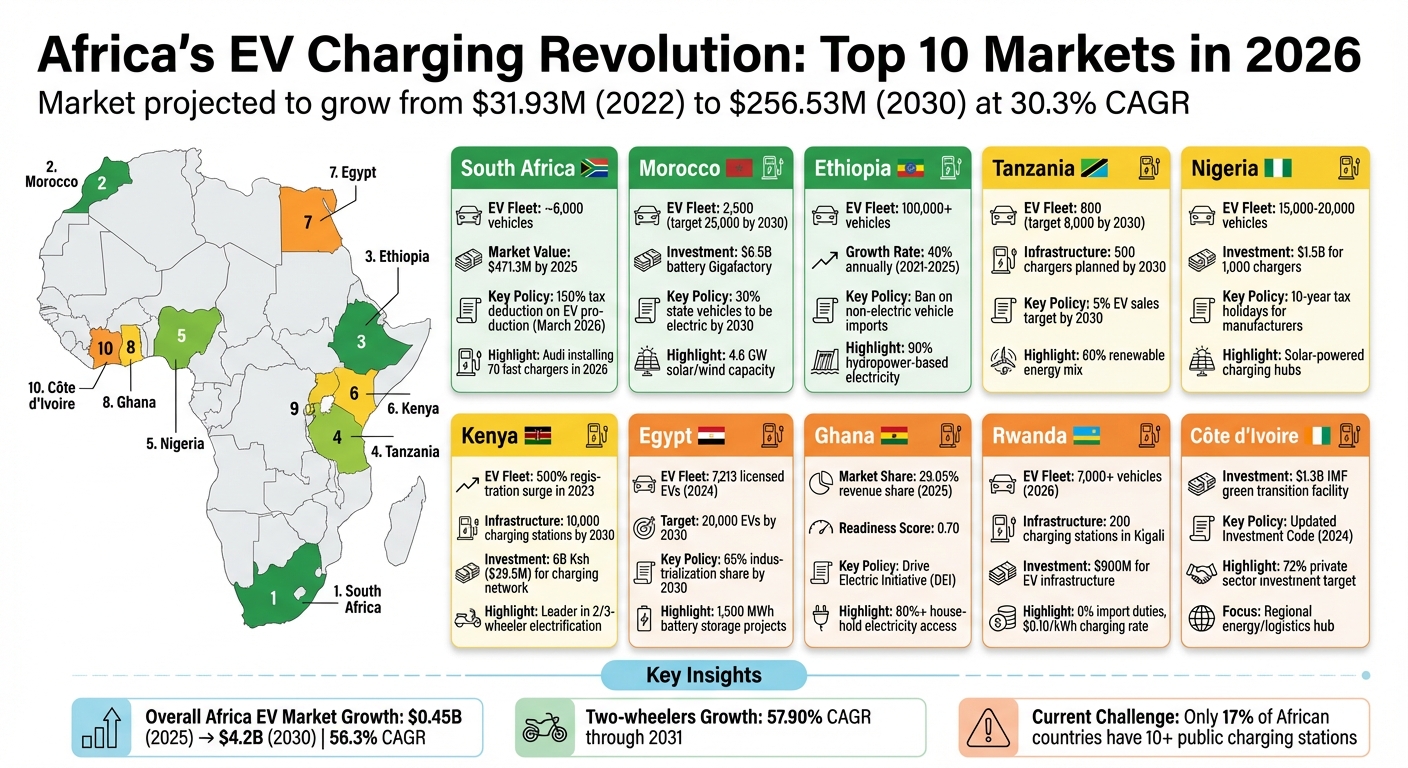

Africa’s electric vehicle (EV) charging infrastructure is growing fast, with the market expected to jump from $31.93M in 2022 to $256.53M by 2030 (30.3% CAGR). This growth is driven by bold government policies, renewable energy integration, and innovative financing. Here’s a quick look at the top 10 markets leading this transformation:

- South Africa: ~6,000 EVs, tax incentives for manufacturing, and $471.3M market by 2025. Audi plans 70 fast chargers in 2026.

- Morocco: 25,000 EVs projected by 2030, strong solar energy integration, and $6.5B battery investments.

- Ethiopia: 100,000 EVs (2025), import ban on non-electric vehicles, and solar-hybrid charging stations.

- Tanzania: Focus on 2/3-wheelers, 500 planned chargers by 2030, and hydropower-backed infrastructure.

