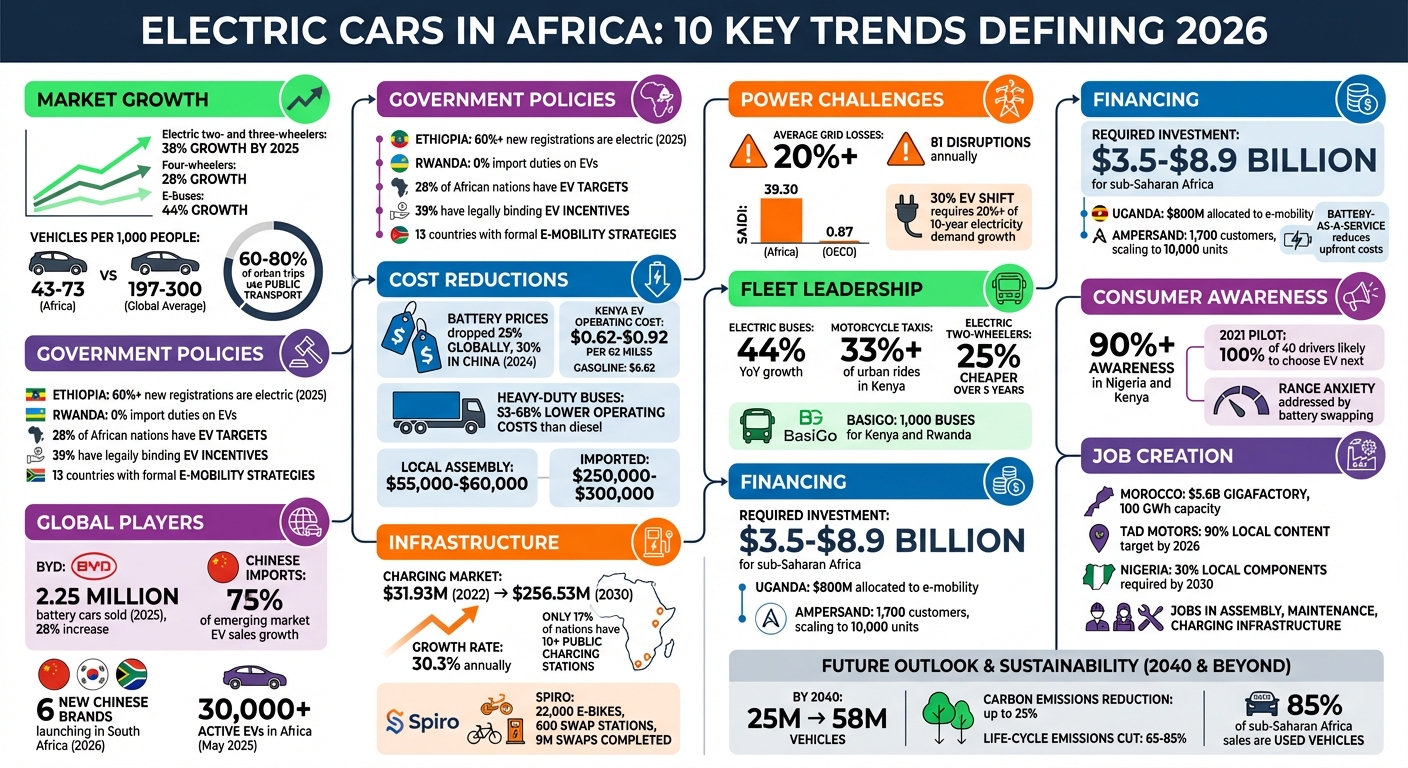

Africa’s electric vehicle (EV) market is undergoing a major shift, with rapid growth and new developments shaping 2026. Here’s what you need to know:

- Market Growth: EV adoption is accelerating, driven by commercial fleets, with two- and three-wheelers growing fastest.

- Government Policies: Countries like Ethiopia, Rwanda, and South Africa are implementing tax incentives, bans on internal combustion engines (ICEs), and local manufacturing requirements.

- Cost Reductions: Falling battery prices and local assembly are making EVs more affordable, with total ownership costs often lower than gas-powered vehicles.

- Global Players: Chinese brands like BYD and Xpeng are entering the market aggressively, alongside local manufacturers like Kenya’s TAD Motors.

