What’s the best vehicle type for Africa in 2026? It depends on where you drive and what you need. Hybrids are great for rural areas with limited charging options. Plug-in hybrids suit city drivers who take occasional long trips. Fully electric vehicles (EVs) work best in urban hubs with growing charging infrastructure, offering the lowest running costs.

Key insights:

- Hybrids: Self-charging, ideal for areas with unreliable grids or long distances.

- Plug-in Hybrids: Combine electric and fuel power, perfect for urban use with occasional road trips.

- EVs: Cheapest to run, best for fleets and cities with charging stations.

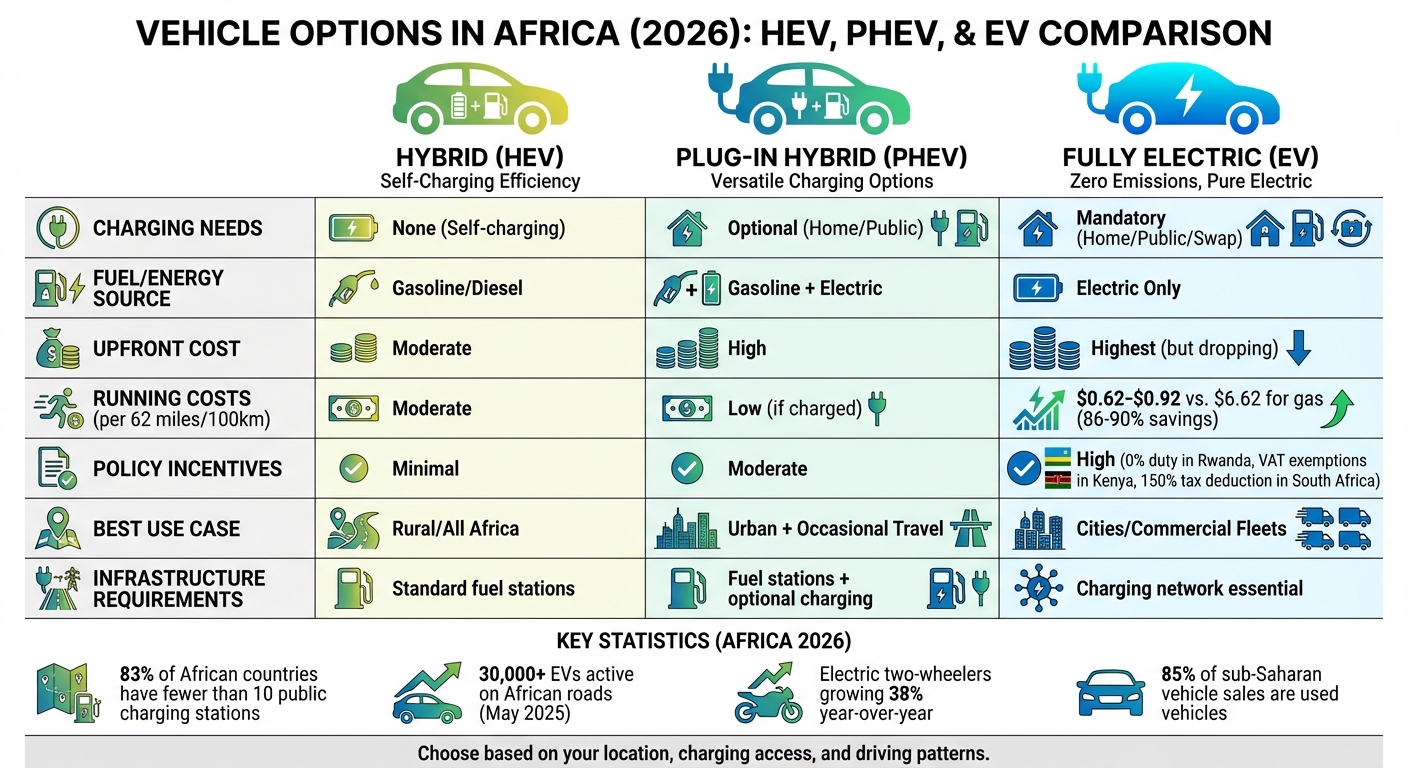

Quick Comparison

| Feature | Hybrid (HEV) | Plug-in Hybrid (PHEV) | Fully Electric (EV) |

|---|---|---|---|

| Charging Needs | None | Optional (Home/Public) | Mandatory (Home/Public) |

| Fuel/Energy Source | Gasoline/Diesel | Gasoline + Electric | Electric Only |

| Upfront Cost | Moderate | High | Highest (but dropping) |

| Running Costs (62 mi) | Moderate | Low (if charged) | $0.62–$0.92 vs. $6.62 gas |

| Best Use Case | Rural/All Africa | Urban + Occasional Travel | Cities/Fleets |

Each type has pros and cons, but EVs are gaining traction thanks to cost savings and policy incentives in countries like Kenya, Rwanda, and South Africa. Keep reading for a deeper dive into Africa’s evolving automotive market.

Hybrid vs Plug-in Hybrid vs Electric Vehicle Comparison for Africa 2026

Hybrids in Africa

Why Hybrids Work in Africa

In Africa, where charging infrastructure is sparse and grid reliability can be unpredictable, hybrids offer a practical solution. One standout benefit of hybrid electric vehicles (HEVs) is their independence from charging stations. These vehicles recharge themselves using regenerative braking and their internal combustion engines, making them well-suited for the 83% of African countries with fewer than 10 public charging stations.

This self-sufficiency becomes even more crucial when you consider that only eight African nations currently maintain stable electrical grids. In contrast, countries like Sierra Leone experienced an average of 53 unscheduled power outages per day in 2017. With hybrids, drivers don’t have to worry about unreliable electricity disrupting their mobility.

