Africa’s electric vehicle (EV) market is growing, but high upfront costs and limited access to financing remain major barriers. To address this, governments, banks, and private companies are introducing new ways to make EVs more affordable. Here’s what you need to know:

- Government Incentives: South Africa offers tax breaks for EV production, while Rwanda eliminates VAT on imports and caps electricity tariffs for charging.

- Bank Loans: Programs like Uganda Development Bank’s asset financing make EVs accessible without requiring traditional collateral.

- Private Sector Models: Pay-As-You-Go systems and Battery-as-a-Service reduce upfront costs for two- and three-wheelers.

- International Funding: Development finance institutions like the African Development Bank provide concessional loans to support EV adoption.

- Platforms like EV24.africa: These simplify the process of finding and financing EVs with flexible payment plans.

Whether you’re an individual buyer or a business, these options can help you navigate the financial challenges of EV ownership. Each approach has its pros and cons, depending on your needs and budget.

The Funding Gap in Africa’s EV Race

Government Programs and Policies for EV Financing

African governments are stepping up with initiatives aimed at cutting costs and encouraging local EV production. These efforts include tax breaks for manufacturers and waivers on import duties, both of which help lower the purchase price for consumers. However, only 39% of African nations currently offer binding EV incentives, signaling a need for stronger policies to address the high initial costs of EVs. South Africa and Rwanda provide notable examples of such measures in action.

South Africa: Tax Breaks to Drive EV Production

South Africa has introduced a significant tax incentive to promote the production of battery-electric and hydrogen-powered vehicles. Starting March 1, 2026, manufacturers can claim a 150% tax allowance on qualifying investments in new plants, machinery, and buildings. This policy, announced by Finance Minister Enoch Godongwana in February 2024 and signed into law by President Cyril Ramaphosa, will remain in effect for 10 years, covering assets brought into use between March 2026 and March 2036.

This initiative is not just about boosting local production; it’s also a strategic move to protect South Africa’s automotive exports. Currently, about 46% of the vehicles produced in South Africa are exported to regions like the European Union and Britain, where EV regulations are becoming more stringent. To prevent misuse of the incentive, a 50% recoupment rule applies if manufacturers sell or repurpose the asset within five years.

"We are committed to working hand-in-hand with the private sector to promote the production of new energy vehicles and the development of the necessary infrastructure to support them."

– Cyril Ramaphosa, President of South Africa

Ramaphosa has also emphasized the need for consumer-focused incentives, such as tax rebates, to further accelerate EV adoption.

Rwanda: Tax Exemptions to Lower Costs

Rwanda is taking a different approach by focusing on fiscal exemptions to make EVs more affordable. Ranked 5th in Africa for EV readiness with a score of 0.74, Rwanda owes much of its progress to a supportive policy framework. The government has eliminated VAT on EV imports, making them cheaper than conventional vehicles. This is especially critical in a region where only 13% of people over the age of 15 have access to formal financial institutions for borrowing.

In addition to import tax exemptions, Rwanda offers capped electricity tariffs for EV charging and provides rent-free land for companies building charging infrastructure. Such measures significantly reduce both the upfront and operational costs of EV ownership. The country’s focus on two- and three-wheelers reflects the economic realities and transportation needs of its population, making EVs more accessible to everyday users.

While other African nations have introduced similar incentives, policy uncertainty remains a challenge. For example, countries like Kenya and Uganda have recently scaled back some of their EV tax benefits, complicating long-term planning for manufacturers and consumers alike. Still, these targeted policies play a key role in addressing the financial barriers to EV adoption, paving the way for broader accessibility.

Bank Loans and Local Financing Programs

Local banks and development institutions are stepping up to address the challenges of financing electric vehicles (EVs), even as high capital costs remain a hurdle. In African countries, the cost of capital for energy projects is 2–3 times higher than in advanced economies and China, making traditional loans pricier. Despite these challenges, some banks are introducing specialized financial products to make EV ownership more attainable for both individuals and businesses.

Uganda Development Bank‘s E-Motorcycle Financing

The Uganda Development Bank (UDB) has introduced an Asset Finance program specifically designed to help businesses acquire electric motorcycles and other EVs without depleting their working capital. Under this initiative, the EV itself serves as collateral, removing the need for borrowers to pledge land or property. This approach opens the door for small businesses and entrepreneurs who may not own real estate but rely on commercial vehicles for their operations.