- Nigeria: 15,000–20,000 EVs, $1.5B for 1,000 chargers, and solar-powered hubs addressing grid issues.

- Kenya: Leading in 2/3-wheelers, fintech-enabled financing, and 10,000 charging stations planned by 2030.

- Egypt: 7,213 EVs (2024), battery storage projects, and public-private charging station partnerships.

- Ghana: 29.05% market revenue share (2025), solar-powered chargers, and EV-friendly policies.

- Rwanda: 7,000 EVs (2026), incentives for adoption, and $900M investment in infrastructure.

- Côte d’Ivoire: Green-focused policies, IMF-backed investments, and partnerships for EV leasing programs.

Africa’s EV future is shaped by diverse strategies, from high-tech manufacturing hubs to solar-powered solutions for off-grid areas. Each market offers unique opportunities for investment and innovation in charging infrastructure.

Top 10 African EV Markets 2026: Fleet Size, Investment & Policy Comparison

1. South Africa

Current EV Fleet Size

South Africa stands out as Africa’s top electric vehicle (EV) market, with around 6,000 EVs currently on its roads. The country’s automotive sector, which accounts for over 7% of its GDP, is beginning to pivot toward electric mobility. In fact, the combined market for EVs and charging infrastructure hit $373.1 million in 2024, growing at a rapid 33.5% CAGR between 2020 and 2024.

These strong market figures are paving the way for government-backed initiatives.

Government Policies

To encourage EV adoption, the South African government has eliminated import duties on electric vehicles. On top of that, a 150% tax deduction on qualifying investments in electric and hydrogen-powered vehicle production assets will roll out in March 2026. This bold initiative aims to establish South Africa as a manufacturing hub, not only for domestic needs but also for exports to the EU and UK markets.

These policies are driving a wave of investment and industrial activity.

2026 Investment Projections

The EV market is forecasted to grow to $471.3 million by 2025, reflecting an annual growth rate of 26.3%, and is expected to surpass $1.01 billion by 2029. In a major development, German automaker Audi announced in January 2026 its plans to build 70 fast (150 kW) public charging stations across 33 locations in South Africa, utilizing DC technology. These investments will initially focus on Tier 1 cities, with plans to expand to fleet hubs, workplaces, and popular destinations.

To tackle energy challenges, the country is also exploring solar-powered charging and Vehicle-to-Grid (V2G) technologies. With manufacturing incentives kicking in and global automakers committing to infrastructure expansion, South Africa is making a decisive move from cautious interest to full-scale EV industrialization.

2. Morocco

Current EV Fleet Size

As of 2025, Morocco had approximately 2,500 electric vehicles (EVs) on the road, with projections to grow to 25,000 by 2030. The country also had around 300 public charging points, most of which were Level 2 chargers. The EV market is anticipated to expand significantly, increasing from $150 million in 2025 to $650 million by 2030, reflecting an impressive 33.9% annual growth rate. Morocco’s automotive industry, which produced 614,000 vehicles in 2024, provides a strong foundation for the transition to electric mobility. This growth positions Morocco as a leader in integrating renewable energy into its transportation sector.

Solar Off-Grid Readiness

By 2023, Morocco had installed 4.6 GW of solar and wind capacity, supporting its goal to achieve a 52% renewable energy share by 2030. The Moroccan Agency for Solar Energy (MASEN) is strategically placing charging stations near renewable energy facilities, such as the Noor Solar Complex and the 400 MW Midelt Solar Plant, to reduce reliance on the grid and lower operational costs.

Solar-powered charging is a game-changer, cutting operating costs by 47–83%. Driving 62 miles in a light-duty EV costs between $0.62 and $0.92, compared to $6.62 for a traditional fuel vehicle.

Government Policies

Morocco’s 2030 Sustainable Development Strategy sets a target for 30% of state-owned vehicles to be electric or hybrid. To encourage EV adoption, the government provides reduced import taxes and VAT exemptions for electric vehicles. Additionally, the Moroccan Agency for Energy Efficiency (AMEE) offers subsidies for installing charging stations, benefiting both public and private sectors.

These measures align with Morocco’s pledge under the Paris Agreement to cut greenhouse gas emissions by 45.5% by 2030. The combination of tax incentives and subsidies is driving significant investments in EV batteries and charging infrastructure.

