Africa’s electric vehicle (EV) market is growing fast, with sales nearly doubling in 2024 to 11,000 units. But importing EVs into African countries comes with challenges like taxes, safety inspections, and varying regulations. Here’s what you need to know:

- South Africa: High import taxes on EVs (25%) make them pricier than internal combustion engine (ICE) cars. New incentives for local EV production are coming in 2026.

- Kenya: Strict rules limit imports to right-hand drive vehicles under 8 years old, with mandatory inspections for roadworthiness.

- Nigeria: Duty exemptions and local production goals aim to increase EV affordability, with models starting at $8,000.

Many countries, like Rwanda and Zimbabwe, offer tax breaks to encourage EV adoption, while others focus on boosting local manufacturing. Importers should prepare for country-specific rules, paperwork, and inspections to avoid delays. Africa’s EV market is expanding, but navigating regulations is key to success.

Ethiopia bans importation of non-electric private cars

EV Import Rules by Country in 2025

This section explores how South Africa, Kenya, and Nigeria are shaping their 2025 EV import policies to encourage growth in the electric vehicle market while addressing unique regional challenges.

South Africa: Balancing EV Costs and Local Manufacturing

South Africa applies a 25% import tax on EVs, compared to 18% for internal combustion engine (ICE) vehicles. On top of that, there’s an additional 17% ad valorem tax for vehicles priced over R700,000 (around $38,000), which makes EVs less competitive in the market.

Industry voices have raised concerns over this pricing disparity. Mark Raine, co-CEO of Mercedes-Benz SA, shared his perspective:

"Electric vehicles in South Africa are too expensive and I always lobby for the fact that we need price parity of internal combustion engines and electric vehicles. I’m just saying don’t put electric vehicles at a disadvantage. I could import a V12 super sports car at lesser import duties than an electric vehicle."

To encourage local EV production, South Africa has proposed a 15% import tax on new energy vehicle batteries. Additionally, the International Trade Administration Commission (ITAC) is working to broaden the list of qualifying materials under the Automotive Production Development Programme.

The market is showing signs of progress. In 2023, nearly 1,000 EVs were sold, a notable increase from around 502 in 2022. For context, fewer than 500 EVs were sold in total during the four years leading up to 2022.

Kenya: Strict Import Rules for a Growing Market

Kenya maintains some of the most stringent import regulations in the region. Vehicles must meet the Kenya Bureau of Standards‘ KS 1515:2000 standard, which limits imports to cars less than 8 years old. Additionally, only right-hand drive vehicles are allowed, narrowing import sources to countries like the United Kingdom, Japan, South Africa, and Singapore.

Imported vehicles must also pass rigorous inspections by agencies such as JEVIC and QISJ to ensure roadworthiness. Registration must occur within one year of manufacture.

To navigate these rules, importers can use tools like the KRA Duty Calculator to estimate costs and should work with licensed clearing agents to avoid delays or fraud.

Nigeria: Tax Incentives and Local Deployment

Nigeria is making bold moves to accelerate EV adoption. The country has pledged to achieve 100% zero-emission sales for new cars and vans by 2040, aligning with its commitment under the Zero Emission Vehicles (ZEV) Declaration. Policies like duty exemptions and the National Automotive Design and Development Council‘s (NADDC) target of 30% locally manufactured EVs by 2033 are helping to drive this shift.

These measures are already influencing EV affordability. Current models like the Wuling Mini EV are priced at ₦9 million (about $8,000), while the SAGLEV Compact and Dongfeng E70 Sedan are priced at ₦11.5 million (around $10,500) and ₦14 million, respectively. Compliance with emission and safety standards is essential for imports.

Joseph Osanipin, NADDC’s Director-General, highlighted the broader impact of these initiatives:

"This regulation is a systemic intervention to reposition Nigeria’s automotive ecosystem. We are setting up a framework that creates green jobs, attracts local investment, generates sub-national revenue, and reduces urban pollution."

