Africa’s electric vehicle (EV) charging infrastructure is growing faster than ever. By May 2025, over 30,000 EVs were on the road, with electric buses seeing a 44% adoption increase year-over-year. Countries like Ethiopia, Kenya, and South Africa are driving progress through policies, incentives, and investments in fast-charging networks.

Key highlights:

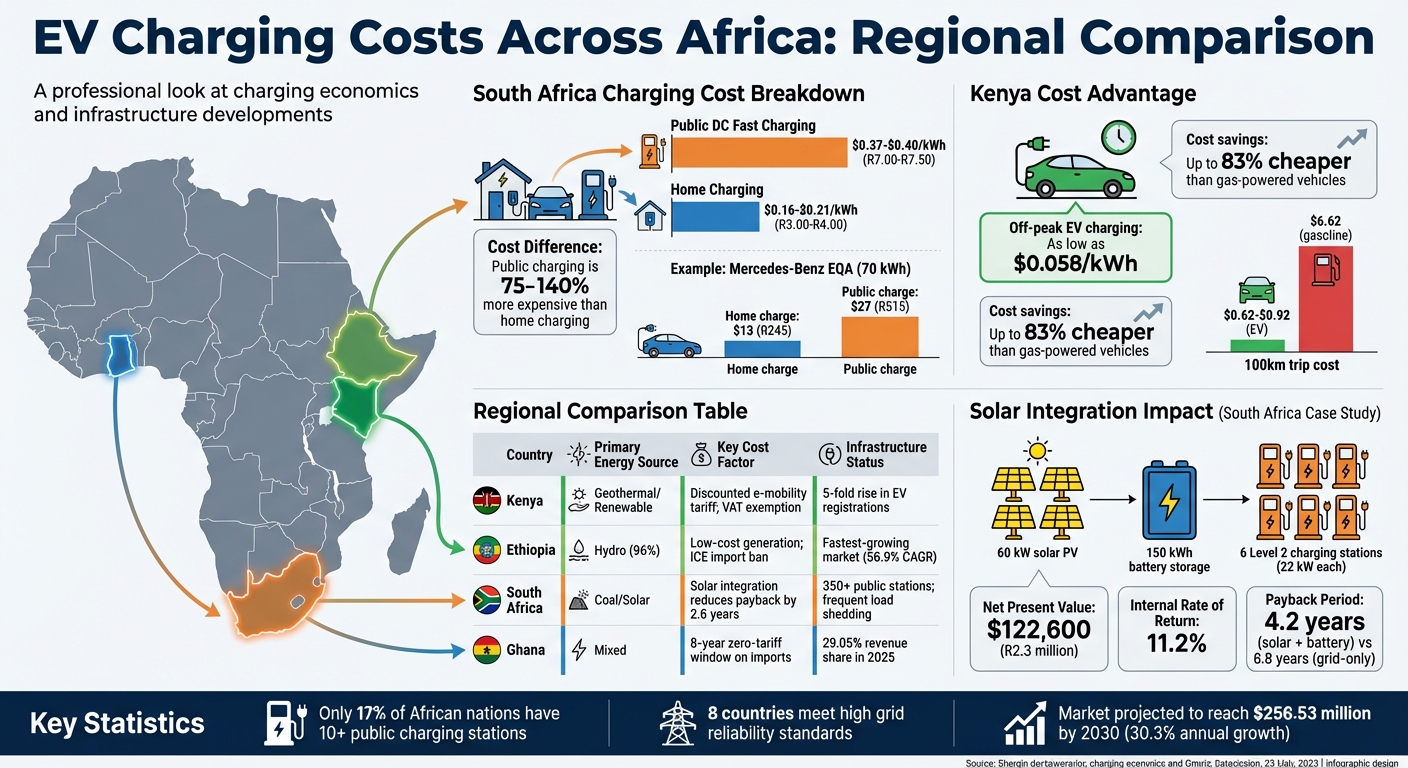

- Kenya: Off-peak EV charging costs as low as $0.058/kWh, making EV trips up to 83% cheaper than gas-powered vehicles.

- South Africa: Public DC fast charging costs $0.37–$0.40/kWh, while home charging is $0.16–$0.21/kWh.

- Ethiopia: 96% of electricity comes from hydropower, keeping costs low after banning ICE vehicle imports in 2024.

