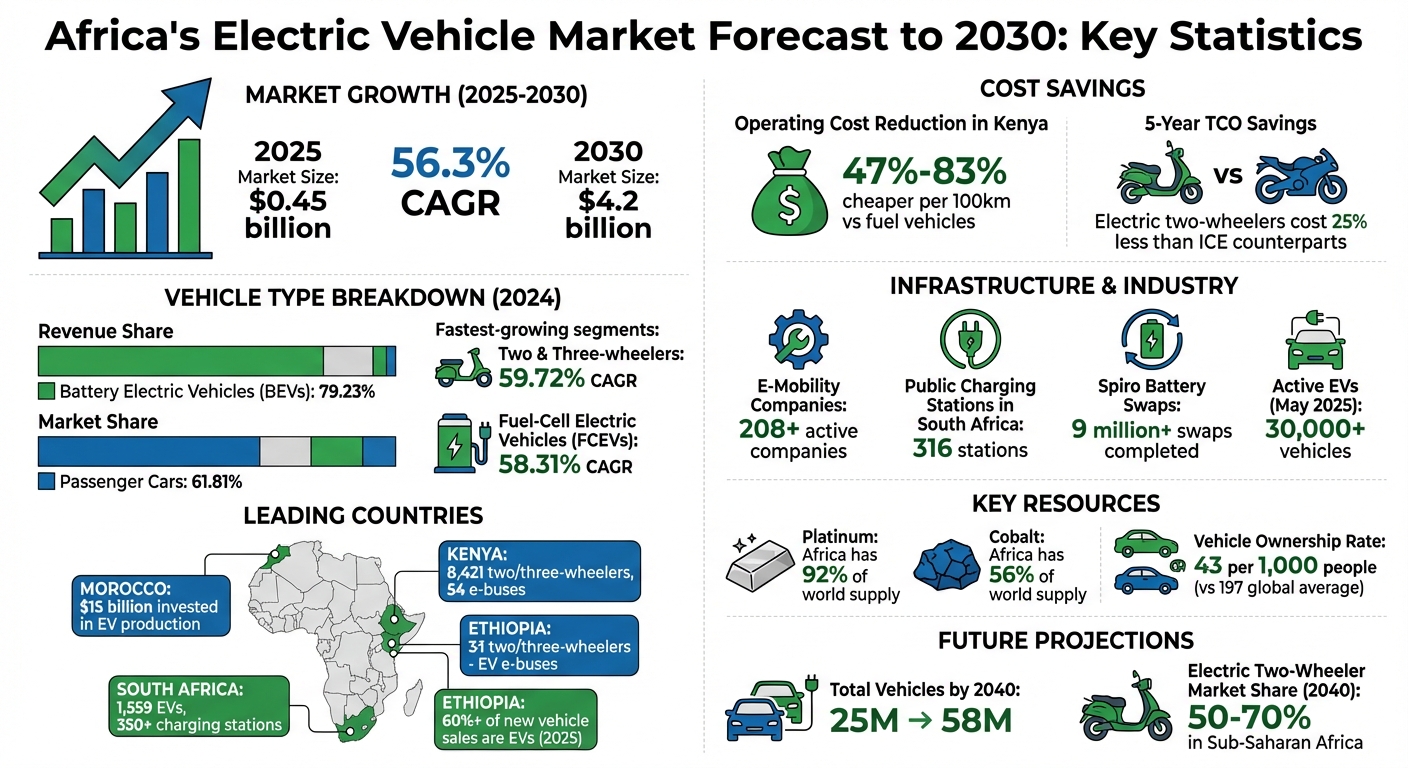

Africa’s electric vehicle (EV) market is set for explosive growth, projected to expand from $0.45 billion in 2025 to $4.2 billion by 2030, with an astounding 56.3% annual growth rate. This surge is driven by the rapid adoption of electric two- and three-wheelers, favorable government policies, and declining battery costs. Ethiopia, Rwanda, Kenya, and South Africa are leading the charge with bold initiatives like tax incentives, bans on internal combustion engine (ICE) imports, and investments in charging infrastructure.

Key Insights:

- Market Growth: Two- and three-wheelers are expected to grow the fastest, with a 59.72% annual growth rate.

- Cost Savings: Operating an EV in Kenya is 47%-83% cheaper per 100 kilometers than using fuel-powered vehicles.

