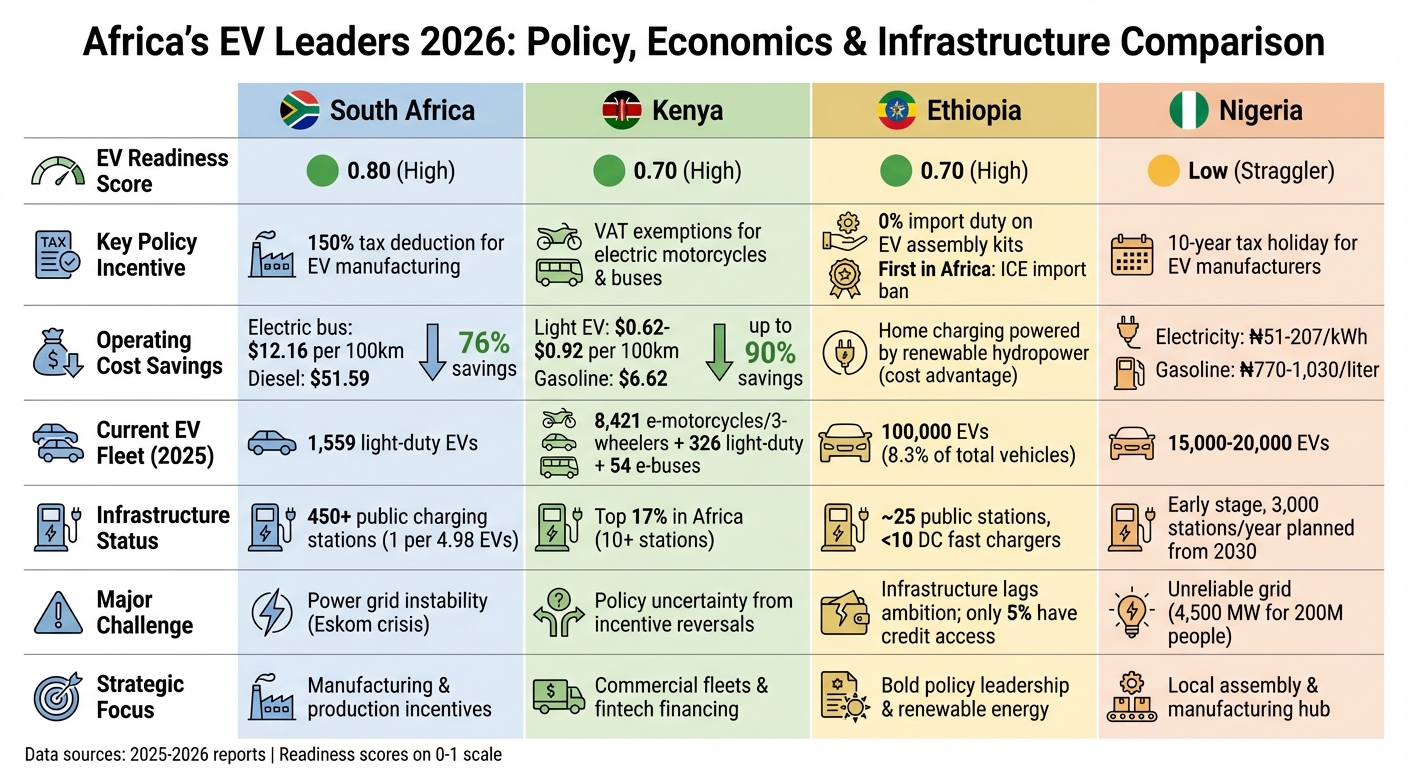

Africa’s electric vehicle (EV) market is evolving rapidly, driven by policy shifts and economic incentives. Here’s what you need to know:

- South Africa: Leading with manufacturing incentives like a 150% tax deduction for EV production. Despite grid challenges, it boasts the continent’s most advanced charging network and growing EV sales.

- Kenya: Focused on commercial EVs with VAT exemptions and innovative financing for electric motorcycles. Lower operating costs make EVs highly appealing, though policy uncertainty has caused investor concerns.

