan Africa, prohibits used vehicle imports, encouraging the sale of new vehicles and bolstering local manufacturing. The country leads the continent in light-duty EV adoption, with 1,559 units registered as of May 2025. Additionally, Southern Africa is home to 46 of the 208 e-mobility companies operating across Africa.

Government policies are also driving progress. Starting in March 2026, manufacturers investing in EV and hydrogen vehicle production will benefit from a 150% tax deduction, aimed at boosting local production. Companies like BAIC-SA are setting goals to promote inclusivity, such as achieving a 30% female workforce.

Commercial fleets are adopting EVs early, with companies like Moove operating ride-hailing fleets that capitalize on EVs’ lower total cost of ownership for high-mileage use. Meanwhile, REVOV is repurposing used EV batteries for energy storage, adding a sustainability angle to the transition. However, the country faces challenges with electricity reliability, with a System Average Interruption Disruption Index of 39.30 compared to just 0.87 in OECD countries.

Nigeria: Fast Growth and Infrastructure Investments

Nigeria is positioning itself as a key player in Africa’s EV movement, thanks to bold policy decisions. The 2023 National EV Policy and Energy Transition Plan aim for carbon neutrality by 2060, with a goal of 100% zero-emission new car and van sales by 2040. The removal of a national fuel subsidy in May 2023, which nearly tripled gasoline prices, has made electric vehicles a more attractive option.

Awareness of EVs is high, with over 90% of vehicle owners familiar with the technology. To encourage adoption, the government offers 10-year tax holidays for EV companies and plans to introduce vehicle purchase subsidies and loan guarantees to lower interest rates. The focus is on commercial vehicles like electric buses and motorcycle taxis (okadas), which benefit from better economics due to high daily mileage.

Local manufacturing is also a priority. Nigeria currently produces only 14,000 vehicles annually against a demand of 720,000. Vehicle imports cost the economy around $8 billion each year. Companies like Moove are expanding EV ride-hailing fleets, while MAX.ng has launched women-only driver networks to promote inclusivity in the electric two-wheeler sector. Thinkbikes is contributing to sustainability by repurposing used EV batteries for solar energy storage.

"The rewards – economic development, reduced transportation costs, job creation, reduction of import dependency, and a leadership position in Africa’s energy and transportation transition – are substantial." – Kriti Singh, RMI

Nigeria’s approach combines ambitious policies with infrastructure investments, reflecting Africa’s broader push for sustainable, locally tailored mobility solutions.

Challenges to EV Adoption in Africa

Infrastructure Gaps: Charging Networks

In key markets like Kenya and Nigeria, over 90% of vehicle owners struggle with range anxiety, a major concern for potential EV users. As of late 2021, West Africa had only about 12.5 public chargers available. To meet projected EV adoption by 2050, nearly 986,000 chargers will be required. This massive gap in charging infrastructure is a significant obstacle to the widespread use of EVs.

The cost of installing charging stations varies widely depending on the technology. Level 2 chargers, suitable for homes and workplaces, cost between $200 and $1,000 per unit, making them relatively affordable. On the other hand, Level 3 DC fast chargers, critical for commercial buses and long-distance travel, come with a hefty price tag – tens of thousands of dollars per unit. Meeting the additional electricity demand for EVs in West Africa by 2050 will require an estimated $20 billion investment in power generation and grid upgrades.

Urban areas face unique challenges as EV adoption is likely to concentrate in wealthier neighborhoods. This creates "pressure points" on local grids, requiring substantial infrastructure upgrades to handle the added load. Battery-swapping models have emerged as a potential solution, offering quick turnaround times, particularly for two-wheelers.

These infrastructure challenges, combined with financial barriers, make EV accessibility even more difficult.

Affordability and Financing Options

The high upfront costs of EVs remain a significant barrier. For instance, electric two-wheelers cost around $1,700–$1,800, compared to $1,300 for their internal combustion engine (ICE) counterparts. While EVs offer 25% lower costs over a five-year lifecycle, the initial price difference can deter buyers. Additionally, 85% of four-wheel vehicle sales in sub-Saharan Africa are used cars, typically priced between $6,000 and $10,000, making new EVs less competitive in the region.

