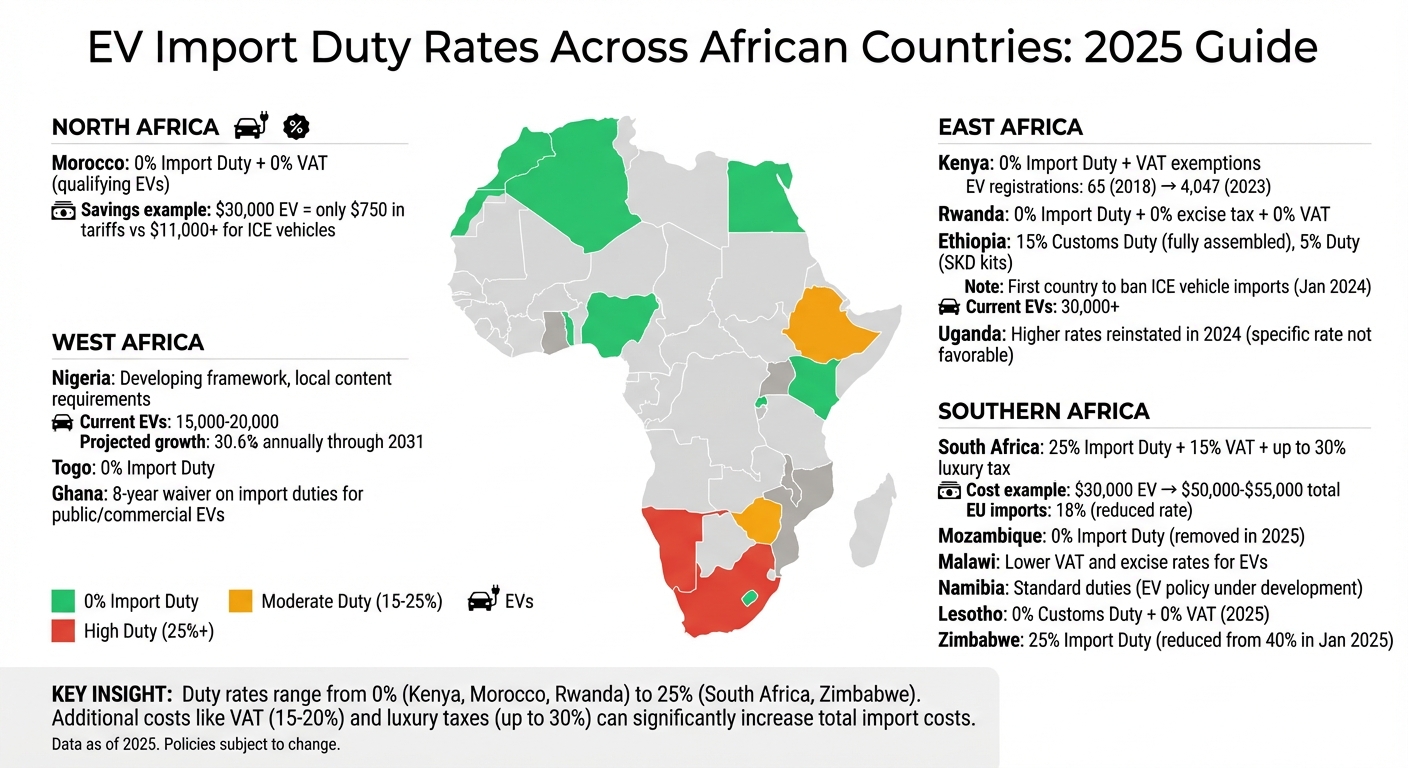

Electric vehicle (EV) import duties in Africa vary widely, directly affecting their affordability. Some countries, like Kenya and Morocco, have zero import duties, making EVs more accessible, while others, like South Africa and Uganda, impose tariffs as high as 25%, significantly increasing costs. These policies impact EV adoption rates, with additional charges like VAT, luxury taxes, and shipping further inflating prices. For example, importing a $30,000 EV into South Africa can cost $50,000–$55,000 after taxes, while Morocco’s zero-duty policy saves buyers up to $13,000.

Key insights:

- Kenya & Morocco: 0% import duty on EVs.

- South Africa: 25% duty, plus VAT and luxury taxes.

- Rwanda: Full tax exemptions for EVs.

- Ethiopia: Banned combustion engine imports; 15% duty on EVs.

- Mozambique: Removed all EV import duties in 2025.