2026 Investment Projections

Morocco is positioning itself as a key player in battery manufacturing for Europe. In June 2025, the Sino-Moroccan company COBCO began producing EV battery materials with an annual capacity of 70 GWh, enough to power nearly 1 million vehicles. Meanwhile, Gotion High-Tech Co. has committed $6.5 billion to build a battery Gigafactory with a planned capacity of 100 GWh, and BTR is investing $366 million in a cathode production facility.

In addition, a Moroccan consortium pledged $140 million in 2023 to install 5,000 charging stations across highways and public spaces by 2028. These investments are setting the stage for a robust EV ecosystem in the country.

3. Ethiopia

Current EV Fleet Size

Ethiopia’s electric vehicle (EV) fleet has grown to over 100,000 units as of mid-2025, marking an impressive annual growth rate of over 40% between 2021 and 2025. The government has set an ambitious target to expand this fleet to 500,000 EVs within the next decade, aiming to replace 95% of fuel-powered vehicles and significantly reduce the country’s reliance on fuel imports.

Government Policies

This rapid expansion is driven by bold government initiatives. In January 2024, Ethiopia introduced a ban on non-electric vehicle imports, requiring all new vehicles brought into the country to be electric [13,15]. To encourage local EV assembly, the government offers duty-free imports for EV components, applies a 5% tax on partially assembled vehicles, and imposes a 15% tax on fully assembled EVs. Additionally, the Petroleum and Energy Authority is rolling out plans to install charging stations every 50–120 kilometers (approximately 31–75 miles) along major highways.

"The move to electric vehicles would benefit Ethiopia economically by saving a significant amount of foreign money spent on fuel expenditures each year."

– Bareo Hassen, Minister of Transport and Logistics

By Q2 2025, Ethiopia had 25 public charging stations in operation, supplemented by 30–40 private or fleet-specific charging hubs. The Ethiopian Electric Utility (EEU) plays a key role by managing grid connections for these new charging networks.

Solar Off-Grid Readiness

Ethiopia’s energy landscape is well-suited for EV adoption, with around 90% of its electricity generated from hydropower, offering a carbon-neutral foundation for EV charging. To extend access to remote areas, the country is piloting solar-hybrid charging stations in peri-urban and off-grid regions. These initiatives are supported by international organizations, including UNDP and GIZ.

2026 Investment Projections

Ethiopia’s EV ecosystem continues to develop through strategic investments and innovative practices. By mid-2025, Ethio eMobility Solutions had installed over 200 7–22 kW AC wallbox chargers in Addis Ababa. Meanwhile, Hawassa Industrial Park is testing electric truck and fleet integration projects. These efforts are paving the way for a market projected to be worth $100–150 million by 2030, requiring an estimated 5,000–7,500 chargers to meet demand.

4. Tanzania

Current EV Fleet Size

Tanzania currently has a modest fleet of about 800 electric vehicles (EVs), with the majority being two- and three-wheelers commonly found in urban centers like Dar es Salaam and Zanzibar. Projections suggest this number could grow significantly, reaching 8,000 vehicles by 2030. The country’s charging infrastructure is still in its early stages, featuring around 15 public charging stations, most of which are Level 2 chargers concentrated in the capital. These early steps provide a foundation for further market development, driven by supportive policies.

Government Policies

Tanzania has implemented several measures to encourage EV adoption. The Finance Act 2022 introduced reduced import duties and VAT exemptions, cutting upfront costs by approximately 25%. Additionally, a draft E-mobility Framework sets a target for 5% of new vehicle sales to be electric by 2030 and outlines plans to establish 500 charging stations nationwide. TANESCO (Tanzania Electric Supply Company) is also playing a key role, with plans to expand its pilot charging stations to a network of 50 by 2027, focusing on major cities like Dar es Salaam, Dodoma, and Arusha. Another ambitious project is the National EV Corridor, which aims to connect Dar es Salaam to Mwanza with a reliable network of fast chargers.

Solar Off-Grid Readiness

Tanzania’s energy profile is well-suited for sustainable EV charging, with around 60% of its electricity coming from renewable sources like hydropower and solar. The Rural Energy Agency (REA) is actively working on solar-powered charging hubs in areas where grid access is limited. Pilot projects are already underway in regions such as Lindi and Mtwara. The cost benefits of EVs are clear: an electric vehicle journey costs approximately TZS 6,000 per 100 kilometers, compared to TZS 32,000 for petrol vehicles over the same distance. This renewable energy backbone is set to support further investments in EV infrastructure.

