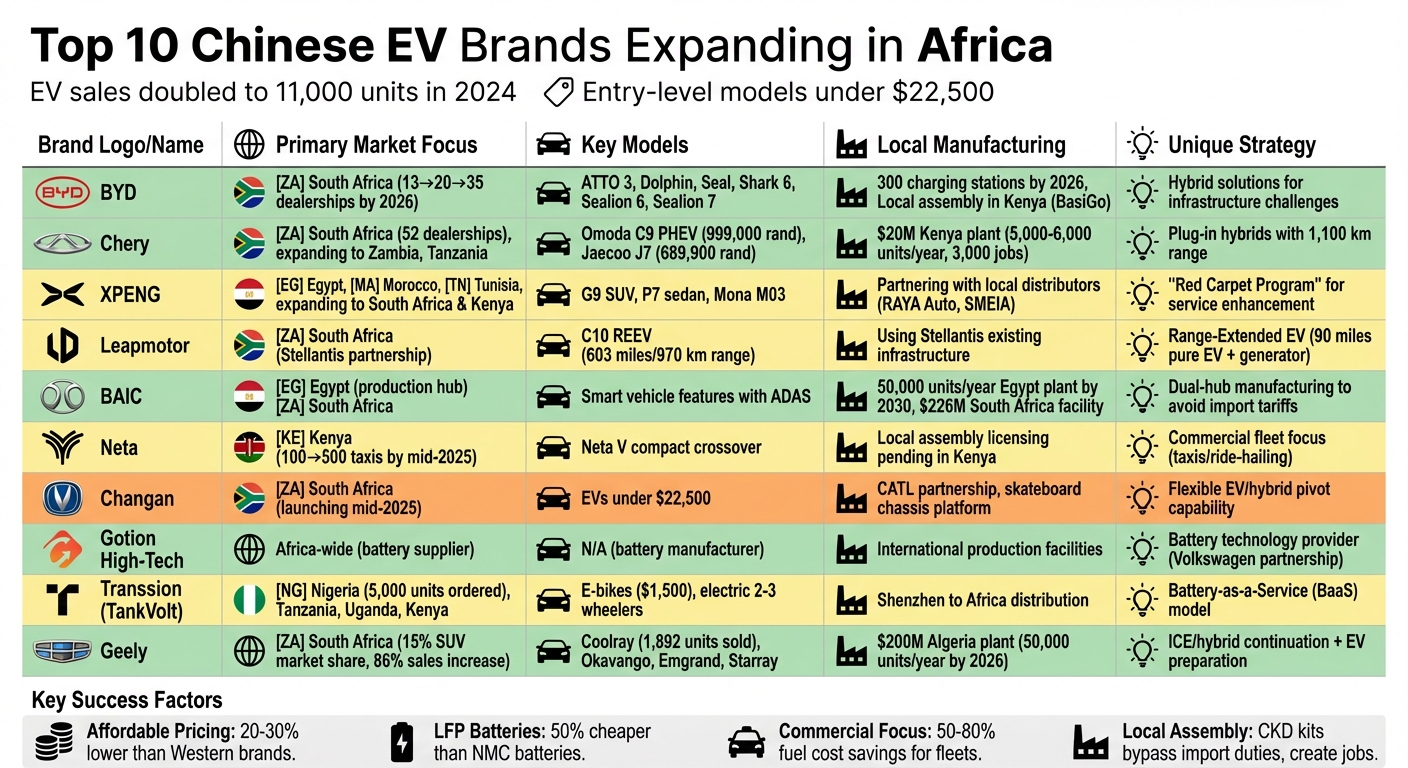

Chinese electric vehicle (EV) brands are reshaping Africa’s auto industry by offering affordable, tech-packed vehicles tailored to local needs. With EV sales doubling to 11,000 units in 2024, brands like BYD, Chery, and XPENG are targeting untapped markets. Key strategies include:

- Affordable Pricing: Entry-level models under $22,500.

- Local Assembly: Reducing costs and creating jobs in countries like Egypt, Kenya, and South Africa.

- Hybrid Solutions: Plug-in hybrids address limited EV infrastructure.

- Commercial Focus: EV taxis and buses cut fuel costs by up to 80%.