Borrowers benefit from loan terms ranging from 2 to 8 years, along with grace periods that provide flexibility in repayment. This program is part of UDB’s broader efforts to promote climate-friendly investments while supporting improved operational efficiency for enterprises.

Meanwhile, South African banks are also starting to offer financing options tailored for EV buyers.

South African Banks’ EV-Specific Loans

In South Africa, banks are rolling out "green financing" packages aimed at facilitating EV purchases, though the market is still in its early stages. As of 2022, there were only about 1,000 electric vehicles in a total fleet of 12 million vehicles, highlighting the untapped potential of this sector. One major hurdle is the steep cost difference: the average EV price in South Africa is around $111,000, compared to $25,000 for a traditional car, leaving an $86,000 price gap that financing must help close.

To apply for these loans, applicants need to provide several documents, including three months of recent payslips, an employment letter, and six months of certified bank statements. Additionally, a pro-forma invoice from an authorized EV dealer is required, and once the loan is approved, a professional valuation report – such as one from the AA – must be submitted. For personal-use vehicles, banks typically require that the financed EVs be no older than seven years. Some financing packages even include maintenance services, such as battery checks and software updates, further incentivizing EV adoption.

International and Development Finance Programs

International funding plays a crucial role in strengthening Africa’s electric vehicle (EV) ecosystem, complementing national and local financing efforts. Despite Africa being home to one-fifth of the world’s population, it currently attracts only 3% of global energy investment. Development Finance Institutions (DFIs) are stepping up with concessional capital – loans offered at below-market interest rates – to reduce risks for private investors. By 2030, an estimated $28 billion in concessional capital will be required to mobilize $90 billion in private investment for clean energy projects across the continent.

African Development Bank‘s SEFA Program

The African Development Bank (AfDB) manages the Sustainable Energy Fund for Africa (SEFA), which provides technical support and concessional loans to encourage private sector investment in renewable energy. A notable example is SEFA’s $4 million reimbursable grant approved in July 2025 for the Burn Electric Cooking Expansion Program (BEEP). This initiative aims to distribute 115,000 IoT-enabled induction cookers across Kenya, Uganda, and Zambia. By leveraging carbon credit sales in voluntary markets, the program subsidizes costs for end-users, making clean energy solutions more affordable.

"This marks the Bank’s first carbon finance transaction of its kind, with SEFA playing a critical role in mitigating carbon market risks and enhancing the Program’s financial sustainability." – Dr. Daniel Schroth, Director for Renewable Energy and Energy Efficiency, African Development Bank Group

SEFA’s strategy focuses on breaking down market barriers by improving the risk-return profile of renewable energy investments, making it easier for private companies to secure additional funding.

Africa50 and BII Support for BasiGo E-Buses

Africa50 and British International Investment (BII) are also making strides by investing in BasiGo, a Kenyan e-mobility startup focused on electric bus fleets for public transportation. BasiGo offers a pay-per-kilometer financing model, which eliminates the significant upfront costs typically associated with electric buses. This allows transport operators to transition to greener mobility without straining their budgets.

In Kenya, where an electric vehicle costs around $38,000 compared to $7,600 for a gasoline-powered equivalent, this financing model is a game-changer. Additionally, BasiGo supports the local assembly of electric buses, creating jobs and reducing the influx of low-quality imports. By tailoring its financing structure for high-utilization fleets, the company maximizes emission reductions while ensuring financial sustainability for operators.

IFC and AfricaGoGreen’s Investment in Ampersand

The International Finance Corporation (IFC) and AfricaGoGreen have teamed up to invest in Ampersand, a company that operates electric motorcycle networks and battery-swapping infrastructure across East Africa. Ampersand’s battery-as-a-service model allows drivers to exchange depleted batteries for fully charged ones in just minutes, addressing range anxiety and minimizing downtime. This is especially beneficial for motorcycle taxi drivers, who depend on their vehicles for daily income, as it reduces operational disruptions and lowers fuel expenses.

sbb-itb-99e19e3

Private Sector Leasing Models and Partnerships

Across Africa, private companies are introducing flexible leasing programs that remove the burden of steep upfront costs. These initiatives bring together EV dealers, banks, and infrastructure providers to create partnerships that make electric mobility more accessible for individuals and businesses. A standout example of this approach is the rise of Pay-As-You-Go (PayGo) systems, which are transforming how leasing solutions are structured.