"New EVs will therefore struggle to compete with old, low-cost ICE vehicles that are readily available in the region." – McKinsey & Company

Scaling the electric two-wheeler market in Africa could require $3.5 billion to $8.9 billion in financing. Companies like BasiGo are addressing this issue with innovative solutions. For example, their "Pay-As-You-Drive" financing model has secured $42 million in funding as of May 2025, enabling the deployment of 1,000 electric buses in Kenya and Rwanda.

However, even with creative financing models, unreliable electricity remains a critical challenge.

Electricity Reliability and Energy Access

Across African markets, unreliable power supply poses a fundamental challenge to EV adoption. In 2020, the System Average Interruption Duration Index (SAIDI) for sub-Saharan Africa stood at 39.30, compared to just 0.87 for OECD high-income countries. Grid-connected consumers in West Africa experience an average of 44 hours of power outages per month. A 2019 survey spanning 34 African countries revealed that fewer than half of grid-connected households enjoy reliable electricity.

Evening peak charging, typically between 7–10 p.m., adds further strain to the grid. A January 2025 study of Nairobi’s power grid found that achieving a 5% EV adoption target with unmanaged charging would require $300,000 in transformer upgrades within five years. However, smart charging could save utilities up to $610,000 by delaying transformer replacements.

"Unmanaged home charging could significantly exacerbate already constrained evening peak demand–increasing daily peak electricity demand by 24% in Kenya if the country’s 5% EV adoption target is met." – June Lukuyu, Rebekah Shirley, and Jay Taneja, Energy for Growth Hub

To address these issues, solutions like time-of-use pricing could encourage off-peak charging. Solar-powered charging kiosks in areas with limited grid access offer another alternative, as does repurposing degraded EV batteries for solar energy storage. Additionally, public transport fleets charging during daytime off-peak hours could actually improve overall power system efficiency.

sbb-itb-99e19e3

Africa’s EV Revolution & Urban Mobility Solutions | Anazi Zote-Piper

How EV24.africa Is Accelerating EV Adoption

EV24.africa is reshaping Africa’s electric vehicle (EV) market by addressing key challenges like affordability, accessibility, and regional mobility needs.

Wide Selection of EVs

EV24.africa caters to Africa’s diverse transportation demands by offering both new and pre-owned EVs from top global brands. This approach aligns with a market where used vehicle sales dominate, providing an alternative to the steady influx of low-cost internal combustion engine imports. By offering high-quality pre-owned options, the platform ensures affordability without compromising on quality.

Additionally, EV24.africa places a strong emphasis on commercial vehicles, reflecting the region’s reliance on public and shared transportation. With 60–80% of urban trips in Africa dependent on public transit, the platform focuses on high-demand vehicles like buses, taxis, and delivery vans. This strategy not only supports the region’s transportation infrastructure but also highlights the economic advantages of EVs, particularly their lower operating costs, making them a practical choice for businesses.

Transparent Pricing and Financing Options

To tackle the affordability barrier, EV24.africa provides clear pricing details and flexible financing plans. By breaking down costs, the platform demonstrates significant long-term savings. For example, over a five-year period, electric two-wheelers can cost up to 25% less than their gas-powered counterparts.

Flexible financing options further ease the path to EV ownership, particularly in areas where low household incomes and limited access to affordable financing have slowed adoption. These financial solutions are supported by a robust delivery and service network, ensuring that buyers across the continent have access to the resources they need.

Pan-African Delivery and Support Services

Beyond affordability, EV24.africa eliminates geographic barriers with its extensive delivery and support network, covering all 54 African countries. Buyers benefit from expert service support and customer reviews, enabling them to make informed decisions. This comprehensive approach ensures that even emerging markets can access EVs with confidence and convenience.

Conclusion: Changing Transportation for a Better Future

The rise of electric vehicles is reshaping Africa’s transportation landscape in profound ways. Recent data highlights this ongoing shift, showing how EV adoption is not just about cleaner air but also about economic benefits. With operating costs up to 83% lower than traditional vehicles, EVs are driving economic resilience while creating opportunities for local assembly and green job development.

