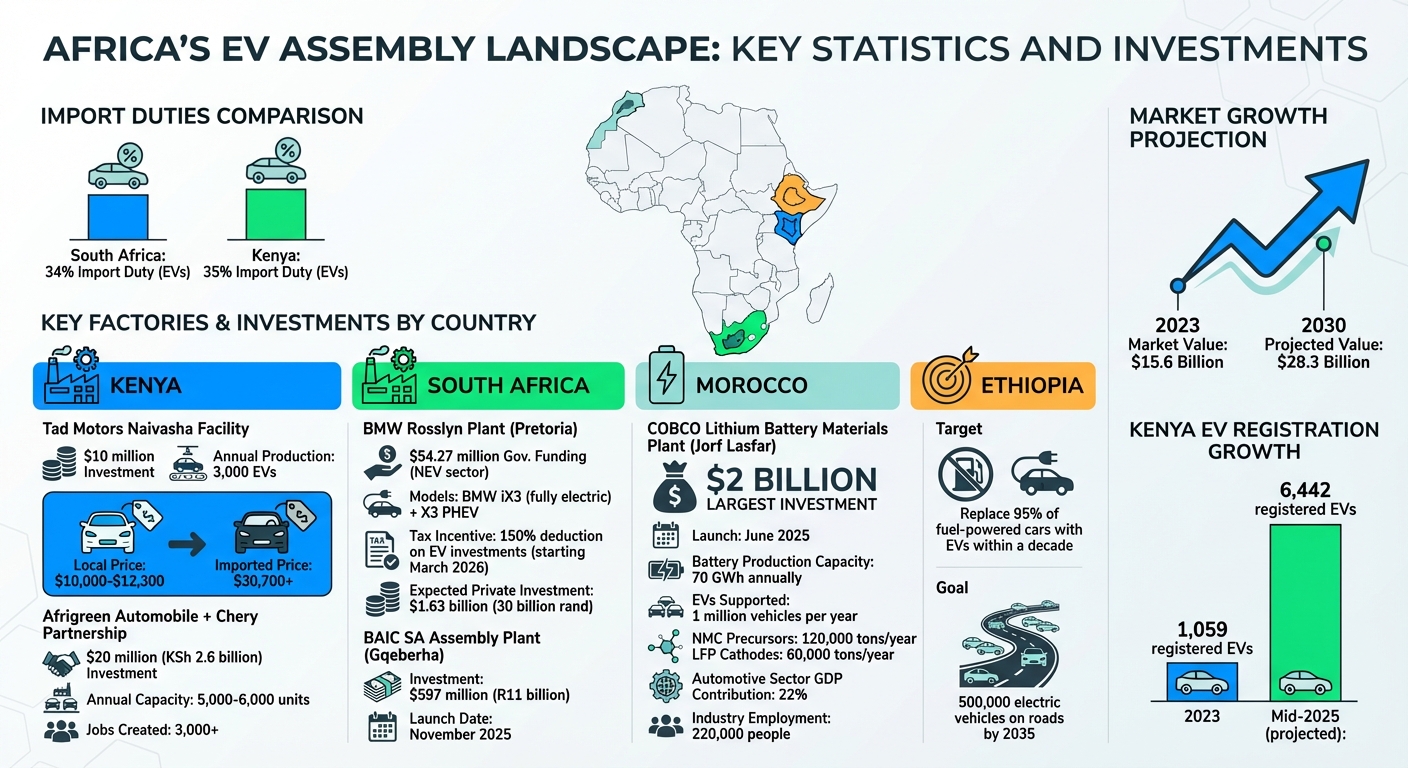

Africa is shifting gears in the electric vehicle (EV) market by focusing on local assembly instead of relying on imports. Why? High import duties – like 34% in South Africa and 35% in Kenya – make imported EVs too expensive. Local production not only cuts costs but also creates jobs and tailors vehicles for African conditions.

Here’s what’s happening:

- Kenya: Tad Motors launched a $10M facility in Naivasha to produce 3,000 EVs annually. Afrigreen Automobile partnered with Chery in 2024 to build a $20M assembly plant.

- South Africa: BMW’s Rosslyn plant now produces EVs, backed by $54.27M in government funding for new energy vehicles.

- Morocco: A $2B battery materials plant opened in 2025, producing components for one million EVs annually.

- Ethiopia: Plans to replace 95% of fuel-powered cars with EVs within a decade.

Governments are encouraging this shift with tax breaks, reduced import duties, and funding. For example, South Africa offers a 150% tax deduction on EV-related investments starting March 2026.

The result? Affordable EVs, like Tad Motors’ sedans priced at $10,000–$12,300, compared to imported models costing $30,700+. This transformation is not only making EVs accessible but also positioning Africa as a key player in the global EV market.

