Africa’s electric vehicle (EV) market is growing, but affordability is a major barrier. High upfront costs, limited financing options, and infrastructure challenges make EV adoption difficult for many buyers, especially in sub-Saharan Africa. By 2040, EV sales in key markets like Kenya, Uganda, and Nigeria could reach 3.8–4.9 million units, led by electric two-wheelers. However, achieving this requires billions in financing for vehicles, charging infrastructure, and local assembly.

Key takeaways:

- High Costs: EVs are expensive, and traditional loans often have high interest rates (20%+).

- Innovative Financing: Leasing, Battery-as-a-Service (BaaS), and microfinance are helping reduce upfront costs.

- Regional Differences: East Africa focuses on two-wheelers, while South Africa targets passenger EVs.

- Government Support: Policies like tax breaks in Rwanda and VAT exemptions in Kenya are improving affordability.

- Infrastructure Needs: Charging networks require $3.5–$8.9 billion in investment, with solar solutions gaining traction.

New financing models, such as pay-as-you-go systems and battery-swapping networks, are reshaping the market. Commercial fleets like motorcycle taxis and buses are driving adoption due to lower operating costs. Collaboration between governments, private lenders, and development organizations is critical to meet Africa’s EV goals.

How Africa Is Powering a New Electric Future – AU Transport Boss Breaks It Down

Current State of EV Financing in Africa

As of 2026, the landscape for financing electric vehicles (EVs) in Africa is still in its early stages. Traditional lenders remain cautious, largely because assessing the long-term resale value of EVs is a challenge. Banks struggle to establish the worth of EVs as collateral for auto loans, primarily due to a lack of data on how batteries degrade under African conditions. This uncertainty makes EV financing appear risky, leading to either outright loan rejections or interest rates so high that most buyers are effectively priced out.

The funding gap is massive. For electric two-wheelers alone, an estimated $3.5 billion to $8.9 billion is needed to cover the costs of vehicle purchases, charging infrastructure, and local assembly operations in countries like Ethiopia, Kenya, Nigeria, Rwanda, and Uganda. And that’s just the tip of the iceberg – additional capital is required for passenger EVs and fleet vehicles.

Despite these hurdles, there are glimmers of progress. Digital platforms and partnerships with banks are beginning to reshape the financing landscape. For example, EV24.africa has teamed up with local banks across several countries to offer flexible payment plans and leasing options. By breaking down upfront costs into manageable monthly installments, these programs align better with consumer cash flows. The focus here is on commercial operators – like motorcycle taxi drivers, delivery services, and shared transport providers – who can justify financing through steady, predictable income.

How Financing Access Varies by Region

Access to EV financing varies widely across Africa, influenced by tax policies and infrastructure development. For instance, Kenya and Uganda impose a 25% import duty and 14% VAT on EVs, while South Africa has proposed a 15% tax on EV batteries. These tax policies directly shape loan amounts and monthly payments, making entry into some markets significantly more expensive than others.

In East Africa, countries like Kenya, Rwanda, and Uganda have become hubs for electric two-wheeler financing. These markets prioritize motorcycles and three-wheelers, which are less dependent on extensive charging networks and offer quicker returns for commercial users. In Kenya, the operating costs for an EV are 47% to 83% lower than those of a gasoline-powered vehicle, depending on the vehicle type, making the financial case for EV adoption particularly strong. Tanzania leads the region, with an estimated 10,000 electric two- and three-wheelers on the road as of mid-2025.

South Africa, on the other hand, has taken a different path, focusing on light-duty passenger vehicles. By May 2025, the country had 1,559 such vehicles in operation. South Africa’s advanced banking sector provides better access to traditional auto loans, but interest rates for EVs remain higher than those for gasoline vehicles. Starting in 2026, a 150% tax deduction for EV production is expected to bolster local manufacturing, potentially driving down vehicle prices and improving loan terms over time.

In response to Africa’s unreliable power grids, financing models are increasingly tied to infrastructure solutions. In rural areas, lenders are bundling solar-powered charging systems with vehicle purchases or leases. This approach helps mitigate the risk of loan defaults caused by limited access to charging facilities. These region-specific approaches highlight the diverse challenges and opportunities shaping EV financing across the continent.

