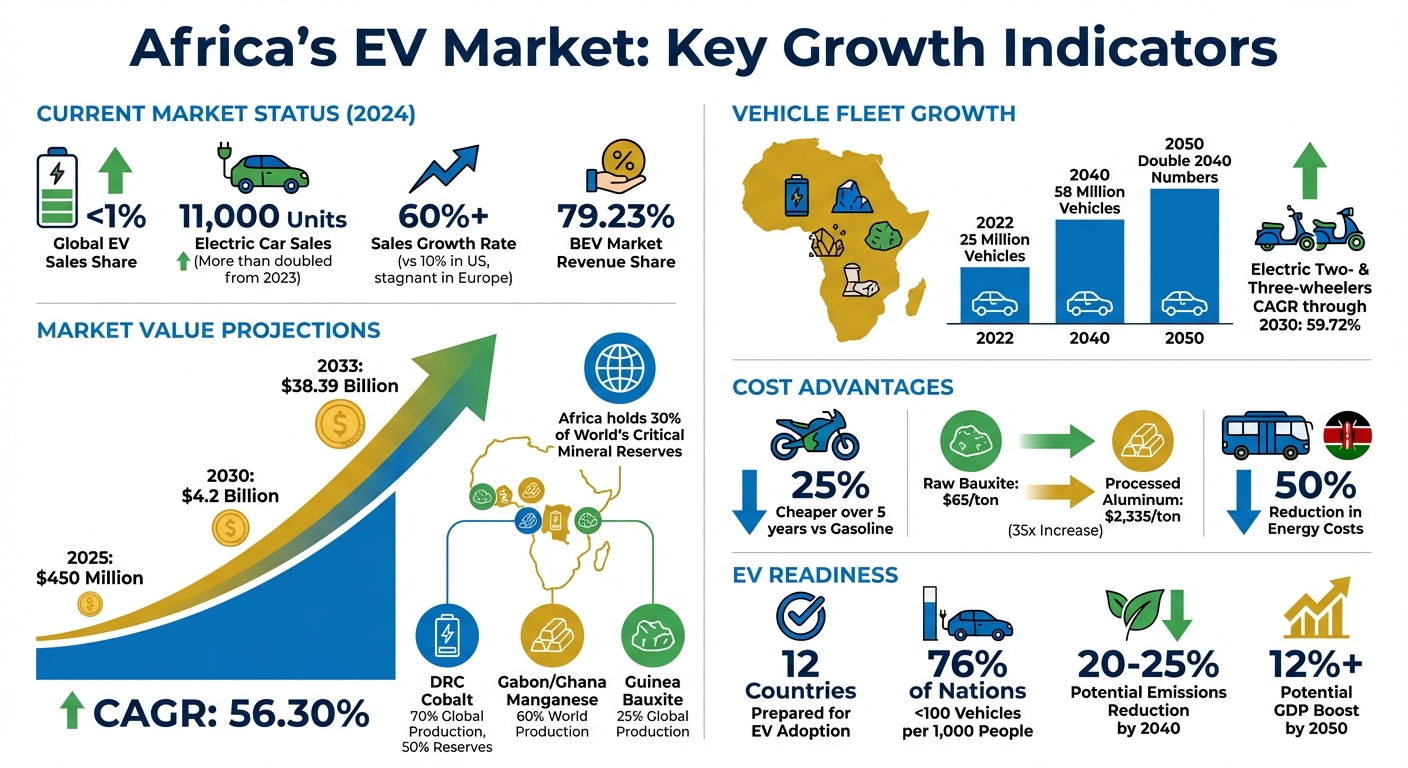

Africa is emerging as a key player in the global electric vehicle (EV) market. Despite accounting for less than 1% of global EV sales today, the continent is positioned for rapid growth due to its unique needs, abundant resources, and supportive policies. Here’s why:

- Vehicle Growth: Africa’s vehicle fleet is expected to grow from 25 million in 2022 to 58 million by 2040, with electric two- and three-wheelers leading adoption due to their affordability and suitability for urban transport.

- Natural Resources: The continent holds 30% of the world’s critical minerals like cobalt, lithium, and platinum, essential for EV batteries, and is moving toward local processing to capture more value.