Challenges remain, including unreliable grids, high import tariffs, and limited rural infrastructure. However, solar-powered chargers, battery-swapping solutions, and universal payment systems are helping bridge gaps. Africa’s EV future depends on addressing these hurdles while expanding reliable, accessible charging networks.

China’s BYD Plans 200 to 300 Charging Stations in South Africa by End 2026

Fast-Charging Network Growth Across Africa

Countries like South Africa, Morocco, Kenya, and Egypt are leading the way in building Africa’s fast-charging infrastructure. Rising fuel prices and government incentives have played a big role in driving this expansion. By 2030, the market is expected to hit $256.53 million, growing at an impressive 30.3% annual rate from 2023. However, as of late 2024, only 17% of African nations had more than 10 public charging stations.

Two key players, Roam Kenya and BYD South Africa, are making strides in this space. Roam Kenya is focusing on light electric vehicles (LEVs), while BYD South Africa is targeting high-power charging for passenger vehicles. Together, they’re offering diverse solutions to meet Africa’s growing demand for EV charging.

Roam Kenya‘s Nationwide Fast-Charging Network

In November 2025, Roam unveiled "Roam Point" on Waiyaki Way in Nairobi, marking the launch of the first universal fast-charging station for light electric vehicles. These stations are equipped with Type 6 connectors and open-charge standards, ensuring compatibility with a variety of LEVs, including motorcycles and Tuk-Tuks. This flexibility is essential in a market where riders often switch between vehicle types. Roam’s chargers offer 10–20 km (6–12 miles) of range in under 5 minutes.

Designed for convenience, the stations operate 24/7 with a self-service model. Riders, such as Boda Boda operators, can make payments through USSD codes or the Roam App, eliminating the need for attendants. Habib Lukaya, Roam’s Country Manager, explains:

"The Roam Point builds on the battery ownership model, which gives riders full control of their batteries, allowing them to ‘ride everywhere and charge anywhere’".

BYD South Africa’s High-Power Charging Stations

In March 2025, BYD introduced its Super-e platform, a high-power charging solution built on a 1,000-volt system capable of delivering up to 1 megawatt (MW) of power. This translates to about 400 km (250 miles) of range in just 5 minutes, making it comparable to traditional fuel refueling times. To handle the heat generated during such high-power charging, the platform uses advanced silicon carbide power chips and an all-liquid-cooling system.

Many of these DC fast-charging stations are being integrated with solar power and battery storage, addressing concerns about grid reliability. This approach not only ensures consistent power supply but also aligns with the push for cleaner energy solutions across the continent.

Actual Cost per kWh of EV Charging in Africa

EV Charging Costs Across African Countries: Regional Comparison 2025-2026

The cost of charging electric vehicles (EVs) across Africa shows significant variation. For instance, in South Africa, public DC fast charging costs range from $0.37 to $0.40 per kWh (R7.00–R7.50), while charging at home is much cheaper, between $0.16 and $0.21 per kWh (R3.00–R4.00). This means public fast charging can be 75% to 140% more expensive than home charging. To illustrate, charging a Mercedes-Benz EQA (70 kWh) at home costs around $13 (R245), but the same charge at a public station jumps to $27 (R515).

Interestingly, in areas with grids powered heavily by renewables, the cost gap between home and public charging tends to narrow. Ethiopia, for example, generates 96% of its electricity from hydropower, which keeps production costs low and minimizes emissions. Similarly, Kenya has introduced a discounted e-mobility electricity tariff to reduce costs for EV operators.

Solar energy is also playing a game-changing role in EV charging. A study conducted at the University of South Africa (UNISA) Florida campus in December 2025 evaluated six Level 2 charging stations (22 kW each) paired with a 60 kW solar PV system and 150 kWh battery storage. This setup achieved a Net Present Value of $122,600 (R2.3 million) and an 11.2% Internal Rate of Return, with a payback period of just 4.2 years, compared to 6.8 years for grid-only systems.

Main Factors Affecting Charging Costs

Several elements contribute to the cost per kWh of EV charging, and one of the biggest challenges is grid reliability. South Africa, for instance, recorded 288 load shedding events in 2022, with outages lasting up to 8–10 hours on some days. These interruptions often force EV users to rely on more expensive backup solutions, like private solar systems.

Government policies also play a major role. Countries with high renewable energy penetration, such as Ethiopia and Kenya, tend to have lower charging costs, while reliance on coal-based power, as seen in South Africa, drives prices higher. Additionally, time-of-use pricing – where electricity costs vary by peak and off-peak hours – is still in its early stages of development in many regions.

