Electric vehicles (EVs) are saving Cameroonians money and cutting emissions. With government support, rising fuel prices, and affordable models, EVs are becoming a smart choice for drivers. Here’s what you need to know:

- Cost Savings: Driving an EV costs 50% less than gas-powered cars, and maintenance is 30% cheaper.

- Government Incentives: Starting in 2025, EVs enjoy excise duty exemptions, 50% tax reductions on imports, and road tax exemptions.

- Top Models: Options range from luxury SUVs like the Tesla Model 3 to budget-friendly bikes like the Babana 237 ($830).

- Import Process: Shipping costs range from $900 to $3,000, with total import fees between $2,800 and $4,500.

- Growing Infrastructure: Charging stations and service centers are expanding, making EV ownership easier.

Why Now? With reduced taxes, lower running costs, and expanding infrastructure, 2025 is the ideal time to switch to electric vehicles in Cameroon.

Importing Exporting An EV from China’s Leading Electric Vehicle Maker

Top Electric Car Models in Cameroon

Cameroon’s electric vehicle (EV) market is steadily growing, offering a mix of globally recognized brands and locally designed two-wheelers. From high-end SUVs to affordable electric bikes, there’s something for every need and budget.

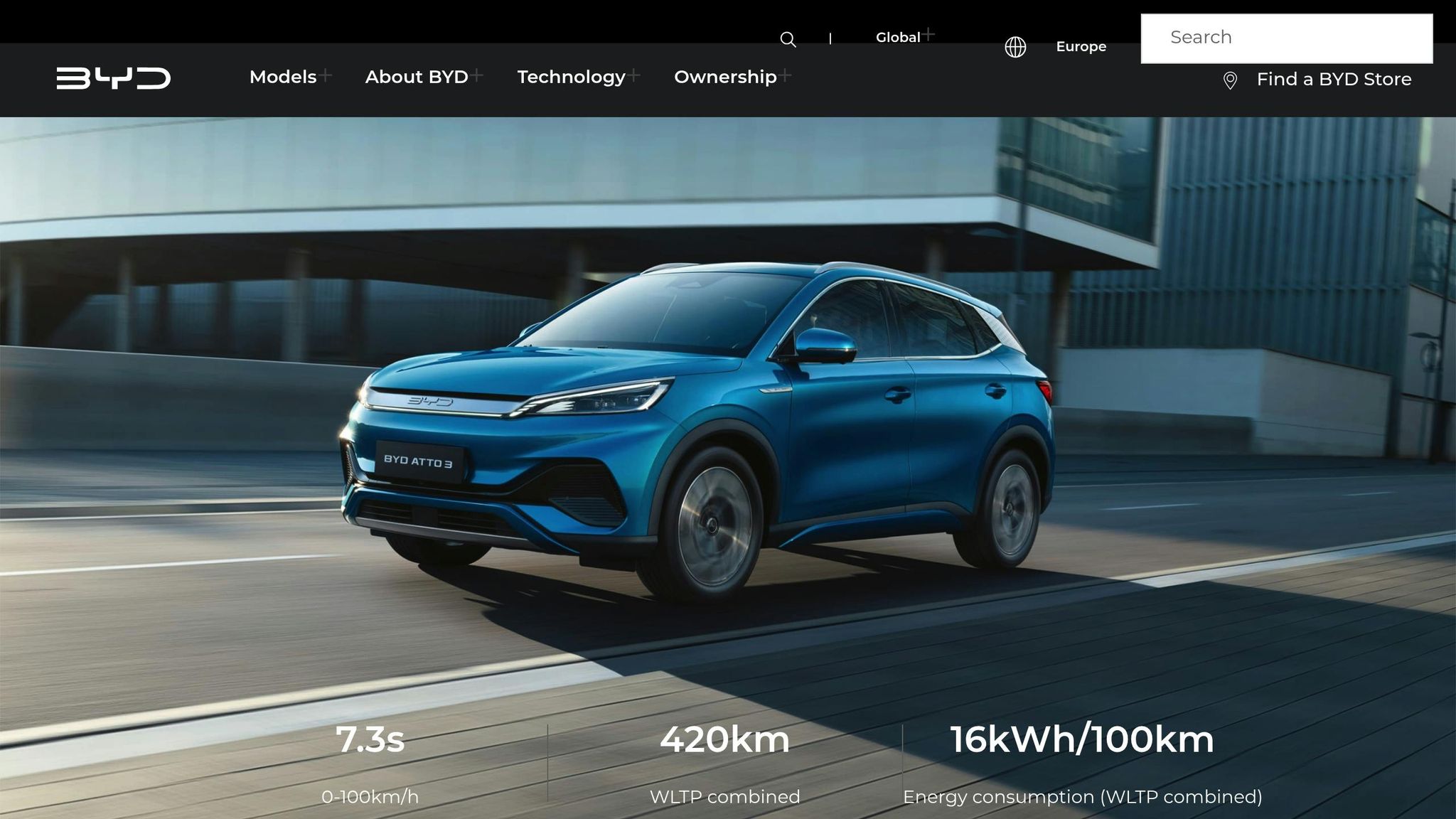

BYD Atto 3

The BYD Atto 3 stands out as a popular electric SUV option in Cameroon. This model, manufactured in China, boasts an impressive 420-km range per charge and starts at $47,500 FOB. Its elevated ground clearance makes it well-suited for the country’s varied road conditions. For those interested in importing this vehicle, EV24.africa simplifies the process. As one of the leading international models, the Atto 3 sets a high standard for performance and quality in Cameroon’s EV market.

Tesla Model 3

In the luxury EV segment, the Tesla Model 3 remains a top choice. A used 2024 dual-motor Tesla Model 3 is currently available in Yaoundé for FCFA 65 million (around $108,000), while new models have a base price of $33,384. This model is known for its fully electric drivetrain, quick charging capabilities, and over-the-air software updates, appealing to tech enthusiasts. Although its price positions it as a premium option, the Tesla Model 3 continues to attract attention for its cutting-edge features and innovation.

Local EV Options

In addition to international brands, locally adapted electric two-wheelers are making a significant impact, addressing the transportation needs of everyday commuters.

- The Babana 237 electric bike costs just CFA 500,000 (about $830). This affordable option is noteworthy in a country where motorcycles dominate as taxis – nearly 30 million are in operation, with 99% still using internal combustion engines.