- Policy Support: Countries like Ethiopia, Kenya, and Nigeria are implementing bans on combustion engine imports, tax incentives, and infrastructure investments to boost EV adoption.

- Market Growth: Africa’s EV market is projected to grow from $450 million in 2025 to $4.2 billion by 2030, with a compound annual growth rate (CAGR) of 56.30%.

- Innovations: Battery-swapping stations, fintech-enabled financing, and solar-powered charging systems are addressing infrastructure challenges and making EVs more accessible.

While challenges like unreliable power grids remain, Africa is leveraging decentralized renewable energy and localized manufacturing to address these issues. With vehicle numbers set to double by 2050 and 12 countries already prepared for EV adoption, Africa is shaping its own path in the global EV landscape.

Africa’s Electric Vehicle Market Growth Statistics and Projections 2024-2050

4 Business Strategies Changing Africa’s EV Game

Rapid Growth Projections for Africa’s EV Market

Africa’s electric vehicle (EV) market is not just growing – it’s transforming how mobility is perceived and practiced across the continent.

Market Size and Growth Rates

The growth in Africa’s EV market outpaces that of the United States, where EV sales grew by just 10% in 2024. In contrast, electric car sales in Africa soared to nearly 11,000 units in 2024, more than doubling from the previous year. Globally, emerging and developing regions, including Africa, experienced a sales increase of over 60% in 2024, far surpassing the modest 10% growth in the U.S. and stagnant figures in Europe.

Projections indicate a dramatic rise in Africa’s EV market value, expected to grow from $450 million in 2025 to $4.2 billion by 2030 – a compound annual growth rate (CAGR) of 56.30%. By 2033, this figure is projected to hit $38.39 billion, starting from a 2025 baseline of $17.58 billion. South Africa, a key player in this trend, reported an 85.46% increase in Battery Electric Vehicle (BEV) sales between 2022 (502 units) and 2023 (931 units). This explosive growth positions BEVs as a dominant force in Africa’s EV market.

Battery Electric Vehicles (BEVs) Lead the Market

BEVs currently hold the largest share of the African EV market, accounting for a 79.23% revenue share in 2024. Their popularity is largely attributed to their lower maintenance needs and their ability to integrate seamlessly with decentralized solar energy systems – a crucial benefit in areas where national power grids are unreliable.

Local assembly initiatives are also driving this momentum. For instance, BMW’s iX1 is now being assembled in South Africa, and Renault-Nissan’s Dacia Spring, priced under $20,000, has gained traction in Morocco. These developments highlight BEVs’ strong appeal across the region. While BEVs dominate in revenue, electric two- and three-wheelers are emerging as a fast-growing segment.

Electric Two- and Three-Wheelers Gain Traction

Electric two- and three-wheelers are set to grow at a staggering CAGR of 59.72% through 2030. Their rise is fueled by urban logistics, ride-hailing services, and their affordability – operating costs over five years are approximately 25% lower than those of gasoline-powered alternatives.

South Africa, for example, is seeing increased demand for last-mile delivery micro-mobility, expected to grow at a CAGR of 8.5% through 2030. Kenya is also making strides, with Roam Electric partnering with County Bus Service in April 2024 to roll out 200 electric buses by 2026. This initiative aims to cut energy costs for operators by 50%.

These trends underscore the rapid evolution of Africa’s EV market, driven by both technological advancements and practical needs.

Africa’s Natural Resources for Battery Production

Africa holds around 30% of the world’s proven critical mineral reserves – the essential components behind every electric vehicle (EV) battery. This wealth of resources places the continent in a prime position to reshape the global EV supply chain. A closer look at these minerals reveals just how central Africa is to the future of battery production.

Cobalt, Lithium, and Platinum Reserves

The Democratic Republic of Congo (DRC) leads the world in cobalt production, accounting for over 70% of global output and holding 50% of known reserves. Cobalt is a key ingredient in lithium-ion battery cathodes, making the DRC crucial for today’s EV production. However, a staggering 97% of the country’s cobalt exports leave unprocessed, heading to China.

