Africa is accelerating its transition to electric vehicles (EVs) through various government policies aimed at boosting adoption and manufacturing. Here’s a snapshot of efforts in three key countries:

- South Africa: A 150% tax deduction for EV production investments will start in March 2026. However, high import duties (25%) on EVs make them less affordable for consumers. Infrastructure growth is led by private companies like GridCars.

- Kenya: Tax cuts, including a halved excise duty (10%) on EVs and VAT exemptions, have driven EV adoption. Investments in charging infrastructure and battery-swapping models are underway to support growth.

- Rwanda: Import duty waivers and 0% VAT on pure EVs aim to lower costs. The government is encouraging private investment in charging stations and battery-swapping for motorcycles and tuktuks.

Challenges

- Charging infrastructure remains underdeveloped across all three nations.

- South Africa’s coal-heavy power grid reduces the environmental benefits of EVs.

Opportunities

- Kenya and Rwanda focus on affordability and infrastructure, while South Africa targets local manufacturing and exports.

Each country is adopting tailored strategies to address local challenges and promote EV adoption.

1. South Africa’s EV Incentives

Tax Benefits

South Africa is making a strong push to boost its electric vehicle (EV) manufacturing sector by offering a 150% tax deduction for investments in EV production facilities. For example, a $1 million investment can result in a $1.5 million tax write-off. However, there’s a catch: if the equipment stops being used primarily for EV production within five years, the deduction drops significantly to just 50% of the asset’s cost.

This program, while generous, comes with a price tag. It’s expected to cost the government $27.1 million in foregone tax revenue for fiscal year 2026/27 and has been allocated a total of $52.3 million over three years. These funds aim to support both manufacturing and infrastructure initiatives.

The Automotive Business Council (Naamsa) has praised the legislation, calling it "a crucial step in attracting investments, fostering innovation, and enhancing the sector’s growth within South Africa". These incentives have also sparked parallel investments in EV infrastructure, laying the groundwork for the industry’s expansion.

Infrastructure Development

The manufacturing incentives are complemented by efforts to improve EV infrastructure, with private companies stepping up to the challenge. Companies like Zero Carbon Charge and GridCars have been instrumental in expanding the country’s charging network. Additionally, the government has allocated $54.27 million (R1 billion) through its industrial development support program to scale up production facilities and related infrastructure by 2035.

A notable example of these efforts is BMW Group South Africa. In October 2024, the company began producing the X3 30e xDrive plug-in hybrid at its Rosslyn plant in Pretoria. This milestone followed a $227.8 million (R4.2 billion) investment in electrifying the plant, training workers, and developing local suppliers. This demonstrates how manufacturing incentives can translate into tangible infrastructure advancements.

Consumer Accessibility

While manufacturing and infrastructure are gaining momentum, consumer adoption of EVs remains a challenge. One major hurdle is the high import duties on EVs. South Africa imposes a 25% import duty on EVs, compared to just 18% for gasoline vehicles. This disparity makes imported EVs significantly more expensive. As a result, EV sales in the first three quarters of 2024 totaled only 1,079 units, while traditional hybrids reached 9,447 units during the same period.

Toyota’s locally-produced Corolla Cross Hybrid stands out as a success story. In 2024, it accounted for 10,109 sales – representing 74% of all hybrid sales in South Africa. Refilwe Ramatlhodi-Ndhlovu, Manager of Corporate Communications at Toyota South Africa Motors, explained:

"The local production of the Corolla Cross Hybrid has made hybrid technology more affordable and accessible to South African buyers".

This example underscores how domestic manufacturing can lower costs and improve accessibility, even in the absence of direct subsidies for consumers.

sbb-itb-99e19e3

2. Kenya’s E-Mobility Policies

Tax Benefits

Kenya has introduced tax incentives to encourage the adoption of electric vehicles (EVs), similar to initiatives seen in South Africa. The government has halved excise duty on fully electric cars from 20% to 10% and waived it entirely for locally assembled electric motorcycles. Energy Cabinet Secretary Davis Chirchir highlighted this commitment, stating:

"Locally assembled E-motorcycles are exempted from excise duty and affordability of the electric vehicle batteries has been prioritised through VAT and Import duty exemptions".

The Finance Bill 2025, which takes effect in July 2025, extends these tax breaks to electric bicycles, buses, and vehicle batteries by exempting them from VAT and import duties . These policies have driven remarkable growth: EV sales surged from just 65 units in 2018 to 4,047 units in 2023, with the sector achieving an 86% compound annual growth rate between 2020 and 2024. These tax incentives are also paving the way for improvements in charging infrastructure.

