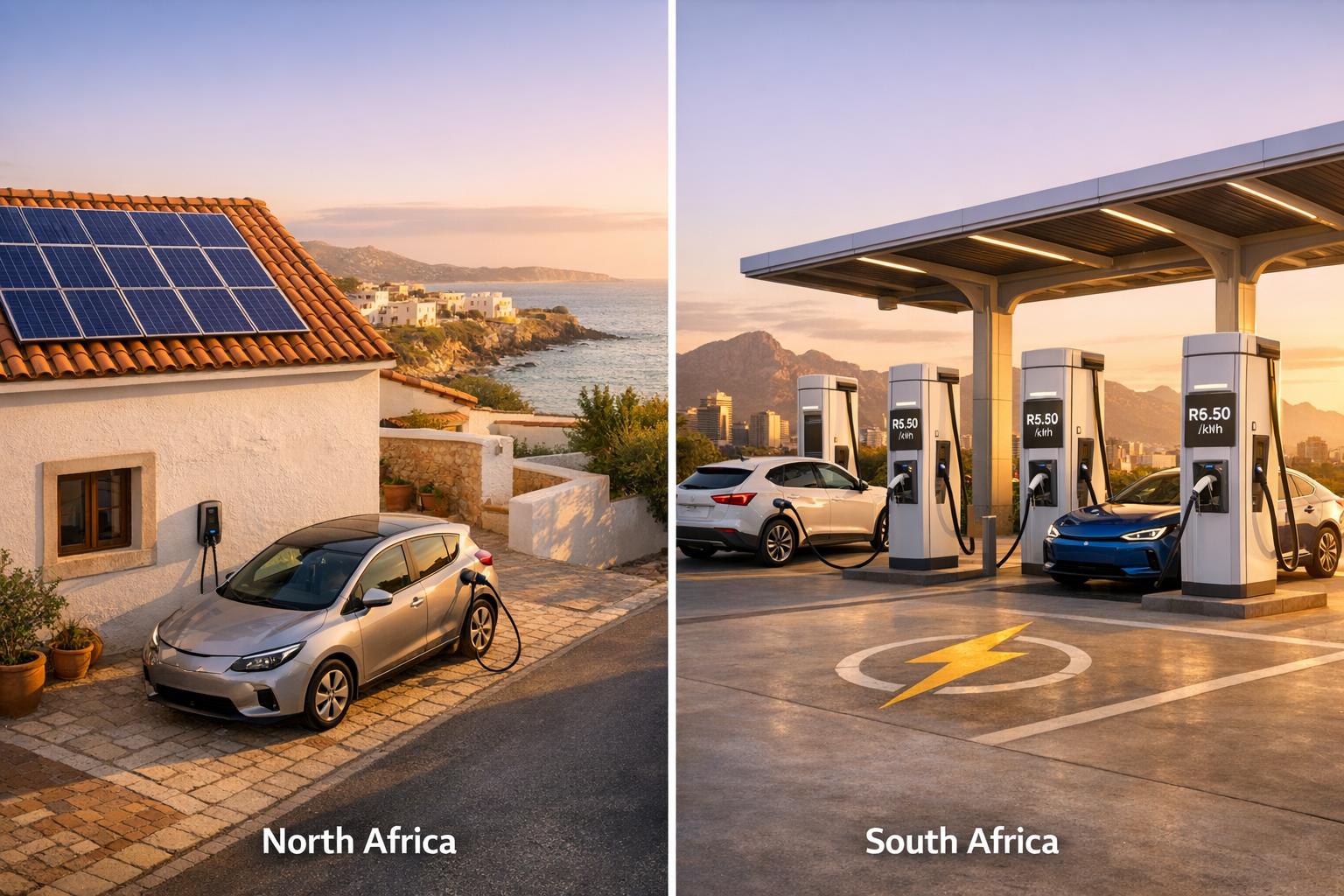

Africa’s EV charging costs vary greatly between Northern and Southern regions, impacting affordability and adoption. Here’s the key takeaway:

- Southern Africa (led by South Africa): Home charging is cheaper, costing $0.17–$0.22 per kWh, while public DC fast chargers are pricier at $0.39–$0.42 per kWh. South Africa has around 400 public charging points, but public charging can cost up to 140% more than home charging.