Lithium, another essential mineral for batteries, is found in Zimbabwe, the DRC, Mali, and Namibia. Zimbabwe has emerged as a hotspot, attracting significant Chinese investment in lithium concentrate facilities. With global lithium demand expected to rise tenfold by 2050, these countries are poised to play a major role in future battery production.

South Africa holds a leading position in platinum-group metals, while Gabon and Ghana produce over 60% of the world’s manganese. Mozambique supplies graphite for battery anodes, and Zambia and the DRC are key sources of copper for EV motors and wiring. Guinea, meanwhile, contributes 25% of global bauxite production, a material critical for aluminum used in EV frames and battery casings.

The disparity between raw and processed materials is striking. For instance, raw bauxite sells for about $65 per ton, while processed aluminum fetches approximately $2,335 per ton – a 35-fold increase in value. To capture more economic benefits, countries like Zimbabwe, Namibia, Ghana, and Nigeria have implemented bans on raw mineral exports, encouraging local processing instead. These reserves are more than just a regional advantage – they are becoming the backbone of Africa’s growing influence in the EV industry.

Local Battery Production and Recycling Programs

Africa is taking steps to move beyond exporting raw materials by developing its own battery production capabilities. In June 2023, Morocco signed a $6.4 billion deal with Chinese battery giant Gotion High-Tech Co. to establish an EV battery factory in the Rabat-Salé-Kénitra region. This facility, with an annual capacity of 100 gigawatts, will primarily serve the European market.

The DRC and Zambia are also working to create a localized EV battery supply chain. In 2022, the two countries agreed to collaborate on producing batteries for two- and three-wheeled vehicles. By December 2024, a Memorandum of Understanding facilitated by the United Nations Economic Commission for Africa brought Morocco into the Zambia-DRC Special Economic Zone, strengthening Africa’s e-mobility ambitions.

"A precursor facility in the DRC would be three times cheaper than it would cost for a similar plant in the USA as a result of cost competitiveness and proximity to raw materials."

– Mrs. Oluranti Doherty, Director for Export Development at Afreximbank

In April 2025, Namibia launched Africa’s first industrial green iron facility. Powered by solar energy and the region’s largest electrolyser, the plant produces green hydrogen for zero-emissions iron production. By 2030, it aims to scale up to 2 million tonnes annually. This project underscores how Africa’s renewable energy potential can drive eco-friendly mineral processing aligned with global low-carbon goals.

The StamiNa project, recognized in July 2025, highlights Africa’s growing expertise in EV battery technology. This collaboration between Swansea University and institutions in Nigeria and Kenya focuses on advancing local battery production and bridging knowledge gaps. These initiatives mark a shift from Africa’s traditional role as a raw material exporter to becoming a key player in the global EV manufacturing landscape.

Government Policies Driving EV Adoption

Across Africa, governments are rolling out policies aimed at making electric vehicles (EVs) more accessible and practical. These initiatives include tax breaks for buyers, incentives for manufacturers, and measures to improve infrastructure, creating a supportive environment for the EV market. While the specifics vary by country, the goal is clear: Africa is setting the stage for rapid EV expansion. Below, we explore tax incentives, infrastructure laws, and production rebates that are driving this transformation.

Tax Incentives and Import Duty Reductions

Several African nations are slashing taxes and duties to make EVs more affordable. For example, Rwanda has removed tax barriers by offering direct exemptions on EV sales, significantly lowering costs for consumers. Ghana has embedded fiscal incentives within its eight-point framework to build a local EV value chain, even going so far as to ban raw material exports to support this goal. Meanwhile, South Africa is preparing to reduce import duties on batteries used in vehicles produced and sold domestically starting March 1, 2026.

Nigeria’s Electric Vehicle Transition and Green Mobility Bill, set for 2025, proposes a range of incentives, including tax holidays, subsidies, and waivers for EV businesses. Additionally, consumers could benefit from exemptions on road taxes and emission testing. The cost-effectiveness of electric two-wheelers, which are about 25% cheaper than gasoline models over five years due to lower fuel and maintenance expenses, adds another layer of economic appeal.

