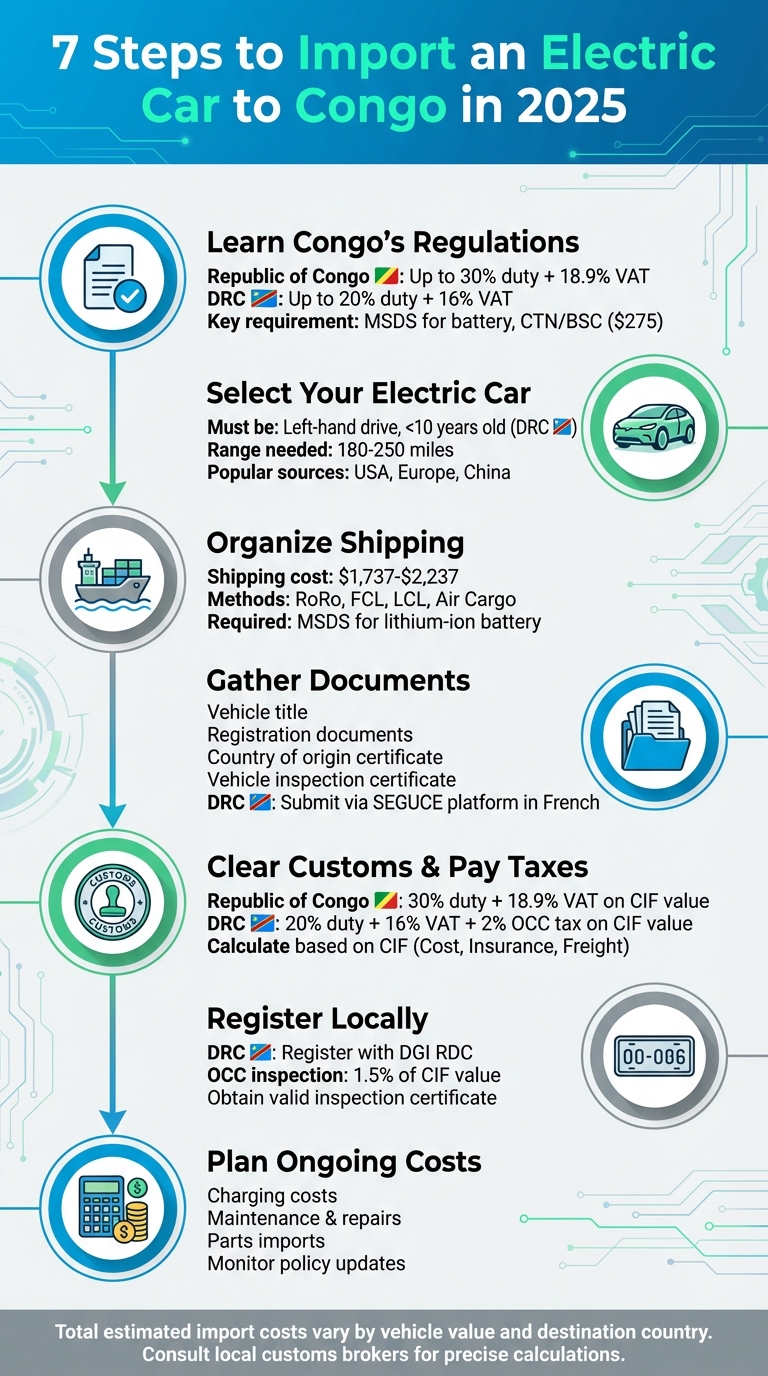

Importing an electric car to Congo in 2025 involves navigating regulations, managing logistics, and preparing for costs. Here’s a simplified guide:

- Understand Regulations: The Republic of Congo has straightforward import rules, while the DRC’s process is more complex, requiring pre-shipment inspections and higher taxes. Both countries impose significant duties and VAT without offering tax breaks for EVs.

