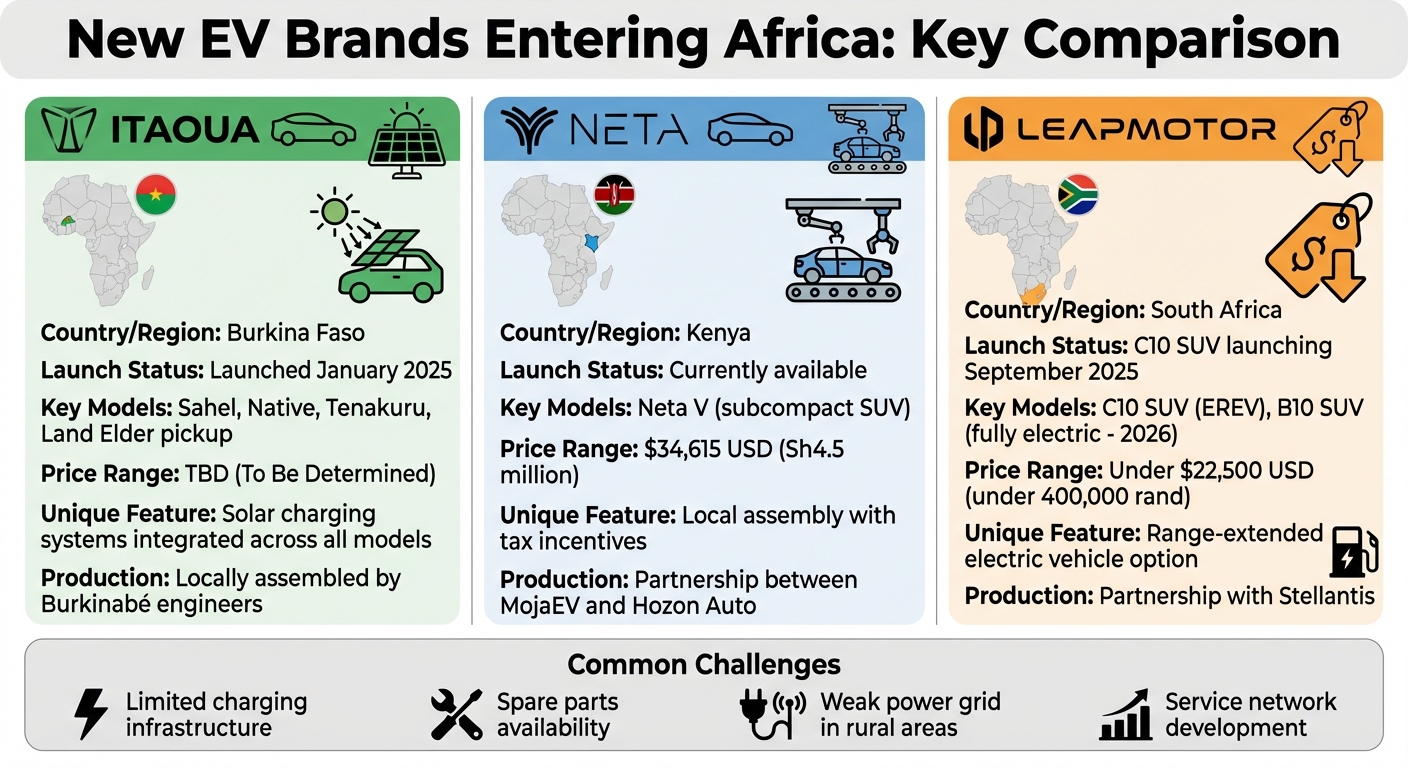

Africa’s electric vehicle (EV) market is growing fast, with brands like Itaoua, Neta, and Leapmotor making key moves to establish themselves. Here’s what you need to know:

- Itaoua: A Burkina Faso-based company focusing on locally assembled EVs with solar charging capabilities. Models include the Sahel, Native, Tenakuru, and Land Elder pickup. Pricing details are pending, but local assembly aims to lower costs.

- Neta: Partnering with MojaEV in Kenya, Neta is assembling the Neta V subcompact SUV locally. Priced at approximately $34,615, this approach leverages tax incentives to reduce costs.

- Leapmotor: Launching in South Africa with the C10 SUV in late 2025, Leapmotor plans to expand with fully electric models in 2026. Target pricing is under $22,500 to appeal to middle-class buyers.

