Electric vehicles (EVs) are becoming much more affordable in 2026, and this could reshape Africa’s transportation landscape. Here’s why:

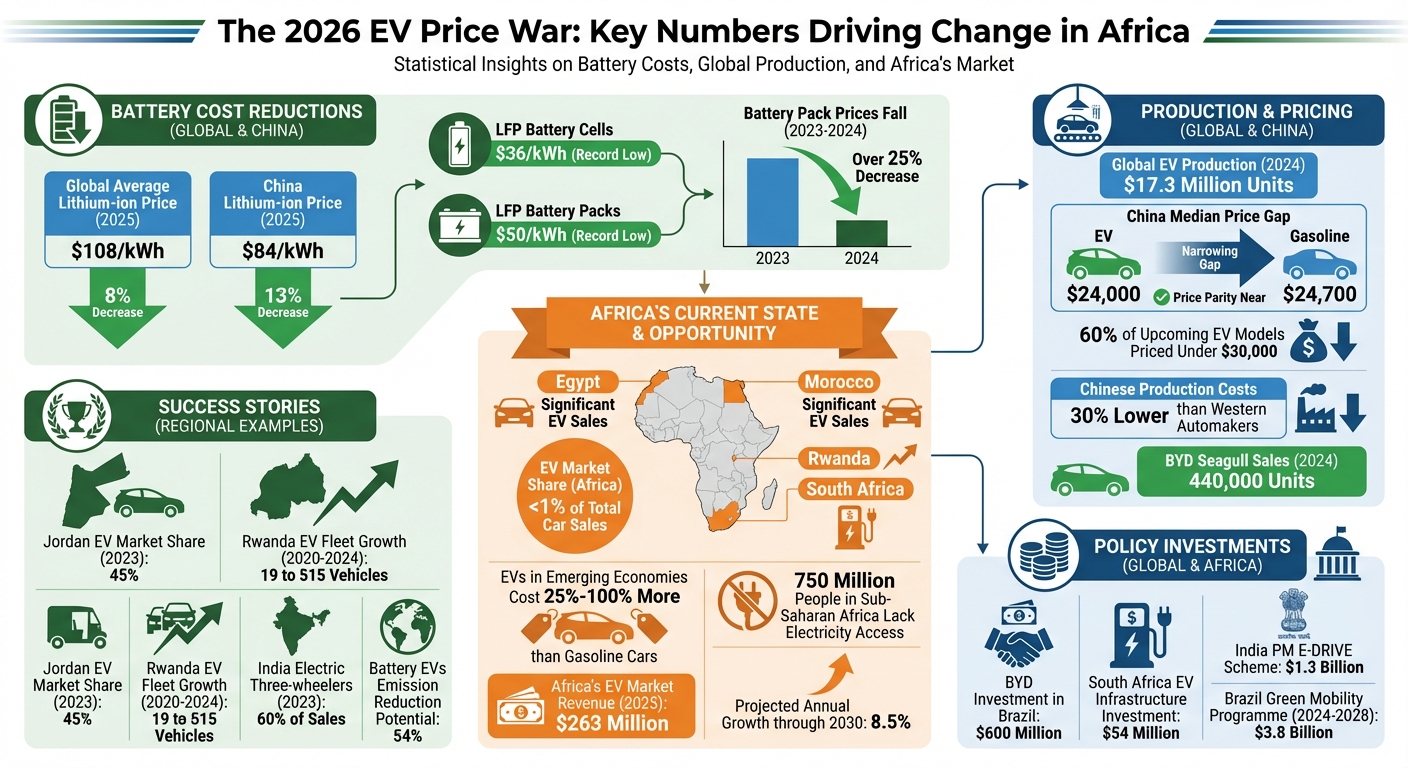

- Battery prices are dropping fast: Lithium-ion battery costs fell by over 25% between 2023 and 2024, with further reductions expected due to oversupply and new technologies like sodium-ion batteries.