Hybrids also shine in urban and hilly environments. Mild hybrid systems, for example, can cut fuel consumption by up to 15% in stop-and-go traffic. Regenerative braking captures energy that would otherwise dissipate as heat, making hybrids especially efficient in busy cities or on steep terrain. Additionally, most modern HEVs are equipped with start-stop systems, which turn off the engine when idling at traffic lights, reducing emissions in densely populated areas.

Hybrid Limitations in Africa

While hybrids have their advantages, they also face notable challenges in African markets. The most significant hurdle is cost. Hybrids are often positioned as premium vehicles, with price tags well above $20,000, whereas comparable internal combustion engine (ICE) cars typically cost under $20,000. This price gap makes hybrids inaccessible for many African consumers, especially given limited financing options.

Another issue is maintenance. Hybrid systems are more complex than traditional ICE vehicles, and finding qualified technicians to service them can be difficult, particularly in rural areas. Unlike conventional cars, where mechanics are widely available, hybrid owners may struggle to get repairs done when needed.

Hybrids also rely on gasoline or diesel, which ties their operation to fluctuating fuel prices and supply chain disruptions – problems that are all too common across the continent. Moreover, Africa’s automotive market is dominated by imported used vehicles. Over 60% of annual registrations are for pre-owned cars, and in countries like Nigeria and Uganda, this figure can reach as high as 90%. This makes it difficult for hybrids, which are often newer and more expensive, to compete in the market.

Despite these obstacles, some regions, like South Africa, are emerging as exceptions where hybrid adoption is gaining traction.

Hybrid Adoption in South Africa

South Africa is leading the way in hybrid and electric vehicle adoption on the continent, with 1,559 light-duty units in operation as of May 2025. This success is driven by several factors: a more reliable electrical grid, higher average income levels, and a ban on used-vehicle imports, which prevents the market from being flooded with older, cheaper ICE cars.

To further boost hybrid and electric vehicle production, South Africa is introducing a 150% tax deduction starting in 2026. This policy aims to support the country’s large automotive manufacturing sector as global markets shift away from ICE vehicles by 2035. By focusing on the supply side, the country is ensuring that its manufacturing base remains competitive while addressing the infrastructure and cost challenges that hinder broader adoption.