Africa EV Assembly Investment and Production Statistics by Country

Ghana Is Partnering With Tesla Rival BYD To Construct An Electric Vehicle Assembly Plant

Key EV Assembly Factories in Africa

Africa is making strides in localized electric vehicle (EV) production, with several key facilities driving this transformation. By producing vehicles and essential components domestically, these factories are tackling challenges like affordability and accessibility while strengthening local industries and reducing reliance on imports.

LUG West Africa Assembly Plant, Nigeria

Located in Lagos, the LUG West Africa plant is addressing Nigeria’s lack of public EV charging stations in a unique way – by integrating EV chargers into street lighting systems. This approach uses existing urban infrastructure to expand EV charging networks while the facility focuses on assembling electric vehicles. Additionally, international brands are repurposing older facilities in the region to support the shift toward EV production.

BMW Rosslyn Plant, South Africa

In Pretoria, BMW’s Rosslyn plant plays a pivotal role in South Africa’s transition to EVs. This facility produces the fully electric BMW iX3 and the X3 plug-in hybrid (PHEV) models. To facilitate this shift, BMW has revamped the plant and retrained its workforce, transitioning from traditional engine assembly to EV production. As part of South Africa’s broader plan to modernize its automotive sector – one of the largest in sub-Saharan Africa – this initiative aims to align the industry with new energy vehicle targets by 2035. The Rosslyn plant demonstrates how existing automotive infrastructure can be adapted to meet the demands of the EV era, blending legacy operations with forward-looking strategies.

COBCO Lithium Battery Materials Plant, Morocco

The COBCO Lithium Battery Materials Plant in Jorf Lasfar, Morocco, is a game-changer for the regional EV supply chain. This $2 billion joint venture between Morocco’s Al Mada investment fund and China’s CNGR Advanced Materials began operations in June 2025. The plant focuses on manufacturing NMC (nickel-manganese-cobalt) and precursor cathodes for lithium-ion batteries, with an annual production capacity of 70 GWh – enough to power around one million EVs. It also aims to produce 120,000 tons of NMC precursors and 60,000 tons of LFP (lithium iron phosphate) cathodes each year.

By producing these critical battery components locally, COBCO significantly reduces costs. As an Innoson Motors representative put it:

"It just doesn’t make sense to import batteries and major components".

This facility not only strengthens Morocco’s position as a leader in regional automotive manufacturing but also supports an industry that contributes 22% to the nation’s GDP and employs 220,000 people.

Upcoming EV Assembly Plans and Investments

The electric vehicle (EV) assembly scene in Africa is gaining momentum, with automakers – both established giants and fresh contenders – announcing ambitious projects across the continent. This shift from importing vehicles to local production is expected to lower costs and create thousands of jobs. Here’s how some key players are driving this transformation.

BYD’s EV Assembly Negotiations in Ghana

Chinese automaker BYD is in discussions with the Ghanaian government to establish a full-scale EV assembly plant. This move could make Ghana a central hub for EV production in West Africa, building on the country’s existing automotive infrastructure, which includes skilled technicians and robust maintenance networks. The plant would produce a variety of vehicles, including sedans, SUVs, and commercial trucks. A key factor fueling this plan is the anticipated surge in EV demand as Ghanaian businesses transition their fleets to electric by 2026, creating an immediate market for locally assembled vehicles.

Toyota‘s EV Production Plans in South Africa

While BYD focuses on West Africa, Toyota is making strides in the southern region. Toyota South Africa Motors (TSAM) plans to introduce three battery electric vehicle (BEV) models by 2026, aligning with the company’s global goal of achieving carbon neutrality. This effort is bolstered by South Africa’s government, which offers a 150% tax deduction on qualifying investments in electric and hydrogen-powered vehicles starting March 1, 2026. Additionally, the government has allocated 1 billion rand (approximately $54.27 million) to support local production of EVs and batteries, aiming to attract 30 billion rand in private sector investments.

Refilwe Ramatlhodi-Ndhlovu, Corporate Communications Manager at TSAM, highlighted the growing interest in Toyota’s electrified models:

"Demand for Toyota’s hybrid models has grown significantly in recent years… reflecting increasing consumer confidence and interest in our electrified mobility".

This trend is evident in Toyota’s sales figures: in 2024, the company sold 13,604 hybrid vehicles in South Africa, more than double the previous year’s numbers.

New Assembly Projects in Kenya and Ethiopia

East Africa is also becoming a focal point for EV assembly projects. Kenya, for instance, is attracting significant investments. In August 2024, Afrigreen Automobile and Chery signed a KSh 2.6 billion ($20 million) deal to set up an assembly plant in the country. With an annual production capacity of 5,000 to 6,000 units, this plant is expected to generate at least 3,000 jobs. Additionally, Dongfeng has partnered with Associated Vehicle Assemblers (AVA) to begin local assembly of passenger and light commercial EVs by 2026.

