Importing electric vehicles (EVs) into Somaliland in 2025 requires understanding updated rules, costs, and documentation. Here’s what you need to know:

- Tax Benefits: Fully electric vehicles are exempt from import duties and VAT.

- Required Documents: Logbook, importation certificate, roadworthiness certificate, and vehicle tax clearance.

- Costs: Key fees include shipping (~$1,500), customs processing ($150), and inspection ($75).

- Vehicle Standards: EVs must meet safety and technical compliance, with battery systems thoroughly inspected.

- Registration: After customs clearance, vehicles must be registered with local authorities.

For a smooth process, work with licensed customs brokers, double-check paperwork, and stay updated on evolving policies. EV24.africa can assist with sourcing compliant EVs and managing imports.

How to Import Electric Vehicles into Somaliland

Bringing an electric vehicle (EV) into Somaliland involves three key steps: selecting the vehicle, preparing the necessary paperwork, and completing customs clearance and registration. Each phase has specific requirements, so careful planning is essential to avoid unnecessary delays or costs.

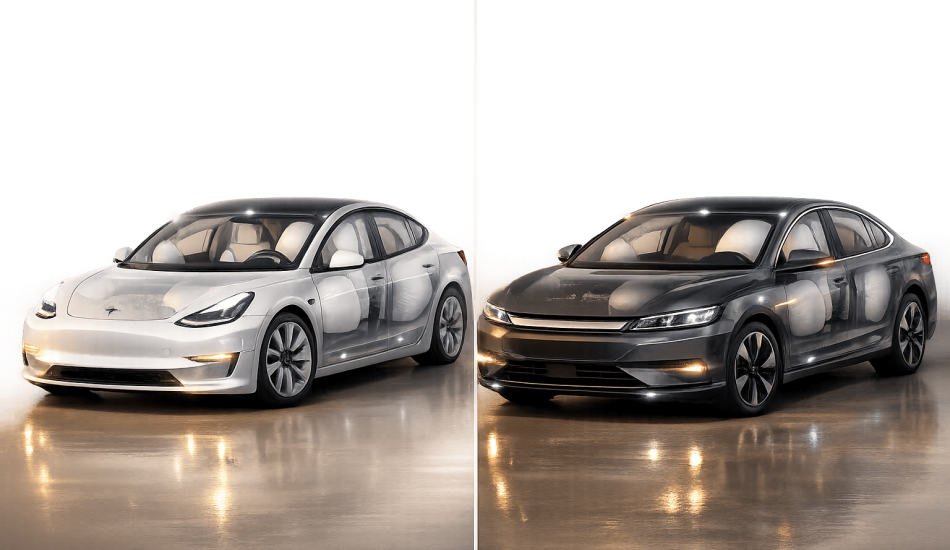

Finding and Choosing EVs to Import

The first step is identifying electric vehicles that align with Somaliland’s import standards. Battery electric vehicles (BEVs), whether for personal or commercial use, are the primary focus of these regulations.

When evaluating suppliers, look for those who offer strong after-sales support. This includes warranties, access to spare parts, and maintenance services. These factors are crucial for ensuring the long-term reliability of your EV.

Documents You Need for EV Imports

Having the correct documentation is critical to a smooth import process. Missing or incomplete paperwork can result in delays, fines, or even rejection at customs. The required documents fall into a few key categories, each serving a specific role in the import process.

- Ownership and legal documents: These include a valid logbook to prove ownership and an importation certificate to authorize the vehicle’s entry into Somaliland.

- Safety and compliance certificates: A roadworthiness certificate confirms the vehicle meets safety standards, while a vehicle tax clearance ensures financial compliance and helps avoid unexpected penalties.

| Document | Purpose | Importance |

|---|---|---|

| Logbook | Proves legal ownership | Confirms your right to export/import |

| Importation Certificate | Authorizes legal entry | Required for customs clearance |

| Roadworthiness Certificate | Verifies safety compliance | Ensures the vehicle meets safety standards |

| Vehicle Tax Clearance | Confirms financial compliance | Prevents penalties and delays |

All documents must be original, and certified translations may be required for any non-English paperwork. Once your documentation is in order, you’re ready to move on to customs processing.