However, even South Africa is not immune to delays. Passenger car adoption is expected to lag behind Europe by about a decade, as used hybrid and electric vehicles won’t become widely available until the mid-to-late 2030s. The country is classified as an "Emulator" market, following a pathway similar to developed nations by prioritizing passenger cars. This contrasts with East African "Innovator" markets like Kenya and Rwanda, which focus more on two- and three-wheelers.

Plug-in Hybrids in Africa

PHEVs for Urban and Rural Areas

Plug-in hybrid electric vehicles (PHEVs) are carving out a unique niche in Africa’s evolving automotive landscape. They provide a practical solution for urban commuters, combining electric power for short daily trips with a gasoline backup for longer journeys. This dual capability addresses a key concern for over 90% of vehicle owners in Nigeria and Kenya – range anxiety.

In Kenya, driving 62 miles (100 km) in electric mode costs 47–83% less than using gasoline. For city dwellers, this cost-saving potential makes PHEVs an attractive option, especially since many can charge their vehicles at home using standard outlets, gaining 3–5 miles (5–8 km) of range per hour. The gasoline engine comes in handy for weekend getaways or intercity travel, where charging infrastructure is still scarce.

Another advantage of PHEVs is their reliability during power outages. With a System Average Interruption Duration Index (SAIDI) of 39.30 – 45 times higher than that of OECD countries – power disruptions are a common challenge in Africa. PHEVs ensure mobility even during such outages. While urban areas in major markets boast electricity access rates above 70%, fewer than half of those connected experience consistent, reliable power.

Now, let’s take a closer look at the challenges holding back wider PHEV adoption.

Barriers to PHEV Adoption

Despite their practicality, PHEVs face significant hurdles in gaining traction across African markets. The biggest roadblock? Cost. With price tags exceeding $10,000, PHEVs struggle to compete against used internal combustion engine (ICE) vehicles, which are priced more affordably between $6,000 and $10,000 in countries like Kenya and Nigeria. Used ICE vehicles dominate the market, accounting for 85% of four-wheel vehicle sales in most sub-Saharan nations. Without substantial government incentives, PHEVs remain out of reach for many consumers.

Infrastructure is another major challenge. Only 17% of African countries currently have 10 or more public charging stations. For drivers without access to home charging, the plug-in feature of PHEVs loses much of its appeal. Adding to this is policy uncertainty – both Kenya and Uganda have rolled back previously established tax incentives for electric and hybrid vehicles, creating instability in the market.

In some cases, governments are skipping hybrids altogether. Ethiopia, for example, implemented a groundbreaking ban on internal combustion engine vehicle imports in 2024, steering its market directly toward fully electric options. Such aggressive policies may leave PHEVs without a clear regulatory path in certain regions, even though they remain a practical solution for many consumers.

However, innovative approaches like battery-swapping systems are emerging to address some of these challenges.

Battery-Swap Solutions in Kenya and Rwanda

East Africa is leading the way with battery-swapping ecosystems that could transform how plug-in vehicles are utilized. Companies like Ampersand and Roam are expanding battery-swap networks in Kenya and Rwanda, mainly targeting electric two-wheelers and buses. While these systems currently don’t cater to PHEV passenger cars, they highlight a promising alternative to traditional charging infrastructure in areas with unreliable power grids.

Battery swapping solves two key problems: slow charging times and grid instability. Instead of waiting hours for a full charge, drivers can exchange depleted batteries for fully charged ones in just minutes. This model is especially beneficial for commercial vehicles that rack up high daily mileage, where downtime directly impacts earnings. As these networks grow, they could eventually influence how PHEV batteries are managed or even repurposed for second-life applications.

In Africa’s complex automotive environment, PHEVs serve as a transitional technology – offering a practical blend of electric and gasoline power. They’re a viable option for those who can afford them and have access to home charging, but their broader adoption is hindered by high costs, limited infrastructure, and uncertain policy support.

