Governments across Africa are working to make electric vehicles (EVs) more affordable and accessible. Here’s a quick summary of the key incentives and challenges:

- Lowering Costs: Tax breaks, subsidies, and reduced import duties are being introduced to cut EV prices.

- Boosting Local Production: South Africa offers a 150% tax deduction for EV manufacturing investments starting in 2026.

- Expanding Infrastructure: Countries like Zimbabwe and Nigeria are building charging networks to support EV adoption.

- Country-Specific Measures: Kenya reduced excise duty on EVs, while Zimbabwe proposed suspending import duties altogether.

Quick Comparison

| Country | Import Duties | Tax Benefits | Charging Infrastructure | Local Production Focus |

|---|---|---|---|---|

| South Africa | 25% on EVs (higher than 18% for conventional vehicles) | 150% tax deduction for EV production (from 2026) | Expanding public networks | Strong focus, contributing 5.3% to GDP |

| Kenya | Reduced from 20% to 10% on EVs | Limited tax incentives under development | Financing for two-wheelers | No major local production initiatives |

| Nigeria | High duties remain a challenge | Few incentives available | Limited and unreliable grid | Some progress with local assembly (e.g., Hyundai Kona) |

Key Challenges

- High Import Duties: EVs face a 25% duty in South Africa, making them pricier than conventional cars.

- Limited Charging Networks: Only 17% of African countries have sufficient charging stations.

- Affordability: EVs remain expensive for most consumers, with limited financing options.

To grow the EV market, governments need to reduce import duties, expand infrastructure, and offer more financial incentives for both buyers and manufacturers.

South Africa Proposes R80,000 EV Incentives to Spark …

Main EV Buyer Incentives in Africa

Governments across Africa are introducing financial measures to make electric vehicles (EVs) more affordable for both buyers and manufacturers. These efforts aim to create a competitive EV market across the continent.

Tax Reductions

South Africa stands out with tax policies designed to encourage EV growth. The government has implemented a 150% tax deduction for investments in electric and hydrogen-powered vehicle production. However, high import duties remain a barrier to affordability, leading to calls for a six-year tax holiday on EV imports. These tax breaks, combined with other incentives, help reduce the initial cost of owning an EV.

Direct Purchase Support

Direct subsidies are gaining traction as a way to encourage EV adoption. South Africa’s government is exploring consumer subsidies to make EVs more accessible. President Cyril Ramaphosa emphasized the importance of these measures:

"Consideration must be given to incentives for manufacturers, as well as tax rebates or subsidies for consumers, to accelerate the uptake of electric vehicles".

Import Tax Relief

In Zimbabwe, the Energy Regulatory Authority (Zera) has proposed steps to reduce costs for EV buyers, including:

- Suspending import duties on EVs

- Offering preferential licensing fees for EV owners

These measures aim to make EVs more affordable and appealing to consumers.

Local Production Benefits

Incentives for local production are transforming Africa’s automotive industry. South Africa’s automotive sector, which contributes 5.3% to the country’s GDP, highlights the potential of domestic manufacturing. In 2023, the sector exported goods worth R270.8 billion, showcasing the economic benefits of producing EVs locally.

