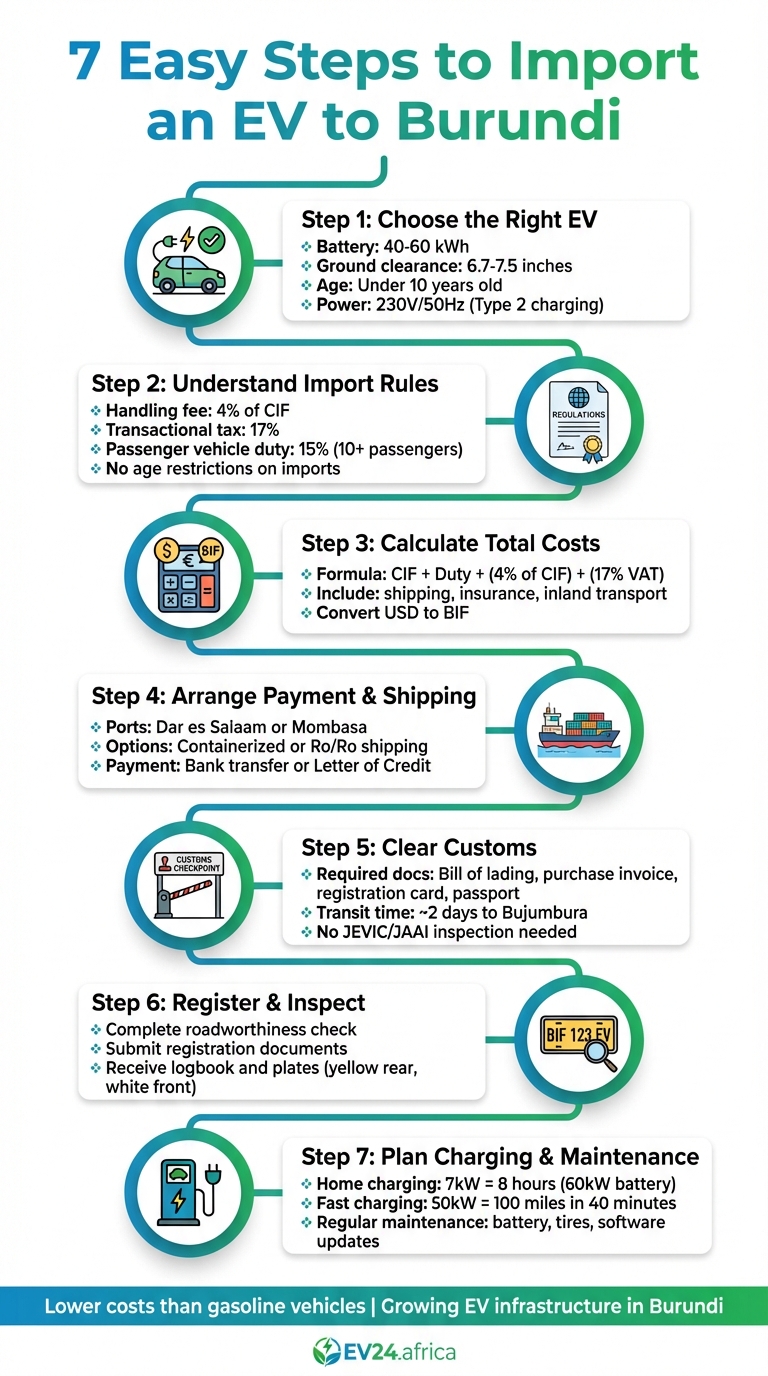

Importing an electric vehicle (EV) to Burundi in 2025 is straightforward when you follow a clear process. Here’s what you need to know:

- Choose the right EV: Focus on battery capacity (40–60 kWh), ground clearance (6.7–7.5 inches), and compatibility with Burundi’s 230V/50Hz power grid. Avoid vehicles over 10 years old to bypass extra taxes.

- Understand import rules: No age restrictions on vehicles, but be ready to pay handling fees (4% of CIF), a 17% tax, and other charges based on your EV type.

- Calculate total costs: Include CIF (Cost, Insurance, Freight), duties, VAT, and inland transport fees.

- Arrange payment and shipping: Opt for secure payment methods and ship through nearby ports like Dar es Salaam or Mombasa.

- Clear customs: Prepare key documents like the bill of lading, purchase invoice, and registration card to avoid delays.

