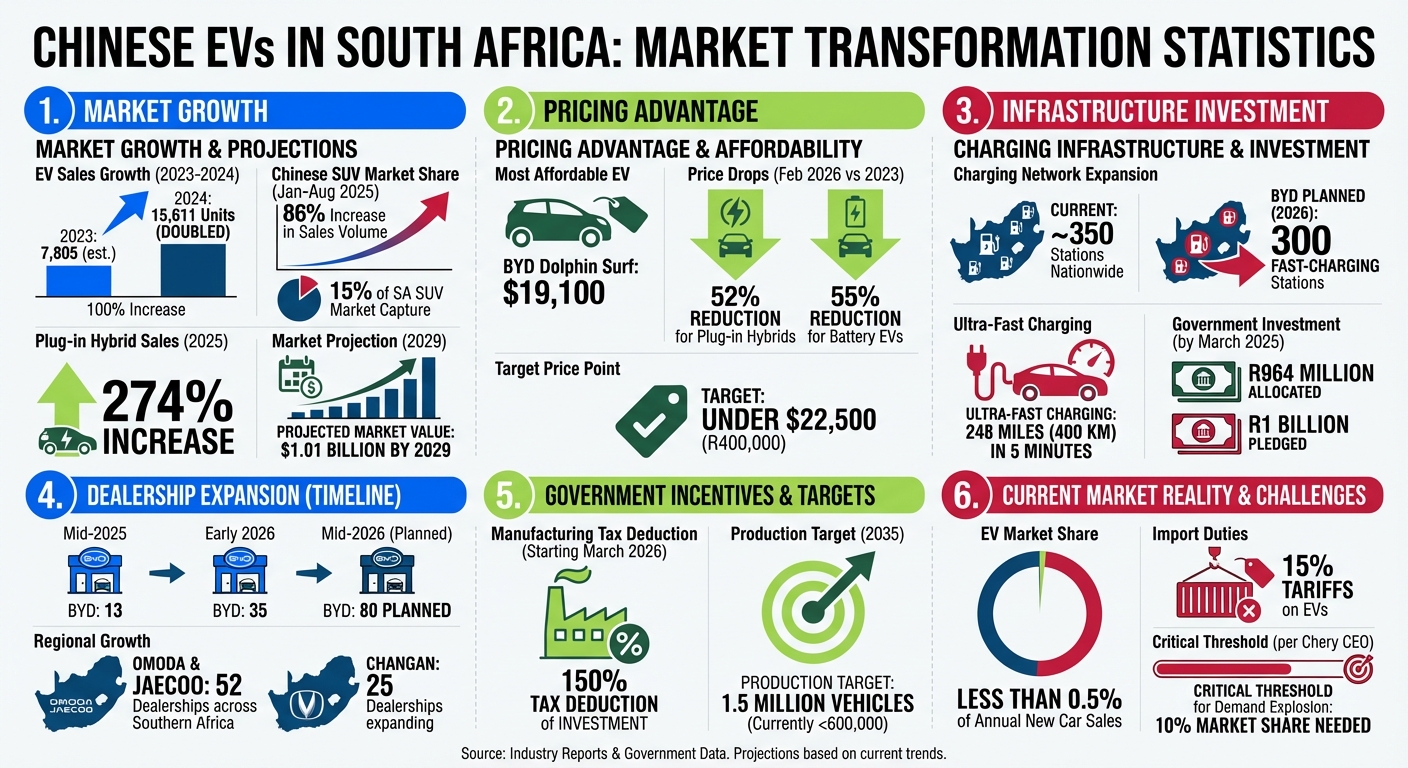

Chinese electric vehicle (EV) manufacturers like BYD, NIO, and Geely are reshaping South Africa’s car market. With competitive pricing, advanced models, and plans for local manufacturing, they aim to make EVs more accessible. Here’s what’s happening:

- Competitive Pricing: BYD’s Dolphin Surf starts at $19,100, far cheaper than European options like BMW hybrids.

- Market Growth: EV sales in South Africa doubled between 2023 and 2024, reaching 15,611 units.

- Infrastructure Investment: BYD plans 300 fast-charging stations by 2026, addressing charging concerns.