- Northern Africa: Electricity is subsidized, making home charging affordable in some areas. However, public charging infrastructure is limited, and costs vary widely. Off-grid solar systems are emerging as a solution for high infrastructure costs.

Quick Comparison

| Metric | Northern Africa (e.g., Algeria, Sudan) | Southern Africa (e.g., South Africa) |

|---|---|---|

| Home Charging Cost | Variable, subsidized rates | $0.17–$0.22 per kWh |

| Public AC Charging | Limited availability | ~$0.33 per kWh |

| Public DC Charging | Rare, developing infrastructure | $0.39–$0.42 per kWh |

| Public Charging Points | Sparse | ~400 points |

Southern Africa benefits from more developed infrastructure, while Northern Africa relies on subsidies and emerging solar solutions. Both regions face unique barriers, but renewable energy and policy shifts could shape the future of EV adoption.

North vs South Africa EV Charging Costs Comparison

EV Charging Costs In SOUTH AFRICA | Feat. Alfa Romeo Junior

EV Charging Costs in Northern Africa

Northern Africa benefits from state-controlled energy systems and significant subsidies, resulting in some of the lowest household electricity rates globally. With nearly universal electricity access achieved by 2021, the region is well-positioned for home-based EV charging. However, public charging infrastructure is still in its early stages, and costs vary widely between countries. These factors play a key role in determining how financially viable EV adoption is across Northern Africa.

Home Charging Costs

Charging an EV at home is particularly affordable in Northern Africa, thanks to heavily subsidized electricity rates. That said, there’s a notable range in costs – for instance, Algerian residential electricity rates are nearly six times higher than those in Sudan. To keep expenses even lower, EV owners can take advantage of smart charging systems, which allow charging during off-peak hours when electricity is cheaper.

Public Charging Infrastructure

While home charging is economical, the public charging scene is a different story. Public charging stations are mostly concentrated in commercial areas and along major transport routes, especially in Morocco and Egypt. Fast DC chargers, capable of delivering up to 200 kW for long-distance travel, are significantly more expensive to use compared to slower AC chargers. The high costs associated with installing Level 3 DC fast chargers – despite subsidies and creative financing solutions – have slowed the expansion of public charging networks.

Government Incentives and Policies

Governments in Northern Africa are actively shaping the EV landscape through targeted policies. For example, Morocco and Egypt have introduced national e-mobility roadmaps aimed at increasing EV adoption and production over the next ten years. These initiatives include reduced import duties on EV components, which help lower the upfront costs of building charging infrastructure. Additionally, public-private partnerships, often backed by international development organizations, are funding pilot projects and feasibility studies to improve infrastructure. To address gaps in the network, governments are also exploring solar-powered and off-grid charging solutions. EV owners should stay informed about local home charging subsidies, as these can significantly reduce installation costs.

EV Charging Costs in Southern Africa

Southern Africa, with South Africa leading the way, is seeing its electric vehicle (EV) market grow, but charging costs remain a challenge. Slower adoption of EV-specific incentives and reliance on market-driven pricing contribute to higher costs, especially at public charging stations. Here’s a closer look at home charging, public infrastructure, and government policies shaping the region’s EV landscape.

Home Charging Costs

Charging your EV at home is by far the most budget-friendly option, costing 4 to 6 times less than fueling a petrol car. In South Africa, electricity rates for home charging range between $0.10 and $0.22 per kWh (R1.80–R4.00), depending on the city and your electricity usage tier. For example, Cape Town residents pay between $0.10 and $0.18 per kWh (R1.80–R3.20), while Durban rates are slightly steeper at $0.12 to $0.18 per kWh (R2.13–R3.33). Charging a medium-sized EV with a 70 kWh battery at home costs around $13.50 (R245), compared to over $28.50 (R515) at a public DC fast charger.

