Importing an electric vehicle (EV) into Cape Verde in 2025 is easier and more affordable than ever. Here’s what you need to know:

- Customs and Taxes: EVs are exempt from VAT, customs duties, and excise duties, significantly reducing costs compared to gas or diesel vehicles.

- Required Documents: You’ll need essential paperwork like the vehicle title, bill of sale, shipping documents, and a Material Safety Data Sheet (MSDS) for EV batteries.

- Shipping and Safety: Ensure compliance with international safety standards for lithium-ion batteries, and choose a reliable shipping method like Roll-on/Roll-off (RoRo) or container shipping.

- Permits and Registration: Obtain an import permit and register your EV locally. Registration costs range from $48 to $177, depending on your documentation.

- Incentives: Cape Verde offers an internationally backed rebate program to offset the higher upfront cost of EVs.

Cape Verde’s push for 100% electric vehicle adoption by 2050, supported by projects like ProMEC, makes this the perfect time to switch to electric mobility. For hassle-free importing, consider using services like EV24.africa to handle customs, permits, and delivery.

Next Steps: Prepare your documents, select a shipping method, and take advantage of tax exemptions to bring your EV to Cape Verde smoothly.

Customs Procedures for EV Imports to Cape Verde

Bringing an electric vehicle (EV) into Cape Verde involves a detailed process that differs from standard imports. It requires specific steps, proper documentation, and adherence to safety guidelines to ensure a smooth customs clearance.

Step-by-Step Customs Process

The journey of importing an EV begins well before the vehicle leaves its country of origin. The process involves seven key steps:

- Choose the Right Shipping Company: Start by researching and selecting a shipping company experienced in Cape Verde routes. Not all carriers handle EVs due to the safety requirements associated with their batteries.

- Compare Shipping Rates: Request quotes from multiple companies to find the best rates and services for your needs. There are four main shipping options to consider: Roll-on/Roll-off (RO-RO), full container, shared container, or air cargo. RO-RO is often the most practical choice for individual imports.

- Book and Prepare for Shipping: Once you’ve chosen a shipping method, book your shipment, submit the necessary paperwork, and deliver the EV to the designated port facility.

- Forward Documentation: Pay for the shipping service and send the shipping documents to your clearing agent or customs broker.

- Customs Clearance: Your clearing agent will handle the customs procedures, including verifying documents, paying taxes and duties, and obtaining the final release of your vehicle.

Required Documentation

To clear customs, you’ll need a mix of standard vehicle documents and EV-specific paperwork. Here’s what to prepare:

- Vehicle Title: The original title must include complete buyer and seller information. If the vehicle has a lien, the title must be stamped and signed by the financial institution. Alternatively, provide a lien release letter confirming full payment.

- Bill of Sale or Commercial Invoice: This document should include the vehicle’s value and confirm that the balance is fully paid.

- Vehicle Specifications: Include the year, make, model, VIN, weight, and dimensions of the EV.

- Shipping Documents: You’ll need the original Bill of Lading, a Cape Verde driver’s license or International Driver’s ID, the original invoice, a packing list, the Combined Certificate of Value and Origin (CCVO), Cape Verde Customs "Form C", and proof of pier fees for the Praia terminal.

For EVs, additional documentation is required:

- Material Safety Data Sheet (MSDS): This confirms the battery complies with hazardous material regulations.

- Import Notification: Notify both the car transporter and Cape Verde Customs of your intent to import an EV before shipping begins.

If your situation involves unique certificates or licenses, contact the Chambers of Commerce for specific guidance based on your vehicle type and its country of origin.

Shipping and Safety Regulations

Once your documents are ready, focus on meeting shipping and safety requirements. EVs are classified under International Maritime Organization (IMO) regulations for hazardous materials due to their lithium-ion batteries. Not all shipping companies accept EVs, so confirm that your carrier complies with these regulations.

