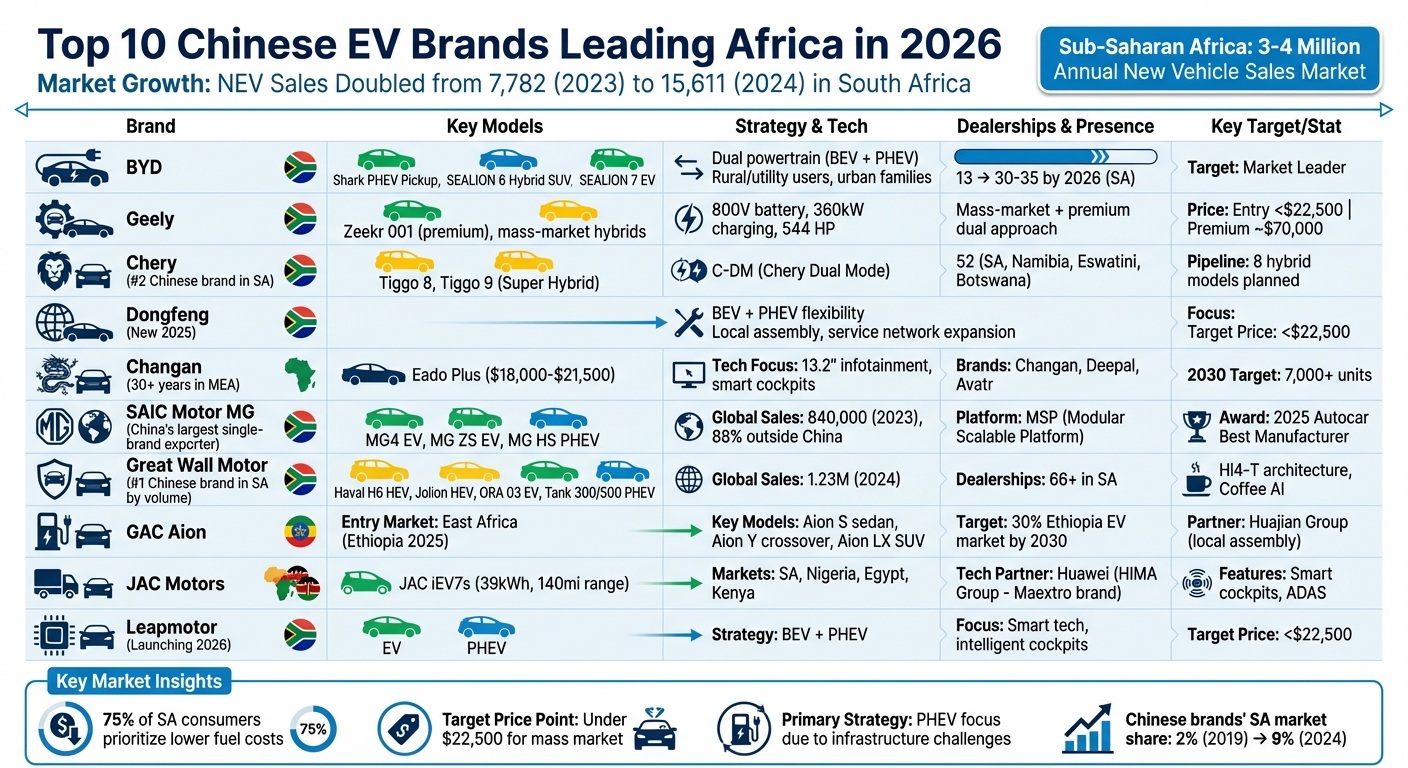

Chinese EV brands are reshaping Africa’s auto market, driven by competitive pricing, hybrid-focused strategies, and solutions tailored for local challenges like unreliable power grids. With South Africa as the main entry point, sales of new energy vehicles (NEVs) doubled between 2023 and 2024, reaching 15,611 units. Here’s a quick look at the top brands making waves:

- BYD: Focuses on hybrids like the Shark pickup and SEALION SUVs, addressing range anxiety with expanded service networks.

