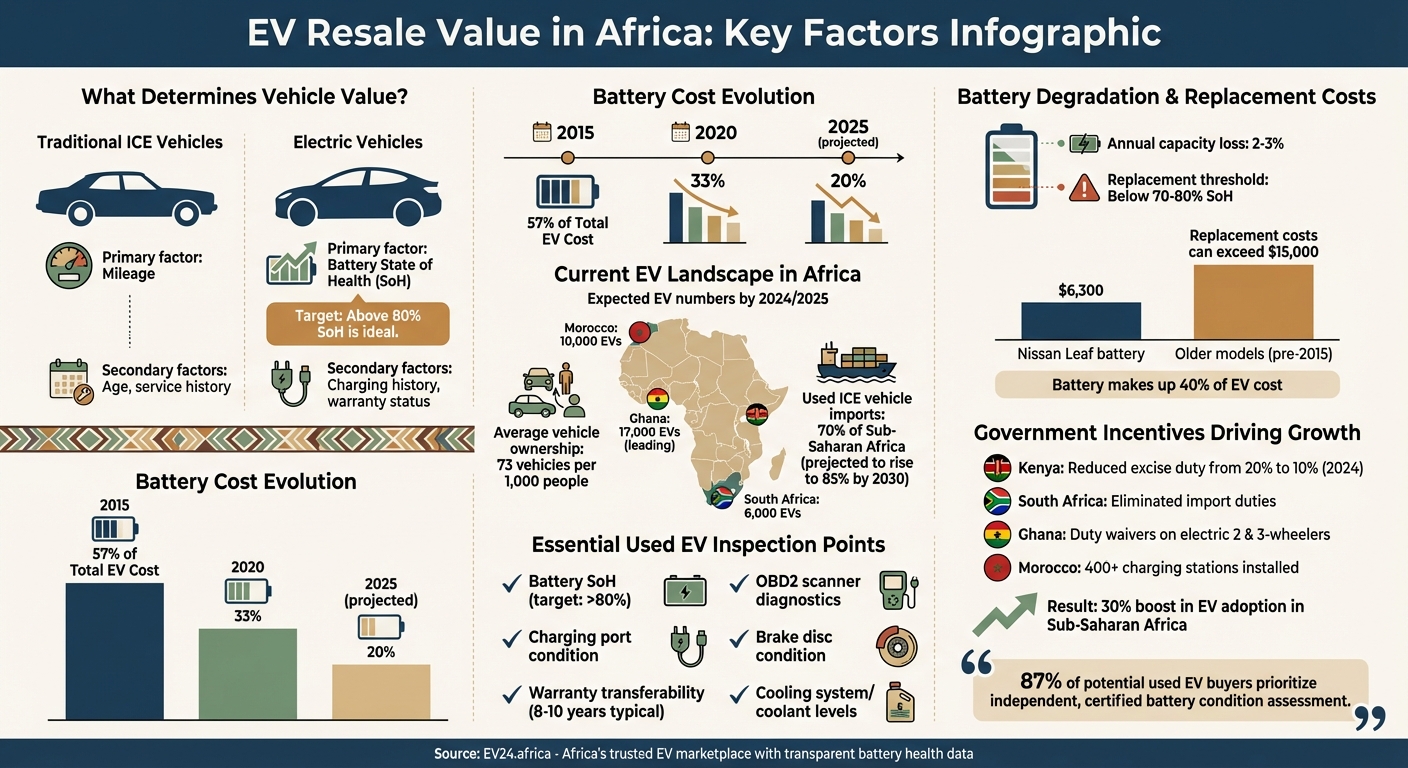

Electric vehicle (EV) resale value in Africa depends heavily on battery health, market demand, and charging infrastructure. Unlike gas-powered cars, where mileage is key, an EV’s value is tied to its battery’s State of Health (SoH), charging history, and warranty status. Key insights include:

- Battery Costs & Lifespan: Batteries make up 40% of an EV’s cost. Older models (pre-2015) are more likely to need expensive replacements, with costs sometimes exceeding $15,000.

- Market Challenges: Africa’s EV market is small, with only 73 vehicles per 1,000 people on average. Limited charging infrastructure and unreliable grids further complicate resale.

- Regional Variations: Countries like Ghana, Kenya, and South Africa are leading EV adoption with incentives and better infrastructure, boosting resale prices.