For buyers, platforms like EV24.africa simplify cost calculations by breaking down duties, VAT, and other fees, helping you compare costs across countries before purchasing. Policies are evolving, so staying informed is essential for navigating Africa’s EV market.

EV Import Duty Rates Across African Countries 2025

North Africa: Import Duty Policies

Morocco’s Zero-Duty Policy for EVs

Morocco has made significant strides in promoting electric vehicles (EVs) by slashing customs duties for qualifying EVs. For instance, a $30,000 EV now incurs just $750 in tariffs, compared to over $11,000 for a traditional internal combustion engine (ICE) vehicle. Additionally, EVs that meet the criteria are exempt from the standard 20% VAT, leaving buyers responsible for only $200–$800 in administrative and port fees.

To qualify for these benefits, vehicles must meet specific requirements: they must be fully electric (not hybrids), have a minimum battery capacity, and include a Certificate of Conformity (CoC). In contrast, ICE vehicles face much steeper costs, including customs duties of 10–17.5%, a 20% VAT, and a 0.25% parafiscal tax – resulting in total fees ranging from 32–55% of the vehicle’s value.

This policy aligns with Morocco’s ambitious $2.3 billion plan to establish itself as a regional EV hub, with a production capacity goal of 1 million vehicles by 2025.

In a notable development, U.S.-based Cenntro Inc. partnered with Electricove Maroc in November 2025 to locally assemble EV models, taking full advantage of the duty exemptions. Among their plans is an $11,000 EV set to launch in 2026, targeting the regional market. Philip Carter of AInvest News highlighted the strategic importance of this move:

"Morocco’s $11,000 EV in 2026 is more than a product – it is a calculated move to anchor the country as a regional EV powerhouse."

These regulatory measures have sparked additional initiatives across the region.

North Africa’s Growing EV Incentives

Morocco is leading the charge in EV adoption across North Africa, with brands like BYD, Citroën, and Dacia driving market growth. The Moroccan EV market is forecasted to expand from $150 million in 2025 to $650 million by 2030, reflecting a compound annual growth rate of 33.9%.

To support this growth, the country plans to increase its charging infrastructure from 1,000 stations in 2023 to 3,500 stations by 2026, with a longer-term goal of 5,000 stations by 2028. In 2023, Moroccan private sector companies committed $140 million to install these 5,000 stations, prioritizing high-traffic highways and urban hubs like Casablanca and Rabat. To further reduce the cost of EV ownership, Morocco offers green electricity subsidies of $0.02 per kilowatt-hour. Additionally, a national mandate requires that 30% of the state’s vehicle fleet be electric or hybrid, further advancing the adoption of cleaner transportation options.

East Africa: Tax Reductions and Import Bans

Kenya: 0% Import Duty on EVs

Kenya has taken bold steps to encourage electric vehicle (EV) adoption by removing excise duties on EVs and offering VAT exemptions on EVs, batteries, and charging equipment. This strategy significantly reduces the upfront costs for consumers. Samuel Kamunya, Head of Business Development at BasiGo, highlighted the impact of these measures:

"When you reduce that upfront cost by eliminating taxes and duties on EVs, you’re increasing adoption."

The results are evident: EV registrations in Kenya surged from just 65 vehicles in 2018 to 4,047 in 2023. To further support this growth, the government has committed 6 billion Kenyan shillings (about $39.5 million) to set up 10,000 public charging stations by 2030.

Rwanda: Full Tax Exemptions for EVs

Rwanda has gone even further than Kenya, offering a zero-tax regime for EVs. This includes exemptions from import duties, excise taxes, and VAT, with these incentives extended through fiscal year 2024/25 to promote EV adoption. For luxury vehicles valued at over $60,000 CIF, Rwanda also waives the 25% Common External Tariff to support sectors like tourism and high-profile events.

However, Rwanda faces logistical hurdles as a landlocked nation. EV components often arrive via Kenya, leading to potential delays of up to 14 days at customs and border control. Despite these challenges, the tax incentives make EVs a more attractive option compared to internal combustion engine (ICE) vehicles, which are subject to higher costs.

Ethiopia and Uganda: Different Policy Directions

Ethiopia made a groundbreaking move in January 2024 by becoming the first country in the world to ban the import of internal combustion engine vehicles. This decision aims to reduce reliance on costly fossil fuels and accelerate the shift to a greener economy. As of mid-2024, Ethiopia has over 30,000 EVs on its roads and plans to reach 148,000 passenger EVs and 4,855 commercial EVs by 2032. The country has implemented a favorable tax structure for EVs: fully assembled EVs face a 15% customs duty, while semi-knocked-down (SKD) kits enjoy a reduced 5% duty. Nine Ethiopian companies are currently assembling vehicles from these kits, producing models from brands like Kia, Hyundai, Isuzu, Peugeot, and IVECO. In addition, Addis Ababa invested $15 million in 2022 to acquire 110 electric buses, signaling a strong commitment to electrifying public transport.

