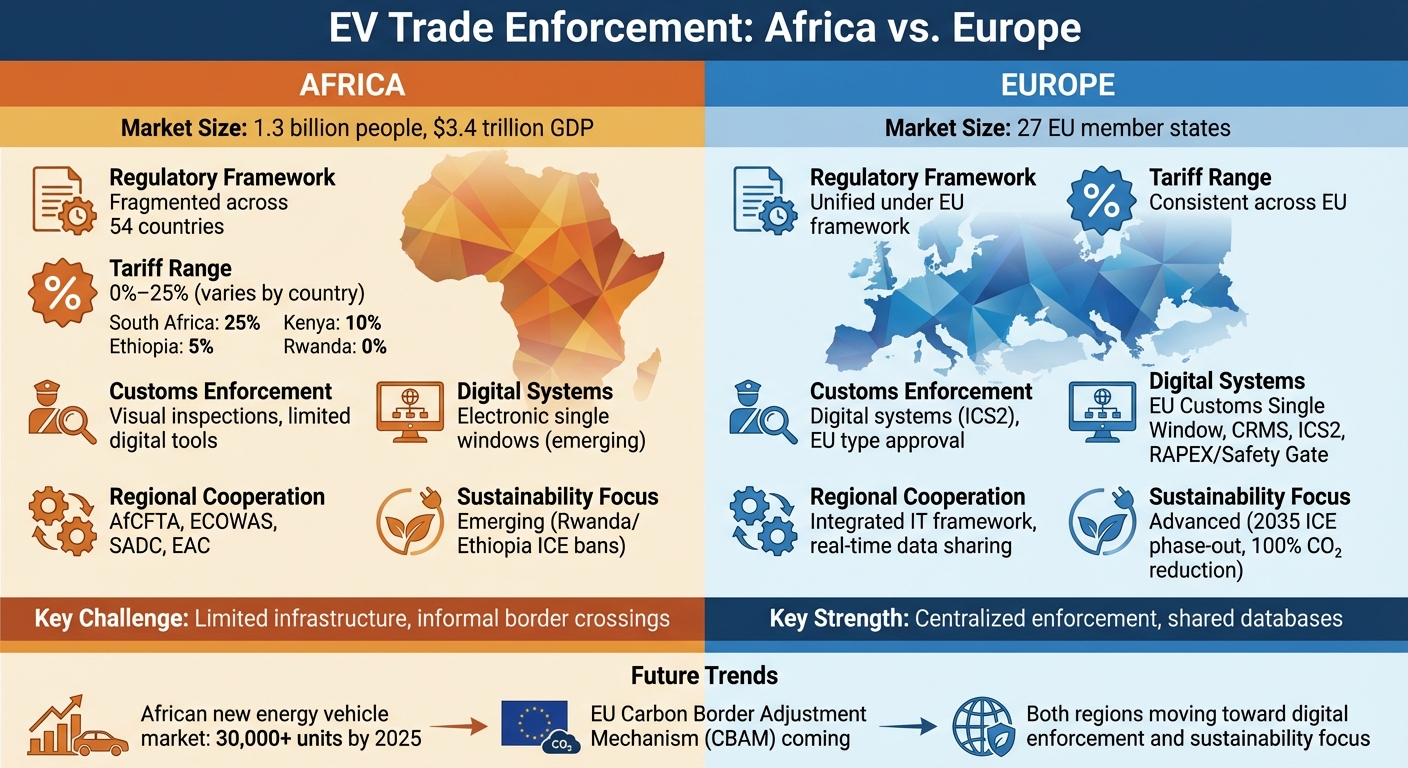

The global electric vehicle (EV) market is expanding, but trade enforcement varies widely across regions. Africa faces fragmented policies across its 54 nations, leading to higher costs, delays, and inconsistent standards. In contrast, Europe benefits from unified regulations under the EU framework, simplifying EV trade and ensuring compliance through digital systems and harmonized standards.

