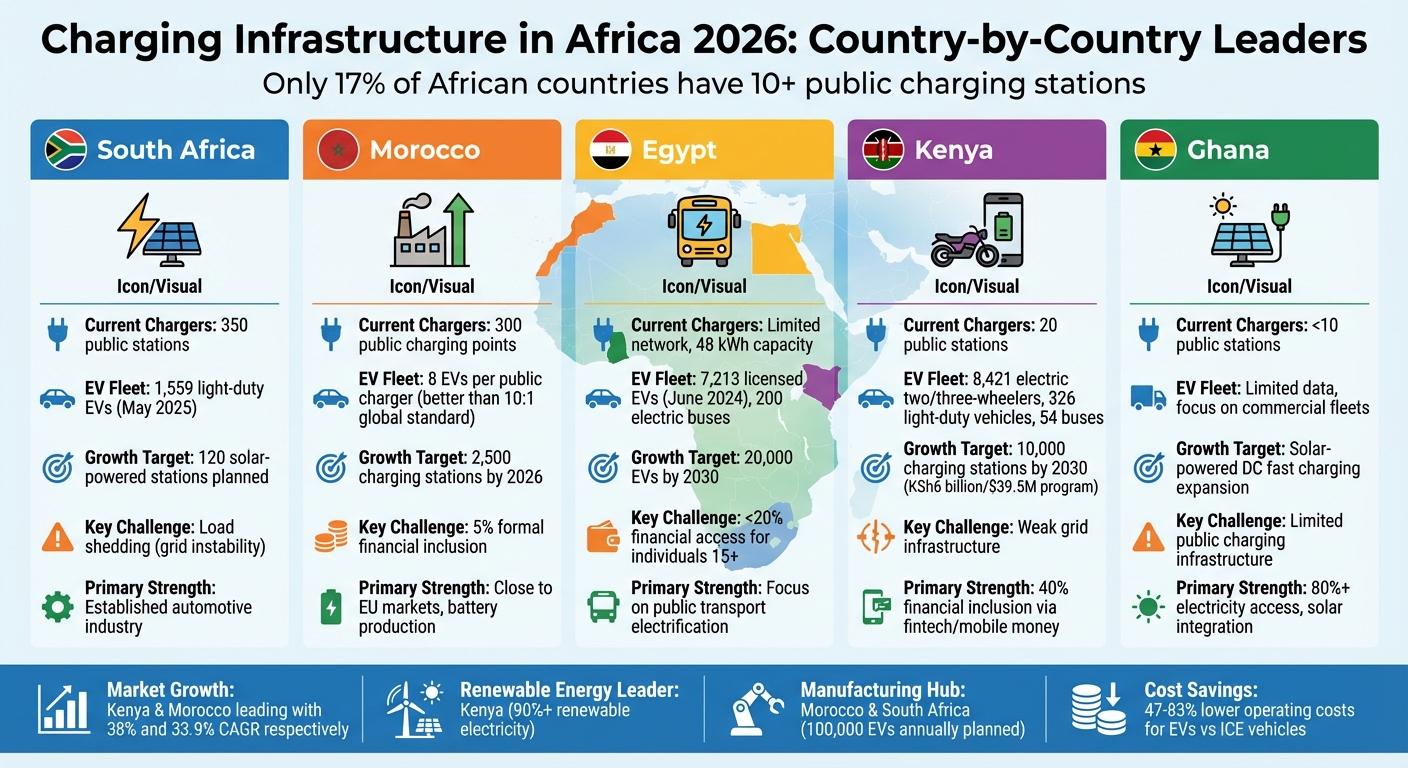

Africa’s electric vehicle (EV) market is growing, but charging infrastructure remains a major challenge. Only 17% of African countries have 10 or more public charging stations, making expansion critical for EV adoption. Here’s what you need to know:

- South Africa leads with 350 public chargers, but grid instability (load shedding) is a major issue.

- Morocco is rapidly scaling up, with plans for 2,500 chargers by 2026, backed by strong EV manufacturing efforts.

- Egypt focuses on electrifying public transport, with 200 electric buses, but private EV adoption lags due to limited charging capacity.

- Kenya prioritizes electric motorcycles and public transport, with plans for 10,000 charging stations by 2030.

- Ghana is adopting solar-powered chargers and targeting commercial fleet electrification, though private EV adoption remains low.

