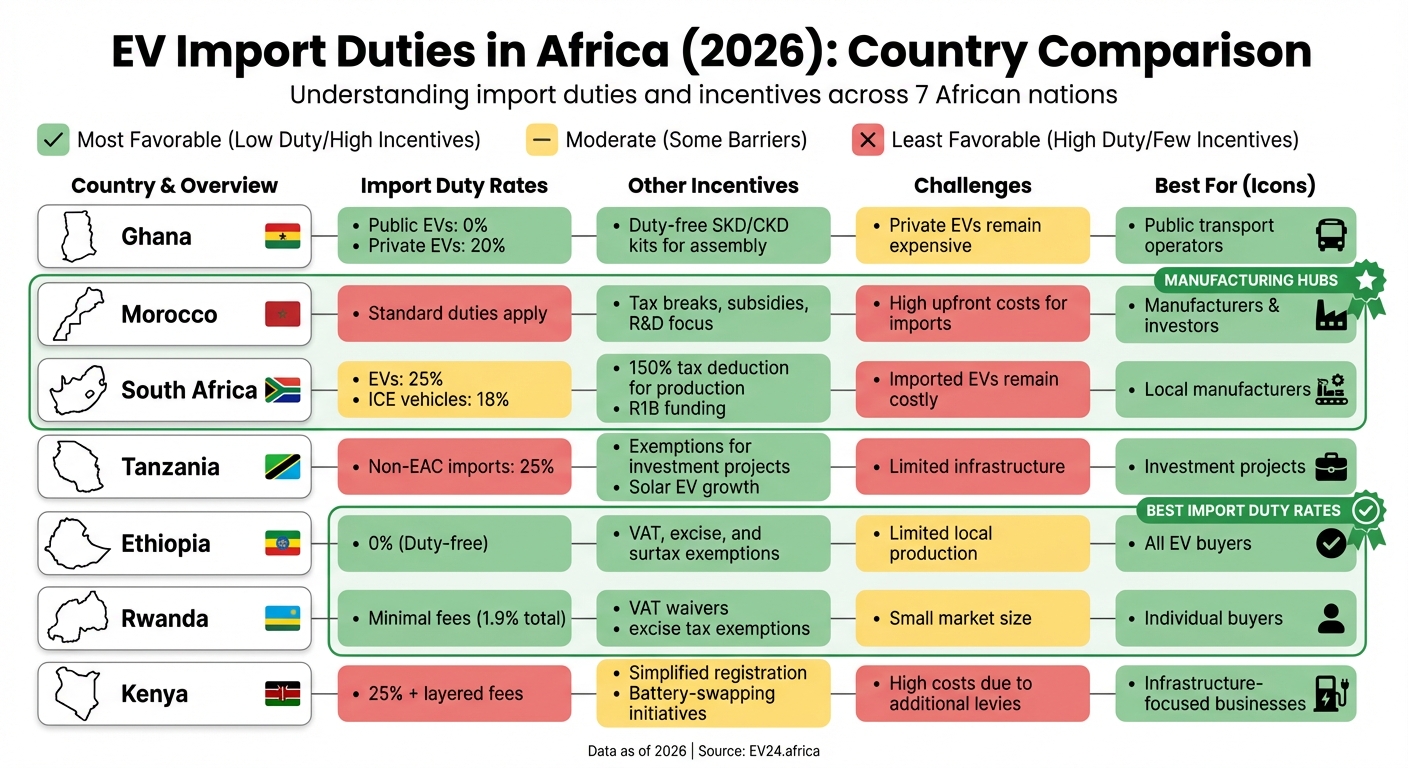

Electric vehicles (EVs) are becoming more accessible across Africa, thanks to evolving import duty policies. While some countries are slashing tariffs to encourage adoption, others are focusing on boosting local production. Here’s a quick overview of key EV policies in 2026:

- Ghana: Zero import duties for public transport EVs until 2032, but private EVs face a 20% tariff. Local assembly is incentivized with duty-free SKD/CKD kits.