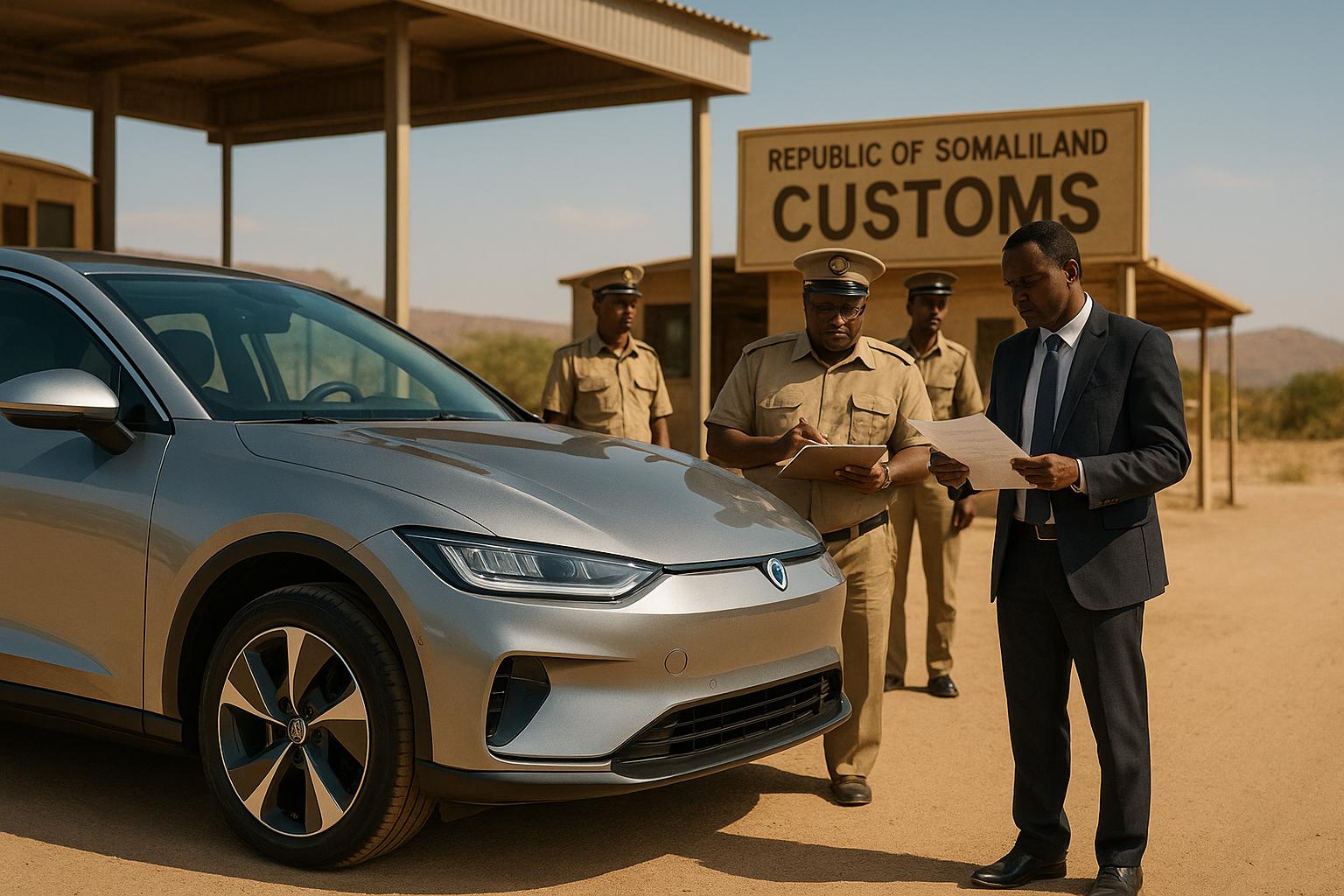

Customs Processing and Vehicle Registration

With your paperwork complete, the next step is navigating customs clearance and registering the vehicle. This phase includes a physical inspection, document verification, and payment of applicable duties and taxes.

Customs officers will inspect the vehicle to confirm its specifications, check for any modifications or damage, and verify the presence of required safety features. Special attention is given to the battery system to ensure compliance with safety and environmental standards.

To simplify this process, consider working with a licensed customs broker. Their expertise can help avoid common pitfalls and speed up the clearance process.

Once customs clearance is complete, the final step is registering the vehicle with local authorities. This requires submitting your cleared customs documents and paying the necessary fees. Be sure to understand which payments must be made immediately and which can be deferred. Keep all receipts for future reference, as they may be needed during registration or for other administrative processes.

The customs and registration process usually takes a few days, provided all your documents are accurate and fees are paid on time.