- Geely: Combines affordability with high-end options like the Zeekr 001, offering cutting-edge battery tech and performance.

- Chery: Prioritizes plug-in hybrids like the Tiggo 8 and Tiggo 9, with plans for local assembly and tech partnerships.

- Dongfeng: Offers flexible hybrid and electric models while expanding its service network.

- Changan: Balances budget-friendly options with tech-forward features like large infotainment systems.

- SAIC Motor MG: Leverages European-standard designs and steady battery supply for models like the MG4 EV.

- Great Wall Motor (Haval/ORA): Leads in South Africa with hybrids and rugged models like the Tank series.

- GAC Aion: Targets East Africa with diverse models and local assembly partnerships.

- JAC Motors: Affordable BEVs and hybrids, integrating smart features via Huawei partnerships.

- Leapmotor: Debuts in 2026 with a focus on smart tech and affordability.

Chinese automakers are pricing most models under $22,500, focusing on hybrids to overcome charging infrastructure limitations. As demand grows, local assembly and digital platforms like EV24.africa are making EVs more accessible across the region.

Top 10 Chinese EV Brands in Africa 2026: Market Positioning and Key Models

What Chinese EV Brands Need to Succeed in Africa

1. BYD

BYD has taken a smart approach to growing its presence by offering both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). This dual powertrain strategy addresses two key challenges: unreliable power grids and limited charging infrastructure. By not focusing solely on fully electric models, BYD helps ease range anxiety and encourages broader adoption of EVs. This approach is evident in the company’s recent model launches and service expansions in South Africa.

In April 2025, BYD introduced three new models to complement its ATTO 3 lineup: the Shark plug-in hybrid pick-up, the SEALION 6 hybrid SUV, and the SEALION 7 electric SUV. The Shark pick-up, in particular, is designed to meet the local demand for utility vehicles while offering the flexibility of a hybrid powertrain to alleviate concerns about range.

To support its growing customer base, BYD is also expanding its service network. In June 2025, General Manager Steve Chang announced plans to increase South Africa’s dealership footprint from 13 locations to between 30 and 35 by 2026, ensuring customers have access to maintenance and support nationwide. As Chang explained:

"South Africa is actually one of the most important automotive markets in the southern Hemisphere. It’s probably the biggest market in all of Africa, so it’s a market that we have to look at and see how we can develop the market."

This combination of new models, expanded services, and consumer education efforts has contributed to a surge in NEV sales – from 7,782 in 2023 to 15,611 in 2024. While BYD hasn’t disclosed specific pricing for African markets, its focus on educating consumers and building early momentum has clearly paid off. Chang emphasized the importance of this educational mission:

"We want to educate and cultivate the market of South Africa and make sure that the South African consumers can catch up with the rest of the world."

2. Geely

Geely is making waves in the African market by combining premium performance with cutting-edge technology from its high-end brands like Volvo, Polestar, and Lotus. South Africa plays a key role in Geely’s plans, serving as a launchpad for broader expansion across the continent. What sets Geely apart is its dual focus: offering both mass-market hybrids and premium electric vehicles (EVs) through its Zeekr sub-brand. This approach allows Geely to cater to a wide range of consumers while pushing forward with innovative model designs.

One standout model is the Zeekr 001, which features an advanced 800-volt battery system capable of charging at up to 360 kW. This means drivers can add up to 310 miles of range in just 15 minutes. The dual-motor version is no slouch either, delivering 544 horsepower and accelerating from 0 to 62 mph in only 3.8 seconds. These specs put the Zeekr 001 in direct competition with high-performance EVs like the Tesla Model Y Performance.

Geely’s strategy isn’t just about high-end performance; it’s also about practicality and affordability. To address infrastructure challenges, the company offers a mix of plug-in hybrids, traditional hybrids, and fully electric vehicles. Industry expert Greg Cress highlights Geely’s competitive edge, saying, "As long as they remain affordable from an up-front cost perspective, they will be differentiated against legacy brands offering similar specifications".