Infrastructure Development

Kenya’s energy regulator, EPRA, has mandated the establishment of strategically located, universally compatible charging stations. To support this, Kenya Power is investing 10 billion Kenyan shillings (around $83 million) to expand its network for the e-mobility sector. In October 2025, the utility company began installing 45 fast-charging stations across six counties as part of a nationwide rollout plan.

Additionally, the government has introduced a special e-mobility electricity tariff to make charging more affordable. The tariff is set at $0.12/kWh during peak hours and $0.058/kWh during off-peak hours, with capped fees to further reduce costs . With 91% of Kenya’s energy coming from renewable sources as of July 2023, the country offers one of the cleanest energy mixes for EV charging in Africa. These initiatives are helping to close the gap between policy ambitions and consumer adoption.

Consumer Accessibility

Kenya has prioritized making EVs more accessible, with a particular focus on electric motorcycles, which made up 4,862 of the 5,924 registered EVs by the end of 2024. To address high upfront costs, companies have adopted battery-as-a-service models. For example, Nairobi-based BasiGo secured 5.43 billion Kenyan shillings (approximately $30.5 million) in funding from British International Investment and the U.S. Development Finance Corporation.

In September 2025, ARC Ride raised $10 million to expand its battery-swapping network for electric two-wheelers. Meanwhile, the government has allocated 6 billion Kenyan shillings (about $39.5 million) to install 10,000 public charging stations by 2030. Projections suggest that EVs will account for 5% of all new vehicle sales by the end of 2025. Energy Cabinet Secretary Davis Chirchir underscored the government’s long-term vision:

"E-mobility will contribute significantly to our goal of achieving a 100 percent transition to renewable energy by 2030".

3. Rwanda’s NST2 Tax Waivers

Tax Benefits

Rwanda’s NST-2 framework offers a range of incentives aimed at promoting electric vehicle (EV) adoption. Starting February 2025, the Rwandan Ministry of Finance and Economic Planning introduced exemptions for pure EVs from Value Added Tax (VAT), withholding tax, and excise duty. For the 2024/2025 fiscal year, the government also implemented a 0% import duty rate for electric vehicles, hybrid vehicles, and electric motorcycles. Additionally, businesses investing in the e-mobility sector can benefit from a reduced corporate income tax rate of 15%.

In early 2025, Rwanda shifted its focus to cleaner technologies by reinstating VAT, withholding tax, and excise duty on hybrid vehicles while keeping full tax exemptions for pure EVs. Explaining this move, the Ministry of Finance and Economic Planning stated:

"This initiative aims to promote the purchase of efficient vehicles, prevent Rwanda from becoming a dumping ground for outdated hybrids, and contribute to environmental sustainability".

These measures not only make EVs more affordable for consumers but also encourage private sector investment in the growing e-mobility market.

Infrastructure Development

Rwanda’s tax policies are also designed to stimulate private sector investment in e-mobility infrastructure. Eng. Alfred Byiringiro, Director General for Transport, highlighted the broader goal:

"The incentives will also play a role to mobilize investment into the e-mobility sector which has rapidly emerged as a key sector".

The reduced 15% corporate tax rate supports investments in e-mobility, energy, and mass transit, paving the way for the construction of charging stations and battery-swapping facilities. Companies like Ampersand, Volkswagen Rwanda, Rwanda Electric Motorcycles, Safi Universal Links, and Guraride are already key players in the country’s e-mobility landscape. A particular focus has been placed on developing battery-swapping infrastructure for motorcycles and tuktuks, which account for over 95% of electric vehicles currently in use in the region.

Consumer Accessibility

These tax incentives have significantly lowered the cost of EV ownership in Rwanda, making them a more accessible option for both individuals and businesses. The 0% import duty is reviewed annually to ensure it aligns with Rwanda’s economic recovery strategies and environmental goals. By removing VAT, excise duty, and import duties on pure EVs, the government has reduced the overall cost of ownership compared to conventional vehicles.

This initiative is part of Rwanda’s broader Vision 2050 plan, which aims to achieve carbon neutrality and a green economy [18, 19]. Additionally, the government is promoting a cashless economy to complement EV adoption and support technological advancement. Through this integrated approach, Rwanda is setting an example for other African nations looking to embrace electric mobility and sustainable development.