These brands are not only selling cars but also investing in local partnerships, charging infrastructure, and assembly plants to drive adoption across Africa.

Top 10 Chinese EV Brands in Africa: Market Strategy and Key Models Comparison

1. BYD

Market Penetration Strategy

BYD is positioning South Africa as its entry point into the African market, with plans to grow its dealership network significantly. By the end of 2025, the company aims to increase its dealerships from 13 to 20, and by the close of 2026, that number is set to reach 30–35. Steve Chang, General Manager of BYD Auto South Africa, highlighted this strategy:

"By the end of the year, we will have about 20 dealerships around the country, and we aim to grow that to around 30–35 by next year".

Stella Li, BYD’s Executive Vice President, emphasized the broader vision:

"South Africa is a very important market. Once we start here, you can duplicate the story into other African countries".

In addition to expanding its retail footprint, BYD is tackling Africa’s charging infrastructure challenges. The company has committed to installing 300 new charging stations across South Africa by the end of 2026. Beyond South Africa, BYD is also making strides in East Africa. Through a collaboration with BasiGo in Kenya, BYD electric buses are being assembled locally, benefiting from regional manufacturing incentives.

Key EV Models Offered

BYD’s South African lineup includes six vehicles, featuring both battery-electric and plug-in hybrid options. In April 2025, the company introduced three models tailored to the region: the Shark 6 hybrid pickup, the Sealion 6 plug-in hybrid SUV, and the Sealion 7 all-electric SUV. The Shark 6, priced between R640,000 and R1.3 million, caters to the popular "bakkie" market, offering a hybrid solution to address range concerns.

Earlier launches included the ATTO 3 (a compact electric SUV), Dolphin (an affordable electric hatchback), and Seal (a premium electric sedan). Steve Chang explained BYD’s strategy:

"While the share of NEVs to total car sales is still low, BYD is hoping to capture the market early on, in preparation for a meaningful transition".

These models demonstrate BYD’s approach to adapting its offerings to meet the specific demands of the African market.

Adaptation to African Infrastructure and Consumer Needs

Understanding the challenges posed by unreliable power grids and limited charging networks, BYD has diversified its lineup to include plug-in hybrids. While the all-electric ATTO 3 was the company’s initial launch, the introduction of hybrid models provides a practical alternative for areas where fully electric vehicles face adoption hurdles. Additionally, BYD is focusing on affordability by keeping entry-level models priced under 400,000 rand (roughly $22,500), ensuring competitiveness in the market.

2. Chery

Market Penetration Strategy

Chery has identified South Africa as its strategic entry point into the African market, capitalizing on the country’s well-established automotive infrastructure. Tony Liu, CEO of Chery South Africa, emphasized this approach:

"We treat South Africa as a very important market for our global expansion… a gateway to the African continent." [7,17]

Currently, Chery operates 52 dealerships across South Africa, Namibia, Eswatini, and Botswana under its Omoda & Jaecoo brands. The company has secured the position of the second-largest Chinese automotive brand in South Africa by sales volume and is planning expansions into Zambia and Tanzania within the next 18 months. While many competitors are focusing heavily on pure electric vehicles, Chery is taking a different route. The company is prioritizing hybrid technology, specifically plug-in hybrid electric vehicles (PHEVs) and Super Hybrids, to address the challenges posed by Africa’s limited charging infrastructure and unreliable power supply [7,15].

Key EV Models Offered

In June 2025, Chery introduced its hybrid Omoda C9 and Jaecoo J7 SUVs to the African market. Hans Greyling highlighted the significance of this launch:

"This is the first time that Omoda and Jaecoo have launched the plug-in hybrids for the local or the African market, and the move really is because that’s the way technology is going, because you get the best of both worlds."

The Omoda C9 PHEV, priced at 999,000 rand (about $56,275), comes equipped with a 34.5 kWh battery offering an all-electric range of 150 km (approximately 93 miles) and a combined range of 1,100 km (roughly 684 miles). Meanwhile, the Jaecoo J7 Super Hybrid is available for 689,900 rand (around $38,860). Chery’s Super Hybrid technology boasts an impressive thermal efficiency of 46.5%, with fuel consumption as low as 2 to 3 liters per 100 kilometers. Looking ahead, Chery plans to release three additional models by the end of 2025, including the Jaecoo J5 and Omoda C7. The company also has future launches in the pipeline for its dedicated EV line, iCar, and another brand called Lepas [16,17].