Before shipping, ensure the vehicle’s battery system is intact and free from damage or leaks. Any signs of compromise could result in the shipment being denied. Additionally, the EV must have a visible label on the windshield showing the VIN and propulsion type, making it easier for customs and port workers to identify and handle it safely.

The MSDS for the battery must be included with your shipping documents. This ensures compliance with hazardous material protocols and provides emergency response guidelines if needed.

Recent advancements in maritime safety have strengthened the protocols for transporting EVs. The Maritime Technologies Forum has introduced guidelines covering fire detection, firefighting, explosion prevention, and crew safety. Updates to the International Maritime Dangerous Goods Code now specifically address lithium-ion battery transport requirements. These measures aim to ensure safer and more efficient EV shipping across international waters.

Taxes and Incentives for EV Imports

Cape Verde has introduced a tax policy designed to make importing electric vehicles (EVs) much more affordable than their gasoline or diesel counterparts. Backed by the government’s ambitious goal to achieve 100% electric vehicle adoption by 2050, these incentives aim to lower costs and streamline the import process for EVs.

Tax Rates and Exemptions

One of the standout benefits for EV importers is the complete exemption from VAT, customs duties, and excise duties. This applies to a wide range of EVs, including motorcycles, passenger cars, and commercial vehicles.

EV charging equipment also enjoys tax advantages. While VAT does apply to the import of new charging equipment – such as connectors, protective devices, cables, and meters – these items are still treated favorably under Cape Verde’s tax framework.

To qualify for these exemptions, importers must meet Cape Verde’s safety and environmental standards and provide documentation confirming the vehicle is electric-powered.

EV vs. Gas Vehicle Tax Comparison

The financial benefits of importing EVs over traditional vehicles are clear when comparing tax structures. Gasoline and diesel vehicles are subject to standard import taxes, while EVs are entirely exempt. Here’s a quick breakdown:

| Tax Type | Electric Vehicles | Conventional Vehicles |

|---|---|---|

| Customs Duties | 0% (Exempt) | Standard rates apply |

| Value-Added Tax (VAT) | 0% (Exempt) | Standard VAT rates apply |

| Excise Duties | 0% (Exempt) | Standard excise rates apply |

How to Qualify for Tax Breaks

In addition to tax exemptions, Cape Verde offers a rebate program supported by international initiatives. This program helps offset the higher upfront costs of EVs compared to traditional vehicles. It aligns with the government’s target to ensure all new light-duty vehicle sales are electric by 2035. However, importers must meet specific requirements, such as restrictions on vehicle age, energy efficiency ratings, and adherence to environmental standards.

Permits and Registration Requirements

Getting the right permits and completing vehicle registration are key steps when importing your electric vehicle into Cape Verde. These tasks require coordination with government bodies and ensuring all necessary paperwork is in order.

Getting Your Import Permit

To import your EV, you need to secure an import authorization through a commercial operator certificate and, if applicable, an import license from the Chambers of Commerce. You’ll need to provide several key documents, including the bill of lading, commercial invoice, certificate of origin, and, in some cases, health or phytosanitary certificates. Depending on your vehicle’s specifications, additional certificates may also be required.

For a smoother process, EV24.africa offers support with customs clearance, registration, and import taxes, ensuring that you meet all local regulations.

Once your import permit is approved, you can move on to registering your vehicle locally.

Registering Your Vehicle Locally

After obtaining your import permit and clearing customs, the next step is to register your EV with local authorities. This process typically involves inspections, compliance checks, and submitting the necessary paperwork. Your vehicle must meet Cape Verde’s safety and environmental standards, which reflect the country’s push toward a sustainable electric vehicle market.

The cost of registration varies depending on the documentation you have:

- $48 USD if you have a Certificate of Conformity (COC) or National Homologation.

- $177 USD if you don’t have these documents.

In some cases, local authorities may require additional documentation or conduct further inspections to ensure your vehicle meets all legal requirements.

