To import an electric vehicle (EV) to Cameroon in 2025, follow these simplified steps:

- Understand Regulations: Cameroon’s 2025 Finance Law offers a 50% reduction in taxable import value for EVs and exempts them from road tax. Only fully electric vehicles (BEVs) qualify.

- Calculate Costs: Include purchase price, shipping, insurance, reduced import duties, VAT, and port fees. EVs are cheaper to import than gasoline cars due to tax incentives.

- Select a Vehicle and Seller: Choose a BEV that meets Cameroon’s standards. Platforms like EV24.africa list compliant EVs and provide transparent pricing.

- Arrange Shipping: Opt for Ro-Ro (budget-friendly) or container shipping (better protection). Ensure proper documentation and marine insurance.

- Prepare Customs Documents: Gather the bill of sale, title, insurance, and other required paperwork. Submit through the CAMCIS system for faster processing.

- Clear the Port: Work with customs brokers to complete inspections and pay any remaining fees. Obtain a Delivery Order to release your vehicle.

- Register and Set Up Charging: Register your EV at the Ministry of Transport and install a home charging station or use public chargers in Douala or Yaoundé.

Cameroon’s tax breaks and incentives make EV imports more affordable, reducing costs compared to gasoline cars. By following these steps, you can navigate the process efficiently and start driving your EV in Cameroon.

Stage 1: Learn Cameroon’s 2025 EV Import Regulations

Before diving into the process of purchasing an electric vehicle (EV), it’s crucial to understand the incentives laid out by Cameroon’s 2025 Finance Bill. These government measures can significantly lower your import costs, helping you plan your budget more effectively and avoid unexpected expenses at customs.

The regulations cover all-electric vehicles, electric motorcycles, and related equipment like batteries and charging stations. Knowing which items qualify under these rules ensures you select the right vehicle and maximize the available benefits. This knowledge is key to calculating costs, which will be discussed further in Stage 2.

Tax Benefits Under Cameroon’s 2025 Finance Law

The 2025 Finance Bill introduces two major cost-saving measures for EV imports. First, it reduces the taxable import value of all-electric vehicles by 50% for a period of 24 months, starting in 2025. Second, it exempts EVs, including their batteries and charging equipment, from road tax.

Considering that traditional vehicle import taxes in Cameroon can climb as high as 200% of a vehicle’s value, this 50% reduction significantly lowers the overall cost of importing an EV compared to gasoline-powered cars. The reduction applies before additional taxes are calculated, making it a substantial financial relief.

Additionally, the road tax exemption eliminates the annual fees that owners of gasoline and diesel vehicles typically pay. Over time, this translates into considerable savings for EV owners.

The benefits also extend to EV batteries and charging stations. If you’re planning to import a home charging unit or an extra battery, these items qualify for reduced duties. On top of that, the Finance Bill includes a subsidy for taxpayers who use EV charging facilities, further reducing the cost of operating your EV.

These incentives align with global efforts to promote renewable energy and cleaner transportation. By making EVs more affordable, the government aims to cut greenhouse gas emissions and support climate objectives.

How Customs Define ‘Electric Vehicle’

To ensure your vehicle qualifies for these benefits, customs officials will verify its classification during the import process. This step is crucial for avoiding delays and ensuring you receive the correct tax treatment.

An all-electric vehicle must run entirely on battery power, with no internal combustion engine or tailpipe emissions. Hybrid vehicles, which combine electric motors with gasoline engines, do not qualify for the full benefits under the 2025 Finance Law. Only fully electric vehicles (BEVs) are eligible for the 50% reduction on taxable value and the road tax exemption.

Upon arrival, customs officers will check the vehicle’s vehicle identification number (VIN), technical documentation, and manufacturer details to confirm it is a BEV. The paperwork must specify the vehicle type, battery capacity, and power source.

Electric motorcycles are also eligible, but only if they are fully electric. Hybrids or scooters with gasoline engines are excluded from these benefits.

To streamline the customs process and avoid complications, ensure your seller provides comprehensive technical documentation that clearly identifies the vehicle as fully electric. Proper paperwork not only speeds up clearance but also guarantees you can take full advantage of the available tax breaks and exemptions.

Stage 2: Calculate Your Total Import Costs

Planning to import an EV? Make sure to account for all expenses, including the purchase price, shipping, insurance, import duties, VAT, and additional fees.

