BYD, a leading electric vehicle (EV) manufacturer, is expanding its footprint in Africa, focusing on Nigeria, Ghana, and Kenya. With over 3.02 million EVs sold globally by 2023, BYD sees Africa’s low motorization rate and growing interest in clean transportation as an opportunity. Here’s what you need to know:

- Why Africa? Africa’s motorization rate is just 43 vehicles per 1,000 people, far below the global average of 197. Public transportation dominates urban travel, making it a key entry point for EVs.

- Challenges: Limited charging infrastructure, unreliable electricity, and high vehicle costs are barriers. However, BYD’s plug-in hybrids and battery-swapping solutions address these issues.

- Government Support: Kenya leads with tax incentives and policies promoting EVs. Ghana offers duty waivers, while Nigeria lags in policy development.

- BYD’s Strategy: Partnering with local companies like BasiGo in Kenya, BYD is investing in local assembly, charging networks, and service centers. It also offers affordable models tailored to African markets.

BYD’s entry into these countries marks a step toward cleaner transportation, economic growth, and job creation. However, challenges like infrastructure gaps and vehicle affordability must be addressed for broader adoption.

Ghana to Become West Africa’s Electric Vehicle Hub? BYD Says YES.

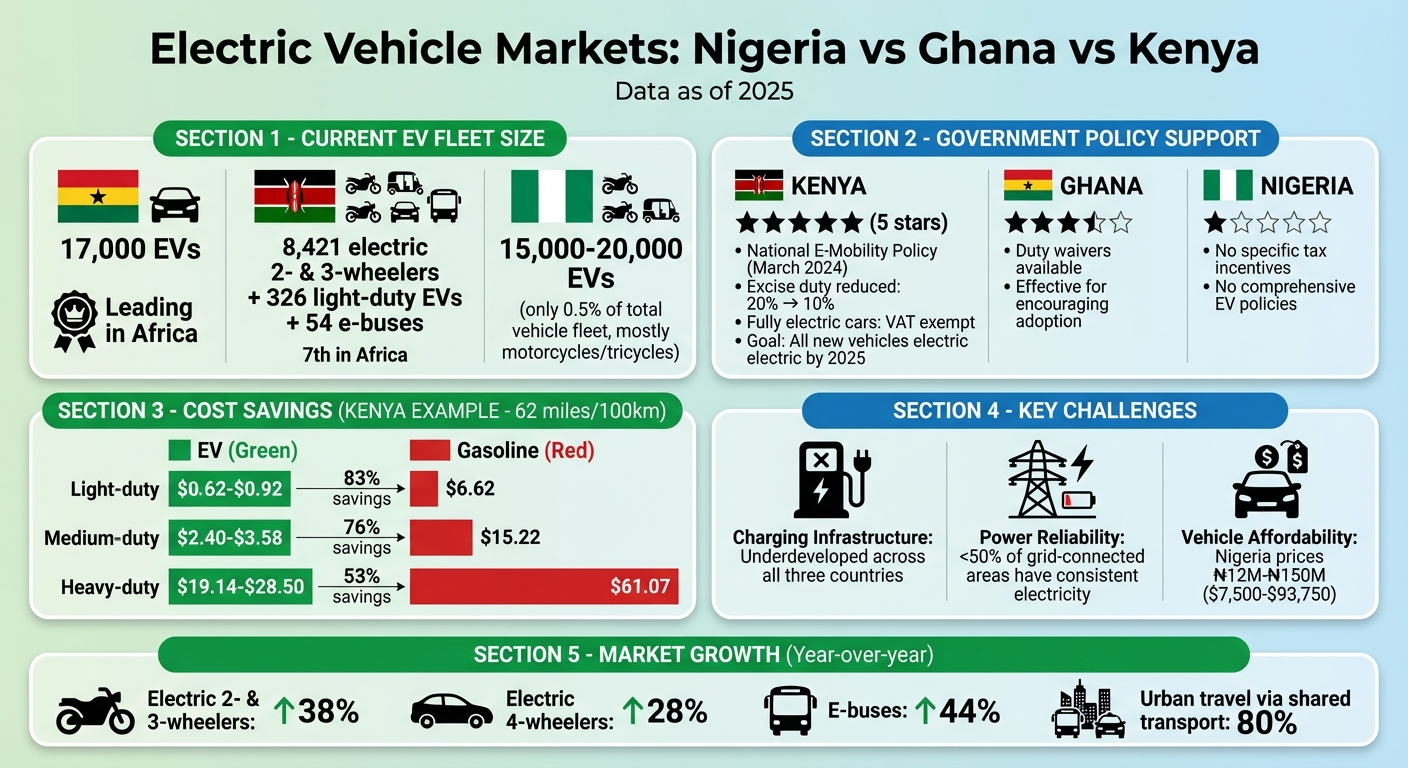

Electric Vehicle Markets in Nigeria, Ghana, and Kenya

BYD Electric Vehicle Market Comparison: Nigeria, Ghana, and Kenya 2025

The electric vehicle (EV) markets in Nigeria, Ghana, and Kenya present a mix of opportunities and challenges, reflecting their varying levels of market maturity. Ghana currently leads the way in Africa with an estimated 17,000 EVs on the road, largely due to government duty waivers that have made EVs more affordable. Kenya, ranked seventh among African nations for EV adoption, has 8,421 electric 2- and 3-wheelers, 326 light-duty EVs, and 54 e-buses as of May 2025. Nigeria, despite its large population, has only 15,000–20,000 EVs, accounting for just 0.5% of its total vehicle fleet. Most of these are motorcycles and tricycles.

Government Policies and Tax Incentives