Ethiopia is ramping up its EV ambitions as well. In April 2025, the Ethiopian government initiated discussions with China’s Shanghai Launch Automotive Technology Company to establish EV manufacturing facilities and a research and development center. This follows the assembly of 100 electric buses by the Belayneh Kindie Metal Engineering Complex using Chinese components. The government has set a bold goal: to have 500,000 electric vehicles on Ethiopian roads within the next decade, replacing 95% of the country’s fuel-powered vehicles.

sbb-itb-99e19e3

Government Policies and Market Incentives Supporting EV Assembly

Across Africa, governments are rolling out a variety of incentives to attract electric vehicle (EV) manufacturers and position the continent as a competitive hub for production. These initiatives include tax breaks, direct funding, and measures to lower costs associated with retooling and battery supply chains. Here’s a closer look at how these policies are driving investment in EV assembly.

South Africa’s EV Investment Incentives

South Africa stands out with some of the most comprehensive EV incentives on the continent. Starting March 1, 2026, the government will offer a 150% tax deduction on qualifying investments in electric and hydrogen vehicle production assets, such as buildings, plants, and machinery. This policy is expected to cost 500 million rand ($27.14 million) in tax revenue for the 2026/27 period.

Additionally, the government has allocated 1 billion rand ($54.27 million) through its Industrial Development Support Programme to promote New Energy Vehicle (NEV) and battery projects. This funding aims to strengthen local assembly capacity and is projected to attract 30 billion rand in private sector investment, creating a ripple effect across the automotive industry. Mikel Mabasa, CEO of the National Association of Automobile Manufacturers of South Africa, highlighted the importance of these measures:

"This financial incentive is a crucial step in attracting investments, fostering innovation, and driving the growth of the EV sector within South Africa."

The Automotive Investment Scheme (AIS) provides additional support through non-taxable cash grants. These grants cover 20% of the qualifying investment value for original equipment manufacturers and 25% for component and tooling manufacturers. To qualify, manufacturers must assemble "completely knocked down" (CKD) kits locally, rather than relying on imported finished vehicles. Temporary reductions in battery import duties further cut costs for vehicles produced and sold domestically.

| Incentive Type | Benefit | Target Group |

|---|---|---|

| Investment Allowance | 150% tax deduction on qualifying assets | EV and hydrogen vehicle producers |

| AIS Cash Grant | 20% of qualifying investment value | Original Equipment Manufacturers |

| AIS Cash Grant | 25% of qualifying investment value | Component and tooling manufacturers |

| Direct Funding | $54.27 million support fund | NEV and battery projects |

| Import Duties | Temporary reduction on battery duties | Local vehicle producers |

Regional Support for EV Infrastructure Development

Beyond local assembly efforts, regional policies are helping to streamline cross-border trade and improve resource access. While South Africa leads with its robust measures, other African nations are also introducing incentives to support EV infrastructure. Countries like Togo, Ghana, Benin, Uganda, Tanzania, and Zambia have implemented tax breaks for battery-electric vehicles, making them more affordable and appealing to manufacturers. These initiatives are part of broader frameworks like the African Continental Free Trade Area (AfCFTA), which aims to lower import tariffs and facilitate cross-border trade of locally assembled vehicles.

The Southern Africa Development Community (SADC) is working on regional incentives to establish a cross-border electric battery value chain, covering everything from mineral refinement to final vehicle assembly. South Africa’s Department of Trade and Industry, in collaboration with the Department of Mineral Resources, is leading a regional critical minerals strategy. This strategy focuses on securing and refining essential materials like copper, cobalt, and lithium, connecting Africa’s raw material wealth directly to EV manufacturing and reducing reliance on imported components.

Strategic partnerships are also playing a key role in infrastructure development. For instance, the R11 billion ($597 million) BAIC SA assembly plant in Gqeberha, South Africa, launched in November 2025, is a joint venture between China’s BAIC and South Africa’s state-owned Industrial Development Corporation, which holds a 35% stake. Tebogo Makube, Deputy Director-General at the Department of Trade, Industry and Competition, underscored the significance of these collaborations:

"The partnership that we have with the government of China has led to an increase in bilateral trade, driven by investments such as this one."

Conclusion and Future Outlook

Africa’s electric vehicle (EV) assembly sector is gaining momentum. With operational factories like Tad Motors in Kenya and substantial government backing – such as South Africa’s $54.27 million incentive package – the continent is proving its capacity to produce EVs on a large scale. These initiatives are attracting global players like BYD and Toyota, positioning Africa as a rising force in the global EV industry. Beyond showcasing production capabilities, these developments also pave the way for tackling key market challenges.