Fully Electric Vehicles in Africa

Why EVs Work in Africa

Electric vehicles (EVs) are proving to be a cost-effective option in Africa. In Kenya, for instance, driving 62 miles (100 km) in an EV costs just $0.62 to $0.92, compared to $6.62 for a gasoline-powered car. That’s an 86–90% savings on fuel costs. For taxi drivers and delivery fleets, these savings translate directly into higher daily profits.

Pairing EVs with solar-powered off-grid charging systems makes them even more economical. Installing a solar setup for a small car traveling about 31 miles (50 km) daily costs roughly $2,700. Once installed, charging costs drop to less than 4% of the vehicle’s total ownership costs. This setup is especially helpful in areas where power outages are frequent – up to 45 times more common than in wealthier nations – giving drivers a reliable energy source.

"Battery electric vehicles with solar off-grid chargers will have lower costs and negative greenhouse gas abatement costs well before 2040 in most countries and segments." – Nature

EVs also simplify vehicle maintenance. With no oil changes, exhaust systems, or complex transmissions, they reduce upkeep headaches. On top of that, EVs produce zero tailpipe emissions, improving air quality in urban areas. Their life-cycle emissions are 65% to 85% lower than those of internal combustion engine (ICE) vehicles. They also help cut down on costly fossil fuel imports, which weigh heavily on many African economies.

Despite these advantages, challenges remain in scaling EV adoption across the continent.

What’s Driving and Blocking EV Adoption

As of May 2025, over 30,000 EVs were active on African roads, with electric two- and three-wheelers growing 38% year-over-year and electric buses increasing by 44%. Commercial fleets are leading the charge. For example, BasiGo, a Kenyan electric bus company, secured $42 million in funding in 2025 to expand its fleet to 1,000 buses across Kenya and Rwanda, improving public transportation.

Falling battery prices and increasing investments are boosting EV adoption, but challenges persist. Ethiopia made headlines in 2024 by becoming the first country in the world to ban imports of internal combustion engine vehicles. This bold move aims to capitalize on the nation’s abundant renewable energy and reduce its reliance on fossil fuels. However, for many countries, powering a significant shift to EVs would require diverting over 20% of their projected electricity demand growth over the next decade.

The dominance of used gasoline vehicles also complicates matters. These vehicles make up about 85% of the sub-Saharan market, with prices ranging from $6,000 to $10,000. Meanwhile, fewer than 20% of consumers in key markets like Morocco and South Africa have access to formal credit, making EVs less affordable.

"The biggest barrier to EV affordability isn’t just cost – it’s poverty." – Rose Mutiso, Research Director, Energy for Growth Hub

To address these hurdles, creative financing and infrastructure solutions are emerging. Kenyan fintech firms like M-KOPA and Watu Credit now offer digital loans for electric motorcycles, allowing drivers to pay in manageable installments. Additionally, expanding battery-swapping networks are helping commercial riders reduce downtime and ease concerns about range limitations.

Investments and Policy Support in Morocco and South Africa

Morocco is making waves as a hub for EV manufacturing, attracting nearly $15 billion in investments for EV and battery production by 2025. Its proximity to European markets and well-established automotive infrastructure have positioned it as a key player in the global EV supply chain.

South Africa is also stepping up with new policies. Starting in 2026, the government will offer a 150% tax deduction for investments in EV production. This initiative is geared toward transforming the country’s large automotive industry into a leader in electric vehicle manufacturing.

Both nations are not just focused on exports; they are also building local supply chains for batteries, charging stations, and vehicle assembly. As production scales and more EV models hit the market, the price gap between EVs and traditional vehicles is expected to shrink, making electric mobility more accessible across Africa.