Among these countries, Kenya has made the most strides in developing policies to support EV adoption. In March 2024, the Kenyan government introduced the National E-Mobility Policy, aiming to create a favorable environment for EV growth. Key measures included reducing excise duty on EVs from 20% to 10% and exempting fully electric cars from Value-Added Tax (VAT). Additionally, Kenya’s National Energy Efficiency and Conservation Strategy set an ambitious goal for all newly registered vehicles to be electric by 2025, although progress has been slower than expected.

In Ghana, the focus has been on duty waivers, which have proven effective in encouraging EV adoption. Nigeria, on the other hand, has yet to implement specific tax incentives or comprehensive policies to boost its EV market.

While strong policies can unlock market potential, the lack of reliable infrastructure remains a major obstacle.

Charging Infrastructure and Power Grid Challenges

Charging infrastructure across Nigeria, Ghana, and Kenya remains underdeveloped, posing a significant barrier to EV adoption. Charging stations are scarce, and unreliable electricity – fewer than half of grid-connected areas in these countries have consistent power – further complicates the situation.

To address these issues, battery swapping technology has gained traction, especially for commercial fleets like motorcycle taxis and minibuses. This approach not only reduces charging times but also lowers the upfront costs of EV ownership, making it a practical solution in regions with unstable power grids.

Despite these challenges, demand for EVs – particularly in commercial sectors – continues to grow.

Consumer Interest and Fleet Buyers

Commercial fleets are leading the charge in EV adoption, far outpacing private ownership. Across Africa, electric 2- and 3-wheelers saw a 38% year-over-year increase, while electric 4-wheelers grew by 28%, and e-buses surged by 44%. With as much as 80% of urban travel in these regions relying on shared taxis or motorcycle taxis, commercial fleets have become the natural entry point for electric mobility.

The financial benefits are hard to ignore. In Kenya, driving 62 miles (100 km) in an EV costs 47–83% less than using a gasoline vehicle. Here’s a comparison of costs for 62 miles (100 km):

- Light-duty vehicles: $0.62–$0.92 (EV) vs. $6.62 (gasoline)

- Medium-duty vehicles: $2.40–$3.58 (EV) vs. $15.22 (gasoline)

- Heavy-duty vehicles: $19.14–$28.50 (EV) vs. $61.07 (gasoline).