Laws Supporting EV Infrastructure

Beyond tax relief, governments are enacting laws to ensure the infrastructure needed for EVs is in place. Kenya’s Draft E-Mobility Policy mandates infrastructure development, and in June 2021, the government designated Nairobi’s Bus Rapid Transit (BRT) lanes exclusively for electric buses, creating a dedicated space for e-mobility in the capital. In Nigeria, the 2025 bill requires all fuel stations to install EV charging points and offers toll-free highway access for EVs, further reducing operational costs. Uganda has also introduced its National Electric Mobility Policy to address charging infrastructure gaps.

Production Rebates for Local Assembly

To complement infrastructure initiatives, production incentives are being introduced to bolster local manufacturing. South Africa, for instance, will allow manufacturers to claim 150% of qualifying investments in electric and hydrogen vehicles starting March 1, 2026. This policy is backed by a 1 billion rand fund ($54.27 million) aimed at boosting domestic production of new energy vehicles. Notably, South Africa’s automotive industry, which exports 46% of its vehicles to the UK and EU, is looking to pivot toward more sustainable practices.

"Consideration must be given to incentives for manufacturers, as well as tax rebates or subsidies for consumers, to accelerate the uptake of electric vehicles."

– Cyril Ramaphosa, President, South Africa

Nigeria’s approach combines incentives with strict requirements. Under the 2025 bill, foreign automakers must set up local assembly plants within three years of starting operations. By 2030, at least 30% of vehicle components must be sourced locally. Companies failing to comply face penalties of N250 million ($170,000) per violation, while unauthorized EV imports could result in fines of N500 million ($340,000) per shipment. Similarly, the Democratic Republic of the Congo (DRC) and Zambia have teamed up on a regional policy to move beyond raw mineral exports by establishing battery manufacturing capabilities.

These policies mark a shift from merely importing EVs to building local expertise and production capacity. Together, tax incentives, infrastructure laws, and manufacturing rebates are reducing costs for consumers, fostering local industries, and positioning Africa as a growing player in the global EV market.

sbb-itb-99e19e3

Leading EV Markets in Africa: South Africa, Kenya, and Nigeria

Three nations are leading the charge in Africa’s shift to electric vehicles (EVs), each carving out a path shaped by their unique economic strengths and infrastructure landscapes. South Africa is safeguarding its automotive manufacturing base while embracing green hydrogen. Kenya is tapping into its vast renewable energy resources, especially geothermal power, to promote electric two-wheelers and public transit. Meanwhile, Nigeria is addressing urban mobility issues with electric motorcycles, despite grappling with power grid challenges. Together, these countries showcase diverse strategies that are accelerating EV adoption across the continent.

South Africa: Green Hydrogen and Automotive Industry Evolution

South Africa’s approach to EVs is deeply tied to its well-established automotive sector, with a focus on transitioning to cleaner technologies. In 2024, the country held 31.7% of the EV market share in the Middle East and Africa region. In 2022, nearly half (46%) of its locally manufactured vehicles were exported to the EU and UK – markets that aim to phase out fossil-fuel vehicles by 2035.

Commercial fleets are leading the EV transition in South Africa, as passenger EVs remain prohibitively expensive for many, often priced at $50,000 or more. Companies like Everlectric highlight the cost advantage of EVs, with operating costs of 40 cents per kilometer compared to R2.50 for diesel. In February 2023, BMW Group took a significant step by launching local EV production at its Plant Rosslyn, marking the first time a luxury automaker has produced EVs on the continent. This initiative also includes a technician training program in collaboration with Tshwane University of Technology to address skill shortages.

"The iPhone moment in telecoms is now happening to automotive… South Africa will not be an exception to this rule."

– Greg Cress, Principal Director, Accenture South Africa

South Africa is also positioning itself as a global leader in green hydrogen production, leveraging its vast platinum reserves, a critical component for fuel-cell electric vehicles. To encourage investment, the government’s Automotive Production and Jobs Plan offers a 150% tax deduction for electric and hydrogen vehicle production facilities starting in March 2026. In 2025, Golden Arrow, the nation’s largest bus operator, launched its first major EV depot, transitioning its fleet from diesel to electric power. While South Africa focuses on green hydrogen, Kenya is pursuing a different route, centered on its renewable energy resources.