- Global competition is heating up: Chinese manufacturers are driving prices down, with many EV models now priced under $30,000.

- Production is scaling up: EV production surged to 17.3 million units in 2024, cutting costs through economies of scale.

- Government policies are pushing adoption: Incentives, reduced import duties, and investments in charging infrastructure are making EVs more accessible.

For Africa, cheaper EVs mean overcoming high upfront costs, reducing reliance on fuel imports, and improving urban mobility with electric two-wheelers and public transport. However, challenges like limited charging infrastructure, high import tariffs, and weak financing options still need to be addressed.

The 2026 EV price drop offers Africa a chance to modernize its transportation while tackling affordability and infrastructure gaps. But success depends on targeted policies, local investments, and innovative financing solutions.

EV Price Drop Statistics 2023-2026: Battery Costs, Production Growth, and Market Impact

Chinese Tech Driving EV Boom Africa Can’t Afford to Miss

sbb-itb-99e19e3

Why Electric Vehicles Have Been Too Expensive in Africa

Electric vehicles (EVs) remain out of reach for most African consumers, with EVs making up less than 1% of total car sales across the continent. The reasons for this go far beyond just high price tags.

High Purchase Costs and Import Barriers

One of the biggest hurdles is the high cost of importing EVs. Many African countries impose steep tariffs on imported EVs, which significantly drive up their prices. On average, EVs in emerging economies cost 25%–100% more than traditional gasoline-powered cars. Unlike wealthier nations, many African governments lack the resources to offer subsidies that could help narrow this price gap.

Other regions have taken a different approach. For instance, Jordan managed to boost EV sales to an impressive 45% of market share by reducing import duties on EVs compared to traditional cars. In Africa, however, high tariffs and a market dominated by luxury SUVs and premium models from China, Europe, and the U.S. leave few affordable options. This pricing imbalance is further aggravated by the high cost of batteries and a lack of supporting infrastructure.

Expensive Batteries and Missing Infrastructure

The cost of EV batteries is another major factor inflating prices. At the same time, the continent’s unreliable electricity infrastructure adds to the challenge. Around 750 million people worldwide lack access to electricity, and most of them live in sub-Saharan Africa. Even for those connected to the grid, frequent outages make charging EVs a daunting task.

Public charging infrastructure is another weak link. Without widespread charging stations, potential EV owners are often forced to invest in private charging setups, significantly increasing the overall cost of ownership. Public fast chargers, where available, typically cost about twice as much as charging at home, making EVs even less practical for households without home charging options. These infrastructure gaps restrict EV use to urban areas and amplify concerns about driving range. Combined with policy shortcomings, these challenges make EV adoption difficult.

Weak Policies and Fragmented Markets

In Europe, strict CO2 regulations push automakers to release more affordable EV models. But in many African countries, weak emissions standards mean there’s little incentive for manufacturers to prioritize low-cost EVs.

Currently, EV sales in Africa are concentrated in just two countries: Egypt and Morocco. Unlike markets such as Thailand or Brazil, where local incentives and investments have spurred growth – BYD, for example, invested over $600 million in Brazil – Africa’s fragmented markets and reliance on imports prevent economies of scale. To make EVs more accessible, addressing these policy gaps and market fragmentation will be essential.

What’s Behind the 2026 EV Price Drop

Three major factors are driving down the cost of electric vehicles (EVs): advancements in battery technology, increased production and competition, and supportive government policies.

Better and Cheaper Battery Technology

The cost of EV batteries is dropping fast, reshaping the industry. In 2025, the global average price of lithium-ion batteries fell to $108/kWh, marking an 8% decrease from the previous year. In China, the decline was even steeper, with prices dropping 13% to $84/kWh. For Lithium Iron Phosphate (LFP) batteries, prices hit record lows – $36/kWh for individual cells and $50/kWh for complete battery packs.