- Government Support: Ethiopia banned ICE imports in 2024; Rwanda aims to phase out ICE motorcycles by 2025.

- Infrastructure Investments: Over 208 e-mobility companies are driving innovation, with countries like Morocco and Uganda committing billions to EV production and infrastructure.

Challenges like unreliable power grids, upfront costs, and limited rural charging infrastructure remain, but solutions like battery-swapping networks and solar-powered chargers are gaining traction. Africa’s low vehicle ownership rate (43 per 1,000 people) presents an opportunity to leap directly into electric mobility, bypassing traditional automotive systems. The region’s abundant resources, including cobalt and platinum, further position it as a key player in the global EV market.

Africa EV Market Growth 2025-2030: Key Statistics and Projections

Market Size and Growth Through 2030

Africa’s EV Market by the Numbers

Africa’s electric vehicle (EV) market is projected to grow from $0.45 billion in 2025 to an impressive $4.20 billion by 2030 – a nearly tenfold jump in just five years. With a compound annual growth rate (CAGR) of 56.30%, it’s among the fastest-growing EV markets worldwide.

In 2024, Battery Electric Vehicles (BEVs) dominated the market, accounting for 79.23% of the revenue share, while passenger cars led the way with 61.81%. However, it’s the two- and three-wheelers that are expected to grow the fastest, with a CAGR of 59.72% through 2030. Similarly, Fuel-Cell Electric Vehicles (FCEVs) are forecasted to expand at a 58.31% CAGR, though their current market size is smaller. The rapid rise of electric motorcycles and tuk-tuks highlights their suitability for last-mile logistics and their lower dependency on extensive infrastructure. These numbers reflect a market on the move, driven by several critical factors.

What’s Driving Market Growth

One major catalyst for growth is the declining cost of batteries, which is making EVs more affordable for a broader audience. Local gigafactories, like Morocco’s Gotion plant, are paving the way for mass-market EVs priced under $15,000 by 2027. Additionally, the Sino-Moroccan joint venture, COBCO, began producing EV-battery materials in June 2025. With an annual capacity of 70 GWh, this facility can support nearly 1 million vehicles.

Government policies are also playing a pivotal role. Ghana, for instance, offers an eight-year zero-tariff window for electric imports, significantly reducing costs for both importers and buyers. Furthermore, Africa’s abundant natural resources – 92% of the world’s platinum and 56% of its cobalt – are enabling local battery assembly hubs. This reduces logistics expenses and mitigates risks associated with currency fluctuations.

Innovative financing solutions are further breaking down adoption barriers. Fintech companies are introducing micro-leasing programs and pay-per-use battery subscriptions, which help informal-sector drivers avoid hefty upfront costs. Meanwhile, battery-swapping networks like Spiro are tackling range anxiety. With 22,000 e-bikes and 600 swapping stations, Spiro is making EV ownership more practical by eliminating the need for costly battery purchases.

Africa’s EV market is clearly on a fast track, fueled by a mix of technological advancements, resource advantages, and creative financial models.

Market Drivers and Challenges

Factors Accelerating EV Adoption

Africa’s electric vehicle (EV) market is picking up speed, driven by a mix of economic incentives, government policies, and creative business models. One of the strongest motivators is the Total Cost of Ownership (TCO), which already tilts in favor of EVs in many cases – especially for high-mileage users like taxis and delivery services. Over a five-year period, electric two-wheelers cost about 25% less than their internal combustion engine (ICE) counterparts, thanks to savings on fuel and maintenance.

Government policies are also playing a big role in this shift. In October 2023, Ethiopia introduced a policy that exempts electric vehicles from VAT, surtax, and excise tax. It also became the first country in the world to ban ICE passenger vehicle imports. Similarly, Rwanda has committed to banning ICE motorcycles in Kigali by 2025. These aggressive moves are speeding up EV adoption far beyond what organic market demand could achieve on its own.

Electric two-wheelers are leading the way, with a 38% year-over-year growth as of mid-2025. Companies like Roam are stepping up to meet demand, opening a production plant in Nairobi in July 2023 capable of manufacturing 50,000 electric motorcycles annually. Spiro has also partnered with the Ugandan government in a five-year initiative to replace 140,000 ICE motorbikes with electric models and establish a battery-swapping network. In Rwanda, Ampersand has seen overwhelming interest, with a waitlist of over 7,000 drivers in Kigali as of March 2023.