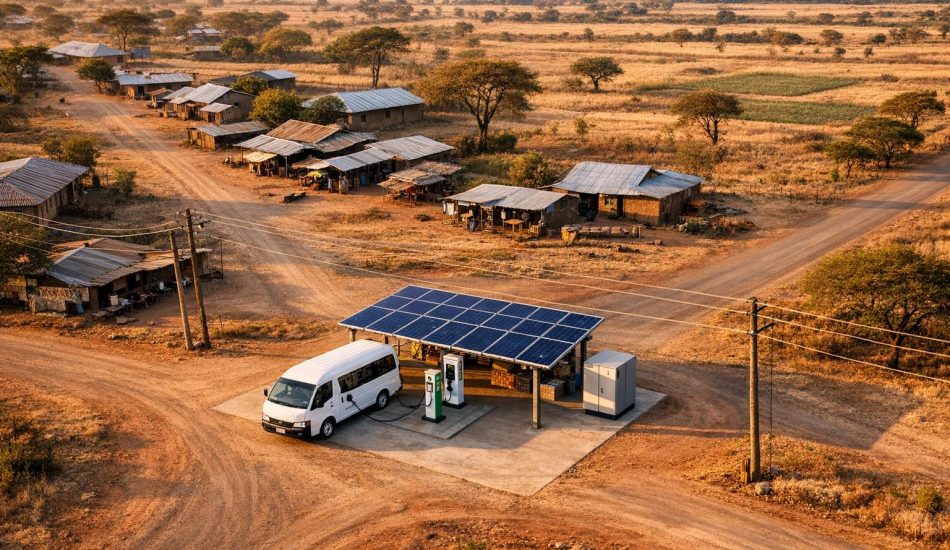

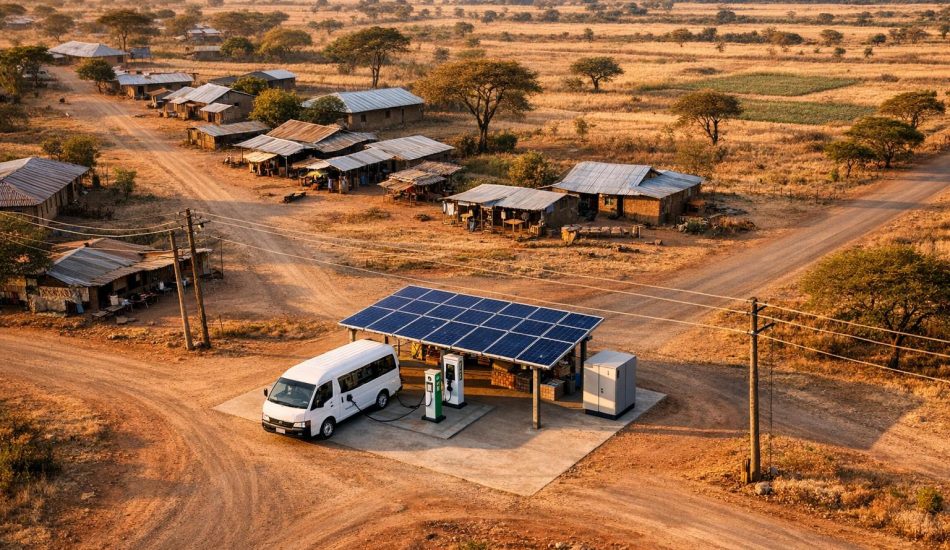

Local deployment efforts are also gaining momentum. In 2023, EV Automobiles, a subsidiary of the Nedcomoaks Group led by Dr. Kennedy Okonkwo, introduced 2,000 EVs across Nigeria. They are also developing solar-powered charging stations and training over 1,000 EV professionals. Looking ahead, the End-of-Life Vehicle Waste Recycling Regulation will take effect in October 2025, while the Energy Transition Plan aims for 60% EV adoption by 2050 and full adoption by 2060.