- Infrastructure Expansion: Charging networks are growing, with solar-powered and battery-swapping stations addressing grid challenges.

- Power Challenges: Weak grids are pushing off-grid solutions like mini-grids and smart charging to support EV adoption.

- Fleet Leadership: Public transport and delivery fleets are leading the transition, benefiting from lower operating costs.

- Financing Innovations: Models like Battery-as-a-Service (BaaS) and pay-as-you-go (PAYG) are reducing upfront costs.

- Consumer Awareness: Education campaigns and visible EV use cases are addressing concerns like range anxiety.

- Job Creation: Local assembly plants and battery production are creating thousands of jobs across the continent.

Africa’s EV market is at a turning point, with policies, investments, and innovation driving growth while addressing challenges like grid reliability and affordability. The shift to electric mobility offers lower costs, cleaner energy, and new opportunities for businesses and consumers alike.

Africa’s Electric Vehicle Market: 10 Key Trends Shaping 2026

How Kenya Is Quietly Building Its Own Electric Cars

sbb-itb-99e19e3

1. Growing Market Size and Faster Adoption

Africa’s electric vehicle (EV) market is expanding rapidly, drawing global attention with impressive year-over-year growth projections. By 2025, electric two- and three-wheelers are set to grow by 38%, four-wheelers by 28%, and e-buses by an astounding 44%. This momentum highlights a shift fueled by innovative ownership and usage models.

Unlike Western markets, where private car ownership dominates, Africa’s EV growth is being driven by commercial fleets. Motorcycle taxi drivers, bus companies, and delivery services are leading the charge, benefiting from the economic advantages of EVs. For high-mileage operators, the cost savings offered by electric vehicles are a game-changer, helping them maintain profitability while reducing operational expenses.

One standout example is Roam Electric’s partnership with the County Bus Service in Kenya. In April 2024, they introduced 200 electric buses on major Nairobi routes. These locally assembled buses are expected to serve thousands of passengers daily by 2026, all while keeping fares competitive with diesel-powered alternatives. Similarly, BasiGo has adopted a "Pay-As-You-Drive" model to make EVs more accessible. In May 2025, the company secured $42 million to deliver 1,000 electric buses to fleet operators in Kenya and Rwanda, eliminating the upfront cost barrier.

In addition to the economic benefits, strategic government policies are playing a crucial role in accelerating EV adoption. Regulatory measures across various countries have created an environment that encourages EV deployment.

The growth potential is enormous. Africa’s motorization rate remains low, with just 43 to 73 vehicles per 1,000 people – far below the global average of 197 to 300. With urbanization on the rise and 60–80% of urban trips already relying on public transport, the continent is uniquely positioned to bypass traditional car ownership models and focus on shared, electric mobility solutions.

2. Government Policies and New Regulations

Governments across Africa are rolling out policies aimed at accelerating the shift to electric vehicles (EVs). Ethiopia set a global precedent in 2024 by banning imports of internal combustion engine (ICE) vehicles entirely. By early 2025, over 60% of new vehicle registrations in the country were electric. Rwanda has also taken bold steps, instituting an ICE motorcycle ban starting in 2025, while offering 0% import duties on EVs and providing tax holidays for e-mobility companies. These regulatory moves align closely with the broader market expansion efforts mentioned earlier.

Tax incentives are playing a major role in reducing the cost barriers to EV adoption. Ghana’s eight-year zero-tariff policy and Kenya’s VAT exemptions on e-motorcycles and e-buses have made EVs more affordable and accessible by eliminating customs duties. Kenya has also implemented a robust battery quality standard, prohibiting the importation of batteries with less than 80% health to safeguard against low-quality components entering the market.

South Africa is focusing on building a local EV production ecosystem. Starting in March 2026, the government is offering a 150% tax deduction on investments in electric and hydrogen vehicle production assets. This initiative aims to reinforce South Africa’s automotive heritage while positioning the country as a regional EV manufacturing hub. Meanwhile, Morocco has attracted $15 billion in EV and battery-related investments through targeted industrial policies. A key milestone came in June 2025, when the Sino-Moroccan joint venture COBCO began producing EV-battery materials in Morocco, with an impressive annual capacity of 70 GWh. Nigeria is also stepping up with its Electric Vehicle Transition and Green Mobility Bill, which requires foreign automakers to set up local assembly plants and source 30% of components domestically by 2030.