Each country is tackling unique challenges, from grid reliability to affordability, while exploring tailored solutions like solar charging, battery swapping, and fintech-driven financing. The race to expand EV infrastructure across Africa highlights both opportunities and hurdles, with South Africa, Morocco, and Kenya emerging as key players.

Africa EV Charging Infrastructure 2026: Top 5 Countries Comparison

1. South Africa

Current Infrastructure

South Africa stands out in Africa with 350 public charging stations as of 2023, making it the leader in EV infrastructure on the continent. However, most of these stations are concentrated in three major cities – Johannesburg, Cape Town, and Durban – and along the key transport routes connecting them. Companies like GridCars, in collaboration with automakers such as BMW and Jaguar, have played a significant role in developing this network, with nearly 50 charging stations operating free of charge, primarily at BMW service centers.

Even with this head start, EV adoption remains minimal, contributing to less than 0.5% of new car sales annually. By May 2025, the country had 1,559 light-duty EVs, the highest number in Africa but still a small share of the overall market. A notable shift is happening, though, with a growing focus on off-grid, solar-powered charging stations. In March 2025, CHARGE launched South Africa’s first solar-powered EV charging station in Wolmaransstad, North West, and has plans to establish 120 similar stations along major highways to address concerns about grid reliability. While the network is primarily urban, this approach hints at a more deliberate and sector-focused expansion.

Growth Rate to 2026

South Africa’s EV growth is gradual, largely driven by private initiatives, but significant acceleration is anticipated post-2026. Fleet electrification efforts in urban logistics, ride-hailing services, and public transport are expected to be the main drivers, as these sectors offer the steady demand needed to justify infrastructure investments. In late 2024, the state utility Eskom joined the EV landscape, marking a shift from private-led development to state-supported infrastructure. By August 2024, Eskom had installed its first charging stations at the Eskom Academy of Learning in Midrand, Johannesburg, featuring 60kW DC fast chargers and 22kW dual AC chargers in collaboration with GridCars.

"By investing in eMobility and the charging infrastructure needed for electric vehicles, we are not only reducing our carbon footprint but also stimulating the local economy and creating new opportunities for growth." – Gabriel Kgabo, General Manager, Eskom

Policy and Investment Drivers

Government incentives, like a 150% tax deduction for EV production, and BMW’s $238 million investment in its Rosslyn plant are paving the way for local EV manufacturing. However, full-scale production incentives are still in development. The 2021 Green Paper on New Energy Vehicles set out a vision for industrializing the EV sector, but as of early 2026, implementation remains a work in progress. On the downside, import duties of 15% plus additional ad valorem taxes continue to make EVs significantly pricier than traditional vehicles. While policies and investments are moving the needle, technical and geographic hurdles persist.

Key Challenges

Despite strides in policy and investment, South Africa faces several operational challenges. The most pressing issue is grid instability. Frequent rolling blackouts, known locally as "load shedding", erode consumer confidence and pose serious risks for charging station operators. To counter this, new projects are increasingly incorporating solar PV and Battery Energy Storage Systems (BESS). Other obstacles include the heavy urban concentration of charging stations, leaving rural areas underserved, and the lack of standardized charging protocols across private networks. These challenges highlight the infrastructure gaps that still need to be addressed.

2. Morocco

Current Infrastructure

Morocco has carved out a unique position in Africa’s EV landscape, blending established market strategies with ambitious growth plans. As of 2025, the country operates around 300 public charging points, mainly concentrated in urban hubs like Casablanca, Rabat, and Marrakech. However, rural areas lag behind due to the high costs of installing fast chargers and grid limitations. Morocco ranks as the 2nd most EV-ready country in Africa, earning its reputation as an "Emulator" of mature global markets. Impressively, the country boasts a ratio of 8 EVs per public charger, surpassing the global standard of 10:1. Additionally, Morocco’s 98.9% electricity access rate forms a strong foundation for expanding its charging network.

Growth Rate to 2026

Morocco’s EV infrastructure is on the brink of rapid expansion, driven by the Apime initiative, which aims to install 2,500 charging stations by 2026 – a nearly ninefold increase. The country is aligning its efforts with the broader African push for sustainable mobility. Projections show Morocco’s EV market growing at a 33.9% CAGR, with its value expected to rise from $0.15 billion in 2025 to $0.65 billion by 2030. Deployment efforts are concentrated along the Agadir-Tangier axis, ensuring coverage of high-traffic routes. On the manufacturing side, major players like Stellantis and Renault have set ambitious goals, planning to produce a combined 100,000 EVs annually by 2025. This surge in production is expected to fuel demand for charging infrastructure.

