Importing electric vehicles (EVs) from China to Congo (Brazza) can be a rewarding opportunity, but it requires careful planning. Here’s what you need to know:

- China leads EV production and exports: Over 60% of global EVs are manufactured in China, with affordable models like the Wuling Bingo starting under $12,000.

- Congo’s growing EV potential: While Congo’s EV market is small, it offers untapped opportunities as interest in cleaner, cost-efficient transportation rises.

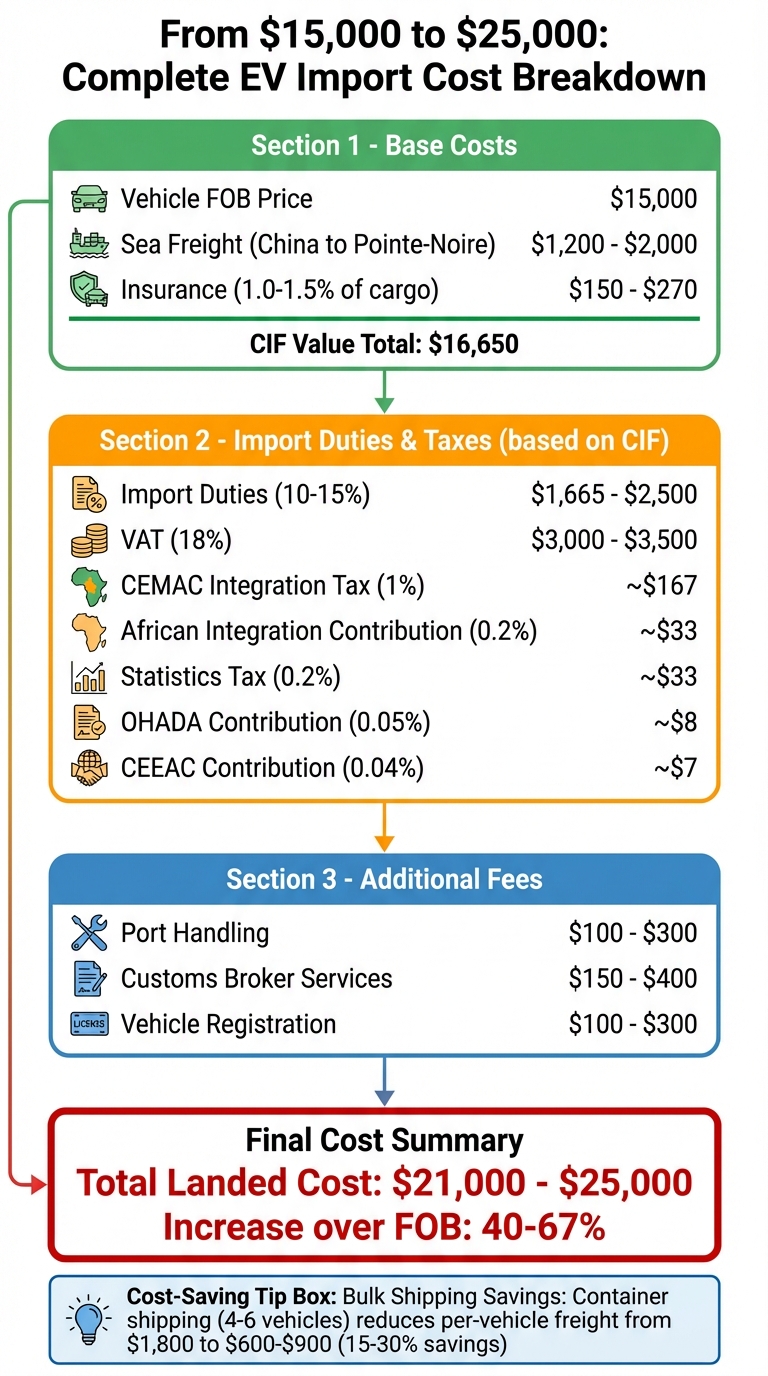

- Costs and taxes: Importing involves duties (10–15%), VAT (18.9%), and other fees, adding 40–67% to the vehicle’s base price. A $15,000 EV could cost $21,000–$25,000 after import.

- Shipping logistics: Sea freight, especially Roll-on/Roll-off (RoRo) or container shipping, is the most cost-effective option. Proper handling of lithium-ion batteries is crucial.

- Challenges: Limited charging infrastructure and complex customs processes require preparation, including home charging solutions and working with experienced brokers.

Tip: Act before 2026 to avoid potential delays from China’s new EV export licensing rules. Partnering with platforms like EV24.africa can simplify the process, from sourcing to registration.

How to Import Electric Cars from China?