However, challenges remain. Policy adoption across the continent is uneven. Only 28% of African nations have established at least one national EV target, and just 39% have legally binding EV incentives. Still, progress is evident: 13 countries, including Egypt, Nigeria, and Morocco, have published formal national e-mobility strategies to guide infrastructure development and promote EV adoption. These policies not only drive immediate market changes but also lay the groundwork for the long-term growth of Africa’s EV sector.

"We do have some taxation structures that are a little bit counterproductive and so we’ve made some fiscally neutral policy proposals… We are hoping that in the next six months there will be some short-term interventions that can be announced."

- Andrew Kirby, CEO, Toyota South Africa

3. Price Changes and Total Ownership Costs

In 2024, battery pack prices dropped by over 25% globally – and by 30% in China alone – giving electric vehicles (EVs) a stronger edge in the market. These cost reductions are paving the way for more affordable EVs, especially in regions like Africa. When considering the total cost of ownership (TCO), which includes fuel and maintenance, EVs are becoming a more appealing alternative to traditional gasoline-powered vehicles.

Local manufacturing is playing a big role in slashing costs even further. For instance, in Kenya, a locally assembled electric mini or mid-size bus is priced between $55,000 and $60,000. In contrast, imported models like those from BYD in South Africa cost significantly more, ranging from $250,000 to $300,000. Similarly, Uganda’s Kiira Motors offers locally assembled electric buses priced between $58,800 and $90,000. These stark price differences are encouraging a shift toward regional production.

Operating costs for EVs also highlight their economic advantage. In Kenya, driving a light-duty EV costs just $0.62–$0.92 per 62 miles, compared to $6.62 for a gasoline-powered vehicle. For heavy-duty buses, the savings are even more impressive, with operating costs 53%–68% lower than diesel alternatives.

"Lower operating costs drive EV policies Africa adoption, but bridging early-to-late-stage funding is essential for rapid scaling." – Africa E-Mobility Alliance

Aggressive fiscal measures are also helping to make EVs more accessible. Chinese imports, which accounted for 75% of the rise in electric car sales across emerging markets in 2024, are bringing more budget-friendly options to African consumers. Combined with duty waivers in countries like Rwanda and Kenya, these initiatives are tilting the TCO equation even further in favor of EVs.

4. Chinese and Global Brands Entering the Market

Chinese automakers are shaking up Africa’s EV market with bold expansion plans. BYD, for instance, sold over 2.25 million battery-powered cars in 2025 – a 28% increase compared to the previous year – overtaking Tesla to become the world’s top EV seller. In South Africa alone, six additional Chinese brands are set to launch in 2026, offering a mix of all-electric and hybrid options.

These companies are employing diverse strategies to establish a foothold. Early in 2026, Xpeng Motors chose Egypt as its main hub in North Africa, introducing its P7 sedan and G9 SUV flagship models. Nezha Automobile, on the other hand, opened its first brand store in Kenya in 2025, with plans to expand into 20 more African countries within two years. By offering competitive pricing and covering everything from budget-friendly ride-hailing vehicles to premium models, these brands are giving Western rivals a run for their money.

"Africa’s still-nascent EV sector offers a chance to lock in early dominance." – Njenga Hakeenah, China-Global South Project

Collaboration with local partners is also driving this rapid market entry. For instance, in late 2025, Uber started using the Henrey four-seat minicar in South Africa, imported by Valternative Energy, as a fully electric and affordable ride-hailing option. Meanwhile, in Kenya, TAD Motors is pushing the envelope with prototypes built using local steel and Chinese electronics, aiming for 90% local content by the end of 2026. Tesla, not to be left behind, introduced lower-priced variants of its Model 3 and Model Y in late 2025.

This surge in activity isn’t limited to passenger vehicles. In 2025, Gotion High-Tech announced a $5.6 billion investment to build a battery Gigafactory in Morocco, with an annual production capacity of 100 GWh. This move toward vertical integration – from battery production to vehicle assembly – is helping Africa transition from being an import-dependent market to an emerging manufacturing hub. Platforms like EV24.africa are also making it easier for buyers to compare a growing selection of models from brands like BYD, Tesla, Geely, and others. With these global players entering the scene, Africa’s EV ecosystem continues to evolve, building on earlier trends.