For the budget-conscious buyer, Geely offers entry-level EVs and hybrids priced under $22,500. On the other hand, premium models like the Zeekr 001 are positioned at around $70,000. The company also leverages Volvo’s global network to ensure reliable service and support. However, challenges like consumer concerns over spare parts availability and resale value remain. Even so, Geely’s global infrastructure is expected to help address these issues and establish trust across African markets.

With 75% of South African consumers prioritizing lower fuel costs when choosing EVs, Geely’s blend of affordable hybrids and high-performance electric models is well-suited to meet diverse market demands. This dual approach reflects Geely’s ability to balance forward-thinking innovation with the practical needs of local consumers.

3. Chery

Chery has established itself as the second-largest Chinese automotive brand in South Africa, using the region as a strategic entry point into the broader African market. Recognizing the challenges posed by unreliable power grids and limited charging infrastructure across Africa, Chery has concentrated on plug-in hybrids (PHEVs) and extended-range hybrids. Hans Greyling, General Manager of Omoda & Jaecoo South Africa, explains the rationale:

"Battery electric vehicles have not really taken off in South Africa. We’ve gone the route of looking more towards traditional hybrids or plug-in hybrids".

In June 2025, Chery introduced its Super Hybrid (CSH) lineup, which includes the Tiggo 8 and Tiggo 9 models. These vehicles feature the company’s proprietary "Chery Dual Mode" (C-DM) technology, combining high-efficiency engines with electric motors to extend driving range without relying on charging stations. Looking ahead, Chery plans to launch eight hybrid models in South Africa, including five extended-range PHEVs and three traditional hybrids, alongside electric vehicles from its iCar and Lepas sub-brands. This approach allows Chery to offer advanced technology while maintaining competitive pricing.

To attract budget-conscious consumers, Chery aims to price its new energy vehicles below 400,000 rand (approximately $22,500). The premium Omoda & Jaecoo brand has already established a solid footprint with 52 dealerships across South Africa, Namibia, Eswatini, and Botswana, and plans to expand into Zambia and Tanzania to improve accessibility.

Chery isn’t stopping there. The company is exploring local vehicle assembly to cut import costs and take advantage of government incentives. It’s also working with industry leaders like CATL, Gotion High-tech, and Nio on battery-swapping technology, ensuring it stays ahead in innovation. Tony Liu, CEO of Chery South Africa, highlights the potential for growth:

"Based on our experience in China, once the market share of new energy vehicles reaches almost 10%, then the demand will start to explode".

4. Dongfeng

Introduced in 2025, Dongfeng is one of the latest Chinese automakers to enter the South African market, joining nearly half of the 14 Chinese brands that made their debut last year.

To address local infrastructure limitations, Dongfeng offers both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), giving buyers more flexibility. Greg Cress from Accenture highlights this strategy, stating:

"As long as they remain affordable from an up-front cost perspective, they will be differentiated against legacy brands offering similar specifications."

However, Dongfeng faces challenges like consumer doubts about spare parts availability and resale value. To tackle these issues, the company is expanding its local service network and considering local assembly. By setting up semi-knockdown plants, Dongfeng aims to take advantage of government incentives, improve access to parts, and cut costs.

With these efforts underway, Dongfeng plans to offer entry-level models priced below $22,500 (around 400,000 rand). This strategic pricing targets a growing market, as South Africa’s new energy vehicle sales have surged, doubling to 15,611 units. Beyond South Africa, Dongfeng also sees potential in the broader Sub-Saharan region, which boasts an annual market of 3 to 4 million new vehicle sales.

5. Changan

Changan is no newcomer to the automotive scene in the Middle East and Africa. With over 30 years of experience in these regions, the brand is leveraging its history as it gears up for an ambitious EV rollout by 2026. This long-standing presence gives Changan a unique edge among Chinese automakers operating on the continent, allowing it to navigate the market with confidence and strategy. The company is transforming itself into what it calls an "intelligent low-carbon mobility technology company", implementing a multi-brand approach that includes Changan, Deepal, and Avatr, each catering to different market needs.