Uganda, on the other hand, has taken a different path. After briefly lowering EV import duties, the country reverted to higher rates in 2024, contrasting sharply with Ethiopia’s decisive policies. This rollback has created uncertainty in Uganda’s EV market, making it less competitive compared to its regional counterparts.

Southern Africa: High Duties and Recent Changes

South Africa: High Import Duties Remain

South Africa stands out for imposing some of the steepest import duties on electric vehicles (EVs) in the region. EVs face a 25% import duty, which is notably higher than the 18% duty applied to internal combustion engine vehicles (ICEVs). This policy is designed to protect the local automotive industry and encourage global manufacturers to establish production facilities in South Africa instead of relying on imports.

Dr. Norman Lamprecht from the Automotive Business Council (NAAMSA) shed light on the strategy:

"South Africa’s policy aims to nurture local EV production through free trade agreements… we need to start building these vehicles in South Africa."

Beyond the import duty, additional costs include a 15% VAT applied to all vehicles, and luxury models priced over $50,000 also incur an ad valorem tax of up to 30%. However, vehicles imported from the European Union (EU) under Free Trade Agreements benefit from a 7% reduction in duties, lowering the rate to 18%.

The tax structure has drawn criticism. Tesla CEO Elon Musk described South Africa’s import duties as "super high", making the market challenging for Tesla’s entry. Despite these hurdles, EV sales are growing steadily. Between January and September 2024, new EV registrations climbed to 1,079 units, compared to 720 during the same period in 2023.

In December 2024, South Africa introduced a 150% tax incentive for manufacturers of EVs and hydrogen-powered vehicles. However, this incentive focuses on production investments rather than consumer purchases and is set to take effect in March 2026. Additionally, the government has allocated about $63.5 million (R964 million) over three years to support the shift toward electric mobility.

| Tax/Duty Type | Rate for EVs | Rate for ICEVs |

|---|---|---|

| Import Duty | 25% | 18% |

| VAT | 15% | 15% |

| Ad Valorem (Luxury) Tax | Up to 30% | Up to 30% |

| EU Tariff Reduction | 18% (7% reduction) | 11% (7% reduction) |

These high taxes highlight the challenges for EV buyers in South Africa, especially compared to neighboring countries like Mozambique, Malawi, and Namibia, which have adopted more favorable tax policies.

Mozambique and Malawi: Lower Taxes for EVs

In contrast to South Africa, Mozambique has completely removed import duties on EVs, making it one of the most appealing markets for electric vehicles in the region. This move aims to boost EV adoption and reduce reliance on imported fossil fuels.

Malawi has also taken steps to make EVs more affordable by applying lower VAT and excise rates. While the exact rates depend on the vehicle’s type and value, these measures help narrow the price gap between EVs and traditional vehicles, addressing one of the main barriers to EV adoption in developing markets.

Namibia: Developing a National EV Policy

Namibia is currently working on its own EV policy, aiming to follow the example of countries like Kenya and Rwanda, which have introduced tax incentives to encourage EV adoption. While the framework is still under development, the government has expressed a commitment to fostering electric mobility as part of its broader climate and energy goals.

For now, Namibia applies standard import duties to EVs, but the upcoming policy is expected to tackle several key areas. These include reducing import duties, setting up charging infrastructure standards, integrating EVs into the power grid, and exploring local assembly opportunities. The finalized policy will likely play a significant role in shaping the accessibility and growth of the EV market in Namibia.

West Africa: New Regulations and Trade Agreements

Nigeria: Advancing EV Adoption and Reducing Import Duties

Nigeria is taking bold steps to embrace electric mobility. In November 2025, the Nigerian Senate moved the Electric Vehicle Transition and Green Mobility Bill to its second reading, laying the groundwork for a structured regulatory framework for the EV industry. Unlike Kenya and Rwanda, which rely on straightforward tax breaks, Nigeria’s approach combines financial incentives with strict compliance measures and local manufacturing requirements.