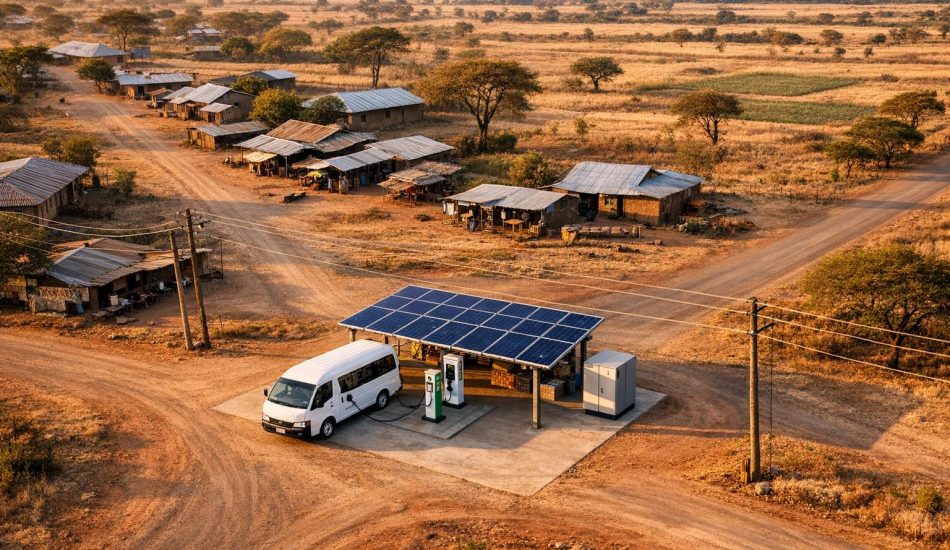

Charging Network Development

Developing EV infrastructure is another priority. In Zimbabwe, Zera is actively promoting EV technology through demonstration projects. Samuel Zaranyika, a senior engineer at Zera, explained:

"What we are doing as Zera is that we want to promote this (EVs) technology; we are actually buying an electric vehicle, which would be used for demonstrations".

These financial and infrastructure-focused strategies are working together to accelerate EV adoption across Africa.

EV Incentives by Country

South Africa’s EV Programs

South Africa offers a 150% tax deduction on investments in EV production, set to take effect in 2026. This initiative highlights the country’s focus on boosting local manufacturing efforts.

Kenya’s EV Support

Kenya is making strides in promoting EV adoption with targeted measures. The country generates nearly 85% of its electricity from renewable sources, providing a solid foundation for sustainable EV growth. Kenya has established 21 EV standards addressing safety, operational protocols, and electrical safety. Additionally, the 2019 Finance Bill slashed excise duty on battery electric vehicles from 20% to 10%, helping to make EVs more affordable. These steps align with broader efforts to reduce costs and expand the EV market.

Nigeria’s EV Initiatives

Nigeria is focusing on infrastructure and local production to support EV adoption, although affordability remains a major hurdle. With new EVs priced at approximately $55,600 (₦23 million) compared to an average annual salary of ₦2 million in Lagos, the cost barrier is significant.

As noted by Energy for Growth Hub:

"High import duties are a primary driver of low vehicle ownership in Nigeria. Fiscal incentives such as removal of the import duty, a value-added tax, and reduced vehicle insurance for EVs could make EVs more attractive and affordable for Nigerians."

– Energy for Growth Hub

Nigeria has made some progress, launching its first locally assembled EV, the Hyundai Kona, in June 2021. The country also opened its first EV charging station at Usmanu Danfodiyo University in Sokoto State in April 2021. The government is working with private companies to expand charging networks in major cities.

sbb-itb-99e19e3

Market Incentive Comparison

EV incentive programs differ widely across Africa, shaped by each country’s priorities and market conditions.

Country Incentive Overview

| Incentive Category | South Africa | Kenya | Nigeria |

|---|---|---|---|

| Import Duties | High import duties make EVs less affordable | Policies support EV adoption | High duties remain a challenge |

| Tax Benefits | 150% tax deduction for EV production investments (starting 2026) | Tax incentives under development | Few tax incentives available |

| Infrastructure | Expanding public charging networks | Digital loans for electric two-wheelers | Limited charging options and unreliable grid |

| Market Performance | 1,179 BEVs sold (Jan-Nov 2024), 0.23% market share | Growth in two- and three-wheeler segments | Limited adoption due to high costs |

These differences highlight unique national approaches. South Africa focuses on industrial growth through production incentives, Kenya encourages adoption with creative financing for specific segments, and Nigeria grapples with basic infrastructure challenges.

Experts from CHARGE highlight the need for more balanced policies:

"This incentive to boost local manufacturing is a positive step forward, but we also need to reduce the current high import duties for EVs – 25% compared to 18% for combustion engine vehicles. These taxes inflate EV prices, slow demand, and limit market growth."

Infrastructure remains a major hurdle, with only 17% of African countries hosting 10 or more public charging stations. South Africa’s established charging network, Kenya’s financing innovations, and Nigeria’s infrastructural difficulties reflect varying levels of market readiness.

Impact of EV Incentives

Cost Reduction Effects

Import duties play a major role in the affordability of electric vehicles (EVs) in Africa. Currently, EVs face a 25% import duty, compared to just 18% for conventional vehicles. This price difference directly impacts the cost of purchasing EVs.