Policy and Investment Drivers

Morocco is positioning itself as a leader in EV production across the continent, leveraging its status as the 25th largest vehicle producer globally. Government policies are playing a key role, including a mandate requiring 30% of the state fleet to be electric or hybrid, which is helping to generate baseline demand. On the investment front, Chinese company Gotion High-Tech has committed a staggering $6.5 billion to build Africa’s first EV battery gigafactory, while Moroccan firms have contributed an additional $140 million toward charging infrastructure. To make EVs more financially appealing, the government offers reduced import taxes and VAT exemptions, bringing the five-year total cost of ownership for EVs down to $58,620, slightly under the $58,800 cost for conventional vehicles. Furthermore, recent updates to renewable energy laws aim to encourage private sector involvement in the electricity market.

Key Challenges

Despite its progress, Morocco faces several obstacles. The transport sector accounts for 35% of national energy consumption, putting significant pressure on the national grid, which has a capacity of 8.2 GW. Expanding charging infrastructure in rural areas is particularly costly, and the lack of standardized connector types across networks adds complexity. Financial inclusion is another hurdle, with only 5% of individuals accessing formal loans, making EV financing more difficult compared to countries like Kenya, where this figure reaches 40%. Morocco is exploring innovative solutions like Vehicle-to-Grid (V2G) systems and integrating charging stations with solar projects, such as the Noor Solar Complex. However, challenges around grid management and the lack of finalized interoperability standards remain barriers to attracting long-term private investment. These issues highlight the strengths and weaknesses of Morocco’s approach, setting the stage for further analysis in the following section.

3. Egypt

Current Infrastructure

Egypt is steadily building its electric vehicle (EV) infrastructure, ranking 5th in Africa for EV readiness with a score of 0.74. A major focus has been on electrifying public transportation. By early 2025, Greater Cairo had introduced 200 electric buses, marking the largest e-bus fleet in the country and a step toward reducing air pollution. On the private vehicle side, the numbers are more modest, with approximately 380 electric light-duty vehicles currently in use. By June 2024, the total number of licensed EVs reached 7,213. However, the charging infrastructure lags behind global standards. Most charging stations in Egypt have a capacity of only 48 kWh, far below the 150 kWh standard commonly seen in Europe. This results in charging times ranging from 30 minutes to 2 hours. While the existing infrastructure is functional, it highlights the need for significant upgrades, which are anticipated by 2026.

Growth Rate to 2026

Egypt’s EV market is gaining momentum. By 2025, projected revenue is expected to reach $5.3 million, with a goal of 20,000 EVs on the road by 2030. A key development occurred in February 2025, when a public-private partnership launched a nationwide EV charging network. This initiative includes both AC and DC fast chargers installed at busy gas stations. To support the increased energy demands, the Egyptian Electricity Transmission Company, in collaboration with AMEA Power, is developing 1,500 MWh of battery storage. This includes 500 MWh at Banban and 1,000 MWh at Zafarana.

Policy and Investment Drivers

Government initiatives are playing a crucial role in driving EV adoption. Tax exemptions and purchase subsidies make EVs more accessible, while investments in regulatory frameworks encourage private sector involvement in infrastructure development. Egypt is also making strides toward renewable energy, aiming for 42% of its power generation to come from renewable sources by 2030 and increasing this to 65% by 2040.

"Deploying battery storage is central to the country’s strategic vision and the Ministry’s plan to fully harness renewable energy resources." – Mahmoud Esmat, Minister of Electricity and Renewable Energy

"By joining forces with industry leaders, we are not only expanding charging infrastructure but also laying the groundwork for a more sustainable mobility ecosystem." – Nayer Fouad, Co-founder and CEO of Infinity

To further support these goals, the World Bank is providing analytics and advisory services to help overcome regulatory challenges and accelerate e-mobility adoption.

Key Challenges

Despite these advancements, Egypt faces notable hurdles. Fewer than 20% of individuals over the age of 15 have access to formal financial borrowing, making it difficult for many to afford the high upfront costs of EVs. This lack of financial inclusion limits consumer financing options, especially for private buyers. While Egypt’s EV impact score of 0.81 points to significant potential benefits – such as better air quality and reduced reliance on fossil fuels – scaling up from infrastructure readiness to widespread adoption remains a challenge. The focus on public transport electrification has laid a strong foundation, but expanding EV use among private owners will require creative financing solutions and broader economic accessibility.

