Want to import an electric car from China to Burundi? Here’s what you need to know:

- Why China? China dominates the electric vehicle (EV) market with affordable pricing, fast production, and advanced technology. Brands like BYD and Leapmotor offer reliable options for budget-conscious buyers.

- Burundi’s EV Landscape: While only 10% of the population has electricity access, the country’s renewable energy potential (hydropower and solar) supports EV adoption. Electric two- and three-wheelers are affordable for rural areas.

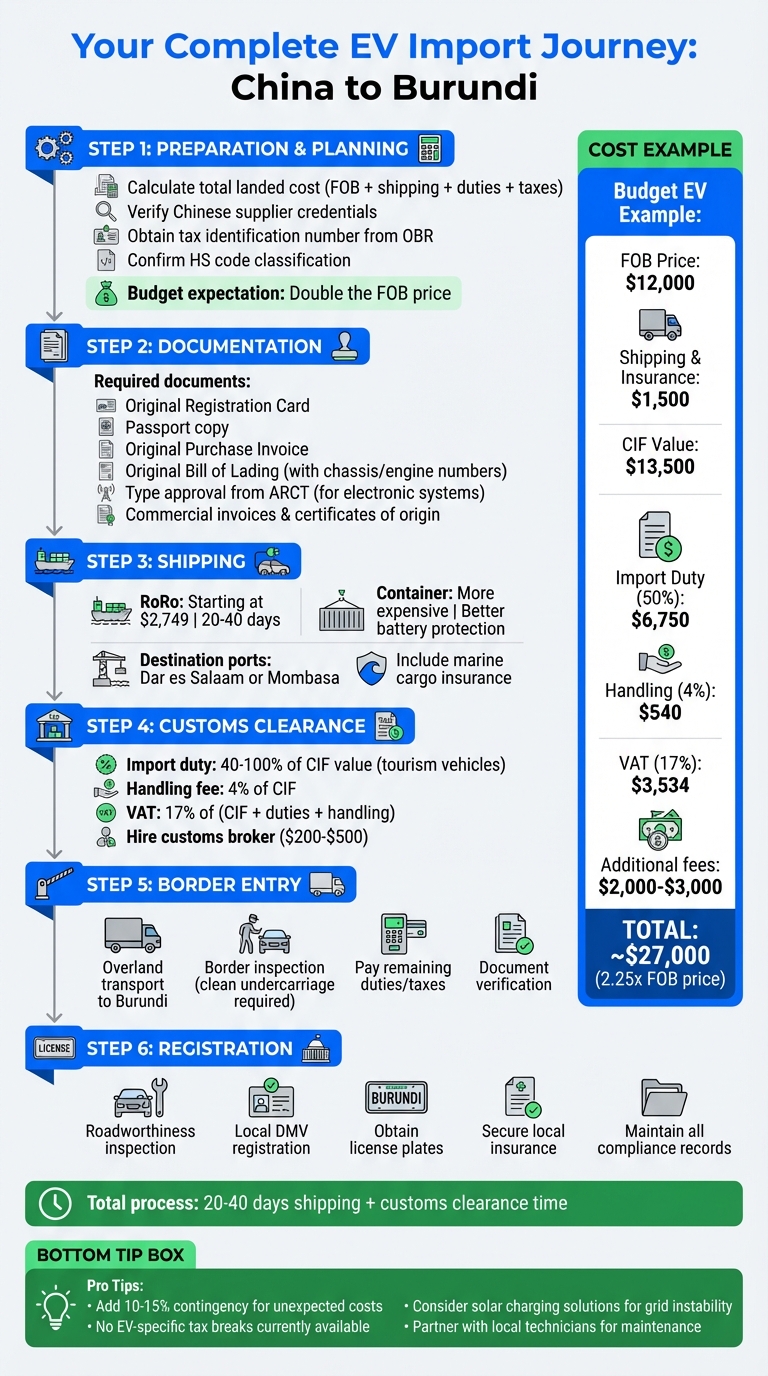

- Import Process:

- Gather documents: purchase invoice, bill of lading, registration card, and more.

- Pay import duties (up to 100% of the CIF value), a 4% handling fee, and 17% VAT.

- Use a customs broker to simplify clearance and avoid delays.

- Costs: Expect to pay double the vehicle’s FOB price after shipping, duties, and taxes. For example, a $12,000 EV could cost $27,000 after all fees.