- Local Manufacturing: Chinese automakers are exploring assembly plants to cut costs and utilize South Africa’s duty-free access to Europe.

- Hybrid Focus: Plug-in hybrids are gaining traction due to power outage concerns, with sales up 274% in 2025.

Despite challenges like limited charging stations and high import duties, Chinese EV brands are driving change with affordable and practical solutions for South African consumers.

Chinese EV Market Impact in South Africa: Key Statistics and Growth Metrics

China’s BYD Plans 200 to 300 Charging Stations in South Africa by End 2026

How Chinese EV Makers Are Entering the South African Market

Chinese electric vehicle (EV) manufacturers are tapping into South Africa’s market by combining competitive pricing, advanced technologies, and strategic partnerships. This approach is helping them carve out a growing share of the country’s automotive landscape.

Lower Prices and Competitive Models

By offering vehicles priced under $22,500 (R400,000), Chinese EV makers are undercutting established European and Japanese brands. This pricing strategy is paying off – Chinese original equipment manufacturers (OEMs) saw an 86% increase in sales volume in the South African SUV market between January and August 2025, capturing 15% of the market.

Rather than focusing solely on pure EVs, these manufacturers are prioritizing plug-in hybrids and traditional hybrids. For instance, Chery introduced eight hybrid models in June 2025, including five extended-range plug-in versions, addressing consumer concerns about power outages. This dual-powertrain approach is proving effective, as plug-in hybrid sales skyrocketed 274% in 2025, appealing to buyers seeking a balance between affordability and practicality.

"As long as they remain affordable from an up-front cost perspective, they will be differentiated against legacy brands offering similar specifications."

- Greg Cress, Advisory Firm Accenture

Battery Range, Fast Charging, and Smart Features

Chinese EV makers are tackling infrastructure challenges head-on with cutting-edge technology. Take BYD’s "Blade Battery", for example – it enhances energy density for greater range while prioritizing safety. On the charging front, BYD has introduced "Megawatt Flash Chargers", which deliver 248 miles (400 km) of range in just five minutes, rivaling the speed of traditional refueling.

Meanwhile, range-extender solutions are gaining traction. The Leapmotor C10 REEV offers an impressive range of 603 miles (970 km) using a petrol generator backup, while the BYD Shark 6 PHEV provides an all-electric range of 53 miles (85 km) with a 29.58kWh battery. Both models leverage BYD’s e-Platform 3.0 for improved efficiency and seamless digital integration.

To address South Africa’s grid instability, manufacturers are introducing solar-integrated charging systems, allowing EV owners to charge their vehicles independently of the national power grid. Premium models, like the BYD Seal, also come equipped with heat pump systems to enhance energy efficiency across different weather conditions.

"The new EV chargers will be able to provide as much as 400km of range to a vehicle in about five minutes, equivalent to the refueling time for a traditional petrol- or diesel-powered vehicle."

- Stella Li, Executive Vice President, BYD

Beyond technology, Chinese brands are strengthening their presence through local partnerships and dealer networks.

Working with South African Distributors and Dealers

Expanding dealership networks has been a key focus for Chinese EV makers. BYD, for example, increased its dealership count from 13 in mid-2025 to 35 by early 2026, with plans to reach 80 dealerships by mid-2026, ensuring coverage across all South African provinces. Similarly, Omoda & Jaecoo operates 52 dealerships in South Africa and neighboring countries.

In addition to retail expansion, manufacturers are exploring local assembly options to cut costs and take advantage of government incentives. Chery, GWM, and Omoda & Jaecoo are conducting feasibility studies for semi-knockdown (SKD) plants or partnering with local manufacturers. Starting in March 2026, the South African government will offer a subsidy allowing manufacturers to claim 150% of any investment made in electric and hydrogen-fueled vehicles.

Infrastructure investment is another critical step. BYD Auto South Africa announced plans in October 2025 to build 300 fast-charging stations nationwide by the end of 2026, with construction beginning in the second quarter of 2026. Furthermore, they are setting up dedicated distribution centers for spare parts and expanding after-sales support to ease consumer concerns about long-term vehicle maintenance.