4. Ghana

Current Infrastructure

Ghana ranks 9th in Africa for EV readiness, with a score of 0.70, putting it in the company of other high-performing nations like Kenya and Ethiopia. Over 80% of Ghanaian households have access to electricity, which provides a solid base for home charging solutions. However, the country lags in public charging infrastructure, with fewer than 10 public charging stations – a milestone achieved by just 17% of African countries.

In November 2025, the Energy Commission of Ghana launched a flagship solar-powered DC fast charging station at its Accra Head Office. Developed in collaboration with GIZ and the German Embassy, this project features 105 solar panels (61.43 kWp) and a 60 kWh lithium-ion battery. This clean energy initiative highlights a move toward grid-independent charging solutions, setting the stage for accelerated growth in Ghana’s EV infrastructure.

Growth Rate to 2026

Ghana’s EV strategy leans toward solar-powered charging stations and commercial fleet use rather than widespread private ownership. In May 2025, Moove, a mobility fintech company, expanded its EV ride-hailing operations to Ghana after successful launches in Nigeria and South Africa. This focus on commercial fleets addresses affordability challenges, especially since new EV models like the Hyundai Kona are priced above $55,000. By prioritizing solar integration and fleet-based adoption, Ghana aligns itself with innovative approaches seen in other leading African nations.

Looking further ahead, the government plans to transform traditional fossil fuel stations into multi-fuel hubs offering electricity and Compressed Natural Gas (CNG) by 2040. In November 2025, new regulations were introduced to standardize EV charging infrastructure and encourage private sector investment.

Policy and Investment Drivers

The Drive Electric Initiative (DEI), led by the Energy Commission, is central to Ghana’s EV infrastructure development. Minister for Energy and Green Transition, Hon. John Abdulai Jinapor, expressed strong support for solar-powered charging, stating:

"I endorse this project, your actions are deeply aligned with sustainable development goals, charging with solar is charging clean."

Acting Executive Secretary Mrs. Eunice Biritwum highlighted the broader impact of the initiative:

"The charging station sets a benchmark for climate-conscious innovation and a decisive shift toward green infrastructure."

Ghana’s EV impact potential score of 0.76 reflects the significant benefits the country could see in reducing fossil fuel reliance and improving urban air quality. International partnerships, especially with GIZ and the German Embassy, are playing a key role by providing funding and technical expertise for pilot projects.

Key Challenges

Despite the progress, Ghana faces hurdles in achieving widespread EV adoption. A 30% electricity price hike in early 2023, coupled with the high cost of EVs – often exceeding $55,000 – limits consumer affordability.

Infrastructure challenges go beyond charging stations, with a notable shortage of trained EV technicians. To address this, institutions like the West African Vehicle Academy and the Design and Technology Institute are working to train workers from the informal auto repair sector to handle EV maintenance. Additionally, while only about 6% of Ghanaian drivers travel more than 31 miles (50 km) daily, concerns about charging times and range anxiety persist. These barriers highlight the need for further strategic planning, which will be explored in the following sections.

sbb-itb-99e19e3

5. Kenya

Current Infrastructure

Kenya’s existing EV infrastructure includes 20 public charging stations concentrated in Nairobi and Mombasa. However, the country has launched an ambitious KSh6 billion ($39.5 million) program to establish 10,000 public charging stations by 2030. This initiative is divided into three phases: the first focuses on 17 key cities and the Mombasa–Busia transport corridor, the second expands to 23 additional cities, and the third aims to connect district capitals and satellite towns.

As of May 2025, Kenya’s EV fleet consisted of 8,421 electric two- and three-wheelers, 326 light-duty vehicles, and 54 electric buses. Kenya Power is currently rolling out 45 fast-charging stations across six counties – Nairobi, Mombasa, Kisumu, Nakuru, Eldoret, and Nyeri. To ease concerns about range limitations, the government plans to install charging stations every 15.5 miles (25 kilometers) along major highways. While the existing network is limited, these plans signal a significant push toward expanding EV infrastructure.