2026 Investment Projections

Tanzania’s focus on renewable energy and innovative charging solutions aligns with a broader regional push for sustainable mobility. The World Bank’s $200 million Energy Sector Reform Program is strengthening grid capacity, while private companies like Ampersand are spearheading battery-swapping initiatives for motorcycles, reducing refueling times to just 3–5 minutes. The completion of the 2.1 GW Julius Nyerere Hydropower Plant in 2025 will add surplus power, enabling the deployment of high-capacity DC fast chargers. These advancements are expected to propel Tanzania’s EV market from $40 million in 2025 to $220 million by 2030, reflecting an impressive annual growth rate of 40.5%.

5. Nigeria

Current EV Fleet Size

Nigeria is steadily making its mark in Africa’s growing EV landscape, even though it’s still in the early stages. The country currently has an estimated 15,000–20,000 electric vehicles, which account for just 0.5–1% of its total vehicle market. While this is a modest beginning, the infrastructure is expanding to meet future demand, with fewer than 100 charging stations currently supporting a projected 300,000 EVs. The EV market in Nigeria is valued at $1.2 billion as of late 2025, with commercial fleets leading the way. Ride-hailing companies like Moove and motorcycle networks such as MAX.ng are at the forefront of adoption. Notably, motorcycle taxis contribute around $4.4 billion annually to Nigeria’s economy, making them a key focus for electrification efforts.

Government Policies

Nigeria has introduced several initiatives to promote EV adoption through its National Electric Vehicle Policy. These include 10-year tax holidays for EV manufacturers and infrastructure developers. The government has also allocated approximately $1.5 billion to build 1,000 charging stations across major cities and rural areas. To further encourage adoption, EVs and charging components are exempt from import duties and VAT, and the removal of fuel subsidies has freed up an estimated $3.7 billion annually for EV-related incentives.

The National Automotive Design and Development Council (NADDC) is spearheading pilot projects to integrate solar-powered charging stations into the ecosystem. For instance, solar hubs were commissioned at the University of Lagos in July 2021 and the University of Nigeria Nsukka in August 2023 to support research and innovation. Additionally, Nigeria has set a target for 30% of EV production to be local by 2032, with domestic manufacturers like Innoson and JET Motor Company playing a crucial role in assembly and production efforts.

Solar Off-Grid Readiness

Given the country’s unreliable power grid, solar-powered charging stations are critical for Nigeria’s EV future. Renewable energy capacity is expected to reach 10,000 MW, largely driven by investments in solar and wind energy. Pilot solar hubs in cities like Sokoto, Lagos, and Nsukka are already providing grid-independent charging solutions. With electricity prices ranging from ₦51–207 per kWh and petrol costing ₦770–1,030 per liter, EVs present a strong economic advantage. Hybrid systems that combine solar panels with battery storage are also being deployed to ensure charging availability during nighttime or low solar production periods.

2026 Investment Projections

Nigeria is entering a pivotal phase in its EV journey, with significant investment required to unlock its potential. An estimated $500 million is needed to develop the initial charging network, with public-private partnerships emerging as the preferred model for deployment. Key urban centers like Lagos, Abuja, and Port Harcourt are primary targets for these investments.

In 2025, the startup Possible EVS launched the country’s first public fast-charging station at 7 Hombori Street in Abuja, offering free charging for the first six months to encourage adoption. The focus is now shifting toward DC fast-charging stations to ease range anxiety, particularly for intercity travel. Additionally, stakeholders are beginning to explore Vehicle-to-Grid (V2G) technology, which allows EVs to act as mobile energy storage units during power outages.

6. Kenya

Current EV Fleet Size

Kenya’s electric vehicle (EV) market is heavily focused on two- and three-wheelers, which play a vital role in the country’s public and commercial transport systems. In 2023, EV registrations jumped fivefold, thanks to VAT exemptions and reduced e-mobility tariffs. This rapid growth has earned Kenya a spot as an "Innovator" in EV readiness across Africa, with a readiness score of 0.70, placing it among the top 10 most prepared nations on the continent.

The commercial sector is leading the charge, with fintech-enabled financing models paving the way for broader EV adoption. Around 40% of Kenyans have access to financial services, and platforms like mobile money and fintech loans have made EVs more accessible. A prime example is BasiGo, which has delivered 100 electric buses across Kenya and Rwanda. Meanwhile, the government is stepping up, aiming to add 1,000 EVs to its fleets annually.