- Challenges: Burundi lacks specific tax breaks for EVs, and grid instability makes charging infrastructure a priority. Solar-powered chargers and battery-swapping stations are practical solutions.

- Maintenance: Focus on battery health and ensure access to spare parts. Partnering with local technicians is key to keeping your EV roadworthy.

Bottom Line: Importing an EV to Burundi is a multi-step process, but with proper planning, it’s achievable. Start by calculating total costs, verifying suppliers, and ensuring regulatory compliance.

Complete Process for Importing Electric Vehicles from China to Burundi

How to Import Electric Cars from China?

Burundi’s EV Import Regulations Explained

Bringing an electric vehicle (EV) into Burundi requires navigating specific documentation and compliance steps. The Burundi Revenue Authority (obr.gov.bi) manages the customs process, so being prepared can help you avoid unnecessary delays or costs.

Required Documents and Import Rules

To clear customs, you’ll need to gather several key documents:

- Original Registration Card: Confirms the vehicle’s ownership history.

- Copy of Your Passport: Used for identity verification.

- Original Purchase Invoice: Proof of the transaction.

- Original Bill of Lading: Must include details like the chassis and engine numbers, cubic capacity, year of manufacture, brand, and model.

In addition, general import documentation such as commercial invoices, packing lists, and certificates of origin are necessary for all goods. Unlike many other nations, Burundi does not require inspection for used car imports, simplifying the process.

A recent regulatory update adds an extra layer to EV imports. In May 2025, the Ministry of Communication, Information Technology and Media issued Ministerial Order No. 580/01. This regulation mandates type approval for all radio and electronic communication equipment. Since modern EVs often include infotainment systems and telematics, you’ll need to secure approval from the Authority of Regulations and Control of Telecommunications (ARCT). This involves submitting technical documentation, conformity certificates (ITU, ETSI, IEEE), and lab test reports from certified facilities.

To streamline the process, consider hiring a customs broker. They can ensure all duties and taxes are calculated correctly and assist with compliance. For specific queries about your vehicle model, contacting the Burundi Revenue Authority directly is a good idea.

Now, let’s break down how these documents tie into the calculation of import duties and taxes.

Import Duties and Tax Calculations

All imported vehicles in Burundi are subject to duties and taxes, calculated based on the vehicle’s Cost, Insurance, and Freight (CIF) value. Here’s how it works:

- Start with the FOB price and convert it to a CIF value.

- Use the current exchange rate to convert the CIF amount into Burundian Francs (BIF).

The import duties depend on the type of vehicle. For example:

- Vehicles carrying more than ten passengers are taxed at 15% of the CIF value.

- Tourism vehicles face duties ranging from 40% to 100% of the CIF value.

On top of this, a 4% handling fee is added to the CIF value. Then, a transactional tax (VAT) of 17% is applied to the combined total of CIF, duties, and handling fees. While Burundi’s standard VAT rate is 18%, the rate for imported vehicles is slightly lower at 17%.

To avoid surprises, calculate these costs in advance. Determine the CIF value for your delivery port, convert it to BIF using a reliable exchange rate, and factor in the duty rate, handling fee, and VAT step by step.

Let’s now explore whether there are any tax breaks for EVs.

Tax Benefits for Electric Vehicles

Currently, Burundi does not offer specific tax incentives or reduced import duties for EVs, even in connection with environmental goals or renewable energy initiatives. The same duties and taxes outlined earlier apply to all vehicles, including EVs.

However, there is one exception worth noting. East African Community (EAC) countries, including Burundi, provide duty exemptions for photovoltaic (PV) panels and batteries. While this exemption applies to solar energy equipment, it’s unclear if it extends to EV batteries as separate components. Importantly, it does not cover EV accessories or the vehicles themselves.

When planning your EV purchase, budget for the full import duties and taxes. Stay updated on any regulatory changes by consulting the Burundi Revenue Authority directly.

Selecting Your Electric Car and Chinese Supplier

Choosing the right electric vehicle (EV) and supplier for use in Burundi requires careful consideration of local conditions and market challenges. These decisions directly influence the vehicle’s performance, reliability, and overall costs. Below, we’ll dive into key aspects like selecting the ideal EV model, verifying suppliers, and deciding between new and used EVs.

Choosing an EV Model for Burundi’s Conditions

Burundi’s equatorial climate, with temperatures ranging from 61°F to 73°F and distinct rainy seasons, calls for EVs with strong thermal management systems and higher ground clearance to handle rugged, unpaved roads. With climate projections suggesting rising temperatures and shifting rainfall patterns by 2050, durability becomes even more critical.

