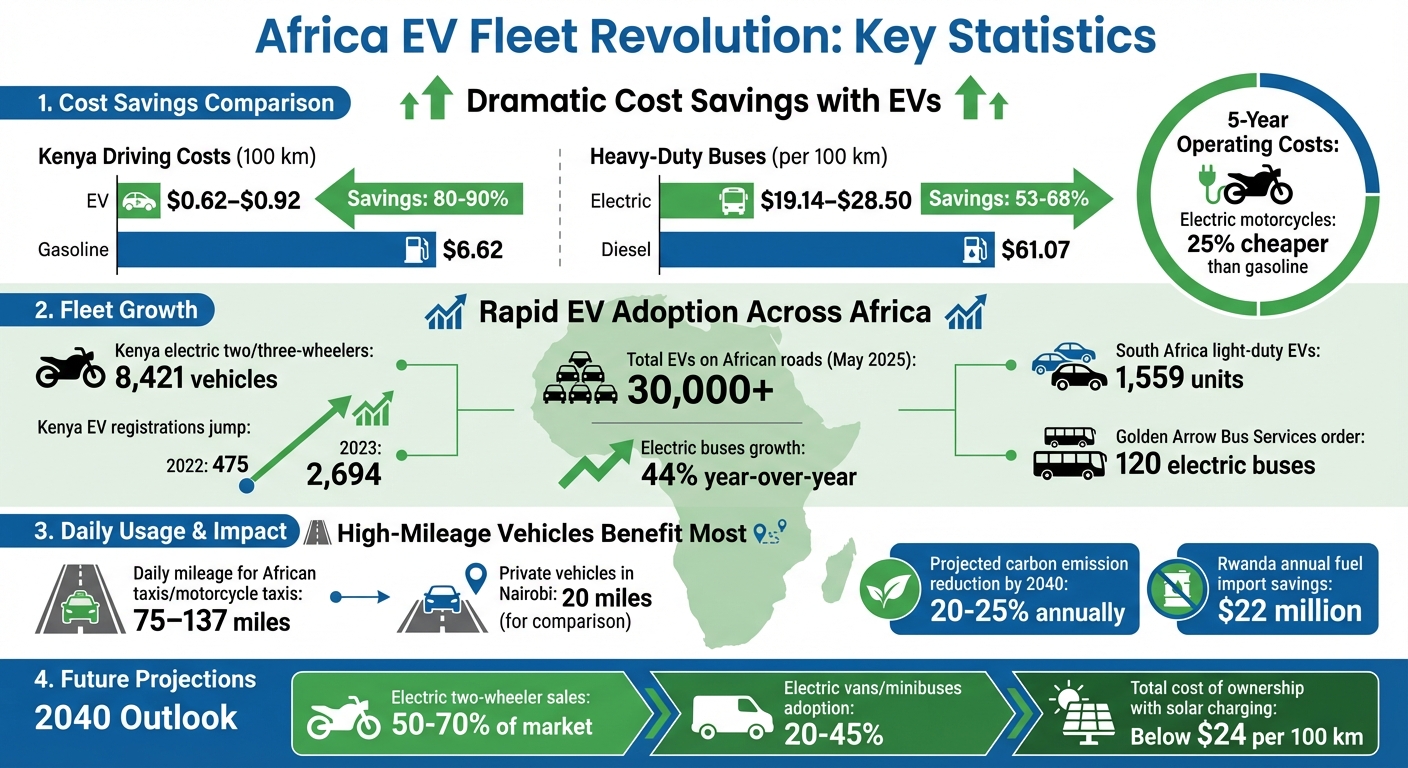

- Cost Savings: Driving 100 km in Kenya costs $0.62–$0.92 with an EV, compared to $6.62 for gasoline. Over five years, electric motorcycles are 25% cheaper to operate.

- Government Policies: Countries like Ethiopia and Rwanda are leading with bans on internal combustion engine (ICE) imports and mandates for electric public transport.

- Fleet Growth: By May 2025, over 30,000 EVs were on African roads, with electric buses growing 44% year-over-year.

- Energy Independence: EVs reduce reliance on fuel imports, saving countries like Rwanda millions annually.

This shift is fueled by lower operating costs, supportive policies, and the rise of solar-powered charging infrastructure. Fleet operators across Africa are already seeing reduced expenses and improved efficiency, making EV adoption a smart move for high-mileage vehicles.