Congo (Brazza)’s Import Regulations for EVs

Bringing electric vehicles (EVs) into Congo (Brazza) involves navigating customs procedures, understanding tax obligations, and keeping up with evolving policies. Here’s a breakdown of the current customs rules, tax structures, and compliance requirements.

Customs Rules for Electric Vehicles

Congo (Brazza) follows the customs framework of the Central African Economic and Monetary Community (CEMAC), which standardizes regulations across member countries. To import a vehicle, you’ll need essential documents like a bill of lading and an invoice. These are used to calculate the CIF (Cost, Insurance, and Freight) value, which forms the basis for duties and taxes. Additionally, import permits are mandatory for certain items, such as agricultural products and hazardous materials.

Duties, Taxes, and Potential Incentives

Electric vehicles currently face a range of taxes under the 2025 Finance Law. These include a 15% excise duty and an 18.9% VAT, which combines an 18% standard VAT rate with a 5% surtax. Import duties range between 5% and 30% of the customs value, with higher rates typically applied to consumer goods. Other entry taxes include:

- 1% CEMAC integration tax

- 0.2% African integration contribution

- 0.2% statistics tax

- 0.05% OHADA contribution

- 0.04% CEEAC contribution

All these are calculated based on the CIF value.

While these costs currently apply, the government has expressed plans to exempt fully electric vehicles from VAT and customs duties. However, these exemptions are still in the works, so importers should budget for the full range of taxes until the policies are officially enacted.

Vehicle Eligibility and Compliance

At present, Congo (Brazza) lacks detailed eligibility criteria for EV imports. There are no explicit rules regarding factors like vehicle age, left-hand drive specifications, or technical compliance. This regulatory gray area makes it essential for importers to collaborate with customs officials to ensure all requirements are met before shipping. As the EV market expands, more comprehensive guidelines are expected to be introduced, providing clearer standards for importers.

Logistics and Shipping Options from China to Congo

Bringing an electric vehicle (EV) from China to Congo (Brazza) requires thoughtful planning. From choosing the right shipping method to managing battery regulations, each step impacts both time and cost.

Sea Freight vs. Air Freight for Electric Vehicles

When it comes to shipping EVs, the method you choose can make a big difference. Sea freight is often the go-to option for most importers. Among the sea freight methods, Roll-on/Roll-off (RoRo) shipping stands out. It’s a practical and cost-effective solution for new, operational vehicles since it minimizes handling risks. Vehicles are simply driven onto the ship at the port of departure and off at the destination. Another option is Full Container Load (FCL) shipping, which offers added security but comes with extra requirements. Some carriers, like CMA CGM, may require specialized refrigerated containers for EVs, which can push up costs significantly. Additionally, carriers might impose restrictions on battery charge levels or require extra documentation.

Air freight, while available, is rarely used due to its high cost. It’s generally reserved for urgent shipments or luxury EVs where speed outweighs the expense.

Handling EV Batteries During Shipping

Shipping EVs comes with unique challenges due to their lithium-ion batteries, which are classified as dangerous goods by both the International Maritime Organization (IMO) and the International Air Transport Association (IATA). These batteries carry risks of overheating and even igniting. However, when batteries are installed in vehicles (classified as UN 3171 for fully electric vehicles or UN 3166 for hybrids), they are typically treated as "unrestricted goods" for sea transport. This means no special packaging is needed, which makes RoRo shipping especially convenient. Unlike other methods, RoRo carriers usually don’t require batteries to be removed or disconnected, saving time and avoiding warranty complications.

To ship an EV, you’ll need to provide a Material Safety Data Sheet (MSDS) for the battery. Additionally, the vehicle must display a label on the windshield with its VIN and propulsion type. Some carriers also require the battery’s charge to be below 65% before accepting the vehicle. The battery system must also be in good condition – leak-free, undamaged, and with the main power supply turned off during transit.

Main Ports and Shipping Routes

Most EV shipments from China begin at major export hubs like Shanghai, Shenzhen, Guangzhou, Ningbo, or Tianjin. These ports handle a large volume of international vehicle exports and offer regular shipping schedules. For Congo (Brazza), the primary destination port is Pointe-Noire.

Sea freight transit times can vary depending on the route and carrier but generally take several weeks. When booking, it’s essential to ensure your shipping agent complies with IMO regulations for hazardous materials and to notify both the vehicle transporter and Congo Customs about the EV import. These steps are crucial for a smooth shipping process and lay the groundwork for calculating the total costs involved.

sbb-itb-99e19e3

Cost Breakdown and Financial Strategies for Importing EVs

Complete Cost Breakdown for Importing Chinese EVs to Congo Brazzaville 2025

Complete Cost Breakdown

Bringing a Chinese electric vehicle (EV) into Congo (Brazza) involves more than just the sticker price – it’s a multi-layered process with several additional costs to consider.