Barriers to EV Financing Growth

Several systemic issues continue to hinder the growth of EV financing. One major obstacle is the lack of financial products tailored specifically for EVs. Traditional loan models rely on outdated depreciation data designed for gasoline vehicles, which doesn’t account for the unique features and valuation challenges of EVs in African markets.

Another challenge is the limited credit history of potential buyers. Many commercial operators – the primary audience for EV financing – work within the informal economy. Without documented income or credit scores, they remain invisible to traditional banks, even when their daily earnings could comfortably cover loan payments.

High interest rates also pose a significant barrier. In many African markets, consumer asset financing comes with annual rates exceeding 20%, making EV ownership unattainable for most people. Without government-backed guarantees or subsidized lending programs, private lenders charge these premiums to offset the perceived risks.

Then there’s the infrastructure problem – a classic chicken-and-egg scenario. Banks are reluctant to finance EVs without reliable charging networks, but charging networks struggle to secure funding without a critical mass of EVs to serve. Breaking this cycle requires coordinated investment in both vehicle financing and charging infrastructure, a task too large for any single entity to handle alone.

Loans and Credit Options for EV Buyers

In Africa, conventional auto loans remain the primary financing option for electric vehicles (EVs), but the landscape is shifting to address the unique challenges of EV ownership. In Kenya, for example, fintech companies are tapping into mobile money data to offer digital loans specifically for electric two-wheelers. This approach is particularly beneficial for drivers who lack traditional credit histories. Kenya’s relatively high level of financial inclusion – 40% of people over 15 have accessed formal loans or mobile money services – creates an ideal environment for these innovative financing solutions.

Currently, financing is more readily available for commercial EV buyers than for private individuals. Lenders are drawn to e-motorcycle taxis, delivery fleets, and e-buses because these vehicles have lower operating costs, which translates into more predictable cash flows. To illustrate, driving 62 miles (100 km) in an EV in Kenya costs between 47% and 83% less than driving a gasoline vehicle. This cost advantage makes loan repayments more manageable for commercial operators. A notable example is BasiGo, a Kenyan e-bus company, which secured $42 million in 2025 to roll out 1,000 electric buses using a "Pay-As-You-Drive" model. This setup aligns loan payments with daily revenues, making it easier for operators to manage their finances. These developments highlight how tailored financing structures are fueling EV adoption in the region.

Auto Loan Structures and Interest Rates

EV loans often require a down payment of 20–30%, with repayment terms spanning three to five years. These conditions reflect the risks associated with EVs, such as uncertainties around depreciation and battery lifespan. Electric two-wheelers, which typically cost between $1,700 and $1,800, require smaller loans compared to passenger EVs. On the other hand, many African consumers currently spend $6,000 to $10,000 on used gasoline vehicles, while new EVs are often much pricier. This makes financing a critical factor in expanding EV adoption.

EV24.africa has partnered with local banks to provide flexible payment plans with affordable monthly installments. Initially, these programs focus on commercial operators, where the financial benefits of EVs are more evident. Over time, the aim is to extend these options to private buyers as the market becomes more established.

Government-Backed Loan Programs

In addition to private financing, government initiatives are helping to reduce borrowing costs for EV buyers. Instead of offering direct loans, many governments are using fiscal incentives to make EVs more affordable. For instance, Rwanda has eliminated import duties on EVs, while Kenya provides VAT exemptions for e-motorcycles and e-buses. Starting in 2026, South Africa will implement a 150% tax deduction on EV production to encourage local manufacturing and lower vehicle costs.

Regional development organizations are also stepping in. The African Development Bank‘s Green Mobility Facility offers early-stage grants and catalytic funding to encourage commercial banks to lend for EV projects in seven countries. Meanwhile, Nigeria provides 10-year tax holidays for EV manufacturers, and Ethiopia, which banned gasoline vehicle imports in 2024, offers duty-free completely knocked down (CKD) kits to promote local assembly.