Key Takeaways:

- Africa: Disjointed policies increase trade complexity. Countries like South Africa impose high tariffs (25%), while others, like Rwanda, waive import duties entirely. Efforts like AfCFTA aim to harmonize rules, but progress is slow.

- Europe: Streamlined regulations under the EU ensure consistent enforcement, with tools like type approval and digital customs systems. Strict CO₂ and battery standards drive compliance.

- Challenges: Africa struggles with limited infrastructure and informal border crossings, while Europe’s advanced systems ensure tighter controls.

- Future Trends: Both regions are moving toward stricter rules focused on sustainability and digital enforcement.

Quick Comparison:

| Aspect | Africa | Europe |

|---|---|---|

| Regulations | Fragmented across 54 countries | Unified under EU framework |

| Customs Enforcement | Visual inspections, limited digital tools | Digital systems like ICS2, type approval |

| Tariffs | Vary widely (e.g., 0%-25%) | Consistent across EU |

| Sustainability Focus | Emerging (e.g., bans on ICE vehicles in Rwanda) | Advanced (e.g., 2035 ICE phase-out policy) |

Africa’s EV trade policies are evolving, but regional cooperation and digital systems are critical for progress. Europe’s unified approach offers lessons for streamlining trade and boosting EV adoption.

Africa vs Europe EV Trade Enforcement: Key Differences in Regulations and Systems

Trade Policies and Regulations: Africa vs. Europe

Africa’s EV Trade Policies

Across Africa, fragmented national policies make electric vehicle (EV) trade more expensive and complicated. The African Continental Free Trade Area (AfCFTA) is working to change this by unifying trade rules across the continent. For example, South Africa has proposed an African Auto Pact to standardize policies and rules of origin. However, regional organizations like ECOWAS, SADC, and the East African Community face challenges due to limited resources and lack of centralized authority, making progress slower compared to Europe.

National policies differ significantly. Some countries, such as Rwanda and Mozambique, completely waive import duties on EVs. Others, like Kenya, Ethiopia, Uganda, and South Africa, impose tariffs ranging from 5% to 25%, alongside varying VAT and excise rules. Kenya, for instance, provides VAT exemptions for locally assembled two- and four-wheelers and imposes a 10% import duty on four-wheelers. Ethiopia charges only 5% on partially-assembled EVs and exempts them from VAT, excise, and surtax. Uganda, however, revoked its tariff exemptions in 2024, though domestic manufacturers remain exempt from stamp duty. South Africa applies a 25% import tariff on EVs, which is higher than the 18% tariff on gasoline vehicles, along with a 15% VAT ad valorem tax.

| Country | Tax Incentive Summary |

|---|---|

| Kenya | VAT exemption for locally assembled E2/E4W; 10% import duties on E4W |

| Rwanda | EVs and motorcycles exempt from import duties |

| Uganda | Tariff exemptions revoked in 2024; domestic manufacturers exempt from stamp duty |

| Ethiopia | 5% tariff on partially-assembled EVs; no VAT, excise, or surtax on imports |

Beyond tariffs, supply-side regulations are shaping trade trends. Ethiopia and Rwanda have introduced bans on internal combustion engine (ICE) vehicles to encourage EV imports and local assembly. Nigeria has reduced import duties by 50% and launched the National Environmental (Battery Control) Regulations 2024, which require manufacturers to take responsibility for battery recycling. South Africa enforces similar recycling obligations under its Waste Act, mandating that producers join organizations focused on recycling. These varied approaches highlight the contrast with Europe’s more unified regulatory structure.

Europe’s EV Trade Policies

Unlike Africa’s patchwork of policies, Europe operates under a unified regulatory framework that simplifies EV trade. The European Commission enforces strict CO₂ emission standards, which have progressively pushed manufacturers toward EV production. This has positioned Europe, alongside China, as a leader in global EV sales, with significant growth expected by 2030. To sell or register vehicles within the EU, manufacturers must secure EU type approval, which ensures compliance with technical and safety standards. Non-compliant imports are blocked by authorities.