Barriers to EV Adoption in South Africa

South Africa’s electric vehicle (EV) market is grappling with a host of challenges, despite the rapid global expansion of Chinese EV manufacturers. With EVs making up less than 0.5% of annual new car sales in the country, structural and policy-related hurdles are slowing adoption rates.

Charging Station Shortages and Power Outages

One of the biggest obstacles is the limited public charging infrastructure. South Africa has around 350 charging stations, primarily located in urban hubs like Johannesburg, Cape Town, and Durban. This leaves vast rural areas without access, making long-distance travel in an EV a daunting prospect.

Adding to this is the issue of frequent power outages, or "load shedding", which have become a hallmark of South Africa’s electricity system. These rolling blackouts, driven by the struggles of state utility Eskom, have eroded consumer confidence in EVs. Many potential buyers worry about the reliability of charging stations during outages.

"Electricity reliability is South Africa’s most critical barrier. Rolling blackouts (‘load shedding’) undermine consumer confidence in EV adoption and create risks for operators."

- Anari Energy Report

In response, companies are exploring solar-powered charging solutions. For example, Zero Carbon Charge secured a R100 million investment in late 2025 from the Development Bank of Southern Africa (DBSA) to develop a network of solar-integrated stations. The aim is to install stations approximately every 93 miles (150 km) along national highways.

Another challenge is the absence of standardized charging protocols. Currently, private networks operate independently, creating a fragmented experience for EV users and making it difficult to charge vehicles across different networks.

These infrastructure gaps are compounded by policy issues that further dampen consumer interest.

Lack of Government Policies and Incentives

South Africa’s high import duties – 15% tariffs combined with an outdated luxury goods tax – classify many mid-range EVs as luxury items, effectively pricing them out of reach for middle-income consumers.

Government incentives, where they exist, are focused on manufacturers rather than consumers. For instance, in February 2024, Finance Minister Enoch Godongwana proposed allowing manufacturers to claim 150% of any investment in electric and hydrogen vehicle production starting in March 2026. However, there are no direct subsidies or tax credits for buyers, unlike the incentives seen in Europe and the United States.

"If government is not supportive the industry will die."

- Mikel Mabasa, CEO, Automotive Business Council

The lack of a finalized Automotive Production and Development Programme (APDP) framework for New Energy Vehicles has created uncertainty for both investors and consumers. Industry leaders argue that without consumer-focused incentives like purchase rebates or tax credits, South Africa risks falling behind in the global shift to EVs.

The Automotive Business Council has been lobbying for lower import duties and an overhaul of the ad valorem tax system. However, progress has been slow, leaving Chinese manufacturers to rely on aggressive pricing to attract buyers in the meantime.

sbb-itb-99e19e3

Benefits Chinese EVs Could Bring to South Africa

Chinese electric vehicles (EVs) could bring meaningful changes to South Africa’s economy and environment. With competitive pricing and a strong focus on technology, these vehicles are reshaping the automotive landscape and creating new opportunities for local consumers.

Government Programs to Support EV Buyers

South Africa has introduced policies to encourage EV production locally. For example, a 150% tax deduction on investments in electric and hydrogen vehicle production aims to lower costs by promoting assembly within the country. Additionally, the government has allocated R964 million to support the EV transition and pledged another R1 billion by March 2025 to expand EV production capacity by 2035. While these measures don’t directly provide subsidies for buyers like those seen in other countries, they aim to reduce prices in the long run by fostering local manufacturing.

"With good government policies, we will attract new investment, we will increase and retain investment."

- Mikel Mabasa, CEO, Automotive Business Council

These initiatives not only make EVs more affordable but also set the stage for job creation and industrial development.

Job Creation and Economic Growth

Thanks to these policies, South Africa is poised to see a boost in employment tied to EV manufacturing and infrastructure development. Several major brands are conducting feasibility studies to transition from semi-knockdown (SKD) assembly to full completely knocked-down (CKD) production. This shift is expected to significantly increase job opportunities.

