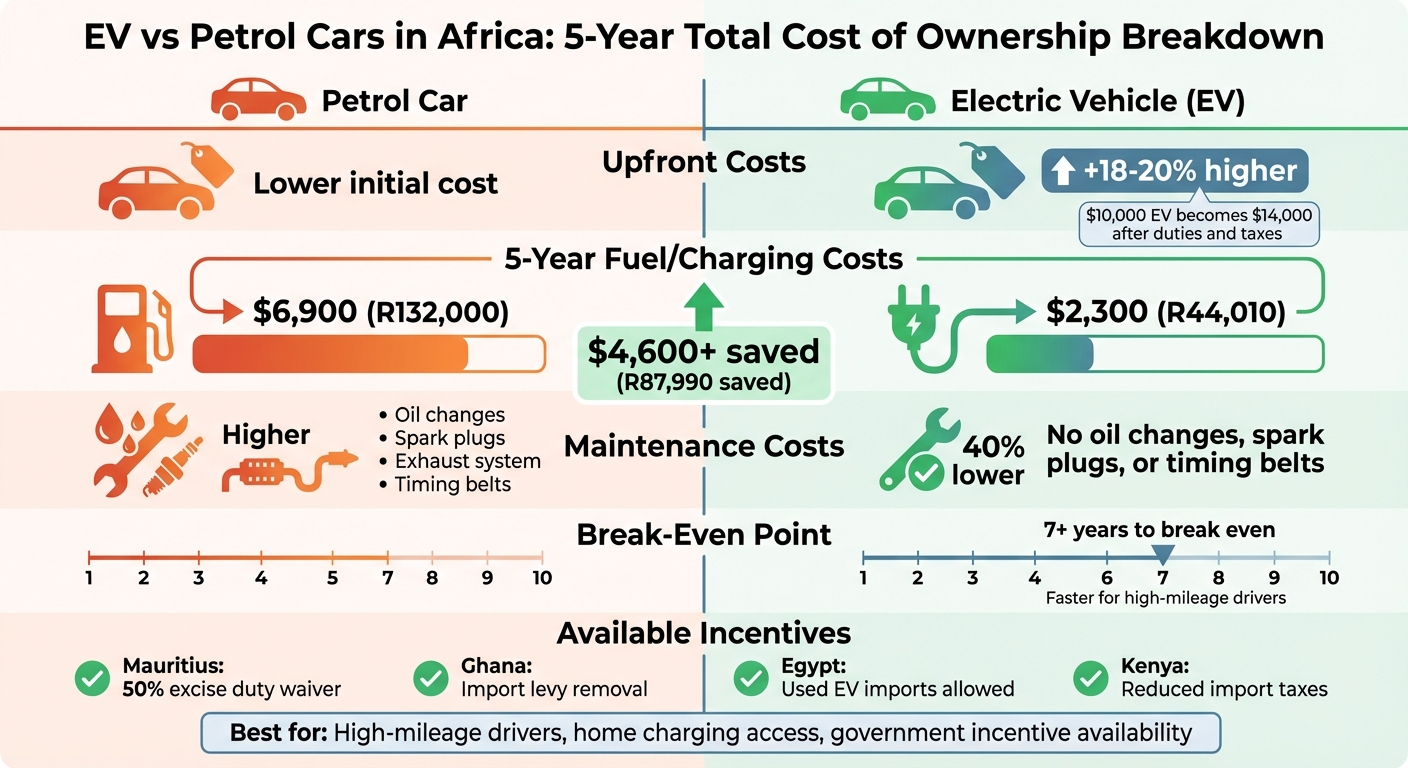

Choosing between an EV and a petrol car in Africa boils down to understanding the Total Cost of Ownership (TCO). While petrol cars have lower upfront costs, EVs offer long-term savings in fuel and maintenance. Here’s the breakdown:

- Upfront Costs: EVs cost 18–20% more than petrol cars due to import duties and taxes. For example, a $10,000 EV might cost $14,000 after fees.

- Fuel vs Charging: Charging an EV costs significantly less. Over five years, petrol costs about $6,900, while EV charging costs around $2,300, saving over $4,600.

- Maintenance: EVs are simpler to maintain, with fewer moving parts, cutting maintenance costs by 40% compared to petrol cars.

- Incentives: Some countries, like Mauritius and Ghana, offer tax breaks or reduced duties for EVs, but these don’t always offset higher initial costs.

- Break-Even Point: EVs can become cheaper to own after 7+ years, depending on mileage, charging access, and government policies.