- Bee Group’s Tembo motorcycles are priced at around CFA 600,000. These electric motorcycles drastically cut daily fuel costs for mototaxi drivers, reducing expenses from CFA 6,000 to about CFA 1,600 – saving approximately CFA 4,400 per day. As Bee CEO Patrick Timani highlights:

"This isn’t just about vehicles; it’s about financial inclusion."

In June 2023, Bee Group partnered with Advans Cameroon and Atlantique Assurance to provide financing and insurance for 3,600 motorcycle taxi drivers over two years, in a deal worth 2.3 billion CFA francs (roughly $3.8 million).

Meanwhile, Spiro is carving out its place in Cameroon’s electric motorcycle market. The company plans to roll out 100 motorcycles in Douala by July 2025, along with 20 battery-swapping stations strategically placed every 3 kilometers. Switching to electric two-wheelers can cut annual fuel and maintenance costs by around 45%. In Douala, where motorcycle taxis account for 61% of all trips, these savings could significantly impact the local economy and transportation landscape.

From premium SUVs like the BYD Atto 3 and Tesla Model 3 to accessible electric two-wheelers, Cameroon’s EV market is evolving to meet the demands of diverse consumers while offering substantial economic advantages.

How to Import Electric Cars into Cameroon

Bringing an electric vehicle into Cameroon involves careful planning, gathering the right documents, and following customs regulations. These steps directly impact both the timeline and the overall cost of the process. Here’s what you need to know.

Required Documents

To ensure a hassle-free clearance at Douala Port, you’ll need to have the following documents ready:

- Original vehicle title: Copies won’t be accepted. If the vehicle has an active loan, include a notarized lien release letter from the lender.

- Bill of sale: This should detail the buyer and seller’s information, the vehicle’s specifics, and the sale price.

- Bill of Lading (BOL): Provided by your shipping company once the vehicle is loaded. It confirms Douala as the destination port and includes shipper and consignee details.

- Passport copy and proof of marine insurance: These documents verify ownership and insurance coverage.

- Customs declaration form: This form lists the vehicle’s make, model, year, and Vehicle Identification Number (VIN).

- Import duty payment receipt: Proof that all required taxes and duties have been paid.

- Power of attorney and packing list: If you’re using a shipping agent, these are mandatory. A commercial invoice may also be required.

Having all these documents prepared in advance helps avoid delays during the customs process.

Shipping Methods and Timelines

When it comes to shipping, you can choose between two main methods:

- RoRo (Roll-on/Roll-off): Vehicles are driven onto the ship, making this option faster and more affordable. Costs typically range from $900 to $1,500.

- Container Shipping: Offers better protection from weather and other risks, but at a higher cost, usually between $1,500 and $3,000.