Standard Bank’s Lydia Zhang highlighted the importance of this transition, calling it "critical for job creation and meaningful local industry participation, supported by South Africa’s automotive supplier base". Currently, South Africa produces just under 600,000 vehicles annually, but government projections suggest this number could climb to 1.5 million by 2035.

Investments in charging infrastructure will also create skilled jobs. BYD, for instance, plans to install 200 to 300 public charging stations, including ultra-fast 1MW units. Meanwhile, Changan is expanding with 25 dealerships across the country, and Omoda & Jaecoo already operate 52 dealerships across Southern Africa. These developments will require technicians, sales staff, and maintenance teams, further boosting employment.

South Africa’s rich mineral resources – like manganese, platinum, nickel, and rare earths – offer promising opportunities for a localized battery supply chain. With Chinese companies expected to control 79% of African lithium output by 2025, integrating local resources into EV production could create mining and processing jobs while cutting import costs. Additionally, South Africa’s duty-free trade access to Europe positions it as a potential export hub for Chinese-made EVs, extending economic benefits beyond the domestic market.

Together, the government’s initiatives and the growing presence of Chinese EV manufacturers highlight the potential for South Africa’s automotive industry to evolve into a key player in the global market.

Buying Guide for South African Consumers

Chinese electric vehicles (EVs) have become much more accessible for South African buyers. By February 2026, prices for the most affordable plug-in hybrids and battery-electric vehicles dropped by 52% and nearly 55%, respectively, compared to 2023. This price reduction has opened up a wider range of options for consumers, as highlighted by the available Chinese EV models.

Chinese EV Models Available in South Africa

South African buyers now have a variety of Chinese EVs and plug-in hybrids to choose from, catering to different budgets and needs. One standout option is the BYD Dolphin Surf, which is the most affordable EV in the country. Priced at R339,900 ($19,900), it offers a range of 340–400 km, making it perfect for city driving and daily commutes. For those needing more versatility, the BYD Sealion 5 PHEV starts at R499,900 ($29,300) and pairs electric driving with a petrol engine for extended range.

Mid-tier options include the Geely E5 EM-i Aspire, priced at R599,999 ($35,200), and the Chery Tiggo 7 CSH, available for R619,000 ($36,300). For long-distance travelers, the Leapmotor C10 REEV offers a total range of up to 970 km (603 miles), thanks to its petrol generator, and is priced at R759,900 ($44,600). If you’re in the market for a utility vehicle, the BYD Shark 6 PHEV bakkie combines workhorse capabilities with faster acceleration than the Ford Ranger Raptor, all for R959,900 ($56,300), which is over R300,000 cheaper.

| Model | Type | Range | Price (ZAR / USD) | Best For |

|---|---|---|---|---|

| BYD Dolphin Surf | BEV | 340–400 km | R339,900 / $19,900 | City driving, budget buyers |

| BYD Sealion 5 | PHEV | 50–180 km electric | R499,900 / $29,300 | Daily commutes with long-trip flexibility |

| Geely E5 EM-i Aspire | PHEV | N/A | R599,999 / $35,200 | Mid-range hybrid option |

| Leapmotor C10 REEV | REEV | 970 km total | R759,900 / $44,600 | Long-distance family travel |

| BYD Shark 6 | PHEV Bakkie | N/A | R959,900 / $56,300 | Work and leisure utility |

All BYD models currently boast five-star NCAP safety ratings, ensuring peace of mind for buyers. Additionally, BYD plans to install between 200 and 300 public charging stations across South Africa by 2026. These will include ultra-fast 1MW chargers capable of adding up to 400 km (249 miles) of range in just five minutes. With these advancements, Chinese EVs are becoming a practical and affordable choice for South Africans.

Where to Buy: EV24.africa

For those looking to purchase Chinese EVs, EV24.africa is a dedicated online marketplace serving South African consumers. The platform offers a wide range of models, from budget options like the Geely Panda Mini (starting at $5,880 / R100,300) to luxury vehicles like the Zeekr 009 (priced at $85,000 / R1,450,000).

EV24.africa simplifies the buying process by handling everything from import logistics to local registration and compliance documentation. Buyers can choose between port-to-port and door-to-door delivery services, with options for Roll-on/Roll-off or container shipping. Financing plans are also available, and the platform connects buyers with dealership networks for maintenance and support. For example, the Dongfeng NanoBox is listed at $8,300 (R141,600) and offers a range of 321 km (199 miles).