Quick Comparison:

| Category | Petrol Car | Electric Vehicle (EV) |

|---|---|---|

| Upfront Cost | Lower | 18–20% higher |

| Fuel/Charging | $6,900 (5 years) | $2,300 (5 years) |

| Maintenance | Higher (engine upkeep) | Lower (fewer parts) |

| Break-Even Point | Not applicable | ~7 years (varies by usage) |

For high-mileage drivers or those with access to affordable charging, EVs can offer long-term savings. However, limited infrastructure and higher purchase prices still make petrol cars the more accessible option for most buyers today.

EV vs Petrol Car 5-Year Total Cost of Ownership in Africa

Electric Cars Don’t Make Sense In South Africa

Purchase Prices: EVs vs. Petrol Cars

When it comes to buying a car in Africa, the upfront costs for electric vehicles (EVs) and petrol cars show a noticeable difference. On average, EVs are priced 18% to 20% higher than their petrol counterparts as of 2025. This price gap is influenced by factors like import duties, tax policies, and the widespread reliance on used vehicles in many African markets.

For example, a $10,000 EV can end up costing $14,000 once you factor in 15% import duties, 20% registration fees, and an additional 5% CO₂ tax. The situation gets more complex in countries like Algeria, Sudan, South Africa, Egypt, and Morocco, where used vehicle imports are completely banned – though Egypt does allow used EV imports. Kenya, on the other hand, tightened its rules in 2019, banning the import of vehicles older than five years. Let’s break down the costs for both EVs and petrol vehicles.

EV Purchase Costs

If you browse EV24.africa, you’ll find options from brands like BYD, Leapmotor, Tesla, and Nissan. While prices vary across African countries depending on local taxes, Chinese EV models stand out for their affordability, averaging 60% lower costs than non-Chinese brands. Even though battery prices have dropped to around $100 per kWh, which helps reduce the overall cost, high import duties in Africa can still push EV prices sky-high – sometimes doubling the cost compared to locally assembled models.

Petrol Car Purchase Costs

Petrol cars, like the Toyota Corolla, dominate African roads because of their lower upfront price, ease of maintenance, and the widespread availability of spare parts. In Ghana, the petrol-powered Toyota Corolla is often used as a baseline for cost comparisons. Across the continent, at least 85% of vehicles are used cars, which makes petrol vehicles even more appealing due to their lower initial investment and simpler servicing needs compared to new EVs.

Fuel vs Charging Costs: 5-Year Operating Expenses

Driving 15,000 kilometers annually highlights a clear difference between the costs of fueling a petrol car and charging an electric vehicle (EV). Over five years, this gap plays a significant role in overall ownership expenses. Let’s break down the numbers to see how petrol fueling compares to EV charging.

Petrol Fuel Costs

Fueling a petrol car takes up a major chunk of operating expenses. In South Africa, where petrol prices average around R22.00 per liter, a car that consumes 8 liters per 100 kilometers will need about 1,200 liters of fuel each year. That’s an annual cost of R26,400, assuming prices remain stable (which they rarely do). Over five years, this adds up to R132,000 – a hefty sum that underscores the ongoing expense of petrol-powered vehicles.

EV Charging Costs

Charging an EV flips the equation. With electricity rates averaging R3.26 per kWh in South Africa and an EV consuming roughly 18 kWh per 100 kilometers, the annual energy usage comes to 2,700 kWh, costing just R8,802. EVs are far more efficient, converting between 60% to 85% of electrical energy into motion, unlike petrol engines that lose over 60% of fuel energy to heat and friction. Charging at home reduces costs even further compared to public fast chargers. Plus, regenerative braking in city traffic allows EVs to reclaim an extra 10% to 15% of energy, further improving efficiency.

5-Year Fuel vs Charging Cost Comparison

When you compare the five-year costs, the difference is striking. Petrol car owners spend R132,000 on fuel, while EV owners pay just R44,010 for charging. That’s a savings of R87,990 over five years. This cost advantage is a key factor in offsetting the higher upfront price of EVs. Studies suggest that EVs can be 3 to 5 times cheaper per mile to operate than petrol cars, making them a financially smart choice in the long run – even in regions where electricity infrastructure is still evolving.

| Expense Category | Petrol Vehicle | Electric Vehicle |

|---|---|---|

| Energy Price | R22.00 / Liter | R3.26 / kWh |

| Average Consumption | 8.0 L / 100 km | 18.0 kWh / 100 km |

| Annual Energy Cost (15,000 km) | R26,400 | R8,802 |

| 5-Year Energy Total | R132,000 | R44,010 |

| 5-Year Savings | – | R87,990 |

sbb-itb-99e19e3

Maintenance and Servicing Costs

When analyzing total cost of ownership (TCO), maintenance costs highlight another major difference between electric vehicles (EVs) and petrol cars. EVs are mechanically simpler, with far fewer moving parts. They lack components like pistons, valves, timing belts, and exhaust systems, which means no oil changes, spark plug replacements, or engine tune-ups. On average, EV maintenance and repair costs are about 40% lower per mile compared to similar petrol vehicles.

