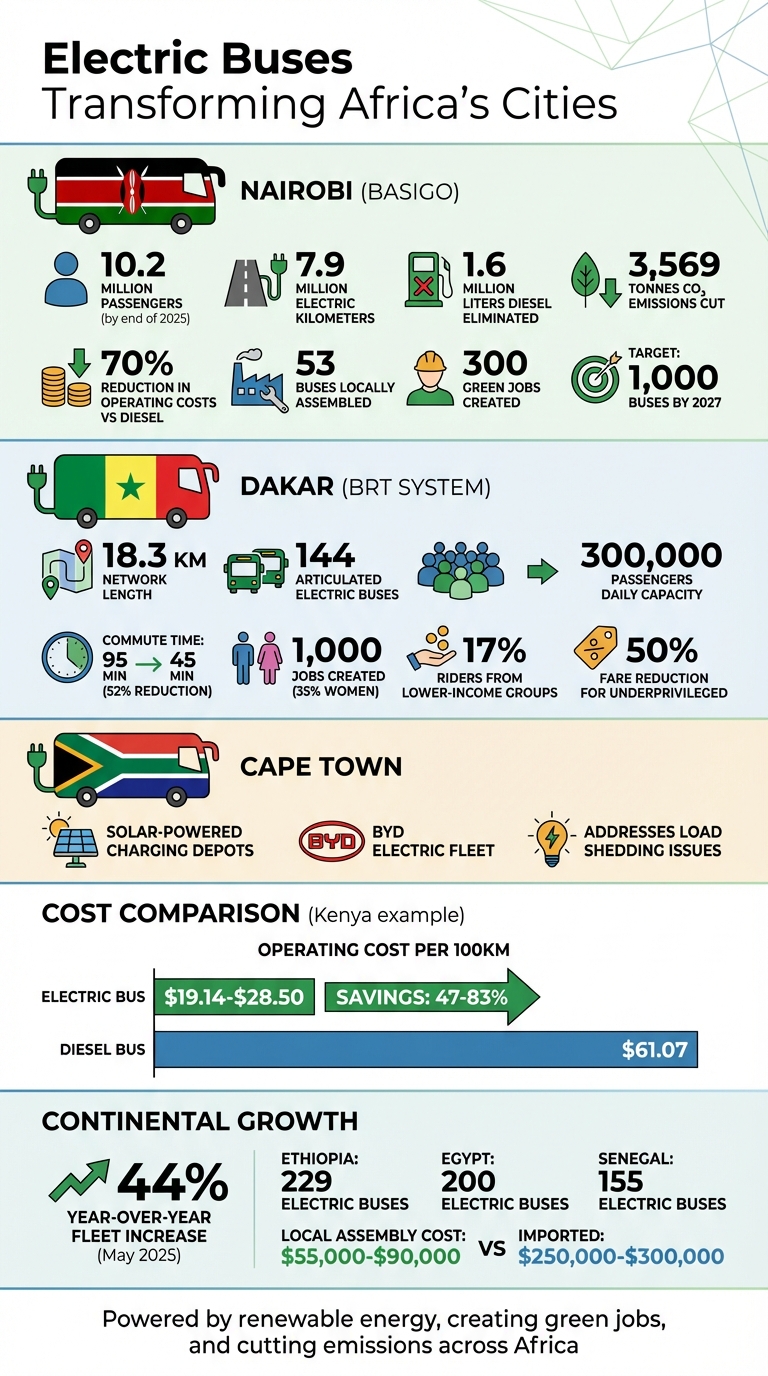

Electric buses are transforming public transportation in Africa, addressing rising pollution, high fuel costs, and outdated diesel fleets. Cities like Nairobi, Cape Town, and Dakar are leading this shift with innovative projects that combine renewable energy, cost savings, and local manufacturing. Here’s what you need to know:

- Nairobi’s Success: BasiGo’s electric buses have cut emissions by thousands of tons, saved millions in fuel costs, and now include locally assembled units priced competitively.