Pay-As-You-Go Financing Models

PayGo models are making it easier for commercial drivers to access electric two-wheelers. In March 2023, a Kenyan program backed by $792,500 in catalytic grant funding from P4G launched 60 e-bikes and set up eight charging stations at three fuel sites. This program uses a daily payment structure that covers both the e-bike lease and charging costs, offering a more affordable alternative to traditional petrol-powered bikes by cutting down on fuel and maintenance expenses.

Watu Africa is another player in this space, running leasing programs for electric two- and three-wheelers in Kenya, Uganda, Nigeria, and Rwanda. These programs are particularly aimed at unbanked entrepreneurs, addressing a significant challenge in Sub-Saharan Africa, where access to traditional consumer credit is limited.

Fleet Leasing with Charging Support

Drivelectric Kenya has teamed up with commercial banks to offer up to 75% financing for electric vehicles. These leases come with integrated charging support, easing range anxiety for fleet operators. For larger financing facilities, businesses must provide documentation like board resolutions, tax PINs, and audited accounts.

In November 2025, Stanbic IBTC Bank partnered with LOXEA Nigeria, a subsidiary of CFAO Mobility, to promote BYD electric vehicles, including the ATTO 3 and Dolphin models. This partnership introduced reduced interest rates and vendor discounts to encourage adoption.

"By combining LOXEA BYD’s innovative electric and hybrid vehicles with our flexible financing, we are not just offering cars, we are driving a cleaner future." – Olu Delano, Executive Director, Stanbic IBTC Bank

Adding to these efforts, EV24.africa provides a marketplace designed to meet Africa’s specific EV financing needs.

EV24.africa‘s Financing and Leasing Options

EV24.africa simplifies the process of buying and financing electric vehicles by connecting buyers with flexible payment options for both new and used EVs. The platform offers transparent pricing, detailed vehicle comparisons, and streamlined purchasing processes. Operating across 54 African countries, it links buyers with financing partners, helping them secure payment plans that align with their budgets or business goals. Through this marketplace, buyers can review vehicle specifications, compare financing terms, and even coordinate delivery – all in one place tailored to the African EV market.