5. Local Assembly Plants and New Jobs

Africa is making a big move from importing fully built vehicles to assembling them locally, and the impact is huge – lower costs and thousands of new jobs. Leading the charge are countries like Kenya, South Africa, Morocco, and Nigeria, which are setting up assembly plants that use CKD (completely knocked down) and SKD (semi-knocked down) kits. These kits are far cheaper than importing fully built vehicles. For example, in Ethiopia, CKD kits are duty-free, while SKD kits face just a 5% duty. This shift not only brings down vehicle prices but also makes the market more competitive.

Producing vehicles locally slashes costs in a big way. Cars assembled domestically are significantly cheaper than imports, making electric vehicles (EVs) more affordable for everyday consumers in Africa.

One standout example is TAD Motors, which unveiled Kenya’s first "homegrown" EV prototypes in Nairobi in late 2025. These vehicles were built using locally sourced steel, with only the batteries and electronics imported from China. TAD Motors has set an ambitious goal of reaching 90% local content by the end of 2026, which will further drive down costs.

"The TAD Motors launch marks the birth of an authentic Kenyan vehicle brand aiming for local manufacturing… This venture’s success could lessen Kenya’s dependence on imported vehicles." – Njenga Hakeenah, China-Global South Project

Government policies are playing a critical role in this transition. Nigeria’s 2025 Electric Vehicle Bill requires foreign automakers to set up local assembly plants within three years of entering the market and to source at least 30% of their components locally by 2030. Meanwhile, Egypt has set its sights on achieving a 65% local share in its EV manufacturing value chain by 2030. Morocco, on the other hand, scored a $5.6 billion deal with Gotion High-Tech in 2025 to build a battery Gigafactory capable of producing 100 GWh annually.

This shift to local assembly doesn’t just save money – it’s creating jobs across the board. From assembling vehicles to producing batteries, processing minerals like cobalt in the DRC and lithium in Zimbabwe, maintaining EVs, building charging stations, and recycling batteries, the job opportunities are multiplying. For instance, BasiGo secured $42 million in funding during 2024/2025 to roll out 1,000 locally assembled electric buses in Kenya and Rwanda. This initiative is generating jobs in assembly, maintenance, and driver operations. As domestic production grows, more affordable EVs become available, fueling the ongoing transformation of Africa’s EV market.

6. More Charging Stations and New Technologies

Africa’s charging infrastructure is growing at an impressive pace. The market is expected to surge from $31.93 million in 2022 to $256.53 million by 2030, reflecting an annual growth rate of 30.3%. Countries like South Africa, Morocco, Kenya, and Egypt are leading the charge by expanding networks in urban areas and along major highways, making long-distance EV travel more feasible. Still, as of mid-2025, only 17% of African nations had 10 or more public charging stations.

What’s driving innovation in this space is how these stations are powered. With only eight countries on the continent meeting high grid reliability standards, many are turning to solar-powered and off-grid solutions. For example, Zembo in Uganda has introduced solar-powered charging and battery-swapping kiosks tailored for "boda boda" motorcycle taxis. These kiosks, often managed by women, ensure reliable service in areas with unstable grid connections. In Kenya, Drivelectric, and in Rwanda, SLS Energy, are finding new uses for EV batteries by converting them into stationary solar storage systems. This approach not only reduces costs but also supports a circular economy.

Battery-swapping technology is emerging as another game-changer, particularly for two- and three-wheelers. Instead of waiting hours for a battery to charge, drivers can swap out a drained battery for a fully charged one in just minutes at dedicated stations. This method is especially beneficial for commercial operators who can’t afford downtime, keeping their vehicles on the road and operations running smoothly.

Another promising development is Vehicle-to-Grid (V2G) technology, which is currently being tested in parts of East and Southern Africa. V2G allows EVs to feed power back into the grid during peak demand or outages. Essentially, this technology transforms EVs into mobile power banks, helping to stabilize energy grids and offering a new layer of functionality to electric vehicles.

7. Power Grid Challenges and Off-Grid Options

Africa’s power grids face significant hurdles that complicate the widespread adoption of electric vehicles (EVs). On average, the region’s power systems lose over 20% of their energy, with grids experiencing an alarming 81 disruptions annually. For context, the 2020 System Average Interruption Disruption Index (SAIDI) in sub-Saharan Africa stood at 39.30, while high-income OECD countries reported just 0.87. Moreover, fewer than half of grid-connected households in 34 surveyed African nations have access to reliable electricity. These challenges highlight the urgent need for alternative energy solutions that operate independently of the grid.

