Importing an electric vehicle (EV) to Sierra Leone in 2025 involves planning, paperwork, and understanding costs. Here’s what you need to know:

- Tax Incentives: Fully electric vehicles are exempt from VAT and customs duties, while traditional and hybrid vehicles have reduced import duties.

- Costs: Import duties are 10%, VAT is 12.5%, and local fees range from $1,500 to $2,500. Shipping from the U.S. costs $2,212–$3,079.

- Shipping: Choose between Roll-on/Roll-off (RoRo) or container shipping. Transit takes 18–28 days.

- Documents: Key paperwork includes the original vehicle title, bill of sale, VIN details, and the battery’s Material Safety Data Sheet (MSDS).

- Compliance: EVs must meet safety and environmental standards set by Sierra Leone’s agencies.

With streamlined systems like ASYCUDA World and updated regulations, importing EVs is becoming easier. Work with a clearing agent to navigate the process smoothly.

How to Import an EV: Complete Process

Before You Import: Planning Steps

Importing an electric vehicle (EV) to Sierra Leone begins with thorough preparation. Start by identifying U.S.-based car shipping companies that specialize in EV transportation, as not all providers handle vehicles with lithium-ion batteries. For instance, BR LOGISTICS USA INC offers EV shipping services priced between $1,142 and $3,079, depending on the service level and departure port. Transit times typically range from 18 to 28 days. When requesting quotes, include essential details such as your EV’s year, make, model, and current location.

Keep in mind that Sierra Leone enforces an age restriction on imported vehicles – cars older than 10 years may attract extra taxes. Double-check your EV’s battery condition and ensure that the VIN and propulsion type are clearly labeled. Once your preparations are complete, arrange shipping services that comply with these requirements.

Shipping and Customs Steps

When shipping an EV, compliance with International Maritime Organization (IMO) regulations is critical, especially for transporting lithium-ion batteries classified as hazardous materials. Inform both your shipper and local customs about your EV import. You’ll need to provide the shipping company with several documents, including the original vehicle title, bill of sale, vehicle specifications, and the battery’s Material Safety Data Sheet (MSDS).

Typically, the process involves delivering your EV to an export port, completing payment, and then shipping the vehicle by sea to Freetown, Sierra Leone’s main import hub. Once the EV arrives, forward the release document or bill of lading to your clearing agent or customs broker to facilitate the customs clearance process.

Registering Your EV in Sierra Leone

After clearing customs, you’ll need to register your EV through Sierra Leone’s updated system. The National Revenue Authority transitioned to the ASYCUDA World platform in 2021, which streamlines processing and reduces clearance times. Additionally, since 2009, Sierra Leone has replaced pre-shipment inspections with destination inspections, meaning your EV will be inspected upon arrival rather than before shipping.

During the registration process, work closely with customs officials to ensure all required documents are submitted. Be prepared to pay a 10% import duty and a 12.5% VAT on the vehicle. Additional local fees can range from $1,500 to $2,500, depending on the specifics of your shipment. Once registration is complete, coordinate with your clearing agent to retrieve your EV or container from the terminal in Freetown. For the latest updates, check the National Revenue Authority’s website.

Required Documents and Rules

Documents You Need for EV Imports

Bringing an electric vehicle (EV) into Sierra Leone involves a detailed list of documents. You’ll need the original bill of lading and either a valid Sierra Leone or International driver’s license. Additionally, include the original invoice, a detailed packing list, and the Combined Certificate of Value and Origin (CCVO). Completing the Sierra Leone Customs "Form C" is mandatory, along with providing the pier fees document for the Freetown terminal to account for port handling charges.

Another key requirement is submitting a Material Safety Data Sheet (MSDS) for the lithium-ion battery. This document must confirm that the battery is free from damage and leakage. Furthermore, both the transporter and Sierra Leone Customs must be informed of the EV import to comply with International Maritime Organization regulations.

Once you’ve gathered all the necessary paperwork, ensure the vehicle meets the country’s safety standards before proceeding.

Meeting Local and Safety Standards

Imported EVs must align with the safety and environmental guidelines set by the Environmental Protection Agency Sierra Leone (EPA-SL), the Standards Bureau, and the Ministry of Trade and Industry. Upon arrival at Freetown port, your EV will undergo an inspection to confirm it complies with approved electrical and safety standards.