- Inspection Tips: Check battery SoH (above 80% is ideal), charging port condition, and warranty transferability. Use tools like OBD2 scanners for detailed diagnostics.

- Strong Resale Models: Tesla models retain value due to durable batteries, while BYD offers affordable, reliable options. Premium brands like BMW and Volvo also perform well.

For buyers and sellers, platforms like EV24.africa provide transparent listings and battery health data, making transactions smoother. As policies and technology improve, Africa’s EV resale market is expected to grow steadily.

Key Factors Affecting EV Resale Value in Africa: Battery Health vs Traditional Metrics

What Affects EV Resale Value in Africa

Market Demand and Depreciation Rates

In Africa, the resale value of electric vehicles (EVs) largely depends on regional market demand and concerns surrounding battery performance. High-end brands like Tesla, Porsche, and BMW tend to maintain their value better than traditional internal combustion engine (ICE) vehicles. However, consumer confidence in EVs is still influenced by perceptions of battery reliability and the pace of technological advancements.

EVs typically experience faster depreciation than ICE vehicles during their first year, but the rate of depreciation slows significantly afterward. According to Greg Cress, Principal Director of Automotive & eMobility at Accenture South Africa:

"Where vehicle mileage covered was an important consideration in residual value insofar as ICE vehicles… this was not the case with EVs where the state of battery health was the most important determinant".

Adoption rates also shape the resale market. By 2024/2025, Ghana is expected to lead with around 17,000 EVs, followed by Morocco with 10,000 and South Africa with 6,000. These relatively low numbers limit the pool of potential buyers, especially when used ICE vehicles – making up 70% of imports in Sub-Saharan Africa and projected to rise to 85% by 2030 – dominate the market.

While market factors play a role, the health and longevity of EV batteries are critical to their resale value.

Battery Lifespan and Health

The state of battery health (SOH) is a key factor in determining an EV’s resale value in Africa. Unlike traditional vehicles, where mileage is a major indicator of wear and tear, an EV’s value hinges on battery performance. EV batteries typically lose 2%–3% of their capacity each year, and once the SOH drops below 70%–80%, replacing the battery becomes necessary.

The cost of EV batteries has been declining over the years. In 2015, batteries accounted for 57% of an EV’s total cost, dropping to 33% by 2020 and projected to fall further to 20% by 2025. Even so, battery replacement remains expensive. For instance, replacing a Nissan Leaf battery costs approximately $6,300. In many African markets, these repair costs can exceed the remaining value of the vehicle, making buyers cautious about potential out-of-warranty expenses.

Climate also plays a significant role in battery health. The high temperatures across much of Africa can accelerate battery degradation, making proper storage and charging practices essential. Premium EV brands, which often feature advanced battery management systems, tend to hold their value better than entry-level models like the Nissan Leaf. Additionally, as battery technology continues to improve, older systems may quickly become outdated, further affecting resale values.

Beyond battery considerations, the development of charging infrastructure is another major factor influencing EV resale prices.

Charging Infrastructure and Accessibility

The availability and quality of charging infrastructure have a direct impact on the resale value of EVs. Expanding charging networks helps reduce depreciation rates, but infrastructure development remains uneven across the continent.

In Kenya, for example, DC fast chargers can provide 2 kilometers of range per minute, whereas AC chargers deliver only 0.3 kilometers per minute. EVs that support fast charging are generally more desirable and command higher resale prices. However, the limited range of some EVs compared to their diesel counterparts can be a drawback. For instance, an electric minibus in Africa currently achieves only 21% of the range of a diesel minibus. Researchers MJ Booysen and Joubert Van Eeden from Stellenbosch University highlight this challenge:

"Electric vehicles charge slowly… while a diesel minibus taxi takes only one minute to fill up… the fastest currently available electric minibus recharges at a mere 2 km per minute".

Regional differences in infrastructure also play a role. In countries like South Africa and Kenya, where charging networks are more developed, EV resale values tend to be higher. The 2024 Africa EV Readiness and Impact Index offers a detailed look at these infrastructure disparities across the continent. As noted by Energy for Growth Hub:

"Comprehensive data and insights are crucial to empower investors with market clarity, enable companies to scale, and equip policymakers to tailor and champion EV agendas effectively".