These incentives help reduce the overall cost of EVs, making loans more affordable for buyers. For example, a locally assembled mini e-bus in Kenya costs between $55,000 and $60,000, compared to $250,000 to $300,000 for imported models. This significant price difference results in smaller loan amounts and lower monthly payments. However, the financing gap remains a major challenge. Scaling electric two-wheelers alone is estimated to require between $3.5 billion and $8.9 billion for vehicle purchases, charging infrastructure, and assembly facilities .

EV Leasing and Subscription Services

Leasing offers a smart way to reduce upfront costs by spreading payments over time and often bundling maintenance. This approach tackles two major hurdles of electric vehicles (EVs): high purchase prices and uncertainties about battery performance.

The choice of leasing model largely depends on whether you’re running a fleet or driving as an individual. Operational leasing functions much like a rental – you pay based on usage, while the provider takes care of maintenance, and you never actually own the vehicle. This is a great fit for large fleet operators, like bus companies, who prioritize predictable monthly costs and want to avoid risks like battery degradation. A prime example is BasiGo’s "Pay-As-You-Drive" model in Kenya, which has already deployed 100 electric buses and secured $42 million to scale up to 1,000 buses. On the other hand, financial leasing offers a path to ownership. For instance, motorcycle taxi riders using electric two-wheelers often make daily or weekly payments until they fully own their vehicles.

Operational vs. Financial Leasing

The key difference between these two leasing models lies in who assumes the risk and who ultimately owns the vehicle. With operational leasing, the provider retains ownership and handles risks like battery health and depreciation. This setup allows fleet operators to upgrade to newer models without getting stuck with outdated technology. Financial leasing, however, shifts ownership – and the associated risks – to the lessee over time. While this typically comes with higher overall costs, it’s an attractive option for entrepreneurs who rely on electric two-wheelers, as it provides a clear path to long-term ownership. Meanwhile, commercial fleets operating electric buses often lean toward operational leasing to conserve capital and enjoy the convenience of bundled maintenance and service packages.

Battery-as-a-Service and Subscription Models

Beyond traditional leasing, battery subscription models are shaking things up by making EVs even more accessible.

Battery-as-a-Service (BaaS) separates the battery cost from the vehicle price, dramatically lowering the upfront investment needed to get started. Instead of purchasing the battery outright, customers subscribe to battery services, which makes EVs more affordable. Companies like Ampersand in Rwanda have pioneered battery-swapping networks, enabling drivers to quickly exchange depleted batteries. This shift not only takes battery maintenance off the driver’s plate but also eliminates the need to worry about replacement costs.

BaaS is particularly effective in regions like Africa, where infrastructure challenges are common. With limited access to reliable home charging, battery-swapping stations help ease "range anxiety", the fear of running out of power during a shift. Additionally, subscription fees provide a steady revenue stream that supports the development of charging networks and other infrastructure. As an example, EV24.africa is actively exploring partnerships with local providers to incorporate these subscription options into its financing programs, offering commercial buyers the dual benefit of lower operating costs and reduced entry barriers.

sbb-itb-99e19e3

New Financing Models for African Markets

To tackle the challenges of high upfront costs and limited access to traditional financing, new approaches are taking shape across Africa. Conventional bank loans, often burdened with high interest rates and rigid credit requirements, fall short of meeting the needs of the continent’s growing electric vehicle (EV) market. These fresh financing models aim to address core issues like limited banking access, steep initial costs, and the necessity for payment structures that fit irregular income patterns.

Microfinance and Peer-to-Peer Lending

Pay-As-You-Go financing has emerged as a game-changer for motorcycle taxi riders and small business owners. Instead of requiring a hefty down payment, this model allows users to make small, consistent payments over time. A prime example is Ecobodaa in Kenya, which has successfully applied this approach to electric motorcycles. Riders can acquire vehicles through daily micro-payments, a system that mirrors the widespread success of mobile money platforms across Africa, where frequent, smaller transactions are the norm.

Microfinance institutions are stepping in to bridge the gap left by traditional banks, offering incremental payment options tailored to local needs. However, financing costs for EVs can be steep, sometimes exceeding 100% to 150% of the vehicle’s price due to high-risk premiums. Companies like Ampersand in Rwanda are addressing this challenge by pairing asset-based lending with battery-swapping networks, enabling them to scale their fleets more effectively.