Government Policies

Kenya’s rapid EV growth is supported by a range of government initiatives aimed at transforming the transport sector. The national e-mobility strategy outlines a clear plan for transitioning to electric vehicles. VAT exemptions specifically target electric motorcycles and buses, focusing on segments where adoption is most feasible. Additionally, Kenya Power has introduced special electricity tariffs for EV charging, significantly cutting operating costs for fleet operators. To ensure quality, the government has banned the import of EV batteries with less than 80% capacity, maintaining high standards in the market.

The government has also set an ambitious goal of establishing 10,000 public charging stations by 2030, ensuring no more than 25 kilometers (15.5 miles) between charging points on major highways. As part of the first phase, Kenya Power is installing 45 fast-charging stations across six counties, prioritizing key routes like the Mombasa–Busia corridor, a crucial trade artery.

Solar Off-Grid Readiness

Kenya is taking advantage of its abundant solar energy to address grid limitations and expand EV infrastructure. Solar-powered and off-grid charging solutions are being developed to bypass challenges tied to grid capacity. By integrating solar mini-grids with Vehicle-to-Grid (V2G) technology, EVs can double as mobile energy storage units, benefiting off-grid communities.

2026 Investment Projections

Kenya has earmarked 6 billion Ksh (around $39.5 million) to build a nationwide network of public charging stations. The rollout is divided into three phases:

- Phase 1: 1.18 billion Ksh will fund charging stations in 17 key cities and transport corridors.

- Phase 2: 1.81 billion Ksh is allocated to expand the network to 23 additional cities.

- Phase 3: 3.13 billion Ksh will connect district capitals and satellite cities.

This phased approach ensures that urban hubs and rural areas alike are equipped with the infrastructure needed to support Kenya’s growing EV ecosystem.

7. Egypt

Current EV Fleet Size

Egypt’s electric vehicle (EV) market is steadily expanding. By June 2024, there were 7,213 licensed EVs on the nation’s roads. In just the first quarter of 2024, Egypt issued licenses for 1,419 EVs, which accounts for about one-third of the total EVs licensed over the previous three years. The commercial sector is playing a big role in this growth, with Egypt leading Africa in electric bus deployment, boasting 200 units as of May 2025, alongside approximately 380 light-duty vehicles. The government has ambitious plans, aiming for 20,000 EVs by 2030, with market revenue projections reaching $5.3 million by 2025.

Government Policies

The Egyptian government is actively driving EV adoption. Efforts to electrify public transportation are focused on buses and taxis in major cities like Cairo and Alexandria. Tax breaks and customs incentives are making EVs more affordable, while government-supported financing programs are helping consumers make the switch. Additionally, Egypt is negotiating Completely Knocked Down (CKD) assembly agreements with manufacturers such as Volkswagen. These initiatives aim to localize production and achieve a 65% industrialization share in the EV manufacturing value chain by 2030.

2026 Investment Projections

Public-private partnerships are laying the foundation for a nationwide EV charging network. In February 2025, the Egyptian Ministry of Petroleum and Mineral Resources, Hassan Allam Utilities, and Infinity signed an agreement during the EGYPES conference to deploy chargers at high-traffic gas stations. These stations, operated by Misr Petroleum and Gastec, will feature both AC and DC chargers. Speaking about the initiative, Nayer Fouad, Co-founder and CEO of Infinity, said:

"By joining forces with industry leaders, we are not only expanding charging infrastructure but also laying the groundwork for a more sustainable mobility ecosystem."

Energy storage is another area of focus. In February 2025, the Egyptian Electricity Transmission Company (EETC) partnered with AMEA Power, a UAE-based firm, to develop two battery storage facilities with a combined capacity of 1,500MWh. This includes the 500MWh Banban Station and the 1,000MWh Zafarana Station. These projects align with Egypt’s National Energy Strategy, which targets 42% renewable energy by 2030 and 65% by 2040.

Solar Off-Grid Readiness

Egypt is leveraging its abundant solar resources to support off-grid EV charging, especially in areas with limited grid access. Solar-powered charging systems are proving to be cost-effective for daily travel needs of around 31 miles (50 km). For context, operating an EV in Egypt costs roughly $0.62 to $0.92 per 62 miles (100 km), offering 47–83% savings compared to gasoline-powered vehicles. This significant cost advantage, combined with solar integration, positions Egypt to expand EV charging infrastructure beyond urban areas, making it more accessible to a broader population.

sbb-itb-99e19e3

8. Ghana

Current EV Fleet Size

Ghana holds the 9th spot in African EV readiness, with a score of 0.70 as of late 2024. The commercial sector is leading the charge, with companies like Moove operating ride-hailing fleets across the country as of May 2025. Government incentives, such as import exemptions and pilot programs for assembling electric buses, are also fueling the growth of EVs. Additionally, with over 80% of households having access to electricity, the country has a solid foundation for home charging infrastructure.