Many EV owners invest in dedicated wallbox chargers, which typically range from 7 kW to 22 kW. Installing a 7 kW system costs between $660 and $1,380 (R12,000–R25,000), but the savings on fuel often offset this cost within 6 to 12 months. Adding solar panels to your home charging setup is becoming increasingly popular, particularly in South Africa, where frequent load shedding makes energy independence appealing. With solar integration, the cost per kWh can drop to nearly zero, offering long-term savings.

Public Charging Infrastructure

Public charging stations, while more accessible in urban areas and along key highways, are pricier than home charging. By late 2023, South Africa had about 400 public charging points, mainly located in major cities and along highways like the N1, N2, and N3. Public AC chargers cost around $0.32 per kWh (R5.88), while DC fast chargers range from $0.39 to $0.41 per kWh (R7.00–R7.35). These rates are 75% to 140% higher than residential electricity prices.

"It’s not just about electricity; it’s about infrastructure, access, and convenience."

– Hilton Musk, Head of E-mobility, Rubicon

Public charging costs also reflect the involvement of multiple players. Charge Point Operators manage the hardware, while E-mobility Service Providers handle billing, adding about a 15% markup to the final price. Some automakers, like Jaguar Land Rover, offer reduced rates for their customers, with prices as low as $0.17 per kWh (R3.00) at select branded stations. Despite the premium, EV travel remains cheaper than gasoline, costing around $0.07 to $0.08 per km (R1.20–R1.50) versus $0.14 per km (R2.50) for petrol vehicles.

Government Incentives and Policies

Southern African governments have been slow to introduce EV-specific incentives, especially compared to regions further north. High import duties and recent electricity tariff hikes have driven up both vehicle prices and residential electricity rates. For now, there are no direct subsidies for public charging infrastructure. Instead, costs are shaped by infrastructure recovery expenses and wholesale electricity rates from Eskom.

"Currently in South Africa, we only use flat rate tariffs."

– Hilton Musk, Head of E-mobility, Rubicon

While government support for residential solar installations can help EV owners reduce their reliance on the grid, the initial investment remains a barrier for many. Public-private partnerships, such as those involving the Automotive Industry Development Centre Eastern Cape (AIDC-EC), have negotiated charging tariffs, but these can sometimes result in higher prices. For instance, some GridCars users pay up to $0.45 per kWh (R8.24) at certain locations.