How to Calculate Total Landed Cost

Start with the purchase price of your EV. For instance, a used Nissan Leaf might cost around $12,000 USD. Then, add shipping costs, which can vary depending on the method (e.g., Ro-Ro or container shipping), the port of origin, and the size of the vehicle. Don’t forget marine insurance, which typically ranges from 1% to 2% of the car’s value and protects it during transit.

Once the vehicle arrives, calculate the customs value by adding the purchase price, shipping, and insurance. Using the example:

- Purchase Price: $12,000

- Shipping: ~$1,500

- Insurance: ~$150

This gives a customs value of approximately $13,650.

Electric vehicles may qualify for reduced taxable values under Cameroon’s import policies. If a 50% reduction applies, the taxable value in this example would be $6,825. Duties are then calculated on this reduced amount. At a 20% duty rate, the duty would be about $1,365. Add VAT at 19.25%, which comes to roughly $1,578. Include port handling fees (around $250) and other costs like customs brokerage and documentation fees (about $25).

For currency conversion, Cameroon uses the Central African CFA franc (XAF). If the exchange rate is 600 XAF to 1 USD, multiply the USD amounts by 600 to estimate the costs in local currency.

Here’s how the total cost might look:

- Purchase Price: $12,000

- Shipping: ~$1,500

- Insurance: ~$150

- Customs Value: ~$13,650

- Taxable Value (50% reduction): ~$6,825

- Import Duty (20%): ~$1,365

- VAT (19.25%): ~$1,578

- Port Fees: ~$250

- Agent & Misc. Fees: ~$25

This brings the total landed cost to about $16,868 USD (or approximately 10,120,800 XAF at the example exchange rate). Keep in mind, these figures are estimates, and actual costs may vary based on market conditions and policy changes.

Import Cost Comparison: Electric vs. Gasoline Cars

Now, let’s compare the costs of importing an EV with a gasoline-powered vehicle. If a similar gasoline car were imported, it wouldn’t benefit from the reduced taxable value. The full customs value (e.g., $13,650) would apply for duty calculations. A 20% duty would amount to $2,730, and VAT on the higher base would add about $3,152. Including other fees, the total landed cost for the gasoline vehicle would be around $19,807 USD.

Here’s a side-by-side comparison:

| Cost Component | EV | Gasoline |

|---|---|---|

| Purchase Price | $12,000 | $12,000 |

| Shipping | ~$1,500 | ~$1,500 |

| Insurance | ~$150 | ~$150 |

| Customs Value | ~$13,650 | ~$13,650 |

| Taxable Value | ~$6,825 | ~$13,650 |

| Import Duty (20%) | ~$1,365 | ~$2,730 |

| VAT (19.25%) | ~$1,578 | ~$3,152 |

| Port Fees | ~$250 | ~$250 |

| Agent & Misc. Fees | ~$25 | ~$25 |

| Total Landed Cost | ~$16,868 | ~$19,807 |

| Savings | ~$2,940 less | – |

This example highlights how tax incentives can make EV imports more affordable compared to gasoline vehicles. Plus, EVs often come with lower energy costs, offering additional long-term savings.

Stage 3: Choose Your Electric Car and Seller

Once you’ve got a handle on the costs, the next step is selecting the right electric vehicle (EV) and finding a reliable seller to ship it to Cameroon. At this stage, it’s all about ensuring compliance with local regulations, evaluating technical specs, and choosing a trustworthy seller to make the import process as smooth as possible.

How to Pick an EV That Meets Compliance Standards

To qualify for the 2025 tax incentives in Cameroon, your EV must meet the country’s import standards. The first thing to check? Make sure the vehicle is fully electric – a battery electric vehicle (BEV) – not a hybrid. Under the 2025 Finance Law, Cameroon offers a 50% reduction on the taxable value of newly imported electric cars, motorcycles, batteries, and charging stations for a 24-month period. But this incentive applies only to all-electric models.

Choosing a compliant car doesn’t just save you money on taxes – it also makes customs clearance much easier. Here’s what you’ll need to gather:

- Essential documents: Vehicle Identification Number (VIN), manufacturing year, odometer reading, certificate of conformity, and complete battery specifications. These documents confirm the car meets safety and regulatory requirements and are crucial for customs and insurance purposes.

