Electric vehicles (EVs) in South Africa are gaining attention but face hurdles like high upfront costs, limited infrastructure, and load shedding. Here’s the bottom line:

- Costs: EVs are expensive – starting around $22,200 compared to $13,200 or less for gas cars. But EVs save you about 61% on running costs, with annual savings of $1,490 for a 31-mile daily commute.

- Charging: South Africa has over 500 public charging points, mostly in urban areas. Home charging is common but depends on reliable power, which can be tricky with load shedding.

- Government Incentives: Starting March 2026, manufacturers get tax breaks, but there’s little direct help for consumers yet.

- Performance: EVs excel in cities with regenerative braking but have shorter ranges (124–158 miles on highways) compared to gas cars.

While EVs can save money over time, the high upfront cost and infrastructure challenges mean they’re better suited for urban drivers with predictable routes or those who can afford the investment. For now, gas cars remain a more practical option for many South Africans.

Electric Cars Don’t Make Sense In South Africa

Cost Comparison: EVs vs. Gas-Powered Vehicles

EV vs Gas Car 5-Year Cost Comparison in South Africa

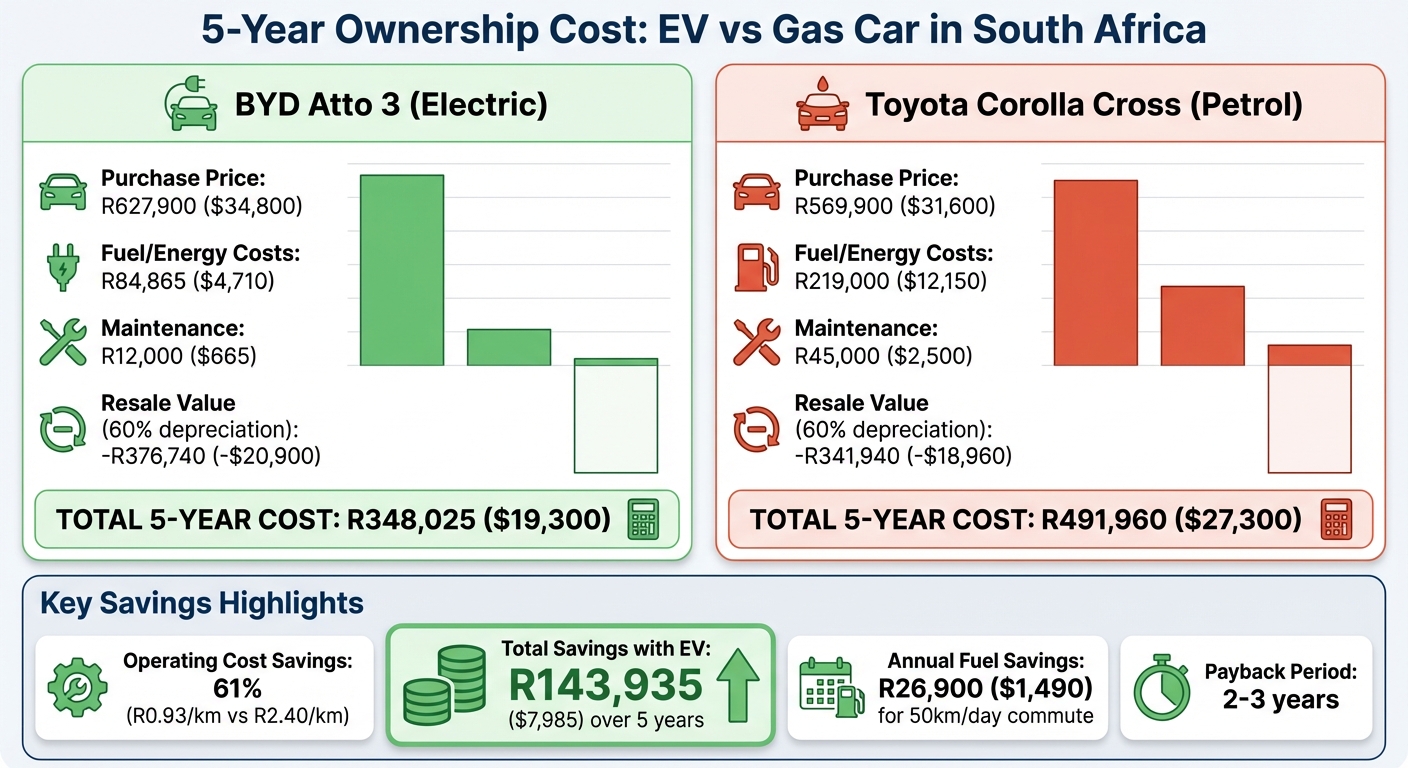

Buying an electric vehicle (EV) might seem pricey upfront. For example, a new EV costs around R627,900 ($34,800), while a gas-powered alternative like the Toyota Corolla Cross is priced at R569,900 ($31,600). That’s a 10–15% price difference, which can discourage many buyers at first glance. But when you look beyond the sticker price, the story changes.

EVs shine when it comes to operating costs. Running an EV costs about R0.93 per kilometer compared to R2.40 per kilometer for a petrol vehicle – a savings of 61%. Charging at home is also much cheaper, costing around R245 ($14) versus R515 ($29) at public fast chargers. For someone driving 50 kilometers a day, this adds up to an annual savings of about R26,900 ($1,490) in fuel costs.

"EVs cost R0.93/km to run versus R2.40/km for petrol – a 61% saving that translates to R26,900 annual savings for an average 50km/day commuter."

- ChargePointSA

Maintenance is another area where EVs pull ahead. Over five years, EV owners spend about R12,000 ($665) on maintenance, compared to R45,000 ($2,500) for petrol vehicles. This difference comes down to EVs having fewer moving parts and no need for oil changes. However, insurance for EVs can be about 35% higher, largely due to the cost of replacing batteries.

Here’s how the numbers stack up over five years:

| 5-Year Ownership Cost | BYD Atto 3 (Electric) | Toyota Corolla Cross (Petrol) |

|---|---|---|

| Purchase Price | R627,900 ($34,800) | R569,900 ($31,600) |

| Fuel/Energy Costs | R84,865 ($4,710) | R219,000 ($12,150) |

| Maintenance | R12,000 ($665) | R45,000 ($2,500) |

| Resale Value (60% depreciation) | -R376,740 (-$20,900) | -R341,940 (-$18,960) |

| Total 5-Year Cost | R348,025 ($19,300) | R491,960 ($27,300) |

Despite the higher purchase price, the EV comes out ahead with a total savings of R143,935 ($7,985) over five years. For most drivers who primarily charge at home, the payback period is just two to three years.

As William Kelly from TechCentral puts it:

"The message is clear: electric wins hands down. They are simply cheaper to own and run".

Charging Stations vs. Gas Stations: What’s Available

By mid-2025, South Africa had over 500 public EV charging points – significantly fewer than the thousands of gas stations spread across the country. This translates to roughly one charger for every seven EVs, reflecting infrastructure growth that’s outpacing the current demand. Despite electric vehicles making up less than 0.5% of annual new car sales, the charging network is expanding in anticipation of future adoption.

Interestingly, the majority of EV charging happens at home. Around 70% to 80% of charging occurs in residential garages or driveways, where owners typically plug in overnight. This makes home charging a cornerstone of EV usage, while public chargers mainly cater to long-distance travelers or those needing quick top-ups.

Public charging stations are mostly concentrated in urban hubs. Gauteng (home to Johannesburg and Pretoria) and the Western Cape (including Cape Town) lead the way with the highest number of stations. Key highways like the N1, N2, and N3 are well-equipped with charging points, thanks to providers like GridCars, which operates between 350 and 450 chargers nationwide. However, rural regions lag behind, with limited access to charging infrastructure. To address these gaps, innovative off-grid solutions are being explored.

One promising development is the rise of solar-powered, off-grid charging stations. In March 2025, CHARGE (Zero Carbon Charge) launched South Africa’s first fully off-grid, solar-powered EV charging station in Wolmaransstad, North West. This marked the beginning of a planned 120-station network designed for long-distance travel without relying on Eskom’s grid. Similarly, Rubicon has rolled out more than 110 charging points and aims to reach 250 by the end of 2025, focusing on high-traffic areas like shopping malls and gas stations.