"If financing costs can be reduced, the transition will accelerate dramatically." – Bessie Noll, Senior Researcher, ETH Zurich

For commercial riders who rely on their vehicles for income, these financing models can make a real difference. The savings generated by using EVs often help cover loan payments while still leaving room for profit. Additionally, partnerships and structured collaborations are helping to further distribute the risks and costs associated with EV adoption.

Public-Private Partnerships for EV Financing

On a larger scale, public-private partnerships are proving essential in providing the financial muscle needed to support EV adoption. For instance, the African Development Bank (AfDB) launched the Green Mobility Facility for Africa in 2025, offering early-stage grants and investment support across seven countries. In October 2024, BasiGo secured $42 million in funding to roll out 1,000 electric buses in Kenya and Rwanda. Similarly, Uganda saw a combined investment of $160 million in e-mobility between 2018 and 2024, with forecasts suggesting an additional $800 million will be needed to scale efforts further.

Blended finance structures, which combine government-backed guarantees with private investments, are helping to lower interest rates in high-risk markets. This approach is particularly beneficial for fleet operators purchasing multiple vehicles, where financing needs can reach into the millions. Companies like EV24.africa are actively working with local providers to integrate these financing programs, offering commercial buyers reduced entry barriers and lower operating costs.

Country-Specific Incentives and Policies

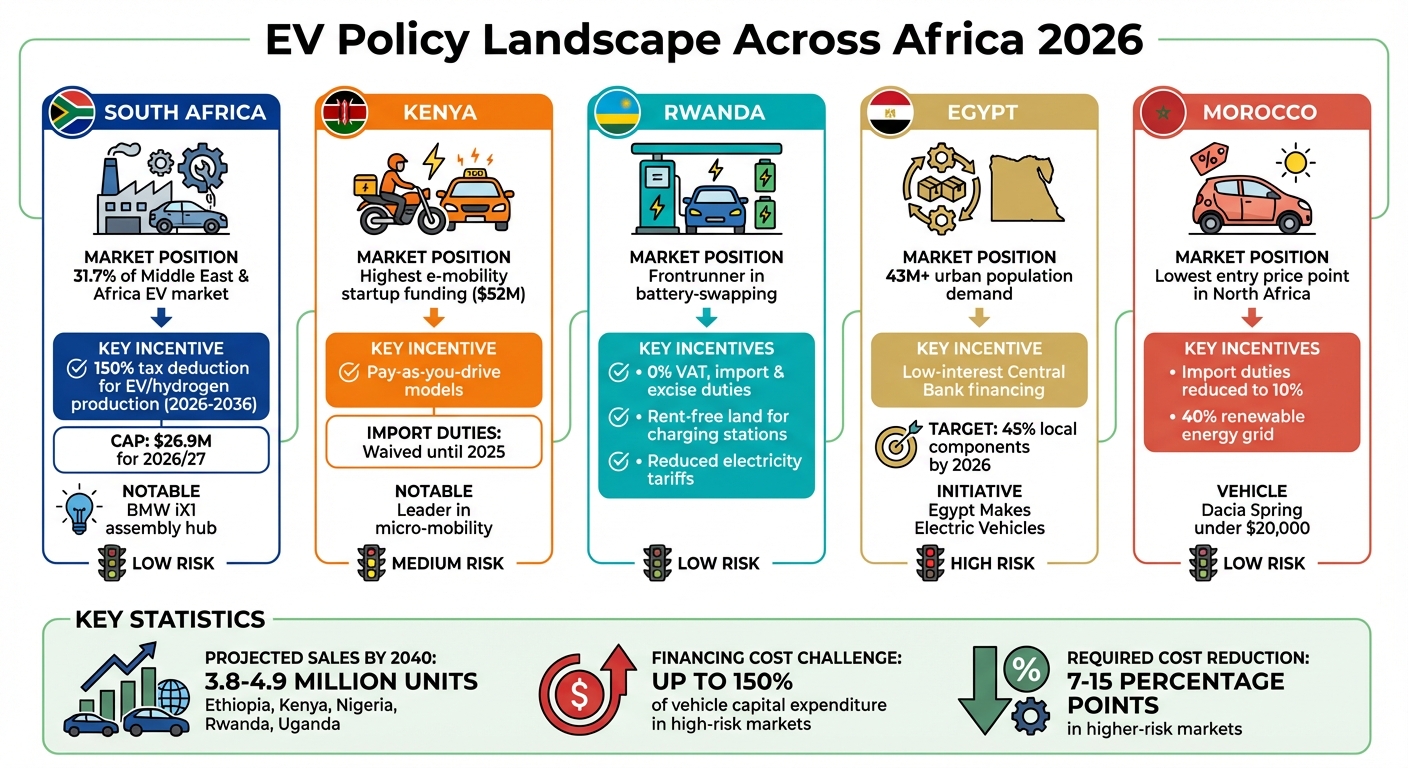

EV Financing Incentives and Policies Across Key African Markets 2026

Policy Examples by Country

Governments across Africa are rolling out diverse measures to make electric vehicles (EVs) more affordable and encourage adoption. South Africa has introduced a 150% tax deduction for EV and hydrogen vehicle production from 2026 to 2036, with a cap of $26.9 million for the 2026/27 fiscal year. This initiative has already attracted significant investments, such as BMW‘s launch of luxury EV assembly in Gauteng in February 2023, showcasing how such policies can draw global players .

"To encourage production of EVs in South Africa, the government will introduce an investment allowance for new investments, beginning 1 March 2026"

Rwanda has adopted a highly supportive approach, offering full exemptions from VAT, import duties, and excise taxes on EVs and their spare parts. The country also provides rent-free land for charging stations and lower electricity tariffs to further boost EV infrastructure. Meanwhile, Kenya has waived import duties on EVs until 2025 and promotes adoption through electric bus corridors. In a notable move, GreenMax Capital Group and MojaEV Africa launched a pilot program in June 2025, allowing taxi drivers to lease Neta EVs – vehicles with a 217-mile range – without a 20% down payment. This initiative is backed by a $150,000 first-loss facility from the IKEA Foundation and CLASP.