Adding unmanaged EV charging to the mix only worsens the strain on fragile grids. Most private EV owners charge their vehicles during evening peak hours (7–10 pm), a time when transformers and distribution systems are already under heavy load. In Nairobi, for instance, the cost of transformer upgrades to handle unmanaged EV demand could range from $300,000 (with just 5% EV penetration) to $6.5 million at higher penetration levels over five years. Across Africa, accommodating a 30% shift to EVs would require over 20% of the region’s projected ten-year electricity demand growth to be redirected solely to transportation needs.

"Africa’s grids are not ready for large-scale EV adoption. Most countries would need to divert more than a fifth of their ten-year electricity demand growth to support a 30% conversion of road transportation to EVs." – Rose Mutiso, Project Lead, Energy for Growth Hub

Off-grid energy solutions are emerging as a critical part of the equation. Mini-grids and solar-powered charging stations are proving particularly effective for electric two-wheelers, which have smaller batteries and lower energy demands. In Kenya and Rwanda, repurposed EV batteries are being used in solar storage systems, ensuring charging stations remain operational even during power outages.

Smart charging strategies also offer a way to ease the burden on existing grids. Time-of-use pricing, for example, encourages EV owners to charge during off-peak hours (1–6 am), potentially cutting transformer replacement costs by as much as 40%. Electric buses and minibuses, which typically charge during daytime off-peak hours, can actually enhance the grid’s load factor and efficiency – unlike private cars that contribute to evening peaks. Additionally, combining ultra-fast chargers with battery storage systems, as seen in earlier solar-powered kiosk models, helps manage peak demand and expands charging infrastructure without overwhelming the grid.

8. Fleet Operators and Business Buyers Leading Adoption

Commercial fleet operators are at the forefront of Africa’s shift to electric vehicles (EVs). For high-mileage vehicles, the appeal lies in EVs’ significantly lower operating costs. These savings quickly offset the higher upfront costs, making the transition not just practical but financially rewarding.

Public transportation fleets are setting the pace for this change, supported by favorable policies and growing market momentum. By May 2025, Africa boasted over 30,000 active EVs, with electric buses leading the charge at a 44% year-over-year growth rate. Companies like Roam Electric and BasiGo are spearheading this movement, rolling out hundreds of electric buses. They’ve introduced innovative financing models that align the initial costs of electric buses with those of traditional diesel buses. These fleets are also taking advantage of Africa’s renewable energy-rich electricity grids, showcasing how EV adoption can simultaneously boost efficiency and sustainability.

The growth in two-wheeler fleets is happening even faster. Spiro, for instance, has deployed 22,000 electric motorbikes and established 600 battery-swap stations across Benin and Togo. These stations allow riders to swap batteries quickly, minimizing downtime and keeping operations smooth. This is particularly impactful in regions like Kenya and Nigeria, where motorcycle taxis account for a significant portion of urban transportation – over one-third of urban rides in Kenya and up to 80% in some cities. On top of that, electric two-wheelers prove to be 25% cheaper over a five-year period compared to gas-powered models, thanks to savings on fuel and maintenance costs.

Ride-hailing and delivery platforms are also getting on board with the EV transition. Moove, a mobility fintech company, has introduced EV ride-hailing fleets in countries like Nigeria, South Africa, and Ghana. By collaborating with platforms such as Uber, Moove provides drivers with revenue-based financing options. Similarly, asset financing companies like M-KOPA and Watu Credit are offering digital loans tailored for electric two-wheelers, enabling drivers with limited credit histories to access these vehicles.

To address infrastructure challenges, fleet operators are taking matters into their own hands. Instead of relying solely on public charging networks, they are setting up private depot charging stations and working with solar energy providers to ensure a steady power supply. Charging during off-peak hours not only eases pressure on the electricity grid but also lowers costs – an advantage that individual EV owners may struggle to achieve. These efforts by fleet operators are enhancing accessibility and helping to solidify EVs as a viable option across Africa’s mobility landscape.