- Ethiopia: The first country to ban internal combustion engine (ICE) vehicle imports. Leveraging renewable energy and duty-free assembly kits, but infrastructure and financing remain hurdles.

- Nigeria: Offers a 10-year tax holiday for EV manufacturers and mandates charging stations at fuel stations. However, grid reliability and limited infrastructure pose significant challenges.

Each country is adopting unique strategies based on its strengths: South Africa prioritizes production, Kenya targets commercial fleets, Ethiopia takes bold policy steps, and Nigeria focuses on local manufacturing. The future of EVs in Africa depends on balancing these efforts with infrastructure development and reliable energy access.

Africa EV Adoption 2026: Country Comparison of Policies, Costs, and Infrastructure

1. South Africa

Policy Mechanisms

South Africa is using production-side incentives to reshape its automotive industry. Starting March 1, 2026, the government will offer EV manufacturers a 150% tax deduction on qualifying investment spending in the first year for electric and hydrogen-powered vehicles. This generous incentive is designed to keep the country competitive as major export markets like the UK and the European Union – accounting for 46% of South Africa’s vehicle production – prepare to ban internal combustion engine (ICE) vehicles by 2035.

The December 2023 EV White Paper, backed by $51.5 million (R964 million), outlines a dual-platform strategy to transition both EVs and ICE vehicles by 2035. Trade Minister Ebrahim Patel highlighted the importance of this shift, stating:

"Decarbonisation should not lead to de-industrialisation but rather be leveraged for growth, deepening the automotive value chain".

These policies aim to create efficiencies while ensuring the automotive sector remains competitive in a rapidly changing global market.

Economic Factors

While the upfront cost of an electric bus – ranging from $288,000 to $432,000 (R5.4 million to R8.1 million) – is significantly higher than a diesel bus at $144,000 (R2.7 million), the operational savings make a compelling case for EVs. Running an electric bus costs just $12.16 (R227.70) per 62 miles (100 km), compared to $51.59 (R966.40) for its diesel counterpart.

Golden Arrow Bus Services in Cape Town is already reaping these benefits, piloting electric commuter buses and committing to procure 60 electric buses annually to replace its diesel fleet. Similarly, Volvo and KDG Logistics have introduced one of the world’s first electric auto-carrier trucks in KwaZulu-Natal, showcasing the potential for freight transport electrification. In the minibus taxi sector – South Africa’s largest public transport segment – Flx EV launched the first electric minibus taxi pilot in 2023/2024, marking a significant step toward assessing the feasibility of electrifying this key mode of transport.

Infrastructure Investments

South Africa has developed a robust charging network, with over 450 public charging stations as of 2026. This translates to one public charger for every 4.98 private passenger EVs, far surpassing the global recommendation of one charger for every 10 vehicles. The country ranks 3rd in Africa for EV readiness, with a score of 0.80, following Seychelles (0.88) and Morocco (0.85).

However, the country’s power crisis poses a significant challenge. Eskom, the state utility, struggles with grid instability, which threatens both EV manufacturing and charging infrastructure reliability. According to the Just Energy Transition (JET) plan, $6.84 billion (128.1 billion rand) is needed between 2023 and 2027 to decarbonize the transport sector.

Despite these hurdles, ongoing investments in infrastructure are laying the foundation for market expansion.

Market Growth Projections

South Africa’s efforts reflect the broader evolution of the EV market in Africa. In just one year, EV sales jumped 85.46%, from 502 units in 2022 to 931 units in 2023. By May 2025, the country had 1,559 light-duty electric vehicles, the highest number in Africa. Minister Patel shared an optimistic outlook:

"We’re already producing hybrids but we anticipate that the first electric vehicles are likely to be produced already by 2026".

The market is diversifying rapidly, expanding to include heavy-duty trucks, light delivery vehicles, and electric two- and three-wheelers. Notably, 2023 marked the first official sales of heavy-duty trucks and light delivery vehicles. Rising fuel costs have also driven interest in electric two- and three-wheelers for last-mile delivery, with the potential market for these vehicles expected to reach 90,000 units by 2030.

sbb-itb-99e19e3

2. Kenya

Policy Mechanisms

Kenya’s national e-mobility strategy focuses on commercial vehicles, offering VAT exemptions for electric motorcycles and buses to drive adoption in high-use sectors like public transport and delivery services. To further reduce costs for fleet operators, the Energy and Petroleum Regulatory Authority (EPRA) has introduced preferential electricity tariffs for EV charging.