The country’s diverse topography adds another layer of complexity. Elevations range from 2,543 feet near Lake Tanganyika to 8,806 feet at Mount Heha, meaning some regions are accessible only by vehicles capable of navigating rough terrain. When choosing an EV, prioritize models with features like elevated ground clearance and battery systems designed to withstand hot, humid conditions. Manufacturers that clearly specify operating temperature ranges for their vehicles are a safer bet, ensuring both compliance with Burundi’s import standards and better on-road performance.

How to Verify Chinese EV Suppliers

Ensuring you partner with a reliable Chinese EV supplier requires a thorough verification process. Start by checking the supplier’s business licenses and legal certifications, and cross-reference these with government databases to confirm their legitimacy.

"Verifying a Chinese supplier is crucial to ensuring a secure and successful business transaction." – Zignify.net

Request product samples and conduct factory audits – either in person or virtually – to evaluate production capacity and quality control. This step also helps confirm whether the supplier is a genuine manufacturer or a trading company. Additionally, gather references from previous clients and review customer feedback, online reviews, and industry forums to gauge their reputation.

For added assurance, consider using third-party verification services. For example, CargoFromChina offers Supplier Verification Reports for $99, typically delivered within 24 hours. This option is far more affordable than on-site inspections by companies like SGS, which can cost $800 or more. Once you’ve identified a trustworthy supplier, draft comprehensive legal agreements detailing pricing, payment terms, delivery schedules, product specifications, and quality control measures. To minimize risks, start with smaller orders before scaling up.

New vs Used EVs: Making the Right Choice

The decision between new and used EVs in Burundi is nuanced. Data shows that around 85% of Africa’s vehicle fleet consists of used vehicles, and the distinction between new and used doesn’t always correlate with quality or environmental impact in this context.

"The findings so far infer that using a used or new vehicle classification to determine whether a vehicle is likely to produce more emissions or decrease the risk of safety in the event of an accident is ineffective. In terms of emissions, vehicles should be classified based on their emission standard and in terms of safety, vehicles should be graded in terms of vehicle standard." – Transportation Research Interdisciplinary Perspectives

In Africa, new EVs may sometimes come with outdated technology or insufficient safety features, while certain used vehicles meet high efficiency and safety standards. Instead of focusing solely on whether a vehicle is new or used, prioritize its emission standard and safety rating (such as NCAP stars). Ownership costs are another key factor – battery replacement alone can account for 30–40% of a used EV’s initial value, which should be factored into your decision.

Complete Import Process: China to Burundi

Bringing an electric vehicle (EV) from China to Burundi is a detailed process that spans several stages. From preparation and shipping to customs clearance and registration, each step requires careful coordination with suppliers and authorities.

Preparation Before Purchase

Start by ensuring your EV complies with Burundian regulations. Contact the Office Burundais des Recettes (OBR) to confirm import requirements and register your business to obtain a tax identification number. Request detailed vehicle specifications from your supplier and classify your EV using the correct HS code to calculate applicable duties and taxes.

If special permits or licenses are required for electric vehicles, obtain these from the relevant authorities in Burundi before shipping. Keep thorough records of all communications with your supplier, including agreements on pricing, payment terms, and delivery schedules. Proper preparation at this stage helps avoid delays later in the process.

Shipping Options and Customs Clearance

You have two main options for shipping your EV: Roll-On/Roll-Off (RoRo) or container shipping. RoRo is often cheaper, with costs starting at $2,749 and shipping times ranging from 20 to 40 days. On the other hand, container shipping – though more expensive – offers better protection by securing the EV inside a metal container. This method is particularly popular for electric vehicles because it ensures the safe handling of lithium-ion batteries.

Since Burundi is landlocked, your EV will arrive at a regional port like Dar es Salaam (Tanzania) or Mombasa (Kenya). Chinese manufacturers often do not handle export licenses, so working with a freight forwarder or shipping company is essential. Schedule pre-loading inspections to verify the vehicle’s condition matches the provided documentation. Additionally, invest in marine cargo insurance to cover potential damages during transit, including weather-related incidents and theft.