- Choose the Right Vehicle: Opt for left-hand drive models suited for Congo’s terrain. Prioritize cars with durable batteries, good ground clearance, and a range of at least 180-250 miles.

- Arrange Shipping: Select a shipping method (RoRo, container, or air cargo) and ensure compliance with hazardous material regulations for lithium-ion batteries.

- Prepare Documents: Gather all required paperwork, including vehicle title, MSDS for the battery, and customs forms. Accuracy is critical to avoid delays.

- Clear Customs: Pay duties and taxes based on the vehicle’s CIF value. The Republic of Congo has simpler procedures, while the DRC requires additional steps like using the SEGUCE platform.

- Register Locally: Complete vehicle registration with local authorities to drive legally. Ensure inspection certificates are in order.

- Plan for Costs: Budget for charging, maintenance, and potential parts imports. Keep track of policy updates, as regulations may change.

Key Costs:

- Shipping: $1,737–$2,237

- Republic of Congo Taxes: Up to 30% duty + 18.9% VAT

- DRC Taxes: Up to 20% duty + 16% VAT

This guide ensures you’re prepared for every step of the process.

7 Steps to Import an Electric Car to Congo in 2025

Step 1: Learn Congo’s 2025 Electric Car Import Regulations

Congo is made up of two distinct countries – each with its own customs systems, ports, and tax rules. Understanding the regulations of both nations ahead of time can save you from costly mistakes during the import process.

The Democratic Republic of Congo (DRC) has a particularly challenging system, involving multiple agencies, lengthy wait times, and high risks of non-compliance due to incorrect paperwork. On the other hand, the Republic of Congo follows CEMAC standards, which simplify its regulations. Below, we’ll break down the specific requirements for each country.

Republic of Congo Import Regulations

In the Republic of Congo, most vehicle imports are handled through Pointe-Noire, the country’s primary port. One benefit is the lack of age restrictions on imported vehicles, allowing you to choose a model that fits your budget without limitations.

However, importing electric or hybrid vehicles comes with additional safety requirements due to their battery systems. These vehicles must have a label on the front windshield that clearly displays the VIN and propulsion type (electric, hybrid, plug-in hybrid, etc.). The battery system must also be intact, free of leaks, and meet shipping standards set by the International Maritime Organization (IMO) for hazardous materials. To comply, the shipper must provide a Material Safety Data Sheet (MSDS) for the battery. Additionally, you’ll need to inform both the car transporter and Congo Customs about your intent to import an electric vehicle.

All shipments require a mandatory Cargo Tracking Note (CTN/BSC), which costs $275 plus an administrative fee.

When it comes to taxes, the Republic of Congo imposes import duties ranging from 5% to 30% of the CIF (Cost, Insurance, and Freight) value, depending on the category of goods. Motor vehicles are subject to a 15% excise duty under the 2025 Finance Law. An 18% Value-Added Tax (VAT) applies, along with a 5% surtax on the VAT, effectively raising the VAT rate to 18.9%. Additional charges include a CEMAC integration tax (1%), African integration contribution (0.2%), statistics tax (0.2%), OHADA contribution (0.05%), CEEAC contribution (0.04%), and a computer royalty of 0.5% to 2% based on the customs taxable value.

Unfortunately, there are no tax breaks or reduced duties for electric vehicles in the Republic of Congo. You’ll pay the same taxes as you would for a traditional fuel-powered car, even with the added shipping requirements for the battery system. This differs from the DRC’s more intricate process, which is outlined below.

Democratic Republic of Congo Import Regulations

In the DRC, vehicles are typically imported through the Matadi port. The customs process here is more complicated, often requiring pre-shipment inspections and the involvement of a registered Importer of Record (IOR).

The tax structure includes a General Tax of up to 21% and a General Duty of up to 20%. Technology imports, including electric vehicles, are also subject to substantial duties and VAT. Like the Republic of Congo, the DRC does not offer specific tax incentives for electric vehicles.