Government Policies

Ghana is doubling down on policies to boost EV adoption. Through its Energy Commission, the country launched the Drive Electric Initiative (DEI) to encourage EV use and promote green technologies. On November 17, 2025, the Commission introduced new regulations for EV charging. To make EV charging more competitive, the government is also evaluating tariff options. Minister John Abdulai Jinapor emphasized the importance of clean energy, stating:

"I endorse this project, your actions are deeply aligned with sustainable development goals, charging with solar is charging clean."

2026 Investment Projections

These progressive policies are inspiring innovative investment strategies. Businesses are adopting circular models that combine EV sales, leasing, and servicing with charging solutions, tackling the challenge of achieving profitability after the required 5,000+ charging hours. In March 2025, UNDP Ghana invested $64,617 to launch its first EV and on-site charging station in Accra as part of the "Greening Moonshot" initiative. This project aims to cut vehicle emissions by 50% by 2030, saving over $2,138 annually and preventing 5.23 tonnes of CO2 emissions. Later, in November 2025, the Energy Commission and GIZ Ghana unveiled a solar-powered DC fast charger at their Accra headquarters. This system includes 105 solar panels (61.43 kWp) and a 60 kWh lithium-ion battery.

9. Rwanda

Current EV Fleet Size

Rwanda’s electric vehicle (EV) sector is steadily advancing. By early 2026, the country had over 7,000 electric and hybrid vehicles on its roads, including 512 fully electric ones [33, 34]. Ranked 5th in Africa for EV readiness with a score of 0.74, Rwanda has been prioritizing the expansion of two-wheelers and public transport. Kigali alone boasts nearly 200 charging stations, with 35 designed for cars and 165 dedicated to electric motorbikes. The government has set ambitious goals, aiming to electrify 20% of buses and 30% of motorcycles by 2030 [32, 33]. These efforts highlight Rwanda’s commitment to a greener future.

Government Policies

Rwanda has introduced bold policies to accelerate EV adoption. Since 2025, new petrol motorcycle registrations in Kigali have been prohibited, pushing the market toward electric options. Additionally, all new buses in the city must now be electric. To encourage investment, the government offers a range of incentives, including 0% import duties, VAT exemptions, a reduced 15% corporate tax rate for e-mobility businesses, and a 7-year tax holiday for major manufacturers. Companies like Spiro have taken advantage of these measures, providing electric motorcycles to "boda boda" riders for $500. To further support EV infrastructure, the government offers rent-free land for charging stations and subsidizes electricity rates for EV charging to $0.10/kWh, significantly lower than the standard rate of $0.20/kWh. Dr. Jimmy Gasore, Rwanda’s Minister of Infrastructure, reaffirmed this commitment, stating:

"The Government of Rwanda is committed to accelerating the transition to electric mobility as part of our climate and development agenda."

2026 Investment Projections

Achieving Rwanda’s e-mobility goals will require an estimated $900 million in investments for vehicle procurement and infrastructure [31, 33]. In September 2025, the government launched Ecofleet Solutions, a state-owned enterprise focused on transforming Kigali’s public transport system with electric buses and smart mobility solutions. By January 2026, the Ministry of Infrastructure had begun a $7.7 million project at the Nyabugogo transit hub, featuring 18 chargers powered by an 800-kW rooftop solar PV system with battery storage [31, 34]. Private companies like BasiGo, IZI, Ampersand, and Spiro are actively piloting electric buses and motorcycles across Kigali. To ensure widespread access to EV charging, a geospatial study identified 226 potential sites for new infrastructure, and a national Master Plan for EV Charging Stations is in the works, aiming for availability every 31 miles (50 kilometers) nationwide.

10. Côte d’Ivoire

Government Policies

Côte d’Ivoire is taking meaningful steps to expand its EV infrastructure as part of its 2025–2030 National Development Plan. This strategy emphasizes green growth, digital transformation, and value-added processing. To support these goals, the government secured a $1.3 billion Resilience and Sustainability Facility from the IMF, aimed at advancing its green transition. Additionally, in September 2024, the Investment Code (Ordinance No. 2024-857) was updated to offer a mix of tax exemptions and credits designed to encourage "green investments".