To simplify customs clearance, hire a customs broker at the port. They will assist with managing required documents and resolving any issues that arise. Ensure you have the original bill of lading, bill of sale, foreign registration documents, and any emission or safety compliance forms required by Burundian authorities. Duties will need to be paid upon the vehicle’s arrival, calculated based on the type of vehicle and its CIF (Cost, Insurance, and Freight) value. Once cleared, the focus shifts to transporting the vehicle overland to Burundi.

Transport to Burundi and Border Entry

After clearing customs at the regional port, arrange overland transport to Burundi through your freight forwarder. At the border, customs officials will inspect your documentation and the vehicle itself. Border procedures can sometimes change unexpectedly, so be prepared for possible delays. Make sure the vehicle’s undercarriage is clean and free of foreign soil, as this is a routine part of border inspections.

Officials will verify that the vehicle matches its documentation and complies with Burundian standards. Keep all paperwork organized and readily accessible to avoid unnecessary delays or costs. Any remaining import duties or taxes must be paid during the border clearance process. Completing these steps prepares you for the final stage: registration.

Vehicle Registration and Legal Compliance

Once the vehicle is in Burundi, begin the registration process to obtain license plates. Contact your local equivalent of the Department of Motor Vehicles (DMV) for specific regional requirements, as these can vary. Submit the vehicle for a roadworthiness inspection to ensure it meets safety standards. Additionally, secure insurance that aligns with local regulations and keep all insurance and inspection documents on hand.

Maintain detailed records of all transactions, including supply chain audits, software bills of materials (SBOMs), and declarations of conformity. These documents may be required for future inspections or warranty claims. After registration is finalized, you will receive official license plates, allowing you to legally operate your EV on Burundian roads. With this step complete, your EV is ready to be part of Burundi’s transportation network.

sbb-itb-99e19e3

Import Costs and Budget Planning

When planning to import a vehicle, calculating the total landed cost is essential. This includes the FOB (Free on Board) price, international shipping, marine insurance, and other fees to arrive at the CIF (Cost, Insurance, and Freight) value, which is used for duty calculations. For tourism vehicles, import duties in Burundi range from 40% to 100% of the CIF value, with an additional 4% handling fee. On top of that, a 17% transactional tax is applied to the sum of the CIF value, duty, and handling fee.

Additional costs to factor in include port fees, inland transport, customs broker fees (ranging from US$200 to US$500), inspection charges, registration, and insurance. If the vehicle is over 10 years old, an anti-pollution penalty of about US$920 plus VAT is also applicable.

Here’s a practical formula for estimating your total landed cost:

Total Landed Cost = FOB Price + International Shipping + Marine Insurance + Port & Handling Fees + Inland Transport + Import Duty + Handling Charge (4% of CIF) + Transactional Tax (17% of CIF + Duties + Handling) + Broker Fees + Registration & Plates + Initial Insurance

For example, importing a budget EV with a FOB price of US$12,000 and US$1,500 for shipping and insurance results in a CIF value of US$13,500. With a 50% import duty, the duty cost is US$6,750. A 4% handling charge adds US$540, and the 17% transactional tax on the total (US$13,500 + US$6,750 + US$540 = US$20,790) amounts to about US$3,534. Before adding port fees, inland transport, brokerage, and registration, the cost reaches approximately US$24,324. Including an estimated US$2,000–US$3,000 for these additional expenses brings the total to around US$26,500–US$27,500, more than double the FOB price.

Don’t forget to account for currency exchange fees (2–3%) and potential storage charges of US$50–US$100 per day due to delays. Adding a 10–15% contingency for unexpected costs is also a smart move.

Cost Comparison: Budget vs. Premium EVs

The costs of importing a budget electric vehicle versus a premium model vary not only in the initial price but also in proportional taxes and duties. Fixed costs like inland transport and registration remain relatively stable, but higher-priced vehicles face a much larger tax burden. The table below shows how costs differ between these categories:

| Cost Component | Budget EV (Example) | Premium EV (Example) |

|---|---|---|

| FOB Vehicle Price | US$12,000.00 | US$35,000.00 |

| International Shipping | US$1,500.00 | US$1,800.00 |

| Marine Insurance | US$180.00 | US$525.00 |

| CIF Value | US$13,680.00 | US$37,325.00 |

| Import Duty (50% of CIF) | US$6,840.00 | US$18,662.50 |

| Handling Charge (4% of CIF) | US$547.20 | US$1,493.00 |

| Transactional Tax (17%) | US$3,581.42 | US$9,811.69 |

| Port & Handling Fees | US$400.00 | US$600.00 |

| Inland Transport to Burundi | US$1,200.00 | US$1,400.00 |

| Brokerage/Clearing Fees | US$350.00 | US$450.00 |

| Registration & Plates | US$250.00 | US$250.00 |

| Initial Insurance | US$300.00 | US$800.00 |

| Total Landed Cost | US$27,148.62 | US$70,792.19 |

While the FOB price of the premium EV is nearly three times higher, fixed costs like inland transport and registration don’t change much. This results in duties and taxes forming a larger proportion of the total cost for premium models. For buyers on a budget, options like the BYD Dolphin Active at US$11,800 or the Leapmotor T03 at US$9,500 offer more affordable entry points, though the total landed cost still doubles after all additional charges.

Financing Options and Budget Management

After estimating the landed cost, securing financing becomes the next step. Accurate cost estimation is key to choosing the right financing option.

In Burundi, financing options vary. Traditional bank loans often require a 20–30% down payment with terms of 3 to 5 years, and interest rates can be as high as 15–20% annually. Business importers may use trade finance or letters of credit, but these typically require established banking relationships. Microfinance institutions cater to smaller importers, especially those focusing on two- or three-wheel electric vehicles. Additionally, some East African platforms offer vendor-related installment plans, helping importers manage cash flow challenges.

When evaluating financing, calculate the effective annual interest rate and total interest over the loan term. For example, financing a US$25,000 import at 18% interest over 4 years could result in total interest payments exceeding US$10,000, significantly increasing the overall cost of ownership. Currency risk is another important factor, especially if loans are in Burundian francs while vehicle prices are quoted in U.S. dollars.

Platforms like EV24.africa simplify budgeting by offering transparent pricing and comprehensive import packages. They provide upfront vehicle listings in U.S. dollars, tools for estimating shipping and duties, and pre-arranged logistics through key East African ports. Flexible payment options – such as staged payments with an initial deposit and balance due before shipment – help mitigate unexpected expenses. Services like vehicle inspection, paperwork assistance, and customs support are often bundled into these packages.

Beyond the import costs, think about the long-term total cost of ownership. Electric vehicles generally have lower fuel and maintenance expenses compared to traditional gas-powered cars. In Burundi, with its increasing renewable energy capacity, operational savings can help offset the higher upfront costs, particularly for high-mileage users like taxi drivers or delivery services.

Using and Maintaining Your EV in Burundi

Charging Solutions and Power Supply

Burundi’s electricity grid is known for its instability, which makes off-grid and hybrid charging solutions essential for electric vehicle (EV) users. While the country has significant hydropower resources, the unreliable grid means practical alternatives are a must.

Solar-powered chargers with battery storage are a smart choice for areas with inconsistent electricity. These systems can store energy for use when the grid is down. For at-home or destination charging, AC chargers are a good option, as they can fully charge an EV overnight in about 6–8 hours. On the other hand, DC fast chargers are ideal for quick top-ups, reaching 80% charge in less than an hour. However, they require a higher power supply and come with a larger price tag.

Fleet operators should consider a mix of charging options – AC chargers for regular overnight use and DC fast chargers for those moments when quick charging is needed. Smart charging systems are another great tool, as they optimize energy distribution across multiple vehicles, helping to improve efficiency and ease the strain on the grid during peak times.

The Combined Charging System (CCS2) is becoming the standard across Africa and is already widely used in Europe. When setting up your charging infrastructure, it’s important to ensure compatibility with this standard to accommodate a variety of EV models. For tailored advice, EV24.africa offers expertise in selecting charging solutions that match your vehicle’s needs and usage patterns.

For two-wheeled EVs, battery swapping stations provide an efficient alternative to traditional charging. A good example is Kigali, Rwanda, which by 2024 had about 200 charging stations – 35 for electric cars and 165 for electric motorbikes. This shows how battery swapping can drive the adoption of e-motorcycles on a larger scale.

"The real question isn’t if Africa can build out a proper EV charging network, but how. The issues of grid stability, cost, and skills are demanding a smarter, more resilient approach – one that’s designed for African realities, not just copied from Europe or North America." – EV24.africa

Once reliable charging options are in place, attention must turn to maintenance and technical support to keep your EV running smoothly.

Maintenance and Technical Support

Keeping your EV in top condition requires consistent maintenance, with a particular focus on battery health. In Burundi, where EV technology is still developing, careful planning for maintenance and technical support is essential.