The bill stipulates that only certified and registered entities can import, assemble, or sell EVs in Nigeria. Foreign automakers are required to set up local assembly plants within three years of starting operations. By 2030, at least 30% of EV components must be sourced locally. Non-compliance comes with steep penalties – unlicensed importers face fines of ₦500 million per shipment, roughly equivalent to the cost of nine or ten vehicles. Currently, Nigeria has an estimated 15,000 to 20,000 EVs on its roads, with demand projected to grow by 30.6% annually through 2031. To address infrastructure challenges, the legislation mandates that every fuel station in the country install EV charging points, a critical step toward supporting widespread EV adoption.

Sam Faleye, CEO of SAGLEV, expressed strong support for the bill, saying:

"This bill is at least 30 years overdue… Nigeria can’t remain a dumping ground for used cars while importing jobs that should exist here."

On the other hand, Stanley Awelewa, Senior Sales Manager of Tim International Group, raised concerns:

"A 30% local content requirement by 2030 may not be realistic given Nigeria’s current infrastructure and workforce constraints".

Meanwhile, other West African nations are also implementing EV-friendly policies. Togo, for example, has removed all import duties on electric vehicles to encourage green mobility and lower carbon emissions. Ghana offers an eight-year waiver on import duties for EVs used in public transportation and commercial operations, including semi-knocked down (SKD) and completely knocked down (CKD) EV kits. These efforts are paving the way for broader regional reforms in the EV market.

How AfCFTA Affects EV Import Costs

In addition to these national initiatives, the African Continental Free Trade Area (AfCFTA) is reshaping EV import economics across the continent. With 54 countries signed on since July 2019, AfCFTA aims to eliminate tariffs on 90% of goods, creating the largest free trade area in the world. Previously, intra-African trade faced an average tariff of 6.1%, a barrier that AfCFTA is working to eliminate. For the EV sector, this means reduced costs for cross-border trade and greater access to regional markets, potentially increasing intra-African trade by 52.3%.

AfCFTA also complements existing regional frameworks like the West African Monetary Union and the West African Monetary Zone. By encouraging a shift from raw material exports to value-added products, such as finished goods and machine parts, AfCFTA aligns closely with Nigeria’s local content goals. This could lead to the emergence of regional EV assembly hubs, strengthening supply chains across West Africa. As countries harmonize their EV policies under the AfCFTA framework, they stand to benefit from lower import costs and more integrated regional manufacturing networks.

sbb-itb-99e19e3

Using EV24.africa to Calculate Import Costs

Tools for Estimating Total Costs

Importing an electric vehicle (EV) involves more than just the price tag you see on the car. EV24.africa simplifies the process by breaking down all associated costs – like the base price, country-specific duties, VAT, and delivery fees – into a clear, upfront total. As Easyship explains:

"We make sure that you know upfront how much to pay so you can avoid unpleasant surprises and shipment delays in the future."

This detailed cost breakdown empowers buyers to make well-informed decisions by comparing all expenses upfront. By taking the guesswork out of cost calculations, EV24.africa makes adopting EVs across Africa a smoother and more straightforward process.

Why Choose EV24.africa for EV Purchases

EV24.africa doesn’t stop at cost transparency – it also provides a seamless buying experience with plenty of options and support. The platform offers a wide range of EVs, including brands like Tesla, BYD, Leapmotor, ROX, Dongfeng, Geely, Hyundai, Toyota, and Suzuki. Whether you’re looking for a new or used vehicle, EV24.africa has options to suit your needs, along with flexible financing plans to make ownership more achievable.

To help you make the best choice, the platform provides expert advice, detailed vehicle specifications, and customer reviews. For buyers, single listings are free, while dealers can take advantage of bulk listing options that boost visibility. With transparent pricing and comprehensive support, EV24.africa simplifies the often-complicated process of importing EVs, making it easier for buyers across Africa to navigate the market confidently.

Conclusion

What to Know About EV Import Duties

The varying import duties on electric vehicles (EVs) across Africa reveal the need for careful cost analysis, as highlighted in this guide. Policies differ widely, leading to significant price disparities. For example, Mozambique abolished its 20% EV import duty in 2025, while Lesotho removed both customs duties and VAT on EVs starting the same year. Zimbabwe, on the other hand, reduced its EV import duty from 40% to 25%, effective January 1, 2025. These examples illustrate the range of approaches, from Mozambique’s zero-duty policy to South Africa’s 25% tariff, emphasizing the importance of calculating total costs before purchasing. Morocco also provides full exemptions on duties and VAT for EVs that meet specific technical standards.