9. New Financing Options and Used EV Sales

One of the biggest hurdles to adopting electric vehicles (EVs) in Africa has been their high upfront cost. However, 2026 is seeing a shift as creative financing models are making EVs more accessible. One standout approach is Battery-as-a-Service (BaaS), which separates the battery cost from the vehicle’s purchase price. Instead of paying for the entire EV upfront, buyers only cover energy usage or battery swaps over time. This setup significantly reduces the initial cost, making it particularly appealing to commercial operators who can match payments to their daily earnings. Building on this, pay-as-you-go (PAYG) models further ease the financial burden by allowing payments based on usage.

PAYG financing has been especially successful in the electric two-wheeler market, turning what used to be a hefty purchase into a subscription-like model based on mileage. For instance, Ampersand expanded its battery-swapping network to 32 stations by late 2024, serving 1,700 customers. The company plans to scale up to 10,000 units, offering financing options that directly compete with traditional petrol costs. These efforts are opening the door for riders and operators who previously couldn’t afford the upfront investment in EVs.

Beyond new vehicle purchases, financing innovations are also boosting the second-hand EV market. Expanding EV adoption in sub-Saharan Africa will require an estimated $3.5–$8.9 billion in investments across asset financing, local assembly, and charging infrastructure. Governments are stepping in to help. For example, South Africa has introduced a 150% tax deduction for EV production starting in 2026, while Uganda is projected to allocate $800 million toward e-mobility funding. Digital lending platforms are also playing a role by offering targeted loans for electric motorcycles, making them accessible to drivers with limited credit histories.

The emerging used EV market adds another layer of opportunity to reduce upfront costs. Although still in its early stages, this market is poised for growth as global economies push toward 100% EV sales by 2035. Kenya has already taken steps to regulate imported EV batteries, requiring them to maintain at least 80% battery health, ensuring Africa doesn’t become a dumping ground for degraded vehicles. Additionally, second-life battery applications are gaining momentum. Used EV batteries are being repurposed for stationary solar energy storage, creating extra value that can help lower financing barriers while advancing Africa’s renewable energy goals.

"Commercial E2W leads adoption due to strong product-market fit and financing, positioning Africa for scalable e-mobility growth." – Africa E-Mobility Alliance

10. Consumer Education and Real-World Use Cases

While market growth and creative financing options are helping drive the adoption of electric vehicles (EVs), consumer education remains a critical piece of the puzzle. A key challenge in Africa is addressing knowledge gaps. For instance, over 90% of vehicle owners in Nigeria and Kenya are aware of EVs, yet most cite range anxiety and high upfront costs as their biggest concerns. The task now is to share the benefits of EVs in ways that feel both reliable and relatable.

Real-world examples are proving to be more persuasive than traditional marketing. Commercial EV fleets, acting as "rolling showrooms", demonstrate their reliability to thousands of commuters every day. This visible performance helps build trust. In urban areas, where 60–80% of daily trips rely on public transportation, these demonstrations reach a significant audience.

Educational programs are also stepping up to close the knowledge gap. Initiatives like Roam’s Women in EV Program in Kenya and Ampersand’s driver training in Rwanda aim to increase women’s participation in e-mobility. A 2021 pilot study in East Africa, involving 40 drivers, revealed that after hands-on experience, every participant expressed a strong likelihood of choosing an electric two-wheeler as their next vehicle. Physical brand stores, like those opened by Nezha Automobile in Kenya, further enhance consumer understanding by allowing direct interaction with EV technology and addressing questions about maintenance and performance. These efforts, combined with hands-on demonstrations, are empowering consumers to make informed decisions about switching to EVs.

"The total cost of ownership (TCO) of EVs is more favorable than that of ICE vehicles, even in countries with fairly high electricity costs like Kenya." – McKinsey & Company

Another major hurdle – range anxiety – is being tackled head-on with battery-swapping solutions. Spiro’s network of 22,000 electric bikes and 600 battery-swap stations across Africa has completed 9 million battery swaps, proving that "refueling" an EV can be just as convenient as stopping for gas. For prospective buyers, platforms like EV24.africa offer transparent pricing and detailed specifications, making it easier to compare the total cost of ownership rather than focusing solely on upfront costs.

Conclusion

Africa’s electric vehicle (EV) market is hitting a critical juncture. The trends we’ve explored – ranging from increasing adoption rates and government incentives to local manufacturing initiatives and creative financing models – show that the shift to electric mobility is gaining momentum. By 2040, key markets are expected to nearly double their vehicle numbers, growing from 25 million to 58 million, while slashing carbon emissions by up to 25%. With such transformative potential, action from all sectors is essential.