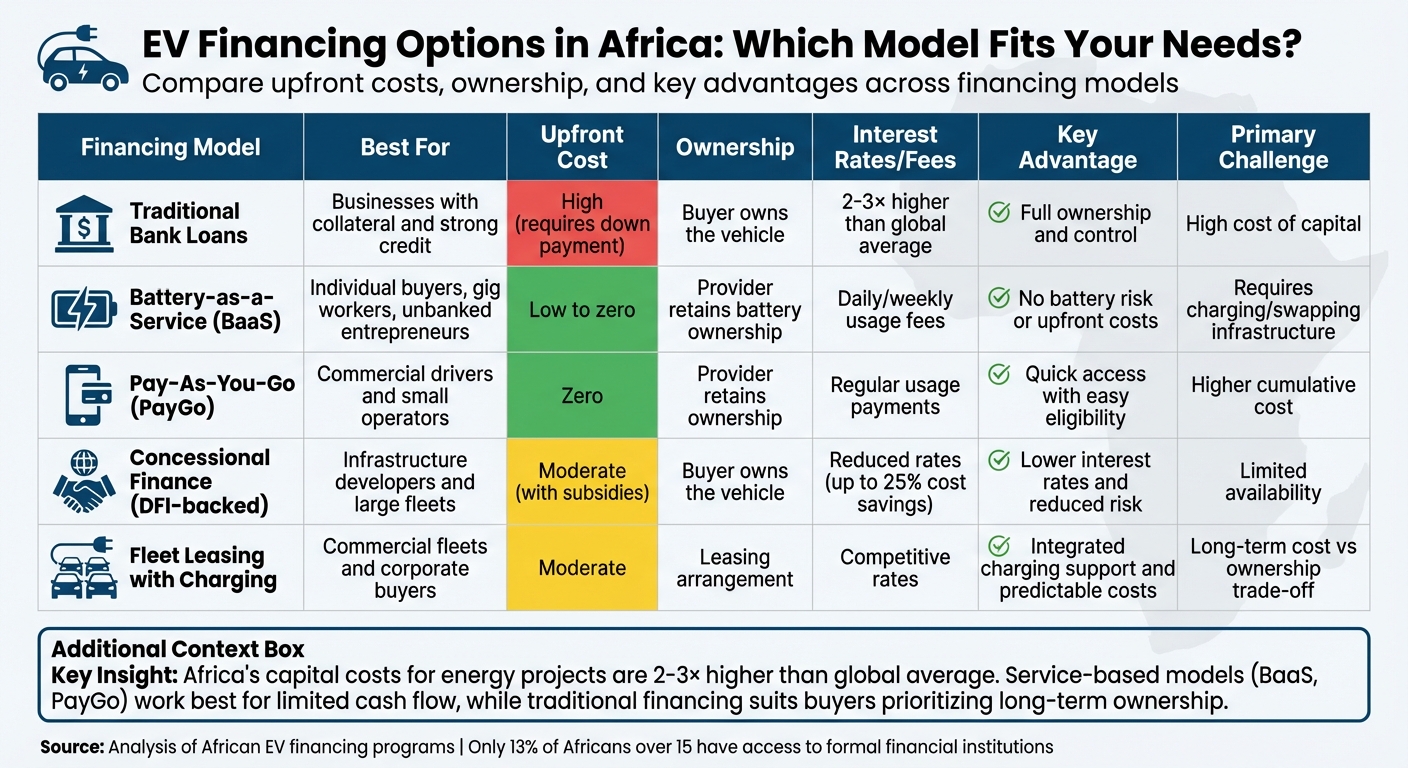

Comparing EV Financing and Leasing Options

EV Financing Options in Africa: Comparison of Models, Costs, and Benefits

Deciding between financing and leasing for an electric vehicle (EV) comes down to your financial situation and how you plan to use the vehicle. Traditional asset financing gives you full ownership but requires a significant down payment upfront. In Africa, capital costs for such financing tend to be 2–3 times higher than the global average, making it a costly option for many.

On the other hand, leasing and Battery-as-a-Service (BaaS) models remove the need for large upfront payments. These options make EVs more accessible, especially for entrepreneurs and small businesses that might find traditional financing out of reach. However, it’s worth noting that the total payments over time can exceed the cost of outright ownership. Some programs, particularly those supported by Development Finance Institutions, offer reduced interest rates through blended finance models. These programs can lower project costs by as much as 25%.

For businesses operating commercial fleets, traditional financing might be the better choice if the long-term savings justify the higher upfront costs. Electric two-wheelers, which are expected to dominate EV usage in countries like Kenya and Rwanda, are particularly appealing for commercial use due to their minimal charging needs and frequent fleet turnover. However, companies must weigh the uncertainty of EV resale values against the benefits of leasing, which often includes support for charging infrastructure.

These various options highlight the range of financing solutions available in Africa, each with its own advantages and challenges. The table below provides a concise comparison of these financing models.

Comparison Table of Financing Options

| Financing Model | Best For | Upfront Cost | Ownership | Interest Rates/Fees | Key Advantage | Primary Challenge |

|---|---|---|---|---|---|---|

| Traditional Bank Loans | Businesses with collateral and strong credit | High (requires down payment) | Buyer owns the vehicle | 2–3× higher than global average | Full ownership and control | High cost of capital |

| Battery-as-a-Service (BaaS) | Individual buyers, gig workers, unbanked entrepreneurs | Low to zero | Provider retains battery ownership | Daily/weekly usage fees | No battery risk or upfront costs | Requires charging/swapping infrastructure |

| Pay-As-You-Go (PayGo) | Commercial drivers and small operators | Zero | Provider retains ownership | Regular usage payments | Quick access with easy eligibility | Higher cumulative cost |

| Concessional Finance (DFI-backed) | Infrastructure developers and large fleets | Moderate (with subsidies) | Buyer owns the vehicle | Reduced rates (up to 25% cost savings) | Lower interest rates and reduced risk | Limited availability |

| Fleet Leasing with Charging | Commercial fleets and corporate buyers | Moderate | Leasing arrangement | Competitive rates | Integrated charging support and predictable costs | – |

Ultimately, the best option depends on whether you value immediate affordability or long-term ownership. Service-based models work well for those with limited cash flow, while traditional financing is better suited for buyers who prioritize full ownership and long-term cost efficiency.

How to Secure EV Financing Through EV24.africa

EV24.africa provides a straightforward way to access financing for electric vehicles (EVs), offering solutions tailored to individual and commercial needs. To get started, ensure your vehicle meets the eligibility criteria. For personal EVs, the vehicle must be less than 7 years old, while commercial vehicles may have stricter requirements. Once eligibility is confirmed, the platform connects you with local banking partners, offering financing for up to 75% of the vehicle’s value. Repayment terms can extend up to 48 months, giving you flexibility to manage payments over time.