Kenya: Geothermal Power and E-Mobility Expansion

Kenya is charting its own course by prioritizing electric two-wheelers and public transit, supported by a grid that is over 90% powered by renewable energy, particularly geothermal. The country saw EV registrations increase fivefold in 2023, thanks to VAT exemptions and reduced electricity tariffs for e-mobility. With 2.2 million boda-bodas (motorcycle taxis) in operation, full electrification could cut transport emissions by 85%.

In a symbolic move, President William Ruto drove himself to the Africa Climate Summit in May 2024 in an electric Autopax Air EV Yetu, signaling high-level political commitment. Nairobi’s Bus Rapid Transit (BRT) system has also mandated the exclusive use of electric buses, with dedicated lanes introduced in 2021. By 2026, Roam Electric, in partnership with County Bus Service, plans to deploy 200 electric buses, which have already demonstrated a 50% reduction in energy costs for operators.

Kenya is also making use of its geothermal resources to provide low-cost nighttime EV charging. The rise of Battery-as-a-Service (BaaS) models is further easing adoption. Companies like M-KOPA and Watu Credit are offering digital loans specifically tailored for electric motorcycles. With 40% of Kenyans over 15 having access to formal credit or mobile money, the financial ecosystem is well-suited to support this transition. While Kenya benefits from its renewable energy abundance, Nigeria is tackling its EV journey under different circumstances.

Nigeria: Urban Mobility and Electric Motorcycles

Nigeria’s EV market is dominated by electric motorcycles, driven by the widespread use of commercial okadas (motorcycle taxis) in urban areas. These vehicles are typically replaced every two to three years, creating a natural opportunity for fleet electrification. However, the country faces a major hurdle: an unreliable national power grid.

Private-sector innovation is stepping in to address this challenge. In March 2025, Lagos launched Africa’s largest DC fast-charging station, equipped with a solar-storage hybrid system to bypass grid issues. The government’s 2025 Electric Vehicle Transition and Green Mobility Bill requires foreign automakers to establish local assembly plants within three years of starting operations, with a mandate that 30% of vehicle components be locally sourced by 2030. Non-compliance carries steep penalties of $170,000 per violation.

Although electric motorcycles have higher upfront costs, they are 25% cheaper to operate over five years due to fuel and maintenance savings. However, Nigeria faces a critical shortage of EV technicians – there are only a handful available to serve a population of over 200 million. This shortage raises concerns about vehicle downtime and safety as the market grows.

These varied approaches highlight how Africa’s leading EV markets are navigating unique challenges and opportunities, collectively advancing the continent’s role in the global EV landscape.

Addressing Challenges and Seizing Opportunities

Africa’s efforts to expand its electric vehicle (EV) market and implement supportive policies are now met with operational hurdles. Yet, these challenges are driving inventive solutions. One of the biggest obstacles is the reliability of the power grid. In 34 African countries, less than half of grid-connected individuals have access to dependable electricity. To put this into perspective, the System Average Interruption Disruption Index (SAIDI) for sub-Saharan Africa is a staggering 39.30, compared to just 0.87 in high-income OECD countries. Despite these issues, African nations are leveraging market growth and policy support to implement creative, localized strategies to address infrastructure gaps.

Grid Limitations and Renewable Energy Solutions

Instead of waiting for large-scale grid upgrades, many African countries are turning to decentralized renewable energy systems. For instance, solar-powered mini-grids provide a practical solution for charging electric two-wheelers in areas with unreliable or nonexistent grid access. These two-wheelers, with their smaller battery sizes, are well-suited for this type of infrastructure. This approach is particularly important given that only eight African countries currently meet high standards for grid reliability.

Battery-Swapping and Affordable Charging Infrastructure

Innovative charging models are also helping to overcome power-related challenges. Battery-swapping stations allow drivers to exchange drained batteries for fully charged ones in minutes, addressing the range anxiety that affects 90% of EV owners in Nigeria and Kenya. Companies like M-KOPA and Watu Credit are making this transition easier by offering digital lending options and mobile payment systems. Electric two-wheelers, in particular, promise substantial long-term cost savings. Standardizing battery designs could further cut costs by enabling shared swapping networks.