EV Maintenance Costs

Routine servicing for EVs is minimal. Thanks to regenerative braking, brake pads last longer, which is especially helpful in the stop-and-go traffic typical of many urban areas in Africa. Maintenance for EVs generally includes tire rotations, replacing cabin air filters, and the occasional battery coolant check.

"Without spark plugs to replace or oil to change, electric vehicles have a clear leg up on maintenance costs." – Courtney Lindwall, NRDC

That said, there are challenges in some African countries. According to G.K. Ayetor, a researcher focused on EV adoption in Ghana:

"A significant maintenance skills gap and limited spare parts availability challenge EV adoption in Ghana and other countries in Africa."

Finding technicians with the expertise to handle high-voltage systems can be tricky, and importing spare parts individually may lead to longer repair times. Despite these hurdles, the long-term savings on maintenance remain a strong point in favor of EVs.

Petrol Car Maintenance Costs

Petrol cars, with their complex mechanical systems, require frequent servicing. Regular tasks include oil and filter changes every 3,000 to 6,000 miles (or 5,000 to 10,000 kilometers), along with periodic replacements for spark plugs, timing belts, and brake pads. In many African countries, poor fuel quality adds to engine wear, further increasing maintenance demands.

Maintenance Cost Comparison Over Time

Over the course of ownership, the cost advantage of EVs becomes more evident. Petrol cars accumulate regular expenses for engine servicing and part replacements, while EVs benefit from their simpler design and fewer scheduled maintenance tasks. Over time, this translates to notable savings for EV owners.

Taxes, Incentives, and Insurance Costs

Government policies like import duties, tax rebates, and insurance premiums play a major role in determining how affordable vehicles are across Africa.

Government Incentives for EVs

To encourage the use of electric vehicles (EVs), several African countries have introduced tax incentives. For instance, Mauritius offers a 50% excise duty waiver on electric and hybrid vehicles. This policy has led to a dramatic increase in hybrid registrations, jumping from just 43 in 2009 to 11,841 by 2019. Similarly, pure EV registrations grew from a mere 2 in 2011 to 132 by 2019.

In Ghana, the government eliminated the import levy on fully electric vehicles to support local assembly efforts. However, studies show this measure only reduces the cost per mile by 2.5%. Despite the levy removal, owning an EV in Ghana still costs at least 13.5% more than owning a petrol vehicle.

Egypt has taken a different approach by allowing the import of used electric vehicles while banning most used petrol cars. Kenya, on the other hand, enforces age restrictions on imported petrol vehicles and is working to lower import taxes for EVs.

While these policies aim to make EVs more accessible, recurring costs like road taxes and insurance significantly affect the overall economics of owning an EV.

Road Taxes and Insurance Premiums

Annual registration fees and insurance premiums are ongoing expenses that add to the cost of owning an EV. In Africa, insurance for EVs tends to be higher than for petrol cars. This is largely because premiums are calculated based on the vehicle’s higher purchase price. Additionally, factors like specialized technology, costly battery replacements, and the limited availability of spare parts and expertise drive up insurance rates.

Tax and Incentive Comparison Table

| Country | Primary EV Incentive | Impact on Ownership |

|---|---|---|

| Mauritius | 50% Excise Duty Waiver | Hybrid registrations soared from 43 to 11,841 (2009–2019) |

| Ghana | Import Levy Removal | 2.5% reduction in cost per mile; EVs cost 13.5% more to own |

| Egypt | Used EV Import Allowance | Permits used EV imports while banning most used petrol cars |

| Kenya | Age Restrictions/Tax Reductions | Age limits on imported petrol vehicles; reducing EV import taxes |

Although these incentives provide some financial relief, they often don’t bring EV ownership costs down to the level of high-volume petrol models. According to the International Energy Agency, reducing upfront costs through subsidies or tax cuts can make EVs more competitive in terms of total ownership expenses.

