Think EVs cost a lot in taxes in Africa? Not really. Many places in Africa are changing tax rules to help people buy electric cars (EVs). Here’s what you should know:

- Myth: EVs have bigger taxes than gas cars.

Fact: Places like Kenya, Rwanda, and Morocco are giving tax cuts and lower import fees for EVs, making them cheaper. - Myth: No places in Africa give tax cuts for EVs.

Fact: Mauritius cut EV import taxes by half back in 2009. Ghana took away import taxes on New Energy Vehicles (NEVs), which made running costs drop by 2.5%. - Myth: Taxes are the main cost of having an EV.

Fact: First costs, setting up charging, and upkeep (like changing batteries) often cost more than taxes. But, EVs usually need less care than gas cars.

Tax rules are very different all over Africa, with some places having low import fees (like 2.5% in Morocco) while others have high fees (like 25% in South Africa). For buyers, knowing these changes is important to figure out the real cost of owning a car.

Sites like EV24.africa make this easier by giving you good details on taxes and costs in each country, helping you make smarter choices when looking at EV options.

EV adoption stalls as import taxes return

Myth: EVs Pay More Tax Than Gas Cars

Many think that electric vehicles (EVs) have bigger taxes than cars that use gas. In truth, lots of governments in Africa are changing their tax rules to help people switch to cleaner cars. With tax cuts and not having to pay some taxes, EVs often have smaller taxes than cars that use gas. Let’s look more closely at how these policies are set up.

Tax Cuts in African Countries

In many places in Africa, countries are making tax cuts to attract people to buy EVs. For example, some have cut taxes on bringing EVs into the country or they don’t charge extra tax on the sale of EVs. These steps are part of a big effort to make the air cleaner and to use less oil from other countries. Countries like Rwanda, Kenya, South Africa, and Morocco are in front. Each one has its own way, like lowering taxes or helping local EV making, making it easier for people to pick EVs. Websites like EV24.africa show how these changes make more people want EVs there.

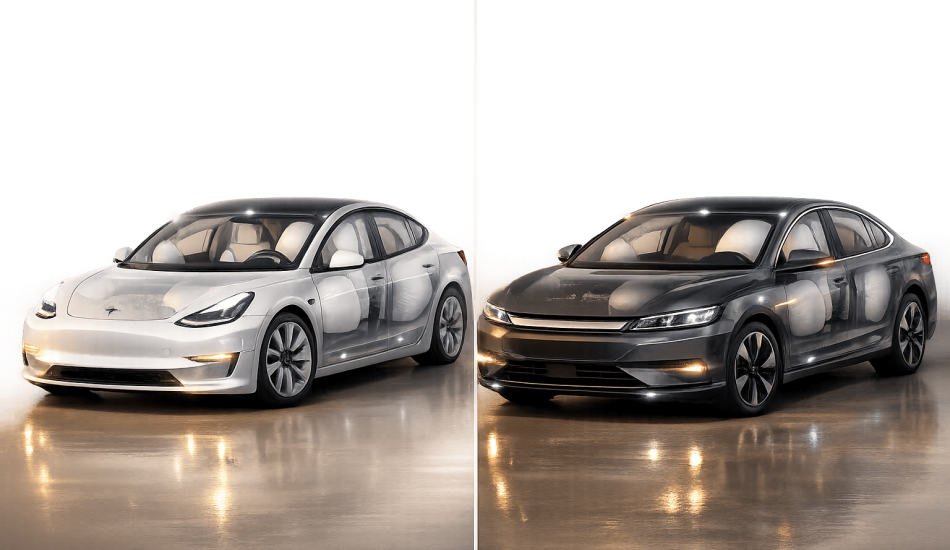

EV vs. Gas Car Tax Comparisons

If you look straight at the tax rates, the idea that EVs are taxed more does not stand. While each country is different, the main aim is clear: to lower the tax load on EVs to make them a better choice. These moves not only cut down how much you pay to get an EV, but they also save you money for the long run, making going electric a wise move for money and the environment for many in Africa.

Myth: African Nations Have No EV Tax Cuts

It’s wrongly thought that no African place gives tax cuts for electric cars (EVs). In truth, many governments on the land have set perks to help make EVs cheaper and push less use of oil cars. Let’s look deeply at some of these moves.

EV Tax Cuts Across Africa

In 2009, Mauritius cut a big 50% tax on electric and hybrid cars. This rule has made EVs far easier for people to buy by cutting the price they pay first. Also, Ghana stopped taxes on bringing in New Energy Vehicles (NEVs), cutting the price per mile by 2.5%. These cases show how tax cuts can help get more people to use EVs all over the land.

Along with tax cuts, many governments in Africa are putting money into places to charge and helping make EVs locally to speed up the change.

African Lands with EV Tax Cuts

Here’s a quick look at some big rules:

| Place | Tax Good Thing | Year Began | Effect |

|---|---|---|---|

| Mauritius | Half cut on tax for electric and mix fuel cars | 2009 | Big cut in EV prices for buyers |

| Ghana | No tax on import for New Energy Cars (NECs) | – | Made cost per mile 2.5% less |

These plans are making EVs a better and cheaper pick for buyers.

For folks looking into Africa’s rising EV market, sites like EV24.africa give full listings and clear prices. This makes it easy to see what’s out there.

