Niger’s new 2025 electric vehicle (EV) import rules bring major changes for buyers and importers. Here’s what you need to know:

- 10-Year Age Limit: Only EVs manufactured in 2015 or later are allowed without extra penalties.

- Import Costs: Duties range from 10%-20%, with a 15% levy and shipping costs averaging $1,600.

- Tax Breaks: Buyers get full VAT exemptions and no Green Tax, reducing overall expenses.

- Documentation: Compliance requires certificates for emissions, origin, and safety standards.

Navigating these changes will require attention to detail and working with experienced customs agents to avoid delays and extra costs.

Major Changes in Niger’s 2025 EV Import Regulations

Niger is rolling out a revamped framework for importing electric vehicles (EVs) in 2025, bringing three significant changes that will shape the market. These updates aim to balance environmental priorities with practical considerations, creating both opportunities and hurdles for buyers and stakeholders. Let’s break down these key changes and what they mean for EV importation.

Age Limits for Imported EVs

One major shift is the introduction of a stricter age limit for imported vehicles, including EVs. Starting in 2025, only vehicles manufactured in 2015 or later will be allowed without incurring punitive duties. This aligns Niger with regional practices, as similar rules are already in place elsewhere. Previously, vehicles up to 15 years old were acceptable, but the new 10-year limit reflects a push for safer, more efficient, and technologically advanced models.

For buyers, this change emphasizes the importance of verifying the manufacturing date – not just the model year – of an EV before purchase. Since the age limit was tightened in May 2022, confirming compliance with the latest regulations through customs or a trusted clearing agent is now essential.

Import Tariffs, Duties, and Taxes on EVs

Costs are another critical factor under the new rules. Importing an EV to Niger in 2025 will involve various expenses that buyers need to consider. Import duties range between 10% and 20%, depending on the vehicle classification, and a 15% National Automotive Council (NAC) Levy is also expected to apply.

Transportation costs further add to the expense. Shipping a container from China to West African ports averages about $600, with inland transport and port handling fees adding roughly $1,000 per container. Since some duty rates remain undefined, it’s wise to budget for potential changes and confirm rates with customs authorities before making any commitments.

Tax Breaks and Exemptions for EV Buyers

On a brighter note, Niger’s 2025 regulations include financial incentives to encourage EV adoption. Buyers will benefit from a full VAT exemption and won’t have to pay the Green Tax Surcharge, significantly lowering overall costs.

Additionally, the National Action Plan for the Development of Electric Vehicles (EVDP) introduces reduced import duties for EVs. However, claiming VAT exemptions may involve detailed paperwork and longer processing times. Staying informed through customs services and finance ministries will be key to navigating these incentives effectively and maximizing savings.

These financial benefits are designed to encourage EV adoption, but they also require careful attention to compliance steps, which are explored in the next section.

Compliance Guide for EV Buyers and Importers

Navigating Niger’s 2025 EV import regulations requires attention to detail, especially when it comes to documentation, customs procedures, and meeting technical standards. Following a clear process can help you avoid delays and ensure your shipment clears customs without unnecessary hurdles.

Required Documents and Certifications

Having the right paperwork in order is critical when importing an EV. Missing or inconsistent documentation can lead to customs issues or costly delays. Here’s what you’ll need:

- Business registration and tax ID

- Vehicle inspection certificate

- Final invoice

- Certificate of origin and pricing

- Packing list

- Ocean Bill of Lading

- Marine insurance certificate

In addition to these documents, your EV must meet specific certification requirements. For instance, the vehicle must comply with a minimum Euro II emission standard. You’ll also need approval from the Standards Organisation of Nigeria Conformity Assessment Program (SONCAP), which involves obtaining both a Product Certificate (PC) and a Shipment Certificate (SC). With these certifications and documents ready, you’ll be better prepared to handle customs procedures.

Customs Process and Payment Steps

Once your documentation is complete, the next step is understanding customs clearance. This process starts even before your EV arrives at the port. Working with experienced freight forwarders can make this step much smoother. They can assist with verifying documents, calculating import duties, and managing customs declarations. For example, companies like Cargoburg Logistics Limited specialize in handling electric vehicle imports, taking care of everything from paperwork to port handling and delivery.