Due to the complexity of the DRC’s customs procedures, many importers work with local compliance experts to navigate the system. Opting for Delivered Duty Paid (DDP) shipping terms can also help by covering all duties and taxes upfront, allowing you to know the total cost before the vehicle arrives.

While the DRC does not enforce specific age limits or emission standards for electric vehicles, accurate documentation is critical to avoid delays in both countries.

Step 2: Select Your Electric Car and Find a Seller

Once you’re familiar with Congo’s import rules, it’s time to pick the right electric car and find a reliable seller. Your decision should strike a balance between compliance with local laws, suitability for Congo’s terrain and climate, and ease of long-term maintenance.

What to Consider When Choosing an Electric Car

In the DRC, imported used cars must be less than 10 years old to simplify customs clearance. Additionally, both Congos require left-hand drive vehicles for proper registration and safer driving conditions. Vehicles from the United States, Europe, and China generally meet these criteria.

Pay attention to the car’s ground clearance and durability, especially if you’ll be driving on rough roads outside major cities. SUVs, trucks, and rugged vehicles are popular imports in the DRC due to challenging road conditions. For electric vehicles, crossovers and SUVs – like the Tesla Model Y or BYD Atto 3 – are better suited to handle these demands compared to low-clearance sedans.

To ensure the battery is in good shape, get a diagnostic certificate that provides details on its health, remaining capacity, and any high-voltage issues. Given the long distances between cities and the limited availability of fast-charging stations, opt for a model with a practical range of at least 180–250 miles.

Finally, check the vehicle’s history using services like Carfax or AutoCheck. These reports can verify accident records, flood damage, odometer accuracy, and title status, giving you peace of mind about your purchase.

Once you’ve identified your ideal vehicle, the next step is finding the best source to buy it.

Where to Buy Your Electric Car

Now that you know what you’re looking for, explore key sourcing regions: the United States, Europe, and China. Each offers unique advantages depending on your budget, preferred models, and shipping logistics.

- United States: Popular models like the Tesla Model 3, Model Y, Chevrolet Bolt, and Ford Mustang Mach-E are widely available. Shipping routes from the U.S. typically connect to Matadi (DRC) or Pointe-Noire (Republic of Congo) via roll-on/roll-off or container shipping. Keep in mind that many U.S. vehicles use CCS1 charging connectors, so you may need adapters for compatibility with local charging stations.

- Europe: European electric cars, such as the Renault Zoe, Volkswagen ID.4, and Hyundai Kona Electric, meet strict EU safety and environmental standards, which can simplify the pre-shipment inspection process in Congo. These vehicles often use the CCS2 fast-charging system, and their proximity to Africa can mean shorter shipping times and lower freight costs.

- China: Chinese brands like BYD, Geely, and SAIC (MG) offer competitively priced electric vehicles. Established shipping routes from China to Congo and turnkey packages – including documentation, customs handling, and coordination with local clearing agents – make this a convenient option.

For an Africa-focused option, EV24.africa is an online marketplace specializing in electric vehicle imports. They provide curated listings tailored to local conditions, along with technical support, import advice, and logistics coordination.

Before finalizing your purchase, share the vehicle details (make, model, year, VIN, and dimensions) with a shipping company experienced in transporting to Matadi or Pointe-Noire. Confirm your selection with the shipping provider to ensure it meets Congo’s import requirements. This step will also help you prepare for the next stages, including organizing transport and gathering the necessary documentation.

Step 3: Organize Shipping and Transport

After selecting your vehicle in Step 2, the next step is arranging transport for your electric car. Shipping an EV comes with specific challenges, particularly due to the lithium-ion battery, which is classified as hazardous goods. To avoid delays, it’s essential to understand your shipping options and have all the required documentation ready. Let’s break it down.