To ensure quality and reliability, regulators now prohibit the import of EV batteries with less than 80% health. This aligns with regional efforts to streamline e-mobility adoption through targeted regulations. However, the policy environment experienced some turbulence in late 2024 and early 2025 when certain tax incentives were scaled back, causing uncertainty for investors. The current focus has shifted toward promoting local assembly and manufacturing, reducing dependency on fully built imports while sustaining growth.

These measures aim to lower operational costs while encouraging innovative financing models and local production.

Economic Factors

The cost advantage of electric vehicles in Kenya is striking. Driving 100 km in a light-duty EV costs between $0.62 and $0.92, compared to $6.62 for a gasoline-powered vehicle – a savings of up to 90%. For heavy-duty buses, the difference is equally significant, with electric models operating at $19.14–$28.50 versus $61.07 for diesel counterparts.

Kenya’s financial inclusion rate of 40% has also fueled the growth of fintech solutions like M-KOPA and Watu Credit, which offer pay-as-you-go financing for electric motorcycles. This approach helps reduce upfront costs in a motorcycle sector contributing approximately $4.4 billion to the economy each year.

Local assembly plays a crucial role in reducing costs. Mini and mid-size e-buses assembled in Kenya cost between $55,000 and $60,000 – far more affordable than the $250,000 to $300,000 price tag for imported buses in South Africa. These cost advantages are helping to build market confidence and attract infrastructure investments.

Infrastructure Investments

As of 2026, Kenya ranks among the top 17% of African nations with more than 10 public charging stations and an EV readiness score of 0.70.

A standout example of Kenya’s infrastructure growth is the e-mobility startup BasiGo. By May 2025, the company had deployed 100 electric buses, serving thousands of passengers daily across Kenya and Rwanda. In late 2024, BasiGo secured $42 million in funding to scale its operations to 1,000 buses. Additionally, the WEEE Centre, in collaboration with Drivelectric, launched an initiative to repurpose degraded EV batteries for solar power storage, addressing both waste management and energy challenges.

However, a major hurdle remains: Kenya’s electrical grid lacks the capacity and reliability needed to support large-scale EV adoption.

Market Growth Projections

Kenya’s EV market is growing rapidly, supported by strong policies and economic incentives. By May 2025, the country’s EV fleet included 8,421 electric 2- and 3-wheelers, 326 light-duty vehicles, and 54 e-buses. The World Resources Institute has highlighted Kenya’s strategic importance in Africa’s vehicle market:

"Africa is now regarded as the continent where sales of vehicles will surge the most, so tipping Kenya’s market toward EVs could have an impact beyond its borders – on other countries and on the climate."

The market is predominantly driven by commercial applications rather than private ownership, as high-utilization vehicles offer the most compelling economic returns. Kenya’s EV Impact Score of 0.76 – surpassing South Africa’s 0.67 – indicates significant benefits from electrification, including improved air quality and reduced fuel import dependence. Kenya’s progress reflects a broader shift across Africa toward more sustainable and cost-effective transportation solutions.

3. Ethiopia

Policy Mechanisms

In 2023, Ethiopia made headlines as the first country to ban the import of internal combustion engine (ICE) passenger vehicles. By tapping into surplus renewable energy from the Grand Ethiopian Renaissance Dam (GERD), the country aims to reduce its reliance on fossil fuels. To encourage local electric vehicle (EV) assembly, Ethiopia has implemented a tiered import duty structure: 0% on Completely Knocked Down (CKD) kits, 5% on Semi-Knocked Down (SKD) kits, and 15% on Fully Built Up (FBU) EVs. These policies are designed to create economic opportunities while accelerating EV adoption.

Economic Factors

Ethiopia’s economic challenges further push the shift toward EVs. Chronic foreign currency shortages have restricted imports of vehicles and fuel, while frequent fuel shortages and increasing pump prices make EVs a more appealing option for urban consumers. Home charging, powered by reliable hydropower, adds to the appeal. However, limited access to credit remains a significant hurdle. Only 5% of Ethiopian adults have access to formal credit, compared to 40% in neighboring Kenya, making vehicle financing a challenge. Additionally, the recent shift to a market-based foreign exchange system has increased the cost of importing vehicles and components, further complicating the affordability of EVs.