Automakers are increasingly switching from expensive Nickel Manganese Cobalt (NMC) batteries to more affordable LFP batteries. These alternatives not only cost less but also handle fluctuations in raw material prices better. Colin McKerracher, Head of Clean Transport at BloombergNEF, noted:

"The industry absorbed these shocks through greater LFP adoption, long-term contracts and broader hedging strategies".

Looking ahead, sodium-ion batteries are expected to enter production in 2026, offering another budget-friendly option. These batteries are already approaching cost parity with lithium-ion, adding further momentum to the downward trend in battery prices.

More Production and Stronger Competition

China, responsible for over 70% of global EV production, is a key player in driving down costs. Higher production volumes and competitive pricing strategies have made EVs more affordable. For example, in China, the median price of a battery-electric car is around $24,000, which is $700 less than a typical gasoline-powered vehicle.

In 2024, BYD’s compact electric car, the Seagull, became a global best-seller with approximately 440,000 units sold – a success fueled by its low price. Tesla also contributed to the price drop by repeatedly cutting the cost of its Model Y in the U.S., prompting rivals to follow suit. Battery pack prices fell by more than 25% that same year. Additionally, about 60% of upcoming EV models with disclosed prices are expected to launch under the $30,000 price point.

Chinese manufacturers maintain a competitive edge, with production costs roughly 30% lower than those of Western automakers. This advantage comes from vertical integration and highly efficient supply chains.

Government Support and Regulations

While technological and market dynamics are driving costs down, government policies are accelerating the shift. Stricter emissions rules and incentives are pushing automakers to offer more affordable EV options. For instance, the European Union’s new CO₂ standards, set to take effect in 2025, are expected to lead to the launch of nearly 10 EV models priced under €25,000 (around $27,000) by the end of 2026.

In the United States, the Inflation Reduction Act is helping lower manufacturing costs by subsidizing domestic battery and EV production. Policies in other regions are making a similar impact. For example:

- In India, the FAME II subsidy program helped electric three-wheelers account for nearly 60% of sales in 2023.

- Indonesia waived import duties for Chinese EV makers in 2024 under certain local investment conditions. This move allowed Chinese brands to dominate two-thirds of Indonesia’s EV market and reduced the price gap between EVs and traditional vehicles from 100% to 50%.

- Brazil is introducing higher tariffs on EV imports, set to reach 35% by mid-2026, prompting BYD to build a manufacturing hub in Camaçari to avoid these duties and serve the local market.

These global initiatives not only make EVs more accessible but also provide a roadmap for other regions, including Africa, to follow in reducing costs and encouraging local adoption.

How Cheaper EVs Could Change Transportation in Africa

By 2026, falling prices for electric vehicles (EVs) could reshape how people in Africa move around, both in cities and rural areas. With battery costs dropping and more affordable models hitting the market, EVs are becoming less of a luxury and more of a practical choice for millions. This shift could open up local markets and redefine everyday transportation across the continent.

More People Can Afford EVs

Lower prices are making EVs accessible to middle-income families and commercial operators who once found them too expensive. This affordability is especially impactful in Africa, where electrifying two- and three-wheelers (2/3Ws) and public transport could lead to widespread adoption. These vehicles are the backbone of urban mobility in many African cities, and emerging economies now account for 90% of the global stock of conventional 2/3Ws.

Take Rwanda, for example. The country has set a goal for 30% of its 2/3W fleet to go electric, seeing this as the quickest way to bring EVs to the mass market. While the upfront cost of electric models may still be slightly higher, their lower long-term expenses – thanks to reduced fuel and maintenance costs – make them a smart investment. This economic edge positions electric 2/3Ws and public transport as key players in Africa’s EV adoption story.

Expanding Local EV Markets and Support Services

As EVs become more affordable, the need for local charging stations, maintenance, and service networks will grow. Platforms like EV24.africa are stepping in to connect buyers with reasonably priced EVs from leading brands across all 54 African countries. Additionally, as Chinese manufacturers ramp up overseas production, shipping costs could drop, making EVs even more accessible for African importers.