Africa EV Fleet Cost Savings and Growth Statistics 2025-2026

Market Trends Driving EV Adoption in Taxis, Delivery, and Corporate Fleets

Countries Leading Fleet Electrification

Several African nations are spearheading the transition to electric vehicles (EVs) in commercial fleets, thanks to forward-thinking policies and initiatives. Ethiopia, for instance, has announced a ban on internal combustion engine (ICE) passenger vehicle imports starting in 2024, prompting a rapid shift to EVs among importers and fleet operators. Similarly, Rwanda has mandated that all public transport motorcycles in Kigali must be electric by January 2025, spurring investments in infrastructure and training programs for operators. Kenya, on the other hand, is leveraging its widespread mobile money usage – reaching 40% penetration – to support fintech-driven EV financing, complemented by VAT exemptions.

In North Africa, countries like South Africa, Morocco, and Egypt are making strides by focusing on local EV production. South Africa plans to introduce a 150% tax deduction for EV manufacturing starting in 2026. Morocco has committed $15 billion to EV and battery production, while Egypt aims to put 20,000 EVs on the road by 2030. Companies such as BasiGo and Moove are scaling operations across multiple regions, with Moove deploying EV ride-hailing fleets in Nigeria, South Africa, and Ghana. Moove has also partnered with Uber to provide vehicle financing for drivers. These governmental and corporate efforts are laying the groundwork for innovative solutions, including solar-powered charging infrastructure.

Solar-Powered Charging Infrastructure

Frequent power outages across Africa make solar-powered charging a critical solution for fleet reliability. To put it into perspective, Africa’s System Average Interruption Disruption Index (SAIDI) in 2020 was 39.30, compared to just 0.87 in high-income OECD countries. Solar-powered charging stations allow fleet operators to sidestep unreliable grids by setting up charging points at key locations like taxi hubs, delivery centers, and parking lots.

Battery-swapping stations powered by solar energy are also gaining traction, especially for electric motorcycle taxis and delivery services. For example, Ampersand operates a network in Kigali where drivers can swap out depleted batteries in minutes. In Uganda, Zembo offers solar-powered battery-swapping kiosks for electric motorcycles and emphasizes training women as operators. By 2030, solar off-grid charging is expected to account for less than 4% of the total cost of ownership for small four-wheeler EVs. A complete solar charging setup – including photovoltaic panels, a stationary battery, and an inverter – for a small EV driving about 31 miles (50 km) daily costs around $2,700. These cost-effective solutions not only address infrastructure challenges but also enhance the economic appeal of fleet electrification.

Economic Benefits of Commercial EV Fleets

Commercial fleets, particularly those with high daily mileage, stand to gain the most from electrification. In many African cities, shared taxis and motorcycle taxis cover 75–137 miles daily, far exceeding the 20-mile average for private vehicles in cities like Nairobi. This higher utilization translates to significant fuel savings. For example, driving 62 miles in Kenya costs 47–83% less with an EV compared to an ICE vehicle. For heavy-duty e-buses, the cost per 62 miles ranges from $19.14 to $28.50, significantly lower than the $61.07 required for diesel models.

Maintenance costs are another area where EVs shine. With fewer moving parts and features like regenerative braking, EVs are cheaper to maintain. Over five years, electric motorcycles can be about 25% less expensive to operate than their gasoline counterparts. Financing solutions are also making EV adoption more accessible. Companies like M-KOPA and Watu Credit offer digital loans and pay-as-you-go payment models, enabling drivers to acquire electric motorcycles without hefty upfront costs. These models work particularly well in East Africa, where mobile money usage is widespread, but access to traditional banking remains limited.

sbb-itb-99e19e3

Case Studies: EV Fleet Implementations in Africa

Kenya: Electric Motorcycle Taxis and Delivery Services

Kenya has made impressive strides in electric mobility, with 8,421 electric two- and three-wheelers on the roads as of early 2025. The boda-boda taxi industry, a key player in the economy contributing $4.4 billion annually, is embracing electric vehicles at a remarkable pace.

Uber introduced its first African electric motorbike service, "Electric Boda", in Nairobi. Over just six months, the initiative, led by Kagiso Khaole, General Manager for Sub-Saharan Africa, rolled out 3,000 bikes – 20% of its local fleet. The benefits were clear: drivers experienced a 30-35% drop in operating costs, and passengers enjoyed 15-20% lower fares. Highlighting the advantages, Khaole remarked:

"You will experience lower vibrations, less sound".

Local startups are also fueling this shift by retaining battery ownership and setting up rapid-swap stations. These allow riders to exchange batteries in minutes, cutting daily energy costs from $6 for petrol to $1.42 for electric charging. Moses Lugalia, a boda-boda rider, shared his perspective:

"Because of the cost of petrol, I am able to save a lot more using my electric bike".