sbb-itb-99e19e3

Comparing Infrastructure, Affordability, and Policies

Comparison Table: Hybrids vs. Plug-in Hybrids vs. EVs

| Feature | Hybrid (HEV) | Plug-in Hybrid (PHEV) | Fully Electric (EV) |

|---|---|---|---|

| Charging Needs | None (Self-charging) | Optional (Home/Public) | Mandatory (Home/Public/Swap) |

| Refueling | Standard Petrol/Diesel | Standard Petrol/Diesel | None |

| Upfront Cost | Moderate | High | Highest (but dropping) |

| Running Costs (per 62 miles) | Lower than ICE | Very Low (if charged) | $0.62–$0.92 vs. $6.62 for ICE |

| Policy Incentives | Minimal | Moderate | High (0% duty in Rwanda, VAT exemptions in Kenya, 150% tax deduction in South Africa) |

| Best Region | Rural/All Africa | Urban with occasional travel | Urban/Commercial hubs |

What the Comparison Shows

This table highlights the distinct advantages and challenges of hybrids, plug-in hybrids, and fully electric vehicles (EVs) in Africa’s growing automotive market. It distills key factors like infrastructure, costs, and government policies, offering a snapshot of how these vehicle types fit into different environments.

Hybrids shine in areas with limited infrastructure, relying on widely available petrol or diesel. They’re especially practical for long-distance travel in regions where power grids are unreliable or charging stations are sparse. This makes them a dependable option for rural areas or across the continent as a whole.

Plug-in hybrids, on the other hand, combine the benefits of electric and combustion engines. Drivers can charge at home when possible but still rely on a fuel tank for longer trips. This dual capability makes them a great fit for urban commuters who occasionally travel to areas with fewer charging options. However, these vehicles lag behind EVs in terms of policy incentives. For example, while EVs enjoy perks like South Africa’s 150% tax deduction for production starting in 2026 and Rwanda’s 0% import duties, plug-in hybrids receive more modest support.

Fully electric vehicles offer the lowest running costs, often as little as $0.62–$0.92 per 62 miles, compared to $6.62 for internal combustion engines (ICE). This cost efficiency makes them particularly appealing for commercial users like taxi fleets and delivery services, where lower operating expenses directly boost profitability. However, EVs depend heavily on charging infrastructure, which is still concentrated in major cities. Grid reliability also remains a hurdle in many parts of Africa, limiting their broader adoption.

For commercial fleets, the financial benefits of EVs are hard to ignore. Electric two-wheelers and buses are leading the way, thanks to their high utilization rates and easier access to financing solutions. In contrast, rural users may find hybrids more practical until charging networks expand. This breakdown provides a clear roadmap for consumers and businesses navigating Africa’s automotive landscape in 2026.

Which Option Makes Sense for African Consumers in 2026

Recommendations by Use Case

Rural drivers and long-distance travelers will find hybrids to be a practical choice. These vehicles rely on widely available petrol or diesel, eliminating the need for charging infrastructure, which can be unreliable in areas with inconsistent power grids.

Urban commuters with occasional road trips are well-suited for plug-in hybrids. Charging these vehicles overnight at home makes city driving efficient, while the fuel tank provides the range needed for longer trips. This combination works well in growing urban centers where charging stations are becoming more common, even though they remain sparse outside city limits.

Commercial fleets and city-based businesses should explore fully electric vehicles. EVs offer substantial fuel savings, and operators in forward-thinking countries like Kenya and Rwanda can take advantage of VAT exemptions on electric motorcycles and buses, as well as preferential electricity rates for charging.

Private car buyers in South Africa, Morocco, or Egypt should keep an eye on upcoming policy changes. South Africa’s 150% tax deduction for EV production aims to lower costs and increase model availability, while Morocco’s $15 billion investment in EV and battery manufacturing is expected to bring more affordable options to the market.

These tailored recommendations align with regional needs and are further bolstered by EV24.africa’s extensive support services.

How EV24.africa Supports the Transition

EV24.africa simplifies the process of buying electric vehicles in Africa, offering a wide selection of new and used EVs from brands like Tesla, BYD, Leapmotor, and Hyundai. The platform provides transparent pricing, detailed specifications, and financing options, making it easy to compare vehicles side-by-side. Buyers can also check battery health ratings and arrange financing directly through the site.