Companies like BasiGo have already deployed 100 e-buses in Kenya, serving thousands of commuters daily, while Moove operates EV ride-hailing fleets across Nigeria, Ghana, and South Africa.

For private buyers, however, the high cost of EVs remains a significant barrier. In Nigeria, EV prices range from ₦12 million to ₦150 million (about $7,500 to $93,750), making them inaccessible for most. Femi Oriowo, Co-founder and CEO of Carbin Africa, highlights the issue:

"A lot of people have had their purchasing power eroded in the past couple of years. The average user cannot afford to buy a used car outright. The demand for financing surged heavily, and for mass adoption to happen, the government needs to look into financing initiatives."

Despite these hurdles, interest in EVs is growing. In Nigeria, Kemet Automotive, a local EV startup, has received over 10,000 pre-orders for its vehicles. In Kenya, high financial inclusion has enabled companies like M-KOPA and Watu Credit to offer digital loans tailored for electric 2-wheelers, further fueling market growth.

How BYD Is Entering African Markets

BYD is making strides in Africa by building strategic partnerships, improving its supply chain, and expanding charging networks. The company is focusing on long-term collaborations to bring technology to the region and develop essential infrastructure. Below, we explore BYD’s local strategies, from partnerships to charging solutions.

Local Partnerships and Distribution Networks

In Kenya, BYD has teamed up with BasiGo, a Nairobi-based electric bus solutions provider. Since at least 2022, this partnership has combined BYD’s expertise in electric vehicles with BasiGo’s local assembly capabilities, financing options, and renewable energy projects. BasiGo initially started with two imported buses from China in 2022 and has now reached a milestone of deploying its 100th locally assembled electric bus powered by BYD technology. These buses are now operating in both Kenya and Rwanda, marking significant growth in the region.

Local Assembly and Manufacturing Plans

The collaboration between BYD and BasiGo in Kenya highlights the automaker’s most advanced local production initiative in Africa. By merging BYD’s EV technology with Kenyan assembly and financing expertise, the partnership underscores a commitment to building local capacity. This approach not only supports economic growth but also aims to reduce emissions, which can lead to cleaner air and better public health outcomes.

Service Centers and Charging Infrastructure

To support its growing presence, BYD is also expanding its service and charging networks. South Africa has become a key entry point and a testing ground for the company’s strategies, which it plans to replicate in other markets like Nigeria, Ghana, and Kenya. BYD is aiming to install 200–300 ultra-fast charging stations in South Africa by the end of 2026, including high-capacity megawatt-class stations. These efforts are designed to tackle current charging challenges and provide a scalable model for other parts of Africa.

sbb-itb-99e19e3

BYD Vehicle Models Available in Nigeria, Ghana, and Kenya

BYD offers a variety of vehicles in these markets, catering to both individual car buyers and public transportation needs with electric buses. These vehicles are designed to handle the challenges of hot climates and urban settings, reflecting BYD’s focus on sustainable transportation solutions in Africa.

Passenger Cars: Models and Features

Through EV24.africa, BYD provides a selection of passenger vehicles across the region. Here are some key models:

- BYD Atto 3: Priced at ₦45 million (about $28,000) in Nigeria, this model has a driving range of 430 km (267 miles) and delivers 200 horsepower. It features BYD’s Blade battery technology, known for its durability and heat management, and supports fast charging, reaching 30–80% capacity in roughly 30 minutes with a DC charger.

- BYD Dolphin Active: A budget-friendly option at $11,800, offering a range of 340 km (211 miles).

- BYD Tang EV 2024: A premium model priced at $34,700, boasting an impressive range of 730 km (454 miles).

- BYD Song Plus EV: Priced at $18,680, this car offers a range of 505 km (314 miles).

- BYD Qin Plus EV: Starting at $14,180, it provides a range of 400 km (249 miles).

These models combine affordability with efficiency, making them appealing options for a wide range of customers.