How to Evaluate Used EVs in Africa

Battery and Vehicle Inspection Checklist

When it comes to evaluating used EVs, a detailed inspection is non-negotiable. The battery’s State of Health (SoH) is a critical factor – anything above 80% is considered a good benchmark for a used EV. As Marcus Berger, CEO of Aviloo, emphasizes:

"With an EV, mileage and age don’t tell you anything. It’s all about the battery."

Start by checking the dashboard for a "Service" or "Battery Information" section, where the SoH percentage is often displayed. For a deeper dive, an OBD2 scanner can provide insights into cell voltages, temperature data, and charging patterns. Keep in mind that after reaching 62,140 miles (100,000 km), battery health can decline by up to 30%, depending on charging habits.

Other areas to inspect include the charging port – look for physical damage or signs of overheating – and test the car at a fast-charging station to ensure everything works as it should. Pay attention to the brake discs, as EVs rely less on traditional friction brakes, which can lead to rust, especially in humid or coastal areas. The cooling system is another critical component; check coolant levels to ensure the battery’s thermal management system is functioning properly, particularly in hotter climates. Lastly, verify whether the battery warranty is transferable. Many manufacturers offer warranties ranging from 8 to 10 years, with some, like Lexus, covering up to 10 years or 600,000 miles.

| Inspection Category | Key Items to Check |

|---|---|

| Battery | State of Health (SoH) %, Range at full charge, Warranty status |

| Charging | Condition of charging socket, Cable quality, Fast-charging functionality |

| Mechanical | Brake condition, Tire tread/wear, Suspension system |

| Documentation | Service records, Software update history, Battery ownership (leased or owned) |

These steps address key concerns about battery and charging systems, helping buyers make informed decisions.

Using EV24.africa for Transparent Listings

Once you’ve conducted a thorough inspection, using a reliable platform like EV24.africa can simplify the process further. This platform provides detailed vehicle specifications and transparent pricing, making it easier to compare options for used EVs. Each listing includes vital details about the car’s condition, brand, and features – information that’s essential for evaluating its overall value.

EV24.africa also stands out for its customer reviews and verified listings, which help buyers steer clear of vehicles with hidden problems. Transparency is a big deal for buyers – 87% of potential used EV buyers prioritize an independent, certified battery condition assessment. By offering access to this kind of data, EV24.africa builds trust and confidence.

Additionally, the platform connects buyers with expert service providers who can perform professional diagnostics before a purchase. For example, in Rwanda, IZI Electric operates specialized battery labs that provide in-depth assessments. With delivery services available across all 54 African countries, EV24.africa also makes it easier to source vehicles from regions with better charging infrastructure and well-maintained fleets.

EV Models with Strong Resale Potential

Tesla and BYD Models

Tesla models hold their value exceptionally well in Africa, largely thanks to their durable batteries. Take the Tesla Model S, for example – tests reveal its battery retains at least 80% of its original capacity even after 93,205 miles (150,000 km) of use. This level of performance underscores why battery health is such a key factor in determining an EV’s resale value in the African market. Simply put, a robust battery equals a higher resale price.

BYD, often referred to as the "Chinese Tesla", is making waves with its combination of competitive pricing and cutting-edge technology. The BYD Atto 3, priced between $768,000 and $835,000 in South Africa, is a compact-to-midsized crossover that appeals to budget-conscious buyers without skimping on quality. Meanwhile, the BYD Dolphin, starting at $539,900, comes equipped with Blade Battery technology, which enhances both safety and longevity. For those seeking a premium option, the BYD Seal offers an 800V electrical platform and pricing between $999,900 and $1.199 million, making it a strong contender in the high-end EV market.

Other Models in the African Market

Tesla and BYD may dominate discussions around battery performance and brand strength, but other EVs are also carving out their place in the African market. The BMW iX1, priced between $1.205 million and $1.245 million, has gained solid traction in South Africa, indicating strong resale potential. Similarly, the Volvo EX30, with prices ranging from $791,900 to $1.055 million, pairs sleek design with impressive acceleration – 0 to 62 mph (0 to 100 km/h) in just 3.6 seconds – making it particularly appealing to younger, tech-savvy buyers.

For those on a tighter budget, options like the GWM Ora 03 ($686,950–$835,950) and the Dayun Yuehu ($399,900–$449,900) provide affordable yet stylish alternatives. The GWM Ora 03 even benefits from design input by a former Porsche designer, while the Dayun Yuehu holds the title of the most affordable EV in South Africa.