Local Manufacturing or Assembly Initiatives

Chery is also making moves in local production to solidify its presence in the region. In July 2024, the company partnered with Kenyan firm Afrigreen Automobile, committing $20 million to Kenya’s EV sector. This collaboration includes the establishment of an assembly plant in Nairobi, which is expected to produce 5,000–6,000 vehicles annually and create 3,000 jobs. In South Africa, Chery is evaluating whether to build a factory or collaborate on local assembly to take advantage of new government tax incentives introduced in January 2025 [15,17].

Adaptation to African Infrastructure and Consumer Needs

Understanding the challenges of adopting pure battery electric vehicles in Africa, Chery has tailored its hybrid offerings to align with the continent’s infrastructure and consumer demands. Jay Jay Botes, General Manager for Chery South Africa, explained:

"We believe Super Hybrid technology will become a key growth driver in markets like South Africa, especially as we expand our local line-up with electrified models later this year."

With a combined range of 1,100 km (approximately 684 miles), Chery’s hybrid models address the issue of limited charging stations, especially for long-distance travel. Additionally, the company is planning to introduce models with entry prices below 400,000 rand (around $22,500) to remain competitive with established brands in the region [7,17].

3. XPENG

Market Penetration Strategy

XPENG has mapped out a deliberate entry into Africa, focusing first on key North African markets along the Mediterranean coastal belt before branching out further across the continent. The company made its African debut in June 2024 by partnering with Egyptian distributor RAYA Auto to launch its G9 SUV and P7 sedan. These models quickly climbed to the top of Egypt’s monthly EV registration charts and earned the "2025 Electric Vehicle of the Year" award at the 7th Egyptian Annual Auto Awards. Building on this momentum, XPENG expanded its reach in September 2025 by forming strategic alliances with SMEIA Group in Morocco and XP CARS in Tunisia. SMEIA, a veteran in the luxury automotive sector with 44 years of experience, commands a 30% market share in Morocco and operates a service network that covers 97% of the country’s population.

Wang Ke, General Manager of XPENG’s Middle East and Africa Region, highlighted the importance of this strategy:

"Africa is one of the key pieces of our global strategy. Morocco, as one of Africa’s largest automobile producers, has a mature automotive industry chain; Tunisia, with its geographical location adjacent to Europe, has become a strategic hub connecting the African and European markets."

To further solidify its position, XPENG launched the "Red Carpet Program", an initiative aimed at enhancing the service capabilities and after-sales infrastructure of its local partners. Looking ahead, the company has identified South Africa and Kenya as key markets for its expansion into sub-Saharan Africa.

Key EV Models Offered

XPENG has introduced three models tailored to the African market. The G9 SUV and P7 sedan are already available in Egypt, while the company is rolling out the Mona M03, a low-cost sedan designed to make EV ownership more accessible. This move aligns with the broader strategy of Chinese EV brands in Africa, which often target starting price points below $22,500. Notably, XPENG achieved a significant milestone in late 2024 by producing its one millionth electric vehicle – an impressive feat just 11 years after its founding.

Adaptation to African Infrastructure and Consumer Needs

Instead of developing its own charging networks, XPENG relies on partnerships with local automotive groups, which already provide coverage across 97% of targeted market areas. This strategy ensures reliable after-sales support while minimizing upfront infrastructure investments. As Wang Ke explained:

"The African market has significant potential and unique needs. We… will continue to invest resources to strengthen the service capabilities of local partners through the ‘Red Carpet Program.’"

Focusing on North African countries like Morocco and Tunisia offers additional benefits. These regions boast well-established automotive industry chains and are strategically located near European markets, which helps streamline logistics and improve parts availability.

4. Leapmotor

Market Penetration Strategy

Leapmotor has entered the African market through a 51/49 joint venture with Stellantis, taking advantage of Stellantis‘ established dealership network and service infrastructure in South Africa. The brand officially launched during SA Auto Week in Gqeberha, Eastern Cape, in October 2025, with plans for dealership rollouts across the country soon after.