- Battery safety report: Before shipping, get an updated battery safety report. Many shipping companies require a Material Safety Data Sheet (MSDS) or a battery safety declaration to transport electric vehicles.

Cameroon’s road conditions can be challenging, so make sure the EV has enough range, ground clearance, and suspension to handle them. Keep in mind there are currently only three public charging stations in the country, located in Douala and Yaoundé. If you’re planning to install a home or workplace charger, verify the car’s compatibility with local charging standards and voltages.

Before finalizing your purchase, double-check the vehicle’s compliance and eligibility for tax incentives with a customs broker. Use the specific details provided by the seller to avoid surprises.

Finding the Right Seller with EV24.africa

Once you’ve confirmed your EV meets all compliance requirements, it’s time to find a seller. One option is EV24.africa, an online marketplace that specializes in electric vehicles for African buyers, including those in Cameroon. This platform lets you explore a variety of EV models from different brands, complete with detailed specifications and upfront pricing.

For instance, as of December 2025, EV24.africa lists models like:

- BYD DOLPHIN ACTIVE: $11,800

- GEELY PANDA MINI BASE: $5,880

- BYD ATTO 3 2025: $47,500 (with a range of about 420 km, or 261 miles)

- DONGFENG eπ 008 EV: $28,700

Each listing includes key details such as range, transmission type, and battery capacity, making it easier to find an EV that fits your budget and driving needs.

One of the platform’s standout features is its transparency. Prices are clearly displayed, helping you calculate the total landed cost when you factor in shipping, insurance, and import taxes. EV24.africa also connects buyers with vetted sellers and logistics partners experienced in exporting EVs to African ports. This minimizes the risks of dealing with unverified exporters who may not fully understand the specific shipping and customs requirements for electric vehicles.

Evaluating Sellers

When choosing a seller, focus on their reliability and experience. Look for sellers who can provide all the necessary shipping and customs documents, including:

- Bill of Lading

- Commercial invoice with complete buyer and seller details

- Detailed vehicle specifications, including the VIN

- Battery documentation, like an MSDS if required

Ask the seller to clearly label the vehicle as "electric" on the shipping paperwork and, if possible, on the vehicle itself (e.g., VIN and propulsion type). This helps avoid classification issues during customs processing.

It’s also wise to check the seller’s track record. Request references from past African customers, evidence of previous shipments to ports like Douala or Kribi, and sample documents such as bills of lading. Sellers partnered with international logistics companies experienced in EV shipments are often a safer bet.

Avoid sellers who:

- Refuse to provide a detailed purchase contract or proof of prior exports

- Lack transparency about the vehicle’s condition or battery health

- Insist on untraceable payment methods

- Fail to issue proper invoices needed for customs and tax calculations

Authorized dealers and exporters with a history of shipping vehicles to African ports are generally more reliable.

Lastly, think beyond the purchase price. Consider the total cost of ownership, including the availability and cost of compatible charging equipment, replacement batteries, and spare parts. Importing a reasonably priced Chinese EV, combined with Cameroon’s 2025 tax reductions, can result in a lower overall cost compared to similar gasoline-powered vehicles.

Stage 4: Organize Shipping and Insurance

Once you’ve chosen your electric vehicle and finalized the purchase with the seller, the next step is figuring out how to get your EV safely to Cameroon. Shipping an electric car comes with unique challenges, especially since the battery requires special care and documentation. This stage is all about arranging a reliable shipping method and securing the right insurance to ensure your EV arrives safely.

Ro-Ro vs. Container Shipping Methods

When it comes to shipping an electric vehicle to Cameroon, you have two main options: Roll-on/Roll-off (Ro-Ro) or container shipping. Each has its own pros and cons, particularly when it comes to protecting the battery.

- Ro-Ro Shipping: This is the budget-friendly option. Your vehicle is driven onto the ship, secured on the deck, and then driven off at the destination. It’s straightforward and cost-effective for operable cars. However, the downside is that your EV remains exposed to weather conditions during the voyage, which can pose risks to its exterior and battery.

- Container Shipping: This method offers the highest level of protection. Your EV is placed inside a shipping container – either as a full container load (FCL) if it’s the only cargo or as a less-than-container load (LCL) if space is shared. This option is ideal for high-value or delicate vehicles, as the container shields them from environmental exposure. While container shipping costs more than Ro-Ro, the added protection for your EV, especially its battery, often makes it worth the expense.