Infrastructure Investments

Ethiopia’s EV charging infrastructure is still in its early stages. By mid-2025, the country had about 25 public charging stations and 30–40 private or fleet-specific hubs. However, fewer than 10 DC fast chargers have been installed so far. The Ethiopian Electric Utility (EEU) is responsible for connecting the grid and developing public charging corridors, but progress has been slow.

"Ethiopia’s historic ICE ban has turned it into a test case for how EV ambition can outpace infrastructure development." – Hamna Tariq, Research Associate, Energy for Growth Hub

To meet its EV fleet targets, the government estimates the need for 5,000 to 7,500 chargers by 2030, representing a potential market worth $100–150 million.

Market Growth Projections

Official reports suggest Ethiopia’s EV fleet has reached 100,000 vehicles, accounting for 8.3% of the 1.2 million-vehicle total. However, independent estimates put the number closer to 30,000. The government’s ambitious goal is to increase this to 400,000 EVs by 2032. Adoption is heavily concentrated in Addis Ababa, where electricity access exceeds 90%, compared to the national average of 55%. Ethiopia ranks 9th in Africa for EV readiness (score 0.70) but leads in potential EV impact (score 0.81), thanks to its abundant clean energy resources and the need to reduce fuel subsidies. With one of the lowest motorization rates in Africa – just 6.7 vehicles per 1,000 people – there’s plenty of room for growth as the economy expands. Ethiopia’s trajectory highlights its pivotal role in advancing Africa’s electrification efforts.

From Ethiopia To Nepal: The EV Boom You Didn’t See Coming

4. Nigeria

Nigeria is making waves in Africa’s electric vehicle (EV) landscape, introducing policies and initiatives that aim to reshape its automotive market and energy future.

Policy Mechanisms

In November 2025, Nigeria passed the Electric Vehicle Transition and Green Mobility Bill, which lays out a robust framework to encourage EV adoption. The bill includes enticing incentives like 10-year tax holidays, import duty waivers, and toll exemptions. On the flip side, it imposes steep penalties of ₦500 million per shipment on unlicensed EV importers. To ensure local industry participation, foreign manufacturers must collaborate with Nigerian assemblers, establish assembly plants within three years, and source at least 30% of components locally by 2030. Additionally, the legislation mandates that every fuel station install EV charging points.

As Senator Orji Uzor Kalu, who sponsored the bill, explained:

"This bill will help Nigeria move from dependence on fossil fuels toward a cleaner and sustainable energy system. It will ensure that our local industries benefit directly from the global electric vehicle market, create jobs, and reduce emissions in our cities".

The government has also set an ambitious target: achieving 100% zero-emission new vehicle sales by 2040, aligning with Nigeria’s broader goal of carbon neutrality by 2060.

Economic Factors

The removal of fuel subsidies in May 2023 caused gasoline prices to nearly triple, saving the government about $3.7 billion annually. This shift highlights Nigeria’s potential to transition to EVs, especially when considering its automotive market. The country produces just 14,000 vehicles annually to meet a demand of 720,000 units, leading to imports costing around $8 billion each year. Companies like Moove and Innoson Motors are stepping up, focusing on EV ride-hailing and expanding local assembly operations.

However, challenges remain. Nigeria’s power grid generates only around 4,500 MW for a population exceeding 200 million, and access to affordable financing for EVs is limited. Sam Faleye, CEO of SAGLEV, captured the urgency of the situation:

"This bill is long overdue… Nigeria can’t remain a dumping ground for used cars while importing jobs that should exist here".

Infrastructure Investments

As of late 2025, Nigeria has between 15,000 and 20,000 EVs on its roads, but the supporting infrastructure is still in its early stages. To address this, the government plans to deploy 3,000 charging stations annually starting in 2030, with a focus on commercial vehicles. Private initiatives are also gaining traction. For instance, Spiro has introduced battery-swapping stations in Ogun State, and JET Motor Company is concentrating on e-buses with backing from World Bank programs.