- Morocco: Focuses on EV manufacturing with tax incentives and subsidies. Import duties remain but are offset by investments in local production and R&D.

- South Africa: A 25% import duty on EVs (higher than ICE vehicles) limits affordability, but local production is incentivized with a 150% tax deduction starting in 2026.

- Tanzania: Applies a 25% duty on non-EAC EV imports but offers exemptions for certain investment projects. Solar-powered EVs are gaining traction.

- Ethiopia: Fully banned gasoline and diesel vehicles, offering duty-free and tax-exempt EV imports until 2026.

- Rwanda: EVs and their components are exempt from the 25% EAC tariff, with minimal additional fees and VAT waivers.

- Kenya: A 25% import duty applies, but layered fees (like VAT and levies) make EVs costly. Private companies are driving infrastructure and financing solutions.

Quick Comparison

| Country | Import Duty | Other Incentives | Challenges |

|---|---|---|---|

| Ghana | 0% for public EVs, 20% for private | Duty-free SKD/CKD kits for assembly | Private EVs remain expensive |

| Morocco | Standard duties apply | Tax breaks, subsidies, R&D focus | High upfront costs for imports |

| South Africa | 25% (EVs), 18% (ICE vehicles) | 150% tax deduction for production, R1B funding | Imported EVs remain costly |

| Tanzania | 25% (non-EAC imports) | Exemptions for investment projects, solar EV growth | Limited infrastructure |

| Ethiopia | 0% (duty-free) | VAT, excise, and surtax exemptions | Limited local production |

| Rwanda | Minimal fees (1.9% total) | VAT waivers, excise tax exemptions | Small market size |

| Kenya | 25% + layered fees | Simplified registration, battery-swapping initiatives | High costs due to additional levies |

Each country is approaching the EV market differently, balancing affordability, infrastructure, and local industry growth. Ethiopia and Rwanda lead in cost reduction, while South Africa and Morocco prioritize local manufacturing. For buyers and businesses, understanding these policies is essential to navigating Africa’s evolving EV landscape.

Africa EV Import Duties Comparison 2026: Best Countries for Electric Vehicle Incentives

1. Ghana

Import Duty Status

Ghana has introduced an eight-year zero-tariff policy (2024–2032) that exempts public transport EVs – like electric buses, tro-tros, and taxi sedans – from import duties. However, EVs intended for private use are subject to a 20% tariff, which is verified by the Ghana Revenue Authority (GRA) through DVLA registration. Finance Minister Ken Ofori-Atta officially announced this duty exemption for public EVs, aiming to encourage widespread adoption. This policy also lays the groundwork for broader initiatives to support local EV production.

Other Incentives

During the same period, EV assembly companies in Ghana benefit from zero tariffs on Semi-Knocked Down (SKD) and Completely Knocked Down (CKD) kits. This move is designed to accelerate EV adoption while also encouraging local manufacturing and assembly. By combining these tariff exemptions with support for local assembly, the government hopes to stimulate market growth and domestic production. A key focus is on electrifying Ghana’s tro-tro fleet, which is a major contributor to CO₂ emissions. Stakeholders are also exploring the possibility of extending these exemptions to include EV spare parts and kits for converting internal combustion engine (ICE) vehicles to EVs. For ride-hailing services and public utility operators, the duty waivers significantly lower the upfront costs compared to traditional gasoline-powered vehicles.

2. Morocco

Import Duty Status

Morocco is positioning itself as a key player in the global EV manufacturing landscape, thanks to regulations that favor EV components. Instead of solely cutting import duties on finished vehicles, the country focuses on attracting international investment through tax incentives and manufacturing subsidies. This approach has allowed Morocco to move beyond simple vehicle assembly to building a comprehensive EV value chain, including battery production.