Europe also enforces stringent battery regulations covering sustainability, recycling, and performance standards. These rules require traceability and labeling, which customs officials and market regulators enforce during import inspections. The EU’s legal framework is backed by treaties and harmonized regulations, allowing the European Commission to take action against non-compliant member states and coordinate enforcement measures.

The EU’s 2035 ICE phase-out policy is a major driver of change. This policy mandates a 100% reduction in CO₂ emissions from new vehicles compared to 2021 levels, effectively ending the sale of new ICE cars and vans by 2035. While this doesn’t immediately ban ICE imports, manufacturers selling in the EU must meet strict fleet-average CO₂ targets, regardless of where their vehicles are produced. Customs and registration authorities ensure compliance by verifying type approvals and emissions certifications, while regulators monitor fleet performance and impose penalties for exceeding CO₂ limits. As 2035 approaches, ICE vehicles that fail to meet these tightening standards will lose access to the EU market, which could impact export demand from African manufacturing hubs like South Africa. These policies directly influence trade flows and market dynamics, creating a stark contrast with Africa’s more fragmented approach.

Enforcement Methods and Border Controls

Africa’s Enforcement Methods

In Africa, customs officials primarily rely on visual inspections and document checks at border crossings to verify tariff classifications and collect duties. These inspections, however, rarely involve advanced technical testing. A UNECE project highlighted that the lack of stringent regulations on used vehicle imports has led to an influx of unsafe or heavily polluting vehicles – often referred to as "junk" exports from Europe.

Without advanced testing tools or effective tracking systems, customs authorities face significant challenges in verifying the safety and quality of electric vehicles (EVs). This issue is further compounded by the prevalence of informal border crossings, which bypass official oversight.

To address these gaps, organizations like UNECE, UNEP, CITA, and FIA are working to establish technical, safety, and environmental standards for used vehicles in areas such as ECOWAS and the East African Community. An Informal Working Group under WP.29 is also harmonizing these standards to prevent unsafe imports. However, progress remains slow due to limited infrastructure and enforcement capabilities. Platforms like EV24.africa aim to fill these gaps by streamlining customs clearance and local registration processes across 54 African countries.

In stark contrast, Europe employs a far more advanced and integrated approach to enforcing EV trade standards.

Europe’s Enforcement Methods

Europe’s enforcement system is built on digital integration and standardized regulations. The Union Customs Code ensures consistent tariff application across all EU countries, while the Import Control System 2 (ICS2) performs pre-arrival risk analyses to identify and flag non-compliant shipments before they enter the region.

Once goods clear customs, the EU’s Market Surveillance Regulation takes over, using rapid alert systems and regular inspections to ensure products meet market standards. For EVs, type-approval databases play a key role by verifying that each certified vehicle possesses a valid EU Whole Vehicle Type Approval certificate, confirming compliance with technical and safety requirements. Additionally, trade defense measures are in place to block non-compliant imports.

Environmental compliance receives equally rigorous attention. Officials conduct in-depth reviews to ensure that imported vehicles meet CO₂ emission standards and adhere to strict battery regulations, reinforcing the EU’s commitment to sustainability and safety.

Cross-Border Cooperation and Data Sharing

Africa’s Regional Collaboration

The African Continental Free Trade Area (AfCFTA) serves as a cornerstone for customs cooperation across Africa, connecting a market of 1.3 billion people with a combined GDP of approximately $3.4 trillion. This framework emphasizes the exchange of information and coordinated border management, aiming to reduce non-tariff barriers and improve the movement of electric vehicles (EVs).