Shipping Methods Available to Congo

When shipping an electric vehicle to Congo, you have several options to choose from, each with its own benefits based on your budget, timeline, and the level of protection your car requires:

- Roll-on/Roll-off (RoRo): This is a budget-friendly method where your car is driven onto the ship and off at the destination port. While cost-effective, your vehicle will be exposed to weather and external conditions during transit.

- Full Container Load (FCL): If you’re looking for maximum protection, FCL is a great option. Your car is shipped in a sealed container, safe from external elements.

- Shared Container Load (LCL): For those looking to save on costs, LCL allows you to share container space with other shipments. However, this involves additional handling, so it’s best suited for less urgent shipments or when coordinating with others importing vehicles.

- Air Cargo: The fastest (and most expensive) option, air cargo is ideal for urgent shipments or high-value vehicles. Keep in mind that not all air carriers are equipped to handle lithium-ion battery vehicles, so confirm this before booking.

To make an informed choice, request quotes from shipping companies with experience in transporting electric vehicles to Congo. Ensure they’re familiar with the regulations for EV transport and can handle the special requirements of lithium-ion batteries.

Once you’ve chosen a shipping method, it’s time to gather and organize all necessary transport documents.

Required Transport Documents for Electric Vehicles

Shipping an electric car involves additional paperwork due to safety regulations for lithium-ion batteries. Your shipment must comply with International Maritime Organization (IMO) guidelines, as these batteries are classified as hazardous materials. Be sure to inform your shipping agent about the condition of the vehicle.

The most critical document is the Material Safety Data Sheet (MSDS) for the car battery, which ensures compliance with hazardous material regulations. Additionally, confirm that the battery system is intact, leak-free, and approved for transport. Refer back to Step 1 for details on EV labeling requirements.

Other standard documents you’ll need include:

- The original state title (either lien-free or accompanied by an original lien release letter)

- A bill of sale or commercial invoice with complete vehicle details (year, make, model, VIN, shipping weight, and dimensions)

- Contact information for both the shipper and the consignee

For shipments to Congo, compliance with CTN/NVU requirements (outlined in Step 1) is mandatory. If you’re importing into the Democratic Republic of Congo, you’ll also need a Bureau Veritas Certificate of Inspection (BIVAC). Without a valid BIVAC number, carriers will reject your shipment, and non-compliant cargo may be returned at your expense.

Double-check all documentation with your shipping agent before departure to avoid customs delays and ensure a smooth transport process.

Step 4: Gather All Required Documents

After arranging shipping, the next step is to pull together all the paperwork needed for customs clearance and vehicle registration. Missing or incorrect documents can cause delays, fines, or even the return of your vehicle.

Here’s what you’ll need:

- Legal Conveyance Certificate (vehicle title)

- Original Car Registration Documents from the country of purchase

- Official Country of Origin document

- Vehicle Inspection Certificate

If you’re importing to the Democratic Republic of Congo (DRC), all customs documentation must be submitted in French through the GUICE platform (https://segucerdc.com/).

It’s a good idea to have both physical and digital copies of all these documents. The DRC’s customs process involves multiple agencies and can take time, so even small mistakes in your paperwork could lead to penalties for non-compliance. If you’re unsure about the requirements, consider consulting a customs broker or using a pre-compliance service to handle classification, licensing, and tax analysis.

Double-check that details like the VIN, vehicle specifications, and shipper/consignee information match perfectly across all documents. Once everything is in order, you’ll be ready to move on to customs clearance in Step 5.

sbb-itb-99e19e3

Step 5: Complete Customs Clearance and Pay Taxes

Once your paperwork is in order, the next step is to clear customs and pay the required taxes and duties, which are calculated based on your vehicle’s CIF (Cost, Insurance, and Freight) value.

Customs Clearance in Republic of Congo

If your shipment is headed to Pointe-Noire, you’ll need to secure a Cargo Tracking Note (CTN/BSC), which costs $275 plus an administrative fee. Additionally, the CNCA/ARCCLA document is mandatory for shipments to all ports in the Republic of Congo. If your vehicle has a lithium-ion battery, ensure you provide a Material Safety Data Sheet (MSDS) to comply with IMO regulations for hazardous materials.