This platform provides a convenient and comprehensive solution for South Africans exploring the growing world of Chinese EVs.

Conclusion: What’s Next for South Africa’s EV Market

Chinese electric vehicle (EV) brands are reshaping South Africa’s auto industry, with the market expected to grow to around $1.01 billion by 2029. Industry experts suggest that the most significant changes are still on the horizon.

"Based on our experience in China, once the market share of new energy vehicles reaches almost 10%, then the demand will start to explode" – Tony Liu, CEO of Chery South Africa.

This anticipated growth is driving investments in local manufacturing and infrastructure. Local production is seen as the next major step, with Chinese automakers gearing up to export vehicles across Africa. A new incentive beginning in March 2026 allows manufacturers to claim 150% of qualifying investment spending for EV and hybrid production. Additionally, BYD’s plan to install 300 fast-charging stations by the end of 2026 aims to tackle the long-standing issue of insufficient charging infrastructure.

However, challenges remain. Frequent power outages, a limited charging network, and consumer hesitation continue to hinder EV adoption. To overcome these barriers, manufacturers are rolling out creative solutions, such as plug-in hybrids, which reduce dependence on extensive charging networks.

"I think South Africa and the rest of Africa have a very big opportunity to what I call leapfrog from ICE into renewable energy (cars)" – Steve Chang, General Manager of BYD Auto South Africa.

For South African consumers, this shift promises greater access to affordable electric mobility. With competitive pricing, cutting-edge technology, and a growing support network, the move from internal combustion engines to electric vehicles is becoming more achievable. The real question now is not if Chinese EVs will revolutionize South Africa’s market, but how quickly that change will take place.

FAQs

How are Chinese EV companies improving South Africa’s charging infrastructure?

Chinese electric vehicle manufacturers, such as BYD, are addressing South Africa’s charging infrastructure challenges with forward-thinking solutions. One major step is BYD’s rollout of high-capacity charging networks. These include ultra-fast chargers that can boost a vehicle’s battery from 20% to 80% in just 30 minutes. To maximize accessibility, these chargers will be strategically installed at dealerships and along key highways.

BYD is also planning to introduce ‘flash charging’ stations, capable of recharging vehicles in as little as five minutes. By 2026, the company aims to create a network of around 300 charging stations, including hundreds of public chargers. These initiatives are designed to make electric vehicle ownership more convenient and practical for South African drivers, helping to bridge the country’s current infrastructure gaps.

How could manufacturing Chinese EVs locally benefit South Africa’s economy?

Local production of Chinese electric vehicles (EVs) in South Africa has the potential to deliver major economic advantages. Establishing manufacturing plants for companies like BYD, NIO, and Geely could generate thousands of jobs, drive industrial expansion, and build stronger local supply chains. This approach would also cut down on import dependency and improve trade balance, all while introducing advanced technologies to the region.

These initiatives also align with South Africa’s broader ambitions to expand its automotive industry and create a more sustainable, resilient sector. Government programs, such as rebates for vehicles assembled locally, are designed to attract investments and position South Africa as a key manufacturing hub for the African market. The result? More exports, a diversified economy, and steady industrial growth over time.

Why are plug-in hybrid vehicles becoming a popular choice in South Africa?

Plug-in hybrid vehicles are becoming increasingly popular in South Africa, and it’s easy to see why. They tackle two major challenges head-on: range anxiety and the lack of widespread charging infrastructure. In areas where charging stations are few and far between – or where power supply can be unpredictable – pure electric vehicles (EVs) might not seem practical. Hybrids, however, offer a clever workaround by blending an electric battery with a traditional combustion engine. This dual setup gives drivers the flexibility to switch between power sources as needed.

Many view hybrids as a bridge to full EV adoption. They offer the perks of lower fuel consumption and reduced emissions without requiring total dependence on a charging network. For South African buyers, this combination of eco-friendliness and practicality makes hybrids a compelling choice, especially in a market still developing its EV infrastructure.