Rwanda’s E-mobility revolution accelerates

Pros and Cons

Electric Vehicle Incentives Comparison: South Africa vs Kenya vs Rwanda

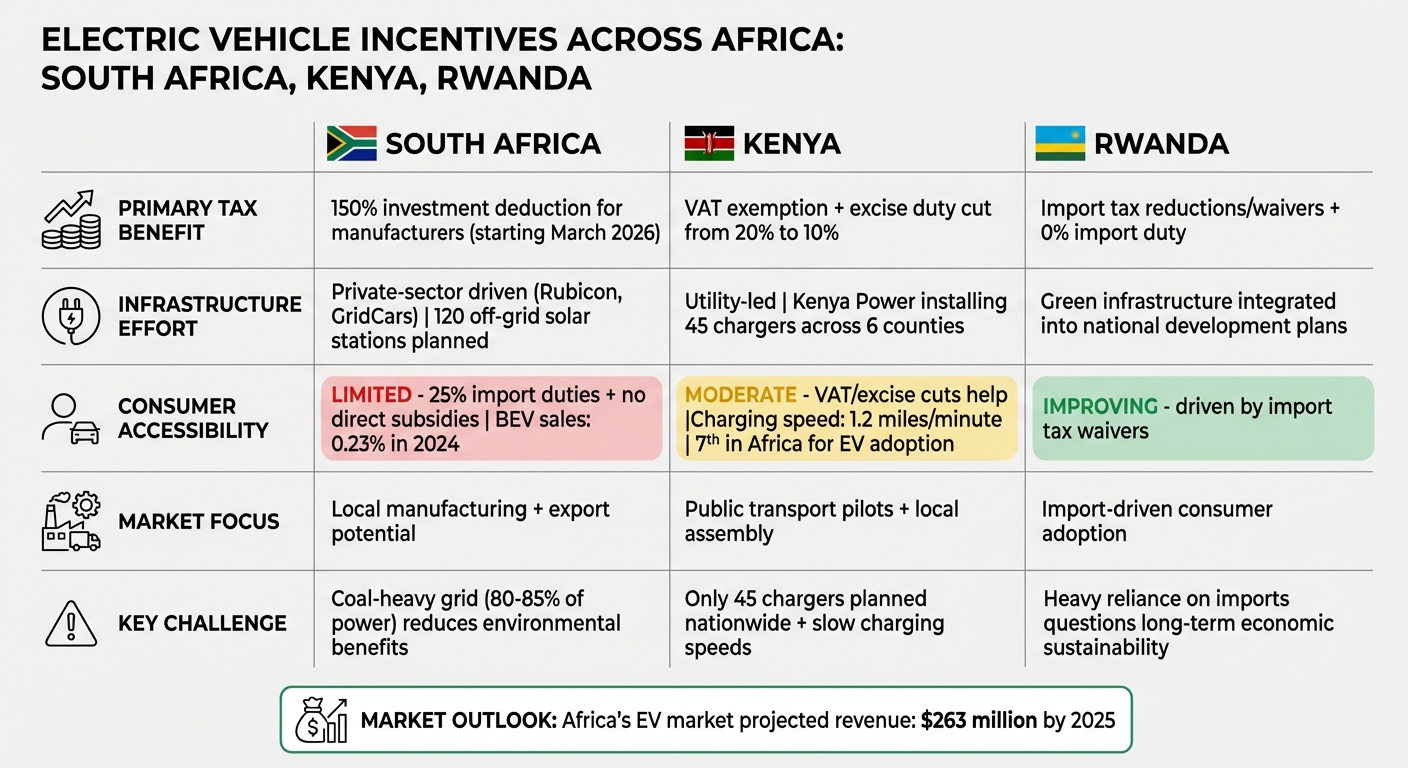

Here’s a closer look at how South Africa, Kenya, and Rwanda are approaching the transition to electric vehicles (EVs), highlighting their strategies, challenges, and opportunities:

South Africa is banking on a 150% manufacturer tax deduction, set to take effect in March 2026, and the development of a private charging network. Plans include 120 off-grid solar-powered stations to support infrastructure growth. However, 25% import duties and the absence of consumer subsidies have kept battery electric vehicle (BEV) sales extremely low – just 0.23% in 2024.

Kenya’s National E-Mobility Policy offers VAT exemptions and cuts excise duty from 20% to 10%, placing it among the top EV adopters in Africa at 7th place. Yet, progress is slow. The country has just 45 planned chargers nationwide, and charging efficiency remains an issue – electric minibuses, for instance, charge at a sluggish rate of 1.2 miles per minute.

Rwanda, on the other hand, is focused on import tax waivers to make EVs more affordable while incorporating green infrastructure into its broader development plans. But its heavy reliance on imports raises questions about the long-term economic benefits of this strategy.

The table below summarizes the key features of each country’s approach:

| Feature | South Africa | Kenya | Rwanda |

|---|---|---|---|

| Primary Tax Benefit | 150% investment deduction for manufacturers (starting 2026) | VAT exemption and excise duty cut from 20% to 10% | Import tax reductions/waivers |

| Infrastructure Effort | Private-sector driven (Rubicon, GridCars); 120 off-grid solar stations planned | Utility-led; Kenya Power installing 45 chargers across 6 counties | Green infrastructure integrated into national plans |

| Consumer Accessibility | Limited; hampered by 25% import duties and no direct subsidies | Moderate; VAT/excise duty cuts help, but charging speeds remain a barrier | Improving; driven by import tax waivers |

| Market Focus | Local manufacturing and export potential | Public transport pilots and local assembly | Import-driven consumer adoption |

Despite their efforts, all three countries are grappling with the same fundamental issue: underdeveloped charging infrastructure. South Africa’s reliance on a coal-heavy grid (accounting for 80–85% of power generation) also undercuts the environmental benefits of EV adoption. Still, Africa’s EV market is expected to grow significantly, with revenues projected to reach $263 million by 2025.