In Africa, Changan has adopted a dual-track strategy, offering both budget-friendly gasoline vehicles and a growing lineup of electric and plug-in hybrid models. This approach ensures buyers have options that align with their financial means and the available infrastructure. The company has set an entry price point below $22,500, making its vehicles accessible to a wide range of consumers.

When it comes to technology, Changan prioritizes smart features over sheer performance. Take the Eado Plus, for example – priced between $18,000 and $21,500, it boasts a 13.2-inch infotainment screen, a feature typically found in more expensive cars. According to Stephen Dyer from AlixPartners, Chinese brands like Changan excel at delivering "intelligent cockpits and advanced driver-assistance systems… at relatively affordable prices".

To address concerns about service and long-term reliability – key barriers for Chinese brands in Africa – Changan has launched global service skills competitions aimed at setting "Global Service Excellence" standards. This effort directly tackles issues like spare parts availability and after-sales support, which are critical for building consumer trust.

Changan’s green initiatives are driven by programs like the "Vast Ocean Plan" and "Mission of Shangri-La", while its "Dubhe Plan" focuses on advancing intelligent vehicle technologies. With Africa’s EV market expected to grow significantly, Changan is well-positioned to capture a wide range of price segments. By 2025, the company anticipates revenue of around $263 million, with total sales projected to surpass 7,000 units by 2030.

6. SAIC Motor MG

MG Motor, a brand under SAIC Motor, has firmly established itself as China’s largest single-brand car exporter, a title it has proudly held for five years straight as of 2024. The brand made its first move into Africa in early 2023, starting with Morocco through a distribution partnership with Abdul Latif Jameel. By 2026, MG had expanded its reach across the continent, offering affordable vehicles designed to European standards. This growth highlights a broader trend of Chinese carmakers tailoring their offerings to meet Africa’s specific needs.

MG’s electric lineup includes models like the MG4 EV (a C-segment hatchback), the MG ZS EV, and the MG HS PHEV. These vehicles are built on MG’s Modular Scalable Platform (MSP), a system specifically developed for European battery electric vehicles. One of MG’s standout advantages is SAIC Motor’s steady access to traction battery supplies, ensuring a consistent flow of EV models to the market – something that often challenges other automakers. Like other Chinese brands operating in Africa, MG offers a mix of fully electric vehicles and plug-in hybrids, catering to regions where charging infrastructure is still developing.

The brand combines quality, affordability, and modern design, a winning formula that earned it the 2025 Autocar Awards Best Manufacturer title. Globally, MG sold approximately 840,000 vehicles in 2023, with 88% of those sales occurring outside China. The MG ZS was a standout performer, with 201,874 units exported in 2023, alongside 49,418 units of the ZS EV. In Africa, MG aligns with market preferences by offering models priced under $22,500.

Expanding its service network is another key focus for MG, building on its established retail presence in the Middle East and North Africa, including countries like Jordan, Lebanon, Morocco, and the UAE. While most MG cars are manufactured in China, SAIC also operates production facilities in Thailand, India, and Indonesia – plants that could potentially support local assembly in Africa. With the MG4 EV earning widespread praise in the press and boosting global sales, MG is positioning itself as a go-to choice for African buyers looking for reliable technology at accessible prices.

sbb-itb-99e19e3

7. Great Wall Motor (Haval/ORA)

Great Wall Motor (GWM) has established itself as the top-selling Chinese automaker in South Africa by sales volume. Globally, the company sold an impressive 1.23 million vehicles in 2024 and has built a strong presence in South Africa with over 66 dealerships. Its reach extends beyond South Africa into markets like Algeria, Egypt, Libya, Mauritius, Morocco, Mozambique, and Tunisia.