Mike Whitfield, Managing Director of Stellantis South Africa, highlighted the importance of this partnership:

"South Africa is a key market for Stellantis, and the launch of Leapmotor marks an important step in offering innovative new energy vehicle options through product, innovation, and partnerships."

Instead of investing in independent facilities, Leapmotor is utilizing Stellantis’ existing resources to speed up its entry into the market while keeping initial costs low. The company has set a bold goal of achieving 300,000 annual sales outside China by 2030, with Africa playing a critical role in this expansion.

Key EV Models Offered

The Leapmotor C10 REEV takes center stage for the South African launch. This SUV employs Range-Extended Electric Vehicle (REEV) technology, which includes a 50kW onboard generator that recharges its 28.4kW battery pack without directly powering the wheels. The result? A total range of up to 603 miles (970 km), including 90 miles (145 km) in pure EV mode.

The C10 REEV is equipped with multiple energy modes to adapt to different driving conditions. It also supports DC fast-charging, reaching 50% charge in just 18 minutes. Additionally, the vehicle boasts a five-star Euro NCAP safety rating, ensuring peace of mind for drivers and passengers alike.

Adaptation to African Infrastructure and Consumer Needs

Leapmotor’s REEV technology is designed to tackle the challenges posed by Africa’s limited charging infrastructure and energy constraints. While new energy vehicle sales more than doubled between 2023 and 2024, they still account for only 3% of total new vehicle sales – a reflection of range anxiety and the lack of charging stations in rural areas.

The REEV system provides a practical solution by allowing drivers to refuel at regular petrol stations when charging isn’t an option. Its 1.5L petrol engine consumes just 0.3 liters per kWh of electricity generated, making it an economical choice for long-distance travel across Africa’s vast landscapes.

Positioning itself as a tech-forward and budget-friendly brand, Leapmotor is also tailoring its Advanced Driver Assistance System (ADAS) with over-the-air updates to better suit local driving conditions.

5. BAIC

Market Penetration Strategy

BAIC is expanding its footprint in Africa through a smart dual-hub manufacturing strategy, with Egypt serving as its primary production and distribution center. In June 2025, the company joined forces with Alkan Auto in Egypt to establish a dedicated EV plant, aiming to produce 50,000 units annually by 2030.

This strategy helps BAIC sidestep high import tariffs while taking advantage of regional trade agreements, making its vehicles more accessible to African buyers. Alongside its Egyptian operations, BAIC runs a $226 million manufacturing facility in South Africa, which has been producing vehicles since 2018 with an annual capacity of 50,000 units. By focusing on local assembly, BAIC not only cuts costs but also positions itself as a competitive player by offering advanced technology at attractive prices. These local manufacturing efforts further solidify its market presence.

Local Manufacturing or Assembly Initiatives

The Egyptian plant is expected to begin operations by late 2025, with plans to reach its full annual capacity of 50,000 units within five years. This move aligns with BAIC’s broader goal of making EVs more affordable while contributing to Africa’s green transition. Notably, transportation accounts for about 24% of the continent’s carbon dioxide emissions from fuel combustion.

Stephen Dyer, Partner and Managing Director at AlixPartners, highlighted the appeal of Chinese EV brands:

"Chinese EV brands are particularly strong in smart vehicle features… They also offer appealing designs and solid mechanical performance at relatively affordable prices, which helps attract African consumers".

Adaptation to African Infrastructure and Consumer Needs

BAIC recognizes the unique challenges of Africa’s infrastructure and adapts its offerings accordingly. The company prioritizes affordability and cutting-edge technology, integrating features like intelligent cockpits, ADAS (Advanced Driver Assistance Systems), and competitive pricing. Leveraging advanced Chinese battery technology and software, BAIC enhances smart vehicle functionalities to appeal to tech-savvy buyers across the continent.

In addition to providing affordable EVs, BAIC’s local manufacturing efforts contribute to job creation and help build the technical expertise needed to support and maintain electric vehicles throughout Africa.