Conclusion

Kenya is focusing on affordability through tax cuts, South Africa is encouraging local production with a 150% manufacturer deduction, and Rwanda is leveraging import duty waivers to promote early electric vehicle (EV) adoption while incorporating green infrastructure into its national development plans. While these strategies differ, they all face similar challenges when it comes to infrastructure.

Kenya’s tax incentives aim to make EVs more accessible to consumers quickly, while South Africa and Rwanda are looking at the bigger picture, targeting long-term goals such as job creation and sustainable transformation. Rwanda, in particular, is attempting to strike a balance between encouraging early adoption and building a self-sustaining ecosystem for electric mobility.

However, infrastructure remains a major bottleneck. For instance, South Africa’s reliance on coal for 80 to 85% of its electricity diminishes the environmental benefits of EVs. Additionally, the lack of adequate charging stations in various regions creates practical barriers for EV users.

To ensure these policies achieve their full potential, significant investments in charging infrastructure and renewable energy are essential. A combined effort – pairing strong policy incentives with infrastructure development – will be key to driving Africa’s shift to electric mobility forward.

FAQs

What challenges are slowing the adoption of electric vehicles in Africa?

Electric vehicles (EVs) hold great potential, but their adoption in Africa is fraught with obstacles. One of the biggest challenges is the high upfront cost. Taxes and import duties can inflate the price of an EV by as much as 45%, making them significantly more expensive than traditional gas-powered cars. This price gap makes EVs less accessible to the average consumer.

Another major issue is the lack of reliable charging infrastructure. In many African countries, charging stations are scarce, and even where they exist, inconsistent electricity supply adds another layer of difficulty. This makes owning and operating an EV impractical for daily use in many areas.

Financing is also a sticking point. Even with tax breaks or incentives, many individuals and businesses struggle to find affordable financing options. Low-interest loans or leasing plans are often unavailable, making the initial investment in an EV financially daunting. Compounding this issue is the reliance on imported EVs, which raises costs and creates supply chain headaches for parts and maintenance.

On top of these hurdles, systemic issues like underdeveloped battery recycling systems and vague policy frameworks further complicate efforts to scale EV adoption. Without clear policies or recycling solutions, long-term sustainability becomes a challenge.

Solving these problems will require a multi-faceted approach, including reforms in taxation, investments in charging infrastructure, better financing options, and support for local EV manufacturing.

What tax incentives are available for electric vehicles in South Africa, Kenya, and Rwanda?

In South Africa, the government has introduced appealing tax benefits to promote the production of electric vehicles (EVs). Thanks to the Taxation Laws Amendment Act of 2024, manufacturers are eligible for a 150% income tax deduction on expenses tied to buildings, machinery, and plants used in producing battery-electric or hydrogen-powered vehicles. This incentive is available for assets put into use between March 1, 2026, and March 1, 2036. On the flip side, South Africa imposes a 25% import duty on fully assembled EVs, which is noticeably higher than the 18% duty applied to conventional vehicles. Additionally, investments in EV production benefit from VAT exemptions, further sweetening the deal for manufacturers.

Meanwhile, Kenya and Rwanda lag behind in offering detailed or structured tax incentives for EVs. Reports indicate that their current focus leans more toward electric motorcycles, with limited or unclear frameworks for encouraging passenger EV production. While South Africa has laid out concrete policies to drive EV manufacturing, Kenya and Rwanda are still in the early phases of developing comparable initiatives.

How does infrastructure impact the success of electric vehicle policies in Africa?

Infrastructure plays a key role in shaping the success of electric vehicle (EV) policies across Africa. While tax breaks and reduced import duties help lower the upfront cost of EVs, their effectiveness is limited if drivers don’t have access to dependable charging stations. A sparse charging network can significantly undermine convenience and confidence, discouraging potential buyers from making the switch to EVs.

To tackle this challenge, governments are combining financial incentives with investments in charging infrastructure. This includes installing public fast chargers along highways, introducing workplace and home charging options, and upgrading the electrical grid to handle increased demand. Building a reliable charging network not only supports the growing interest in EVs but also ensures that financial incentives translate into real-world benefits, making EV ownership more practical and accessible for both individuals and businesses.