With these policies in place, the groundwork is being laid for a more streamlined and supportive regulatory framework, which will be explored further in the next section.

How to Import EVs and Stay Compliant

Bringing electric vehicles (EVs) into Africa requires careful planning and attention to detail. Each country has its own regulations, and even minor mistakes can lead to delays or outright rejection. Here’s a practical guide to help you navigate the process.

Getting Documents and Checking Standards

Having the right paperwork in order is the first step. You’ll typically need documents like the original purchase invoice, Bill of Lading (BOL), Vehicle Inspection Certificate, Deregistration Certificate, Road Worthiness Certificate, Import Declaration Form (IDF), and tax payment receipts. It’s also crucial to confirm that the vehicle meets local age restrictions. Many African countries only allow the import of vehicles that are 8 years old or newer.

In South Africa, for example, you’ll need a Letter of Authority (LOA) from the National Regulator for Compulsory Specifications (NRCS). To get this, you must complete Form LA01 and pay a non-refundable fee ranging from ZAR300 to ZAR1,800 (about $16 to $98). This ensures the vehicle meets essential safety and environmental standards before it can be imported.

Some countries, like Uganda and Tanzania, require pre-shipment inspections by agencies such as JEVIC to confirm roadworthiness and compliance with local standards. Skipping this step could result in delays at the port. Double-check all documents and inspection requirements to avoid unnecessary complications.

Once your documents are in order, you’ll need to decide on the best shipping method to protect your EV during transit.

Choosing Shipping and Delivery Methods

Transporting EVs involves special care due to their sensitive electrical components and batteries. The shipping method you choose will depend on whether you’re importing a new or used EV.

For new EVs, RoRo (Roll-on/Roll-off) shipping is a cost-effective option. Vehicles are driven directly onto the ship and secured for transport. Used EVs, however, often require Hazmat containers because of stricter safety regulations for lithium-ion batteries.

"Electric and hybrid cars require specific handling during transportation to prevent any damage to their sensitive electrical components and battery systems." – All TransportDepot Inc.

Before shipping, make sure the vehicle is cleaned thoroughly and free of personal items. Battery safety is critical – disconnect the battery or reduce its charge to meet international shipping regulations. When choosing a logistics provider, look for companies experienced in EV transportation. For instance, All TransportDepot Inc. offers tailored shipping solutions for both new and used EVs, ensuring compliance with safety and shipping standards.

Get detailed quotes from multiple providers, factoring in your vehicle’s type, size, destination, and preferred shipping method. After shipping, the focus shifts to clearing customs and paying duties.

Customs Process and Paying Duties

Clearing customs can vary widely across African countries, but understanding the basics can save you from common problems. Accurate vehicle valuation is critical, as it determines duty costs. It’s a good idea to consult with local customs authorities or experienced clearing officers before finalizing your import.

In Kenya, for instance, import duties for EVs are set at 25%, with an additional 10% excise duty. The duty is calculated based on the Current Retail Selling Price (CRSP) and the vehicle’s age. For exact figures, confirm with the Kenya Revenue Authority (KRA) or a knowledgeable clearing officer.

Some countries offer tax incentives to encourage EV imports. Ghana, for example, exempts EVs from import duties entirely, while Nigeria recently announced duty exemptions starting in January 2024. This aligns with Nigeria’s goal of having 30% of all vehicles sold locally by 2033 be EVs.

Adhering to customs regulations ensures your EV meets local standards. Certifications like GCC, IRAM, or GSA may be required depending on the destination country. Partnering with logistics companies familiar with African port operations and customs procedures can make the process smoother.