Recognizing the challenges posed by Africa’s inconsistent power grids and limited charging infrastructure, GWM has chosen to emphasize Plug-in Hybrid Electric Vehicles (PHEVs) and traditional hybrids, rather than focusing solely on battery electric vehicles (BEVs). Their lineup includes models tailored to a range of needs: the Haval H6 HEV and Jolion HEV for urban families, the fully electric ORA 03 (Good Cat) for tech-savvy buyers, and the rugged Tank 300 and Tank 500 PHEVs for off-road enthusiasts. The Haval H6, in particular, has enjoyed global success, with over 4 million units sold worldwide by 2024. The Tank series is powered by GWM’s Hi4-T (Off-road Super Hybrid Architecture), while "Coffee AI" technology enhances the vehicles’ intelligent cabin features. This blend of advanced technology and affordability is central to the brand’s strategy.

Affordability is a key focus, with GWM pricing many of its models under $22,500 to stand out from traditional automakers. Conrad Groenewald, COO of GWM South Africa, has hinted at the possibility of local semi-knockdown (SKD) assembly within the next year, which could lower production costs even further and improve vehicle accessibility across the continent.

GWM’s "One GWM" strategy ties together its sub-brands – Haval, ORA, Tank, and Wey – under a unified hybrid-focused approach, aligning with the evolving electric vehicle market in Africa.

8. GAC Aion

GAC Aion is making a bold move into East Africa, with Ethiopia set to become its entry point starting in 2025. The brand’s lineup includes three distinct models aimed at meeting the needs of various market segments: the Aion S sedan, designed for city commuters; the Aion Y crossover, perfect for families seeking flexibility; and the Aion LX premium SUV, catering to those who prioritize space and luxury. This diverse range ensures the brand can serve both urban and rural customers effectively.

To strengthen its foothold, GAC Aion is focusing on partnerships and local production. The company has ambitious goals, aiming to secure 30% of Ethiopia’s electric vehicle market by 2030. A key part of this plan involves teaming up with the Huajian Group, an African manufacturing veteran, to handle distribution and after-sales services. According to Birr Metrics, "The partnership is expected to include local assembly operations and long-term technical knowledge transfer". This collaboration is designed to address challenges like infrastructure and maintenance, which have traditionally hampered EV adoption in the region.

GAC Aion’s African expansion is part of a larger movement by Chinese automakers to enter global markets, where profit margins are often more attractive. The company is also gaining traction in South Africa, the continent’s largest market for new energy vehicles. Sales of NEVs in South Africa surged from 7,782 units in 2023 to 15,611 units in 2024, highlighting the growing demand in the region.

Beyond selling vehicles, GAC Aion is tying its growth strategy to the battery mineral supply chain. The company is negotiating partnerships in resource-rich countries like Nigeria, which holds key reserves of lithium, cobalt, and nickel. This integrated approach – combining vehicle distribution, local assembly, and resource partnerships – creates a more reliable ecosystem for African EV buyers. By sourcing components directly from manufacturers, GAC Aion is improving access to spare parts and maintenance services. This comprehensive strategy reflects how Chinese automakers are adapting to Africa’s unique market dynamics.

9. JAC Motors

JAC Motors is making strides across South Africa, Nigeria, Egypt, and Kenya, following the trend of Chinese EVs adapting to Africa’s unique market needs. The brand’s pitch is simple but effective: offer advanced technology at prices that don’t break the bank. In South Africa, Chinese car brands have collectively grown their market share from 2% in 2019 to 9% by July 2024, and JAC has played a role in this growth. Their focus on affordability and practicality is evident in the technical specs of their vehicles.

Take the JAC iEV7s, for example. This BEV comes equipped with a 39.0 kWh battery, providing a real-world range of around 140 miles (225 km). While this range is ideal for city driving, the vehicle also supports fast charging at 37 kW DC, allowing it to go from 10% to 80% charge in 57 minutes. It’s no speedster, but with an acceleration time of 12.0 seconds from 0-62 mph (0-100 km/h) and front-wheel drive delivering 270 Nm of torque, it’s well-suited for everyday use.