To serve all 54 African countries, EV24.africa manages cross-border shipping and import documentation, ensuring a smooth delivery process. With 85% of four-wheel vehicle sales on the continent being used vehicles, the platform ensures buyers receive accurate information about battery condition and vehicle history, addressing a key concern in the market.

Final Thoughts

Africa’s automotive future depends on matching vehicle types to local conditions and individual driving needs. While hybrids offer a practical solution for regions with limited infrastructure, plug-in hybrids provide a balance of efficiency and flexibility. Fully electric vehicles deliver lower operating costs in areas where charging facilities are accessible.

As Energy for Growth Hub points out, "The biggest barrier to EV affordability isn’t just cost – it’s poverty". Choosing the right vehicle involves considering daily driving habits and the availability of charging options. With EV24.africa’s tools and resources, making an informed decision for 2026 becomes much easier.

Will electric cars work in South Africa? In-depth discussion with Alex Parker

FAQs

What challenges could slow down EV adoption in Africa by 2026?

The road to widespread electric vehicle (EV) adoption in Africa by 2026 comes with some serious hurdles, especially when it comes to infrastructure and affordability. For starters, public charging stations are few and far between, making long-distance travel a real challenge. On top of that, many areas struggle with unreliable electricity grids and frequent power outages, which raises concerns about whether charging an EV is even practical – or affordable – in the long run.

Then there’s the high upfront cost of EVs, which puts them out of reach for many consumers. Steep import taxes, limited financing options, and the absence of local manufacturing mean prices remain high. Even after purchase, finding maintenance and repair services can be tough, with spare parts often in short supply. To make matters worse, public awareness about EVs is still low, and myths about their reliability and long-term costs only add to the hesitation.

Tackling these issues will take a combination of major investments in infrastructure, supportive government policies, and initiatives to educate people about the benefits of EVs.

What policy incentives are available for hybrids, plug-in hybrids, and EVs in Africa?

In Africa, government policies are strongly geared toward promoting fully electric vehicles (EVs), while hybrids (HEVs) and plug-in hybrids (PHEVs) receive minimal attention. For instance, South Africa plans to introduce a 150% tax deduction for EV and hydrogen vehicle production starting in 2026. Similarly, Kenya and Rwanda have taken steps to make EVs more accessible by eliminating or reducing import duties. Rwanda goes a step further by offering VAT exemptions and even providing rent-free land for building charging stations. Other incentives, like special electricity rates and priority parking, are also being rolled out in countries such as Kenya, Uganda, and Rwanda.

On the other hand, hybrids and PHEVs often miss out on these benefits. They are typically taxed at rates similar to traditional gasoline vehicles, with no dedicated policies to make them more affordable. While EVs enjoy focused efforts to reduce costs and improve infrastructure, hybrids and PHEVs are left to rely on broader clean-energy goals rather than direct government backing.

What should you consider when deciding between hybrid, plug-in hybrid, and electric vehicles in Africa?

When deciding between hybrid vehicles (HEVs), plug-in hybrids (PHEVs), and electric vehicles (EVs) in Africa, it’s important to weigh factors like infrastructure, cost, and practicality.

Infrastructure: EVs need a dependable charging network, which remains scarce in many parts of Africa. This makes HEVs a convenient option since they don’t rely on charging stations. PHEVs, on the other hand, strike a balance by running on both electricity and gasoline, making them a flexible choice in areas where charging access is limited.

Cost: HEVs are typically the most budget-friendly option upfront, while PHEVs and EVs come with higher purchase prices. That said, EVs can offer lower running costs thanks to cheaper electricity and reduced maintenance, particularly in countries that provide tax breaks or discounted electricity rates for EV owners.

Practicality: HEVs are a solid choice for improving fuel efficiency without worrying about charging or range limitations. PHEVs work well for those who need a mix of electric driving for short trips and gasoline for longer journeys. EVs, with their zero emissions and quiet operation, are ideal for eco-conscious drivers but heavily depend on the availability of charging stations.

To make the right choice, think about your driving patterns, the local charging infrastructure, and any government incentives that might be available in your area.