But it’s not just about selling vehicles. The price drop is opening doors for charging infrastructure, maintenance services, and battery swapping stations. For instance, EV sales in Egypt and Morocco doubled in 2024, driven by supportive policies and affordable imports. Local businesses have a chance to thrive by meeting the demand for fast chargers, skilled technicians, and battery-related services.

Cleaner Air and Healthier Communities

Electric buses, taxis, minibuses, and delivery motorcycles do more than just reduce emissions – they also cut down on urban noise, improving air quality and public health. The IEA highlights this potential, stating:

"Electrification of 2/3Ws and public or shared mobility will be key to achieve emissions reductions".

These benefits align with the urban development goals of many African cities, which are looking for sustainable ways to manage rapid growth. For the 750 million people in sub-Saharan Africa without reliable electricity access, pairing EV charging with solar power and battery storage could be a game-changer. This approach not only boosts energy security but also enhances air quality, offering a win-win for communities investing in electric mobility solutions.

Barriers That Could Limit Africa’s EV Growth

Even with lower prices on the horizon, Africa faces several challenges that could slow the adoption of electric vehicles (EVs). These obstacles include inconsistent government policies, unreliable power grids, and limited access to affordable financing. Addressing these issues is essential to ensure that a potential price drop in 2026 translates into meaningful growth in EV adoption.

Missing Policies and Inconsistent Rules

One of the key challenges is the lack of reliable data on Africa’s EV markets. Rose Mutiso from the Energy for Growth Hub highlights the importance of this:

"Comprehensive data and insights are crucial to empower investors with market clarity, enable companies to scale, and equip policymakers to tailor and champion EV agendas effectively."

Without this data, governments struggle to create effective policies, and investors lack the clarity needed to make informed decisions. Adding to the complexity, import policies differ widely across African nations. Some countries impose high duties to protect local industries, while others, like Jordan, have successfully boosted EV sales – achieving a 45% EV market share in 2023 – by lowering import duties for electric vehicles compared to traditional internal combustion engine cars.

Limited Financing Options

Another significant barrier is the lack of affordable financing options. High interest rates and limited access to loans prevent many African consumers from purchasing EVs, even as prices drop. For instance, in 2024, India introduced the PM E-DRIVE scheme with $1.3 billion in funding to subsidize electric two- and three-wheelers, buses, and trucks, while deliberately excluding personal cars. Similar targeted financing programs would be beneficial in Africa, but lower economic growth and financial uncertainty make implementing such initiatives more challenging.

The financing gap is just one piece of the puzzle. Infrastructure challenges also play a critical role in limiting EV adoption.

Inadequate Charging Networks and Power Grids

A lack of reliable charging infrastructure poses a major challenge to the widespread adoption of EVs, regardless of consumer interest or declining vehicle costs. In sub-Saharan Africa, around 750 million people live without electricity, and frequent power outages make EV charging even more difficult. While some cities, such as Nairobi, Lagos, and Johannesburg, have seen investments in high-power fast chargers, these systems place significant stress on already fragile power grids. Upgrading grids or adding battery storage systems to handle peak demand will require significant investment.

South Africa has announced plans to invest approximately $54 million to support local EV production and infrastructure. However, building a charging network capable of supporting widespread EV adoption will demand far greater efforts across the continent. Without these upgrades, the EV transition will remain out of reach for many.

How Africa Can Take Advantage of Lower EV Prices

African nations have a unique opportunity to reshape mobility by addressing the challenges of affordability and infrastructure for electric vehicles (EVs). By removing import duties and investing in charging networks, the anticipated EV price drop in 2026 could lead to widespread adoption across the continent. Here’s how targeted policies, market development, and innovative financing can make this vision a reality.