JAC is also leveraging partnerships to strengthen its market position. Through its collaboration with Huawei under the Harmony Intelligent Mobility Alliance (HIMA) Group, JAC is integrating cutting-edge smart features into its vehicles via the "Maextro" brand. This partnership brings Huawei’s expertise in smart software, intelligent cockpits, and advanced driver-assistance systems (ADAS) into JAC’s lineup. As Stephen Dyer, Partner and Managing Director at AlixPartners, explains, "Chinese EV brands are particularly strong in smart vehicle features, including intelligent cockpits and advanced driver-assistance systems… They also offer appealing designs and solid mechanical performance at relatively affordable prices".

To compete with legacy brands, JAC is targeting the under $22,500 price segment. They are actively expanding their sales and service network in South Africa to ensure the availability of spare parts and reliable long-term support – key concerns for local buyers. With offerings in both passenger and commercial vehicle categories, JAC is positioning itself to meet the diverse needs of customers across the continent.

10. Leapmotor

Leapmotor plans to make its debut in South Africa in 2026, aiming to tap into Africa’s growing interest in electric vehicles (EVs). To address the region’s infrastructure challenges, the company is taking a two-pronged approach, offering both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

What sets Leapmotor apart is its focus on integrating smart technology. Features like intelligent cockpits and advanced driver-assistance systems are becoming its signature, helping the brand stand out from more established automakers. To attract buyers in Africa, Leapmotor is targeting an entry-level price under $22,500, making affordability a key part of its strategy.

Although Africa’s EV market is still small, it’s showing promise. In 2024, sales of electric cars in the region more than doubled. However, EVs still make up less than 1% of total vehicle sales. This growth suggests potential, but Leapmotor will need to address the concerns of cautious buyers.

Like other Chinese EV brands entering the market, Leapmotor faces hurdles such as skepticism about spare parts availability and worries over long-term resale value. Building a dependable service network and proving its commitment to after-sales support will be critical for gaining the trust of African consumers.

Brand Comparison Table

As mentioned earlier, affordability and hybrid technology are at the heart of these brands’ strategies in Africa. Chinese automakers are aiming for entry-level pricing below $22,500 to compete with established players. At the same time, they’re prioritizing plug-in hybrids (PHEVs) over fully electric vehicles due to Africa’s inconsistent power grids and limited charging infrastructure.

Here’s a breakdown of how these brands align their offerings with local market demands, considering pricing, vehicle type, and target buyers:

| Brand | Key Model | Type | Target Price (USD) | Target Buyers |

|---|---|---|---|---|

| BYD | Shark | PHEV Pickup | Under $22,500 | Rural/Utility users, Commercial buyers |

| BYD | SEALION 6 | PHEV Crossover | Under $22,500 | Urban families, Daily commuters |

| Chery | Tiggo 8 | Super Hybrid (PHEV) | Under $22,500 | Urban commuters, Tech-focused buyers |

| Geely (Omoda) | C5 | PHEV/EV | Under $22,500 | Premium/Aspirational buyers |

| GWM (ORA) | ORA 03 | BEV | Under $22,500 | Urban commuters, Value-seekers |

| GWM (Haval) | Jolion HEV | Hybrid | Under $22,500 | Urban commuters, Value-seekers |

PHEVs are a standout choice here, offering a practical solution to Africa’s energy challenges. With power grids often unreliable, these vehicles provide flexibility that fully electric models simply can’t match. Local experts highlight this trend, with Greg Cress of Accenture noting, "As long as they remain affordable from an up-front cost perspective, they will be differentiated against legacy brands offering similar specifications".

The combination of competitive pricing – kept below $22,500 – and flexible powertrain options positions these brands to meet the unique needs of African consumers, who must balance daily driving requirements with limited charging infrastructure. This strategic focus underscores how these automakers are tailoring their approach to the African market.

Conclusion

Chinese electric vehicle (EV) brands are reshaping Africa’s auto market. In South Africa alone, sales of new energy vehicles doubled to 15,611 units between 2023 and 2024, signaling immense growth potential in Sub-Saharan Africa, where annual new car sales range between 3 and 4 million units.

