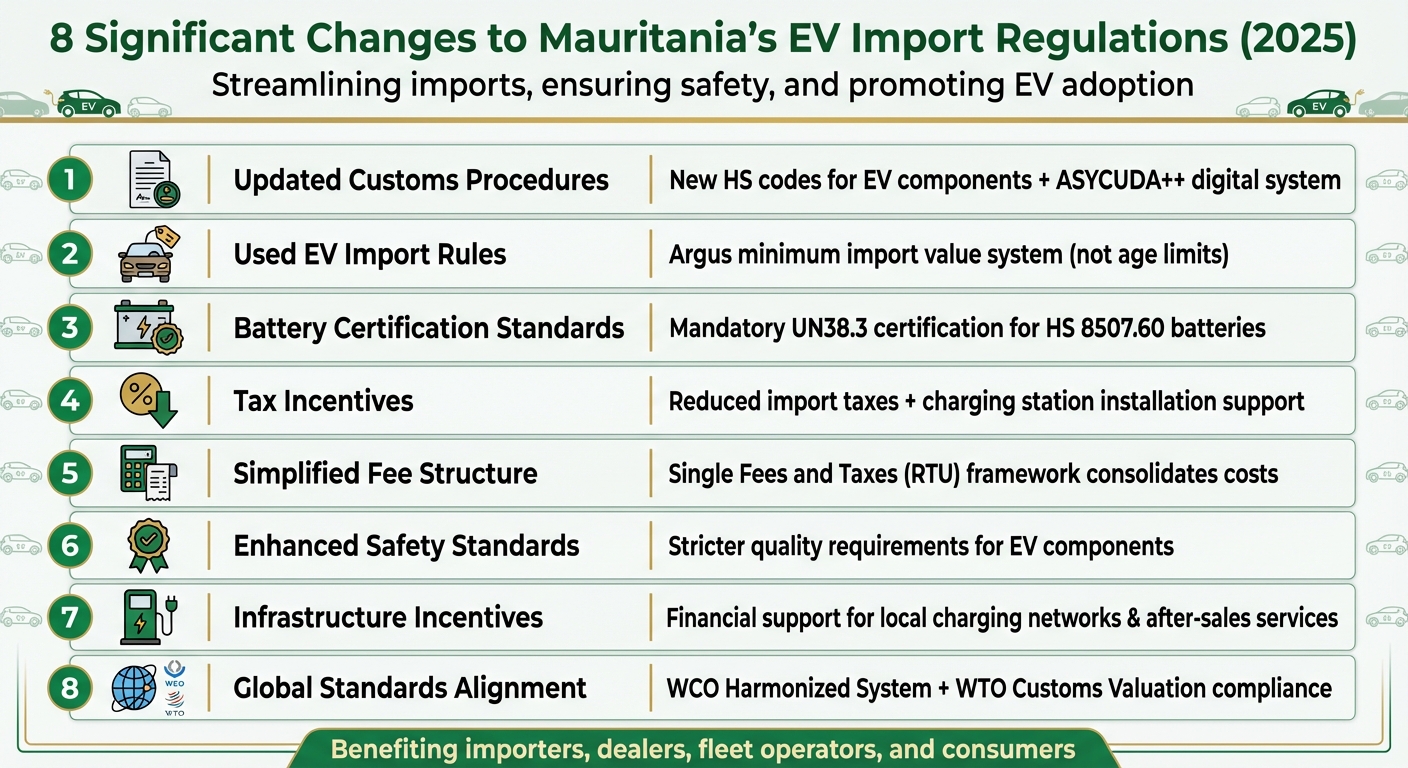

Mauritania has introduced new electric vehicle (EV) import regulations for 2025, aiming to improve the import process, ensure safety standards, and encourage EV adoption. These updates focus on customs procedures, battery certifications, tax incentives, and infrastructure development. Here’s a quick summary of the key changes:

- Customs Procedures: Updated HS codes for EV components and streamlined documentation using the ASYCUDA++ system.

- Used EV Imports: Vehicle eligibility based on the Argus minimum import value system, not strict age limits.

- Battery Standards: Mandatory UN38.3 certification for batteries under HS code 8507.60.

- Tax Incentives: Reduced import taxes for EVs and support for charging station installations.

- Simplified Costs: Consolidated fees under the Single Fees and Taxes (RTU) framework.

- Safety and Quality: Stricter standards for EV components to ensure reliability.

- Infrastructure Support: Financial incentives for local charging networks and after-sales services.

- Alignment with Global Standards: Regulations now follow international and regional EV trade guidelines.

These changes aim to make EV imports more efficient, improve quality, and support the growth of EV infrastructure in Mauritania. Whether you’re an importer, dealer, or consumer, these updates are designed to create a smoother and more reliable EV market.