In 2024, Spiro, a local startup, announced plans to build 3,000 battery-charging and swapping stations across Kenya to support its expanding fleet.

The government has played a critical role in this transformation. Kenya launched a national e-mobility program in September 2023, offering VAT exemptions for electric motorcycles and their parts. This policy led to a surge in EV registrations, jumping from 475 in 2022 to 2,694 in 2023. With a national grid powered by 85-90% renewable energy – including geothermal, hydro, solar, and wind – Kenya’s shift to electric vehicles significantly reduces carbon emissions. These efforts are setting a strong example for fleet electrification across the region.

South Africa: Corporate and Taxi Fleet Transitions

While Kenya focuses on micro-mobility, South Africa is making headway in large-scale corporate fleet conversions. In 2024, Golden Arrow Bus Services acquired 120 electric buses for public transit, marking one of the largest single orders for electric buses on the continent. The country also leads the region in light-duty electric vehicles, with 1,559 units as of May 2025.

Corporate fleets are moving faster than private owners, driven by sustainability goals and the lower total cost of ownership for high-usage vehicles. South Africa boasts a charger-to-car ratio of 1:5, far better than many other regions. To address frequent power outages, operators are adopting managed charging strategies, such as off-peak charging and solar-following systems.

Local innovation is helping tackle infrastructure challenges. Zero Carbon Charge is building a nationwide network of off-grid, solar-powered charging stations, ensuring fleet operations remain unaffected by the unreliable national grid. Stellenbosch University‘s Electric Mobility Day project demonstrated the feasibility of retrofitting existing vehicles by converting a standard petrol minibus taxi and a 65-seater diesel bus into fully electric vehicles. For last-mile logistics, Mellowvans produces electric three-wheelers tailored to South Africa’s delivery needs.

Rwanda and Tanzania: Electric Delivery Fleets

Rwanda is leading the way with bold policy measures. The government has mandated that all public transport motorcycles in Kigali must switch to electric power by January 2025, driving rapid infrastructure growth. This clear policy direction has provided operators with a definitive timeline for transitioning their fleets.

Meanwhile, Tanzania is outpacing other East African countries in deploying electric two- and three-wheelers, although many still rely on older lead-acid battery technology. Both Rwanda and Tanzania are focusing on electric three-wheelers for urban last-mile deliveries, offering a cost-effective and sustainable solution for densely populated areas. These targeted efforts highlight the continent’s growing commitment to cleaner, more efficient mobility solutions.

Economic and Environmental Benefits for African Fleet Operators

Lower Operating Costs

Switching to electric fleets makes financial sense, especially when you compare operating costs. Electricity is far cheaper than gasoline, and electric vehicles (EVs) require significantly less maintenance. In Kenya, for example, EVs save operators 80–90% on fuel and maintenance compared to internal combustion engine (ICE) vehicles. For heavy-duty buses, the savings are just as impressive: operating costs drop to $19.14–$28.50 per 62 miles (100 km) compared to $61.07 for diesel buses – a reduction of 53% to 68%.

High-mileage taxi fleets benefit the most from these reduced costs. With fewer moving parts, EVs avoid the frequent oil changes and engine tune-ups that ICE vehicles demand, slashing maintenance expenses. Solar off-grid charging systems add another layer of savings. By 2030, charging costs are expected to account for less than 4% of the total cost of ownership for small four-wheelers. A solar charging setup, including installation, for a vehicle driven around 31 miles (50 km) daily costs approximately $2,700, shielding operators from fluctuating global oil prices.

On a national scale, Rwanda’s shift to EVs demonstrates the potential for massive savings. The country is projected to save around $22 million annually on fuel imports. Looking ahead, by 2040, the total cost of ownership for battery-electric vehicles with solar charging is expected to fall below $24 per 62 miles (100 km), making EVs cheaper to own and operate than any fossil-fuel alternative. These financial benefits go hand-in-hand with the environmental gains outlined below.

Environmental Impact of Fleet Electrification

The environmental benefits of EV fleets are just as compelling as the financial ones. By eliminating tailpipe emissions, electric fleets tackle air pollution in African cities head-on. With transportation contributing 10% of Africa’s total greenhouse gas emissions, fleet electrification could reduce annual carbon emissions by 20% to 25% by 2040. Depending on how electricity is generated, EVs can achieve a 40% to 100% reduction in tailpipe carbon emissions compared to ICE vehicles. Over their entire lifecycle, EVs produce 65% to 85% fewer emissions.