Leapfrogging Through Two- and Three-Wheelers

Africa is skipping the passenger car phase that dominated EV adoption in wealthier countries. With 76% of African nations having fewer than 100 vehicles per 1,000 people and 85% of four-wheel vehicle sales consisting of used imports, two-wheelers are emerging as the most practical option for electrification. Their lower ownership costs make them especially appealing. According to McKinsey, by 2040, electric two-wheelers could claim 50% of the market in a base case scenario – or even 70% with accelerated adoption – far outpacing passenger cars, which are projected to reach only 20–30%. Ethiopia’s bold move to ban internal combustion engine imports by 2024 spurred EV sales to make up 60% of the market that same year, showcasing how targeted policies can drive swift change.

Investment Opportunities in Africa’s EV Market

Africa’s electric vehicle (EV) market is shifting gears, moving from small-scale pilot projects to structured industrial growth. This transition is opening up exciting investment opportunities in areas like local assembly, charging infrastructure, and digital platforms.

Local Assembly and Manufacturing

The days of relying solely on imported EVs are fading, as local assembly is reshaping the industry. Take MojaEV, for example. In late 2025, they launched a Semi-Knocked Down (SKD) assembly facility in Mombasa, Kenya, aimed at producing affordable electric cars, buses, and matatus while reducing customs duties. Around the same time, Dongfeng Motor Corporation teamed up with ePureMotion to introduce electric passenger vehicles in Kenya, with plans for local assembly and eventual expansion into light commercial vehicles.

Kenya is emerging as a key player in the regional EV market, with ambitions to export locally assembled vehicles to neighboring countries like Uganda, Tanzania, and Rwanda. Commercial vehicles, including minibuses, delivery vans, and two-wheelers, are particularly attractive investments due to their lower total cost of ownership compared to traditional combustion engine models. Isuzu East Africa is also making strides, launching trials for Kenya’s first electric truck in 2025 to evaluate payload efficiency and battery performance in real-world conditions.

Charging Network Expansion

Battery-swapping infrastructure is gaining traction as a practical solution to Africa’s grid challenges and the high upfront costs of EV ownership. Spiro has already rolled out more than 300 battery-swapping stations across Kenya, supporting its electric motorcycle ecosystem. This "battery-as-a-service" model allows drivers to swap out depleted batteries for fully charged ones in just minutes, making electric two-wheelers a viable option for commercial use.

For investors, high-traffic locations like retail centers and petrol stations – where minibuses and taxis often park overnight – present strategic opportunities for charging infrastructure. Standardizing battery designs could further streamline operations, enabling shared networks and reducing costs for operators. However, it’s worth noting the cost differences in charging equipment: Level 2 chargers range from $200 to $1,000, while Level 3 DC fast chargers can cost tens of thousands of dollars to install.

E-Mobility Startups and Marketplaces

The African EV startup scene is buzzing. By late 2021, over 20 startups had raised more than $25 million in funding. A standout example is Roam (formerly Opibus), a Kenyan company focusing on local research, development, and assembly to create electric motorcycles designed to meet the durability demands of "boda boda" drivers.

Digital marketplaces are also playing a crucial role in the EV ecosystem. Platforms like EV24.africa offer end-to-end solutions for sourcing vehicles, forming OEM partnerships, managing logistics, and providing after-sales support across 54 African countries. Their listings include top brands like Tesla, BYD, Leapmotor, Dongfeng, Geely, Hyundai, Toyota, and Suzuki, with transparent pricing and financing options available. These startups are tapping into the momentum of Africa’s growing e-mobility market, setting the stage for long-term growth.

"Africa’s EV future will be local, structured, and industrial." – EV24.africa

Conclusion: Africa’s Path to Becoming a Global EV Leader

Africa is on the brink of a major shift in the global electric vehicle (EV) market. With 30% of the world’s proven reserves of critical minerals, the continent is uniquely positioned to play a transformative role. Sub-Saharan Africa alone could generate nearly $2 trillion in revenue from these minerals over the next 25 years, driven by clean energy transitions.