Charging costs are another advantage. Electricity tariffs ranging from ₦51 to ₦207 per kWh make EV charging significantly cheaper than gasoline, which costs ₦770 to ₦1,030 per liter.

These developments are paving the way for stronger market growth in the years ahead.

Market Growth Projections

Nigeria’s EV market is projected to grow at an annual rate of 30.6% through 2031, with the government aiming for 60% EV adoption by 2050. EV sales climbed from 4.22% in 2020 to 7.11% in 2022, largely driven by commercial sectors. Locally available EVs are priced between ₦12 million and ₦150 million, and initiatives like loan guarantees are being explored to make financing more accessible.

With its legislative push for local assembly, Nigeria is positioning itself as a potential manufacturing hub for the region. This opens doors to exporting EVs to neighboring countries under the African Continental Free Trade Area agreement.

Pros and Cons

Here’s a breakdown of each country’s strengths and challenges in Africa’s electric vehicle (EV) transition.

South Africa:

South Africa stands out with the continent’s most developed EV infrastructure and a generous 150% tax deduction for EV manufacturing. However, the country’s power grid struggles with reliability due to a severe energy crisis, and the emphasis on manufacturing incentives leaves private buyers with limited financial support. Despite these challenges, South Africa achieves an impressive EV readiness score of 0.80 on a scale of 0 to 1.

Kenya:

Kenya leverages a high rate of financial inclusion (40%), which facilitates micro-loans for EV purchases. EV operating costs are significantly lower than those of gasoline vehicles, with savings ranging from 47% to 83%. Commercial adoption is thriving, with 8,421 electric two- and three-wheelers already in use. However, recent reversals in tax incentives have created policy uncertainty, which could hinder further progress.

Ethiopia:

Ethiopia made headlines in 2024 by becoming the first African country to ban internal combustion engine (ICE) imports, while also offering duty-free access to EV assembly kits. Hamna Tariq and Rose Mutiso from Energy for Growth Hub remarked:

"Ethiopia’s historic ICE ban has turned it into a test case for what happens when EV ambition outpaces institutional and infrastructural capacity".

Although Ethiopia has 100,000 EVs on the road, it faces significant hurdles, including a lack of charging infrastructure and low income levels. Only 5% of its population has access to formal credit, which limits EV affordability.

Nigeria:

Nigeria provides a 10-year tax holiday for EV manufacturers, aiming to attract investment in the sector. However, the country grapples with an unreliable power grid and a shortage of public charging stations. As a result, Nigeria’s EV readiness is categorized as a "straggler." Addressing these infrastructure challenges could unlock its potential for growth in the EV market.

Below is a comparative summary of these factors:

| Country | Key Strength | Major Weakness | Readiness Score |

|---|---|---|---|

| South Africa | 150% manufacturing tax deduction; advanced infrastructure | Power grid instability; limited buyer support | 0.80 (High) |

| Kenya | 40% financial inclusion; lower EV operating costs | Policy uncertainty from incentive changes | 0.70 (High) |

| Ethiopia | ICE import ban; duty-free EV kits | Poor charging infrastructure; low credit access | 0.70 (High) |

| Nigeria | 10-year tax holiday for manufacturers | Unreliable grid; scarce charging stations | Low (Straggler) |

These examples highlight the varied strategies and challenges shaping the growth of EVs across Africa, reflecting the intricate balance of policy, infrastructure, and economic factors.

Conclusion

South Africa, Kenya, and Ethiopia are at the forefront of Africa’s electric vehicle (EV) transition as we approach 2026. South Africa stands out for its readiness, while Kenya and Ethiopia are making strides with impactful cost-saving initiatives. Ethiopia, in particular, has set a global precedent by banning internal combustion engine (ICE) imports in 2023, a bold decision that helped put an estimated 100,000 EVs on its roads by mid-2025.

This progress offers clear guidance for policymakers. Prioritizing commercial fleets over private buyers can deliver faster fuel savings and environmental improvements, especially in high-use sectors like taxis, delivery bikes, and buses. However, grid reliability must be addressed immediately, as weak power infrastructure remains a critical obstacle. Fiscal incentives, such as VAT waivers and duty exemptions for commercial operators, can also play a pivotal role.