Other Incentives

As part of its Apime initiative, Morocco plans to install 2,500 new charging stations in major cities by 2026. By 2035, the network is expected to grow to 25,000 stations – up from approximately 1,000 in 2024. To further support e-mobility, the government has established the Green Energy Park and IRESEN, both of which focus on advancing research and development in this space.

Morocco has also attracted substantial international investments. Chinese company Gotion High-Tech has committed $6.5 billion, while UAE-based Falcon Energy Materials is collaborating on battery and anode production. These projects are critical for creating a global EV battery supply chain. Investors benefit from specialized industrial parks and regulatory frameworks tailored to support partners from regions like China, Europe, and the UAE.

Adding to these efforts, Morocco’s renewable energy capacity stands at 8,553 MW, which makes up 40% of its total energy mix. This renewable energy base strengthens the environmental case for EV adoption. On the cost side, electricity in Morocco is priced at $0.14 per kWh, making EVs significantly cheaper to operate. For example, driving an EV costs about $2.60 per 62 miles, compared to $10.50 for gasoline vehicles. Annual energy and maintenance costs for EVs are roughly $624 and $600, respectively, compared to $2,520 and $1,800 for gasoline cars. These savings, combined with government incentives, are driving market growth and boosting EV adoption.

EV Fleet Size (2026 est.)

As of early 2025, Morocco’s EV and hybrid fleet had reached around 5,000 vehicles. With a production capacity expected to hit 100,000 units by 2025 and Dacia accounting for 32% of sales, the market is poised for rapid growth. The country’s long-term goal is to have 2.5 million EVs on the road by 2050, supported by a fast-expanding charging infrastructure stretching from Agadir to Tangier.

3. South Africa

Import Duty Status

South Africa applies a 25% import duty on electric vehicles (EVs), compared to an 18% duty on internal combustion engine (ICE) vehicles. This higher duty makes EVs more expensive than their gasoline counterparts, even before factoring in VAT and other fees, creating a major hurdle for EV adoption.

The South African Revenue Service (SARS) calculates final import costs based on customs value and volume. For goods coming from outside the Southern African Customs Union (SACU), SARS adds a 10% markup to the customs value, followed by 15% VAT on the adjusted amount. However, this markup doesn’t apply to imports from SACU member countries like Botswana, Lesotho, Namibia, or Eswatini.

These import duties make EV pricing a challenge, but the government is attempting to ease the situation with specific tax breaks and incentives for local manufacturing.

VAT/Excise Reductions

In December 2025, South Africa extended APDP 2 rebates to include EVs and their components. This policy shift aims to support local assembly and the importation of cleaner vehicles. On the flip side, the government also proposed a 15% tax on EV battery imports, potentially offsetting some of the benefits provided by APDP 2.

The environmental levy on carbon dioxide emissions rose to R236 per ton (approximately $13) starting January 1, 2025. While this primarily impacts vehicles with higher emissions, EVs face a lighter tax burden due to their lower environmental impact.

Other Incentives

From March 2026, manufacturers involved in EV or hydrogen vehicle production can claim a 150% tax deduction on qualifying investments in facilities, machinery, and equipment. Additionally, the government has allocated R1 billion (around $55 million) to boost local EV production by 2035. For example, BMW Group South Africa invested R4.2 billion (roughly $231 million) to electrify its Rosslyn plant for plug-in hybrid production.

A CHARGE representative emphasized the importance of reducing high import duties to complement these manufacturing incentives.

Private companies are stepping in to address infrastructure challenges. CHARGE is building a nationwide network of 120 solar-powered, off-grid charging stations for EVs and another 120 for electric trucks to counteract grid reliability issues. Meanwhile, Rubicon and GridCars are also expanding charging networks across the country.

EV Fleet Size (2026 est.)

Despite high costs, the EV market in South Africa is starting to grow.