While these brands bring affordability and localized production, challenges like limited charging infrastructure, spare parts availability, and power grid issues remain hurdles. Governments are easing the transition with tax cuts and incentives, making EVs more accessible.

Quick Comparison:

| Brand | Region | Key Model | Price | Unique Feature |

|---|---|---|---|---|

| Itaoua | Burkina Faso | Sahel, Native, etc. | TBD | Solar charging systems |

| Neta | Kenya | Neta V | ~$34,615 | Locally assembled for cost savings |

| Leapmotor | South Africa | C10 SUV | Under $22,500 | Affordable range-extended EV option |

Africa’s EV market is evolving, and these brands are shaping its future with cost-effective, locally-focused solutions.

Comparison of New Electric Vehicle Brands Entering Africa 2025

1. Itaoua

Target Market

Itaoua represents Burkina Faso’s leap into the electric vehicle (EV) market. Officially launched in January 2025, the company focuses on creating EVs designed specifically for African conditions. These vehicles are assembled locally by Burkinabé engineers who received training in Chinese factories, blending Chinese technical expertise with local craftsmanship. The result? Vehicles that are fine-tuned for Africa’s unique roads and climate. Beyond just producing cars, Itaoua aims to drive industrial growth in emerging economies by establishing manufacturing hubs that generate local employment and stimulate economic progress. This effort also highlights the importance of technology transfer in fostering sustainable development.

Key Features

Itaoua’s lineup includes four models: the Sahel, Native, Tenakuru, and the Land Elder pickup. A standout feature across all models is the integration of solar charging systems. This innovation directly addresses the challenges posed by limited charging infrastructure, leveraging Africa’s abundant sunlight as a natural resource.

"Kemet is uniquely positioned to redefine electric mobility in Africa. By combining a deep understanding of local conditions with a commitment to innovation, we are developing electric vehicles specifically tailored to the African market. Our focus on sustainable transportation solutions and our dedication to building a strong local presence set us apart from other EV manufacturers." – Kemet Automotive

Pricing and Affordability

While specific pricing details are yet to be disclosed, Itaoua’s local assembly approach is expected to make its vehicles more competitively priced compared to imported alternatives. By partnering with Chinese manufacturers, the company aims to reduce production costs, potentially making EVs more accessible to African buyers. Itaoua also plans to offer flexible purchasing options, including dealership sales, fleet packages, and online purchases. More detailed information on these options will be shared closer to the product launch. This affordability strategy, combined with features tailored to African needs, positions Itaoua as a strong contender among emerging EV brands.

2. Neta

Target Market

Neta has made its entry into Africa through a partnership between MojaEV and Hozon Auto, starting in Kenya. Instead of importing fully built vehicles, the brand is assembling them locally in Kenya. This approach takes advantage of tax incentives, reduces costs, and ensures better access to spare parts, allowing for quicker responses to market demands. With these strategic moves, the focus now shifts to the features of the Neta V.

Key Features

The Neta V, a subcompact SUV, is the first model introduced in Kenya under this local assembly strategy. By assembling the Neta V locally, availability of spare parts is enhanced, and the brand can respond more efficiently to customer needs.

Pricing and Affordability

In Kenya, the Neta V is priced at Sh4.5 million, which is roughly $34,615 USD. Thanks to local production and competitive pricing, costs are expected to decrease further as production scales up.

3. Leapmotor

Target Market

Leapmotor is set to make its debut in South Africa with the launch of its C10 SUV in September 2025. This move places the brand among a growing number of Chinese automakers entering a market traditionally dominated by well-established names like Volkswagen and Toyota. Looking ahead, Leapmotor plans to introduce fully electric models in 2026, signaling its intent to expand its footprint in the region. The C10’s launch will include features designed specifically with African consumers in mind.

Key Features

The C10 will be Leapmotor’s first offering for African buyers. This SUV is a range-extended electric vehicle (EREV), meaning it uses a gasoline engine solely to recharge its battery. Additionally, Leapmotor has the B10 SUV in its lineup, which is a fully electric model. However, detailed technical specifications for both vehicles in the African context have yet to be released.