8 Key Changes to Mauritania’s 2025 EV Import Regulations

1. Updated Tariff Classification and Customs Procedures for Electric Vehicles

Mauritania’s regulations for 2025 bring changes to the import procedures for electric vehicles (EVs). These updates aim to simplify and standardize the Harmonized System (HS) classification and customs documentation. Importers are now required to accurately classify EV components, such as batteries and electronic systems, to ensure a smoother and more consistent customs process. These adjustments are designed to make the EV import experience in Mauritania more efficient.

The updated guidelines emphasize the importance of thoroughly reviewing the new HS classification rules to avoid disruptions. By aligning its customs procedures with international standards, Mauritania provides reassurance to importers operating across multiple markets. This alignment not only simplifies the import process but also strengthens the groundwork for meeting the increasing demand for electric vehicles in the region.

2. Age and Condition Limits for Used EV Imports

Mauritania has taken a flexible approach to used EV imports as part of its 2025 regulatory updates. Rather than imposing strict age limits, the government uses the Argus minimum import value system to gauge a vehicle’s market worth. This system considers factors like depreciation and the car’s overall condition, allowing customs to decide import eligibility based on value instead of fixed age restrictions.

Customs officials rely on the Argus system to evaluate a vehicle’s condition – better-maintained cars are assigned higher values, which directly influence the calculation of import duties and taxes. For importers, this means pricing strategies need careful planning. Vehicles that barely meet the minimum value threshold can end up with higher effective tax rates, significantly affecting overall import expenses.

3. Technical Standards for EV Batteries and Charging Systems

By 2025, Mauritania will require EV batteries classified under HS code 8507.60 to have UN38.3 certification. This certification ensures they meet international safety standards, providing an added layer of reliability. Additionally, the regulations align with WCO 2022 standards, creating a consistent framework for importers that will remain in place until 2027. These steps are designed to uphold market reliability as the adoption of EVs continues to grow.

4. Import Rules Based on Emissions and Efficiency

Mauritania’s updated regulations are taking a step further by addressing emissions and efficiency standards to encourage the adoption of electric vehicles (EVs). The 2025 EV import rules introduce reduced import taxes for EVs while also providing incentives for installing charging stations, creating a more EV-friendly environment.

Impact on Import Costs and Incentives

Although specific emissions criteria are yet to be announced, the new rules focus on lowering import taxes for EVs, which directly benefits both dealers and consumers. This reduction in taxes makes EVs more affordable, encouraging their adoption across the country. Additionally, incentives for installing EV charging stations aim to support the development of a reliable charging infrastructure. Together, these measures not only make EV ownership more practical but also lay the groundwork for a more connected and accessible EV ecosystem.

Alignment with Broader Environmental and Policy Goals

These regulations align with Mauritania’s larger goal of promoting cleaner transportation technologies. By revising tax policies and offering infrastructure-related incentives, the government provides a clear and predictable framework for importers and dealers. This predictability helps businesses plan their inventory and investments more effectively. Moreover, the framework ties incentives to specific, verified vehicle attributes, simplifying compliance for importers and offering greater clarity for dealers. This streamlined approach enhances transparency throughout the supply chain, enabling dealers to highlight cost advantages to potential buyers more effectively.

5. Simplified Customs Procedures for EV Import Documentation

Mauritania has taken steps to modernize its customs processes, making it easier to import electric vehicles (EVs). With updated tariff classifications and technical standards, the country has introduced digitized systems to enhance efficiency. A key part of this transformation is the adoption of the ASYCUDA++ system, which automates the customs declaration process. This system minimizes delays by speeding up goods inspections, benefiting both dealers and importers alike.

Streamlined Compliance for Importers and Dealers

The shift to an automated system brings several advantages for importers. Declarations can now be submitted electronically, reducing the chances of errors and cutting down the time vehicles spend waiting for clearance. On top of that, the introduction of the Single Fees and Taxes (RTU) framework simplifies cost management by consolidating multiple fees into a single payment. This change not only saves time but also helps importers better plan their budgets, complementing earlier regulatory improvements.

Meeting International EV Standards

Mauritania’s customs updates are designed to align with global practices. Specifically, they adhere to the World Customs Organization (WCO) Harmonized System (HS) and the WTO Agreement on Customs Valuation, ensuring the country keeps pace with international EV trade standards.

Lower Costs and Business Incentives

The quicker customs process translates directly into savings. Faster clearance reduces port storage fees and enables vehicles to enter the market sooner. By cutting down on administrative tasks, dealers can redirect their efforts toward sales and customer service. This efficiency not only lowers costs but also creates a smoother, more profitable import operation overall.

sbb-itb-99e19e3

6. Updated Requirements for EV Importers, Dealers, and Fleet Operators

By 2025, Mauritania will require all imported EV batteries (HS 8507) to align with international safety and quality standards. This regulation aims to prevent subpar products from entering the market, ensuring a safer and more reliable EV ecosystem.

To support these changes, updated customs systems like ASYCUDA++ and the Single Fees and Taxes (RTU) framework are making compliance easier. These automated tools simplify documentation and regulatory processes, freeing importers and dealers to focus on growing their businesses while staying aligned with the latest requirements.