Local assembly is already making EVs more accessible by cutting down high import tariffs. Regional trade agreements further reduce costs, slashing prices by up to 30%. For instance, Kenya’s decision to eliminate taxes on the first 100,000 locally manufactured EVs has spurred market growth, with registered electric vehicles expected to jump from 1,059 in 2023 to 6,442 by mid-2025.

Renewable energy is playing a critical role in this transformation. Solar-powered charging networks, like CrossBoundary Energy’s 36-unit setup, are helping to address grid limitations while reducing emissions. These stations currently support over 10,000 electric two-wheelers in Nairobi, illustrating how renewable solutions can lower operational costs and expand EV infrastructure. With the African EV market projected to grow from $15.6 billion in 2023 to $28.3 billion by 2030, local assembly is not just creating jobs but also building technical expertise and keeping more capital within African economies.

To sustain this progress, investments in infrastructure and workforce development are essential. Reliable power within industrial parks, harmonized tax policies across borders, and vocational training for precision manufacturing are critical steps. The micro-factory model, which produces 10,000 to 20,000 units annually, offers a practical alternative to massive mega-plants. This approach allows multiple nations to join the EV value chain without requiring enormous upfront investments.

Collaboration is the cornerstone of Africa’s EV assembly future. Governments, manufacturers, and regional organizations must work together to ensure success. Initiatives like the Southern Africa Development Community’s cross-border battery value chain and South Africa’s critical minerals strategy highlight the importance of coordinated efforts to secure materials for local production. As Alp Tilev of Ampersand aptly stated:

"The value chain needs to develop locally if we are to stay ahead".

With strategic partnerships, tailored incentives, and designs suited to local needs, Africa has the potential to shift from being a market dependent on imported vehicles to becoming a key global hub for affordable and sustainable electric mobility.

FAQs

How are local EV assembly plants in Africa contributing to jobs and economic growth?

Local electric vehicle (EV) assembly plants in Africa are becoming a powerful driver of job creation and economic growth. By focusing on local assembly rather than relying on imports, these facilities are generating well-paying jobs across manufacturing, supply chains, and infrastructure. They’re also expanding opportunities for women and young workers, encouraging entrepreneurship, and reducing reliance on foreign imports.

The numbers tell a compelling story. In 2024, Africa’s automotive assembly output surpassed 1.1 million vehicles, with South Africa and Morocco taking the lead. The sector contributes approximately 5% to South Africa’s GDP and brings in over $17 billion annually in exports for Morocco. This growth sustains hundreds of thousands of jobs, both directly and indirectly, while boosting regional trade and enhancing technical expertise.

Investments in EV manufacturing are also playing a key role in economic diversification. Electric mobility projects generate three times more jobs per dollar compared to fossil fuel industries. Projections suggest the sector could create up to 14 million jobs across the continent in the coming years. These advancements are positioning African economies to embrace a more sustainable and resilient future.

What incentives are African governments offering to promote local EV production?

African governments are rolling out a variety of measures to encourage local electric vehicle (EV) production. These efforts include financial subsidies, tax incentives, and investment programs aimed at making EV assembly more practical and appealing. For instance, South Africa has earmarked $54 million in its 2025 budget to support initiatives like new-energy vehicle plants, battery production, and related supply chain development. Beginning March 1, 2026, manufacturers will also gain access to tax allowances for large-scale EV projects, making it easier to invest in this growing sector. On the consumer side, incentives like tax rebates and direct subsidies are being explored to encourage more people to embrace EVs.

In Morocco, the government is taking a slightly different approach by introducing business-friendly policies. These include expedited factory approvals and upgrades to infrastructure, such as dedicated freight railways, to attract international automakers. While not all of these measures are specifically focused on EVs, they contribute to building a supportive environment for their production.

Through a mix of direct funding, tax breaks, streamlined regulations, and strategies to secure mineral supplies, African nations are positioning themselves to compete in the global EV market.

How does assembling electric vehicles locally in Africa impact their price and availability compared to importing them?

Local assembly of electric vehicles (EVs) in Africa brings down costs and makes these vehicles more accessible. By using completely knocked-down (CKD) or semi-knocked-down (SKD) kits for on-site assembly, manufacturers can bypass hefty import duties and avoid the high costs of long-distance shipping. This approach often saves buyers several thousand dollars compared to fully imported EV models, making them a more affordable option for local consumers.

Another advantage is quicker delivery times, as domestically assembled vehicles can hit the market faster. Take Rwanda’s Ampersand, for instance. Their locally produced two-wheelers are not only cheaper upfront but also offer ongoing savings on fuel, which is especially beneficial for taxi operators and everyday users. Beyond lowering prices, this approach helps build a regional supply chain, opening the door for more people across Africa to embrace electric mobility.