Shipping Documents and Insurance Requirements

After deciding on a shipping method, the next focus is gathering the necessary documents and arranging insurance. Proper paperwork and coverage are essential to avoid delays or complications.

- Key Documents: You’ll need a detailed Bill of Lading and a commercial invoice. The Bill of Lading serves as proof of ownership, a receipt from the shipping company, and a contract outlining the shipment terms. It’s critical for customs clearance, so ensure all details are accurate. The commercial invoice should include the EV’s Vehicle Identification Number (VIN), make, model, year, battery specifications, and purchase details. This document is also used to calculate import duties and taxes in Cameroon, so clearly identifying the vehicle as a battery electric vehicle (BEV) is important.

- Insurance Coverage: Marine cargo insurance is a must, especially for high-value electric vehicles. Make sure your policy explicitly covers the EV battery, as standard insurance may exclude lithium-ion batteries. Look for coverage that protects against risks like water damage, impacts, extreme temperatures, or electrical issues.

A convenient option is to use CIF (Cost, Insurance, Freight) terms for your shipment. Under CIF, the seller handles both shipping and insurance up to the destination port. This simplifies the process and ensures the insurance cost is included in the total landed value, making tax calculations easier.

Finally, keep both digital and physical copies of all shipping documents. Store backups in a separate location to avoid delays during customs clearance at Douala or Kribi port.

Opting for container shipping combined with comprehensive marine cargo insurance provides peace of mind. While it may cost more upfront, the added protection can save you from expensive repairs or delays once your EV reaches Cameroon.

sbb-itb-99e19e3

Stage 5: Gather Customs Documents

When your vehicle arrives at the port, the next step is to gather and organize all the required customs documents. This is a crucial part of ensuring a smooth clearance process and avoiding unnecessary delays. By assembling the necessary paperwork and understanding how Cameroon’s customs system works, you’re setting yourself up for an efficient experience.

Required Documents for Customs Clearance

To successfully clear customs in Cameroon, you’ll need the following:

- Original Title and Bill of Sale

The original title verifies legal ownership of the vehicle, while the bill of sale provides details like the purchase price and transaction date. - Proof of Identification

A valid government-issued ID, such as a passport or national identity card, is required. If you’re working with a customs broker, include a notarized copy of your ID along with a power of attorney granting them permission to act on your behalf. - Bill of Lading

This document is used by customs agents to determine freight costs, which are factored into the duty calculation. Double-check that all vehicle details are consistent across your documents. - Insurance Documentation

Include your marine cargo insurance certificate as part of your customs paperwork. - FOB Value Documentation

For second-hand electric vehicles imported from Europe, customs agents may refer to resources like L’argus Magazine to confirm the Free on Board (FOB) value. Providing this documentation upfront can expedite the valuation process and help avoid disputes over the assessed value of your vehicle.

Customs calculates the dutiable value by combining the FOB value with freight costs. Vehicles under 15 years old are subject to a 91% duty rate, while those older than 15 years face a 107% rate.