Starting in 2026, a 150% tax deduction on investments in EV production aims to lower costs by encouraging local manufacturing. Here’s a breakdown:

| Cost Impact Area | Current State | Expected Benefit |

|---|---|---|

| Import Duties | 25% on EVs | Could decrease with local production |

| Manufacturing Costs | Limited local production | Lower prices through domestic assembly |

These changes could help reduce costs and set the stage for market growth.

Market Growth Results

While incentives have spurred some growth, the progress is still modest. Key numbers include:

- South Africa’s battery electric vehicle (BEV) sales hit 1,179 units from January to November 2024, the first time sales surpassed 1,000 units.

- BEVs represent only 0.23% of total vehicle sales.

- Vehicle and component exports contributed R270.8 billion in 2023, making up 14.7% of total exports.

"Consideration must be given to incentives for manufacturers, as well as tax rebates or subsidies for consumers, to accelerate the uptake of electric vehicles."

– Cyril Ramaphosa, President of South Africa

While these figures show progress, the overall market still faces significant hurdles.

Current Limitations

High import duties remain a major obstacle, keeping EVs less affordable than conventional vehicles. This persistent cost gap continues to limit accessibility for many consumers. Adjusting the current duty structure will be critical to making EVs a more viable option across African markets.

Conclusion: Making EVs More Affordable in Africa

Government policies play a key role in bridging the gap in electric vehicle (EV) affordability across Africa. Right now, only 39% of African nations have established legally binding EV incentives, showing there’s plenty of room for progress. However, the effectiveness of these policies varies widely across the continent, with several challenges still holding back broader adoption.

Take South Africa, for example. While the upcoming 150% tax deduction on EV production investments in 2026 is a positive move, the 25% import duty continues to drive up prices. These hurdles make it harder for the EV market to grow.

Several key areas need attention to improve affordability:

| Challenge | Current Status | Next Steps |

|---|---|---|

| Financial Access | Only 13% of Africans use formal lending | Create tailored EV financing options |

| Infrastructure | Only 17% of countries have 10+ charging stations | Expand public charging networks |

| Policy Framework | 28% of nations have national EV targets | Develop clear and supportive policies |

Addressing these challenges requires coordinated efforts and decisive action from governments across the region.

FAQs

What challenges do African countries face in building electric vehicle infrastructure?

African countries face several challenges in developing electric vehicle (EV) infrastructure. High upfront costs for EVs and charging stations make it difficult for governments and private investors to scale infrastructure quickly. Additionally, limited access to reliable electricity – especially in rural areas – hampers the functionality of charging networks.

Other obstacles include low motorization rates, which reduce market demand for EVs, and financial barriers like limited access to credit for consumers. Addressing these challenges will require coordinated efforts to improve energy reliability, expand infrastructure, and make EVs more affordable for a broader population.

What government incentives are available in Africa to support electric vehicle adoption, and how do they compare to those in other regions?

Governments in Africa are introducing various incentives to encourage electric vehicle (EV) adoption, including tax breaks, reduced import duties, and investments in charging infrastructure. For example, South Africa exempts EVs from carbon taxes, while Kenya and Nigeria are exploring purchase rebates and infrastructure expansion to make EVs more accessible and affordable.

In comparison, other regions like Europe and Asia offer additional incentives such as direct purchase subsidies, tax credits, and free access to toll roads or parking. For instance, Norway aims for all new car sales to be zero-emission vehicles by 2025, and China provides financial subsidies to EV buyers. While Africa is still developing its EV market, these government measures are a promising step toward wider adoption of electric mobility on the continent.

What are African governments doing to make electric vehicles more affordable and accessible?

African governments are actively implementing measures to make electric vehicles (EVs) more affordable and accessible for consumers. These efforts include tax exemptions and reduced import duties on EVs and related equipment, which help lower costs. For example, South Africa offers tax breaks on EV purchases and incentives for manufacturers investing in electric and hydrogen-powered vehicle production.

Some countries are also exploring purchase rebates to reduce the upfront cost of EVs, making them more budget-friendly. Additionally, governments are expanding charging infrastructure to support EV adoption, ensuring drivers have reliable access to charging stations. These initiatives collectively aim to make electric mobility a practical and attractive option for more people across the continent.