6. Neta

Market Penetration Strategy

Neta has chosen Kenya as its starting point for entering the African market, seeing the country as a strategic gateway to Southern, Central, and Eastern regions. In June 2024, the brand marked its African debut by opening its first flagship showroom in Nairobi. Instead of focusing on private car buyers, Neta is targeting the commercial transport sector – particularly taxi and ride-hailing services. This approach leverages the high daily mileage of these vehicles, maximizing the cost-saving benefits of electric vehicles (EVs).

To address the challenge of limited consumer credit access, Moja EV, Neta’s partner in Kenya, collaborated with financial institutions to create a system where taxi drivers receive ride payments directly into their bank accounts. This setup helps drivers build verifiable financial histories, making it easier for them to qualify for vehicle loans.

In October 2024, Moja EV Kenya introduced a fleet of 100 Neta V electric taxis in Nairobi, with plans to expand to 500 vehicles by mid-2025. The company has ambitious plans to expand further, aiming to enter 20 African countries, establish 100 stores, and achieve annual sales of over 20,000 units within three years. Like other EV brands in the region, Neta is tailoring its strategy to meet Africa’s unique market demands.

Key EV Models Offered

Neta’s flagship model for the African market is the Neta V, a compact crossover designed with features that cater to local conditions. With enhanced ground clearance, it handles various road types effectively. The model’s appeal is further boosted by its zero fuel costs and lower maintenance needs compared to traditional combustion engines – critical factors in a region where fuel prices surged by 64.6% in East Africa by the third quarter of 2024. Neta’s "EVs for the people" philosophy is evident in its effort to keep prices competitive with established brands.

Local Manufacturing or Assembly Initiatives

Neta is actively working toward establishing local assembly operations in Kenya. Erick Lumallas, assistant to the CEO of Moja EV Kenya, shared:

"Licensing is pending, to start assembling the electric vehicles in Kenya".

By assembling vehicles locally, Neta aims to cut down on import costs and adapt its vehicles to meet local technical requirements. This move is seen as a stepping stone toward full-scale domestic manufacturing, which could help lower prices even further while creating job opportunities for the local workforce.

Adaptation to African Infrastructure and Consumer Needs

Neta’s strategy extends beyond taxis, with plans to explore partnerships with SACCOs (Savings and Credit Cooperative Organizations) for long-distance EVs and lorries. This broader focus addresses a range of transportation needs across the continent. Xn Iraki, an Associate Professor at the University of Nairobi, highlighted:

"Chinese cars are affordably priced, reflecting China’s deep understanding of African consumption habits".

7. Changan

Market Penetration Strategy

Changan is gearing up to enter the South African market by mid-2025, positioning it as a gateway to the broader African region. In South Africa, sales of New Energy Vehicles (NEVs) more than doubled between 2023 and 2024, reaching 15,611 units. However, NEVs still make up just 3% of total new vehicle sales. Industry experts predict a significant rise in demand once NEVs achieve a 10% market share.

To fast-track its entry, Changan has teamed up with battery powerhouse CATL through its Changan Mazda joint venture. Together, they’re working on electric vehicles built on a "skateboard" chassis platform, which significantly reduces the time it takes to develop new vehicles. CATL has stated that this technology allows both companies to "greatly shorten the vehicle development cycle and jointly respond flexibly to changes in market demand". This approach enables Changan to quickly adapt to local consumer preferences and infrastructure challenges, paving the way for an affordable and versatile lineup of electric vehicles.

Key EV Models Offered

Changan is aiming to keep its electric and hybrid vehicles priced under $22,500 to stay competitive with established automakers. Offering high-quality vehicles at accessible prices is a cornerstone of their strategy. Greg Cress from Accenture emphasized, "As long as they remain affordable from an up‑front cost perspective, they will be differentiated against legacy brands offering similar specifications". This pricing strategy aligns with Changan’s goal to adapt to local market dynamics while maintaining a competitive edge.