Transit times depend on the departure port:

- From Baltimore (via ACL-Grimaldi Line): About 18 days to Douala.

- From Jacksonville (via Sallaum Shipping Line): Around 20 days.

- From Houston (via Freeport Terminal): Approximately 25 to 28 days.

- From China: Sea freight takes about 25 to 45 days, while air freight is faster but significantly more expensive.

Select the shipping method that best suits your budget and schedule.

Meeting Import Regulations

Once you’ve chosen a shipping method, ensure you comply with Cameroon’s import regulations:

- A BESC/ECTN certificate is mandatory for all shipments. Without it, entry at Douala Port may be denied.

- Electric vehicles must have a left-hand drive configuration, as right-hand drive cars are prohibited.

- Used electric cars must be less than 5 years old and pass a local inspection.

Start organizing your documentation at least two weeks before shipping. Partnering with local agents familiar with Cameroon’s procedures can help streamline the process. Also, avoid shipping in December, as Douala Port experiences heavy congestion during this time, leading to delays and potential storage fees.

Recent policy changes favor electric vehicle imports. Starting January 1, 2025, electric vehicles will be exempt from excise duties. Additionally, newly imported electric vehicles, including motorcycles, batteries, and charging stations, will enjoy a 50% reduction in taxable value for two years. These incentives make importing electric cars more affordable than traditional gas-powered vehicles.

Expect total import costs to range from $2,800 to $4,500. This includes ocean freight, insurance (1.5% of the vehicle’s value), duties (10%–30%), and VAT (19.25%). By planning carefully and taking advantage of these incentives, you can significantly reduce costs and ensure a smooth import process.

Cost Breakdown and Tax Information

When planning to import an electric vehicle into Cameroon, it’s essential to understand the complete financial picture. Beyond the purchase price and shipping fees, there are several mandatory taxes and additional costs that can significantly affect your total outlay.

Import Duties and Tax Structure

Cameroon has recently introduced policies to make importing electric vehicles more appealing. Starting January 1, 2025, electric vehicles will be exempt from excise duties, which previously stood at 12.5%. Additionally, newly imported electric vehicles will enjoy a 50% reduction in taxable value for the first 24 months.

Here’s a breakdown of the primary taxes:

- Import Duty: Typically 10% of the vehicle’s value.

- Value Added Tax (VAT): Applied at 19% on the taxable amount.

For traditional vehicles, import taxes can climb as high as 200%. To illustrate, let’s consider a $30,000 electric vehicle with $3,000 shipping, $600 insurance, and $700 in fees, bringing the total to $34,300. A 10% import duty would add $3,430, and 19% VAT would add roughly $6,525, bringing the total to $44,255. However, with the 50% reduction in taxable value, these charges would decrease significantly, leading to substantial savings.

While these taxes form the bulk of the costs, there are additional fees to consider.

Additional Costs

On top of taxes, several other expenses can impact your budget:

- Port Charges: Depending on the port (e.g., Douala), these typically range from $500 to $1,000.

- Shipping Insurance: Highly recommended, this usually costs 1% to 2% of the vehicle’s value. For a $30,000 vehicle, that’s $300 to $600.

- Customs Broker Fees: If you choose to hire a broker, expect to pay either a flat fee of $395 or 3% of the vehicle’s price, whichever is higher.

- Registration and Compliance Fees: Covering inspections, local registration, and license plates, these fees generally add $200 to $500.

When calculating your budget, it’s important to include these additional costs alongside the vehicle’s purchase and import taxes. Thanks to the government’s incentives, importing an electric vehicle now could be more cost-effective than in previous years.

The financial benefits don’t stop at importation. Electric vehicle owners in 2025 will also be exempt from road tax and can take advantage of government subsidies for EV charging facilities.

sbb-itb-99e19e3

Trusted Platforms for EV Importation

Navigating the complexities of importing electric vehicles (EVs) becomes much easier with experienced providers. These experts handle intricate documentation and specialized shipping needs, ensuring a smoother process. Below, we take a closer look at how one platform, in particular, is making EV importation simpler and more accessible.

EV24.africa‘s Services and Benefits

EV24.africa offers a one-stop solution for Cameroonians looking to import electric vehicles. With access to over 200 EV models from more than 25 global brands, the platform caters to a wide range of preferences, from budget-friendly options to high-end models.

What truly sets EV24.africa apart is its comprehensive, end-to-end service. They handle every step of the importation process, following international commercial terms (Incoterms) and customizing services to meet individual needs. By utilizing Douala Port, they capitalize on local expertise, speeding up the entire process.