Looking further ahead, the country is working on an Integrated Mineral Resources and Energy Policy for 2040. This initiative aims to manage critical resources like lithium and cobalt, which are essential for EV batteries. With an average GDP growth rate of 6.4% over the last decade, Côte d’Ivoire has shown the economic stability needed to support large-scale projects. Investors can also benefit from the CEPICI One-Stop Shop in Abidjan, where setting up a business typically takes just one to three days.

These forward-thinking policies are paving the way for significant private-sector involvement in the EV market.

2026 Investment Projections

Côte d’Ivoire is counting on private-sector contributions for 72% of the investments required under its 2025–2030 National Development Plan. This opens up substantial opportunities for developing EV infrastructure. In 2023, the Renault–Nissan Alliance teamed up with the African Development Bank (AfDB) to launch electric vehicle leasing programs tailored for small businesses in Côte d’Ivoire and Senegal. This partnership combines cost-efficient production with accessible financing, tackling the high upfront costs that have often hindered small businesses from adopting EVs [37, 39].

Positioning itself as a regional hub for energy and logistics, Côte d’Ivoire benefits from its role as a net energy exporter, which helps attract foreign direct investment. The government is also simplifying business registration processes through the 225invest.ci portal. By aligning projects with the green growth objectives of the National Development Plan, investors can take advantage of incentives and preferential policies aimed at fostering sustainable transportation initiatives.

How Chinese EV Makers Are Building a Lead in African Countries

Market Comparison Table

The table below provides a snapshot of key metrics in Africa’s electric vehicle (EV) charging markets. Each country showcases varying levels of EV adoption, policy initiatives, and investment trends.

Fleet sizes differ significantly across the continent. Ethiopia stands out with over 60% of new vehicle registrations being EVs. Morocco has ambitious plans to reach 100,000 EVs by 2025, while Kenya is focusing on electrifying its 2.2 million motorcycles (commonly known as boda-bodas). Ghana dominated Africa’s EV market revenue share in 2025 at 29.05%, and South Africa operates around 316 public chargers, primarily in Gauteng.

Another important factor for EV growth is solar off-grid readiness, which ensures sustainable energy solutions. Kenya, in particular, excels in financial inclusion, paving the way for digital financing of electric two-wheelers.

| Market | Current EV Status | EV Readiness Score | Key Policy Initiative (by 2026) | Investment Target |

|---|---|---|---|---|

| South Africa | ~316 public chargers | 0.80 | 150% tax deduction on EV production assets (March 2026) | $1.01B market by 2029 |

| Morocco | 100,000 EV target by 2025 | 0.85 | Partnerships with BYD, Tesla, and Stellantis | $5.6B Gigafactory; 100k EV production goal |

| Ethiopia | Over 60% of new registrations | 0.70 | Total ban on ICE vehicle imports | 58.92% CAGR growth through 2030 |

| Tanzania | Focus on 2/3-wheeler assembly | N/A | Graphite export value-addition focus | Local assembly of 2- and 3-wheelers |

| Nigeria | 15,000–20,000 EVs on road | Low (<0.70) | EV Transition & Green Mobility Bill | 30% local component sourcing by 2030 |

| Kenya | 2.2M motorcycles; 500% EV surge (2023) | 0.70 | National Building Code mandating 5% parking for chargers | 5% of new registrations to be electric |

| Egypt | High impact potential | 0.74 | Financing programs for consumers; public transit focus | 65% industrialization share by 2030 |

| Ghana | 29.05% market revenue share (2025) | 0.70 | – | – |

| Rwanda | E-mobility startup hub | 0.74 | Zero VAT, import, and excise duties on EVs/chargers | Testing ultra-fast charging hubs |

| Côte d’Ivoire | Emerging market | N/A | – | – |

Africa’s EV market is on track to grow from $0.45 billion in 2025 to over $4.2 billion by 2030, reflecting a compound annual growth rate (CAGR) of 56.3%. Two-wheelers, in particular, are projected to grow at an impressive 57.90% CAGR through 2031. This makes countries like Kenya, Nigeria, and Rwanda especially attractive for last-mile logistics and micro-mobility solutions. The table underscores the diverse strategies fueling Africa’s EV charging transformation.