By focusing on plug-in hybrids to address infrastructure limitations and pricing vehicles below $22,500, these brands are making EVs more accessible. Local assembly not only helps reduce costs but also creates jobs, positioning these manufacturers to thrive in emerging markets. Industry experts suggest that once new energy vehicles capture 10% of the market, consumer demand could surge dramatically. Steve Chang, General Manager of BYD Auto South Africa, emphasized this opportunity, saying:

"I think South Africa and the rest of Africa have a very big opportunity to what I call leapfrog from ICE into renewable energy (cars)"

This "leapfrogging" effect underscores Africa’s potential to bypass traditional automotive development stages and move directly into cleaner, renewable energy technologies.

Digital platforms are also playing a critical role in this transformation. Websites like EV24.africa simplify the process of finding and purchasing Chinese EVs across 54 countries by offering transparent pricing, detailed specifications, and financing options. With brands like BYD, Chery, and Geely expanding their reach in East, Southern, and West Africa, access to these vehicles is becoming more convenient than ever.

As infrastructure develops and consumer confidence grows, Chinese EV brands are poised to lead Africa’s transition to cleaner, more sustainable transportation.

FAQs

How are Chinese EV brands solving Africa’s charging infrastructure challenges?

Chinese electric vehicle (EV) manufacturers are tackling Africa’s limited charging infrastructure with a mix of budget-friendly cars and practical solutions. Brands like BYD and Chery are rolling out plug-in hybrid models that can run on both electricity and gasoline. This dual-fuel approach offers drivers flexibility, especially in regions where charging stations are scarce. These hybrids serve as a temporary but effective solution while fully electric infrastructure continues to grow.

On top of that, Chinese automakers are setting up local assembly plants and teaming up with partners to establish fast-charging stations and battery-swap hubs. These hubs are often strategically placed in busy areas, such as taxi depots, ensuring they’re easily accessible. By combining affordable EVs, hybrid options, and efforts to expand the charging network, these manufacturers are speeding up EV adoption and helping to address Africa’s power availability challenges.

Why are Chinese automakers prioritizing hybrid vehicles for Africa?

Chinese automakers are turning their attention to hybrid vehicles in Africa, largely because the continent’s charging infrastructure is still in its early stages, and electricity supply can be unpredictable. Hybrids strike a balance by offering electric power for shorter trips while relying on a gasoline engine for longer drives or areas without charging facilities. This makes them a practical choice for the varied driving needs across the region.

Another key factor is cost. Hybrids are generally more budget-friendly than fully electric vehicles, which aligns well with the preferences of many African consumers who prioritize affordability. This combination of cost-effectiveness and adaptability to infrastructure challenges is enabling brands like BYD, Chery, and Great Wall to grow their presence rapidly, providing dependable and economical transportation options.

By addressing both environmental concerns and existing infrastructure constraints, hybrids are paving the way for a smoother transition to cleaner mobility across the continent.

How are Chinese EV brands making their vehicles more affordable in Africa?

Chinese electric vehicle (EV) manufacturers are finding creative ways to make their cars more affordable across Africa. One of the key strategies is setting up local assembly plants or forming partnerships. This reduces shipping costs and import duties while taking advantage of government incentives. For instance, Chery has plants in Egypt and Zimbabwe, while BYD assembles vehicles in South Africa and Kenya through local deals.

Another approach is focusing on vertical integration. Companies like BYD manufacture their own batteries to cut expenses, while others, such as Geely, rely on domestic suppliers for essential components. In addition, many brands use competitive pricing strategies by offering budget-friendly options like Geely’s Geometry and RD6, which start at approximately $13,000. Leasing programs tailored for taxi operators and hybrid models, which require less charging infrastructure, also help keep costs down.

Chinese automakers further benefit from favorable trade policies in many African nations, including tax breaks and reduced import duties. These savings are passed along to consumers, making EVs more affordable and appealing in the region. Combined, these tactics are helping Chinese EV brands gain traction in African markets.