- Register and inspect the EV: Complete roadworthiness checks and acquire license plates once in Burundi.

- Plan for charging and maintenance: Install a home charger and use public charging stations where available. Schedule regular EV maintenance for battery health and software updates.

7 Steps to Import an Electric Vehicle to Burundi in 2025

Step 1: Choosing the Right EV

When picking an electric vehicle (EV) for Burundi, it’s crucial to check its technical specs and ensure it meets local regulations. To avoid hefty penalties, choose an EV that’s less than 10 years old from its manufacturing date. Older vehicles are subject to Burundi’s import ban and a 2,000,000 BIF (around $920) anti-pollution tax plus VAT. Always verify the manufacturing year on all relevant documents.

Key Features to Consider

Start by looking at the battery capacity. A range of 40–60 kWh is ideal, as it typically offers 150–250 miles of driving range under real-world conditions, depending on the model and terrain. This range is well-suited for Burundi’s hilly landscapes and limited charging infrastructure. Additionally, ground clearance is a critical factor. Aim for 6.7–7.5 inches (170–190 mm), as it allows the vehicle to handle unpaved or poorly maintained roads. Compact SUVs and crossover EVs usually provide better clearance than smaller city hatchbacks.

Charging compatibility is another essential consideration. Burundi operates on a 230V/50Hz power grid, so EVs with European "Type 2" AC charging systems are generally easier to integrate than those configured for U.S.-spec Type 1 charging. For future convenience, consider vehicles equipped with CCS2 DC fast-charging capabilities, as this aligns with the growing charging infrastructure in East Africa. Always request the vehicle’s charging specifications, including maximum AC and DC charging power and connector types, to ensure compatibility with both home and public charging options.

Essential Technical Documents

To clear customs smoothly, make sure you have all the necessary paperwork. Obtain a pro forma invoice that lists the price, VIN, battery capacity, model year, and incoterms. A technical data sheet is also essential; it should include details like curb weight, battery capacity, motor power, dimensions, ground clearance, energy consumption, and charging specifications. For the battery, gather documentation that outlines its chemistry (e.g., NMC or LFP), total capacity in kWh, nominal voltage, and pack serial numbers. These details are necessary for compliance with UN lithium-battery transport regulations and to confirm the vehicle meets safety standards.

If you’re buying a used EV, request a battery State of Health (SoH) report to verify the remaining capacity and ensure it meets your needs. Double-check that all documents, including invoices, registration papers, and spec sheets, match the vehicle’s VIN to avoid delays during customs clearance.

Simplify Your Search with EV24.africa

EV24.africa makes finding the right EV easier by offering verified listings with transparent pricing and detailed specs. You can filter results by manufacturing year to exclude vehicles over 10 years old, and narrow your search by battery capacity and driving range to find options that suit Burundi’s conditions. For instance, you might find the BYD ATTO 3 2025 with a 420 km range priced at $47,500, or the GEELY PANDA MINI BASE with a 120 km range for $5,880. All listed vehicles are Battery Electric Vehicles (BEVs) with automatic transmissions, and the platform provides assistance with compliance, customs clearance, and local registration. For personalized advice, you can reach out to an EV24 expert through WhatsApp.

Once you’ve selected the right EV and gathered all the required documents, you’re ready to dive into Burundi’s import regulations in Step 2.

Step 2: Understanding Burundi’s Import Rules

Importing used vehicles, including EVs, into Burundi is a straightforward process. The country does not enforce age restrictions on imported cars, so you can bring in vehicles regardless of their manufacturing year. However, it’s essential to understand the specifics of vehicle configurations, taxes, and required documentation.

Vehicle Configurations and Tax Details

Burundi allows both left-hand drive and right-hand drive vehicles, and there’s no requirement for pre-shipment inspections like JEVIC or JAAI. When planning your budget, consider these costs:

- Handling Charges: 4% of the CIF (Cost, Insurance, and Freight) value.

- Transactional Tax: 17%, calculated on the total value, which includes CIF, duties, and handling charges.

- Passenger Vehicle Duty: Vehicles with more than 10 passengers are subject to a 15% duty based on the CIF value.

- Tourism Vehicle Duty: Import duties for tourism vehicles range from 40% to 100% of the CIF value.

- Diplomatic Vehicles: These benefit from a reduced handling fee of just 1%.