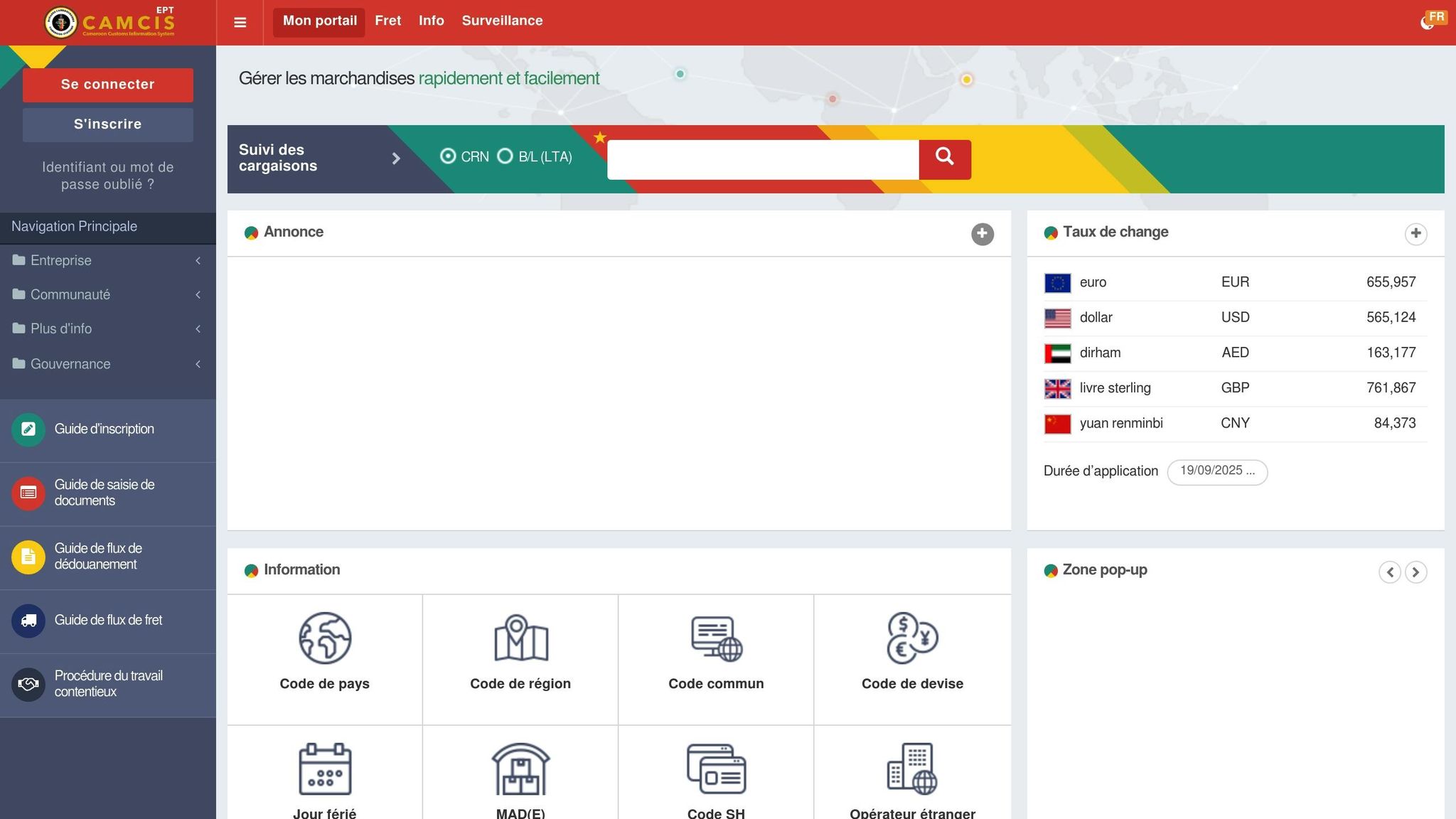

How to Use the CAMCIS Platform

Once your documents are ready, you’ll need to submit them via Cameroon’s integrated customs system, known as CAMCIS.

Cameroon’s customs procedures are managed through the Single Window for Foreign Trade Operations (GUCE), which has been in use at the Port Authority of Douala since December 2000. This system connects various entities like banks, the Douala Port Authority, inspection services, Customs, and the Treasury, making the clearance process more efficient.

To access the CAMCIS platform, you’ll need a licensed customs broker. These brokers are registered with Cameroon Customs and have the necessary credentials to process your import electronically. Your broker will upload all the required information and documents through GUCE. The system calculates duties and taxes based on the provided data and generates payment instructions. Since the platform integrates with banks and the Treasury, payments can be made electronically, cutting down on time spent at the port.

For the latest updates on import regulations and fees, you can reach out to the Cameroon Customs Department directly. Visit their website at https://www.douanes.cm or call them at +237 222 23 46 02. Their main office is located at the Direction Générale des Douanes in Yaoundé, Cameroon.

The CAMCIS system significantly reduces clearance times compared to manual processes, but accuracy is critical. Ensure that the information you submit matches your physical documents exactly to avoid errors or manual reviews, which could delay clearance.

Once your documents are submitted and the duties are paid, the system will issue a release order. Your customs broker will then work with the port authority to arrange the physical release of your vehicle. With everything in order, you’ll be ready to move on to the port clearance stage.

Stage 6: Clear Your Vehicle at the Port

Once you’ve completed the CAMCIS submission and received confirmation that your documents and duties are in order, it’s time to head to the port to collect your electric vehicle. This final step involves working with port authorities, passing required inspections, and securing the Delivery Order needed to release your vehicle. Typically, this process takes place at one of Cameroon’s two major ports for vehicle imports: Douala or Kribi.