The process begins with a digital application. You’ll need to complete a credit assessment through local agencies like the Credit Reference Bureau (CRB) to secure competitive interest rates and flexible terms. EV24.africa collaborates with leading financial institutions to make these terms accessible. After credit vetting, you can explore the platform’s listings, which feature top brands such as Tesla, BYD, and Leapmotor. From there, submit your details online, undergo credit verification, and await approval based on your financial profile and the vehicle you’ve selected. The platform’s digital-first approach ensures a seamless application experience.

Keep in mind that financing terms may vary depending on your location. Banking regulations and credit requirements differ across Africa, but EV24.africa’s network spans 54 African countries, offering region-specific options. If you’re in the commercial sector – such as operating a fleet or working as a taxi driver – there may be additional financing solutions tailored to your needs.

Conclusion

Financing for electric vehicles (EVs) in Africa involves a mix of government tax breaks, tailored loan options for motorcycles in countries like Kenya and Uganda, and creative business models. The steep upfront cost of EVs, particularly their batteries, has driven the rise of solutions like battery-as-a-service and pay-as-you-go financing, which aim to make EVs more accessible.

"Access to finance emerges as a notable weakness… Given the high upfront costs of EVs, improving access to financing will be crucial for accelerating adoption in these markets."

- Energy for Growth

These developments highlight the need to analyze and compare various financing strategies. In Africa, financing options range from traditional corporate loans for passenger cars to digital lending platforms designed for two-wheelers. This innovation is especially critical in a region where only 13% of those over 15 have access to formal financial services. However, in Kenya, where financial inclusion is around 40%, companies like M-KOPA and Watu Credit have successfully rolled out digital loan products specifically for electric motorcycles.

When exploring financing options, it’s important to consider the total cost of ownership, which may include bundled services like charging or battery replacement. Government incentives can also play a big role in reducing overall costs.

Platforms like EV24.africa are stepping in to connect buyers with regional banking partners, offering financing options that cover up to 75% of the cost over a 48-month period.

FAQs

What financing and leasing options are available for buying an EV in Africa?

When it comes to financing or leasing an electric vehicle (EV) in Africa, there are a few popular options to consider. These include installment plans, leasing agreements, and bank loans specifically created for EV buyers. In many cases, these options are backed by government subsidies or special programs that blend debt and equity financing, making EV ownership more attainable.

Additionally, both private and public sector initiatives are stepping in with tailored solutions. These can include asset-financing models or partnerships designed to lower the upfront costs of owning an EV. The goal is to help buyers overcome financial hurdles and make the switch to EVs more affordable.

What impact do government incentives in South Africa and Rwanda have on the affordability of EVs?

Government incentives in South Africa are playing a key role in making electric vehicles (EVs) more accessible by cutting both purchase and ownership expenses. Proposed initiatives include tax breaks, consumer subsidies, and policies designed to boost local EV production. For instance, South Africa’s Electric Vehicles White Paper outlines measures like a 150% tax deduction on EV manufacturing investments and a $54 million fund to support the production of EVs and their batteries. These steps aim to slash the upfront cost of EVs by several thousand dollars, helping them compete more effectively with traditional gas-powered cars.

In Rwanda, there’s increasing support for clean mobility. However, specific details about current incentive programs and their direct impact on EV affordability remain limited. Still, both nations are actively working to encourage EV adoption and ease financial hurdles for consumers.

How do international funding and private sector initiatives support EV adoption in Africa?

International funding organizations, such as the World Bank’s International Finance Corporation (IFC) and the Shell Foundation, play a key role in speeding up the adoption of electric vehicles (EVs) in Africa. By offering early-stage funding and risk-sharing measures, they support vital areas like charging infrastructure, electric vehicles (including two- and three-wheelers), and battery-electric buses. These initiatives help overcome regulatory hurdles and attract private investors, paving the way for growth in the e-mobility sector.

On the other hand, private sector efforts bring practical solutions to the table, such as leasing programs, battery-as-a-service models, and collaborations between local banks and global manufacturers. These approaches lower the upfront costs for buyers and fleet operators, making EVs more affordable. Together, international funding and private sector innovations are driving affordability, improving infrastructure, and encouraging long-term EV adoption across Africa.