Key Documents for Importing

To avoid delays at customs, ensure you have all the necessary paperwork ready before shipping:

- The original registration card to confirm ownership.

- A copy of your passport for identification purposes.

- The original purchase invoice, detailing the transaction.

- The original bill of lading, which must include specifics like the chassis number, engine number, cubic capacity, year of manufacture, and the vehicle’s brand and model.

Stay Updated on Regulations

Import rules can change, so it’s wise to double-check with local authorities for the latest updates. Reach out to the Burundi Revenue Authority (Office Burundais des Recettes, OBR) or the Ministry of Transport for the most accurate and current information.

Step 3: Calculating Total Landed Costs

Building Your Cost Estimate

To figure out your total expenses, start by calculating the CIF (Cost, Insurance, and Freight). This includes the vehicle’s FOB (Free on Board) purchase price, shipping costs, marine insurance, and any inspection fees. Once you have the CIF in USD, convert it to BIF using the current exchange rate provided by your bank or another reliable currency conversion tool.

After that, add a 4% handling fee to the CIF value and apply the duty rate specific to your vehicle. Then, calculate a 17% transactional tax (VAT) on the combined total of the CIF, duty, and handling fee. Don’t forget to factor in inland transport costs from East African ports like Dar Es Salaam or Mombasa. These steps will give you a solid foundation for understanding the core costs involved, allowing you to account for any additional EV-related fiscal policies.

EV-Specific Taxes and Incentives

Reach out to the Burundi Revenue Authority (Office Burundais des Recettes, OBR) to confirm whether there are any specific incentives or tax breaks for EVs. Currently, general import regulations apply to passenger EVs, but checking directly with the OBR ensures you have accurate and up-to-date information for your calculations.

Cost Comparison: New vs. Used EVs

Once you’ve done the math, compare the total costs for new and used EVs. Used EVs are especially popular due to new car shortages and inflation, often offering a lower initial purchase price. However, new EVs might qualify for government incentives or manufacturer support, which could offset their higher upfront costs. Use this formula to make the comparison:

Total Cost = CIF (BIF) + Duty + (4% of CIF) + (17% VAT on [CIF + Duty + Handling Fee])

This breakdown helps you determine which option – new or used – fits your budget and needs better.

Step 4: Arranging Payment and Shipping

Once you’ve calculated the total landed costs, the next step is organizing payment and shipping for your electric vehicle (EV).

Finalizing the Purchase Agreement

Make sure your purchase agreement clearly outlines the Incoterms. These terms define who handles specific costs and where the seller’s responsibility ends, and yours begins. For example, a CIF (Cost, Insurance, and Freight) arrangement covers the vehicle, shipping, and insurance. If the terms are FOB (Free On Board), you’ll need to arrange shipping from the origin point yourself.

Use secure payment methods, such as bank transfers or Letters of Credit, to ensure a smooth transaction. Some export specialists even offer flexible payment options and can guide you through the process. Be sure your agreement includes key documents like the Original Purchase Invoice and the Bill of Lading, which list essential vehicle details.

Once you’ve finalized the purchase agreement, it’s time to arrange shipping.

Shipping to East African Ports

Since Burundi is landlocked, your EV must first arrive at a nearby East African port, either Mombasa in Kenya or Dar es Salaam in Tanzania. Dar es Salaam is often the preferred port because it’s closer to Burundi. Keep in mind that delays can occur at both ports, and transit times may vary.

For shipping, you have two main options:

- Containerized Shipping: Your EV is secured inside a container, offering extra protection.

- Ro/Ro (Roll On/Roll Off) Shipping: A more affordable option where the vehicle is driven directly onto the ship and secured for transit.

Once your shipment is on its way, you’ll need to finalize the logistics for getting the vehicle from the port to Burundi.

Working with Freight and Customs Experts

To ensure the vehicle reaches Burundi without unnecessary complications, hire experienced freight forwarders and customs brokers. These professionals handle transit declarations and coordinate delivery from the port to Bujumbura, which typically takes about two days.

Burundi’s customs procedures can be tricky and are often subject to changes, partly due to the frequent rotation of customs officers under the Office Burundais des Recettes (OBR). To avoid delays, make sure your agent has all the required shipping documents ready to streamline the customs clearance process.