Port Clearance Process Steps

Here’s how the clearance process unfolds:

- Document Verification and Manifest Submission

Your customs broker submits all required paperwork and the manifest to the port authorities. This step involves cross-checking your documents with both the shipping records and the CAMCIS system. Any errors or discrepancies can lead to delays, so accuracy is critical. Once everything matches, the process moves to the next stage. - Physical and Technical Inspection

Port officials carry out a detailed inspection of your electric vehicle. They check the vehicle’s battery, verify the VIN label and propulsion type on the windshield, and review the MSDS for any hazardous materials. The inspection also includes an evaluation of key operational components like the brakes, tires, steering, and electrical systems to ensure they meet Cameroonian standards. - Final Payment Confirmation

After the inspections, port authorities confirm through CAMCIS that all import taxes and duties have been settled. If there are any additional fees, you’ll need to pay them on the spot. - Delivery Order Issuance

Once all inspections are cleared and payments confirmed, the port issues a Delivery Order. This document is essential for releasing your vehicle from the port’s storage. - Vehicle Collection

With the Delivery Order in hand, you or your authorized representative can collect the vehicle. You’ll need to present identification and sign the necessary release documents. After this, your vehicle is officially yours to take home, ready for registration and further setup.

Procedures at Douala and Kribi Ports

Both Douala and Kribi ports follow the same regulatory guidelines and clearance procedures for vehicle imports. While the overall process is consistent, minor operational differences may exist between the two locations. To avoid surprises, consult with your customs broker, who can provide updates on inspection schedules, additional requirements, and the expected timeline for receiving your Delivery Order. Once you’ve picked up your electric vehicle, you can move forward with registration and setting up charging infrastructure.

Stage 7: Register Your EV and Install Charging

Once your electric vehicle arrives from the port, you’re almost ready to hit the road. But first, you’ll need to take care of two important tasks: registering your EV and setting up a charging solution.

How to Register Your EV in Cameroon

Registering an imported electric vehicle in Cameroon involves a few specific steps. Start by visiting the regional office of the Ministry of Transport to begin the registration process.

You’ll need to gather a set of documents, including your original bill of sale, the customs clearance certificate from CAMCIS, proof of payment for import duties and taxes, and a valid insurance policy for your EV. Many insurance providers in Cameroon now offer tailored policies for electric vehicles, so the options may vary depending on your location.

As part of the registration process, officials will verify your vehicle’s VIN and inspect it to ensure it meets Cameroonian road safety standards. For electric vehicles, this includes checking that the battery system is securely installed and that all electrical components are functioning correctly.

Once your EV passes inspection, you’ll pay the registration fee and receive your license plates. The process typically takes three to five business days. Keep both your registration certificate and proof of insurance in your vehicle at all times, as authorities may request them during routine traffic checks.

With your EV officially registered, the next step is to sort out your charging needs.

Setting Up EV Charging Infrastructure

After registration, making sure you have a reliable charging setup is essential. As of 2025, Cameroon provides several charging options, ranging from home installations to a growing network of public charging stations in major cities.

For most EV owners, installing a home charging station is the most practical choice. Cameroon’s electrical grid operates at 220 volts, which is compatible with Level 2 chargers. These chargers typically take 6–8 hours to fully recharge an EV. Before installing a charger, have a licensed electrician evaluate your home’s electrical system to determine if any upgrades are needed.

The government has introduced financial incentives to make charging equipment more affordable. Under the 2025 Finance Law, EV charging stations benefit from a 50% reduction in taxable value for 24 months. As Invest-Time highlights:

"Electric vehicles and motorcycles, together with their batteries and charging stations, will benefit from a 50% reduction on their taxable value for a period of 24 months."

If you’re importing a charging station, the customs process is similar to that for your vehicle. Be sure to clearly label the equipment as an EV charging station on all customs forms to qualify for the tax reduction.

For businesses setting up commercial charging stations, additional government subsidies are available to encourage infrastructure development. A notable example is Spiro, an Indian electric motorcycle manufacturer, which plans to establish 20 battery-swapping stations in Douala in 2025, leveraging these tax incentives.