Adaptation to African Infrastructure and Consumer Needs

Changan is adopting a tailored approach to address infrastructure and economic challenges in South Africa, echoing strategies used by other Chinese automakers in the region. The company plans to offer a mix of fully electric and hybrid models. Hans Greyling, General Manager of Omoda & Jaecoo South Africa, noted, "Battery electric vehicles have not really taken off in South Africa… We’ve gone the route of looking more towards traditional hybrids or plug‑in hybrids". With its partnership with CATL and the flexibility of the skateboard chassis platform, Changan is well-positioned to quickly pivot between pure EVs and plug-in hybrids to meet evolving market demands.

sbb-itb-99e19e3

8. Gotion High-Tech

Market Penetration Strategy

Gotion High-Tech is carving a unique path in Africa’s EV market. Unlike traditional automakers that focus on selling vehicles, this battery manufacturer is concentrating on its "going global" initiative by setting up a strong international presence through localized production and partnerships. To speed up its global reach, Gotion is actively building manufacturing facilities outside of China.

A key factor in Gotion’s strategy is its partnership with Volkswagen, which owns a stake in the company. This connection not only boosts Gotion’s credibility but also helps secure supply contracts with major car brands operating in Africa. As one of the leading battery producers, Gotion focuses on providing the essential technology for powering electric vehicles, leaving vehicle manufacturing to others.

Adapting to African Infrastructure and Consumer Needs

Gotion’s global expansion isn’t just about scaling up; it’s also about meeting local needs. The company understands the unique challenges in Africa, such as inconsistent power grids and a lack of widespread charging infrastructure. To address these issues, Gotion is prioritizing battery durability and reliability, aiming to build trust among consumers in regions where service networks are still developing. By tailoring its battery technology to fit the specific conditions of African markets, Gotion is positioning itself as a key player in the region’s EV ecosystem.

9. Transsion (TankVolt)

Market Penetration Strategy

Transsion, known for dominating Africa’s smartphone market with brands like Tecno, Infinix, and Itel, has leveraged its 50% market share to venture into the electric vehicle (EV) industry. In November 2024, the Niger state government in Nigeria placed an order for 5,000 TankVolt units as part of a clean mobility initiative. Beyond this, Transsion is actively engaging with other provincial governments and Nigeria’s federal administration to encourage broader public-sector adoption.

Instead of focusing solely on individual buyers, Transsion prioritizes partnerships with government fleets and private logistics companies. Its vertically integrated model – spanning manufacturing in Shenzhen to distribution across Africa – gives it a pricing edge. This strategy has propelled TankVolt into the ranks of Africa’s top three EV brands by mid-2025. With a strong foothold established, the company is now working on vehicle designs tailored specifically to local needs.

Key EV Models Offered

TankVolt specializes in electric two-wheelers and three-wheelers designed for African markets. For example, its e-bikes are priced at approximately $1,500, making them a competitive alternative to options like Ethiopia’s Dodai, which costs about $1,800 and includes a built-in battery system.

Adaptation to African Infrastructure and Consumer Needs

Transsion’s approach goes beyond vehicle design – it addresses the unique infrastructure challenges of the region. A key part of its strategy is the Battery-as-a-Service (BaaS) model, which allows third-party charging stations to lease batteries and offers swappable battery options. By mid-2025, BaaS facilities were operational in Tanzania, with similar services introduced in Uganda. This model ensures flexibility and accessibility for users across the region.

In December 2024, Lagos-based Swap Station Mobility selected TankVolt as its main EV supplier after testing several brands. Founder Obiora Okoye highlighted the reasons behind this choice:

"We selected TankVolt based on its technical capabilities, after-sales collaboration, parts availability, and future co-development."

To make its vehicles more affordable, Transsion has partnered with financial institutions like Watu Credit, Mogo Finance, and M-Kopa in Kenya. These partnerships offer flexible payment plans for two-wheelers, easing the financial burden for buyers. Additionally, TankVolt provides fleet management software to streamline logistics and maintenance for fleet operators.

10. Geely

Market Penetration Strategy

Geely is employing a dual strategy to solidify its position in the market – continuing strong sales of internal combustion engine (ICE) and hybrid vehicles while gearing up for the growing demand for electric vehicles (EVs). This approach has already paid off, as Geely captured 15% of South Africa’s SUV market, achieving an impressive 86% increase in sales volume between January and August 2025. The company stands out by offering vehicles packed with advanced features at prices that often undercut competitors from Western and Japanese brands.