Government policies are evolving rapidly, creating a fertile ground for EV adoption. For example, bans on combustion engine imports have already spurred growth in key markets. Countries like Rwanda are offering tax exemptions, Kenya is leveraging fintech to revolutionize two-wheeler adoption, and Morocco is making strides in battery manufacturing. These efforts signal a bold pivot toward electric mobility.

"Emerging markets are no longer catching up, they are leading the shift to electric mobility."

– Euan Graham, Ember

The combination of policy support and market dynamics is paving the way for significant advancements. By 2040, electric two-wheelers could dominate 50–70% of the market. These vehicles offer a clear cost advantage, being 25% cheaper over a five-year life span compared to gas-powered alternatives, making them particularly attractive for commercial use. Add to this the rise of battery-swapping infrastructure and digital lending platforms, and Africa is poised to leap ahead, much like it did with mobile telecommunications.

The benefits go beyond economics. Transitioning to EVs could cut annual carbon emissions by 20–25% by 2040. Moreover, shifting from raw mineral exports to local processing could boost regional GDP by more than 12% by 2050. Innovations such as battery-swapping and local assembly further highlight Africa’s growing edge in the global EV landscape.

"Sub-Saharan Africa, home to 30 percent of the world’s critical minerals, is on the brink of a major transformation with the global move towards clean energy."

– International Monetary Fund

With vehicle numbers expected to double by 2050 and 12 countries already showing high EV readiness, Africa is building a solid foundation for sustainable mobility. Local assembly plants in Kenya and Morocco are expanding, strengthening industrial capacity for long-term growth. While investments in grid and charging infrastructure remain crucial, the momentum for change is undeniable.

FAQs

How are African countries tackling unreliable power grids to support EV adoption?

African nations are tackling power grid challenges by integrating smart charging technologies with renewable energy systems. For example, tools like time-shifted charging and vehicle-to-grid (V2G) technology are helping to manage peak electricity demand and avoid grid overload. This ensures a more efficient use of the existing power infrastructure, particularly for commercial and public transport fleets, which often follow predictable charging patterns.

To encourage the growth of electric vehicles (EVs), governments in countries such as Kenya, Rwanda, and Ethiopia are rolling out solar-powered charging stations and microgrids. These off-grid solutions provide dependable energy for electric buses and two-wheelers, reducing reliance on unstable utility grids. At the same time, utility companies are upgrading infrastructure – like transformers and energy storage systems – to stabilize power supply and accommodate the rising demand.

By blending smart technologies, renewable energy, and targeted grid improvements, these countries are laying the groundwork for broader EV adoption, even as they navigate current grid limitations.

How do Africa’s natural resources contribute to the global EV industry?

Africa is home to an abundance of minerals that are essential for electric vehicle (EV) batteries, such as cobalt, lithium, nickel, copper, and rare earth elements. These materials play a crucial role in manufacturing high-performance batteries, electric drivetrains, and the infrastructure needed for charging. For instance, the Democratic Republic of Congo is responsible for roughly 70% of the world’s cobalt supply, while Zambia is a key supplier of copper and nickel.

As global demand for EVs continues to rise, Africa’s largely untapped mineral reserves could potentially fulfill up to 30% of the projected demand for battery materials by 2030. This positions the continent as a vital resource hub for manufacturers aiming to secure materials and diversify their supply chains. In addition to aiding the global shift toward cleaner transportation, Africa’s rich resources offer substantial economic opportunities for local industries and communities.

What government policies are encouraging EV adoption in Africa?

Governments across Africa are rolling out various policies to speed up the adoption of electric vehicles (EVs). These measures include tax breaks, such as VAT exemptions and reduced import duties on EVs and batteries, making them more affordable. Alongside this, subsidies and financing options are being introduced to lower the upfront costs for both individual buyers and fleet operators.

Many nations are also prioritizing the development of public charging networks, often aligning these efforts with renewable energy initiatives. To encourage local EV production, governments are offering perks like duty-free imports of assembly kits and grants to support the establishment of manufacturing facilities.

Some countries are taking it a step further by implementing fleet procurement mandates, which require that a portion of newly purchased public vehicles be zero-emission. These efforts are positioning Africa as an emerging player in the EV market, with significant strides being made in countries such as South Africa, Kenya, and Nigeria.