7. Incentives for Local EV Charging and After-Sales Support

Support for Local EV Infrastructure Development

Starting in 2025, Mauritania plans to roll out financial incentives aimed at expanding EV charging networks and improving after-sales support. These efforts highlight the government’s determination to address the current gaps in charging infrastructure. Alongside this, new rebate programs and service training initiatives are set to strengthen local support for EV maintenance.

The establishment of Mauritania’s first EV charging station in Nouakchott stands as a major milestone. It reflects the impact of these new incentives and serves as a model for building a reliable charging network and maintenance system that meets international standards. This development also builds on earlier steps to ease import restrictions and improve operational practices.

8. Alignment with Regional and African EV Policy Trends

Alignment with International EV Standards

Mauritania’s 2025 regulations are designed to align with both global and regional EV standards. These rules ensure that battery safety certifications and customs frameworks meet internationally recognized benchmarks, whether batteries are imported as standalone units or as part of electric vehicles. By adhering to these standards, Mauritania guarantees that all EV components comply with established safety requirements.

The country has also updated its customs framework to align with the World Customs Organization (WCO) Harmonized System. This update simplifies tariff classifications, making it easier for importers to navigate the process while ensuring consistency with trade partners across Africa and beyond. Additionally, this effort ties into broader initiatives led by the African Organization for Standardization (ARSO), which aims to create a unified approach for Africa’s automotive sector. By syncing with ARSO guidelines, Mauritania not only improves compliance but also boosts efficiency in trade and regulatory processes.

Ease of Compliance for Importers and Dealers

The adoption of these standardized regulations simplifies customs procedures, reducing delays and confusion for importers and dealers. With internationally recognized standards in place, the process becomes far more straightforward compared to previous, less cohesive regulations, making it easier for businesses to operate within the EV market.

Conclusion

Mauritania’s 2025 electric vehicle (EV) import regulations mark a significant shift aimed at boosting EV adoption while prioritizing quality and safety. These eight policy updates are designed to balance cost, efficiency, and reliability, making EVs more accessible while ensuring only high-standard vehicles enter the market. Here’s how these changes impact key players in the EV ecosystem – importers, dealers, fleet operators, and consumers.

For importers and dealers, the message is clear: adjust quickly to the updated technical requirements and documentation processes. With simplified customs procedures and alignment with global standards, the process becomes less cumbersome. However, meeting battery certification and emissions benchmarks is non-negotiable. Those who act early to align with these standards are likely to gain a head start as the EV market grows.

For fleet operators and businesses, the new incentives for charging infrastructure and after-sales support present a real opportunity. Government-backed tax breaks and support for building local service networks make it easier to establish sustainable EV operations. These measures not only reduce upfront costs but also position businesses to benefit from long-term savings and a growing market demand for EVs.

Consumers arguably have the most to gain. Lower import taxes and stricter quality controls translate to more affordable, dependable EV options. Coupled with expanded access to charging networks, these changes make owning and operating an electric vehicle a more practical and cost-effective choice.

Whether you’re an importer preparing for your next shipment, a dealership looking to expand, or someone considering their first EV purchase, understanding these regulatory updates is key to navigating Mauritania’s evolving EV market. These changes not only reshape the local landscape but also reflect the broader global movement toward electric mobility.

FAQs

What impact will Mauritania’s new EV tax incentives in 2025 have on the cost of owning an electric vehicle?

Mauritania is gearing up to roll out updated tax incentives for electric vehicles (EVs) in 2025, aiming to make EV ownership more accessible and affordable. These incentives are expected to include measures like reduced import taxes, waivers on certain fees, and financial perks for choosing EVs – steps that could significantly cut the initial costs for buyers.

On top of that, EVs come with potential long-term savings. With lower fuel and maintenance expenses compared to gas-powered cars, they could turn out to be a smarter financial choice over time. To understand how these incentives might benefit you personally, keep an eye on the final details once the regulations are fully outlined.

How does the UN38.3 certification requirement for EV batteries affect importers and consumers?

The UN38.3 certification plays a crucial role in ensuring that EV batteries meet international safety standards for transportation. For importers, this translates to more rigorous compliance procedures, which include extra documentation and testing. While these measures enhance safety, they can also lead to longer shipping times and higher costs.

For consumers, the certification offers peace of mind regarding the safety and reliability of EV batteries. However, it may also result in slightly increased prices, as importers often pass along the added compliance expenses. Ultimately, this regulation is designed to prioritize safety while encouraging the continued expansion of the EV market.

How will the updated customs procedures and the adoption of the ASYCUDA++ system make importing EVs into Mauritania easier?

The revised customs procedures, paired with the introduction of the ASYCUDA++ system, are set to make importing electric vehicles into Mauritania much more straightforward. This system works by automating and standardizing customs operations, cutting down on paperwork and reducing hold-ups at customs checkpoints.

With these updates, importers can look forward to quicker processing times, more precise documentation, and a clearer, more transparent import process. These improvements aim to simplify and expedite the experience for both businesses and individuals bringing EVs into the country.