Let’s start with the numbers. A mid-range Chinese EV priced at around $15,000 FOB (Free on Board) comes with sea freight costs ranging from $1,200 to $2,000 to ship from major Chinese ports to Pointe-Noire. Add insurance, which is typically 1.0–1.5% of the cargo value (about $150–$270), and you have the CIF (Cost, Insurance, Freight) value. This CIF value forms the basis for calculating duties and taxes.

In Congo, electric vehicles enjoy lower import duties – about 10–15% of the CIF value – compared to the 20–25% levied on internal combustion engine vehicles. On top of that, there’s an 18% VAT, calculated on the CIF value plus duties, along with other local fees like port handling ($100–$300), customs broker services ($150–$400), and vehicle registration ($100–$300). For instance, a $15,000 EV with $1,500 freight and $150 insurance (CIF of $16,650) could incur $1,665–$2,500 in duties, $3,000–$3,500 in VAT, and $350–$1,000 in miscellaneous fees. This brings the total landed cost to approximately $21,000–$25,000 – an increase of about 40–67% over the original FOB price.

Looking ahead, starting January 1, 2026, China will introduce export licensing for pure electric passenger vehicles. Buying in 2025 could help avoid potential delays and price hikes tied to this new regulation. Locking in contracts now can also help secure current pricing and ensure timely delivery.

Now that we’ve outlined the total landed cost, let’s dive into payment logistics.

Currency and Payment Methods

Once you’ve nailed down the cost structure, the next step is figuring out how to pay securely and efficiently.

Chinese suppliers typically require payments in USD via bank wire transfer (T/T). Standard terms usually involve a 30% deposit at the time of order and the remaining 70% before shipment. For larger orders, a letter of credit (LC) offers added security, though it comes with bank fees of about 1–2% of the transaction value.

If you’re importing EVs to Congo, it’s essential to open a USD account with a local bank that has strong ties to Chinese banks. For example, importing five EVs at $15,000 each ($75,000 total) would mean a 30% deposit of $22,500 and a 70% pre-shipment payment of $52,500. To protect against currency fluctuations, consider using a forward contract to lock in the USD/XAF exchange rate. Avoid holding large amounts of CFA francs before conversion, and shop around for the best foreign exchange rates from banks or trusted international payment services.

Cost-Saving Strategies for EV Imports

There are several ways to manage costs and make the import process more efficient.

One effective strategy is bulk shipping. Consolidating multiple vehicles into a single shipment can significantly cut costs. For example, a 40-foot container can hold four to six compact EVs, reducing sea freight costs per vehicle from around $1,800 to just $600–$900. That’s a savings of 15–30% per vehicle.

Timing your purchase is another way to save. Avoid peak shipping seasons, especially the fourth quarter, when freight rates tend to spike. Working with an experienced customs broker in Pointe-Noire or Brazzaville can also help you sidestep delays and avoid costly storage or demurrage fees. A skilled broker will ensure the correct HS code classification and that all necessary documentation is in order.

Platforms like EV24.africa simplify the import process by offering transparent pricing and flexible payment options. They handle everything – from customs clearance to local registration – so you can avoid administrative hassles and unexpected fees. They also provide financing options, which can help spread out the upfront costs instead of tying up all your capital. For smaller dealers or fleet operators, joining a regional EV import consortium through EV24.africa can help pool orders, negotiate better freight rates, and secure lower insurance premiums. These strategies can make the challenges of importing EVs much easier to manage.

Overcoming Challenges in Congo’s EV Market

Infrastructure Limitations for EVs

Congo’s unreliable power grid and limited public charging stations make EV adoption challenging, especially outside major cities like Brazzaville and Pointe-Noire. Many EV owners rely on home charging setups, often powered by generators or solar systems. If you’re considering importing an EV, it’s crucial to plan for a home charging solution in advance. Companies like EV24.africa can connect you with local installation partners to create charging setups tailored to the region’s intermittent electricity supply.

Customs and Bureaucratic Hurdles

Clearing customs at ports such as Pointe-Noire can be unpredictable, often hinging on accurate paperwork and inspector availability. Delays typically stem from incomplete documentation, errors in vehicle classification, or missing battery compliance certificates. To ensure a smoother process, make sure you have all necessary documents – such as invoices, shipping papers, UN38.3 battery certificates, and proof of payment – ready before shipment. Working with a customs broker experienced in EV imports or partnering with EV24.africa can help streamline the process, reduce delays, and avoid extra fees. Beyond paperwork, it’s also crucial to ensure your EV meets technical compliance standards for a hassle-free import experience.