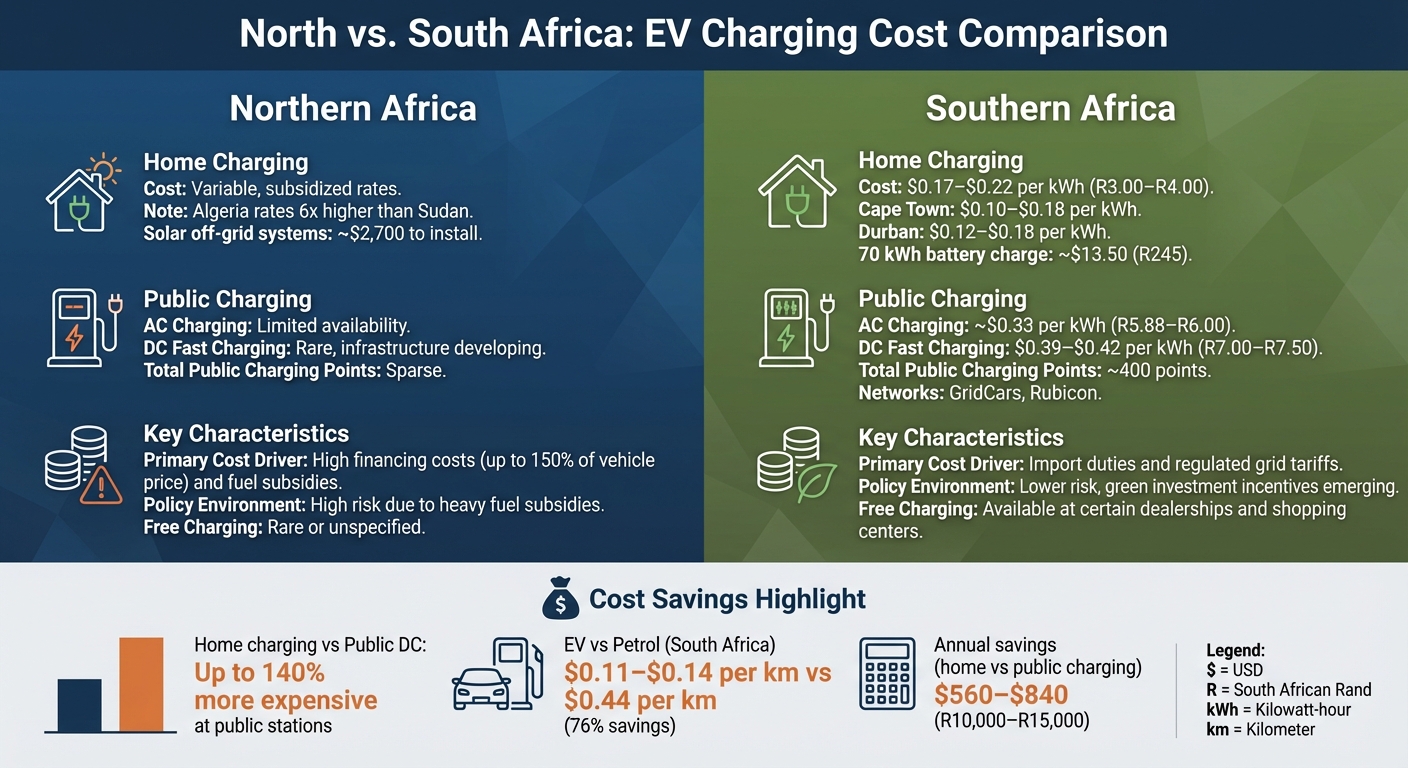

Cost Comparison: Northern vs. Southern Africa

Southern Africa stands out with its more developed infrastructure and clearer pricing for electric vehicle (EV) charging, while Northern Africa struggles with higher costs due to financing hurdles, policy weaknesses, and limited infrastructure. Let’s break down these differences.

In Southern Africa, home charging typically costs between $0.17 and $0.22 per kWh (R3.00–R4.00 per kWh). Public AC charging averages around $0.33 per kWh (R5.88–R6.00 per kWh), and public DC fast charging ranges from $0.39 to $0.42 per kWh (R7.00–R7.50 per kWh).

Meanwhile, Northern Africa faces unique challenges. Countries like Algeria, Sudan, and Mauritania benefit from subsidized fossil fuels, which keep gasoline prices low. However, EV adoption is hampered by financing costs that can soar to 150% of a vehicle’s price, making EVs far less competitive. Public charging networks in the region are sparse, with a growing reliance on off-grid solar solutions to stabilize costs.

Cost Comparison Table

Here’s a snapshot of the key differences between Northern and Southern Africa:

| Metric | Northern Africa (Algeria, Sudan, Mauritania) | Southern Africa (South Africa, Botswana, Namibia) |

|---|---|---|

| Home Charging Cost | Highly variable; solar off-grid systems cost about $2,700 to install | ~$0.17–$0.22 per kWh (R3.00–R4.00 per kWh) |

| Public AC Charging | Limited availability | ~$0.33 per kWh (R5.88–R6.00 per kWh) |

| Public DC Fast Charging | Rare; infrastructure still developing | ~$0.39–$0.42 per kWh (R7.00–R7.50 per kWh) |

| Public Charging Points | Sparse, focused on off-grid solutions | ~400 points, supported by networks like GridCars and Rubicon |

| Primary Cost Driver | High financing costs and fuel subsidies | Import duties and regulated grid tariffs |

| Free Charging | Rare or unspecified | Available at certain dealerships and shopping centers |

| Policy Environment | High risk due to heavy fuel subsidies | Lower risk, with green investment incentives emerging |