In Ethiopia, starting February 6, 2024, Transport and Logistics Minister Alemu Sime announced a ban on importing gasoline and diesel vehicles. Only electric vehicles will be allowed, aiming to reduce pollution and promote green transportation.

Import Costs and Tax Breakdown

Bringing an electric vehicle (EV) into Somaliland comes with various fees, duties, and ongoing expenses that can have a notable impact on your overall budget.

Import Duties and Tax Rates

Somaliland benefits from Somalia‘s progressive EV policies, which provide notable savings for importers. Somalia has eliminated VAT and customs duties on 100% electric vehicles, making EVs much more affordable compared to gasoline or diesel-powered cars. According to the Ministry of the Economy of Somalia, this initiative also includes tax exemptions and a gradual reduction of import duties for traditional, hybrid, and electric vehicles.

Even with these exemptions, some mandatory fees remain. These include ownership transfer fees, which range between $30 and $50, as well as port handling, customs processing, and inspection charges. Additionally, vehicle insurance is required, with basic coverage costing around $15 per month based on current market rates.

To better understand the financial implications, let’s break down the costs using a sample calculation.

Sample Cost Calculation

Let’s consider a mid-range EV priced at $8,000. Here’s how the total import cost looks:

| Cost Component | Amount (USD) | Notes |

|---|---|---|

| Vehicle Purchase Price | $8,000 | |

| Shipping Costs | $1,500 | From UAE/Japan/China |

| Import Duties & VAT | $0 | Exempt for 100% EVs |

| Transfer Fee | $40 | Administrative fees |

| Customs Processing | $150 | |

| Vehicle Inspection | $75 | Safety compliance check |

| Total Import Cost | $9,765 | Complete landed cost |

Shipping costs, which typically range between $1,200 and $1,800 depending on the country of origin and shipping method, are a significant part of the expense. However, thanks to Somalia’s tax exemptions, you avoid the substantial VAT and duty charges that would otherwise apply. Administrative fees, such as the $40 transfer fee and $150 customs processing charge, as well as a $75 inspection fee, round out the total cost.

Ongoing Monthly Costs

Once your EV is imported, the monthly expenses are relatively low compared to traditional vehicles. Here’s a breakdown of typical monthly costs:

- Routine service: $25

- Insurance: $15

- Miscellaneous repairs: $20

One of the biggest savings comes from avoiding fuel costs, which can amount to $80 per month for a gasoline vehicle.

Vehicle Market Overview

If you’re exploring the used car market in Somalia, you’ll find vehicles priced between $3,000 and $12,000, depending on factors like make, model, and condition.

Importing an EV into Somaliland offers clear financial benefits. The combination of tax breaks, reduced operating costs, and government initiatives supporting sustainable transportation makes EVs an appealing choice for both personal and commercial use.

Import Rules and Requirements

Although detailed guidelines for importing EVs into Somaliland in 2025 are scarce, it’s crucial to confirm all requirements directly with Somaliland customs and regulatory bodies. Below, you’ll find an overview of vehicle eligibility, safety compliance, and environmental standards to consider.

Banned and Restricted Vehicle Types

At present, no official bans or restrictions on specific EV types have been published.

Safety and Technical Standards

All imported EVs must adhere to internationally recognized safety and technical standards. Importers should ensure their vehicles come with complete technical documentation and any necessary safety certifications. It’s also recommended to use the Combined Charging System (CCS), a widely accepted standard for EV charging.

Environmental and Road Safety Rules

Specific details about environmental and road safety requirements for EV imports into Somaliland remain unclear. However, imported EVs are expected to pass standard environmental and road safety inspections. This includes compliance with emissions standards, safety checks, and proper battery management protocols. It’s essential to confirm any additional testing requirements with local authorities.

For the most accurate and up-to-date information, always consult Somaliland customs and regulatory agencies directly.

sbb-itb-99e19e3

2025 Updates and Import Tips

New Rules for 2025

Somaliland’s electric vehicle (EV) import policies are shaped by the broader Somali Customs Strategic Plan, which spans 2024 to 2027. While specific EV-related regulations for 2025 have yet to be officially announced, importers should anticipate changes as the global EV market continues to grow.

One key update for 2025: only fully electric vehicles are eligible for tax benefits. This makes confirming a vehicle’s electric-only status a must before making any purchase.

To avoid potential pitfalls, here are some practical steps to ensure a smooth import process.