The Standards Bureau has established specific criteria for electrical components to distinguish between approved and substandard materials. You’ll need to provide documentation verifying that your EV’s electrical systems meet these local requirements. To stay updated on the latest import rules, it’s wise to contact the Sierra Leone Embassy in Washington, D.C., or work with a customs broker to handle the technical and procedural aspects.

These current standards pave the way for the new regulations set to take effect in 2025.

New Rules Coming in 2025

Sierra Leone is preparing to roll out updated EV import regulations in 2025. The Environmental Protection Agency Sierra Leone recently completed a comprehensive review of key e-mobility policy documents, marking a significant step forward for the country’s EV sector.

"The Environmental Protection Agency Sierra Leone has concluded the stakeholders’ final review of key e-mobility policy documents to facilitate Sierra Leone’s transition to electric mobility on Friday, 20th June 2025."

The reviewed materials include the Draft Import Regulations and Vehicle Registration for Electric Vehicles (EVs). These documents outline new procedures aimed at simplifying the import process while ensuring vehicles adhere to strict safety and environmental standards.

These regulatory updates align with Sierra Leone’s broader environmental objectives, such as reducing greenhouse gas emissions to 7.58 million tonnes CO2e by 2030 and achieving carbon neutrality by 2050. The revised framework offers clearer guidance for legislation and enforcement, making document submission and safety compliance more straightforward for importers.

Import Costs: Duties, Taxes, and Fees

Import Duties and Tax Rates

Sierra Leone’s Customs and Excise Department applies a structured tariff system for electric vehicle (EV) imports. As part of the Economic Community of West African States (ECOWAS), the country follows a uniform tariff framework that categorizes goods into four groups: Raw Materials, Capital Goods, Intermediate Goods, and Consumer Goods.

For EVs, import duties are set at 10% of the vehicle’s assessed value, alongside a Value Added Tax (VAT) of 12.5%. The assessed value is determined based on the invoice price, market conditions, and the vehicle’s age.

In an effort to promote environmentally friendly transportation, the government offers reduced or even zero tariffs for qualifying EVs. However, vehicles older than 10 years may face additional taxes. With Sierra Leone’s per capita income hovering around $1,800, these policies aim to balance affordability with environmental priorities. Additionally, the government has pledged not to introduce new taxes in 2025, instead focusing on refining tax systems. Import incentives tied to sustainability goals could further reduce these costs.

Next, let’s look at port and handling fees, which are another key part of your overall import expenses.

Port and Handling Fees

Beyond government-imposed duties, importing a vehicle through the Freetown terminal comes with local charges. These fees, which typically range from $1,500 to $2,500, cover services such as port handling, vehicle inspections, customs processing, and administrative tasks. Required documentation, like pier fee paperwork, is also included in these charges.

Shipping costs from the USA to Sierra Leone vary between $2,212 and $3,079, depending on factors like the vehicle’s size, weight, transport method, and shipping route. Combined, shipping and handling fees can form a significant portion of your total import expenses, sometimes equaling or surpassing government duties.

Cost Examples with Real Numbers

Here’s a clear breakdown of potential costs when importing a new or used EV:

| Cost Component | New EV ($30,000) | Used EV ($15,000) |

|---|---|---|

| Vehicle Value | $30,000 | $15,000 |

| Shipping (USA to Sierra Leone) | $2,212 – $3,079 | $2,212 – $3,079 |

| Import Duty (10%) | $3,000 | $1,500 |

| VAT (12.5%) | $3,750 | $1,875 |

| Local Charges | $1,500 – $2,500 | $1,500 – $2,500 |

| Total Import Cost | $40,462 – $42,329 | $22,087 – $23,954 |

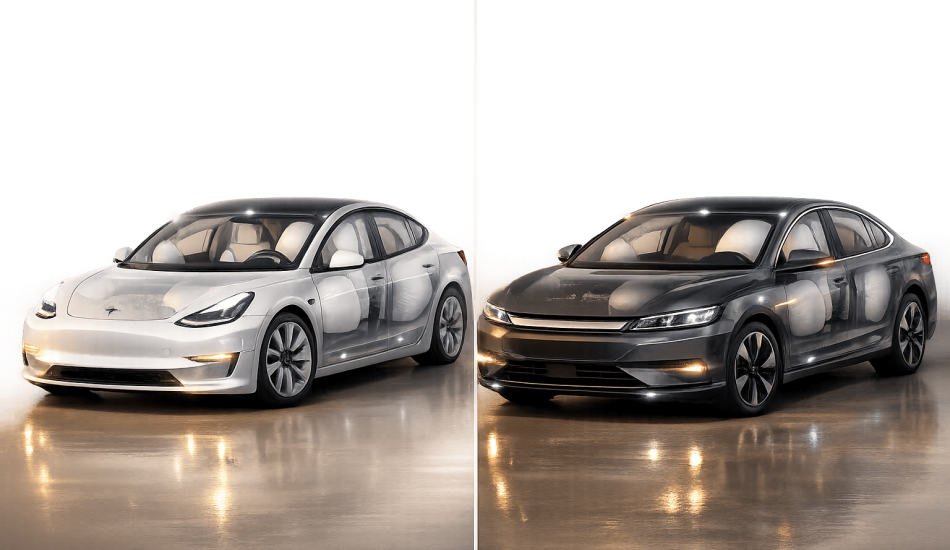

For instance, importing a $30,000 new Tesla Model 3 could cost between $40,462 and $42,329, reflecting a 35% to 41% increase over the car’s purchase price. Meanwhile, a $15,000 used Nissan Leaf might end up costing $22,087 to $23,954 in total, which translates to an additional 47% to 60% over the original price.

These estimates assume standard duty rates. If your EV qualifies for reduced or zero tariffs under the sustainable transport initiative, you could save the full import duty – about $3,000 for a new vehicle or $1,500 for a used one.

It’s worth noting that supply chain issues and semiconductor shortages continue to impact vehicle availability and pricing in Sierra Leone. These factors can influence the customs valuation of your EV, which could affect your final import costs.

To ensure accurate and up-to-date information, consult the Sierra Leone Customs and Excise Department regarding duty rates and potential EV incentives before making your import decision.

sbb-itb-99e19e3

Common Problems and How to Solve Them

Shipping and Logistics Problems

Importing an electric vehicle (EV) comes with its own set of challenges, particularly because of the hazardous nature of lithium-ion batteries. These batteries require specific documentation and must be shipped with a state of charge between 30% and 50%.

One of the most convenient shipping methods is RoRo (Roll-on/Roll-off), as it usually eliminates the need to remove or disconnect the battery, making the process simpler. While container shipping is another option, it’s crucial to confirm that your carrier complies with all battery safety requirements.

Delays can often occur due to port congestion or customs issues, especially if documentation is incomplete or there’s a mismatch in the vehicle’s VIN. To prevent such setbacks, double-check all required documents with your shipping carrier and ensure the EV is in good condition and properly charged before shipment. These logistical hurdles highlight the importance of being prepared for evolving legal requirements.

Staying Legal and Compliant

As shipping challenges are addressed, staying informed about legal regulations becomes equally important. Sierra Leone’s EV import policies are currently undergoing significant changes. The government is in the process of drafting new regulations tailored to electric mobility, including vehicle registration procedures and import guidelines specific to EVs. These efforts aim to establish a framework that supports the adoption of EVs while addressing environmental concerns.

Importers should keep an eye on these developing policies, as they will likely cover critical areas like battery disposal, charging infrastructure, and safety standards unique to EVs. To avoid complications, it’s wise to contact the Sierra Leone Customs and Excise Department for the latest updates, as online resources may not always be up to date.

Thorough documentation is essential. Mistakes such as missing certificates of origin, incorrect vehicle classifications, or outdated emissions standards can lead to fines and delays. Being meticulous with paperwork can save both time and money.

How EV24.africa Makes Importing Easier

Navigating the complexities of EV importation can feel overwhelming, but EV24.africa simplifies the process. They handle everything from sourcing to shipping and delivery, ensuring compliance with international commercial terms (Incoterms) that best suit your needs. The platform collaborates with leading EV brands like Tesla, BYD, Volkswagen, XPeng, Leapmotor, Changan, Wuling, Mercedes-Benz, Citroën, and Peugeot to deliver a seamless experience.

"We make importing and buying electric vehicles (EVs) easy, handling everything from sourcing to shipping and delivery in all 54 African countries."

- EV24.africa

EV24.africa offers flexible shipping options, including DDP (Delivered Duty Paid), which covers all duties, taxes, and delivery costs for a hassle-free experience, and FOB (Free on Board) for those who prefer more control over the shipping process. Whether you choose RoRo or container shipping, their team provides expert advice to help you select the best option based on your vehicle type, budget, and timeline.