Battery performance is a critical factor. For example, BYD’s Blade Battery has shown a lifespan of up to 1.2 million kilometers during testing, which can significantly reduce long-term maintenance needs. Additionally, some brands like NIO offer a Battery-as-a-Service (BaaS) model, which lowers upfront costs by around $9,600 and provides access to battery-swapping stations and ongoing technical support. Choosing EV models with proven battery durability can save you from potential headaches down the road.

Managing Risks and Staying Compliant

To ensure the long-term success of your EV investment in Burundi, building local technical expertise is crucial. Partnering with vocational schools and technical institutes to train mechanics in EV-specific maintenance can help create a reliable support network for both your vehicle and its charging infrastructure. By focusing on developing local skills, you can help ensure that your EV remains operational and efficient for years to come.

Conclusion: Your Path to Importing EVs Successfully

Importing an electric vehicle from China to Burundi can be a smooth process if you follow a well-structured plan. Start by calculating the total landed cost – this includes the vehicle price, shipping, handling, duties, and taxes. Keep in mind that import fees can significantly increase the overall cost. Choosing a trustworthy Chinese supplier is equally important. Verify their business licenses, certifications, and experience in exporting to Africa. Platforms like EV24.africa simplify the process for East African markets, including Burundi, by handling logistics and minimizing documentation errors or delays.

Once your budget is in place, compliance with regulations becomes critical. Non-compliant vehicles or missing paperwork – like an incomplete bill of lading or an incorrect chassis number – can lead to port delays, impoundments, or costly penalties. Burundi’s clean transport initiatives, including its Nationally Determined Contribution (NDC) aiming for a 3% reduction in greenhouse gas emissions by 2030, mean safety, emissions, and battery standards are likely to become stricter. To avoid complications, confirm all requirements with the Burundi Revenue Authority or a trusted intermediary before shipping.

"At EV24.africa, we simplify the process of importing and buying electric vehicles in Africa. Our expertise ensures a seamless, transparent, and stress‑free experience, so you can focus on driving the future of mobility." – EV24.africa

After navigating regulatory requirements, shift your focus to long-term success with your EV. Evaluate local grid reliability and consider backup charging options like solar panels with battery storage. Opt for EV models with accessible spare parts in East Africa and arrange for local technician support, software updates, and battery diagnostics. Burundi’s progress in clean transport is evident through projects like the 25 electric tricycles delivered to OTRACO by Mahindra and the $800,000 funding request from the Global Environment Facility for electric mobility. Importing an EV not only supports Burundi’s goals for energy security and reduced fuel dependency but also positions you to take advantage of future incentives and policy benefits.

With thoughtful planning, reliable suppliers, a clear budget, and adherence to evolving regulations, you can successfully import an electric vehicle from China. Whether you’re purchasing for personal use or building a business fleet, the opportunity is here – and platforms like EV24.africa are ready to guide you every step of the way.

FAQs

What challenges should I expect when importing electric cars from China to Burundi?

Importing electric vehicles (EVs) to Burundi isn’t without its hurdles. High import expenses, including taxes, shipping costs, and customs duties, can take a significant toll on your finances. On top of that, you’ll need to meet Burundi’s technical and safety standards, which can add another layer of complexity. And let’s not forget the often intricate customs procedures and restrictions on vehicle age that you’ll need to navigate.

Another challenge is ensuring that the EV you’re importing is compatible with the local infrastructure. Some vehicles may require specific charging systems that aren’t yet widely available in Burundi. To make matters trickier, regulations and policies surrounding EV imports can shift, so staying informed is key to avoiding unexpected delays or complications.

How can I ensure a Chinese EV supplier is trustworthy?

When evaluating a Chinese EV supplier’s trustworthiness, begin by examining their certifications, like ISO standards. These certifications indicate that the supplier meets international quality standards. Next, dig into their reputation by looking at customer reviews, industry awards, and their experience exporting to global markets.

It’s also a good idea to ask for references from past clients and assess their history of delivering top-notch electric vehicles. Prioritize suppliers with a proven track record of reliability and excellent customer service to reduce potential risks during the import process.

Does Burundi offer tax incentives for importing electric vehicles in 2025?

Burundi is set to offer tax incentives in 2025 to boost the adoption of electric vehicles. These incentives include lower import duties and fees, designed to encourage the shift to eco-friendly transportation and cut down reliance on fuel. This initiative reflects the government’s commitment to promoting cleaner energy alternatives and making electric vehicles more affordable for its citizens.