Brand reputation also plays a significant role in resale value. As Gero Lilleike from Cars.co.za explains:

"The general perception in the market is that Toyota models retain value better than those of many other car brands… our data generally supports this assertion".

In South Africa, Toyota vehicles experience the lowest average annual depreciation at 6.8%, outperforming Ford (9.1%) and Isuzu (11.8%). While Toyota’s electric offerings in Africa remain limited, this trend suggests that well-established brands with strong reputations are likely to maintain their advantage as they expand their EV lineups.

The Nissan Leaf is another noteworthy model, with dependable battery health that bolsters its appeal in the used EV market. As the African EV market continues to grow, the diversity of brands and the increasing availability of specialized maintenance services are expected to stabilize resale values further, making the secondary market more robust.

sbb-itb-99e19e3

Future Trends Impacting EV Resale Value

Declining Battery Costs and Improved Longevity

The growing focus on battery health is reshaping how we think about EV resale values. Advances in battery technology are making newer BEVs (battery electric vehicles) more appealing, especially those with extended ranges. These vehicles are retaining their value better than older models, as buyers are willing to pay a premium for longer driving ranges. This shift is transforming the used EV market, where the condition of the battery is becoming a key selling point.

Traditionally, vehicle assessments have prioritized mileage, but for EVs, it’s a different story. Battery health is now a more critical factor than total mileage when determining resale value. Certified Pre-Owned (CPO) programs are increasingly focusing on battery performance rather than just chassis mileage. Scott Case, CEO of Recurrent, highlights the growing influx of electric vehicles into the used market:

"Six percent of all lease returns in 2025 will be battery-electric or plug-in hybrid. Next year, that jumps to 14%".

This increase in supply could saturate the market, but transparent battery health reports are helping maintain buyer confidence and stable prices.

Between January 2020 and March 2022, BEV listing prices surged by 39%, largely due to pandemic-related disruptions. While this spike was temporary, it underscored how external factors can significantly impact EV values. As battery technology continues to improve and production costs decrease, African markets stand to gain from more affordable replacement batteries and longer-lasting vehicles. These advancements, paired with detailed battery condition reports, will be essential for maintaining resale value stability in the region.

Government Incentives and Policy Support

Falling battery costs and improved longevity are just part of the story. Government policies are also playing a critical role in shaping the EV market. Across Africa, policy changes are making EVs more accessible and boosting their resale potential. For instance, Kenya reduced the excise duty on electric vehicles from 20% to 10% in 2024, while South Africa has eliminated import duties altogether to encourage EV adoption. These tax incentives lower the overall cost of owning an EV, which helps grow the initial fleet size and strengthens the secondary market.

In Ghana, duty waivers on electric two- and three-wheelers have contributed to an estimated 17,000 EVs on the road. Morocco has installed over 400 charging stations to support its fleet of approximately 10,000 EVs, while Ethiopia is leveraging its hydropower resources to back incentives for 5,000 to 7,000 electric vehicles. Mercy C. Wanjiku Nduati, an Engineering for Change Editorial Fellow, explains:

"By lowering the tax burden, the government wanted to ensure that EVs are more competitive than their petrol and diesel counterparts".

The African Continental Free Trade Area (AfCFTA) is also opening up new opportunities for cross-border trade among its 54 member states. This regional integration is expected to create a stronger secondary market, allowing vehicles and parts to move more freely across borders. In Sub-Saharan Africa, supportive policies have already boosted EV adoption by 30%. With more countries rolling out national e-mobility policies – over a dozen are expected by 2025 – and the expansion of charging infrastructure, owning a used EV is becoming more practical and appealing. This naturally supports higher resale values.

Interestingly, while a $7,500 subsidy on new vehicles temporarily lowered resale prices by 3%, the removal of such subsidies may help narrow the price gap between new and used EVs. Boucar Diouf from Kyung Hee University notes:

"The anticipated cessation of subsidies is expected to provide the required leverage to mitigate the rapid value decline in EVs, given the larger price disparity between new and used EVs".

For African buyers, these evolving policies and market dynamics suggest that used EVs could become an increasingly attractive and stable investment. As technology and policy frameworks continue to improve, the resale value of EVs across Africa is expected to strengthen further.