In Egypt, the focus is on localization through the "Egypt Makes Electric Vehicles" initiative, aiming for 45% local component production by 2026. This effort is supported by low-interest financing from the Central Bank. Morocco has reduced import duties on EVs to 10% and leverages its 40% renewable energy grid to support the production of affordable models like the Dacia Spring, priced under $20,000. Platforms like EV24.africa are stepping in to create tailored financing solutions that align with these incentives. Lastly, Ethiopia has taken a bold step by banning the sale of internal combustion engine vehicles altogether, pushing for a rapid shift to electric mobility.

These varied strategies highlight the different approaches nations are taking to balance incentives and overcome financing barriers.

Incentive Comparison Across Key Markets

A closer look at the policies across African countries reveals distinct approaches to EV adoption. Lower-risk markets like Botswana, Mauritius, and South Africa have financing conditions that make EVs nearly as accessible as internal combustion engine (ICE) vehicles. On the other hand, higher-risk markets such as Sudan, Guinea, and Ghana face financing gaps that require a 7–15 percentage point reduction in costs to level the playing field. Here’s how some major markets compare:

| Country | Incentives | Market Share & Adoption Context |

|---|---|---|

| South Africa | 150% tax deduction for EV/hydrogen production (2026–2036); local battery supply chain development | 31.7% of the Middle East & Africa EV market; BMW iX1 assembly hub |

| Kenya | "Pay-as-you-drive" models | Highest e-mobility startup funding in Africa ($52M); leader in micro-mobility |

| Rwanda | Zero VAT, import, and excise duties; rent-free land for charging; reduced electricity tariffs | Frontrunner in battery-swapping networks; comprehensive policy intervention |

| Egypt | Low-interest Central Bank financing; 45% local component target by 2026 | Urban demand exceeds 43 million people; focus on supply chain localization |

| Morocco | Import duties reduced to 10%; 40% renewable energy grid; local Dacia Spring production | Lowest entry-level EV price point in North Africa (under $20,000) |

Projections suggest that EV sales in countries like Ethiopia, Kenya, Nigeria, Rwanda, and Uganda will reach 3.8–4.9 million units by 2040. However, financing remains a major challenge – costs in some segments exceed 150% of the vehicle’s capital expenditure. Platforms such as EV24.africa are stepping in to integrate these country-specific incentives into their financing programs, helping commercial buyers navigate varying tax structures and reduce upfront costs in different markets.