EVs also improve urban life by reducing noise and exhaust fumes, making them a quieter and cleaner alternative in crowded cities. When paired with solar-powered charging hubs, operators can power their fleets entirely with renewable energy, sidestepping unreliable national grids and boosting sustainability. Additionally, used EV batteries can be repurposed for stationary solar energy storage, supporting a circular economy and minimizing waste.

Financing and Support for Fleet Electrification

Although upfront costs for EVs can be high, financing options are expanding rapidly. Fintech companies like M-KOPA and Watu Credit are offering digital loans tailored for electric motorcycles, making these vehicles more accessible to commercial riders without traditional credit. To scale electric two-wheelers across Africa, experts estimate that $3.5 billion to $8.9 billion in financing will be needed.

Government incentives are also easing the transition to EVs. Kenya provides VAT exemptions on electric motorcycles and buses, while Rwanda has removed import duties on EVs and batteries. South Africa plans to introduce a 150% tax deduction for investments in EV production assets by March 2026, and Nigeria offers 10-year tax holidays for EV manufacturers and operators.

International support is growing as well. In August 2023, the LEAP Fund awarded $1.05 million in grants to seven projects in South Africa, Uganda, and Zambia to promote zero-emission public transportation. Rebecca Fisher, Director of the Drive Electric Campaign, highlighted the importance of such initiatives:

"We believe that philanthropic investment can help build political will, drive public and private finance to the sector, and support green industrial development by shifting the market toward clean transportation".

Fleet operators can also explore flexible financing models to manage upfront costs effectively. For instance, BasiGo secured $42 million in funding to deploy 1,000 electric buses in Kenya and Rwanda, signaling strong investor confidence in EV fleets. In regions with unreliable power, solar-assisted charging hubs offer a practical solution, ensuring round-the-clock fleet availability while keeping energy expenses low.

How EV24.africa Supports Fleet Electrification in Africa

EV Options for Taxis, Delivery, and Corporate Needs

EV24.africa is helping fleet operators across Africa make the shift to electric mobility with a variety of vehicles designed for commercial use. Their offerings include everything from electric motorcycles (e-bodas) and three-wheelers for taxi and delivery services to full-sized electric cars and buses for corporate fleets. But they don’t stop at just providing vehicles – they also offer financing options, charging solutions, and after-sales support to make the transition as smooth as possible.

For taxi and delivery operators, EV24.africa has introduced rapid battery-swapping networks. These allow drivers to replace a depleted battery with a fully charged one in under two minutes – quicker than refueling a gas tank. This not only eliminates range anxiety but also maximizes uptime for commercial vehicles. Corporate fleet managers, on the other hand, can rely on the platform to simplify the often-complicated process of importing EVs and to connect with local service centers for ongoing maintenance.

Transparent Pricing and Financing Solutions

In addition to its wide vehicle selection, EV24.africa prioritizes affordability and financial flexibility. By focusing on local assembly, they reduce import duties and shipping costs, making EVs more accessible. The platform uses standard logistics strategies like CIF (Cost, Insurance, and Freight) and DDP (Delivered Duty Paid) to ensure clear and transparent pricing for cross-border deliveries.

To further ease adoption, EV24.africa offers flexible financing options tailored to different needs. These include pay-as-you-go plans, micro-loans, and lease-to-own arrangements. Younes Rabeh from African EV Market News captures the essence of their approach:

"An African EV marketplace functions as an entire ecosystem, not just a storefront. It bundles vehicles, financing, charging, and after-sales support into a single, accessible package, making the transition to electric mobility seamless and logical".

Shipping and Delivery Across Africa

EV24.africa doesn’t just provide vehicles – they ensure they reach every corner of the continent. The platform delivers to all 54 African countries, simplifying the entire process from browsing to import documentation and final delivery. This unified approach makes it easier for taxi companies, delivery services, and corporate fleets to acquire electric vehicles without the usual logistical headaches. By streamlining every step, EV24.africa is making fleet electrification a reality across Africa.

Conclusion: The Future of EV Fleets in Africa

Key Takeaways for Fleet Operators

Electric vehicle (EV) fleets in Africa are proving to be a game-changer, especially for high-mileage vehicles like taxis and delivery vans that clock over 62 miles daily. These vehicles stand to benefit the most from reduced fuel expenses and increased efficiency, making the transition to EVs a smart financial move.

For two-wheelers, battery-swapping technology ensures minimal downtime, while larger fleets like minibuses and delivery vans can rely on depot-based charging stations for overnight recharging without disrupting daily schedules. Fleet operators should also keep an eye on policy changes, such as Ethiopia’s internal combustion engine (ICE) ban and Kigali’s growing focus on electric motorcycles.