Their pricing strategy is especially aggressive, with models available for under 400,000 rand (around $22,500), making them a strong contender against traditional automakers. Greg Cress of Accenture commented:

"As long as they remain affordable from an up-front cost perspective, they will be differentiated against legacy brands offering similar specifications".

This balanced focus on affordability and innovation not only broadens Geely’s market reach but also sets them apart in terms of strategic execution. Let’s take a closer look at the specific EV models that underline their market approach.

Key EV Models Offered

Geely’s lineup in Africa includes several well-received models. The Coolray, for instance, has gained popularity, with 1,892 units sold in recent South African rankings. It’s priced between AED 67,500 and 81,500 in regional markets. Another standout is the Okavango, which offers three versatile seating configurations, catering to both family and commercial needs. Other models in their portfolio include the Emgrand sedan and the Starray SUV, further diversifying their offerings.

Local Manufacturing or Assembly Initiatives

To complement its market strategy, Geely is investing heavily in local production to cut costs and strengthen its regional presence. In December 2024, the company announced a $200 million investment to establish an automobile assembly plant in Algeria. This facility, set to launch in 2026, will have an initial production capacity of 50,000 vehicles annually. Beyond serving local demand, the plant is designed to act as an export hub, supplying vehicles to other African nations, Latin America, and Central Asia. By manufacturing locally, Geely avoids high import duties, making its vehicles more affordable for African buyers. This initiative underscores Geely’s long-term commitment to expanding its footprint across Africa and beyond, while also boosting its competitive edge in the global market.

How Chinese EV Makers Are Building a Lead in African Countries

Brand and Model Comparison

When looking at Chinese EV brands, their strategy in Africa stands out for its focus on affordability, practicality, and clever technology usage. These brands prioritize budget-friendly options over high-performance vehicles, making them a go-to choice for many African buyers. One major reason for their cost advantage is the use of domestic LFP batteries, which are about 50% cheaper than the NMC batteries commonly used by Western and Japanese competitors. This allows Chinese EVs to be priced 20% to 30% lower than similar models from established global brands. As a result, they dominate various price segments in the market.

For many buyers in Africa, the sweet spot is a price tag under 400,000 rand (roughly $22,500). Brands like BYD, Chery, and XPENG have positioned their entry-level models right in this range. Their offerings cater to different budgets, ranging from affordable options ($10,000–$20,000) to mid-range ($20,000–$50,000) and premium vehicles priced above $50,000.

Chinese manufacturers are also addressing the region’s infrastructure challenges, such as unreliable power grids and limited charging facilities, by offering plug-in hybrids. In South Africa, for instance, Chery has plans to roll out eight hybrid models, including five plug-in hybrids. BYD’s Shark pickup combines the versatility of a plug-in hybrid with rugged features for tough terrains. Hans Greyling, General Manager at Omoda & Jaecoo South Africa, highlighted this trend:

"Battery electric vehicles have not really taken off in South Africa. We’ve gone the route of looking more towards traditional hybrids or plug-in hybrids".

When it comes to range, Chinese brands are pushing boundaries. NIO’s ET7 boasts an impressive 1,044 km (648 miles) on semi-solid state batteries. Meanwhile, BYD’s SEALION 6 and Chery’s Super Hybrid models offer extended ranges to counter unreliable power supplies. For North African markets, XPENG’s Mona M03 sedan is designed as a low-cost, high-volume solution.

What truly sets these brands apart is their ability to deliver advanced features at affordable prices. Even entry-level models come packed with perks like large touchscreens, driver-assist systems, and upscale interiors – features that legacy brands often reserve for their premium trims. This focus on delivering more value for less is reshaping consumer expectations across Africa, offering cutting-edge technology without the premium price tag.

Conclusion

Chinese electric vehicle (EV) brands are reshaping Africa’s automotive landscape with aggressive pricing, strategic local partnerships, and adaptable business models – areas where traditional automakers often struggle to compete. By leveraging CKD (completely knocked down) kits for local assembly, these manufacturers not only lower production costs and bypass import duties but also generate local jobs. This approach is paving the way for practical and creative commercial applications.