Financing Charging and Battery Infrastructure

Charging Network Financing Models

Building charging infrastructure in Ethiopia, Kenya, Nigeria, Rwanda, and Uganda requires an estimated $3.5–$8.9 billion. But the challenge isn’t just about raising the money – low electricity access and unreliable grids make traditional financing models riskier for potential investors.

One approach gaining traction is Battery-as-a-Service (BaaS). This model separates battery costs from vehicle prices, making electric vehicles (EVs) more affordable for consumers while providing lenders with steady, predictable revenues. For example, BasiGo in Kenya secured $42 million in 2024/2025 to roll out 1,000 electric buses alongside high-capacity charging infrastructure. Meanwhile, in Uganda, Zembo has adopted solar-powered, off-grid kiosks to bypass the limitations of the national grid, while also promoting gender inclusion within the sector.

Solar-integrated, off-grid charging solutions are becoming a game-changer in areas with unreliable electricity. These decentralized systems allow charging networks to expand into underserved regions without waiting for grid upgrades. Platforms like EV24.africa are helping buyers understand how these financing models impact the total cost of ownership – a critical factor for commercial fleet operators who depend on consistent charging access. By combining solar technology with battery-swapping innovations, these solutions are paving the way for broader e-mobility adoption in challenging environments.

Battery-Swapping Networks and Consumer Benefits

Battery-swapping networks tackle two major barriers to EV adoption: high upfront costs and long charging times. In Rwanda, Ampersand is scaling its battery-swapping network for electric motorcycles by focusing on high-density urban routes, ensuring steady use of its stations through growth debt financing.

The financial advantages of EVs are also compelling. In Kenya, for instance, the cost of operating an EV is around $0.62–$0.92 per 62 miles, compared to $6.62 for fuel-powered vehicles. These savings not only make EVs more appealing but also support investments in charging networks. Organizations like Drivelectric and the WEEE Centre in Kenya are finding additional revenue opportunities by repurposing used EV batteries for solar energy storage, improving the overall return on investment for charging ecosystems.

"Commercial E2W leads adoption due to strong product-market fit and financing, positioning Africa for scalable e-mobility growth." – Africa E-Mobility Alliance

Commercial fleets, such as e-taxis and e-buses, are driving infrastructure investments thanks to their high usage rates and quicker payback periods. Public transport accounts for 60% to 80% of urban trips in Africa, making commercial charging hubs and battery-swapping stations more financially viable than private home charging setups. This focus on commercial infrastructure is also drawing interest from development institutions and private investors looking for sustainable returns in the e-mobility space.

Conclusion

The future of electric vehicle (EV) financing in Africa hinges on adopting inventive approaches. Traditional auto loans remain out of reach for many due to steep interest rates and restricted credit access. However, emerging solutions like Battery-as-a-Service models, battery-swapping networks, and digital asset financing are beginning to bridge this gap. Commercial fleets – such as electric motorcycles, taxis, and buses – are at the forefront of this shift, as EVs boast operating costs that are estimated to be 47–83% lower than those of internal combustion engine (ICE) vehicles.

By May 2025, Africa’s active EV fleet had grown to over 30,000 units, with electric two- and three-wheelers experiencing an impressive 38% annual growth rate. Yet, achieving the ambitious 2040 targets will demand substantial and coordinated investments. This pressing capital requirement highlights the need for collective action across sectors.