- Dakar’s BRT System: Senegal’s electric Bus Rapid Transit system has reduced commute times by over 50% while creating jobs and offering affordable fares.

- Cape Town’s Solar Integration: South Africa’s electric fleets use solar-powered charging to combat grid issues and lower operational costs.

Despite challenges like high upfront costs and inconsistent power grids, innovative financing models and supportive policies are driving adoption. Governments are offering tax breaks, banning diesel imports, and encouraging local assembly to lower costs and create jobs. With abundant renewable energy and raw materials for batteries, Africa is poised for growth in clean transportation.

Africa’s Electric Bus Growth: Key Statistics and Impact by City

BasiGo – Electrifying Urban Transport, Africa50 Impact Series

Major Electric Bus Projects Across Africa

Three standout projects highlight how different models are being used to scale electric bus deployment across Africa.

BasiGo’s Electric Bus Program in Nairobi

Starting with just two buses in 2022, BasiGo has grown to become Kenya’s largest electric bus operator. By the end of 2025, its fleet had carried over 10.2 million passengers, covered 7.9 million electric kilometers, and eliminated the need for 1.6 million liters of diesel, cutting 3,569 tonnes of CO2 emissions.

A key factor in their success is the Pay-As-You-Drive model, which makes electric buses more affordable. Operators pay an upfront cost similar to that of a diesel bus (around $36,000–$46,000), while BasiGo retains battery ownership. Operators then pay a per-kilometer fee of 20 Kenyan shillings ($0.16), slashing operating costs by up to 70% compared to diesel buses.

In 2024, BasiGo took a major step forward by opening Kenya’s first electric bus assembly line at the Kenya Vehicle Manufacturers plant in Thika. This shift from importing buses to local production has already resulted in 53 buses being assembled, with plans to ramp up to 20 buses per month by 2026. This expansion has also created 300 green manufacturing jobs. Major operators like Citi Hoppa and Supermetro, which manages a fleet of 440 buses, are now using BasiGo’s electric buses, with drivers noting strong passenger interest.

"We shall be assembling 20 buses every month and the orders are many. We intend to work round the clock to increase the number, because the demand may rise with time." – Jit Bhattacharya, CEO of BasiGo

The program aligns with Kenya’s 2024 Electric Mobility Policy, which offers reduced excise duties for electric vehicles. BasiGo plans to expand its fleet to 1,000 buses by 2027 and is eyeing Rwanda and Tanzania for further growth.

Cape Town’s BYD Fleet and Solar-Powered Charging

In Cape Town, Golden Arrow Bus Services (GABS) is leading the charge by replacing diesel buses with electric ones from BYD. This shift not only supports sustainable transit but also addresses South Africa’s load shedding issues by incorporating solar-powered charging depots, reducing dependence on the national grid.

Electric buses are particularly well-suited for Cape Town’s urban landscape. Their high torque ensures better acceleration, making them ideal for the city’s hilly terrain. Beyond environmental benefits, these buses cut operational costs and provide passengers with quieter, smoother rides.

Meanwhile, West Africa is making strides with a groundbreaking approach in Dakar.

Dakar’s BRT System and Public-Private Partnerships

In early 2024, Dakar launched Africa’s first fully electric Bus Rapid Transit (BRT) system. The 18.3-kilometer network operates 144 articulated electric buses, each featuring a 560 kWh battery that charges in about six hours at 120 kW.

This ambitious project is the result of a public-private partnership between the Senegalese government and Dakar Mobilité – a consortium comprising Meridiam (70%) and the Sovereign Fund for Strategic Investments of Senegal (30%). The private sector invested $144 million in the fleet and maintenance, while the government took on infrastructure costs and committed $17 million over 15 years to subsidize fares for underprivileged groups.