Having reliable experts on your side can make navigating Burundi’s customs landscape much smoother and stress-free.

sbb-itb-99e19e3

Step 5: Clearing Customs and Inspecting the EV

After your EV arrives at the port, the next step is clearing customs before it can officially enter Burundi.

Customs Clearance at Regional Ports

Most EVs headed for Burundi clear customs at East African ports, with Dar es Salaam being a popular choice due to its proximity. Customs clearance involves verifying all required paperwork and determining the customs valuation of your vehicle. This valuation – based on the Cost, Insurance, and Freight (CIF) value – directly impacts the duties and taxes you’ll need to pay.

To avoid delays or penalties, you’ll need to present several key documents, including the commercial invoice, bill of lading, packing list, certificate of origin, and a validated Burundi Electronic Cargo Tracking Note (ECTN). Fortunately, Burundian importers are exempt from general inspection requirements for used cars, so there’s no need for additional inspection certificates from agencies like JEVIC, JAAI, or Intertek. Your customs agent will also handle transit declarations, using the T1 transit document and securing a bond equivalent to the cargo’s value. With these steps completed, your EV will be ready for a smooth transit into Burundi.

EV-Specific Inspections

Although Burundi doesn’t require specialized inspections for EVs – such as checks for battery safety or high-voltage labeling – your vehicle will still undergo standard inspections to ensure roadworthiness, safety compliance, and emissions standards. It’s a good idea to have documentation that clearly outlines your EV’s battery specifications and safety certifications. While this isn’t a formal requirement, customs officials may still ask for this information during the process. Additionally, make sure your EV meets the eight-year age limit and complies with the right-hand drive requirement to avoid any issues. Once your vehicle passes these inspections, it’s ready to continue its journey to Bujumbura.

Transit to Burundi

After clearing customs, your EV will begin the two-day transit to Bujumbura. During this phase, you’ll need to provide sealed documents at the border post, complete any formalities at the Port of Bujumbura, and possibly arrange for an escort at the exit border point. Your customs agent will coordinate transit declarations and liaise with the Office Burundais des Recettes (OBR) to ensure everything runs smoothly.

It’s worth noting that customs procedures can change without notice, often due to the frequent rotation of customs officers at border posts. Maintaining close communication with your agent is crucial to avoid unexpected delays. Once your EV arrives at the Customs warehouse at the Port of Bujumbura – managed by Global Port Bujumbura – final formalities will be completed, and your vehicle will be ready for delivery to its final destination.

Step 6: Registering and Inspecting the EV in Burundi

When you arrive in Bujumbura, you’ll need to handle the registration and inspection process to legally drive your EV on Burundian roads.

Technical Control and Vehicle Inspection

In Burundi, all residents must register their motor vehicles and display the correct license plates before hitting the road. While there’s no requirement for specialized EV inspections upon entry, your vehicle must still meet the country’s roadworthiness and safety standards. The good news? Importers don’t need inspection certificates from agencies like JEVIC, JAAI, or Intertek.

Make sure you have the following documents ready for inspection:

- Original Registration Card

- Copy of Passport

- Original Purchase Invoice

- Original Bill of Lading (this should clearly display details like the chassis number, engine number, cubic capacity, year of manufacture, brand, and model).

Once your EV passes inspection and complies with local standards, you can move on to the registration process.

Getting Registration and License Plates

After completing the inspection, the next step is to register your EV and secure its legal identification. Submit your documents to the relevant government offices in Burundi. If you’re not familiar with the process, a customs agent or local service provider can assist you. Once your registration is approved, you’ll receive a vehicle logbook and license plates. In Burundi, license plates follow the European standard, with a yellow rear plate and a white front plate.

It’s worth noting that in September 2024, the Burundi Petroleum Company (Sopebu) introduced "Igitoro Pass V 1.0", a system specifically for fuel purchase registration, which is separate from the vehicle registration required for road use.

Step 7: Planning for Charging and Maintenance

Now that your EV is registered and ready to hit the road, it’s time to think about how you’ll handle charging and regular upkeep. Unlike gasoline cars, EVs come with their own set of requirements, so a little planning goes a long way.

Home and Public Charging Options

Setting up a home charging station is a great first step. You can choose between a standard 120V charger or upgrade to a faster 240V option. Installing a 240V charger does require a professional electrician, but it significantly reduces charging time. For instance, a 7kW charger can fully charge a 60kW battery in about 8 hours, while a 50kW fast charger can give you 100 miles of range in just 40 minutes.