Between January and November 2024, 1,179 battery electric vehicles were sold, making up just 0.23% of total vehicle sales. Comparatively, Toyota sold 13,604 hybrids during the same period and plans to release three fully electric models by 2026.

4. Tanzania

Import Duty Status

Tanzania enforces the East African Community (EAC) common external tariff under its Customs Management Act for regulating imports. Electric vehicles (EVs) imported from non-EAC countries are subject to a 25% import duty.

There are, however, opportunities for duty reductions. The Exemption Schedule of the Customs Tariff Act outlines categories eligible for partial or full duty exemptions. Applications for these exemptions, particularly for investment projects that might involve EV imports, are managed by the Tanzania Investment Center (TIC) and the Ministry of Finance. Since January 1, 2010, goods from EAC member states have been allowed duty-free entry, encouraging regional trade in EVs. These duty policies create a foundation for additional financial incentives, such as VAT and excise reductions.

VAT/Excise Reductions

The standard VAT rate is 18% for non-EAC imports. However, exemptions may be available for investors through the Tanzania Investment Center or the Ministry of Finance.

Projections from 2026 suggest that battery-electric vehicles equipped with solar off-grid charging systems will surpass fossil-fuel vehicles in cost-effectiveness in Tanzania well before 2040. Given Tanzania’s abundant solar energy resources, these systems are particularly appealing. They allow EV owners to bypass the challenges of an unreliable grid without requiring costly infrastructure upgrades.

Other Incentives

Beyond duty and VAT adjustments, Tanzania offers additional trade incentives. The Ministry of Industry and Trade administers exemption programs that may benefit EV importers. For instance, raw materials are subject to 0% duty, while industrial used goods incur a 10% duty. This structure could significantly lower costs for businesses involved in EV manufacturing or assembly within the country.

The Tanzania Trade Development Authority (TanTrade) provides a trade portal with detailed information on customs procedures. Unlike Ghana’s centralized system or Ethiopia’s industrial park-focused approach, Tanzania requires direct engagement with government agencies to access specific benefits.

5. Ethiopia

Import Duty Status

Ethiopia is taking bold steps in the electric vehicle (EV) space. As of January 29, 2024, the country has completely banned gasoline and diesel vehicles, allowing only electric and hybrid models. EVs now benefit from duty-free status, meaning import tariffs – often a major hurdle – are no longer an issue. This policy, originally announced on September 16, 2022, will remain in place until 2026, creating a highly supportive environment for EV adoption compared to the tiered approaches seen in other nations.

VAT/Excise Reductions

The Ethiopian Ministry of Finance has introduced sweeping tax exemptions for EVs. These include full exemptions from Value Added Tax (VAT), excise tax, and surtax. These benefits apply to all types of EVs, whether fully imported, locally manufactured, or partially assembled.

| Tax/Duty Type | Status for Electric Vehicles (EVs) |

|---|---|

| Value Added Tax (VAT) | Exempt |

| Excise Tax | Exempt |

| Surtax | Exempt |

| Import Duty | Reduced |

These tax policies demonstrate Ethiopia’s commitment to making EVs more accessible while also fostering local production.

Other Incentives

Beyond tax exemptions, Ethiopia’s policies are designed to strengthen the entire EV supply chain. This includes support for local assembly operations and incentives aimed at encouraging the growth of domestic EV manufacturing, signaling a long-term vision for the sector.

sbb-itb-99e19e3

6. Rwanda

Import Duty Status

Rwanda offers generous customs exemptions for electric vehicles (EVs). EVs, along with their spare parts, batteries, and charging equipment, are entirely exempt from the East African Community (EAC) Common External Tariff, which is typically 25% for finished goods. Instead, these imports are subject to minimal charges: a 1.5% Infrastructure Development Levy, a 0.2% African Union Levy, and a 0.2% Quality Inspection Fee, all calculated based on the customs value. These exemptions create a favorable environment for EV adoption and pave the way for additional financial incentives.