When choosing a charging station, consider factors like charging speed, weather durability, and compatibility with your EV’s charging port. Most modern EVs use either Type 1 or Type 2 connectors, so confirm your vehicle’s requirements before purchasing. Many chargers also come with smart features like app connectivity, scheduling, and energy tracking, which can help you manage costs and charging times effectively.

If installing a home charger isn’t an option, public charging stations are becoming more accessible in cities like Douala and Yaoundé. Shopping malls, hotels, and office buildings are increasingly offering charging facilities, and the government’s continued subsidies for such infrastructure suggest that availability will keep improving throughout 2025 and beyond.

Conclusion

Bringing an electric vehicle (EV) into Cameroon in 2025 has never been more straightforward or cost-effective, thanks to substantial government incentives. By following the seven key stages – understanding regulations, calculating costs, selecting a compliant vehicle, arranging shipping, organizing documentation, clearing customs, and registering your EV – you can confidently navigate the process while avoiding unnecessary expenses.

These steps not only streamline the logistics but also lead to meaningful savings. Under the 2025 Finance Law, Cameroon offers a 50% reduction in import taxes on new electric cars, batteries, and charging stations for a two-year period, along with an exemption from excise duties. For example, these tax benefits can make EVs significantly more affordable compared to traditional gasoline-powered vehicles.

That said, compliance is critical. Mistakes like incomplete paperwork, using incorrect customs codes, or failing to meet battery safety standards can cause delays at ports like Douala or Kribi, incur extra fees, or even result in shipping refusals.

The good news is that Cameroon’s 2025 policies are aimed at making EV adoption feasible for individual buyers, not just businesses. The government is also laying the groundwork for a long-term shift to sustainable transport, with plans to support both local production and importation of EVs. Additionally, ongoing subsidies and private investments are expected to expand the availability of charging stations across the country.

For those looking for extra support, platforms like EV24.africa can simplify the process. This resource helps you find compliant EVs from trusted international sellers, calculate your import costs using the latest incentives, and connect with logistics experts who specialize in EV shipping and customs.

To get started, create a checklist of the outlined stages and double-check the current incentives. It’s also a good idea to work with a reliable intermediary to review your vehicle choice and shipping arrangements. Don’t forget to plan ahead for charging – whether by installing a home charger or locating nearby public charging stations.

Importing an EV to Cameroon isn’t just a smart financial move; it’s also a step toward a greener future. With careful planning and attention to detail, you’ll soon be driving your EV on Cameroonian roads.

FAQs

What tax incentives or exemptions are available for importing electric vehicles to Cameroon in 2025?

In 2025, the Cameroonian government plans to introduce a 50% tax reduction on imported electric vehicles. This initiative aims to promote the use of cleaner transportation options and cut down on the country’s dependence on fossil fuels.

On top of this, certain import duties might also be waived or lowered, depending on the electric vehicle’s features and whether it meets local regulations. To make the most of these incentives, it’s essential to stay updated on the latest policies and requirements before beginning the import process.

How can I make sure the electric car I want to import meets Cameroon’s compliance standards and qualifies for tax benefits?

To make sure your electric vehicle aligns with Cameroon’s regulations and qualifies for tax incentives, it’s important to confirm it meets the country’s specific eligibility criteria. The vehicle must be fully electric, meet the required minimum battery capacity, and carry the appropriate certifications.

Before purchasing, consider checking the vehicle’s eligibility with Cameroonian customs authorities or consulting knowledgeable shipping agents. Taking this step can help you sidestep potential surprises and ensure the import process goes as smoothly as possible.

What should I consider when deciding between Ro-Ro and container shipping for importing an electric car to Cameroon?

When deciding between Ro-Ro (Roll-on/Roll-off) and container shipping, it’s important to weigh the trade-offs between cost and protection for your vehicle.

With Ro-Ro shipping, vehicles are driven directly onto the ship and then off at the destination. It’s often the more budget-friendly and time-efficient option. However, your car will be exposed to the elements throughout the journey, which could leave it vulnerable to weather or other environmental factors.

On the other hand, container shipping provides a higher level of security. Your car is safely enclosed within a container, shielding it from external conditions. This option is especially appealing if you’re transporting a high-value electric vehicle or want to include additional belongings with your car. That said, container shipping typically comes with a higher price tag compared to Ro-Ro.

Ultimately, your decision should reflect your priorities – whether you’re looking to save on costs or prioritize maximum protection for your vehicle.