Electric Buses and Commercial Vehicles

Kenya has taken the lead in adopting BYD’s commercial vehicles, thanks to BasiGo’s local assembly efforts. Starting with two imported buses in 2022, BasiGo reached its 100th locally assembled electric bus by 2025, all powered by BYD technology.

- Cost Advantage: Locally assembled 25-seater buses cost between $55,000 and $60,000, significantly less than imported units priced at $250,000–$300,000 in other African markets.

- Savings for Operators: BasiGo’s pay-as-you-drive financing model allows transport operators to save 5–15% on costs compared to diesel buses.

- Expansion Plans: BasiGo now operates in Kenya and Rwanda, with plans to deploy 1,000 units across East Africa within three years.

In Nigeria and Ghana, Moove manages electric vehicle fleets that include ride-hailing cars and is exploring electric bus projects. However, these efforts are still smaller in scale compared to Kenya.

Buying BYD Vehicles Through EV24.africa

EV24.africa simplifies the process of purchasing BYD vehicles by offering clear pricing, flexible financing options, and reliable delivery services across all 54 African countries. The platform provides detailed information on new passenger cars, including driving range, transmission type, and pricing in U.S. dollars. Buyers can choose between RoRo (Roll-on/Roll-off) or container shipping, with options for port-to-port or door-to-door delivery. EV24.africa also handles customs clearance and local registration, making it easier for buyers to navigate the complexities of importing vehicles into African markets.

Effects and Obstacles of BYD’s African Expansion

Economic and Environmental Results

BYD’s expansion into Africa is sparking economic growth and supporting environmental goals in countries like Nigeria, Ghana, and Kenya. In Ghana, partnerships with Chinese companies are helping to establish the electric vehicle (EV) industry, creating jobs in assembly, sales, and service sectors across West Africa. BYD’s strategy to localize operations includes building dealership networks, which is expected to boost employment opportunities in sales, maintenance, and support services throughout East, Southern, and West Africa.

The environmental impact of this shift is noteworthy. Electric vehicles are significantly more energy-efficient than traditional gasoline-powered cars. EVs use around 87–91% of their battery energy for movement, compared to just 16–25% for gas-powered vehicles. Over a 15-year lifespan (or approximately 124,000 miles), a medium-sized electric car produces about half the lifecycle emissions of a comparable gasoline vehicle. The United Nations Environment Programme estimates that decarbonizing Africa’s transportation and energy systems could save 200,000 lives annually by 2030 and cut CO₂ and methane emissions by 55% and 74%, respectively, by 2063.

"Harnessing Chinese EV technology is vital for Kenya and the broader African continent in advancing the transition to renewable energy in e-mobility." – Dennis Wakaba, Consultant at the Electric Mobility Association of Kenya

While these benefits are clear, challenges remain in fully unlocking BYD’s potential in Africa.

Barriers to Electric Vehicle Growth

One of the biggest hurdles is the cost of EVs. Even though BYD offers models starting at under $22,500, high purchase prices still deter many buyers. In 2024, EV sales in Africa more than doubled to approximately 11,000 units, but they still accounted for less than 1% of the continent’s total vehicle market. Other obstacles include the dominance of petrol and diesel vehicles, evolving consumer preferences, limited charging infrastructure, and unreliable power supplies. Additionally, high import duties and the lack of robust government incentives make EV ownership more expensive.

To tackle these issues, BYD is forming local partnerships, such as its collaboration with Loxea Kenya in October 2024, which focuses on building charging infrastructure and improving after-sales services. The company is also expanding its service networks and introducing plug-in hybrid models to ease range anxiety while the charging infrastructure catches up.

BYD’s Future in Africa Through 2030

Addressing cost and infrastructure challenges will be critical as BYD continues to scale its operations. Chinese EV brands are gaining a foothold among African consumers, positioning themselves to play a growing role in the region’s automotive market. BYD plans to further expand its dealership and service networks across East, Southern, and West Africa, targeting countries like Nigeria, Ghana, and Kenya. The company is also prioritizing affordability and offering plug-in hybrids, which are especially important given the slow adoption of fully electric vehicles.