Their team, consisting of over 200 professionals across five African countries, provides dedicated support from the moment of purchase to final delivery. They also assist with customs clearance, registration, and import taxes, ensuring compliance with Cameroon’s regulations. This is especially important given the excise duty exemptions for EVs that came into effect on January 1, 2025.

"Africa is ready for electric vehicles, and EV24.africa is committed to making this transition smooth and accessible. Our goal is to provide a reliable, transparent, and competitive marketplace for EV buyers across the continent." – Axel Peyriere, Co-Founder and CEO of AUTO24.africa

EV24.africa also offers various shipping options, including RoRo (Roll-on/Roll-off) and container shipping, with the flexibility of port-to-port or door-to-door delivery. Customers can track their vehicle in real-time, ensuring transparency throughout the importation journey.

Pricing transparency is another key feature. By offering detailed quotes upfront, EV24.africa helps customers budget effectively, eliminating unexpected costs during the process.

Partner Logistics Providers

EV24.africa further enhances its services by collaborating with expert logistics providers to ensure efficient and safe EV shipments.

Shipping EVs requires special attention to battery safety. Lithium-ion batteries, classified as dangerous goods under international shipping regulations, demand specialized handling – a capability not all logistics companies have. EV24.africa works with trusted partners who are well-versed in these requirements, ensuring proper battery handling and compliance with hazardous materials declarations to avoid delays.

Their logistics network spans all 54 African countries, with established partnerships in over 40 nations. This extensive reach ensures familiarity with the specific regulations and procedures for each destination, including Cameroon’s customs requirements and the recent excise duty exemptions.

For customers who prefer to manage logistics independently, it’s crucial to verify the provider’s expertise in EV shipments. Key factors to consider include their battery handling protocols, insurance coverage for EV-related risks, and a proven track record of successful deliveries to Cameroon.

Post-Import Steps and Maintenance Tips

Once your electric vehicle has cleared customs, there are several important steps to take. These will not only ensure your EV is legally registered in Cameroon but also help maintain its performance and reliability for years to come.

Registering Your Electric Car

To register your EV in Cameroon, you’ll need to gather all the required documents and visit the Cameroon Ministry of Transport or your local vehicle registration office. Here’s what you’ll need:

- ID and proof of address

- A completed application form

- Bill of sale

- Customs clearance documentation

- Proof of insurance that meets Cameroonian standards

One of the most important items in this process is the Certificate of Conformity, which confirms that your EV meets local safety and emissions standards. Depending on the model, your vehicle might require adjustments to align with Cameroonian regulations, especially regarding safety features and technical specifications.

Before registration, your EV must pass a technical inspection. This inspection ensures compliance with safety and emissions standards specific to Cameroon. It covers critical areas like safety systems, electrical components, and emissions.

Once all your documents are approved and fees are paid, you’ll receive your official Cameroonian license plates. Keep in mind that the process can take several weeks, so it’s best to plan ahead and ensure all paperwork is in order before starting.

Maintenance and Service Centers

When it comes to maintaining your EV, reliable service centers are mostly located in Douala and Yaoundé. For example, SGS Cameroun S.A. in Douala offers specialized diagnostics and repairs for electric vehicles, making it a key resource for EV owners.

The EV service network is growing quickly. In May 2025, Spiro launched operations in Cameroon, aiming to support the country’s transition to electric mobility. Their efforts include creating jobs and building partnerships with local communities and private sector stakeholders. This expansion highlights the increasing availability of support for EV owners.

However, for those living outside major cities, accessing service centers or charging infrastructure may require longer travel times.

For routine maintenance, prioritize battery care above all else. Aim to keep the battery charge between 20% and 80% when possible, avoid exposing it to extreme temperatures, and follow the manufacturer’s recommendations for charging. Basic maintenance tasks – like tire rotation, brake checks, and software updates – can often be handled by trained general automotive technicians.

Warranty and Spare Parts

Before importing your EV, confirm whether the warranty is valid internationally and keep detailed records of all maintenance visits to support any future claims.

Many EVs come equipped with advanced safety systems to protect the battery during shipping and operation. These include sensors that disconnect the battery if temperatures rise too high and electronic cooling systems to safeguard critical components. Familiarizing yourself with these systems can help you communicate effectively with authorized dealers.

Warranty claims and service records can often be managed through systems like Intellinet, which authorized dealers use to streamline the process. While you won’t use these systems directly, understanding their role can make navigating warranty issues easier.

When it comes to spare parts, availability depends on the manufacturer and model. Brands like Tesla and BYD, being global leaders, often have better parts networks. However, delivery times to Cameroon may still be longer than in other regions. To avoid delays, consider ordering commonly needed parts – such as brake pads, filters, and charging cables – in advance.