However, the road ahead comes with its challenges. To make this transition truly successful, Africa must tackle issues like charging infrastructure, affordability, and access to reliable electricity. Countries such as Ethiopia, Kenya, and Rwanda are already stepping up with innovative solutions, including battery swapping, to accelerate progress. Commercial fleets – like motorcycle taxis and delivery vans – are proving that EVs are a smart financial choice for high-mileage use, setting a strong example for others to follow.

This moment offers Africa a unique chance to bypass outdated technologies and avoid becoming a dumping ground for used internal combustion engine vehicles. With the number of vehicles on the continent expected to grow from 25 million to 58 million by 2040, shifting to electric now lays the groundwork for a sustainable future.

Platforms like EV24.africa are making this transition more accessible by connecting buyers with quality EVs and flexible financing options. Whether you’re a business owner aiming to cut fleet expenses or an individual ready to embrace cleaner, more efficient transportation, the tools and resources are already in place to support the switch.

The future of transportation in Africa is electric, cost-effective, and achievable. Now is the time to explore your options and become part of the movement that’s transforming mobility across the continent.

FAQs

What are African countries doing to address the lack of EV charging infrastructure?

African countries are addressing the challenge of limited EV charging infrastructure with creative strategies and collaborations. Governments in nations like South Africa, Kenya, Morocco, and the Seychelles are stepping up by offering subsidies for public charging stations and mandating that new commercial developments include EV chargers. In cities such as Nairobi, solar-powered, off-grid charging hubs are being tested. These hubs not only provide reliable service but also ease the burden on fragile power grids.

Partnerships between public and private sectors are proving essential. Development banks, utility companies, and local entrepreneurs are teaming up to co-finance chargers in convenient locations like fuel stations, shopping malls, and transport hubs. To make cross-border EV use more practical, West African countries are working on standardizing plug types and payment systems, which also helps attract multinational investors.

Many African nations are also weaving EV infrastructure into their broader climate and energy strategies. By linking charging networks with renewable energy projects such as solar farms and battery storage, they aim to build a sustainable system. This integrated approach paves the way for clean energy and electric mobility to grow hand in hand, ensuring EVs become accessible to both urban and rural communities.

What are the economic benefits of electric vehicle adoption in Africa?

Switching to electric vehicles (EVs) brings a wealth of economic benefits for African countries. By cutting down on the need for imported gasoline and diesel, EVs not only reduce fuel costs for families and businesses but also help lower national spending on fuel imports. On top of that, the extra electricity demand from EV charging creates fresh revenue opportunities for utility companies, which can be reinvested into public infrastructure.

The shift to EVs also opens doors for job growth in sectors like installing charging stations, vehicle upkeep, and local assembly. With Africa’s abundant reserves of key battery materials like lithium and cobalt, the continent is well-positioned to play a major role in the global EV supply chain. This advantage attracts foreign investment and boosts exports. Additionally, the growing use of electric two- and three-wheelers supports small businesses and broadens the automotive services market, contributing to stronger economic growth and stability.

How are local innovations making EVs better suited for Africa’s unique roads and needs?

Local creators are reimagining electric vehicles (EVs) to meet the challenges of Africa’s tough terrain, scorching temperatures, and unique transportation needs. In Nigeria, for instance, electric buses and three-wheel "e-tricycles" are being designed with reinforced suspensions, robust components, and cooling systems to handle the heat. What’s more, many of these vehicles incorporate locally-sourced parts, cutting maintenance costs and reducing dependence on imported materials.

To make EVs easier to adopt, flexible business models like pay-as-you-go and lease-to-own programs are gaining traction. These options help users bypass hefty upfront costs. Additionally, local assembly of vehicles allows manufacturers to introduce practical upgrades quickly, such as dust-proof seals and modular battery packs that can be swapped out in remote locations. These advancements ensure EVs remain dependable and budget-friendly, even in areas where charging stations are scarce.