5-Year Total Cost of Ownership Analysis

Complete TCO Comparison Table

When you look at the total cost of owning a car over five years, the purchase price only accounts for about 50% of the expenses. The rest comes from energy and maintenance costs. Here’s a side-by-side comparison of a petrol car versus an electric vehicle (EV) in many African markets:

| Cost Category | Petrol Car (5-Year) | Electric Vehicle (5-Year) |

|---|---|---|

| Purchase Price | ~$21,780 (e.g., Kia Sportage) | Up to 40% more due to battery costs |

| Fuel/Charging | ~$3,950 (for 50,000 km) | Much lower with stable electricity |

| Maintenance | Higher (oil, filter, exhaust care) | Lower (fewer moving parts, no oil changes) |

| Taxes/Insurance | Standard road taxes | Possible tax incentives |

| Total Annual TCO | ~$2,532 (at 10,000 km/year) | ~$2,611 (at 10,000 km/year) |

If you’re considering hybrid cars, like the Toyota Prius, they can cut your cost per mile by up to 30% compared to traditional petrol cars. This table sets the stage for understanding when the operational savings of an EV outweigh its higher upfront cost.

Break-Even Point: When EVs Cost Less

So, when does an EV actually save you money? The break-even point – when an EV becomes cheaper to own than a petrol car – usually happens after about 7 years. This is when the lower running costs of an EV make up for its higher initial price. However, in many African countries, this timeline can stretch further. Factors like higher interest rates on car loans and limited government incentives play a big role. For instance, in Ghana, removing the import levy only reduces costs by 2.5%, which pushes the break-even point beyond five years.

How much you drive each year also makes a huge difference. If you’re driving roughly 100 km per day, you’ll hit the break-even point much faster than someone who drives less, like urban commuters. Fleet operators – such as taxi or delivery services – stand to gain the most because their high mileage means they can quickly recover the EV’s price premium through savings on fuel and maintenance.

Final Thoughts for African Car Buyers

While EVs come with a higher price tag upfront, their long-term savings on fuel and maintenance gradually close the cost gap. Plus, battery prices are dropping, while the cost of petrol and diesel vehicles is climbing due to stricter emission standards. In Ghana, for example, petrol cars emit about 3.35 times more CO₂ than EVs, making EVs a cleaner option. This is especially important as transportation emissions in the region are growing by around 7% each year.

For high-mileage drivers, those with access to home charging (which costs about $826 to install in Ghana), or buyers who can leverage government incentives, EVs become even more attractive. Ghana’s energy surplus of 98.59 GWh could, in theory, power about 1.5 million EVs. With the expansion of charging infrastructure and new tax incentives on the horizon, the cost gap between EVs and petrol cars is expected to narrow further as battery prices continue to decrease and operational efficiencies improve.

FAQs

How do government incentives reduce the cost of owning an EV in Africa?

Government programs are making it easier and more affordable to own an electric vehicle (EV) in Africa. Many nations are stepping up with perks like slashing or completely waiving import duties, offering tax breaks, and providing subsidies. For instance, by reducing or removing import taxes on EVs, governments can significantly bring down their purchase prices.

Beyond that, there are other incentives, such as lower registration fees or financial assistance for setting up home charging stations. These efforts not only help balance out the higher initial cost of EVs but also make the long-term savings on things like maintenance and charging more attainable for potential buyers.

What challenges come with maintaining an EV in Africa?

Maintaining an electric vehicle (EV) in many African countries comes with its fair share of hurdles. One of the biggest challenges is the shortage of skilled technicians and specialized repair facilities. Most local mechanics aren’t trained to work with high-voltage EV systems, which means owners often have to travel long distances or endure long waits to find qualified service. On top of that, spare parts are typically imported, leading to delays and driving up replacement costs.

The hot climate in many parts of Africa adds another layer of difficulty. High temperatures can speed up battery wear and tear, making proper care and monitoring crucial. Unfortunately, access to the necessary expertise and tools for this kind of upkeep is often limited. When you combine these issues with the sparse availability of charging stations, it’s clear that routine maintenance can quickly become a complicated – and expensive – task for EV owners in the region.

How does the number of miles you drive affect the cost savings of owning an EV?

The more you drive, the quicker you can offset the higher upfront cost of an electric vehicle (EV). That’s because EVs are cheaper to run and maintain per mile compared to gas-powered cars. Over time, these savings stack up, making EVs a smart financial choice for those who rack up the miles.

Take this for example: while EVs often come with a higher price tag initially, their reduced fuel costs and lower maintenance needs – like skipping oil changes and replacing brakes less often – help frequent drivers reach the break-even point faster. On the other hand, if your daily drives are short, it might take longer to see those financial perks.