EV24.africa simplifies the entire process, from securing permits to handling registration and import taxes.

sbb-itb-99e19e3

Using EV24.africa for EV Imports

Navigating the intricate customs and registration processes for electric vehicles (EVs) in Cape Verde can be daunting. That’s where EV24.africa steps in, offering complete support at every stage of the import process. From sourcing your EV to delivering it right to your doorstep, the platform simplifies what can otherwise be a challenging experience.

With a team of over 200 professionals and an extensive network to back them up, EV24.africa ensures smooth operations. For Cape Verde, the Port of Praia serves as the main hub for deliveries, streamlining logistics for local customers.

At its core, EV24.africa is all about making EV imports and purchases in Africa straightforward. Their expertise ensures a hassle-free and transparent experience, so you can focus on embracing the future of sustainable mobility.

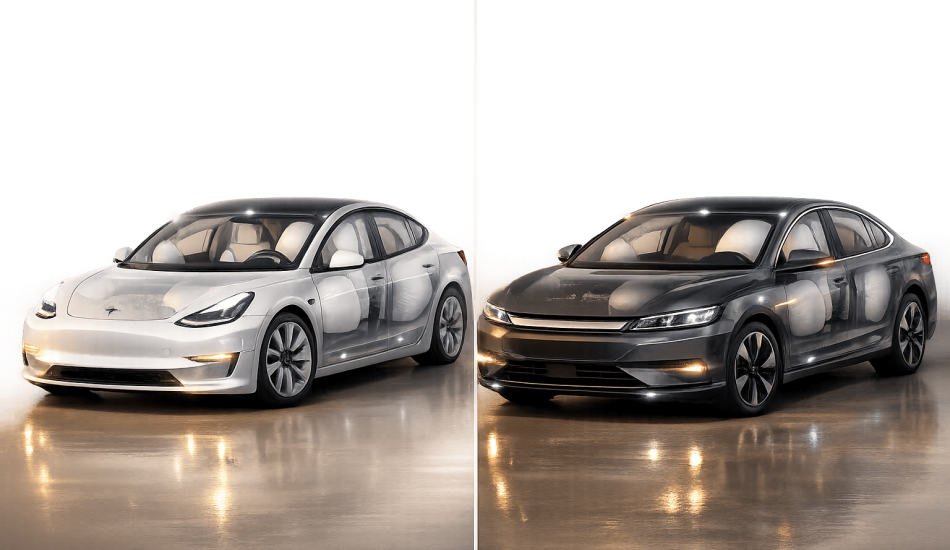

Main EV24.africa Features

EV24.africa connects buyers with a wide range of EVs sourced from leading suppliers across Europe, Asia, North America, and Japan. The platform collaborates with major brands like Tesla, BYD, Volkswagen, XPeng, Leapmotor, Changan, Wuling, Mercedes-Benz, Citroën, and Peugeot.

One of the standout features is its transparent pricing model, paired with real-time updates throughout the shipping and import process. Depending on your needs and budget, you can choose between two shipping methods:

- RoRo (Roll-on/Roll-off): A cost-effective and faster option, ideal for operational vehicles.

- Container shipping: Offers enhanced protection and is suitable for non-operational vehicles.

EV24.africa also provides Delivered Duty Paid (DDP) services, taking care of customs duties, taxes, and compliance with regulatory requirements, so you don’t have to worry about the paperwork.

Benefits for Cape Verde Buyers

To better serve customers in Cape Verde, EV24.africa maintains a local presence, ensuring it understands and addresses the unique needs of buyers in the region. The platform handles every aspect of the import process while ensuring compliance with local regulations.

Delivery options are flexible, offering both door-to-door and port-to-port services based on your location and preferences. With a delivery network that spans all 54 African countries, Cape Verde remains a key focus for EV24.africa.

For those ready to take the leap into EV ownership, the platform allows you to request a custom quote. This provides a clear picture of the services and costs associated with your specific vehicle and delivery requirements. This aligns with Cape Verde’s ambitious vision of achieving 100% electric vehicle adoption by 2050.