Policy Changes Governments Should Make

Rwanda offers a clear example of how effective policies can drive EV adoption. Between 2020 and 2024, Rwanda increased its EV fleet from just 19 vehicles to 515 by eliminating import duties and cutting charging costs. This approach can serve as a model for other African nations: removing import duties and VAT on EVs, batteries, and charging equipment could significantly lower costs and make EVs more accessible.

Looking further afield, Thailand hit price parity between EVs and conventional cars in 2024 by implementing subsidies, reducing import and excise taxes, and incentivizing domestic battery production. This strategy attracted investment from companies like BYD, which committed $500 million to establish a local factory capable of producing 150,000 vehicles annually. African governments could replicate this success by offering tax breaks to companies assembling EVs locally, reducing reliance on imports, cutting shipping costs, and creating jobs. Additionally, setting clear deadlines for transitioning public transport – like motorcycle taxis and buses – to electric can accelerate market growth.

Building Local Markets and Infrastructure

The development of charging networks and service infrastructure is essential to support EV expansion. Public charging capacity for light-duty EVs needs to increase nearly ninefold by 2030 to meet projected demand. A successful example comes from Brazil, where BYD partnered with Raízen in 2024 to establish charging infrastructure in eight major cities. This initiative coincided with a threefold increase in EV registrations, surpassing 50,000 units. Similar partnerships in Africa could yield comparable results.

African businesses should focus on installing ultra-fast chargers (150 kW+) at retail locations and fuel stations to support long-distance travel. In areas with unreliable power grids, solar-powered charging hubs with battery storage offer a practical alternative, bypassing grid limitations. Platforms like EV24.africa simplify the import process by providing clear regulatory information and connecting buyers with local support. Younes Rabeh from EV24.africa explains:

"An African EV marketplace functions as an entire ecosystem, not just a storefront. It bundles vehicles, financing, charging, and after-sales support into a single, accessible package."

Entrepreneurs should prioritize affordable models under $25,000, as this price point has proven critical for mass adoption in countries like Brazil and Thailand. In China, 40% of EV models are already priced below this threshold. Africa could also look to Uzbekistan’s example, where BYD and UzAuto Motors launched a joint venture in 2023 to produce 50,000 electric cars annually, leading to 10,000 local sales within the same year.

Making EVs More Affordable Through Financing

High upfront costs remain a challenge, but innovative financing options can bridge the gap. For instance, in 2023, the Indian and US governments created a $390 million fund to provide loans for electric bus manufacturing, aiming to have 50,000 electric buses on Indian roads by 2027.

African governments could focus similar efforts on two- and three-wheelers, which are already cost-effective over their lifetime and require no major technological advancements. India’s Ministry of Heavy Industries allocated over $60 million to subsidize electric two- and three-wheelers, while Brazil’s Green Mobility and Innovation Programme is set to provide $3.8 billion in tax incentives from 2024 to 2028 to develop low-emissions transport technology.

Pay-as-you-go and lease-to-own financing models are especially effective for commercial drivers, allowing them to offset upfront costs with savings on fuel and maintenance. The IEA Global EV Outlook 2024 highlights the benefits of leasing models:

"In 2023 and 2024, leasing business models enable electric cars to qualify for the tax credits… and these tax credit savings can be passed to lease-holders."

With these approaches, Africa can position itself to take full advantage of the coming EV price reductions, creating a more sustainable and accessible transportation future.

Conclusion: Africa’s Path to Electric Mobility

The anticipated 2026 drop in EV prices could be a game-changer for mobility in Africa, but turning that potential into reality will demand a united effort on several fronts. Governments across the continent face a tricky balancing act: replacing fuel tax revenue – which currently makes up 9% of total income in low-income countries – while also funding the development of charging infrastructure and introducing supportive policies. Solutions like distance-based road charges could help maintain infrastructure funding.