One standout strategy is the commercial fleet model. Electric buses and taxis offer fuel cost savings of 50%–80% compared to traditional vehicles, making them an attractive option even without government subsidies. A great example of this is Moja EV’s rollout of 100 Neta V electric taxis in Nairobi in October 2024. Their innovative financing system allows drivers to pay for the vehicles through earnings from digital ride-hailing, addressing long-standing credit challenges that have hindered vehicle ownership for many African consumers.

For Africa’s EV market to grow sustainably, government support is key. Policymakers have a chance to accelerate the shift by introducing tax breaks, lowering import duties on EV components, and incentivizing local assembly. These measures could help bridge the price gap between electric vehicles and the widely popular second-hand gasoline cars. As Steve Chang, General Manager of BYD South Africa, aptly put it:

"I think South Africa and the rest of Africa have a very big opportunity to what I call leapfrog from ICE into renewable energy (cars)".

This potential to "leapfrog" mirrors Africa’s mobile revolution, where the continent bypassed landline systems entirely, moving straight to mobile technology.

However, market dynamics alone won’t drive the transition. Infrastructure and public policy are equally critical. Addressing Africa’s limited power supply and sparse charging networks is essential for scaling EV adoption. Governments could collaborate with Chinese manufacturers to set up standardized charging networks and establish training programs for local technicians. Burkina Faso’s success with the "Itaoua" brand in January 2025 is a promising example – local engineers began assembling solar-powered vehicles after receiving specialized training, showcasing how technology transfer can create long-term capacity.

With electric car sales in Africa more than doubling to around 11,000 units in 2024, the momentum is undeniable. But sustained progress will require coordinated efforts from manufacturers, governments, and financial institutions to make electric mobility a reality for millions of African consumers. The groundwork is being laid; now it’s about ensuring the pieces come together.

FAQs

How are Chinese EV brands overcoming Africa’s limited charging infrastructure?

Chinese EV brands are tackling Africa’s limited charging infrastructure by building local charging networks and working with regional partners to set up renewable energy-powered stations. The goal? To make charging easier and more environmentally friendly.

On top of that, many companies are introducing batteries with extended lifespans and offering hybrid-electric powertrains. These solutions reduce the dependence on charging stations, addressing the specific needs of the African market while prioritizing convenience and cost-effectiveness for consumers.

How are Chinese EV brands making their vehicles more affordable for African consumers?

Chinese electric vehicle (EV) manufacturers are finding creative ways to make their cars more affordable in Africa. One major approach is setting up local assembly plants or forming joint ventures in countries like Egypt, Kenya, and South Africa. By assembling vehicles locally, they cut down on import duties, shipping fees, and other costs, allowing them to offer more competitive pricing. On top of that, they’re introducing financing and leasing options, making it easier for both individuals and businesses to manage the upfront costs by spreading payments over time.

To appeal to cost-conscious buyers, these companies are rolling out budget-friendly models priced between $13,000 and $30,000. Thanks to China’s efficient production systems, they can keep manufacturing expenses low without sacrificing quality. They’re also teaming up with local dealerships and service centers to ensure reliable after-sales support, which helps reduce the long-term costs of owning an EV. Additionally, by investing in charging infrastructure and renewable energy solutions, they’re lowering the operating costs for EV owners, making these vehicles an even more practical choice.

How are Chinese EV brands creating jobs in Africa through local assembly?

Chinese EV companies are tapping into Africa’s potential by setting up local assembly operations – a move that not only helps them expand but also creates job opportunities. Many of these manufacturers start with complete knock-down (CKD) kits, which are shipped to Africa and assembled on-site by local workers. This method cuts down on import costs while opening up hundreds of skilled jobs in areas like assembly, quality control, and testing. Over time, some brands are scaling up to full-fledged factories that produce key components such as batteries and motors locally. This shift has the potential to generate thousands of jobs and energize related sectors like logistics and after-sales services.

Take Dongfeng as an example. Their assembly plant in Kenya initially employed around 300 people but plans to double that number as production ramps up. By sourcing parts like wiring and interior trims locally, these operations also create indirect jobs across supply chains. Furthermore, Chinese manufacturers are teaming up with local institutions to provide vocational training programs, equipping workers with specialized EV skills, from battery diagnostics to handling high-voltage systems. These initiatives align with Africa’s goals of fostering economic growth and advancing sustainable energy solutions.