Beyond environmental goals, EV adoption is being fueled by practical concerns like reducing costly fossil fuel imports and addressing the health risks of urban air pollution. In 2019, air pollution was linked to 1.1 million deaths across Africa. On top of that, Africa’s rich natural resources and growing local manufacturing capabilities are laying the groundwork for a more sustainable EV industry. Still, while these factors push the market forward, significant hurdles remain.

Barriers to EV Adoption

Even with favorable TCO and policy support, major challenges persist. One of the biggest obstacles is the unreliability of the power grid. As Rose Mutiso, Research Director at Energy for Growth Hub, explains:

Africa’s grids are not ready for large-scale EV adoption. Most countries would need to divert more than a fifth of their ten-year electricity demand growth to support a 30% conversion of road transportation to EVs.

To put it in perspective, the 2020 System Average Interruption Disruption Index (SAIDI) for sub-Saharan Africa was 39.30, compared to just 0.87 for high-income OECD countries. Currently, only eight African countries meet high grid reliability standards.

Affordability is another stumbling block. Around 85% of four-wheel vehicle sales in sub-Saharan Africa are used cars, typically priced between $6,000 and $10,000. For new EVs, competing with these low-cost options is tough. For instance, electric two-wheelers cost about $1,700–$1,800, while ICE models are priced closer to $1,300. This upfront cost difference makes EVs less accessible, even though they offer long-term savings.

Charging infrastructure is also a challenge, especially in rural areas. The high costs of Level 3 DC fast chargers limit the expansion of charging networks. While battery-swapping models have helped make electric two-wheelers more practical, four-wheel EVs still depend on costly fast-charging solutions to stay viable for commercial use. Without stricter regulations, there’s also the risk, as McKinsey warns, that Africa could become:

a dumping ground for used ICE vehicles while the rest of the world transitions to an electric transport future.

Despite these obstacles, they’re inspiring creative solutions. From battery-swapping networks to localized manufacturing and financing models tailored to the region, innovators are finding ways to address Africa’s unique challenges in the EV space.

Charging Infrastructure and Technology Development

Expansion of Charging Networks

Urban areas are seeing a rapid rollout of Level 2 charging networks, especially in cities like Johannesburg, Nairobi, and Lagos. These chargers, commonly installed at homes and workplaces, cost between $200 and $1,000 per unit to set up. For commercial fleets like taxis and delivery vans, more powerful Level 3 DC fast chargers are essential, though they come with a hefty price tag of tens of thousands of dollars each.

South Africa leads the continent with around 316 public charging stations, most of which are concentrated in the Gauteng region. In March 2025, Lagos made headlines by opening Africa’s largest fast-charging station, powered by a hybrid solar-storage system designed to handle the region’s grid instability. As of 2024, AC slow charging dominated the market with a 68.61% share, while DC fast charging is expected to grow significantly, with a projected annual growth rate of 57.21% through 2030.

In rural areas where electricity access is limited, solar-powered mini-grids are proving to be a practical solution. These systems are particularly effective for charging electric two-wheelers, which use smaller batteries. This growing network is also laying the groundwork for new vehicle technologies that improve efficiency and expand accessibility.

New Technologies in Electric Vehicles

Battery-swapping systems are revolutionizing operations for two-wheelers. Instead of waiting hours to recharge, motorcycle taxi drivers can simply exchange their depleted batteries for fully charged ones at swap stations. Spiro’s network, which has already processed over 9 million swaps, eliminates the need for drivers to bear the upfront cost of batteries – they only pay for the energy they consume.

In addition to battery-swapping, green hydrogen and solid-state batteries are making waves. South Africa is investing approximately $6.4 billion (EUR 4.7 billion) into a green-hydrogen program, aiming to support fuel-cell electric vehicles for mining and long-distance freight starting after 2027. The country’s abundant platinum reserves provide a strategic edge in producing the fuel cells required for this technology. Meanwhile, solid-state batteries, known for their higher energy density and enhanced safety, are expected to grow at a 57.62% annual rate between 2025 and 2030, with particular focus on premium SUVs and buses.