Preparation is everything when it comes to customs clearance. Study each country’s regulations and technical standards carefully before making a purchase. File your import declaration and pay duties promptly – some countries even offer pre-clearance or online customs systems to speed things up. Keep an eye on any changes to import laws, as these can be updated annually.

sbb-itb-99e19e3

Tax Breaks, Standards, and Future Changes

Understanding tax incentives, safety regulations, and upcoming policy changes is essential for navigating the electric vehicle (EV) import market in Africa. Governments across the continent are offering enticing benefits while tightening regulations to ensure quality and safety.

Tax Breaks for EV Importers

Many African nations are rolling out financial incentives to promote EV adoption, though the specifics vary widely. Rwanda stands out, offering complete tax exemptions on electric cars, spare parts, batteries, and charging equipment. This means no VAT, import duties, or excise taxes apply to these items.

Kenya has also introduced multiple incentives, such as zero-rated VAT for electric buses and bicycles, along with excise duty exemptions for imported and locally assembled motorcycles. In 2019, Kenya cut import duties on fully electric vehicles from 20% to 10%. However, a 16% VAT on inputs for local vehicle manufacturing, introduced in June 2025, affects both electric and fuel-powered vehicles.

Tunisia offers reduced customs duties of 10% and a 7% VAT on charging equipment, while Egypt provides a 10% FOB discount for used passenger EVs.

Other countries are following suit. Zimbabwe lowered import duties on electric vehicles from 40% to 25% as of January 1, 2025, a move expected to double EV imports by the end of the year.

South Africa, meanwhile, is focusing on boosting local production. The government introduced a 150% tax deduction for investments in electric and hydrogen-powered vehicle production, effective in 2026. Additionally, R1 billion (about $54.4 million) has been allocated over the medium term for industrial development programs to support the production and assembly of EVs and batteries. However, import duties on EVs remain relatively high at 25%, compared to 18% for combustion engine vehicles.

While these tax breaks can significantly reduce costs, importers must also navigate complex safety and environmental requirements.

Meeting Safety and Environmental Requirements

Safety and environmental standards in Africa present both hurdles and opportunities for EV importers. Inconsistent inspections and outdated regulations have allowed unsafe, high-polluting vehicles to enter the market. A UNEP study revealed that most used vehicles exported to Africa between 2015 and 2018 failed to meet basic environmental and safety benchmarks.

The absence of unified import standards across the continent means businesses must tailor their strategies to each market. Limited enforcement and data infrastructure further complicate efforts to regulate the influx of vehicles.

Egypt has taken proactive steps with its Vehicle Scrapping and Recycling Program. This initiative incentivizes taxi owners to trade in older, high-emission vehicles for cleaner, newer models.

To ensure compliance, make sure your EVs meet minimum safety and environmental standards before shipment. Work with suppliers to secure the necessary certifications, as vehicles that align with international standards will have a smoother path through customs and gain greater market acceptance.

Future Changes in EV Import Rules

Africa’s EV market is on the cusp of transformation, driven by tariff reductions, policy alignment, and growing local production. Regional blocs like the East African Community (EAC) and Economic Community of West African States (ECOWAS) are working toward harmonized EV policies, which could streamline trade in EVs and their components.

The market is also expanding rapidly. Kenya’s EV market is growing at an annual rate of 24%, while South Africa saw sales of new-energy vehicles more than double between 2023 and 2024, making up 3% of total new vehicle sales. These trends are drawing attention from global automakers and policymakers.

Chinese manufacturers are increasingly targeting Africa, focusing on electric and hybrid vehicles. Tony Liu, CEO of Chery South Africa, emphasized:

"We treat South Africa as a very important market for our global expansion".

Steve Chang, BYD Auto South Africa’s general manager, echoed this sentiment:

"I think South Africa and the rest of Africa have a very big opportunity to what I call leapfrog from ICE into renewable energy (cars). Africa is a very big market."

Expect more public-private partnerships to develop EV infrastructure, alongside the standardization of safety and environmental requirements. Several countries are also aiming to establish domestic EV production capabilities to reduce reliance on imports.