Growth Rate to 2026

Kenya’s EV market is on the verge of rapid growth, with a focus on commercial fleets rather than private vehicles. The market is expected to grow from $0.05 billion in 2025 to $0.25 billion by 2030, reflecting a compound annual growth rate (CAGR) of 38%. The expansion is largely driven by commercial vehicles, particularly motorcycle taxis (locally known as "boda bodas") and minibuses ("matatus").

Electric bus manufacturer BasiGo is a key player in this growth. By September 2025, the company had delivered 100 electric buses across Kenya and Rwanda. BasiGo operates its own charging hubs in Nairobi, where a two-hour charge supports a range of 155 miles (250 km). With $42 million in funding, the company plans to expand its fleet to 1,000 buses and has partnered with Chinese battery giant CATL as an official service provider.

Policy and Investment Drivers

Kenya has introduced several policy measures to encourage EV adoption. The Finance Act 2023 halved excise duties on EVs from 20% to 10%, and electric motorcycles and buses benefit from VAT exemptions. In 2025, Kenya Power opened a public charging station in Nairobi, offering free services as part of its broader goal to transition to a fully electric fleet by 2027.

The country’s reliance on renewable energy is another advantage. Over 90% of Kenya’s electricity comes from renewable sources like geothermal, hydro, and solar. With an installed energy capacity of 3,074.34 MW and peak demand at 2,056.67 MW, there’s a surplus available for EV charging. Additionally, driving 62 miles (100 km) in an EV costs 47% to 83% less than using a gasoline-powered vehicle.

Key Challenges

Despite these advancements, Kenya faces several hurdles. Infrastructure remains underdeveloped outside major urban centers, and grid instability requires an estimated $5.3 billion to modernize the transmission network. High electricity prices and the steep cost of EVs – often double that of traditional vehicles – are significant barriers to widespread adoption. Technical issues, such as the lack of standardization between connector types (CCS2 vs. CHAdeMO) and interoperability protocols, add to investor hesitation. Moreover, the current reliance on Level 2 chargers, which take 4–5 hours for a full charge, makes long-distance travel challenging without the planned fast-charging network.

China’s BYD Plans 200 to 300 Charging Stations in South Africa by End 2026

Strengths and Weaknesses by Country

Each country brings its own set of advantages and hurdles to the development of EV charging infrastructure. Here’s a closer look at how some nations in Africa are positioning themselves in this evolving landscape.

South Africa has a well-established automotive manufacturing industry, but its progress is hampered by the ongoing challenge of load shedding, which undermines energy reliability. Morocco benefits from its proximity to European markets and a strong focus on battery manufacturing. However, with only 5% formal financial inclusion, the country faces significant obstacles in making EV adoption accessible.

Egypt holds strong potential to reduce fossil fuel imports and improve urban air quality, but its heavy reliance on fossil fuels for power generation remains a concern. Kenya shines as a hub for fintech innovation, with the highest financial inclusion rate on the continent (40%) and a thriving ecosystem for digital lending, particularly for electric two-wheelers. Still, weak grid infrastructure poses a significant challenge. Ghana is seen as a high-readiness nation with promising policy initiatives, though its public charging network is still in its infancy.

These differences reflect two distinct strategies emerging in Africa: "emulator" countries like South Africa and Morocco are focusing on traditional passenger vehicle charging, while "innovator" countries like Kenya are leading in areas such as electric two-wheelers and battery swapping.

| Country | Primary Strength | Primary Weakness |

|---|---|---|

| South Africa | Established automotive industry; mature grid | Persistent power outages (load shedding) |

| Morocco | Close to EU markets; battery production focus | Very low formal financial inclusion (5%) |

| Egypt | High potential to reduce fossil fuel reliance | Heavy dependence on fossil fuel-based power |

| Kenya | Strong fintech sector; two-wheeler innovation | Weak grid infrastructure; low per capita income |

| Ghana | High readiness and policy potential | Limited public charging infrastructure |

This overview highlights the diversity of approaches shaping Africa’s EV landscape. The challenges – ranging from financial access and grid reliability to policy consistency – are as critical as infrastructure investments. At present, only 8 African countries meet the standards for high grid reliability, a key factor in enabling widespread EV adoption.

Conclusion

Drawing from the detailed country analyses, several trends and opportunities emerge in Africa’s growing EV market. Morocco and South Africa are at the forefront among "Emulator" countries, advancing their public charging networks for passenger vehicles. Both nations demonstrate strong readiness for EV adoption, backed by robust support from governments and private sectors. This creates promising opportunities for developers aiming to establish fast-charging networks along major transit routes, mirroring systems in more developed markets.