For those traveling through less-served regions, such as the Free State or Northern Cape, tools like PlugShare or ChargePocket are essential for checking charger availability and planning routes effectively.

Government Incentives and Financial Support

South Africa’s approach to electric vehicles (EVs) focuses heavily on boosting local manufacturing rather than offering direct consumer incentives. Starting March 1, 2026, manufacturers will benefit from a 150% investment allowance. This allows them to claim tax deductions on qualifying capital investments in the production of electric and hydrogen vehicles. The program will run until March 1, 2036, with a cap of R500 million for the 2026/27 tax year. Finance Minister Enoch Godongwana emphasized this shift, stating:

"To encourage production of electric vehicles in South Africa, government will introduce an investment allowance for new investments, beginning 1 March 2026".

This policy prioritizes building production capacity, setting the groundwork for evaluating its impact on EV affordability and market competitiveness.

In addition to manufacturing incentives, the government has redirected R964 million toward EV infrastructure development and transition planning. However, this production-first strategy leaves consumers grappling with significant cost barriers. For instance, imported EVs currently face a 25% import duty, compared to 18% for gas-powered vehicles imported from Europe. This disparity inflates upfront costs, even though EVs offer lower operating expenses.

On the emissions side, traditional vehicles are taxed R146 per gram of CO2/km for passenger cars and R195 per gram for double cabs. EVs are exempt from these emissions taxes, but the higher import duties still make them less affordable. Greg Maruszewski, CEO of Volvo Cars South Africa, highlighted this issue:

"It is only EVs from Europe that are disadvantaged in terms of taxation versus ICE cars from Europe".

The manufacturing incentive is expected to drive 30 billion rand in private investment while costing the government R500 million in forgone tax revenue in the 2026/27 fiscal year. Christopher Axelson, Deputy-Director General for Tax and Financial Sector Policy at National Treasury, explained:

"We do think there will be large investments [as a result of the incentive], it is projected to forgo R500 million in revenue in 2026/27… That revenue forgone will kick up and increase in the outer years".

While the long-term goal is to establish local production capacity by 2035, which could eventually help reduce EV prices, direct consumer subsidies or purchase incentives are unlikely to materialize for at least another two to three years.

sbb-itb-99e19e3

Daily Use: Range, Performance, and Available Models

South Africa now boasts over 60 different EV models, catering to a wide spectrum of buyers – from budget-friendly city cars to high-end luxury vehicles. Entry-level options include the Dayun Yuehu S5, priced at R399,900 ($22,200), the Dongfeng Box at R460,000 ($25,600), and the BYD Dolphin at R539,900 ($30,000). For those looking for mid-tier choices, the GWM Ora 03 starts at R686,950 ($38,200), while the Volvo EX30 comes in at R835,500 ($46,500). Premium models, like the BMW iX1, begin at R1,205,000 (around $66,900). With such a wide selection, understanding how these vehicles perform daily is essential.

When it comes to performance, real-world conditions often tell a different story than manufacturer claims. In highway tests conducted at 75 mph (120 km/h) with air conditioning, EVs with advertised ranges of about 250 miles (400 km) delivered between 124 miles (200 km) and 158 miles (255 km). For instance, the GWM Ora 03 achieved 124 miles (200 km) compared to its 249-mile (400 km) claim, the BMW iX1 managed 148 miles (238.7 km), and the Mercedes-Benz EQA reached 158 miles (254.7 km). George Mienie, CEO of AutoTrader, highlighted the importance of these tests:

"The tests are based on South African conditions rather than the cooler European testing scenarios".

These real-world results are crucial for planning both daily commutes and longer road trips.

City driving, however, plays to the strengths of EVs. Regenerative braking improves efficiency in stop-and-go traffic, making them ideal for urban environments. That said, experts advise keeping battery levels above 10% to maintain battery health, which slightly reduces the effective range for trip planning.