Myth: Taxes Are the Only Cost When You Own an EV

Many people think that taxes are the top cost of having an electric car (EV) in Africa. True, taxes do play a part, but they are just one part. Looking at only taxes misses many other big costs that owning an EV brings.

To choose well when you buy and own an EV in Africa, you need to see all things. Next, we’ll list the main costs in owning an EV.

Key Costs of Owning an EV

The price to buy and pay off the car forms the biggest part of EV costs. The first price of the car, plus the loan interest or pay-off fees, often beat tax costs. Many who buy EVs in Africa choose to spread out paying this large price over many years.

Charging set-up costs are key too, and they can be quite different. In big cities with good charging places, costs might be set. Yet, in small places or spots with few charging options, you may need to buy home charging gear or use costly portable chargers.

Insurance and signing up fees change by country. Some places give cuts on fees for EVs, and the fees to sign up a car often depend on how much the car is worth not how big the engine is.

Keeping the car and changing the battery are costs to think about too. EVs usually need less care than cars that use gas, but changing the battery can cost a lot. Still, new EV batteries last long, and what you pay to change them is less now than before.

For many in Africa, taxes on bringing in cars and shipping costs add more to spend, as most EVs come from other places.

Things That Play Into the Cost of Owning an EV

| Cost Part | Impact Level | Time Span | Notes |

|---|---|---|---|

| Price of Vehicle | High | One-time | Costs most; often paid over a few years |

| Tax and Import Fees | Medium | One-time | Changes by place; some places have cuts or no tax |

| Interest on Finance | Medium | Monthly | Set by loan deal and past money record |

| Cost to Charge | Medium | Ongoing | Tied to local power costs and how often you charge |

| Insurance | Low–Medium | Yearly | Some places give price cuts for electric cars |

| Upkeep | Low | Ongoing | Less than cars that use gas; switching a battery may cost a lot |

You can see, taxes are only a bit of the whole thing. Sites like EV24.africa help folks know the true cost of having an EV by showing clear prices. They list out costs like taxes, shipping, and money plans for all 54 African countries they cover.

Smart buyers think ahead, adding up what they’ll pay over the car’s life. This covers the buy cost, money plans, charging, upkeep, and taxes. Fun fact: some places with high taxes might make up for it with low power costs or good charging spots, keeping total costs fair.

sbb-itb-99e19e3

Fact: African Leaders Are Changing EV Tax Rules

In Africa, leaders are looking at tax rules for electric cars (EVs) to make them cheaper and move people to cleaner cars. They are changing the cost to bring them in, the price to sign up, and other linked costs. Their goal is to create a steady and clear scene for the EV market, helping buyers and companies.

Tax Changes in Africa

Many African places are now making it easier on the wallet to own an EV. Though the details change from country to country, they mostly cut down on import taxes and make paper work simpler. These steps aim to directly help the growth of the EV market in the area.

How New Rules Help More People Get EVs

As these tax cuts make EVs cheaper upfront, more people can buy them. This lower price could lead to more people using EVs, help grow local EV jobs, and pull in money for needed stuff like charge spots. Countries like Mauritius and Ghana have already done well with like plans. Sites like EV24.africa stand to do well in this new rule scene, giving more trust and clear info for buyers and sellers.

Fact: Tax Rates Change in Africa

Tax rates for electric vehicles (EVs) are not the same in all African countries. Each place has its own import duties, sign-up fees, and tax breaks. Then, added costs like VAT and the effects of money rates can change the final price a lot. Since EVs are often brought in from the U.S. and cost in dollars, how strong the local money is matters a lot. A stronger money can make EVs cheaper and easier to buy. If you want a new EV, you must get the details on these differences to deal with the costs across Africa.

Knowing EV Import Duties in Africa

Rules on EV import duties are not the same in each African country. Some places have low rates, while others charge more, which can push up the price of the same EV model. These tax rules also control what kind of EV models you can find in different places.

If you want to know more about the costs, websites like EV24.africa have all the details, from car prices to taxes, duties, and fees. By looking at these sites, buyers can learn what makes EV prices go up or down and make better choices. With this info, handling Africa’s complex EV tax rules is much easier.

Conclusion: True Facts vs False Beliefs to Choose Better EVs

Knowing the real tax rules for electric vehicles (EVs) can change a lot when you pick your next car. Some wide beliefs – like the thought that EVs always have higher taxes than cars with gas engines or that no country in Africa gives tax cuts for EVs – are wrong if you check the facts. Look at Morocco, for example, where the tax to bring in an EV is only 2.5%, while it’s 17.5% for usual cars. Ethiopia keeps its tax low at 5%, but in South Africa, it can go up to 25%. These cases show why it’s key to have the right info to make good EV choices in Africa.

EV24.africa makes tax rules easy by giving clear, specific info on taxes, cuts, and perks for each country. With a group of experts, the site offers custom tips on rules, making things less unclear.

Top people in the field back this goal:

"Africa is ready for electric vehicles, and EV24.africa is committed to making this transition smooth and accessible. Our goal is to provide a reliable, transparent, and competitive marketplace for EV buyers across the continent."

– Axel Peyriere, Co-Founder and CEO of AUTO24.africa