A coordinated "triple-helix" approach is key to overcoming these hurdles. Governments play a pivotal role by offering policy stability, as seen in Ethiopia’s ban on ICE vehicle imports and Rwanda’s 0% import duties on EVs. Meanwhile, the private sector must focus on building standardized battery-swapping infrastructure and leveraging Africa’s widespread mobile money systems to enable pay-as-you-go financing. International organizations can complement these efforts by providing catalytic, first-loss capital to mitigate the risks that traditional banks are hesitant to take on.

The stakes are high, extending well beyond transportation. Meeting EV adoption targets could cut transport-related CO2 emissions by as much as 24% by 2040, offering transformative economic and environmental benefits for millions. Without sustainable financing mechanisms, however, Africa risks becoming a dumping ground for outdated ICE vehicles while the rest of the world moves toward electrification.

Platforms like EV24.africa are stepping up to support this transition by offering clear pricing and financing options across all 54 African nations. Greater collaboration among stakeholders will accelerate the shift to e-mobility, creating new economic opportunities while delivering environmental gains. By addressing financing challenges with creative solutions, platforms like EV24.africa are helping to ensure Africa’s journey toward electric mobility stays on course.

FAQs

What are the latest financing options for electric vehicles in Africa?

Electric vehicle (EV) financing in Africa is taking on new forms, aiming to make EVs more accessible to both individuals and businesses. One standout approach is Pay-As-You-Go (PAYG) leasing, where users make small, regular payments that cover both the vehicle and charging expenses. This eliminates the need for a hefty upfront investment, making EV ownership less daunting.

Banks are also stepping in with asset-based loans, where the vehicle itself serves as collateral, simplifying the borrowing process for potential buyers. For those looking for alternative options, interest-free leasing offers a way to spread payments over the vehicle’s lifespan, while micro-loans cater to lower-income buyers, allowing gradual repayment as they benefit from savings on fuel costs.

Another innovative model is Battery-as-a-Service (BaaS), which separates the cost of the battery from the vehicle. Instead of purchasing the battery outright, buyers can subscribe to a battery service, significantly lowering the initial cost of the vehicle. These diverse financing options are designed to address the unique needs of African consumers, paving the way for a broader adoption of electric mobility.

How are African governments making electric vehicles more affordable?

African governments are stepping up to address the steep upfront costs of electric vehicles (EVs), making them more accessible to consumers. Many countries are slashing import duties, scrapping value-added taxes (VAT), and offering tax exemptions or direct incentives that can cut prices by thousands of dollars. For example, South Africa provides tax breaks for EVs manufactured locally, while Rwanda has taken bold steps by removing VAT on EV imports and capping electricity rates for charging, which helps bring down ongoing operational costs.

Beyond reducing costs for buyers, governments are also boosting local EV production. Initiatives like special economic zones, tax holidays, and production rebates are helping to streamline supply chains, which can make vehicles more affordable. On top of that, some nations are introducing low-interest or even interest-free leasing programs, along with asset-financing options that require little collateral – making EV ownership a possibility for more people.

While these efforts are paving the way for broader EV adoption, challenges remain. Inconsistent implementation of policies, income inequality, and unreliable electricity infrastructure can limit how effective these measures are in practice.

What are the main challenges and solutions for developing EV charging infrastructure in Africa?

Developing a dependable EV charging network in Africa comes with its fair share of hurdles. Frequent power outages in many areas make it tough to keep charging stations running smoothly. In rural regions, the situation is even more challenging, as electricity access is often nonexistent. On top of that, the number of public chargers remains extremely low across most countries. High upfront costs for equipment and land, combined with limited financing options and steep import taxes, further discourage investment. To complicate matters, a lack of trained technicians and unclear regulations slows progress even more.

Governments are stepping in with incentives like tax breaks, VAT exemptions, and capped electricity rates to help lower costs. Meanwhile, the private sector is coming up with creative solutions, such as Pay-As-You-Go models and interest-free leasing programs, to make chargers more affordable. Solar-powered charging stations and home solar kits are also being introduced as a way to sidestep unreliable power grids. Pilot projects in countries like Nigeria and Chad are already exploring these approaches. Additionally, public-private partnerships and blended financing models are helping to attract investment by reducing financial risks. Training programs are also underway to build a skilled workforce capable of installing and maintaining the necessary infrastructure.