Keep detailed maintenance records from the start. Document every service visit, warranty claim, and parts replacement. These records are not only essential for warranty coverage but also help preserve your EV’s resale value. Store both physical and digital copies of all documents, as some warranty claims might require a complete service history.

Lastly, consider joining online forums or communities dedicated to your EV model. These groups often provide practical advice on sourcing parts, finding reliable service, and navigating maintenance challenges specific to African conditions.

Conclusion

Electric vehicles (EVs) in Cameroon are becoming a game-changer, offering substantial financial advantages. With running costs slashed by 50% and maintenance expenses reduced by 30%, EVs are a smart choice for cost-conscious drivers. Add to that the government’s supportive policies – like a 50% tax rebate on imports in 2025 and exemption from road tax for all-electric vehicles – and the financial appeal becomes even stronger.

But it’s not just about saving money. EVs bring significant environmental benefits too. As Cameroon pushes toward its ambitious goals of cutting greenhouse gas emissions by 32% and achieving a 25% renewable energy share in its power mix, EVs are an essential part of the solution. With zero tailpipe emissions, they help combat air pollution, especially in urban areas.

Navigating the import process has also been simplified. Total costs, including duties and fees, range between $2,500 and $4,000. By understanding the required paperwork, selecting the right shipping options, and working with experienced customs agents, buyers can avoid unnecessary delays and costs.

For those looking for a hassle-free experience, platforms like EV24.africa manage the entire process – from sourcing to delivery. Whether you’re eyeing a Tesla or a BYD, there’s an option to suit every preference.

Cameroon’s EV infrastructure is also growing steadily. Service centers are now available in major cities, spare parts are becoming easier to find, and government-backed initiatives like subsidized charging stations are making EV ownership more convenient. This expanding ecosystem makes 2025 an ideal time for the country to embrace electric mobility.

Whether your priority is cutting costs, reducing your environmental footprint, or driving the latest in automotive technology, EVs offer a smart and forward-thinking transportation solution for Cameroon. With these benefits, the country is well-positioned to take the lead in electric vehicle adoption.

FAQs

What government incentives will be available for importing electric vehicles into Cameroon starting in 2025?

Starting in 2025, the Cameroonian government plans to roll out a series of measures to boost the importation of electric vehicles (EVs). Among these are a 50% tax rebate on imported EVs, the elimination of the 12.5% excise duty, and a 50% cut in the taxable value for EV batteries and charging equipment.

The goal is clear: to lower costs and make EVs more accessible, helping the country shift toward cleaner transportation options and minimize environmental harm.

What makes importing electric vehicles (EVs) to Cameroon different from importing traditional cars?

Importing Electric Vehicles (EVs) to Cameroon

Bringing electric vehicles (EVs) into Cameroon comes with some distinct advantages compared to importing traditional cars, thanks to government incentives aimed at encouraging cleaner transportation.

As of 2025, the Cameroonian government offers a 50% tax rebate on EV imports. This policy is part of a broader effort to make EVs more affordable and promote sustainable transportation. In contrast, traditional vehicles can be subject to import taxes as high as 200%, making EVs a much more budget-friendly option for importers.

On top of the financial benefits, the process of importing EVs is often streamlined. Policies designed to encourage electric mobility reduce the paperwork and compliance costs typically associated with importing vehicles. These measures align with Cameroon’s commitment to adopting cleaner energy solutions and cutting greenhouse gas emissions.

What factors should I consider when deciding between RoRo and container shipping to import an electric car to Cameroon?

When deciding how to import an electric car to Cameroon, you’ll likely weigh your options between RoRo (Roll-on/Roll-off) and container shipping. Here’s a closer look at the key factors to consider:

- Cost: If budget is a priority, RoRo is typically the cheaper option, with costs ranging from $900 to $1,500. In contrast, container shipping can set you back anywhere from $1,500 to $3,000.

- Vehicle Protection: Container shipping offers a higher level of security for your car. Since the vehicle is fully enclosed, it’s shielded from weather and potential damage. RoRo, however, leaves the car exposed to the elements during transport.

- Vehicle Condition: RoRo shipping requires the vehicle to be in working order so it can be driven on and off the vessel. If your car is damaged or not operational, container shipping is the better fit, as it can accommodate non-functional vehicles.

- Speed and Availability: RoRo shipping often has more frequent sailings, which might result in quicker delivery compared to container shipping.

By evaluating these factors – cost, protection, condition, and timing – you can make an informed decision that aligns with your needs and priorities.