Designed to carry 300,000 passengers daily, the BRT system has halved commute times from 95 minutes to 45 minutes. It has also created 1,000 jobs, with 35% of them filled by women, marking progress in a traditionally male-dominated industry. The system’s charging infrastructure relies on solar energy and uses real-time monitoring to optimize charging based on passenger demand. Additionally, 17% of riders come from lower-income groups, benefiting from 50% fare reductions supported by government subsidies.

Benefits of Electric Buses: Environmental, Economic, and Social

Electric buses bring clear advantages in three key areas: improving air quality, reducing costs, and enhancing community well-being.

Cleaner Air

One of the standout benefits of electric buses is their ability to eliminate diesel emissions, which significantly improves urban air quality. For countries like Kenya, where 90% of electricity comes from renewable sources like geothermal and hydropower, these buses can operate without relying on fossil fuels. This not only reduces pollution but also aligns with global efforts to combat climate change.

Cost Savings

Electric buses are also a win for the wallet. Their operating and maintenance costs are much lower compared to diesel buses. For instance, in Kenya, running an electric heavy-duty bus for 62 miles costs between $19.14 and $28.50, compared to $61.07 for a diesel bus – resulting in savings of 47% to 83%. Maintenance is another area where electric buses shine; during a pilot program, BasiGo’s electric buses experienced less than two days of technical downtime over 135,000 kilometers of operation.

Community Benefits

The benefits of electric buses extend beyond economics and the environment – they also contribute to stronger communities. Quieter, smoother rides improve the urban experience, while local assembly initiatives make advanced transportation more accessible. These efforts also create green jobs and support local industries, paving the way for sustainable growth. As Christopher Kost, Africa Program Director at the Institute for Transportation and Development Policy, puts it:

"Nairobi will be a much more efficient city if we have a decent public transport system that offers reliable, fast service".

sbb-itb-99e19e3

Challenges and Solutions for Electric Bus Adoption

Scaling electric buses in African cities comes with its fair share of hurdles, despite the obvious advantages. One of the biggest obstacles is the higher upfront cost compared to traditional diesel buses. On top of that, installing the necessary charging infrastructure – particularly Level 3 DC fast chargers – requires substantial investment, often running into tens of thousands of dollars per unit. Another major challenge is the reliability of the power grid. In sub-Saharan Africa, the grid reliability index stands at 39.30, which is nearly 45 times worse than that of OECD countries. To make matters more complicated, in 34 surveyed nations, fewer than half of grid-connected households have consistent electricity access. These issues have sparked the development of creative financing methods and business models aimed at overcoming these barriers.

Franchise Models and Financial Accessibility

To tackle the high initial costs and infrastructure issues, some innovative franchise models have been introduced. One standout example is the battery subscription model launched in Nairobi by BasiGo CEO Jit Bhattacharya in March 2022. This "Pay-As-You-Drive" setup separates the cost of the electric bus from the battery, allowing operators to purchase an e-bus for the same upfront price as a diesel bus. Operators then pay a per-kilometer fee that covers both battery charging and maintenance. This approach enables businesses to adopt electric buses without overhauling their operating models or taking on excessive debt. By 2024, BasiGo had 22 buses on the road and had partnered with Nairobi’s largest operators to scale up to 1,000 buses by 2027. Bhattacharya explains:

"BasiGo’s key innovation is a battery subscription offering that separates the cost and charging of the EV battery from the cost of the bus – which allows owners to buy an e-bus for the same upfront cost as a diesel bus."