For longer journeys, South Africa’s growing network of 200 kW fast chargers along national highways makes intercity travel more practical. This infrastructure is a game-changer for EV users tackling longer distances. Models like the Maxus T90 EV bakkie, with its advertised range of 205 miles (330 km), cater to the popular bakkie market. Meanwhile, the Mercedes-Benz EQS 450+ leads the pack with an impressive advertised range of 486 miles (782 km). The Volvo EX30, known for its speed, accelerates from 0 to 62 mph in just 3.6 seconds, rivaling high-performance sports cars.

To put things into perspective, here’s a comparison of key metrics:

| Metric | EV (BYD Atto 3 / Ora 03) | Gas/Hybrid (Toyota Corolla Cross) |

|---|---|---|

| Advertised Range | 186–323 miles (300–520 km) | 334 miles highway (537 km) – 486 miles urban (782 km) |

| Real-World Highway Range | 124–158 miles (200–255 km) at 75 mph (120 km/h) | ~334 miles (537 km) |

| Energy/Fuel Cost | $0.52 per mile (R0.93/km) | $1.33 per mile (R2.40/km) |

| Model Diversity | 60+ individual models available | High (dominates market) |

| Urban Performance | Highly efficient with regenerative braking | Efficient fuel use |

| Rural/Long Distance | Requires DC fast-charging stops | Widely available gas infrastructure |

These insights underline the practical considerations for daily EV use, from urban efficiency to the infrastructure needed for longer trips.

Pros and Cons

Let’s break down the key advantages and drawbacks of electric vehicles (EVs) compared to gas-powered vehicles in South Africa. While EVs offer some clear benefits, they also come with challenges that are hard to overlook.

Environmental impact is one of the standout benefits of EVs. They produce zero emissions from the tailpipe, which is great for reducing pollution. However, South Africa’s electricity grid is 77% reliant on coal, meaning charging an EV indirectly contributes to carbon emissions. To put this into perspective, road transport in 2019 alone accounted for about 58.54 million metric tons of CO2 equivalent.

Cost-effectiveness is a mixed bag. EVs come with a hefty initial price tag – around $38,200 compared to under $11,100 for gas-powered vehicles. On top of that, EVs are subject to a 25% import duty, while European gas vehicles only face an 18% duty. However, EVs shine when it comes to running costs, offering savings of about 61%. Driving an EV costs roughly $0.52 per mile (R0.93/km), compared to $1.33 per mile (R2.40/km) for petrol cars. Maintenance is also cheaper since EVs have fewer moving parts, though specialized repairs and imported parts can sometimes be pricey.

Convenience is where gas-powered vehicles still have the upper hand. While EVs are cheaper to operate, they struggle with infrastructure challenges. Gas vehicles can refuel in minutes at countless stations, but EVs require 30–70+ minutes to charge, and there are only about 350 public charging stations in the country, mostly in urban areas. A Nedbank analysis highlights a key concern:

"If you’re driving an EV and your battery dies, you’re stuck until you can load your car onto a flatbed truck and transport it to the nearest charge point."

Load shedding further complicates things, making home charging unreliable unless you invest in a solar backup system. In contrast, gas vehicles are unaffected by grid issues, though they come with high fuel costs and face a looming phase-out as manufacturers pivot toward EV production by 2030.

Here’s a quick comparison of the trade-offs:

| Feature | Electric Vehicles (EV) | Gas-Powered Vehicles (ICE) |

|---|---|---|

| Environmental Impact | Zero tailpipe emissions; coal-heavy grid limits benefits; solar charging offers better potential | High CO2 emissions; contributes to air pollution and climate issues |

| Cost-Effectiveness | High upfront cost (~$38,200/R686,950); lower running costs (61% savings); reduced maintenance | Lower upfront cost (~$11,100/R200,000); higher fuel and maintenance costs |

| Convenience | Home charging possible; ~350 public stations; charging takes 30–70+ minutes; load shedding affects reliability | Widespread refueling stations; quick refueling; unaffected by grid issues |

| Limitations | Range anxiety (200–500 km per charge); 25% import tax; requires towing if stranded | High fuel costs; environmental concerns; potential phase-out as EVs become standard |

While EVs are making progress, they still face hurdles that keep gas-powered vehicles in the game for now.