Regional blocs such as ECOWAS, SADC, EAC, and COMESA have implemented customs cooperation programs, which include initiatives like joint border posts and risk analysis systems. Additionally, organizations like UNECE and UNEP collaborate with African nations to promote safer and cleaner used vehicles. They offer technical assistance, regulatory templates, and training for customs and vehicle inspection authorities. These efforts help countries align their technical and environmental standards for imported vehicles using UNECE guidelines, enabling mutual recognition of inspections and type approvals. For example, if a vehicle meets regional standards at one port of entry, other member states can accept those results, reducing redundant inspections and ensuring consistency. Workshops on topics like VIN decoding, database management, and inspection protocols further equip authorities to identify noncompliant vehicles and share intelligence across borders.

However, many African customs and vehicle registration systems still lack integrated digital records that connect key data points like VINs, powertrain type, emissions class, and ownership history across borders. This gap makes it harder to distinguish EVs from conventional vehicles or to spot unsafe imports. Introducing electronic single windows could improve risk targeting and facilitate faster cross-border data sharing. Platforms such as EV24.africa are already working to streamline these processes by integrating digital customs clearance and local vehicle registration across all 54 African countries.

While Africa is making strides in digitalization, Europe’s systems provide a more advanced example of cross-border cooperation.

Europe’s Integrated Cooperation

Europe, by comparison, has established a highly integrated IT framework for seamless, real-time data sharing. Tools like the EU Customs Single Window, Customs Risk Management System (CRMS), and Import Control System 2 (ICS2) require electronic data submission for all incoming cargo. This centralized approach enables customs authorities to efficiently analyze risks and target high-risk shipments.

Once an EV model secures EU Whole Vehicle Type Approval under Regulation (EU) 2018/858, it can move freely across all 27 EU member states. This is supported by shared technical databases and mutual recognition of conformity assessments. Member states exchange data on approvals, recalls, and instances of noncompliance. For instance, if a vehicle is flagged as noncompliant in one country, alerts and technical details are quickly circulated, allowing other states to intercept similar imports at their borders. Networks such as ADCO (Administrative Cooperation Groups) and RAPEX/Safety Gate further strengthen enforcement by coordinating actions against unsafe vehicles and parts. These systems track type approvals, emissions, and safety incidents, ensuring consistent enforcement across the EU.

The EU also collaborates internationally to align its practices for used vehicles through bilateral trade agreements and specialized cooperation projects.

sbb-itb-99e19e3

Comparisons and Future Trends

Shared Enforcement Practices

Africa and Europe share some common ground when it comes to enforcing technical safety and emissions standards for electric vehicles (EVs). In both regions, vehicles must meet specific benchmarks before they can enter the market. Digital customs systems are becoming a key part of this process. Europe has platforms like the EU Customs Single Window and ICS2, while Africa is working on electronic single windows and risk-analysis tools. These systems mark a shift toward data-driven oversight and aligned technical standards. That said, the similarities in approach highlight a stark contrast in the capacities and regulatory frameworks between the two regions.

Differences in Capacity and Regulations

Africa’s regulatory systems are still evolving, and its digital tracking capabilities lag behind Europe’s more centralized and interoperable systems. Efforts like the African Continental Free Trade Area (AfCFTA) and initiatives by regional groups such as ECOWAS and the East African Community (EAC) are beginning to harmonize policies. However, comprehensive systems for tracking vehicle histories – covering details like identification and powertrain data – are still in their infancy. Many African customs and vehicle registries lack robust tools for monitoring cross-border EV movements, which complicates enforcement. For example, investigations have uncovered issues with used vehicle shipments, posing challenges for both continents. Platforms like EV24.africa, which supports EV trade across all 54 African markets and handles customs clearance and local registration, must navigate a patchwork of national regulations rather than a unified framework.

Future Trends in EV Trade Enforcement

Looking ahead, enforcement practices are likely to become more aligned and environmentally focused. Sustainability and climate goals are increasingly driving policy on both continents. In Europe, the upcoming Carbon Border Adjustment Mechanism (CBAM) will introduce carbon-based tariffs on imported EVs and components, requiring exporters to prove lower lifecycle emissions. African markets are also moving in this direction. For instance, South Africa is working on an African Auto Pact aimed at harmonizing EV policies to attract investment. The African new energy vehicle market is expected to surpass 30,000 units by 2025.