While upfront costs remain a challenge, solutions like fintech-driven financing are helping bridge the gap. In Kenya, companies like M-KOPA and Watu Credit are offering digital loans tailored for electric two-wheelers. This is supported by the widespread use of mobile money, with 40% of Kenyans aged 15 and older having access to mobile money accounts. These developments are paving the way for broader adoption and growth in the EV sector.

EV Fleet Growth Projections Beyond 2026

Looking ahead, Africa’s vehicle landscape is set to transform. By 2050, the continent’s total vehicle fleet is expected to double, with EVs playing a significant role in this expansion. Projections suggest that by 2040, electric models will account for 50% to 70% of two-wheeler sales. Adoption rates for electric vans and minibuses could range from 20% to 45%, depending on the progress of policies and infrastructure. This shift could lead to a 20% to 25% annual reduction in carbon emissions across all vehicle categories.

Passenger cars, however, may take longer to catch up, as used EVs are likely to remain less competitive until the mid-to-late 2030s, with ICE vehicles still dominating about 85% of the market. Despite this, the commercial fleet sector is set to lead the charge, driven by cost advantages, cleaner operations, and supportive policies. Fleet operators making the switch now can look forward to lower operating costs, improved air quality, and reduced reliance on fuel.

China’s BYD Powers South Africa’s First Large-Scale Electric Bus Fleet

FAQs

What government policies are encouraging EV adoption in Africa?

African governments are taking bold steps to encourage the adoption of electric vehicles (EVs) through a combination of financial incentives, industrial initiatives, and regulations. Many countries are cutting costs by reducing import duties, offering tax breaks, and providing subsidies or interest-free leasing options for EVs and their components. For instance, South Africa has introduced a 150% tax deduction for the production of EVs and hydrogen-powered vehicles. To further encourage local manufacturing, some governments are offering perks like rent-free land for charging stations and establishing special economic zones to support vehicle assembly and battery production.

Efforts to build EV infrastructure are also gaining momentum. Several nations are developing solar-powered charging stations and offering discounted electricity rates to EV owners. On the regulatory side, countries like Ethiopia are banning the import of new gasoline vehicles, while others are setting ambitious EV targets. Kenya, for example, aims for 5% of new vehicle imports to be electric by 2025, and Cape Verde is planning for 100% of vehicle sales to be electric by 2035. Together, these measures are making EVs more affordable and practical, setting the stage for a broader transition to electric mobility across Africa.

What are the benefits of using solar-powered charging stations for EV fleets in Africa?

Solar-powered charging stations present an efficient and eco-friendly solution for electric vehicle (EV) fleets across Africa, leveraging the continent’s plentiful sunlight. By producing electricity directly on-site, these stations sidestep the challenges of fluctuating and often high grid tariffs, slashing fueling expenses by as much as 83%. They also provide a reliable alternative to frequent power outages, ensuring vehicles stay charged and ready to operate.

Beyond the financial advantages, solar charging infrastructure plays a key role in reducing the environmental impact of fleet operations. Combining zero-emission vehicles with renewable energy sources allows businesses to achieve almost negligible lifecycle emissions. This not only strengthens their commitment to sustainability but also appeals to environmentally conscious customers. Additionally, solar charging hubs are designed to be modular and easy to set up, making it possible for fleets to expand into remote or underserved regions without having to wait for major grid infrastructure to catch up.

What financial incentives are available for businesses adopting EV fleets in Africa?

Governments across Africa are rolling out financial incentives to encourage businesses to transition their fleets to electric vehicles (EVs). Take South Africa, for instance – it’s gearing up to offer a 150% tax deduction for manufacturers of EVs and hydrogen vehicles starting in 2026. Over in Kenya, excise duties on EV imports have been reduced to 10%, and businesses benefit from discounted electricity rates for fleet charging. Meanwhile, Rwanda is stepping up with a full VAT exemption and rent-free land for building charging infrastructure. And in Ethiopia, the government has banned the import of new combustion-engine vehicles entirely, driving a significant shift toward EVs.

Several nations are also addressing upfront costs with import-related benefits. Senegal, for example, has scrapped both VAT and customs duties on fully electric vehicles under its 2025 Finance Act, while also simplifying the registration process. Beyond tax breaks, non-monetary perks like priority parking, reduced carbon taxes, and subsidies for private charging stations are becoming increasingly common.

These measures – spanning tax incentives, import benefits, and infrastructure support – are making EV adoption more accessible for taxis, delivery services, and corporate fleets across Africa.