How to Avoid Import Problems

Bringing EVs into Somaliland without issues requires careful preparation and a solid understanding of local requirements. Here’s what you need to focus on:

- Range matters: Opt for EVs with a minimum range of 250 km (155 miles) to ensure they can handle rural travel reliably.

- Documentation is key: Work closely with local clearing agents who are familiar with the latest import guidelines. Double-check all paperwork with their help to avoid errors.

- Battery health checks: For used EVs, getting a battery health certificate before purchase is highly recommended. This ensures transparency and helps avoid surprises down the line.

Staying ahead of the curve will save time and minimize headaches.

Keeping Up with Rule Changes

To stay aligned with Somaliland’s evolving import policies, keep an eye on announcements from local customs authorities and the Ministry of Commerce and Industry (MOCI). Regularly consulting with clearing agents is a smart move – they often get updates on documentation and procedural changes before they’re widely publicized.

As EV adoption grows, Somaliland’s customs policies are adjusting rapidly. Notably, China dominates global EV production, accounting for 69% of all EVs sold worldwide in 2024. This means many imported vehicles will likely come from Chinese manufacturers, and importers should pay close attention to any product-specific requirements.

Since the Somali Customs Strategic Plan runs through 2027, periodic updates to import procedures are expected. Always verify documentation requirements with your clearing agent before each shipment, as these can vary depending on the vehicle’s origin and entry point. Staying informed will help you navigate the changing landscape with confidence.