Import tariffs and taxes further complicate the cost equation. In South Africa, EVs face a 25% import tariff (compared to 18% for internal combustion vehicles) along with an ad valorem tax of up to 30%. These fees not only increase the cost of EVs but also make charging equipment more expensive, raising per kWh rates. As Bessie Noll, Senior Researcher at ETH Zurich, notes:

"If financing costs can be reduced, the transition will accelerate dramatically. Potential options include government guarantees, new financing models, or international support".

Regional Charging Cost Comparison

A closer look at different regions reveals how factors like energy sources, tariffs, and infrastructure development influence EV charging costs.

| Market | Primary Energy Source | Key Cost Factor | Infrastructure Status |

|---|---|---|---|

| Kenya | Geothermal/Renewable | Discounted e-mobility tariff; VAT exemption | 5-fold rise in EV registrations |

| Ethiopia | Hydro (96%) | Low-cost generation; ICE import ban | Fastest-growing market (56.9% CAGR) |

| South Africa | Coal/Solar | Solar integration reduces payback by 2.6 years | 350+ public stations; frequent load shedding |

| Ghana | Mixed | 8-year zero-tariff window on imports | 29.05% revenue share in 2025 |

Urban hubs like Nairobi, Lagos, and Johannesburg benefit from relatively reliable power supplies and established charging networks. However, rural areas face challenges like weak grids and frequent outages. Electrification programs in these regions often focus on household lighting rather than high-capacity EV chargers, delaying infrastructure development. These disparities highlight the urgency of addressing policy and infrastructure gaps to ensure sustainable EV adoption across the continent.

sbb-itb-99e19e3

Challenges and Solutions for Fast-Charging Growth

Grid Reliability and Energy Access

Africa’s fast-charging expansion faces a major hurdle: unreliable power grids. Right now, only 8 African countries meet high standards for grid reliability, and around 600 million people still don’t have access to electricity.

The challenge is massive. If electric vehicles (EVs) were to make up 30% of road transport, they’d consume more than 20% of the electricity growth projected for the next decade. Rose Mutiso, Research Director at the Energy for Growth Hub, highlights the broader benefits of grid investments:

"Investing in grid infrastructure is especially valuable, as it supports broader economic growth beyond just EVs".

To ensure universal electricity access, Africa needs to ramp up investments to $15 billion annually.

There are ways to ease the strain on grids. Off-grid solar systems and battery-swapping solutions offer immediate relief. For instance, a compact solar setup can power a small EV for about 31 miles daily. Meanwhile, Ampersand, a Rwandan startup, operates swap stations in Kigali and Nairobi, completing 37,000 battery swaps each month. These methods not only lighten the grid’s load but also lower upfront vehicle costs through Battery-as-a-Service models.

Another strategy is placing high-power chargers near existing transmission lines to sidestep expensive grid upgrades. Pairing these chargers with local renewable energy sources and storage systems can further support off-peak charging needs. Beyond physical infrastructure, adopting standardized protocols is key to ensuring a smooth and unified charging experience.

Interoperability and Standardization

While grid improvements address capacity challenges, a seamless charging experience depends on consistent administrative protocols. Right now, inconsistent charging standards create headaches for EV users. Only 17% of African countries have 10 or more public charging stations. The EVRoaming Foundation stresses the importance of harmonization:

"The ultimate goal is to allow any EV driver to charge at any charging station… simplify, standardise and harmonise".

Protocols like OCPI and OCPP allow networks to communicate, giving drivers access to multiple charging stations with a single account. This also prevents vendor lock-in. For example, OCPI version 2.3, introduced in February 2025, adds features like transparent pricing and ad-hoc payment options.

Regulations also play a pivotal role in accelerating EV adoption. Currently, only 28% of African nations have set EV targets, and 39% offer binding EV incentives. Kenya has taken a forward-thinking approach by banning the import of batteries with less than 80% health, ensuring longer-lasting infrastructure. Additionally, requiring universal payment methods – like QR codes or bank cards – at public fast chargers could eliminate barriers for occasional users and non-subscribers.

Standardization is more than just a convenience; it’s a necessity for scaling EV infrastructure. Virta underscores this point:

"Charging shouldn’t become a hindrance to further EV adoption".