The service also takes care of customs clearance, registration, and import taxes, ensuring compliance with Sierra Leone’s evolving regulations. This means you don’t have to constantly monitor policy updates. With delivery available across all 54 African countries – primarily through the Port of Freetown – EV24.africa uses its local expertise to overcome region-specific challenges, making the entire process smooth and stress-free.

Their platform also offers real-time tracking, transparent pricing, and detailed cost breakdowns, helping you budget accurately. If you’re ready to take the next step, explore their extensive catalog of electric vehicles, complete with detailed specifications and clear pricing, and let EV24.africa handle the rest.

African governments welcome Chinese electric vehicle imports, production amid looming trade war

Summary: Main Points for EV Imports in Sierra Leone

Bringing an electric vehicle (EV) into Sierra Leone requires careful planning, proper documentation, and staying up-to-date with changing regulations. The process involves researching vehicle options, obtaining shipping quotes, selecting a shipping method, preparing the necessary paperwork, and working with a clearing agent to manage customs procedures.

Key Documents for Importing EVs

To successfully import an EV, you’ll need the following documents:

- Original title

- Bill of sale

- Vehicle specifications

- Shipper and consignee details

- Battery safety documentation and Material Safety Data Sheet (MSDS) for EVs

Costs and Shipping Details

Shipping an EV from the United States starts at $2,212, with transit times typically ranging from 18 to 28 days. The Port of Freetown is the most efficient point of entry for vehicle imports. Beyond shipping, you’ll need to budget for a 10% import duty and 12.5% VAT, along with local fees, which are estimated to be between $1,500 and $2,500. Keep in mind that older vehicles – those over 10 years old – may attract additional taxes and duties. To minimize costs, it’s worth considering newer EV models that comply with current standards.

Choosing a Shipping Method

The choice of shipping method depends on your EV’s condition and your budget. Roll-on/Roll-off (RoRo) shipping is often the most practical and cost-effective option for vehicles.

Modernized Import Processes and Potential Savings

Sierra Leone has streamlined its import processes with the introduction of the Electronic Single Window system and ASYCUDA World, which have reduced clearance times and enhanced efficiency. Additionally, evolving regulations may offer reduced or even zero tariffs on EVs as part of efforts to promote sustainable transportation. Staying informed about these updates can help you save on import costs while ensuring compliance with local rules.

Partnering with a Clearing Agent

To navigate the import process smoothly, it’s essential to work with a reliable clearing agent. They can help you manage documentation, comply with local regulations, and take full advantage of the streamlined systems in place.

FAQs

What safety and environmental standards do electric vehicles need to meet for import compliance in Sierra Leone?

Electric vehicles brought into Sierra Leone are required to meet stringent safety and emissions standards. For instance, EV batteries must comply with UL 2580, a standard that assesses their electrical, mechanical, and thermal safety. Additionally, vehicles must adhere to guidelines set by Sierra Leone’s Environmental Protection Agency, which emphasize sustainable energy practices and reducing emissions.

These regulations ensure that EVs support a safer and cleaner transportation system, reflecting the nation’s commitment to sustainability and public safety.

What are the import costs and tax benefits for electric vehicles in Sierra Leone compared to traditional and hybrid cars?

In Sierra Leone, bringing in electric vehicles (EVs) is often more affordable due to lower or completely waived import duties. On top of that, tax exemptions and subsidies are available to push the adoption of clean energy technologies. These perks make importing EVs easier on the wallet compared to traditional or hybrid vehicles, which generally come with steeper import taxes and fewer financial breaks.

This pricing advantage aligns with Sierra Leone’s initiative to encourage greener transportation and cut carbon emissions, positioning EVs as an appealing choice for both private owners and businesses.

How can I make sure my EV’s lithium-ion battery meets shipping regulations set by the International Maritime Organization (IMO)?

To make sure your EV’s lithium-ion battery meets IMO shipping regulations, you’ll need to take a few essential steps:

- Pack the battery in UN-certified packaging specifically designed for lithium-ion batteries.

- Verify that the battery has successfully completed UN safety tests, including those required for transport.

- Clearly mark and label the shipment with the correct hazard classifications.

- Provide all necessary shipping documents, such as a declaration of dangerous goods.

For more detailed guidelines, refer to the IMO’s Dangerous Goods Regulations and consider partnering with a certified shipping company that specializes in handling batteries. Proper preparation is key to staying compliant and avoiding transit delays.