With rising global demand for cleaner transportation, coupled with urbanization and economic development in Africa, the outlook for BYD’s expansion is promising. As charging infrastructure improves and governments introduce supportive policies, BYD is well-positioned to capture a larger share of the market by combining affordability, strategic local partnerships, and a robust service network.

Conclusion

BYD is carving out a strong position in Africa’s growing electric vehicle (EV) market, thanks to its strategic market entry, supportive policies, and cutting-edge charging solutions. The company is playing a key role in advancing EV adoption, particularly in Kenya, while also contributing to cleaner transportation initiatives in countries like Nigeria and Ghana. Its partnership with BasiGo in Kenya exemplifies this approach, blending Chinese EV technology with local assembly, financing options, and renewable energy infrastructure. This not only supports job creation but also makes EVs more accessible to African consumers.

In addition to partnerships, BYD is expanding its reach through a growing dealer network and a variety of affordable plug-in hybrid models. These efforts highlight its dedication to integrating into the market for the long haul. The company is also focusing on educating African consumers about the benefits of electric mobility. Globally, BYD recently celebrated the delivery of its 14-millionth new energy vehicle, a milestone that underscores its scale and commitment to accelerating the EV transition.

"In countries like Kenya and South Africa, the Chinese automaker is working with local firms to build infrastructure, transfer technology, and establish itself not merely as a supplier but as a long-term partner in Africa’s electric mobility transition." – China Global South Project

While BYD has made impressive strides, challenges such as high import duties, limited charging infrastructure, and unreliable electricity supplies continue to pose hurdles. However, with its focus on affordability, local collaborations, and technology transfer, BYD is well-positioned to lead the charge in Africa’s EV future. As charging networks grow and governments introduce more supportive policies, BYD’s efforts in Nigeria, Ghana, and Kenya are likely to drive broader adoption of cleaner transportation options.

Looking ahead, investments in infrastructure and consumer education will remain critical. Yet, BYD’s approach of building long-term partnerships rather than acting as a mere supplier offers a strong foundation for advancing electric mobility across Africa in the years to come.

FAQs

How is BYD addressing infrastructure challenges to support electric vehicles in Africa?

BYD is addressing Africa’s infrastructure hurdles with solutions designed specifically for the region. One standout effort is their deployment of solar-powered charging stations that include battery storage. This setup ensures dependable energy availability, even in places where grid access is limited or unreliable. Beyond this, BYD is working with local utilities – like Eskom in South Africa – to connect their charging networks to the grid while improving energy demand management. These initiatives are laying the groundwork for broader electric vehicle adoption across the continent.

What is BYD doing to make its electric vehicles more affordable for consumers in Africa?

BYD is working to bring electric vehicles within reach for more people in Africa by offering models starting at prices below $22,500. The company is concentrating on hybrid and plug-in hybrid options, which provide a more affordable way for consumers to transition to electric mobility. To further this effort, BYD is growing its dealership network in major markets such as Nigeria, Ghana, and Kenya. This expansion aims to make vehicles easier to access, inform potential buyers about their benefits, and encourage the shift toward electric vehicles in the region.

How do local partnerships support BYD’s growth in Africa?

Local partnerships are crucial to BYD’s growth across Africa. They help with technology transfer, the development of essential infrastructure, and tailoring strategies to fit local market needs. These collaborations also make it easier to navigate regional regulations and build consumer trust by tapping into the knowledge and networks of local businesses.

By teaming up with local partners, BYD can tackle specific challenges, like gaps in charging infrastructure and supply chain hurdles, making the transition to electric vehicles smoother in countries such as Nigeria, Ghana, and Kenya. This strategy not only solidifies BYD’s foothold in the region but also supports the broader goal of advancing sustainable transportation.