Government Subsidies and Policy Support

Government policies also play an essential role in driving the adoption of electric buses. Supportive measures have already started to reshape the market. For example, Ethiopia banned the import of internal combustion engine vehicles in 2023, which helped grow its electric vehicle fleet from 4,600 in 2023 to 14,000 by early 2025, including nearly 100 electric buses in Addis Ababa. Similarly, Togo introduced full VAT and customs duty exemptions on EVs starting in October 2024. In South Africa, a 150% tax deduction for vehicle manufacturers, effective March 1, 2026, coupled with a $54.2 million investment in local production of new-energy vehicles and batteries, is fueling industry expansion. These policy efforts are narrowing the financial gap, making electric buses a more practical option for the long term. As the Africa E-Mobility Alliance highlights:

"Infrastructure plays a significant role in e-bus adoption, and this requires support from both ends of the spectrum, that is, private and public sectors."

Future Growth of Electric Buses in Africa

By May 2025, Africa’s electric bus fleet experienced a 44% year-over-year increase. This shift marks a transition from small-scale pilot projects to large-scale deployments integrated into formal Bus Rapid Transit (BRT) systems. Cities like Dakar, Lagos, and Cairo are leading the charge, utilizing their BRT infrastructure to support the adoption of electric buses. As of July 2024, Ethiopia reported 229 electric buses, Egypt had 200, and Senegal followed with 155 units.

This progress is fueled by national policies aimed at accelerating electrification. For instance, Ethiopia exceeded its 2030 vehicle electrification targets after banning internal combustion engine imports in 2024. Similarly, South Africa has announced plans for a major expansion, offering a 150% tax deduction for electric vehicle production starting in 2026. These developments signal growing policy support across the continent.

Strategies for Large-Scale Deployment

A fleet-first approach focused on fixed-route transit is proving effective. This strategy prioritizes depot-based overnight charging, reducing the need for widespread public fast-charging infrastructure.

Innovative financing models – such as battery subscriptions, leasing options, and consumer loans – are helping lower operating costs. Combined with solar-powered mini-grid charging, these strategies also address grid challenges. In Kenya, for example, operating an electric heavy-duty bus costs between $19.14 and $28.50 per 100 kilometers, significantly less than the $61.07 cost for a diesel equivalent. Additionally, electric buses powered by renewable energy reduce emissions by 80% compared to their diesel counterparts.

Regional Growth Trends and Manufacturing Hubs

The sustainable expansion of electric bus fleets depends on cost-efficient local manufacturing. By leveraging supportive policies and innovative financing, local assembly initiatives are transforming the economics of electric bus adoption.

In May 2024, BasiGo, in partnership with Kenya’s Trade Cabinet Secretary Rebecca Miano, introduced the first locally assembled electric buses in Nairobi. Backed by $42 million in funding, the initiative aims to deploy 1,000 buses across Kenya and Rwanda. This shift from importing fully built units to local assembly has significantly reduced costs. Locally assembled buses in East Africa now range between $55,000 and $90,000, compared to $250,000 to $300,000 for imported units.

Regional manufacturing hubs are emerging with distinct strengths. In North Africa, Morocco and Egypt are advancing production with strong government support and established facilities. Meanwhile, East Africa is rapidly building its assembly capabilities. For example, by mid-2024, Uganda’s Kiira Motors deployed four e-buses in Kampala and had 24 more in production through a collaboration with Makerere University. Nigeria is also ramping up domestic production, achieving around 30% local assembly for its electric bus fleet.

Africa’s abundant reserves of key raw materials for battery production – such as lithium, cobalt, and other minerals found in South Africa, the Democratic Republic of Congo, Zimbabwe, and Zambia – position the continent for long-term growth. With the global market for these minerals projected to hit $46 trillion by 2050, African nations have the potential to move up the value chain, advancing from assembly to full-scale manufacturing and mineral processing. This evolution could significantly lower costs, create thousands of green jobs, and solidify Africa’s role in the global electric vehicle industry.

Conclusion

Africa is stepping into the future with its electric bus revolution. By May 2025, cities like Dakar, Lagos, and Cairo had already adopted large-scale Bus Rapid Transit systems, showing how electric buses are becoming a cornerstone of modern public transportation.