Is South Africa ready for the EV revolution? I unpack the details…

Conclusion

The resale value of electric vehicles (EVs) in Africa hinges on three key factors: battery health, market transparency, and informed decision-making. Unlike traditional cars, where mileage is a primary indicator of wear and tear, an EV’s worth is primarily tied to the condition of its battery. As Marcus Berger, CEO of Aviloo, points out:

"With an EV, mileage and age don’t tell you anything. It’s all about the battery".

This makes an independent battery health certificate not just helpful, but essential for assessing value.

Given the battery’s importance, transparent market practices are equally crucial. Africa’s EV market is growing quickly, supported by policies and improving infrastructure. However, the lack of standardized diagnostics still creates uncertainty. Platforms like EV24.africa are stepping in to bridge this gap. By providing listings that include detailed battery diagnostics, charging history, and warranty information, they help build trust among buyers and sellers. As Gajendra Jangid from CARS24 explains:

"Trust can be established through several mechanisms… independent battery health certification, bundled or transferable extended battery warranties, [and] transparent charging and maintenance history".

For buyers, focusing on battery health instead of mileage, verifying warranty transferability, and demanding clear documentation are critical steps. Sellers, on the other hand, should maintain thorough service records and avoid practices that could degrade the battery, such as keeping it consistently charged at 100%.

Looking ahead, the future of Africa’s secondary EV market is promising, bolstered by technological advancements and supportive policies. Declining battery costs, longer ranges, and government incentives in countries like Kenya, South Africa, and Ghana are paving the way for a stronger used EV market. As Alex Johns from Altelium emphasizes:

"If the second-hand car market doesn’t work properly, the new car market doesn’t work properly and the electric transition won’t happen".

FAQs

How does the condition of an EV’s battery affect its resale value in Africa?

The state of an EV’s battery is a key factor in determining its resale value across Africa. A well-maintained battery ensures the vehicle offers a reliable driving range and dependable charging performance – qualities that buyers actively seek. On the flip side, if the battery’s condition deteriorates, the car’s range diminishes, making it less attractive and often forcing sellers to drop the price significantly.

In Africa, where charging infrastructure is still evolving and range anxiety is a common concern, buyers tend to focus on EVs with batteries in good condition. Factors like high temperatures, frequent fast charging, and deep cycling can speed up battery degradation. This means buyers should look beyond just mileage and pay close attention to the battery’s capacity and charging history. Sellers looking to reassure buyers – and secure a better price – can benefit from providing a trusted battery health certification or a detailed test report.

What should I look for when buying a used EV in Africa?

When buying a used electric vehicle (EV) in Africa, one of the first things to assess is the battery’s condition. The battery plays a crucial role in determining the car’s range and resale value. Using reliable battery health tests can give you a clear idea of its remaining lifespan, helping you avoid surprises down the road.

It’s also important to check the availability of charging infrastructure in your area. A well-established network of charging stations can significantly improve convenience and reduce long-term depreciation concerns.

Don’t overlook the mileage and usage history. Instead of focusing solely on miles driven, pay attention to the number of charge cycles, as this often provides a better picture of the battery’s wear and tear. Additionally, research the model’s reputation – vehicles like the Tesla or Nissan Leaf are known for their durable batteries, which can help them retain value over time.

Lastly, review the car’s warranty and service history. Ensure that parts and repairs are easily accessible in your region, as this can save you time and money in the future. By keeping these factors in mind, you’ll be better equipped to make a smart, well-informed purchase.

How does charging infrastructure impact the resale value of EVs in Africa?

The resale value of an electric vehicle (EV) in Africa heavily depends on the availability of charging infrastructure. In regions where reliable public and private charging stations are expanding, buyers feel more assured about the practicality of owning an EV. This increased confidence boosts demand, which helps maintain higher resale prices. For example, cities like Johannesburg, Nairobi, and Lagos, equipped with well-established fast-charging hubs, often see used EVs holding onto more than 70% of their original value after three years.

In contrast, areas with limited or unreliable charging options present a different scenario. Potential buyers may consider the added inconvenience and expense of setting up home chargers, which can lead to lower resale prices. In such regions, EVs tend to depreciate more rapidly, sometimes losing over half of their original value. When assessing a used EV, it’s crucial to evaluate the local charging infrastructure, as it significantly impacts the vehicle’s resale potential.