The opportunities, however, are immense. By 2025, Africa’s EV market is expected to generate nearly $263 million in revenue, with annual growth projected at 8.5% through 2030. Beyond economic gains, battery electric vehicles could slash average emissions by 54%, while also creating jobs through local manufacturing and service industries. South Africa’s $54 million investment in local EV and battery production highlights the economic promise of this shift.

The combination of economic growth and environmental improvements makes the case for urgent, coordinated action even stronger.

"Africa’s journey toward sustainable mobility is not just about technology – it is about shaping a cleaner, smarter, and more resilient future for all." – Weetracker

To succeed, governments will need to cut import duties, while businesses focus on building charging networks and service infrastructure. Local platforms can connect buyers with service providers, making the transition more accessible. Additionally, prioritizing vehicles that require minimal infrastructure investment could help drive early adoption. Regional cooperation, like standardizing charging systems and creating cross-border "EV corridors", will also be key to enabling seamless travel and trade.

FAQs

What can Africa do to address the lack of EV charging infrastructure?

Africa has a chance to address its challenges with limited EV charging infrastructure by focusing on private investment. Offering incentives like tax breaks, duty waivers, and streamlined permits for setting up charging stations could attract businesses to the sector. Governments could also join forces with private companies, sharing costs and risks through tools like development loans. These loans could be repaid over time using fees collected from charging stations. Additionally, creating uniform standards for plug types and payment systems across countries would make the network more efficient and cost-effective.

Tapping into Africa’s plentiful renewable energy resources, particularly solar power, offers another promising path. Off-grid charging stations powered by solar energy, equipped with battery backups or mobile charging units, can be strategically placed along key routes. This approach is especially useful in areas with unreliable electricity supply. Pairing these renewable energy solutions with existing fuel stations to create hybrid sites – offering both gasoline and electricity – can help build consumer trust while the overall grid infrastructure improves. These strategies could turn current obstacles into opportunities for advancing sustainable transportation across the continent.

What are the benefits of using electric two-wheelers in African cities?

Switching to electric motorcycles and scooters presents several compelling benefits for urban areas across Africa. For starters, they are much more affordable to operate than traditional gas-powered bikes. Over a span of five years, electric two-wheelers can cut running costs by up to 25%, thanks to reduced fuel and maintenance expenses. This makes them a practical choice for short daily commutes within cities.

Beyond saving money, electric two-wheelers contribute to cleaner air by producing zero tailpipe emissions, which helps combat air pollution and curb greenhouse gases. They also run much quieter than their gas counterparts, reducing noise pollution and making city environments more enjoyable.

A standout advantage is their ability to pair seamlessly with solar-powered charging systems, which can offer a dependable energy source even in areas where electricity supply is inconsistent. Small solar charging stations can be installed in neighborhoods or near workplaces, providing a clean and sustainable way to power these vehicles. As electric two- and three-wheelers gain momentum worldwide, African cities are well-positioned to adopt this efficient, eco-conscious form of transportation.

How do government policies influence the affordability and adoption of electric vehicles in Africa?

Government policies are key to making electric vehicles (EVs) more accessible and speeding up their adoption across Africa. Strategies like tax rebates, reduced import duties, and lower registration fees help cut the upfront costs of EVs. Similarly, subsidies for charging infrastructure and support for renewable energy make operating these vehicles more cost-effective, increasing their appeal to potential buyers. Countries such as South Africa, Kenya, Rwanda, Egypt, and Zimbabwe have already rolled out incentives and set electrification goals to attract investments and boost local EV production.

On the flip side, many regions still face challenges due to uncoordinated policies. High import taxes, scarce charging stations, and a lack of clear incentives often keep EVs out of financial reach for many. To address this, governments can introduce comprehensive measures like subsidies for low-income buyers, simplified licensing processes, and mandatory installation of charging stations. These steps not only make EVs more affordable but also demonstrate long-term government commitment, encouraging private-sector investments and helping to grow the market.