VAT/Excise Reductions

To further encourage EV usage, Rwanda waives the standard 18% VAT on imported electric vehicles. Locally assembled EVs also benefit from an excise tax exemption. For hybrid vehicles, excise tax rates vary depending on the vehicle’s age and engine size: 5% for those under three years old with engines smaller than 1,500cc, 10% for vehicles aged 3 to 8 years with engines between 1,500cc and 2,500cc, and 15% for older hybrids or those with larger engines.

Other Incentives

In addition to tax breaks, Rwanda imposes an annual Road Maintenance Levy of RWF 50,000 (about $37). This fee helps fund infrastructure projects while keeping costs manageable for EV owners.

7. Kenya

Import Duty Status

Kenya’s import duty system for electric vehicles aligns with the East African Community (EAC) Common External Tariff, which typically applies a 25% duty on most finished goods. However, as of late 2024, the government began revisiting its policies to address the additional fees that have historically made EVs less affordable. On top of the import duty, there are other charges based on the CIF (Cost, Insurance, and Freight) value, including a 3.5% Import Declaration Fee, a 2% Railway Development Levy, and a 10%–17.5% export/investment promotion levy. These layered fees significantly inflate the cost of importing EVs, creating financial barriers even before VAT and excise taxes are applied.

VAT/Excise Reductions

Kenya applies a 16% Value Added Tax (VAT) on all imported vehicles, including EVs. This tax is calculated on the CIF value combined with all other duties. Unlike some of its neighbors, such as Rwanda and Ethiopia, Kenya has yet to introduce broad VAT or excise tax exemptions specifically targeting electric vehicles. Instead, the country has focused on aligning its regulatory framework rather than offering direct tax relief. Excise duties are governed by the 2015 Excise Duty Act, with rates for EVs subject to periodic updates through annual Finance Acts.

Other Incentives

Rather than relying on tax cuts, Kenya has taken steps to simplify vehicle registration processes to encourage EV adoption. The government also launched the "Advancing Transport Climate Strategies" (TraCS) project, aimed at identifying and revising tax policies that have hindered the growth of the EV market. In the absence of significant government subsidies, private companies have stepped in to drive innovation. For example, Ampersand and Powerhive are developing battery-swapping networks, while Ecobodaa offers pay-as-you-go financing options. Additionally, Kenya’s abundant solar energy resources make off-grid charging systems an economically attractive option, with costs reportedly lower than grid-based electricity. These initiatives highlight Kenya’s practical approach to supporting EV adoption, focusing on infrastructure and market-driven solutions over direct fiscal incentives.

Taxes Threaten Chinese EVs Adoption in Kenya

Pros and Cons

Looking at the detailed country profiles, it’s clear that different policy approaches come with their own set of advantages and challenges.

When it comes to EV import duty policies in Africa, the trade-off often lies between making EVs more affordable and promoting local production. Kenya, for instance, offers a relatively accessible market with a 25% import duty under the EAC Common External Tariff. However, the government has been working to adjust additional fees that have historically made EVs less affordable. On the other hand, South Africa focuses on boosting local manufacturing through incentives like a 150% tax deduction for EV production starting in 2026. Yet, the same 25% import duty on EVs limits the appeal of imported vehicles.

Here’s a quick look at the key differences:

| Country | Key Advantages | Key Disadvantages |

|---|---|---|

| Kenya | Lower ancillary charges under review; emphasis on infrastructure and market-driven solutions | Additional fees (3.5% Import Declaration Fee, 2% Railway Development Levy, 10%–17.5% export/investment promotion levy) add to the 25% import duty, raising costs |

| South Africa | 150% tax deduction for EV production starting in 2026; R1 billion allocated for production support by 2035 | 25% import duty on EVs makes them pricier than ICE vehicles, which only face an 18% duty |

This comparison highlights the delicate balance between reducing import costs to encourage EV adoption and supporting domestic manufacturing to build a sustainable industry.