Conclusion

The suitability of EVs in South Africa largely depends on individual driving habits.

For urban commuters traveling around 31 miles (50 km) daily, the savings are clear. These drivers can save approximately $4,730 (R26,827) annually, with models like the BYD Atto 3 offering five-year savings of about $25,370 (R143,935) compared to a Toyota Corolla Cross. These savings come from significantly lower operating costs, allowing urban drivers to recoup the higher upfront price over time. Similarly, commercial fleets with predictable routes – such as local delivery services – stand to gain from these operational cost reductions.

However, high initial costs remain a hurdle for many. The most affordable EVs currently start at around $22,200 (R399,900), almost double the price of entry-level gas-powered vehicles. This price gap, coupled with range anxiety and a 25% import duty, limits EV adoption for budget-conscious drivers or those who frequently travel long distances. While EVs offer lower running costs, these benefits only become apparent after offsetting the steep purchase price.

Looking ahead, several developments could make EVs more accessible. Starting in March 2026, government incentives, the introduction of lower-cost models like the Dayun Yuehu, and the growth of solar-powered charging networks aim to reduce prices and address challenges like load-shedding. These changes, combined with the operational savings already evident, may tip the scales in favor of EVs.

Ultimately, the decision to invest in an EV depends on personal driving patterns and the evolving landscape of infrastructure and policy. While EVs might still feel like a cautious choice today, these advancements point toward a future where they become a more practical option for everyday use.

FAQs

What challenges are slowing the adoption of EVs in South Africa?

South Africa’s shift toward electric vehicles (EVs) comes with a set of tough obstacles. One of the biggest roadblocks? High upfront costs. EVs often come with price tags far beyond what many South Africans can afford. For instance, an entry-level EV might cost over 700,000 ZAR, while a basic internal combustion engine (ICE) car can be purchased for less than 200,000 ZAR. This stark price difference makes EVs a less practical option for the average driver.

Another issue is the limited charging infrastructure. Although there are more than 300 charging stations scattered across the country, they’re not nearly enough to cover major travel routes comprehensively. This lack of coverage fuels range anxiety, leaving potential buyers hesitant. On top of that, frequent electricity shortages – a well-known issue in South Africa – make the situation even more challenging. A reliable power supply is critical for charging networks, and without it, EV adoption remains a tough sell.

Lastly, policy uncertainties and the absence of strong government incentives are slowing progress. Clearer policies and better financial support could pave the way for a more sustainable EV future, but these measures are still lacking. Overcoming these challenges will require a mix of smart investments in infrastructure and decisive action from policymakers.

Are the long-term savings of owning an EV worth the higher upfront cost?

Electric vehicles (EVs) may come with a higher price tag upfront, but the long-term savings can make them a smart financial choice. One of the biggest perks? Lower running costs. EVs are cheaper to operate per mile compared to gas-powered cars, thanks to reduced fuel expenses. For many drivers, this can translate to saving hundreds of dollars each year.

Another bonus is the simplicity of EV mechanics. With fewer moving parts, EVs require less frequent servicing. Plus, components like batteries are designed to last for years, cutting down on maintenance costs even further. For people who drive often, these savings can really add up over time. While the initial price might seem daunting, the financial benefits down the road could make owning an EV a cost-effective decision.

What incentives does the South African government offer for electric vehicle buyers?

The South African government is putting its energy into boosting local electric vehicle (EV) production and attracting investments. Starting in March 2026, EV and hydrogen-powered vehicle manufacturers can benefit from a 150% tax deduction on qualifying investments. This includes expenses for new equipment and buildings used in production, with the incentive set to last for a decade.

As for consumers, direct perks like rebates or subsidies aren’t available yet. However, there’s talk of introducing tax rebates to make EVs more accessible. President Cyril Ramaphosa has alluded to these potential measures, though no concrete plans or timelines have been shared. For now, the focus remains on strengthening the local EV industry and its supporting infrastructure.