Technical Compliance and Maintenance

Battery certification is another critical step. Congo adheres to international standards for lithium-ion batteries, so verifying UN38.3 test certificates before shipping is essential to avoid problems during customs clearance.

When it comes to maintenance, the availability of trained EV technicians in Congo is still limited. Before purchasing, confirm whether your EV brand has authorized service centers in Brazzaville or Pointe-Noire. Brands like BYD are actively expanding their service networks across Africa, which may ease maintenance concerns. Additionally, prioritize models with robust battery technologies, such as lithium iron phosphate (LFP) batteries, which are known for their reliability in tropical climates. EV24.africa offers vehicles from brands with strong after-sales support and can guide you toward models that align with local maintenance capabilities.

Conclusion: Importing EVs from China to Congo

Summary of the Import Process

Bringing electric vehicles (EVs) from China to Congo in 2025 involves three key steps: export preparation, shipping, and customs clearance. Make sure your supplier handles export permits for the vehicles and essential components, especially since new licensing rules will be introduced in 2026. Opt for container shipping – it’s both efficient and cost-effective. Once your shipment arrives in Pointe-Noire, having all the necessary documentation ready will help you avoid customs-related delays.

Budgeting is just as important as logistics. Account for every expense: the vehicle price, shipping charges, import duties, taxes, and any additional costs like setting up charging infrastructure. Collaborating with EV24.africa can simplify the process, offering access to trusted suppliers, shipping solutions, and dependable after-sales support. These steps will help ensure a smooth import experience.

Tips for a Smooth Import Experience

Work with experts familiar with Chinese and Congolese regulations. According to SINO Shipping:

Many a time, potential exporters are met with a wall, realizing that vehicle manufacturers in China, the giants of production, often don’t handle these licenses.

Choose shipping companies that provide clear pricing, conduct pre-loading inspections, and take care to prevent damage during transit.

Plan your charging setup before your EV arrives. Congo’s power grid can be unreliable, so consider home charging options that use generators or solar systems. Look for EV models equipped with durable battery technologies, such as lithium iron phosphate (LFP), which are well-suited for tropical climates. Brands like BYD, which are expanding their service networks in Africa, are a smart choice. EV24.africa can help you find models that align with local maintenance capabilities and connect you with professionals to install charging solutions.

Stay ahead of regulatory changes. China is tightening its EV export policies through 2025 and 2026, while African nations are rolling out new initiatives to encourage EV adoption. With Africa’s EV market expected to generate $263.1 million in revenue by 2025, the opportunities are growing despite infrastructure hurdles. By preparing thoroughly and partnering with the right experts, importing EVs from China to Congo can be a straightforward and rewarding endeavor.

FAQs

What are the main steps to import an electric car from China to Congo (Brazza) in 2025?

Importing an electric car from China to Congo (Brazza) in 2025 involves a few key steps that require thoughtful preparation:

- Check Import Rules: Start by digging into Congo’s specific regulations for bringing in electric vehicles. This includes understanding permits, taxes, and any emission standards you’ll need to meet.

- Organize Shipping: Secure a reliable shipping service from China to Congo. Pay attention to details like transit times, customs clearance, and how the car will reach its final destination.

- Estimate Total Costs: Beyond the car’s price, factor in shipping fees, import duties, insurance, and registration costs to get a clear picture of the overall expenses.

With careful planning and attention to these steps, you can simplify the process and make your import journey as smooth as possible.

What can I do to address the limited charging infrastructure for electric vehicles in Congo (Brazza)?

While the charging infrastructure in Congo (Brazza) is still in its early stages, there are practical ways to navigate this challenge and keep your electric vehicle running smoothly:

- Set up a home charging station: If you have a dependable power source at home, installing a charger can make daily use of your vehicle much more convenient.

- Plan your trips with charging points in mind: Before heading out, identify charging locations, particularly in cities or along main highways where they’re more likely to be found.

- Carry portable charging options: Portable chargers or adapters that work with standard outlets can provide added flexibility, especially for longer journeys.

With a bit of planning and the right tools, you can manage the current infrastructure gaps and still enjoy the perks of owning an electric vehicle in Congo.

How can I save money when importing electric cars to Congo (Brazza)?

Importing electric vehicles (EVs) into Congo (Brazza) can be a budget-friendly option due to tax breaks. Fully electric cars benefit from exemptions on VAT and customs duties, which can substantially cut down the overall cost.

To save even more, consider consolidating shipments or partnering with seasoned logistics providers to reduce transportation expenses. Taking the time to thoroughly understand and follow import regulations can also help you sidestep unexpected charges or delays.