This comparison highlights the stark contrast in EV affordability and infrastructure development between the two regions. While Southern Africa benefits from a growing network and clearer pricing, Northern Africa’s reliance on subsidized fossil fuels and high financing costs creates significant barriers to EV adoption.

sbb-itb-99e19e3

What Drives Regional Cost Differences

Energy Sources and Electricity Pricing

The cost of charging electric vehicles (EVs) is largely influenced by electricity generation and pricing. In Southern Africa, particularly South Africa, utility providers like Eskom set the base wholesale electricity tariffs for charge point operators (CPOs). This regulated pricing structure provides a consistent starting point for costs.

The energy mix of a country also plays a significant role. Nations that depend heavily on imported fossil fuels often face higher electricity costs compared to those with access to local renewable energy sources. This difference impacts how EV charging costs compare to traditional gasoline. For example, in many Northern African countries, gasoline and diesel are heavily subsidized, making EV adoption less attractive unless electricity prices are equally competitive.

Other factors, such as grid reliability and the financial health of utility providers, add to operational costs. Metrics like the Electricity Regulatory Index and utility solvency highlight why some regions can maintain stable and affordable charging options while others struggle with higher costs and inconsistencies. These underlying electricity cost factors also influence where and how infrastructure investments are prioritized.

Infrastructure Development

The availability and type of charging infrastructure significantly affect costs. In Southern Africa, particularly South Africa, there are around 400 public charging points in operation. These networks follow what Hilton Musk, Head of E-mobility at Rubicon, describes as a "fibre internet model". In this setup, CPOs manage the hardware and sell wholesale access to E-mobility Service Providers (eMSPs), who then add a standard 15% retail markup.

"Think of it like the fibre internet model. The fibre network providers… sell bandwidth to internet service providers… who then add their margin before offering it to customers. Public EV charging works in much the same way."

- Hilton Musk, Head of E-mobility, Rubicon

The type of charging equipment used also has a major impact on pricing. DC fast chargers are significantly more expensive to install compared to AC chargers. This cost difference is reflected in the pricing structure. For instance, in August 2025, Rubicon eMSP customers were charged $1.24 per kWh (R7.00) for DC charging, while GridCars customers paid $1.46 per kWh (R8.24) at AIDC-EC stations. These differences arise from varying wholesale-to-retail agreements between CPOs and eMSPs.

"The upfront installation and equipment costs for DC chargers are significantly higher than for AC chargers. Therefore, to recover these costs and remain financially viable, CPOs apply a higher tariff for DC charging."

- Hilton Musk, Head of E-mobility, Rubicon

Access to financing plays a critical role in the pace of charging network expansion. These combined factors explain why Southern Africa has made faster progress in developing public charging infrastructure, while Northern Africa faces slower growth due to challenges like grid reliability and economic constraints.

Future Trends in EV Charging Costs Across Africa

Impact of Renewable Energy Expansion

The growing use of renewable energy is set to reshape EV charging costs across Africa. In South Africa, for example, the abundance of solar energy is paving the way for off-grid and hybrid charging stations. These setups help counter grid instability and are expected to drive EV adoption significantly between 2027 and 2030. This shift toward renewable energy is not only changing the way vehicles are charged but also transforming the economics of both personal and public charging.

For homeowners, installing solar PV systems can bring charging costs down to almost zero once the initial setup costs are paid off. This is a stark contrast to public DC fast charging rates, which range from $1.24 to $1.33 per kWh (R7.00–R7.50), compared to residential rates of $0.53 to $0.71 per kWh (R3.00–R4.00). These cost benefits are encouraging operators to invest in solar PV systems and Battery Energy Storage Systems (BESS), making renewable energy a cornerstone of future charging infrastructure.

Urban logistics and public fleets, in particular, are emerging as key markets. These sectors are drawn to the predictable savings offered by solar-powered, smart charging systems, which are designed to optimize energy use even in areas where the grid is unreliable.