Conclusion

In 2026, Mozambique stands out as a top destination for importing electric vehicles (EVs) by completely removing its 20% import duty on fully electric cars. This move aligns with its National Energy Transition Strategy and commitments under the AfCFTA. By eliminating this duty, Mozambique significantly lowers the upfront costs for buyers, making EV imports more accessible. However, individual buyers should confirm the latest customs tariffs through official channels and ensure they meet AfCFTA regulations to avoid any complications. While Mozambique focuses on duty reduction, other nations are exploring different strategies.

South Africa, for instance, is betting on local EV manufacturing. Starting in 2026, the country will offer a 150% tax deduction on investments in EV production, aiming to establish itself as a manufacturing hub. On the flip side, South Africa continues to impose a 25% import duty on EVs – higher than the 18% duty for traditional vehicles – making imported models less competitive. For industry players, this creates an opportunity to invest in local production while advocating for reduced import duties.

Across Africa, the trend of lowering import duties is gradually reducing upfront costs for EV buyers. When combined with the expansion of off-grid solar charging networks, these policies set the stage for EV growth leading up to 2040. These developments not only benefit consumers but also influence how businesses approach market entry strategies.

For those looking to navigate these diverse markets, platforms like EV24.africa simplify the process. With transparent pricing, extensive EV listings, and dependable delivery services across Africa, they make it easier for buyers to understand duty structures and ensure compliance when importing EVs.

FAQs

Which African countries have the lowest import duties for electric vehicles in 2026?

In 2026, a handful of African nations are making waves with low or zero import duties on electric vehicles, creating ideal conditions for EV adoption. Among these, Rwanda, Kenya, Malawi, and Senegal emerge as frontrunners, offering either no import duties at all or substantial exemptions. Adding to this, Senegal takes things a step further by waiving VAT on EV imports, significantly cutting costs for buyers.

These measures aim to make electric vehicles more affordable and accessible, paving the way for a shift toward cleaner and more sustainable transportation in the region.

How are government incentives for local EV production shaping Africa’s electric vehicle market?

Government initiatives are giving Africa’s electric vehicle (EV) market a noticeable boost by cutting production costs and promoting local assembly. Take South Africa, for instance: starting in March 2026, the country is offering a 150% tax deduction for investments in EV and hydrogen vehicle production facilities. This incentive has already caught the attention of major players like BMW and Toyota, prompting them to expand their local operations to capitalize on these benefits.

Ethiopia is also making moves with its tax policies aimed at encouraging local assembly. Fully assembled EVs face a 15% import tax, but semi-knocked-down kits are taxed at just 5%, and completely knocked-down kits enjoy a tax-free status. These policies are not only making locally assembled EVs more affordable but also helping Ethiopia work toward its goal of having 500,000 EVs on the road by 2030. By reducing vehicle costs, creating manufacturing jobs, and speeding up EV adoption, these strategies are reshaping the market across the continent.

What challenges do African countries face in adopting EVs, even with reduced import duties?

While lower or zero import duties can help, several hurdles continue to slow the adoption of EVs in Africa. One of the biggest challenges is the high upfront cost. Even with reduced import duties, other taxes like VAT, excise fees, and import charges can inflate the price by 30–45%. This makes EVs financially out of reach for many potential buyers. Adding to this, unclear and shifting policies, such as inconsistent tax exemptions, create uncertainty for both consumers and importers.

Another major issue is the lack of charging infrastructure. Public charging stations are sparse in most countries, and their uneven distribution makes long-distance travel with an EV highly impractical. On top of this, strict import regulations – such as requirements for batteries to meet specific standards or vehicles to have a certain driving range – add further complications to the process.

Finally, financing options and consumer awareness are limited. Without affordable credit, leasing programs, or accessible information about the long-term cost benefits of owning an EV, many buyers are hesitant to make the switch. When combined with fragmented regulations across the continent, these factors significantly slow the pace of EV adoption.