Pricing and Affordability

While exact pricing details haven’t been disclosed, Chinese automakers are generally aiming to keep models under 400,000 rand (around $22,500) to make them more accessible. Still, this price point might remain out of reach for many middle-class buyers. Leapmotor’s edge appears to lie in offering more affordable options compared to traditional competitors. Chinese EV makers are leveraging lower production costs to carve out a share of the market, particularly as trade barriers in the U.S. and Europe push them to explore opportunities in regions like Africa. This pricing strategy aligns with local market needs, emphasizing Leapmotor’s goal of making electric mobility more attainable.

sbb-itb-99e19e3

How Chinese EV Makers Are Building a Lead in African Countries

Pros and Cons

These brands bring notable cost advantages to the table, but they also face hurdles when it comes to infrastructure. Leapmotor, for instance, made its debut in South Africa in October 2025 through a partnership with Stellantis. The brand focuses on vehicles priced under 400,000 rand (around $22,755), a segment that accounts for over 60% of the South African market.

However, maintenance issues remain a sticking point. Take Ethiopia as an example: after banning petrol and diesel imports, the country deployed 100,000 electric vehicles in 2024. Yet, garages struggled to source parts, and the rollout of charging stations lagged behind the rapid growth in EV sales. This highlights the need for manufacturing strategies tailored to local conditions.

Another challenge is the weak power grid and limited electrification in rural areas, which complicates EV charging. To address this, Chinese manufacturers have adopted vertical integration, combining battery production with vehicle assembly. This approach not only cuts delivery times but also lowers costs. Over time, it could improve the availability of parts and expand service networks. Still, questions linger about long-term infrastructure support, including warranties, technical expertise, and charging networks. Despite these challenges, the lower production costs of these brands make electric vehicles more attainable for middle-class buyers.

| Brand | Market Status | Key Advantage | Main Challenge |

|---|---|---|---|

| Leapmotor | Launched in South Africa (Oct 2025) | Stellantis partnership and market presence | – |

| Neta | Available through Chinese suppliers | Offers multiple range options | No official pricing or launch date |

| Itaoua | Market entry pending | – | – |

This snapshot highlights both the opportunities and obstacles these brands face as they work to define the future of electric vehicles in Africa.

Conclusion

The rise of new electric vehicle (EV) brands like Leapmotor, Neta, and Itaoua highlights Africa’s growing interest in affordable electric mobility. Leapmotor is gearing up for its entry into South Africa, while Neta is making strides in Kenya with its locally assembled V subcompact SUV, supported by tax incentives. Meanwhile, Itaoua’s presence is still in its early stages, with limited market data available.

For cost-conscious consumers, local assembly offers the promise of reduced prices. However, challenges like access to spare parts, reliable service networks, and adequate charging infrastructure remain significant hurdles. These factors emphasize that the transition to EVs involves more than just lowering upfront costs.

In addition to affordability, aspects such as financing options, the stability of manufacturers, and dependable after-sales support play a key role. While lower production costs can make EVs more accessible, concerns about long-term warranties and maintenance services persist.

FAQs

What obstacles are slowing down electric vehicle adoption in Africa?

Electric vehicle (EV) adoption in Africa comes with its fair share of hurdles. One major obstacle is the high upfront cost of these vehicles, often inflated by import duties, which makes them out of reach for many potential buyers. Then there’s the issue of charging infrastructure – or rather, the lack of it. With few charging stations available, drivers often experience range anxiety, worrying about running out of power with no convenient place to recharge.

On top of that, many regions struggle with unreliable electricity supplies, which only adds another layer of difficulty for EV users. Other challenges include minimal government support in the form of incentives or policies, limited public awareness of EV benefits, and the fact that affordability remains a significant barrier for the average consumer. Tackling these challenges is key to opening the door for electric mobility across the continent.

How do local assembly and tax incentives affect electric vehicle prices in Africa?

Local assembly plays a key role in bringing down the cost of electric vehicles (EVs) by cutting import expenses and tariffs. This makes EVs easier on the wallet for consumers. On top of that, tax incentives provided by governments help further reduce prices, encouraging more people to explore the option of owning an EV. At the same time, these incentives stimulate local manufacturing and create job opportunities.

By making EVs more affordable and fostering local production, these efforts contribute to building a thriving automotive sector in Africa, all while steering the region toward a cleaner and more sustainable future.

What makes Itaoua’s EV models a good fit for Africa?

Itaoua’s electric vehicles are crafted to meet the specific needs of Africa. These EVs are designed to be budget-friendly, taking advantage of lower production costs to make them more accessible to a wider audience. They also integrate seamlessly with decentralized solar charging systems, which is a game-changer for areas where electricity access can be unreliable. On top of that, their sturdy build is tailored to handle rough roads and uneven terrain, making them a reliable option for the diverse landscapes found across the continent.