Payments are another crucial part of the process. You’ll need to settle fees at various stages, including customs duties and handling charges. Following your freight forwarder’s advice can help ensure payments are made on time and that you select the most efficient port for your shipment.

Technical Requirements for Imported EVs

Imported EVs must meet strict technical standards to ensure safety and compliance with environmental regulations. Meeting the Euro II emission standard and securing SONCAP certification are non-negotiable. Importers should also be aware that electric motorcycles and tricycles may face additional scrutiny during classification and registration.

The National Automotive Design and Development Council (NADDC) is also working on new standards for EV conversion, calibration, and maintenance, which could eventually affect imported vehicles. Partnering with knowledgeable customs brokers and freight forwarders can help you navigate these evolving requirements and ensure your EV meets all necessary criteria before it reaches the port.

sbb-itb-99e19e3

Finding Compliant EVs with EV24.africa

With Niger’s 2025 EV regulations raising the bar for compliance, navigating the approval process can feel like a maze. That’s where EV24.africa steps in, making it easier to find electric vehicles (EVs) that meet the updated standards. By offering a curated selection of approved models, transparent pricing, and comprehensive support services, EV24.africa simplifies the process from start to finish.

Using EV24.africa to Find Approved Models

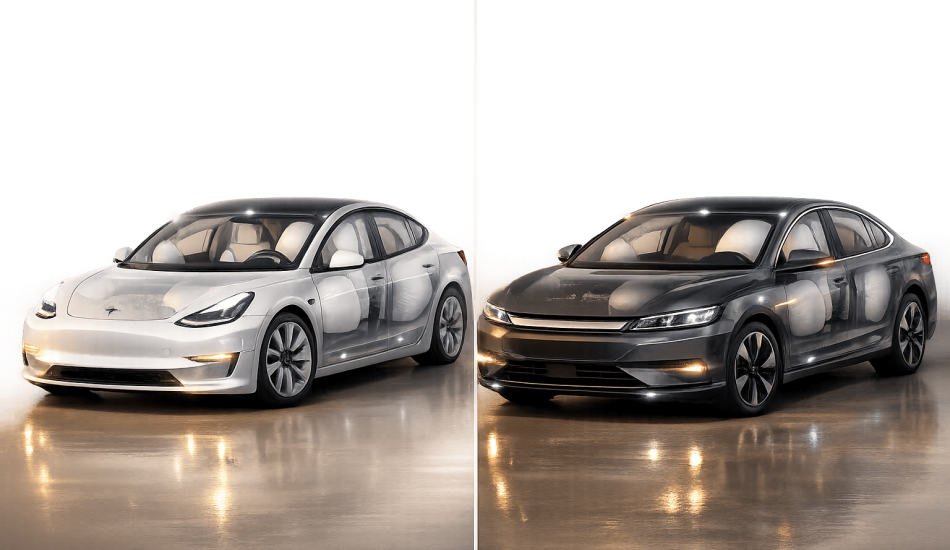

On EV24.africa, you’ll find a lineup of EVs that are already approved for compliance. Each listing includes clear pricing in USD, along with essential details like range and manufacturing year. This setup allows you to make quick, well-informed decisions without the guesswork.

Top EV Models Available for Import in 2025

Here’s a snapshot of some EVs available through EV24.africa, covering budget-friendly, mid-range, and premium options:

| Make | Model | Range (miles) | Price (USD) |

|---|---|---|---|

| BYD | QIN PLUS EV 100 Kw | 249 | $14,180 |

| BYD | DOLPHIN ACTIVE | 211 | $11,800 |

| LEAPMOTOR | C10 | 280 | $18,900 |

| DONGFENG | AEOLUS SKY EV01 | 329 | $20,660 |

| GEELY | GEOMETRY G6 | 385 | $23,860 |

| DONGFENG | eπ 008 EV | 395 | $28,700 |

Financing and Shipping Options through EV24.africa

EV24.africa doesn’t just help you pick the right EV – it also takes care of the logistics. They offer flexible shipping options, including RoRo (Roll-on/Roll-off) and container shipping, with door-to-door delivery available across all 54 African countries. Vehicles typically arrive at the Port of Cotonou, where EV24.africa coordinates overland transport, customs clearance, vehicle registration, and even import tax calculations. This end-to-end support ensures a smooth process every step of the way.