When importing an electric vehicle into the Republic of Congo, be prepared to pay a 30% Common External Tariff on the CIF value, along with a processing fee that varies between 20% and 60% of the CIF value. You’ll also need to pay an 18% VAT. Notify both your shipping agent and Congo Customs in advance that your shipment includes an electric vehicle. Additionally, ensure your car has a label on the front windshield that clearly displays the VIN and propulsion type.

Once you’ve completed these steps, it’s worth comparing these procedures with those in the Democratic Republic of Congo (DRC), as the processes differ significantly.

Customs Clearance in Democratic Republic of Congo

Clearing customs at Matadi in the DRC involves navigating a more intricate process, as multiple agencies are part of the clearance procedure. The DRC employs the Single Window for Foreign Trade system (SEGUCE), which you can access at https://segucerdc.com/. However, pre-shipment inspections and changing regulations can lead to delays. To avoid complications, ensure that your Importer of Record (IOR) is fully registered and compliant. While pre-shipment inspections are typically required, vehicles older than six months from their first registration may be exempt, provided they meet the age requirements.

In the DRC, import duties are set at 20% of the CIF value, with an additional 16% VAT and a 2% OCC tax for imports valued over $2,500. Depending on the specifics of your vehicle, additional taxes can range from 0.59% to 40% of the CIF value. All duties are calculated on an ad valorem basis, using the CIF value as the benchmark. To simplify the process, consider using Delivered Duty Paid (DDP) Incoterms, which allow you to settle all duties upfront.

Step 6: Register Your Electric Car for Local Use

Once your electric car has cleared customs, the next step is to register it with local authorities to ensure you’re legally allowed to drive it on Congo’s roads. In the Democratic Republic of Congo, this process involves registering with the Direction Générale des Impôts (DGI RDC). This step is essential for complying with the country’s tax regulations, and you can complete it at DGI RDC offices located in Kinshasa.

Before registration, make sure your vehicle has a valid inspection certificate. The Office Congolais de Contrôle (OCC) charges 1.5% of the Cost, Insurance, and Freight (CIF) value for its inspection services. If your electric car is more than six months old from its initial registration date and meets the criteria for imported used vehicles, you might be eligible for an exemption from the pre-shipment inspection.

After gathering the necessary documents, complete the registration process through the DGI RDC’s official online portal. If you’re registering as a corporate entity, you’ll need to prepare a dossier that includes your legal name, tax identification numbers, business address, and activity code. Assign someone to oversee the process, monitor policy changes, and manage tasks like setting up electronic filing and scheduling reminders for tax deadlines. Whether you’re handling monthly or quarterly VAT filings or annual corporate income tax returns, keeping organized is key. Always retain payment receipts and maintain a backup of your vehicle’s documentation for future tax-related needs.

Step 7: Prepare for Ongoing Costs and Policy Updates

Once your vehicle is registered, the next step is managing ongoing expenses and staying on top of policy updates. Owning an electric car in Congo means planning for regular operating costs that go beyond the initial import fees. The biggest recurring expense? Charging your car. Electricity rates can vary depending on your location and whether you’re charging at home or using public charging stations. Factor in routine maintenance as well – things like tire rotations, brake fluid checks, and battery inspections. While electric vehicles generally require less upkeep than gas-powered cars, finding qualified EV technicians might be a challenge since local expertise is still catching up. It’s a good idea to set aside extra funds for importing parts or repairs, as some components may not be readily available locally, leading to additional costs and delays.

Staying informed about policy updates is equally important. The rules and incentives around electric vehicles in Congo are still evolving. Changes in taxes, duties, or new government incentives could impact your costs and responsibilities. To stay ahead, consider consulting with agents or auto dealers who are well-versed in the import process and local regulations.