Take Kenya, for instance. Operating an electric bus there costs between $19.14 and $28.50 per 100 kilometers (about 62 miles). That’s less than half the $61.07 it takes to run a diesel bus. And beyond the financial savings, this shift directly addresses a pressing health crisis. As Jane Akumu, a UNEP Programme Officer, highlights:

"If you do not buy or bring in clean technology vehicles, you’re going to spend more on health. We need to look at the overall cost of these poor-technology vehicles because, yes, they will be cheap – but there will be higher costs to be paid”.

With air pollution responsible for one in nine deaths worldwide, moving to soot-free buses isn’t just a smart economic decision – it’s a life-saving one.

But making this transition stick requires teamwork. A mix of steady investment in charging infrastructure, supportive policies, creative financing options, and strong public-private partnerships will be key. Christopher Kost, Africa Program Director at the Institute for Transportation and Development Policy, sums it up perfectly:

"The ideal arrangement is where government is investing in the corridors, in the stations and the depots, and then the private sector is able to bring capital to invest in the buses".

Africa has everything it needs to lead the charge in green transportation: abundant renewable energy, growing local manufacturing, and rich reserves of battery minerals. With vehicle numbers in many African cities doubling every decade, the moment to act is now. The groundwork is in place, and the next decade will show whether Africa can fully embrace its potential in sustainable transportation.

FAQs

What are the key advantages of electric buses in African cities?

Electric buses bring a host of advantages to African cities, transforming urban life by addressing environmental, economic, and social challenges. By replacing diesel-powered buses, they help cut down harmful emissions and noise pollution, resulting in cleaner air and quieter streets. For instance, Nairobi has already experienced these benefits through its electric bus initiatives.

On the economic front, electric buses are cheaper to run, thanks to reduced fuel and maintenance costs. They also complement Africa’s rich renewable energy potential, such as solar and wind, which can power these vehicles while creating jobs in manufacturing and charging infrastructure. Beyond the economic perks, cleaner air leads to better public health, and the reliability of electric buses encourages more people to embrace public transit. This shift reduces dependence on private cars and informal minibuses, paving the way for a more sustainable urban transport system. Together, these factors position electric buses as a key driver of Africa’s greener future.

How do financing models make electric buses more affordable in Africa?

Reducing the steep upfront costs of electric buses is key to making them a viable option for public transit operators and private investors. Innovative financing approaches are stepping in to bridge this gap. By pairing government incentives – such as tax breaks and lower import duties – with flexible funding structures, the initial investment can be distributed across the bus’s operational lifespan, making it more comparable to the cost of traditional diesel buses.

Options like green bonds, public-private partnerships, and leasing or pay-as-you-go plans are giving operators more control over expenses. These strategies have already been put to work in cities like Nairobi and Cape Town, enabling the acquisition of electric buses with impressive ranges exceeding 224 miles. By linking financial gains to environmental progress, these funding models are not only driving broader adoption but also boosting charging infrastructure and advancing the vision of sustainable public transportation throughout Africa.

What are the main challenges African cities face in adopting electric buses?

African cities are grappling with several obstacles when it comes to adopting electric buses. A major challenge is the limited availability of charging infrastructure. Many cities have only a handful of charging points, which makes it tough to expand fleets. This raises concerns about buses running out of charge during operations, making the development of reliable and accessible charging networks a top priority.

Another pressing issue is the high upfront cost of electric buses. These buses cost significantly more than traditional diesel models. Without widespread subsidies or local manufacturing to offset expenses, the financial burden becomes even heavier. On top of that, limited financing options make it challenging for transit agencies to invest in both the buses themselves and the infrastructure they require.

Finally, policy and energy-related hurdles further complicate the shift to electric buses. Inconsistent regulations, a lack of standardized charging equipment, and unreliable electricity grids add layers of uncertainty. Addressing these issues will require focused efforts to improve affordability, establish stronger policy frameworks, and ensure stable energy systems that can support cleaner public transportation.