As EV adoption grows, data-driven enforcement will play a larger role. Both regions will need to tackle ongoing challenges, such as tracking used EVs, ensuring battery safety, and preventing environmental dumping. For EV24.africa, these trends open doors to leverage regional incentives for cross-border EV sales. The platform’s focus on transparent pricing and comprehensive customs support positions it well to adapt as Africa’s regulatory systems develop and digital enforcement tools become more widespread.

Conclusion

Africa and Europe both enforce trade agreements for electric vehicles (EVs), but the two regions operate under vastly different systems. Europe benefits from a unified framework that includes EU-wide vehicle type approvals, integrated customs IT systems, and shared battery safety standards. This setup ensures consistent enforcement across member states. On the other hand, Africa’s regulatory systems are still in development. Many countries face challenges such as limited customs infrastructure, inadequate testing facilities, and a lack of cross-border coordination. These differences highlight the need for stronger regional alliances to address enforcement gaps.

Regional collaboration holds the key to helping Africa build a regulatory system that can match Europe’s efficiency. Initiatives like the African Continental Free Trade Area (AfCFTA) and the African Auto Pact are steps toward harmonizing policies across the continent. However, the complexity of Africa’s regulatory environment is evident, with examples like South Africa’s higher EV import tariffs standing in stark contrast to Europe’s streamlined processes.

To address these challenges, platforms like EV24.africa play a critical role. By managing customs clearance and local registration across all 54 African markets, the platform simplifies compliance in a region marked by diverse national regulations. Its transparent pricing and customs support make it a valuable tool, especially as Africa’s regulatory frameworks evolve and digital enforcement systems become more prevalent.

Looking at Europe’s advanced digital systems and Africa’s ongoing integration efforts, it’s clear that African policymakers must work toward aligning EV tariffs, standards, and documentation across the region. This alignment will help reduce border delays and create a more cohesive market. For businesses and importers, partnering with platforms that understand local and cross-border requirements can streamline operations and ensure compliance in an ever-changing regulatory landscape.

FAQs

How does the African Continental Free Trade Area (AfCFTA) support the growth of EV trade in Africa?

The African Continental Free Trade Area (AfCFTA) is paving the way for the growth of electric vehicle (EV) trade across Africa by creating a unified market. This initiative works to break down trade barriers such as tariffs and customs delays, which often complicate regional commerce.

Another key aspect of AfCFTA’s approach is aligning regulations across member nations. By standardizing these rules, it becomes much easier to trade and distribute electric vehicles throughout the continent.

Through streamlined cross-border transactions and greater economic integration, AfCFTA is not only improving access to EVs but also promoting their adoption. This effort supports the vision of a cleaner, more sustainable transportation system for Africa’s future.

What challenges does Africa face in enforcing electric vehicle trade regulations?

Africa is grappling with a number of hurdles when it comes to enforcing electric vehicle (EV) trade regulations. At the forefront is the absence of well-defined regulatory frameworks, which creates challenges in establishing and maintaining consistent trade standards across the continent. Without a unified approach, ensuring compliance becomes a daunting task.

Another significant issue is the lack of infrastructure. The continent faces shortages in charging networks and struggles with inadequate border control systems, both of which make tracking EV imports and exports more complicated. On top of that, corruption in certain areas undermines efforts to create fair and transparent trade practices. Together, these factors make it difficult for Africa to roll out and enforce uniform EV trade regulations effectively.

How do digital systems in Europe improve the enforcement of EV trade regulations?

Europe is using cutting-edge digital systems to simplify the enforcement of electric vehicle (EV) trade regulations. These systems make real-time data sharing possible, giving stakeholders immediate access to the latest trade information.

With automated compliance checks, authorities can swiftly confirm whether standards are being met, cutting down on manual errors and speeding up processes. On top of that, centralized monitoring platforms improve transparency and enable quicker enforcement actions, helping ensure that regulations are applied consistently throughout the region.