Kenya, Rwanda, and Uganda – classified as "Innovator" markets – are showing how high fuel prices and dynamic startup ecosystems can drive demand for asset financing and battery-swapping solutions. A notable example is BasiGo, which raised $42 million in early 2024 to roll out 1,000 electric buses across Kenya and Rwanda. Their "Pay-As-You-Drive" battery leasing model demonstrates the potential of creative financing in the EV space.

At the same time, countries must balance ambition with infrastructure capacity. Hamna Tariq and Rose Mutiso from Energy for Growth Hub highlight this challenge:

"Ethiopia’s historic ICE ban has turned it into a test case for what happens when EV ambition outpaces institutional and infrastructural capacity".

Investments in charging networks are critical, as only 17% of African nations currently have 10 or more public charging stations. Without this foundational infrastructure, scaling EV adoption will remain a challenge.

Regional strategies must reflect local strengths. For example, "Emulator" countries like South Africa and Morocco should continue focusing on manufacturing and passenger vehicles, while "Innovator" nations can harness their fintech ecosystems to support electric two- and three-wheelers for commercial use. These efforts highlight the growing momentum behind Africa’s EV revolution.

FAQs

What challenges are slowing the adoption of electric vehicles in Africa?

The journey toward widespread electric vehicle (EV) use in Africa is met with some tough roadblocks. For starters, the high price of EVs – largely due to hefty import duties and the lack of local manufacturing – puts these vehicles out of reach for most people. Even for those who can afford them, the absence of a dependable charging network, coupled with frequent power outages, makes owning an EV a logistical headache. In some cases, drivers have to resort to costly diesel generators just to keep their vehicles running.

Adding to the challenge, limited access to financing makes it difficult for buyers to secure loans, further shrinking the pool of potential EV owners. On top of that, inconsistent government incentives and scattered regulations discourage investors and manufacturers from committing to the market. This policy uncertainty slows down efforts to boost local production and build the infrastructure needed to support EVs. Tackling these obstacles is essential if Africa is to tap into the promise of electric mobility.

How are African countries encouraging the growth of electric vehicles?

African nations are rolling out various strategies to speed up the shift to electric vehicles (EVs). In South Africa, the government has announced plans to introduce tax rebates and subsidies for EV buyers by 2026. Alongside this, they’re offering incentives aimed at encouraging manufacturers to set up local production facilities. The goal? To make EVs more accessible for consumers while also attracting global automakers to invest in domestic assembly plants.

In East Africa, countries like Kenya and Tanzania are taking steps to make EV ownership more appealing. They’ve slashed import duties and registration fees for electric two- and three-wheelers, introduced low-interest loans for commercial EVs, and reduced costs on battery imports. These efforts are fueling rapid growth in the region’s EV fleet. Meanwhile, Egypt is focusing on larger-scale solutions by providing tax exemptions for locally produced electric buses and funding the expansion of charging infrastructure, which has significantly boosted the adoption of electric buses.

These financial incentives across the continent are doing more than just reducing costs for consumers – they’re also drawing in foreign investments and laying the groundwork for a sustainable EV supply chain. Together, these efforts are helping Africa move closer to a future powered by electric mobility.

How does infrastructure impact the growth of electric vehicles in Africa?

Infrastructure plays a crucial role in shaping Africa’s electric vehicle (EV) market. A dependable electricity grid and accessible charging stations are critical for easing range anxiety and boosting EV adoption. To address these needs, governments are focusing on building public and depot charging stations, often powered by renewable energy sources. These efforts aim to make EVs more convenient and affordable, particularly in urban areas where most daily commutes take place. This approach is also paving the way for the expansion of electric buses in countries such as Egypt, Senegal, and Kenya.

That said, frequent power outages in certain regions remain a significant hurdle for EV adoption. To tackle this, many nations are incorporating renewable energy projects and off-grid solar charging solutions into their infrastructure plans. By ensuring reliable electricity and expanding charging networks, these initiatives not only lower ownership costs but also attract private investment, driving the rapid growth of EVs in Africa’s leading markets.