Conclusion

Africa’s electric vehicle (EV) charging landscape is at a turning point. The EV charging market on the continent is projected to grow at an impressive 30.3% compound annual growth rate through 2030. This growth signals more than just technological progress – it reflects a broader transformation in how African nations are tackling energy independence and urban mobility.

The ten markets discussed in this article highlight two distinct approaches to electrification. On one hand, established markets like South Africa, Morocco, and Egypt are focusing on conventional passenger vehicle infrastructure, leveraging their mature power grids and manufacturing capabilities. On the other hand, emerging markets like Kenya and Rwanda are taking a different route, prioritizing fintech-driven ownership models and concentrating on two- and three-wheeler vehicles to meet pressing transportation needs. These varied strategies showcase the diversity of investment opportunities across the region.

Africa’s shift toward EVs is as much about economic pragmatism as it is about environmental goals. Reducing reliance on expensive fossil fuel imports and improving urban air quality are driving real market demand. Yet, challenges remain. Currently, only 17% of African countries have 10 or more public charging stations, and grid reliability continues to be a major hurdle. These gaps, however, also present opportunities for targeted investment – especially in commercial sectors like fleet electrification. High-use vehicles such as electric buses, delivery vans, and motorcycles promise strong returns on infrastructure investments. For example, BasiGo’s success in raising $42 million in 2024 to expand its electric bus fleet to 1,000 vehicles in Kenya and Rwanda highlights the potential of this approach. Additionally, markets like Nigeria, which face significant challenges like fuel subsidy burdens and poor air quality, offer enormous long-term potential despite low current readiness.

Momentum in Africa’s EV ecosystem is undeniable. Policy shifts, like Ethiopia’s complete ban on internal combustion engine (ICE) passenger vehicles, are accelerating progress. To fully harness this momentum, investors, manufacturers, and policymakers must act now. Prioritizing grid-independent solutions, innovative financing models, and commercial fleet electrification will be key to driving Africa’s electric mobility revolution forward.

FAQs

What challenges are slowing the growth of EV charging infrastructure in Africa?

The expansion of electric vehicle (EV) charging infrastructure in Africa faces some significant hurdles. One of the biggest challenges is the high upfront costs associated with EVs and charging equipment. These expenses make adoption difficult in regions where affordability is already a concern. On top of that, Africa’s electricity grid infrastructure isn’t equipped to handle widespread charging networks. Frequent power outages and the fact that over 600 million people on the continent still lack access to electricity create serious obstacles. This makes it especially tough to establish and maintain fast-charging stations, which depend on a reliable power supply.

Another issue is the uneven distribution of the existing charging network. Most stations are concentrated in countries like South Africa, leaving many urban and rural areas without adequate access. When you combine this with high EV prices and persistent misconceptions about electric vehicles, the result is reduced demand. This, in turn, discourages private investors from stepping in to build the infrastructure that’s so desperately needed.

How is renewable energy being used to power EV charging stations in Africa?

Africa’s expanding EV charging network is increasingly powered by renewable energy, with solar-powered charging stations leading the way. Thanks to the region’s plentiful sunlight, these stations deliver clean, dependable electricity for electric vehicles. This approach not only reduces dependence on the often-unstable electricity grid but also helps cut operating costs, making EV ownership more accessible over time.

In addition to solar, governments and private investors are incorporating wind energy and battery storage into off-grid and semi-grid charging solutions. These systems provide steady power, even in remote areas or during power outages. By focusing on renewable energy, Africa is lowering fuel import expenses, advancing climate goals, and paving the way for a more resilient EV charging infrastructure.

Which African countries are leading in policies to support electric vehicle adoption?

Several African nations are driving forward with policies aimed at boosting electric vehicle (EV) adoption. Kenya stands out with its National E-Mobility Policy, which offers tax incentives and supports local manufacturing. The goal? To establish Kenya as a key e-mobility hub in the region. Meanwhile, Rwanda has removed import duties on EVs and introduced land and tax perks to speed up the rollout of charging networks. Ethiopia has taken a decisive step by limiting the import of new combustion-engine vehicles, underlining its push toward electrification.

Other countries are also making moves. South Africa is preparing policy reforms, including tax rebates for EV manufacturers, with plans to implement them by 2026. Ghana and Morocco are introducing lower tariffs, tax incentives, and renewable energy benefits to promote local EV production and expand charging infrastructure. Together, these efforts are setting the stage for a growing EV market across Africa, driven by forward-looking government initiatives.