To drive this change, governments need to step up with tax breaks, stricter emissions standards, and age limits on imported used internal combustion engine (ICE) vehicles to prevent dumping. Meanwhile, businesses should prioritize building charging stations in high-traffic areas, and financial institutions must provide affordable financing options to make EVs more accessible.

Experts echo these priorities:

"EVs are a critical component of achieving climate neutrality… and improving quality of life in cities by reducing air and noise pollution." – Julian Conzade, Hauke Engel, Adam Kendall, and Gillian Pais

The benefits are clear: EVs not only reduce overall ownership costs but also cut life-cycle emissions by 65%–85%. This underscores the urgency of addressing affordability challenges, especially in sub-Saharan Africa, where 85% of all four-wheel vehicle sales are for used vehicles.

Collaboration is key. Governments, businesses, and consumers must work together to electrify transportation. Fleet operators should prioritize electrifying minibuses and delivery vans, as these vehicles rack up high daily mileage, making cost savings more immediate. Energy providers must prepare for increased off-peak electricity demand as EVs charge overnight. And in areas with limited grid access, mini-grids can offer reliable charging solutions, making electric two-wheelers a practical option for commercial use.

These efforts align with the trends shaping Africa’s EV journey. With the right mix of supportive policies, infrastructure investments, and consumer awareness, Africa has the opportunity to bypass outdated technologies and build a cleaner, more sustainable future for transportation.

FAQs

What are African governments doing to support the adoption of electric vehicles?

African governments are rolling out a mix of strategies to make electric vehicles (EVs) more affordable and within reach for their citizens. Many nations are offering tax incentives – like reduced import duties, tax exemptions, and subsidies – to bring down the costs tied to owning an EV. On top of that, financial support programs, including low-interest loans and grants, are helping both individuals and businesses manage the initial expenses involved.

To encourage local production, governments are providing manufacturing and assembly incentives, such as tax breaks and the establishment of special economic zones to attract EV manufacturers. Infrastructure development is also a key focus, with investments being funneled into public charging networks, often powered by renewable energy sources like solar and wind. These efforts are further supported by regional cooperation to align standards and simplify trade, building the foundation for a sustainable and scalable EV ecosystem across the continent.

What are the biggest challenges to adopting electric vehicles in Africa?

The shift to electric vehicles (EVs) in Africa is not without its obstacles. One of the biggest challenges is the high upfront cost. EVs come with a price tag that’s noticeably steeper than traditional gasoline-powered cars. To make matters worse, financing options are scarce, leaving many consumers unable to afford them. Adding to the cost are high import duties and the absence of local manufacturing, which further inflate prices.

Another major issue is the limited charging infrastructure. Public charging stations are few and far between, and in many areas, electricity supply is unreliable. This makes it tough to guarantee consistent power for EV chargers, leading to "range anxiety" – the fear of running out of battery before finding a charging station – which discourages potential buyers from making the switch.

On top of that, there’s the problem of non-standardized charging protocols. Different systems like CCS, CHAdeMO, and Type 2 connectors create confusion and drive up installation expenses. This lack of standardization also complicates cross-border travel, as drivers can’t rely on universal compatibility. When you factor in inconsistent government policies and varying incentives, it’s clear why the move to EVs is progressing at a slower pace across the continent.

How does assembling electric vehicles locally in Africa affect costs and job opportunities?

Local assembly of electric vehicles (EVs) in Africa offers a twofold benefit: it makes EVs more affordable for consumers and generates a wealth of job opportunities. By assembling vehicles locally rather than importing them fully built, manufacturers cut down on hefty import duties and shipping expenses. These cost savings often translate into EVs being 10–20% less expensive than their fully imported counterparts. On top of that, many governments sweeten the deal with incentives like tax breaks and production subsidies, further driving down costs.

The advantages don’t stop there. Local assembly sparks job creation across a range of sectors. From assembling vehicles to producing batteries, thousands of positions are opening up in manufacturing, logistics, quality control, and after-sales services. This ripple effect extends to industries like metalworking, software development, and renewable energy, encouraging economic diversification and providing roles for both skilled and semi-skilled workers. In short, assembling EVs locally doesn’t just make them more accessible – it also fuels economic growth and job creation across the continent.