Advances in grid technology are also gaining traction. With only eight African countries currently meeting high grid reliability standards, solutions like managed charging and vehicle-to-grid (V2G) systems are being explored to help stabilize fragile power grids. These technologies could address the challenge highlighted by Rose Mutiso, who noted that most African nations would need to allocate over 20% of their projected ten-year electricity demand growth to achieve a 30% EV adoption rate. Additionally, companies like Drivelectric and Kenya’s WEEE Centre are giving used EV batteries a second life by repurposing them for solar energy storage, contributing to a circular economy that extends the utility of these batteries beyond their original purpose.

sbb-itb-99e19e3

Country-Level Trends and Policies

Top EV Markets in Africa

Several African countries are stepping up as frontrunners in the electric vehicle (EV) space, fueled by strong market growth and increased infrastructure investments.

South Africa is leading the charge with 1,559 light-duty EVs and over 350 public charging stations. The country is pivoting from incentivizing EV consumption to supporting local manufacturing. Starting in 2026, South Africa will offer a 150% tax deduction for EV production.

Kenya has become a hub for electric two- and three-wheelers, with 8,421 units in use and 54 e-buses on the roads. The government’s VAT exemptions and reduced electricity tariffs for e-mobility have spurred a fivefold increase in EV registrations in 2023. By April 2024, Roam Electric and County Bus Service plan to roll out 200 electric buses by 2026. Meanwhile, BasiGo secured $42 million to deploy 1,000 electric buses across Kenya and Rwanda.

Morocco is positioning itself as a manufacturing powerhouse, with approximately $15 billion invested in EV and battery production. In June 2025, COBCO, a Sino-Moroccan joint venture, began producing EV battery materials with an annual capacity of 70 GWh – enough to power nearly 1 million vehicles.

Ethiopia made waves in 2024 by becoming the first country to ban internal combustion engine (ICE) vehicle imports. This bold move boosted EV registrations to over 60% of all new vehicle sales by early 2025.

Rwanda is leading the way in battery-swapping technology, particularly for motorcycle taxis, thanks to companies like Ampersand. The government has also eliminated import duties on electric vehicles and plans to ban ICE motorcycles in Kigali by 2025.

Nigeria introduced its National EV Policy in 2023, offering 10-year tax holidays for manufacturers and setting a goal for zero-emission vehicle sales by 2040. In March 2025, Lagos launched Africa’s largest fast-charging station, further solidifying its commitment to EVs.

Egypt is ahead in e-bus deployment with 200 units already in operation and a goal of reaching 20,000 EVs by 2030. Similarly, Ghana has implemented an eight-year zero-tariff policy for fully electric vehicle imports, helping the country secure a 29.31% revenue share in Africa’s EV market in 2024.

These developments underscore how strategic government policies are reshaping the EV landscape across the continent.

Government Policies Supporting EVs

Governments across Africa are accelerating EV adoption through a mix of fiscal incentives, infrastructure development, and renewable energy integration.

Tax incentives and duty waivers are central to these efforts. Rwanda and Ghana, for instance, impose 0% import duties on EVs, while Kenya offers VAT exemptions specifically for e-motorcycles and e-buses.

Public-private partnerships are also playing a crucial role. BasiGo’s $42 million funding round in 2024/2025 has enabled the deployment of 1,000 electric buses in Kenya and Rwanda, with 100 e-buses already serving thousands of daily passengers in Nairobi. Similarly, Moove is expanding EV ride-hailing fleets in Nigeria, South Africa, and Ghana, using a revenue-sharing model that allows drivers to eventually own their vehicles.

Renewable energy is becoming a key part of the EV ecosystem. Nigeria’s fast-charging station in Lagos uses a hybrid solar-storage setup to address grid instability, while Kenya’s discounted electricity tariff for e-mobility lowers operational costs for businesses. Ethiopia’s duty-free status for Completely Knocked Down (CKD) kits supports local assembly, cutting costs and creating jobs.

These coordinated strategies highlight the importance of investing not just in vehicles but also in charging infrastructure and sustainable energy systems to ensure long-term success in the EV market.

4 Business Strategies Changing Africa’s EV Game

Conclusion

Africa’s electric vehicle (EV) market is poised for impressive growth by 2030, largely fueled by commercial use rather than private ownership. As of May 2025, there are already over 30,000 active EVs on the continent, and the momentum shows no signs of slowing down. In key regions, the total vehicle count is expected to rise from 25 million to 58 million by 2040, with electric two-wheelers projected to dominate, capturing 50% to 70% of all sales in Sub-Saharan Africa.