Role of Platforms Like EV24.africa

Alongside these technical advancements, platforms like EV24.africa are playing a crucial role in boosting EV adoption. By connecting buyers with affordable vehicles from leading brands and offering transparent pricing, these platforms simplify the purchasing process. They also provide clarity on total ownership costs, including charging, which is a significant factor in the decision-making process. Operating across 54 African countries, EV24.africa is helping to close the gap between vehicle availability and charging infrastructure, making electric mobility more accessible.

These developments highlight how infrastructure costs and market accessibility are evolving, shaping the dynamics of EV adoption across the continent, especially when comparing regions like North and South Africa.

Conclusion

The cost differences between Northern and Southern Africa highlight how electricity pricing, infrastructure development, and policy support shape the economics of owning an electric vehicle (EV). In South Africa, charging at home costs around $0.53 to $0.71 per kWh (R3.00–R4.00), while public DC fast charging can climb to $1.24 to $1.33 per kWh (R7.00–R7.50) – nearly double the residential rate. This gap means EV owners who primarily charge at home can save between $560 and $840 annually (R10,000–R15,000) compared to those relying on public charging stations. However, a lack of transparent pricing for EV charging complicates cost comparisons. Unlike gasoline prices, which are clearly displayed at every station, EV charging costs remain less visible, leaving potential buyers uncertain about the financial benefits.

These disparities don’t just affect short-term expenses – they also play a role in shaping long-term decisions. Addressing regional cost differences will require standardized pricing, better integration of renewable energy, and clear, accessible information to empower consumers. For instance, driving an EV powered by home electricity in South Africa costs approximately $0.11–$0.14 per kilometer (R0.60–R0.80), compared to $0.44 per kilometer (R2.50) for a petrol vehicle – a savings of about 76%.

Platforms like EV24.africa are stepping in to improve transparency by providing detailed insights into total ownership costs, including charging expenses, making EV adoption less daunting across Africa’s 54 countries.

As renewable energy adoption grows and digital tools simplify the EV purchasing process, affordable and transparent charging solutions will help reduce regional cost disparities, making EV ownership more accessible across the continent.

FAQs

How do electricity subsidies in Northern Africa impact the cost of charging EVs?

In Northern Africa, electricity subsidies play a big role in cutting energy costs, which directly makes charging electric vehicles (EVs) much cheaper compared to areas without similar financial support. By reducing electricity prices, these subsidies help EV owners save money every time they charge their vehicles.

This cost advantage has a ripple effect, encouraging more people to consider switching to EVs. With lower charging expenses, EVs become a much more practical and budget-friendly option for daily transportation.

Why is charging an electric vehicle at public stations in Southern Africa more expensive than at home?

Public EV charging across Southern Africa typically costs more than charging at home. Why? Operators face hefty expenses to establish and maintain the necessary infrastructure. This includes the price of high-tech equipment, installation fees, and ongoing upkeep – all of which contribute to those higher per kilowatt-hour rates.

On the other hand, home charging taps into standard residential electricity rates, which are usually much cheaper. Public charging stations often tack on extra fees for the convenience and accessibility they offer, adding another layer to the cost difference.

How will renewable energy shape the future of EV charging in Africa?

Renewable energy is transforming EV charging across Africa, offering cleaner, more affordable, and dependable power solutions. With vast resources like solar, wind, and hydropower, the continent is building sustainable charging systems, including solar-powered stations and off-grid setups. These innovations tackle challenges like unreliable electricity grids and high energy costs, paving the way for a greener future.

Countries such as Kenya and Morocco are at the forefront, driving large-scale renewable energy projects that make EV charging more economical while reducing dependence on fossil fuels. Meanwhile, private companies are rolling out solar-powered charging networks and battery-swapping systems in regions with limited grid access. These renewable energy initiatives not only cut down charging expenses but also significantly reduce carbon emissions, contributing to global climate goals and expanding access to electric mobility across Africa.