Sally Njogu, Project Manager and Stakeholder Engagement Coordinator, expressed the continent’s vision:

"Africa’s future isn’t tied to internal combustion engines. We’re building a mobility ecosystem that’s green, inclusive, and ours."

To stay ahead, keep a close watch on policy updates and engage with regional trade organizations. Explore partnerships that align with infrastructure investments and adapt to evolving regulations. The push toward local manufacturing could also open doors for suppliers and assembly operations in the EV space.

Conclusion: Managing EV Import Rules in Africa

Bringing electric vehicles (EVs) into Africa requires a careful balance of regulatory compliance, cost management, and market awareness. The continent’s varied regulatory environment makes it crucial for importers to understand the specific rules of each country to avoid unnecessary delays and penalties. A well-informed approach not only minimizes risks but also takes advantage of financial incentives offered across the region.

Many African countries, including Rwanda, Kenya, and Zimbabwe, are introducing tax breaks and duty reductions to encourage EV adoption. These incentives can significantly lower costs for importers, but they also demand a thorough understanding of local policies to be effectively utilized.

While the regulatory landscape can be challenging, Africa’s EV market is expanding rapidly, creating new opportunities for businesses. However, meeting environmental and safety standards remains a key hurdle. Importers must ensure their vehicles comply with destination country requirements before shipment to avoid complications at customs.

South Africa is also making strides to support EV growth. As Finance Minister Enoch Godongwana stated:

"To encourage production of EVs in South Africa, the government will introduce an investment allowance for new investments, beginning 1 March 2026".

Staying up to date on policy changes and collaborating with local authorities is essential for navigating this dynamic environment. Tools like EV24.africa simplify the process by connecting importers with reliable dealers across all 54 African countries, making compliance and market entry more manageable.

The future of EV imports in Africa is full of potential. Success in this evolving market requires more than just following regulations – it’s about building strong, lasting partnerships and staying ahead in a fast-changing industry.

FAQs

What challenges do importers face when bringing electric vehicles into African countries, and how can they overcome them?

Importing electric vehicles (EVs) into African countries comes with its fair share of challenges. Among the biggest obstacles are high import taxes, limited charging infrastructure, and complex regulations. For example, South Africa imposes a hefty 25% import duty on EVs. Meanwhile, countries like Kenya and Nigeria add to the complexity with strict age restrictions and extra levies.

To overcome these challenges, it’s essential to stay informed about the specific policies in each country. Some regions offer incentives that can help, such as Nigeria’s duty waivers for certain EV imports. Additionally, addressing infrastructure limitations early – like researching or investing in local charging solutions – can make the process smoother while ensuring compliance with environmental regulations.

How do tax incentives and local production goals in South Africa and Nigeria affect the cost and availability of electric vehicles?

Tax incentives in countries like South Africa and Nigeria are helping to make electric vehicles (EVs) more accessible. In South Africa, for instance, businesses investing in EV manufacturing can benefit from generous tax deductions. Meanwhile, Nigeria offers import tax breaks designed to cut down the initial costs of EVs. These measures aim to ease the financial burden for both consumers and businesses.

On top of that, local production targets are shaping the future of EV availability. Nigeria, for example, has set an ambitious goal to produce 30% of its EVs locally by 2032. This push for domestic manufacturing not only reduces dependence on imports but also helps ensure a steady supply of vehicles. By focusing on local production, these efforts are paving the way for more affordable EV options and a stronger market in the region.

How can importers ensure electric vehicles meet safety and environmental standards in different African countries?

Importers need to confirm that electric vehicles align with the specific safety, emission, and other standards required by each country. For instance, South Africa mandates compliance with its local safety regulations, while Rwanda enforces Euro 4 emission standards. Ensuring vehicles meet safety certifications, battery performance benchmarks, and emission limits is crucial.

Keeping up with changing regulations and consulting local regulatory authorities can help avoid fines and simplify the import process. These efforts are key to ensuring a hassle-free entry into various markets across Africa.