When you’re on the go, public charging stations are key. These are becoming more common across places like petrol stations, shopping centers, and parking lots in major cities such as Bujumbura. While Burundi’s public charging network is still growing, these stations are often cheaper than refueling a petrol or diesel car, making them a practical choice for longer trips.

Scheduling Regular Maintenance

One of the perks of owning an EV is lower maintenance needs, but that doesn’t mean you can skip it altogether. Routine checks should focus on battery health, tire wear, brake condition, and software updates. Keeping detailed service records and working with trained EV technicians will help ensure your vehicle runs smoothly for years to come.

Cost Comparison: EV vs. Gasoline Vehicles

EVs are easier on your wallet when it comes to fuel and maintenance costs. In Burundi, where fuel prices can be unpredictable, the steadiness of electricity costs makes financial planning simpler. While the upfront cost of an EV might be higher, the long-term savings in fuel and maintenance can balance it out. Keep track of your expenses in both BIF and USD to clearly see the difference over time.

Conclusion: Key Takeaways for a Successful EV Import

Bringing an electric vehicle (EV) to Burundi can be a smooth process when approached step by step. Start by selecting an EV that fits the country’s terrain and range requirements, ensuring it complies with the 10-year age limit and includes all necessary technical documentation. Check the latest import regulations, including anti-pollution taxes and any EV-related incentives. Don’t forget to calculate the full cost – factoring in the purchase price, shipping, customs duties, and VAT – so you have a clear understanding of your total expenses in USD.

Once your purchase is finalized, partner with experienced freight forwarders and customs agents familiar with Burundi’s requirements. This minimizes the risk of errors in paperwork and avoids delays at regional ports. After customs clearance, follow the registration and setup steps to get your EV ready for the road. Efficient planning and expert assistance not only save time but also reduce long-term costs.

EVs offer significant savings compared to gasoline vehicles, with lower fueling costs per mile and reduced maintenance needs. Given the unpredictability of fuel prices, electricity provides a more stable and budget-friendly alternative. By following these steps, you can join Burundi’s growing EV market with confidence and efficiency.

EV24.africa is here to guide you through every stage of the process. From helping you filter EV listings by range and battery size to connecting you with reliable shippers and providing up-to-date information on Burundi’s import rules, the platform has you covered. They offer flexible Incoterms options like Delivered Duty Paid (DDP) for a hassle-free experience or Free on Board (FOB) if you prefer to handle parts of the process yourself. Whether you’re in Bujumbura, Gitega, or Ngozi, you’ll have access to logistics and compliance support to ensure your EV arrives safely and efficiently.

"At EV24.africa, we simplify the process of importing and buying electric vehicles in Africa. Our expertise ensures a seamless, transparent, and stress-free experience, so you can focus on driving the future of mobility."

FAQs

What should I consider when choosing an EV for Burundi’s terrain?

When picking an electric vehicle (EV) for Burundi, there are a few important things to keep in mind. Start by checking if the EV is compatible with the local charging infrastructure, as charging stations might not be widely available, especially in remote areas. Durability is another key consideration – look for a vehicle that can handle rough or uneven roads, which are common in certain parts of the country.

It’s also smart to go for a model with a battery that can cover long distances between charges, particularly if you’ll be traveling in rural areas. Lastly, make sure the EV aligns with Burundi’s safety and technical standards to avoid issues during the import process and ensure it complies with local regulations.

What is the best way to calculate the total cost of importing an EV to Burundi?

To figure out the total cost of importing an EV to Burundi, begin with the CIF value – this includes the Cost, Insurance, and Freight. From there, add a 15% import duty, a 4% handling fee, and a 17% transactional tax, which is calculated based on the combined sum of the CIF value, import duty, and handling fee. Don’t forget to factor in any extra expenses, such as shipping or customs processing, to ensure your estimate is as accurate as possible.

What steps do I need to follow to register an electric vehicle (EV) in Burundi?

To get your EV registered in Burundi, you’ll need a few essential documents. These include the original registration certificate, a copy of your passport, the original purchase invoice, and the bill of lading or air waybill. Once your vehicle arrives, it must pass all necessary inspections to meet Burundian safety and technical standards.

Double-check that all your paperwork is correct and current to prevent any delays in the registration process.