Preparing for Smooth EV Imports

Navigating Niger’s 2025 regulations for electric vehicle (EV) imports requires a well-planned approach to avoid unnecessary costs and delays. While the new rules present both challenges and opportunities, careful preparation can help you streamline the process and make the most of available benefits.

Steps for Compliance and Cost Savings

Before committing to a purchase, check whether your EV qualifies for tax credits. These credits can range from a few thousand dollars to as much as $10,000, depending on the vehicle’s specifications and features.

Accurate and complete documentation is key to avoiding customs delays or penalties. Ensure that your EV meets all eligibility criteria under the new regulations. Keep all purchase-related documents, such as receipts, registrations, and bills of sale, as they are required for IRS filings, including Form 8834.

Working with experienced freight forwarders can simplify the import process and minimize costs. These professionals are familiar with Niger’s specific import requirements and can guide you through customs clearance and registration. Staying informed about regulatory updates is also essential, as timing your purchase strategically could lead to additional savings. In some cases, vehicles may need to be partially assembled locally to qualify for the full tax credit, so verifying these requirements beforehand is crucial.

By following these steps, you can create a seamless plan that takes you from purchase to delivery while avoiding unnecessary complications. Staying organized and prepared ensures a smoother experience.

Staying Informed and Seeking Expert Assistance

The landscape for EV import regulations is constantly changing, making it essential to stay updated on policy shifts. For example, as of July 26, 2025, Niger remains in a period of political transition following the CNSP coup anniversary. Such developments highlight the importance of working with professionals who closely monitor these changes.

Tax professionals can provide valuable guidance on claiming credits and navigating eligibility requirements. They can help you understand how income limits and specific filing procedures apply to your situation, ensuring you remain compliant.

Platforms like EV24.africa offer comprehensive support throughout the import process. Their expertise goes beyond vehicle selection to include customs clearance, local registration, and transparent pricing with no hidden fees. From shipping logistics to final delivery, their services ensure you have expert help at every stage.

Instead of planning travel to handle in-country procedures, rely on trusted local partners. EV24.africa’s team can manage the entire process remotely, keeping you informed of progress and any regulatory updates that might affect your import. Their localized expertise is particularly beneficial for navigating Niger’s specific requirements.

Maintaining regular communication with your import specialist or platform is another way to stay ahead of potential regulatory changes. This proactive approach ensures your EV import remains on track, from the initial purchase to its final delivery.

FAQs

What documents are required to import an EV into Niger under the 2025 regulations?

To bring an electric vehicle (EV) into Niger starting in 2025, you’ll need to file a Preliminary Import Declaration at least seven days before shipping. This declaration should cover key details like the product description, origin, specifications, manufacture date, and batch or lot number.

You’ll also need to provide additional documents, including proof of ownership, evidence of customs duty and VAT payments, and compliance certificates confirming the EV meets Niger’s regulations. Ensure all documents are accurate and submitted on time to prevent any delays.

How will the new import duties and tax exemptions impact the cost of buying an EV in Niger starting in 2025?

The upcoming regulations scheduled for 2025 will impose import duties of 10% to 20% on electric vehicles (EVs). On the bright side, these added costs are balanced out by VAT exemptions, which help lower the total cost of bringing an EV into the country.

For consumers, this translates to a chance to purchase EVs at a lower price than what they currently pay. It’s a win-win for those looking to switch to cleaner transportation while saving money. Importers and buyers alike can take advantage of these tax breaks, making it easier to adapt to the new rules and embrace the benefits of EV ownership.

How can I make sure my EV meets Niger’s 2025 import requirements?

To make sure your EV aligns with Niger’s 2025 import regulations, first verify that the vehicle was manufactured in 2015 or later, adheres to the specified emission standards, and has an engine capacity of 2,000cc or less.

Gather all required documentation, such as proof of compliance with customs and regulatory requirements. Staying updated on changes to local policies is equally important, as is exploring potential tax incentives or exemptions. Researching eligible EV models ahead of time can help you make an informed and regulation-compliant purchase.