Without interoperability, new charging networks risk creating isolated systems that fragment the market and slow the continent’s shift to electric mobility. Aligning grid investments with universal standards is crucial to keep Africa on track toward a sustainable EV future.

Conclusion

Africa’s electric vehicle (EV) infrastructure is advancing at a remarkable pace. Growing at an annual rate of 30.3%, the market is projected to reach $256.53 million by 2030. With over 30,000 EVs already on the road as of May 2025, this growth is particularly evident in commercial sectors like electric buses and two-wheelers.

In Kenya, the cost benefits of EVs are striking – a 100-kilometer trip costs just $0.62–$0.92, compared to $6.62 for a gasoline-powered vehicle. That’s a savings of up to 83%. However, only eight African nations currently meet high grid reliability standards, making innovations like solar-powered chargers and battery storage crucial for further progress.

Economic gaps and infrastructure challenges highlight the need for systemic improvements. Universal charging protocols and streamlined payment systems are essential to prevent fragmented networks and ensure a smooth experience for EV users. Supportive policies are also playing a key role. For example, South Africa introduced a 150% tax deduction for EV production in 2026, and Ethiopia implemented a ban on internal combustion engine (ICE) imports in 2024.

Platforms like EV24.africa are stepping up to provide critical resources. By offering transparent pricing, detailed vehicle specifications, and comprehensive charging data across 54 countries, they empower businesses and individuals to make informed decisions about EV adoption. As Rose Mutiso aptly puts it:

"Africa’s electric vehicle future can’t be built on guesswork".

To truly unlock the potential of EVs in Africa, coordinated investments in reliable infrastructure and digital solutions are essential. With commercial fleets leading the charge and governments backing the transition with forward-thinking policies, the continent has a real opportunity to establish itself as a pioneer in sustainable electric mobility – provided grid reliability and standardization challenges are addressed.

FAQs

What are the biggest challenges to expanding EV charging infrastructure in Africa?

The development of EV charging infrastructure across Africa comes with its fair share of challenges. One of the most pressing issues is unreliable electricity grids. Frequent power outages and load-shedding disrupt charging services, often forcing operators to turn to costly off-grid or backup power solutions to keep things running. On top of that, more than 600 million people still lack access to electricity, particularly in rural areas. This makes it tough to expand EV charging networks beyond urban hubs, highlighting the need for alternatives like solar-powered or mobile charging setups.

Another major obstacle is the steep cost of building the network. Estimates suggest that establishing a functional charging infrastructure by 2025 could require a staggering $1 billion. These high costs not only push up the price per kWh for consumers but also deter potential investors. When you add in the limited number of charging stations, the high upfront costs of owning an EV, and the varying rates of adoption across different countries, it’s clear that scaling EV charging in Africa faces considerable roadblocks.

How does the cost of charging at home compare to public charging stations in Africa?

Charging your EV at home in Africa is much easier on the wallet compared to using public fast-charging stations. At home, electricity rates usually fall between $0.16 and $0.22 per kWh, while public fast chargers often come with a heftier price tag of around $0.40 per kWh – and in some busy urban areas, that can climb as high as $0.60 per kWh.

The reason for this gap is pretty straightforward. Residential electricity tends to be cheaper, and you can even pair your home setup with solar panels or other off-grid solutions to save even more. Public charging stations, however, have to factor in the costs of maintaining infrastructure and handling higher overhead expenses. For most EV owners, this means home charging can slash costs to as little as one-third of what you’d pay at a public charger, making it the most budget-friendly choice.

How does renewable energy help lower EV charging costs in Africa?

Renewable energy sources like solar, wind, and hydropower are transforming the way electric vehicles (EVs) are charged in Africa. By tapping into the continent’s abundant sunlight, operators can establish solar-powered charging stations that eliminate reliance on expensive diesel-generated electricity and imported oil. This shift not only promotes sustainability but also makes charging more affordable for EV users.

Take solar-powered chargers, for instance. They can drastically cut costs compared to the $0.40–$0.60 per kWh typically charged at public fast-charging stations, bringing prices closer to the $0.16–$0.22 per kWh range associated with home charging. On top of that, EV charging powered by renewables can slash fueling costs by as much as 83% compared to gasoline. Maintenance expenses also see a dramatic reduction – around 87.5%. With the continued rollout of solar-powered stations and battery-swapping networks, owning an EV in Africa is becoming increasingly accessible and economical for consumers.