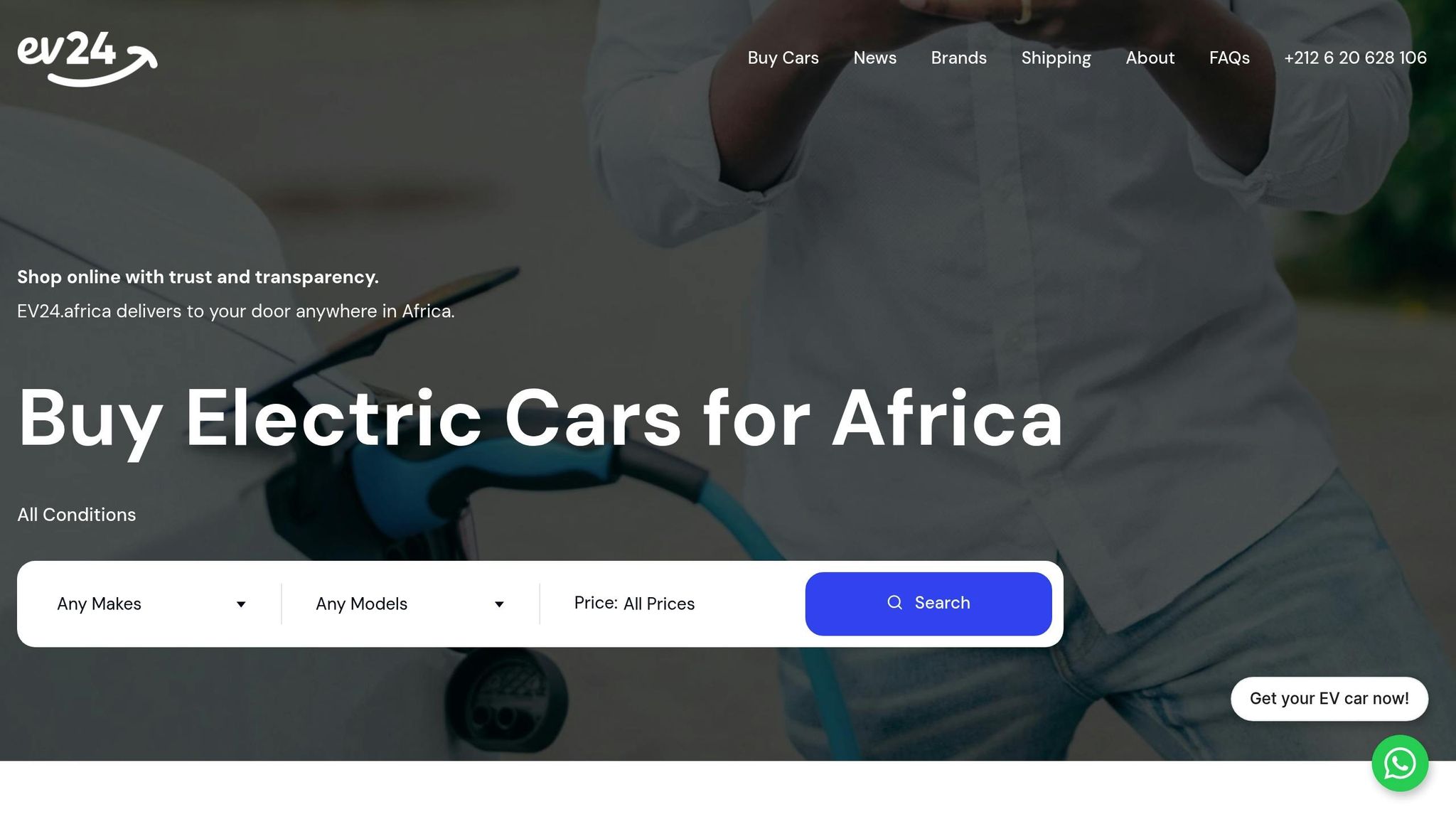

How EV24.africa Helps with Somaliland Imports

EV24.africa simplifies the process of importing electric vehicles (EVs) into Somaliland, offering a range of services designed to make the journey seamless and stress-free.

Finding the Right EVs on EV24.africa

EV24.africa makes it easier to find electric vehicles that meet Somaliland’s import requirements by curating a selection of compliant options. Vehicles are sourced from trusted regions, including Europe, Asia (especially China), North America, and Japan.

Each listing on the platform includes detailed specifications, helping buyers determine whether a vehicle aligns with Somaliland’s import standards. Whether you’re looking for a brand-new EV or a certified pre-owned one, EV24.africa provides transparent pricing with no hidden fees. The platform caters to various needs, offering everything from passenger cars to light commercial vehicles, all backed by a team experienced in African EV markets.

Comprehensive Import Support

EV24.africa doesn’t just help you find the right vehicle – it also manages the entire import process. This includes handling customs clearance, registration, and import taxes, ensuring compliance with Somaliland’s regulations every step of the way.

Shipments to Somalia are typically routed through the Port of Berbera, Somaliland’s primary import hub, taking advantage of streamlined customs processes. With a delivery network spanning all 54 African countries, EV24.africa offers flexible shipping options to suit different budgets and needs. These include roll-on/roll-off (RoRo) and container shipping, with choices for port-to-port or door-to-door delivery.

To make things even easier, their team of experts helps you choose the best shipping method and provides real-time tracking, ensuring a smooth and efficient import experience.

Conclusion

Bringing electric vehicles (EVs) into Somaliland in 2025 means navigating a few key steps: choosing vehicles that meet regulations, gathering the necessary paperwork, calculating total costs, and ensuring safety standards are met. Government incentives also play a role in making imports more appealing.

Having a clear understanding of required documents, restrictions, and compliance standards is crucial for a smooth process. Partnering with local clearing agents and keeping up with any changes in regulations can help you avoid unnecessary delays or complications.

"At EV24.africa, customer satisfaction is our top priority".

FAQs

Why should I use a licensed customs broker to import electric vehicles into Somaliland?

Using a licensed customs broker can simplify the process of importing electric vehicles (EVs) into Somaliland. They help you stay in line with Somaliland’s import regulations, manage intricate paperwork, and minimize the chances of expensive errors or delays.

Thanks to their knowledge, customs brokers can help you save both time and money. They handle duties, taxes, and documentation requirements, so you don’t have to. This can be especially helpful if you’re new to the import system or need to concentrate on other priorities in your business or project.

What steps should I take to ensure the electric vehicle I want to import meets Somaliland’s safety and technical standards?

To make sure your electric vehicle aligns with Somaliland’s safety and technical standards, check that it complies with the Federal Motor Vehicle Safety Standards (FMVSS), including the sound requirements specific to EVs. If the vehicle is pre-owned, ensure it also meets the Euro 4 emissions standards.

It’s equally important to review Somaliland’s import regulations for any required safety certifications or documentation. Before shipping, consider having the vehicle inspected by an authorized agency to verify it meets all the necessary standards.

What should I do if my electric vehicle faces delays or issues during customs clearance in Somaliland?

If you run into delays or problems during the customs clearance process, your first step should be contacting the local customs office. They can provide updates or clarify any issues. Double-check that all necessary documents are complete, accurate, and properly submitted – missing or incorrect paperwork is a frequent cause of delays.

For extra help, you might want to work with a professional import agent who knows Somaliland’s EV import rules inside and out. Staying proactive with regular follow-ups and maintaining clear communication can speed up resolutions and keep your import process moving smoothly.