Additional costs, such as VAT and parafiscal taxes, further complicate the picture. In Morocco, for instance, a 20% VAT is applied to the combined customs value and duties. This means a $34,000 EV would incur an additional $6,800 in VAT alone. Countries like Lesotho, which grant exemptions on both duties and VAT, offer the most savings to buyers.

International trade agreements also play a role in shaping import policies. Mozambique, for instance, aligns its tariff reductions with agreements like the Economic Partnership Agreement and the African Continental Free Trade Area (AfCFTA), creating more favorable conditions for EV imports.

Understanding these policies is essential for navigating Africa’s EV market effectively, and it sets the stage for how EV24.africa simplifies the process.

How EV24.africa Makes Importing Easier

With the complexity of import duties, EV24.africa steps in to simplify the process. The platform provides clear, upfront breakdowns of all costs, including country-specific duties, VAT, and delivery fees, helping buyers understand the total expense before making a purchase. This transparency allows for easy comparison of costs across African markets, removing unexpected surprises.

EV24.africa also offers a broad selection of new and used EVs from brands like Tesla, BYD, Leapmotor, and Toyota. Combined with flexible financing options, detailed cost breakdowns, and delivery to all 54 African countries, the platform equips buyers with the tools they need to navigate the growing EV market. Whether you’re dealing with Morocco’s technical requirements or benefiting from Kenya’s zero-duty policy, EV24.africa takes the guesswork out of EV importing, making the process easier and more accessible.

EV adoption stalls as import taxes return

FAQs

What factors influence the cost of importing an electric vehicle (EV) to Africa?

The price of importing an EV to Africa depends on several factors, starting with import duties and tariffs, which vary greatly by country. For example, Rwanda imposes no import duties on EVs, while South Africa charges up to 25%. These tariffs, combined with additional taxes like VAT, excise taxes, or luxury levies, can significantly drive up the cost. However, some countries offset these expenses by offering tax exemptions or reductions specifically for EVs.

Another major consideration is shipping and logistics costs, which typically range between $1,200 and $4,500, depending on the shipping method and destination. On top of that, documentation requirements – such as certificates of origin, safety certifications, and invoices – must be met. Missing or incomplete paperwork can lead to delays and additional fees. Age restrictions on vehicles also play a role; for instance, Nigeria enforces a 10-year limit on imported cars. Additionally, national policies, like tax incentives for assembling EV kits locally, can either reduce or increase the overall cost of bringing an EV into the market.

All these factors combined influence how affordable and accessible EVs are across various African countries.

How do import duties affect the adoption of electric vehicles in African countries?

Import duties play a major role in shaping the affordability and growth of electric vehicles (EVs) across Africa. Some countries are leading the way with tax reforms aimed at making EVs more accessible. Take Rwanda, for instance – it has completely removed import duties on EVs, offering a 0% import duty alongside tax incentives that extend until 2028. Similarly, Malawi has cut its VAT to 8%, and these measures have made EVs more affordable, boosting adoption rates. Morocco has also introduced tax cuts that can significantly lower fees on a $25,000 EV to just $200–$800. For comparison, traditional vehicles in Morocco face fees ranging from $8,000 to $13,750. These policies are encouraging a noticeable rise in EV imports in these regions.

On the other hand, high tariffs in some countries are slowing progress. In South Africa, for example, EVs are subject to a 25% import duty, compared to just 18% for gas-powered cars. This disparity makes EVs less accessible to many consumers. Kenya also imposes a 25% import duty along with a 10% excise tax, which adds over $5,000 to the price of a $30,000 EV. Meanwhile, Nigeria faces additional challenges with inconsistent duty regulations, creating uncertainty for importers and further hindering EV adoption. These contrasting examples underscore the importance of reducing import duties to drive EV adoption across the continent.

What incentives do African countries offer to EV manufacturers?

Many African nations are rolling out incentives to encourage electric vehicle (EV) production and attract manufacturers to set up operations locally.

In Ethiopia, manufacturers establishing assembly plants benefit from importing completely knocked-down (CKD) kits tax-free. They also receive duty waivers on parts, which helps cut down production costs. Rwanda goes even further, offering exemptions on VAT, customs duties, excise taxes, and withholding taxes for EV units, batteries, and charging equipment. These benefits are available until June 30, 2028. Meanwhile, South Africa provides a 150% tax deduction on qualifying investments in EV manufacturing, making it more appealing for companies to build new facilities. Uganda supports its local producers with exemptions on VAT, stamp duty, and corporate income tax, alongside additional perks for manufacturers that meet local content requirements.

These measures are designed to reduce costs, attract investments, and speed up the development of Africa’s EV industry.