Keep an eye on announcements from the Direction Générale des Impôts and customs authorities for updates on tax breaks, import duty adjustments, or new registration requirements. Setting up alerts or maintaining regular communication with your customs broker can help you catch important updates as they happen. As the electric vehicle market in Congo continues to grow, you might see changes in policies around charging infrastructure, vehicle inspections, or environmental standards. Managing these ongoing costs and staying informed about evolving regulations will ensure you’re well-prepared to enjoy the benefits of your electric vehicle in Congo.

Conclusion

Bringing an electric car into Congo in 2025 requires careful preparation and attention to detail. Start by researching the specific regulations for your destination. For instance, the Democratic Republic of Congo enforces strict limits on vehicle age, while the Republic of Congo has more lenient policies. Tax rates and import duties also differ between the two, so it’s crucial to identify the rules that apply to your situation early on.

Once you’ve clarified the regulations and calculated the associated fees, the next step is ensuring your documentation is complete and accurate. This includes everything from the vehicle title to the Material Safety Data Sheet (MSDS) for the battery. Don’t overlook details like proper labeling on the windshield, which is required under International Maritime Organization (IMO) standards. Missing or incomplete paperwork can lead to costly delays or even rejection.

Another key component is your budget planning. Account for shipping costs, taxes, duties, and parafiscal fees. Additionally, consider ongoing expenses once the car is in Congo, such as charging, maintenance, and possibly importing spare parts.

Stay up to date with policy changes. The electric vehicle market in Congo is evolving, and regulations are likely to shift as infrastructure improves and government incentives are introduced. Work with experienced clearing agents or auto dealers, and keep an eye on updates from customs authorities and the Direction Générale des Impôts regarding tax breaks or registration requirements.

FAQs

What are the key challenges of importing an electric car to the Democratic Republic of Congo (DRC) compared to the Republic of Congo?

Importing an electric car into the Democratic Republic of Congo (DRC) comes with its own set of hurdles, especially when compared to the Republic of Congo. Differences in infrastructure, regulations, and economic conditions play a big role here. For instance, the DRC often has more intricate customs procedures and higher import duties, which can drive up costs significantly. On top of that, the country’s limited EV infrastructure – like charging stations – means you’ll need to carefully plan how and where you’ll charge your vehicle.

Meanwhile, the Republic of Congo might offer a slightly smoother import process and, in some areas, better support for electric vehicle adoption. That said, whether you’re importing into the DRC or the Republic of Congo, it’s crucial to research local tax incentives, understand compliance requirements, and work with a trustworthy seller to make the process as seamless as possible.

What steps should I take to ensure my electric car complies with Congo’s shipping rules for lithium-ion batteries?

To make sure your electric car complies with Congo’s shipping regulations for lithium-ion batteries, start by checking that the battery meets international safety standards, like the UN38.3 certification. This certification confirms the battery has undergone and passed all necessary safety tests for transport.

It’s also important to work with a shipping provider experienced in handling electric vehicles. Verify that they understand Congo’s specific import rules for hazardous materials. You’ll likely need proper documentation too, such as a Material Safety Data Sheet (MSDS) for the battery, to ensure smooth customs clearance. Choosing a dependable shipping company and staying updated on Congo’s import policies can make the entire process much easier.

What are the ongoing costs and maintenance requirements for electric vehicles in Congo?

Electric vehicles (EVs) often come with lower day-to-day costs compared to gas-powered cars, but there are still some important expenses to keep in mind. In Congo, one of the main costs is charging. How much you’ll spend depends on electricity rates and how much you drive. Charging your EV at home is typically less expensive than using public charging stations.

Maintaining an EV is usually more straightforward since they have fewer moving parts and don’t require oil changes. That said, keeping an eye on your battery’s health is essential. Over time, you might face repair or replacement costs for the battery. It’s also worth checking if certified EV technicians and parts are readily available in Congo to ensure your car gets the care it needs. Staying up to date on local infrastructure and policies can help you manage these costs and keep your EV running smoothly.