Closing infrastructure gaps is critical, especially for high-demand fleets like motorcycle taxis and buses. Kenya has demonstrated how cost efficiency can make EVs an appealing choice for commercial operators, with the total cost of ownership proving to be a strong selling point. Expanding battery-swapping networks and installing DC fast-charging stations at commercial hubs will be vital for scaling these operations effectively.

In addition to infrastructure advancements, government initiatives are playing a key role in propelling the EV market forward. Supportive policies are providing the stability and confidence needed for long-term investments. This combination of policy support and infrastructure development creates a fertile ground for platforms like EV24.africa to streamline market integration.

Improved market insights are also giving investors the clarity they need to scale their operations effectively. However, sustained success will depend on aligning fiscal policies and infrastructure investments to cater specifically to high-utilization commercial segments.

Platforms like EV24.africa are pivotal in this transition, connecting buyers and sellers across all 54 African nations. They provide transparent pricing, financing options, and access to top EV brands. With Africa’s motorization rate at just 43 vehicles per 1,000 people – far below the global average of 197 – the potential for growth in sustainable mobility is massive.

FAQs

What is driving the growth of the electric vehicle (EV) market in Africa?

Africa’s electric vehicle (EV) market is gaining momentum, thanks to a mix of supportive policies, rising fuel prices, and technological progress. Governments in countries like Kenya, Ethiopia, and South Africa are stepping up with tax breaks, reduced import duties, and incentives aimed at making EVs more affordable and boosting local production. These measures are helping to lower the initial costs for both consumers and businesses.

At the same time, growing concerns about climate change and air pollution are pushing more people toward cleaner, zero-emission transportation options. Advances in technology, such as improved battery performance and the rise of local manufacturing hubs, are also making EVs more accessible. On top of that, renewable energy projects, including solar-powered charging stations, are expanding infrastructure and tackling issues like unreliable power supplies. Combined, these developments are laying the groundwork for a thriving EV market, which is expected to hit $28 billion in value by 2030.

How are government policies driving the growth of electric vehicles in Africa?

Government policies are playing a major role in speeding up the adoption of electric vehicles (EVs) across Africa. Several countries are introducing tax incentives and import duty reductions to make EVs more affordable. For example, South Africa offers a 150% tax deduction for investments in EV-related projects. Meanwhile, Kenya, Ethiopia, and Rwanda have either reduced or completely removed import taxes and value-added tax (VAT) on EVs. Ethiopia is taking an even bolder step by banning the import of new gasoline and diesel vehicles starting in 2024, showing a strong commitment to electrification.

Beyond tax breaks, governments are focusing on charging infrastructure and local production. South Africa provides subsidies to support the construction of charging stations and grants to encourage domestic EV manufacturing. Ethiopia’s renewable energy initiatives are driving down electricity costs, making EV ownership more affordable in the long run. Additionally, countries like Rwanda and Ethiopia have introduced financing programs to help reduce the upfront costs of purchasing EVs.

By combining tax incentives, infrastructure investments, and financing options, these policies are making EVs more accessible and affordable. This coordinated approach is setting the stage for Africa to experience substantial growth in electric mobility by 2030.

What are the main challenges Africa faces in developing EV infrastructure, and how are they being addressed?

Africa is grappling with several hurdles in building its EV infrastructure. One major issue is the lack of public charging stations, which creates range anxiety for potential buyers and discourages fleet operators from transitioning to electric vehicles. On top of that, the high upfront costs of EVs – largely due to reliance on imports and limited local production – make them out of reach for many consumers. Another significant challenge is the unreliable electricity grids in many areas, which complicates the rollout of traditional charging stations. Lastly, fragmented regulations and financing gaps slow down the pace of investments needed to develop the infrastructure.

Governments across the continent are stepping in with initiatives to tackle these challenges. Measures like tax breaks and reduced import duties aim to lower costs and attract private-sector investment. To address grid limitations, renewable energy-powered charging stations, especially those using solar and wind energy, are being set up in off-grid and rural areas. Countries such as Kenya, Ethiopia, Rwanda, and South Africa are also focusing on local manufacturing and battery recycling, which not only reduces reliance on imports but also helps establish a domestic supply chain. Additionally, public-private partnerships and creative financing solutions – like leasing programs and microloans for smaller EVs – are making it easier to expand infrastructure and bring EV ownership within reach for more people.