Conclusion

Bringing an electric vehicle (EV) into Cape Verde requires careful attention to customs procedures, tax regulations, and permit requirements. Following each step diligently can help you avoid unnecessary delays and costs. Here’s a recap of the key points and what you need to do next to complete the process.

Key Points to Keep in Mind

To ensure a smooth import process, revisit these essential steps:

- Choose a compliant shipping method and prepare key documents, including the vehicle title and proof of ownership.

- Take advantage of exemptions on customs duties and VAT for EVs.

- Work closely with Cape Verde customs and local authorities to secure the necessary permits.

- Verify that the battery system complies with International Maritime Organization regulations.

- Conduct all required safety checks before shipping.

Also, be aware that vehicles older than 10 years will incur additional taxes and duties.

Next Steps

Now’s the time to put these steps into action. Cape Verde’s ambitious goal of achieving 100% EV adoption for new light-duty vehicle sales by 2035 makes this an ideal moment to import your EV. The ProMEC project, which is funding charging infrastructure development through May 2025, further supports this growing market.

Stay informed about any regulation updates by reaching out to the Cape Verde Embassy in Washington, DC, for the latest details on import taxes and requirements. Double-check your documents, coordinate with a customs broker, and finalize your permits to ensure a hassle-free process. Once you’ve completed these steps, you’ll need to work with your customs broker in Cape Verde to pay the required taxes and duties before retrieving your vehicle from the terminal in Praia.

With thorough preparation and adherence to the outlined regulations, importing an EV into Cape Verde can be a straightforward and cost-efficient endeavor. It’s a great way to align yourself with the country’s push toward electric mobility. For additional support, consider using EV24.africa’s expertise to simplify your EV import process.

FAQs

What are the main advantages of importing an electric vehicle to Cape Verde instead of a gas or diesel car?

Importing an electric vehicle (EV) to Cape Verde offers several clear advantages. For starters, EVs are exempt from customs duties and VAT, which means the upfront cost is significantly lower compared to traditional gas or diesel-powered cars. Over the long run, EVs are also easier on your wallet thanks to lower running costs – electricity is more affordable than fuel, and maintenance expenses are reduced because EVs have fewer moving parts.

On top of the financial perks, driving an EV aligns with Cape Verde’s efforts to cut greenhouse gas emissions and reduce dependence on fossil fuels. By choosing an EV, you’re not just saving money – you’re also playing a role in creating a cleaner, greener future.

How can I make sure my EV’s battery system meets international safety standards for shipping?

To make sure your EV’s battery system meets international safety standards for shipping, verify that it complies with the testing requirements in UN Subsection 38.3. This section focuses on evaluating batteries to ensure they are safe for transport. Use packaging specifically designed for lithium batteries, attach clear hazard labels, and include accurate shipping documentation.

It’s also important to stay updated on guidelines from organizations like the International Air Transport Association (IATA) and the Pipeline and Hazardous Materials Safety Administration (PHMSA). These authorities provide essential rules for safe and compliant battery transportation. Working with a certified shipping provider who understands EV battery regulations can simplify the process and help you avoid potential issues.

How can I qualify for Cape Verde’s EV tax exemptions and rebate programs in 2025?

How to Qualify for Cape Verde’s EV Tax Incentives in 2025

If you’re looking to take advantage of Cape Verde’s tax exemptions and rebate programs for electric vehicles in 2025, there are a few key steps to follow. First, make sure the EV you plan to import meets the country’s technical standards. Once imported, you’ll need to register the vehicle with the appropriate local authorities to qualify.

Eligible vehicles can benefit from exemptions on customs duties and VAT, but only if they meet the required criteria. To make the process smoother, gather all necessary documents in advance. This includes proof of purchase, compliance certificates, and completed registration forms.

Lastly, keep an eye on updates to Cape Verde’s EV import policies. Staying informed will help you meet the requirements and take full advantage of these incentives.