While emulator markets focus on stabilizing existing networks, Kenya is carving out a new path as an innovator. The country is making significant strides in electric two-wheelers and battery swapping, aided by its 40% financial inclusion through mobile money – the highest among African innovators. A notable milestone came in October 2024, when BasiGo secured $42 million to roll out 1,000 electric buses on high-use public transport routes. These buses promise operating cost savings of 47–83% compared to internal combustion engine (ICE) alternatives. Meanwhile, Ethiopia has taken a bold step by implementing a complete ban on ICE vehicle imports in 2024, positioning itself as a leader in accelerating the shift to electric mobility.

These developments highlight distinct opportunities for investors. For innovator markets like Kenya, the focus should be on the two-wheeler segment, where electric motorcycles are proving to be 25% cheaper over a five-year lifecycle compared to their ICE counterparts. In contrast, emulator markets such as Morocco and South Africa benefit from more developed grids and higher motorization rates, making them ideal for scaling passenger vehicle charging infrastructure. Businesses should prioritize electrification in commercial fleets – taxis, delivery vans, and buses – where the total cost of ownership already offers clear advantages. Collaborating with existing retail networks and gas stations to install Level 2 chargers, while integrating mobile money systems for pay-as-you-go charging, can unlock significant growth potential.

With only 17% of African countries currently hosting at least 10 public charging stations, early entrants have a unique chance to lead. By pairing charging stations with battery storage solutions, companies can address peak demand challenges and manage supply fluctuations effectively.

FAQs

What are the biggest challenges to expanding EV charging infrastructure in Africa?

Expanding the EV charging infrastructure in Africa comes with a set of tough challenges, particularly when it comes to financing, electricity grids, and regulatory issues.

One of the biggest obstacles is securing the funding needed for widespread charger installations. Many countries across the continent face difficulties in attracting the capital required for such large-scale projects. On top of that, weak and often unreliable electricity grids in many areas make it hard to support fast-charging networks, which depend on a steady and consistent power supply to function effectively.

Regulatory hurdles add another layer of complexity. Inconsistent standards and fragmented permitting processes across different regions discourage long-term investments, slowing down progress. To make matters worse, most charging stations are currently clustered in urban areas, leaving rural regions largely without access.

Tackling these challenges head-on is crucial to speeding up the development of EV infrastructure across Africa by 2026.

How are African countries addressing challenges with unreliable power grids to support EV charging?

Many African countries are addressing the challenge of unreliable power grids by linking electric vehicle (EV) charging infrastructure with broader efforts to enhance electricity systems and incorporate renewable energy. To attract private investments in solar-powered or hybrid charging hubs, governments are rolling out policies such as tax breaks, subsidies, and even offering free land. These measures aim to reduce dependence on unstable national grids.

In regions with weak grid connections, off-grid solutions are gaining traction. Solar-powered chargers and battery storage systems are being promoted to provide consistent charging options. Kenya, for instance, is focusing on battery-swapping stations for electric motorcycles. This approach not only reduces strain on the grid but also allows for quick recharging. Similarly, Rwanda is incentivizing private companies to set up solar-linked charging stations through tax exemptions and land grants. South Africa, on the other hand, is working to strengthen its grid while integrating renewable energy sources, ensuring its expanding public charging network can meet growing demand. These initiatives are paving the way for reliable power as EV adoption continues to rise across the continent.

What are some innovative ways Africa is driving EV adoption?

Africa is taking bold steps to speed up the adoption of electric vehicles (EVs), tackling both infrastructure gaps and policy hurdles. In Kenya, a promising solution is being tested: battery-swapping stations for motorcycles. This system lets riders exchange drained batteries for fully charged ones in minutes, eliminating long wait times. Meanwhile, South Africa is attracting private investment, with plans to roll out up to 300 fast-charging stations by 2026, ensuring better coverage along major travel routes.

On the policy side, Rwanda is making strides by offering tax breaks and free land to encourage private companies to set up charging stations, with a focus on electric motorbikes. To further support progress, tools like the Africa EV Readiness and Impact Index are providing governments and investors with critical data to allocate resources more effectively. Together, these initiatives are shaping a path toward broader and faster EV adoption across the continent.